Key Insights

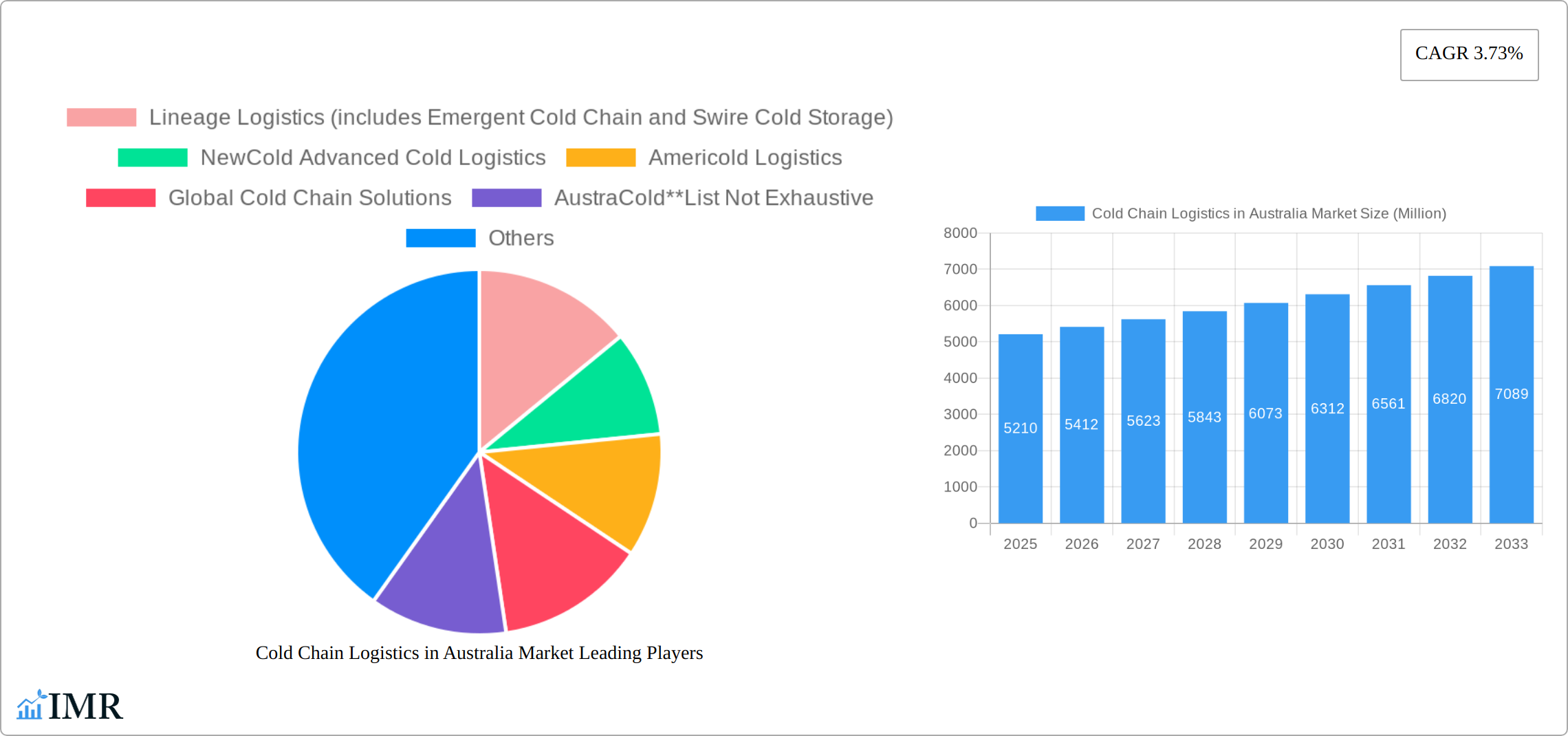

The Australian cold chain logistics market, valued at $5.21 billion in 2025, is projected to experience robust growth, driven by factors such as rising disposable incomes fueling demand for perishable goods, increasing e-commerce penetration necessitating efficient temperature-controlled transportation, and a growing focus on food safety and quality. The market's Compound Annual Growth Rate (CAGR) of 3.73% from 2025 to 2033 indicates a steady expansion, further fueled by the increasing adoption of advanced technologies like IoT sensors for real-time monitoring and automation in warehousing. The diverse segments within the market, including chilled, frozen, and value-added services (like blast freezing and inventory management), across applications like fruits & vegetables, dairy, meat & seafood, pharmaceuticals, and processed foods, provide ample opportunities for growth. Leading players like Lineage Logistics, Americold Logistics, and AustraCold are strategically investing in infrastructure and technology to cater to this expanding market. The growth is further expected to be supported by government initiatives aimed at improving the country's overall logistics infrastructure and cold chain efficiency.

Cold Chain Logistics in Australia Market Market Size (In Billion)

However, the market faces certain challenges. These include the high capital expenditure required for setting up and maintaining cold chain infrastructure, particularly in remote areas, and the increasing reliance on skilled labor to manage sophisticated technology and stringent regulatory compliance. Fluctuations in fuel prices and potential disruptions to the supply chain due to natural disasters also pose risks. Despite these restraints, the long-term outlook remains positive, driven by the continuous growth in the food and pharmaceutical sectors, and the increasing consumer preference for fresh and high-quality products, necessitating a robust and reliable cold chain system. Strategic partnerships and investments in sustainable and eco-friendly cold chain solutions are likely to shape the future of this dynamic market.

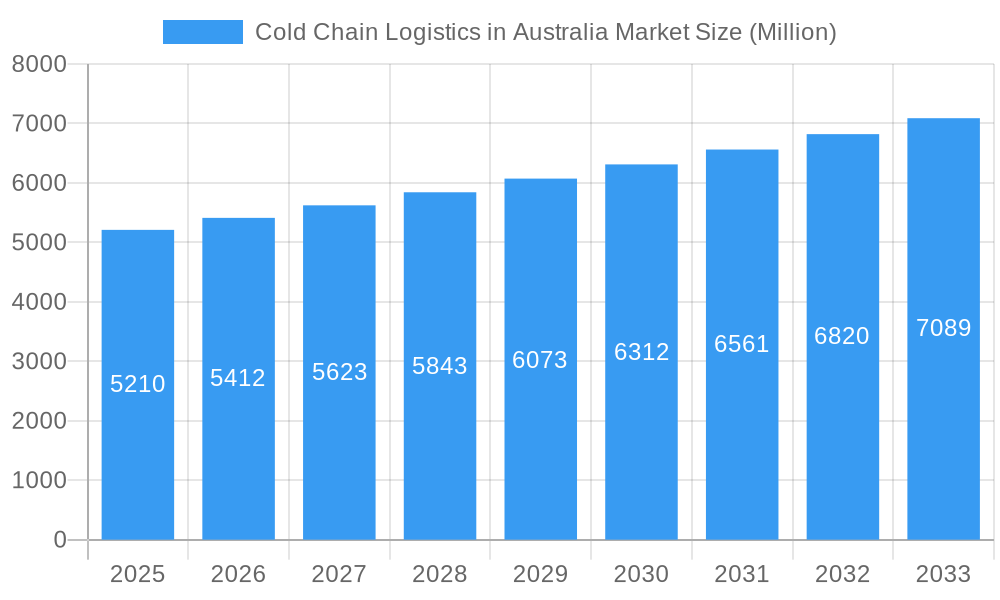

Cold Chain Logistics in Australia Market Company Market Share

Cold Chain Logistics in Australia Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australian cold chain logistics market, encompassing market size, growth trends, key players, and future prospects. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is invaluable for industry professionals, investors, and anyone seeking to understand this dynamic sector. The Australian cold chain logistics market is segmented by services (storage, transportation, value-added services), temperature type (chilled, frozen), and application (fruits & vegetables, dairy, meat & seafood, processed food, pharmaceuticals, bakery & confectionery, and other applications).

Cold Chain Logistics in Australia Market Dynamics & Structure

The Australian cold chain logistics market exhibits a moderately concentrated structure, with several large players alongside numerous smaller, regional operators. Technological innovation, particularly in temperature monitoring, automation, and sustainable solutions, is a key driver. Stringent regulatory frameworks concerning food safety and pharmaceutical handling significantly impact operations. Competitive substitutes, such as improved packaging technologies, also influence market dynamics. End-user demographics, characterized by a growing population and increasing demand for fresh and processed foods, fuel market expansion. The market has witnessed several mergers and acquisitions (M&A) in recent years, reflecting consolidation trends.

- Market Concentration: Moderately concentrated, with a top 5 market share of approximately xx%.

- Technological Innovation: Strong emphasis on automation, IoT-enabled monitoring, and sustainable cold chain solutions.

- Regulatory Framework: Stringent food safety and pharmaceutical regulations drive operational costs and standards.

- M&A Activity: xx deals completed between 2019 and 2024, with a total value of approximately xx million AUD.

- Innovation Barriers: High initial investment costs for advanced technologies and integration challenges.

Cold Chain Logistics in Australia Market Growth Trends & Insights

The Australian cold chain logistics market is experiencing robust growth, driven by factors including rising disposable incomes, changing consumer preferences towards fresh and convenient food, and the expanding e-commerce sector. The market size reached xx million AUD in 2024 and is projected to reach xx million AUD by 2033, exhibiting a CAGR of xx% during the forecast period. Technological disruptions, including the adoption of automation and data analytics, are improving efficiency and reducing costs. Consumer behavior shifts, such as a growing preference for online grocery shopping and home delivery, are significantly impacting the demand for reliable cold chain solutions. Market penetration of advanced technologies remains relatively low, presenting considerable opportunities for growth.

Dominant Regions, Countries, or Segments in Cold Chain Logistics in Australia Market

The eastern seaboard of Australia, encompassing New South Wales, Victoria, and Queensland, continues to be the epicenter of the cold chain logistics market. This dominance is fueled by their substantial population centers, sophisticated existing infrastructure networks, and significant contributions to the nation's agricultural output. Across the service spectrum, storage and transportation remain the primary revenue generators, though the segment of value-added services is demonstrating exceptional growth potential as businesses seek more integrated solutions. While the chilled segment currently holds a larger market share, both chilled and frozen segments are experiencing robust and sustained expansion. The food and beverage industry is the principal application driving demand, with fruits & vegetables, dairy products, and meat & seafood commanding the largest portions of this segment. Notably, the pharmaceuticals (including biopharma) sector is emerging as a rapidly growing application, propelled by the escalating demand for temperature-sensitive medicines and biologics.

- Key Growth Drivers: Escalating consumer expenditure on premium and fresh products, the pervasive expansion of e-commerce and online grocery platforms, and supportive government initiatives aimed at bolstering infrastructure development and technological adoption within the cold chain.

- Dominant Regions: New South Wales, Victoria, and Queensland, owing to their high population densities and established logistical hubs.

- Leading Segments: Dominated by storage and transportation services, the chilled temperature segment, and applications within fruits & vegetables, dairy products, and the burgeoning pharmaceuticals sector.

- Growth Potential: Significant opportunities lie in the expansion of value-added services, further development of the frozen food segment, and strategic outreach into previously underserved regional and remote areas.

Cold Chain Logistics in Australia Market Product Landscape

The Australian cold chain logistics market is witnessing continuous product innovation, particularly in areas like temperature-controlled containers, advanced monitoring systems, and efficient warehouse management solutions. New products focus on enhancing temperature control precision, reducing spoilage, improving traceability, and streamlining operations. Rotational moulded shippers, for example, offer extended temperature maintenance capabilities, representing a significant advancement. Companies are increasingly adopting energy-efficient technologies to minimize their environmental footprint.

Key Drivers, Barriers & Challenges in Cold Chain Logistics in Australia Market

Key Drivers:

- A sustained and increasing consumer appetite for fresh produce, specialty food items, and convenient processed foods.

- The relentless growth of e-commerce and the increasing reliance on efficient online grocery delivery services.

- Ever-tightening food safety standards and quality regulations, necessitating sophisticated temperature-controlled supply chains.

- The ongoing integration of technological advancements, including IoT, AI-powered analytics, and advanced real-time temperature monitoring systems, to enhance efficiency and product integrity.

Key Challenges:

- The substantial capital investment required for establishing and maintaining robust cold chain infrastructure, particularly in dispersed regional and remote locations.

- Persistent labor shortages and a widening skills gap within the logistics workforce, impacting operational capacity and efficiency.

- Volatility in global and domestic fuel prices, directly influencing transportation costs and overall operational expenses.

- Intense competition from both established international cold chain providers and agile domestic players, demanding continuous innovation and cost optimization.

Emerging Opportunities in Cold Chain Logistics in Australia Market

The Australian cold chain logistics landscape is ripe with emerging opportunities, presenting a dynamic environment for growth and innovation:

- Regional Expansion: Tapping into the growing agricultural production in regional and rural areas, establishing more localized cold chain hubs to minimize transit times and reduce spoilage.

- Technological Integration: The increasing adoption of cutting-edge technology, including Artificial Intelligence (AI) for predictive analytics and route optimization, and Blockchain for enhanced traceability and transparency throughout the supply chain.

- Healthcare & Pharma Growth: Capitalizing on the burgeoning pharmaceutical and healthcare sectors, driven by the rising demand for temperature-sensitive vaccines, biologics, and specialized medications requiring strict cold chain management.

- Sustainability Initiatives: A growing emphasis on developing and implementing environmentally sustainable practices, such as the adoption of renewable energy sources for cold storage, optimized routing to reduce emissions, and innovative packaging solutions to minimize the carbon footprint.

Growth Accelerators in the Cold Chain Logistics in Australia Market Industry

Long-term growth in the Australian cold chain logistics market will be fueled by strategic partnerships between logistics providers and food producers/pharmaceuticals companies, fostering greater efficiency and coordination throughout the supply chain. Technological innovation, especially in automation and data analytics, will continue to play a significant role. Government initiatives supporting infrastructure development and sustainable logistics practices will further contribute to market expansion.

Key Players Shaping the Cold Chain Logistics in Australia Market Market

- Lineage Logistics (includes Emergent Cold Chain and Swire Cold Storage)

- NewCold Advanced Cold Logistics

- Americold Logistics

- Global Cold Chain Solutions

- AustraCold

- Auscold Logistics PTY Ltd

- MFR Cool Logistics

- Kerry Logistics

- Karras Cold Logistics

- PakCan

- AGRO Merchants Group LLC

Notable Milestones in Cold Chain Logistics in Australia Market Sector

- July 2022: NewCold's USD 160 million investment expansion in its Melbourne facility, increasing capacity by 110,000 pallet positions. This signifies a major commitment to the Australian market and demonstrates growing demand.

- March 2022: Global Cold Chain Solutions launched new Rotational Moulded Shippers with enhanced temperature maintenance capabilities, improving the efficiency and reliability of temperature-sensitive goods transportation.

In-Depth Cold Chain Logistics in Australia Market Market Outlook

The Australian cold chain logistics market is set for a trajectory of sustained and robust growth. This expansion will be underpinned by continuous technological advancements, a persistent increase in demand for both fresh and processed food products, and the ongoing surge in the e-commerce sector. To maintain a competitive edge and adeptly meet the evolving demands of the market, strategic and significant investments in advanced infrastructure and innovative technological solutions will be paramount. Companies have a compelling opportunity to leverage pioneering solutions, extend their reach into previously underserved geographical areas, and prioritize sustainability to effectively capture market share and drive long-term prosperity. The market is also anticipated to witness further strategic consolidation through mergers and acquisitions (M&A) activity, which is expected to foster enhanced operational efficiencies and economies of scale across the industry.

Cold Chain Logistics in Australia Market Segmentation

-

1. Services

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Chilled

- 2.2. Frozen

-

3. Application

- 3.1. Fruits & Vegetables

- 3.2. Dairy Products

- 3.3. Meat and Seafood

- 3.4. Processed Food

- 3.5. Pharmaceuticals (Include Biopharma)

- 3.6. Bakery and Confectionery

- 3.7. Other Applications

Cold Chain Logistics in Australia Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cold Chain Logistics in Australia Market Regional Market Share

Geographic Coverage of Cold Chain Logistics in Australia Market

Cold Chain Logistics in Australia Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle

- 3.3. Market Restrains

- 3.3.1. Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits

- 3.4. Market Trends

- 3.4.1. Huge Demand for Meat Propelling Demand for Cold Chain Logistics in Australia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cold Chain Logistics in Australia Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Fruits & Vegetables

- 5.3.2. Dairy Products

- 5.3.3. Meat and Seafood

- 5.3.4. Processed Food

- 5.3.5. Pharmaceuticals (Include Biopharma)

- 5.3.6. Bakery and Confectionery

- 5.3.7. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. North America Cold Chain Logistics in Australia Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Services

- 6.1.1. Storage

- 6.1.2. Transportation

- 6.1.3. Value-ad

- 6.2. Market Analysis, Insights and Forecast - by Temperature Type

- 6.2.1. Chilled

- 6.2.2. Frozen

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Fruits & Vegetables

- 6.3.2. Dairy Products

- 6.3.3. Meat and Seafood

- 6.3.4. Processed Food

- 6.3.5. Pharmaceuticals (Include Biopharma)

- 6.3.6. Bakery and Confectionery

- 6.3.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Services

- 7. South America Cold Chain Logistics in Australia Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Services

- 7.1.1. Storage

- 7.1.2. Transportation

- 7.1.3. Value-ad

- 7.2. Market Analysis, Insights and Forecast - by Temperature Type

- 7.2.1. Chilled

- 7.2.2. Frozen

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Fruits & Vegetables

- 7.3.2. Dairy Products

- 7.3.3. Meat and Seafood

- 7.3.4. Processed Food

- 7.3.5. Pharmaceuticals (Include Biopharma)

- 7.3.6. Bakery and Confectionery

- 7.3.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Services

- 8. Europe Cold Chain Logistics in Australia Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Services

- 8.1.1. Storage

- 8.1.2. Transportation

- 8.1.3. Value-ad

- 8.2. Market Analysis, Insights and Forecast - by Temperature Type

- 8.2.1. Chilled

- 8.2.2. Frozen

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Fruits & Vegetables

- 8.3.2. Dairy Products

- 8.3.3. Meat and Seafood

- 8.3.4. Processed Food

- 8.3.5. Pharmaceuticals (Include Biopharma)

- 8.3.6. Bakery and Confectionery

- 8.3.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Services

- 9. Middle East & Africa Cold Chain Logistics in Australia Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Services

- 9.1.1. Storage

- 9.1.2. Transportation

- 9.1.3. Value-ad

- 9.2. Market Analysis, Insights and Forecast - by Temperature Type

- 9.2.1. Chilled

- 9.2.2. Frozen

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Fruits & Vegetables

- 9.3.2. Dairy Products

- 9.3.3. Meat and Seafood

- 9.3.4. Processed Food

- 9.3.5. Pharmaceuticals (Include Biopharma)

- 9.3.6. Bakery and Confectionery

- 9.3.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Services

- 10. Asia Pacific Cold Chain Logistics in Australia Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Services

- 10.1.1. Storage

- 10.1.2. Transportation

- 10.1.3. Value-ad

- 10.2. Market Analysis, Insights and Forecast - by Temperature Type

- 10.2.1. Chilled

- 10.2.2. Frozen

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Fruits & Vegetables

- 10.3.2. Dairy Products

- 10.3.3. Meat and Seafood

- 10.3.4. Processed Food

- 10.3.5. Pharmaceuticals (Include Biopharma)

- 10.3.6. Bakery and Confectionery

- 10.3.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Services

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Lineage Logistics (includes Emergent Cold Chain and Swire Cold Storage)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NewCold Advanced Cold Logistics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Americold Logistics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Global Cold Chain Solutions

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AustraCold**List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Auscold Logistics PTY Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MFR Cool Logistics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kerry Logistics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Karras Cold Logistics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 PakCan

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 AGRO Merchants Group LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Lineage Logistics (includes Emergent Cold Chain and Swire Cold Storage)

List of Figures

- Figure 1: Global Cold Chain Logistics in Australia Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cold Chain Logistics in Australia Market Revenue (Million), by Services 2025 & 2033

- Figure 3: North America Cold Chain Logistics in Australia Market Revenue Share (%), by Services 2025 & 2033

- Figure 4: North America Cold Chain Logistics in Australia Market Revenue (Million), by Temperature Type 2025 & 2033

- Figure 5: North America Cold Chain Logistics in Australia Market Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 6: North America Cold Chain Logistics in Australia Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Cold Chain Logistics in Australia Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Cold Chain Logistics in Australia Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Cold Chain Logistics in Australia Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Cold Chain Logistics in Australia Market Revenue (Million), by Services 2025 & 2033

- Figure 11: South America Cold Chain Logistics in Australia Market Revenue Share (%), by Services 2025 & 2033

- Figure 12: South America Cold Chain Logistics in Australia Market Revenue (Million), by Temperature Type 2025 & 2033

- Figure 13: South America Cold Chain Logistics in Australia Market Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 14: South America Cold Chain Logistics in Australia Market Revenue (Million), by Application 2025 & 2033

- Figure 15: South America Cold Chain Logistics in Australia Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America Cold Chain Logistics in Australia Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Cold Chain Logistics in Australia Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Cold Chain Logistics in Australia Market Revenue (Million), by Services 2025 & 2033

- Figure 19: Europe Cold Chain Logistics in Australia Market Revenue Share (%), by Services 2025 & 2033

- Figure 20: Europe Cold Chain Logistics in Australia Market Revenue (Million), by Temperature Type 2025 & 2033

- Figure 21: Europe Cold Chain Logistics in Australia Market Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 22: Europe Cold Chain Logistics in Australia Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Europe Cold Chain Logistics in Australia Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Cold Chain Logistics in Australia Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Cold Chain Logistics in Australia Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Cold Chain Logistics in Australia Market Revenue (Million), by Services 2025 & 2033

- Figure 27: Middle East & Africa Cold Chain Logistics in Australia Market Revenue Share (%), by Services 2025 & 2033

- Figure 28: Middle East & Africa Cold Chain Logistics in Australia Market Revenue (Million), by Temperature Type 2025 & 2033

- Figure 29: Middle East & Africa Cold Chain Logistics in Australia Market Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 30: Middle East & Africa Cold Chain Logistics in Australia Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Middle East & Africa Cold Chain Logistics in Australia Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Middle East & Africa Cold Chain Logistics in Australia Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Cold Chain Logistics in Australia Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Cold Chain Logistics in Australia Market Revenue (Million), by Services 2025 & 2033

- Figure 35: Asia Pacific Cold Chain Logistics in Australia Market Revenue Share (%), by Services 2025 & 2033

- Figure 36: Asia Pacific Cold Chain Logistics in Australia Market Revenue (Million), by Temperature Type 2025 & 2033

- Figure 37: Asia Pacific Cold Chain Logistics in Australia Market Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 38: Asia Pacific Cold Chain Logistics in Australia Market Revenue (Million), by Application 2025 & 2033

- Figure 39: Asia Pacific Cold Chain Logistics in Australia Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Asia Pacific Cold Chain Logistics in Australia Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Cold Chain Logistics in Australia Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cold Chain Logistics in Australia Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Global Cold Chain Logistics in Australia Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: Global Cold Chain Logistics in Australia Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Cold Chain Logistics in Australia Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Cold Chain Logistics in Australia Market Revenue Million Forecast, by Services 2020 & 2033

- Table 6: Global Cold Chain Logistics in Australia Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 7: Global Cold Chain Logistics in Australia Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Cold Chain Logistics in Australia Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Cold Chain Logistics in Australia Market Revenue Million Forecast, by Services 2020 & 2033

- Table 13: Global Cold Chain Logistics in Australia Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 14: Global Cold Chain Logistics in Australia Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Cold Chain Logistics in Australia Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Cold Chain Logistics in Australia Market Revenue Million Forecast, by Services 2020 & 2033

- Table 20: Global Cold Chain Logistics in Australia Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 21: Global Cold Chain Logistics in Australia Market Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global Cold Chain Logistics in Australia Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Cold Chain Logistics in Australia Market Revenue Million Forecast, by Services 2020 & 2033

- Table 33: Global Cold Chain Logistics in Australia Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 34: Global Cold Chain Logistics in Australia Market Revenue Million Forecast, by Application 2020 & 2033

- Table 35: Global Cold Chain Logistics in Australia Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Cold Chain Logistics in Australia Market Revenue Million Forecast, by Services 2020 & 2033

- Table 43: Global Cold Chain Logistics in Australia Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 44: Global Cold Chain Logistics in Australia Market Revenue Million Forecast, by Application 2020 & 2033

- Table 45: Global Cold Chain Logistics in Australia Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Cold Chain Logistics in Australia Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cold Chain Logistics in Australia Market?

The projected CAGR is approximately 3.73%.

2. Which companies are prominent players in the Cold Chain Logistics in Australia Market?

Key companies in the market include Lineage Logistics (includes Emergent Cold Chain and Swire Cold Storage), NewCold Advanced Cold Logistics, Americold Logistics, Global Cold Chain Solutions, AustraCold**List Not Exhaustive, Auscold Logistics PTY Ltd, MFR Cool Logistics, Kerry Logistics, Karras Cold Logistics, PakCan, AGRO Merchants Group LLC.

3. What are the main segments of the Cold Chain Logistics in Australia Market?

The market segments include Services, Temperature Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle.

6. What are the notable trends driving market growth?

Huge Demand for Meat Propelling Demand for Cold Chain Logistics in Australia.

7. Are there any restraints impacting market growth?

Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits.

8. Can you provide examples of recent developments in the market?

July 2022: NewCold, a pioneering Netherlands-based cold chain logistics company, announced a new customer and an additional USD 160 million investment in its Victorian state-of-the-art facility, bringing its total investment in Victoria to USD 460 million. NewCold's Melbourne 2 facility will more than double in size, providing customers with a powerhouse of advanced features and a seamless experience. The site will grow from 115,000 to 225,000 pallet positions at 43 meters in height, an increase of 110,000 pallets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cold Chain Logistics in Australia Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cold Chain Logistics in Australia Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cold Chain Logistics in Australia Market?

To stay informed about further developments, trends, and reports in the Cold Chain Logistics in Australia Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence