Key Insights

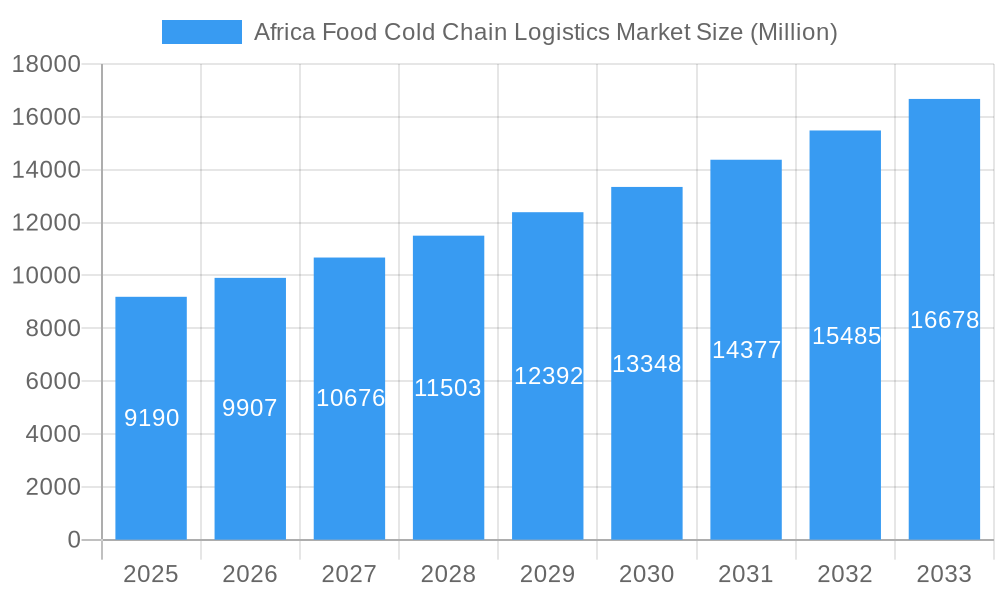

The African food cold chain logistics market, valued at $9.19 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 7.94% from 2025 to 2033. This expansion is fueled by several key factors. Increasing urbanization and a rising middle class are boosting demand for fresh and processed food products, necessitating efficient cold chain solutions to ensure quality and safety. Furthermore, the growth of organized retail and the expansion of e-commerce platforms are creating new opportunities for cold chain logistics providers. Government initiatives aimed at improving infrastructure and food security are also contributing to market growth. The market is segmented by service type (storage, transportation, value-added services like blast freezing and inventory management), temperature (chilled, frozen, ambient), product category (horticulture, dairy, meat, poultry, seafood, processed foods), and country (with South Africa, Nigeria, and Egypt representing significant markets). While challenges remain, such as inadequate infrastructure in certain regions and high transportation costs, the overall market outlook remains positive.

Africa Food Cold Chain Logistics Market Market Size (In Billion)

The competitive landscape features a mix of established players and emerging companies, including CCS Logistics, African Perishable Logistics, and BigCold Kenya Ltd, among others. These companies are strategically investing in infrastructure upgrades, technology adoption, and expanding their service offerings to meet the growing demand. The increasing adoption of temperature-controlled vehicles and warehousing solutions, along with the implementation of sophisticated tracking and monitoring systems, are key trends shaping the market. Future growth will likely depend on addressing infrastructure gaps, improving connectivity, and fostering collaborations across the value chain to create more efficient and reliable cold chain networks. This will involve investments in technology, training, and capacity building to ensure that the African food cold chain is equipped to support sustainable economic growth and food security.

Africa Food Cold Chain Logistics Market Company Market Share

Africa Food Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Africa Food Cold Chain Logistics Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report dissects market dynamics, growth trends, key players, and emerging opportunities within this rapidly expanding sector. The report segments the market by service (storage, transportation, value-added services), temperature (chilled, frozen, ambient), product category (horticulture, dairy, meat, poultry, seafood, processed foods), and country (Egypt, Nigeria, South Africa, and others). The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

Africa Food Cold Chain Logistics Market Market Dynamics & Structure

The African food cold chain logistics market is characterized by a fragmented landscape with a mix of large multinational players and smaller regional operators. Market concentration is relatively low, with no single dominant player controlling a significant share. Technological innovation is a key driver, particularly in areas like temperature monitoring, automation, and improved transportation infrastructure. Regulatory frameworks vary across countries, posing challenges for standardization and efficiency. Competitive product substitutes are limited, primarily focusing on improved preservation techniques and packaging. End-user demographics are diverse, ranging from large-scale retailers and food processors to smaller-scale farmers and distributors. M&A activity has been moderate, primarily focused on expansion and consolidation within regional markets.

- Market Concentration: Low, with no dominant player.

- Technological Innovation: Significant driver, focusing on automation and monitoring.

- Regulatory Framework: Varied across countries, hindering standardization.

- Competitive Substitutes: Limited, primarily focusing on preservation and packaging.

- M&A Activity: Moderate, driven by regional expansion and consolidation. Estimated xx deals in the last 5 years.

Africa Food Cold Chain Logistics Market Growth Trends & Insights

The African food cold chain logistics market is experiencing robust growth, driven by rising disposable incomes, urbanization, and increasing demand for fresh and processed foods. The market witnessed a CAGR of xx% during 2019-2024 and is projected to maintain a strong CAGR of xx% from 2025 to 2033. Adoption rates for advanced cold chain technologies are gradually increasing, although infrastructure limitations remain a challenge. Technological disruptions, such as the use of IoT and blockchain technology, are improving transparency and efficiency in the supply chain. Consumer behavior is shifting towards a preference for higher-quality, safer food products, stimulating demand for reliable cold chain services. Market penetration for temperature-controlled logistics remains relatively low, indicating significant growth potential.

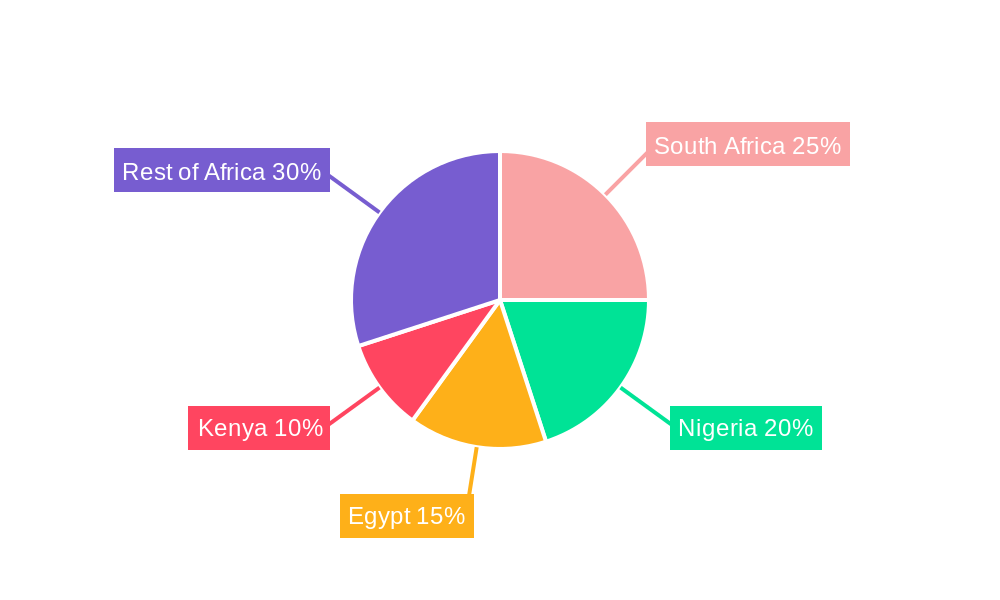

Dominant Regions, Countries, or Segments in Africa Food Cold Chain Logistics Market

South Africa currently holds the largest market share due to its advanced infrastructure and established cold chain industry. Nigeria and Egypt are also significant markets, experiencing rapid growth driven by increasing population and economic activity. Within the segments, the storage sector holds the largest share, followed by transportation. Value-added services are gaining traction as businesses seek to improve product quality and extend shelf life. Horticulture, dairy, and meat/poultry products are the dominant product categories.

- Leading Region: South Africa

- Key Drivers: Rising disposable incomes, urbanization, and demand for fresh/processed foods.

- Growth Potential: High, particularly in West Africa (Nigeria, etc.) due to significant underdevelopment in cold chain infrastructure.

- Dominant Segments: Storage and transportation services. Horticulture and meat products in the product category.

Africa Food Cold Chain Logistics Market Product Landscape

The African food cold chain logistics market is experiencing a dynamic evolution characterized by innovative product development aimed at bolstering temperature integrity, significantly curtailing food spoilage, and elevating end-to-end traceability. Leading the charge are cutting-edge refrigeration technologies, including advancements in variable speed compressors, IoT-enabled sensors for real-time monitoring, and the increasing adoption of natural refrigerants for sustainability. These innovations are synergistically enhancing product preservation and ensuring timely, high-quality delivery across diverse geographical terrains. Unique selling propositions are increasingly centered around highly specialized solutions tailored for specific perishable goods, such as temperature-sensitive fruits, pharmaceuticals, and frozen seafood. Furthermore, the integration of comprehensive logistics platforms that offer end-to-end visibility and advanced digital monitoring systems are becoming crucial differentiators, providing clients with unparalleled control and assurance over their supply chains.

Key Drivers, Barriers & Challenges in Africa Food Cold Chain Logistics Market

Key Drivers: Increasing demand for fresh produce, government initiatives to improve food security, and investments in infrastructure development. Technological advancements in refrigeration and transport are also propelling market growth.

Challenges: Inadequate infrastructure (lack of reliable power, poor road networks), high operational costs, and skills shortages in the cold chain sector pose significant hurdles to growth. Regulatory inconsistencies across countries also impede efficient operations. The impact of these challenges is estimated to reduce annual market growth by xx%.

Emerging Opportunities in Africa Food Cold Chain Logistics Market

The African food cold chain logistics market is poised for substantial growth, fueled by a confluence of powerful economic and societal drivers. The rapid expansion of modern retail chains across the continent is creating a consistent demand for reliable cold storage and transportation to serve a burgeoning urban population. Simultaneously, the burgeoning e-commerce sector, particularly for groceries and fresh produce, necessitates sophisticated cold chain solutions to ensure product quality from order to delivery. Significant investment in agricultural value chains, driven by governments and private entities aiming to boost food security and export capabilities, is further underpinning market expansion. Vast untapped markets, particularly in rural and peri-urban areas, represent a significant frontier for growth, requiring innovative, cost-effective, and resilient cold chain infrastructure. A growing global and local imperative for sustainable cold chain solutions is creating a strong demand for eco-friendly refrigerants, energy-efficient refrigeration units, and optimized transportation routes to minimize carbon footprints. The integration of advanced technologies, such as blockchain for immutable traceability and enhanced food safety certifications, is emerging as a critical avenue for building trust and ensuring compliance, offering a promising pathway for market leaders to gain a competitive edge.

Growth Accelerators in the Africa Food Cold Chain Logistics Market Industry

Technological innovation plays a crucial role in boosting market growth. Strategic partnerships between logistics providers, technology companies, and government agencies foster infrastructure development and market expansion. Investments in training and skills development within the cold chain sector address the skills shortage.

Key Players Shaping the Africa Food Cold Chain Logistics Market Market

- CCS Logistics

- African Perishable Logistics

- BigCold Kenya Ltd

- Southern Shipping Services Ltd (SSSL)

- Khold

- Lieben Logistics

- Vector Logistics

- Go Global

- HFR Transport

- Unitrans

- Cold Solutions East Africa

- Africa Global Logistics (AGL)

- Africa Cold Chain Limited

- Major multinational logistics providers expanding their African presence

- Emerging technology providers focusing on cold chain monitoring and management

- Regional players specializing in specific agricultural commodities

- 7 Other Companies

Notable Milestones in Africa Food Cold Chain Logistics Market Sector

- June 2023: Africa Global Logistics (AGL) Côte d'Ivoire significantly expanded its operational capabilities by tripling its cold storage capacity at the Abidjan Aerohub, enhancing its ability to handle increased volumes of perishable goods and supporting the country's export sector.

- October 2023: Cold Solutions Kenya marked a significant expansion with the launch of a state-of-the-art, 15,000 sq. m cold storage facility in Tatu City. This facility is designed to meet the growing demand for advanced cold chain infrastructure in one of Kenya's key industrial and logistics hubs.

- November 2023: A consortium of African development banks announced a multi-million dollar investment initiative aimed at bolstering cold chain infrastructure across several East African nations, focusing on bridging the gap in rural access to cold storage.

- January 2024: A leading agribusiness in West Africa deployed an innovative fleet of temperature-controlled trucks equipped with real-time GPS and temperature monitoring, reducing spoilage rates by 15% for its produce exports.

In-Depth Africa Food Cold Chain Logistics Market Market Outlook

The African food cold chain logistics market is characterized by robust and sustained long-term growth potential, propelled by a powerful combination of ongoing infrastructure development initiatives, an ever-increasing urban consumer demand for fresh and safe food products, and rapid advancements in technological integration. Strategic investments in developing comprehensive and integrated logistics solutions that encompass storage, transportation, and last-mile delivery will be pivotal in unlocking further market expansion. A concentrated effort to penetrate and serve untapped markets, particularly in rural and remote regions, presents a substantial opportunity for companies that can offer scalable and cost-effective solutions. The unwavering global and local emphasis on food safety and stringent quality standards is a significant catalyst, directly driving the demand for sophisticated cold chain technologies, advanced monitoring systems, and specialized logistics services that ensure product integrity from farm to fork. The market's future trajectory will largely depend on the successful navigation and mitigation of existing infrastructure challenges, such as unreliable power supply and underdeveloped road networks, while simultaneously fostering greater collaboration and strategic partnerships between a diverse range of stakeholders, including governments, private sector operators, technology providers, and agricultural producers.

Africa Food Cold Chain Logistics Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature

- 2.1. Chilled

- 2.2. Frozen

- 2.3. Ambient

-

3. Product Category

- 3.1. Horticulture (Fresh Fruits and Vegetables)

- 3.2. Dairy Products (Milk, Ice Cream, Butter, etc.)

- 3.3. Meat, Poultry, and Seafood

- 3.4. Processed Food Products

- 3.5. Other Categories

Africa Food Cold Chain Logistics Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Food Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Africa Food Cold Chain Logistics Market

Africa Food Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Fruit Exports

- 3.3. Market Restrains

- 3.3.1. Electricity Crisis

- 3.4. Market Trends

- 3.4.1. Electricity Crisis is Negatively Affecting the South African Food Cold Chain Logistics Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Food Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.2.3. Ambient

- 5.3. Market Analysis, Insights and Forecast - by Product Category

- 5.3.1. Horticulture (Fresh Fruits and Vegetables)

- 5.3.2. Dairy Products (Milk, Ice Cream, Butter, etc.)

- 5.3.3. Meat, Poultry, and Seafood

- 5.3.4. Processed Food Products

- 5.3.5. Other Categories

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CCS Logistics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 African Perishable Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BigCold Kenya Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Southern Shipping Services Ltd (SSSL)**List Not Exhaustive 7 3 Other Companie

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Khold

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lieben Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vector Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Go Global

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 HFR Transport

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Unitrans

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Cold Solutions East Africa

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Africa Global Logistics (AGL)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Africa Cold Chain Limited

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 CCS Logistics

List of Figures

- Figure 1: Africa Food Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Food Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Food Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Africa Food Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 3: Africa Food Cold Chain Logistics Market Revenue Million Forecast, by Product Category 2020 & 2033

- Table 4: Africa Food Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Africa Food Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: Africa Food Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 7: Africa Food Cold Chain Logistics Market Revenue Million Forecast, by Product Category 2020 & 2033

- Table 8: Africa Food Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Nigeria Africa Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Africa Africa Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Egypt Africa Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Kenya Africa Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Ethiopia Africa Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Morocco Africa Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Ghana Africa Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Algeria Africa Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Tanzania Africa Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Ivory Coast Africa Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Food Cold Chain Logistics Market?

The projected CAGR is approximately 7.94%.

2. Which companies are prominent players in the Africa Food Cold Chain Logistics Market?

Key companies in the market include CCS Logistics, African Perishable Logistics, BigCold Kenya Ltd, Southern Shipping Services Ltd (SSSL)**List Not Exhaustive 7 3 Other Companie, Khold, Lieben Logistics, Vector Logistics, Go Global, HFR Transport, Unitrans, Cold Solutions East Africa, Africa Global Logistics (AGL), Africa Cold Chain Limited.

3. What are the main segments of the Africa Food Cold Chain Logistics Market?

The market segments include Service, Temperature, Product Category.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Fruit Exports.

6. What are the notable trends driving market growth?

Electricity Crisis is Negatively Affecting the South African Food Cold Chain Logistics Market.

7. Are there any restraints impacting market growth?

Electricity Crisis.

8. Can you provide examples of recent developments in the market?

June 2023: Africa Global Logistics (AGL) Côte d'Ivoire extended its cold room in the Aerohub, the largest contract logistics base in West Africa located near the Felix Houphouët Boigny International Airport in Abidjan. The company has tripled the capacity of the temperature-controlled area to meet the increasing customer demand and was able to do so by using local companies, including Aric, 2I Ivoire ingénierie, and Instafric. Specifically, the new cold zone will support customers in the pharmaceutical, retail, and catering sectors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Food Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Food Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Food Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Africa Food Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence