Key Insights

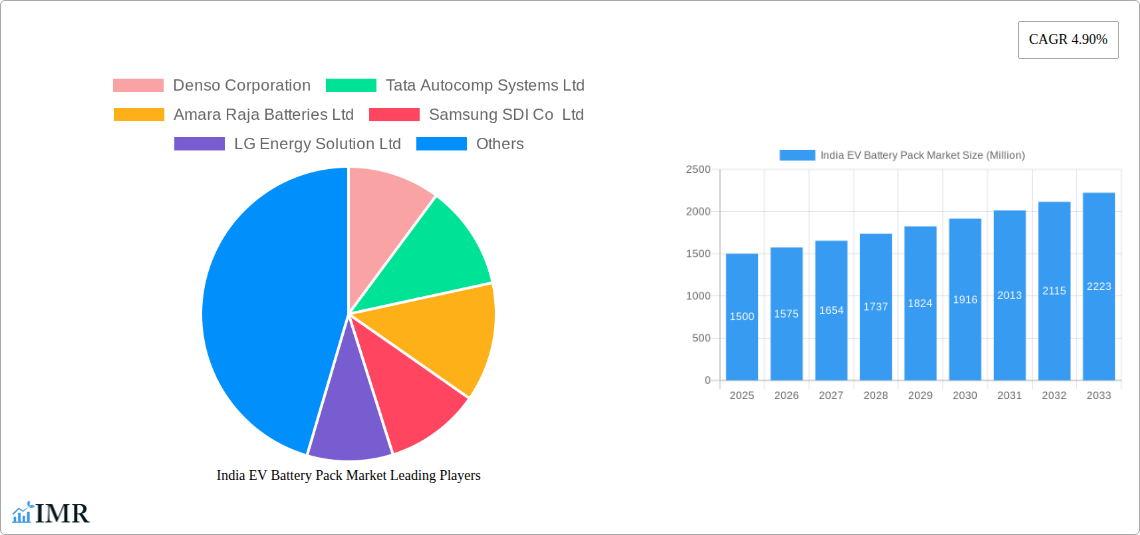

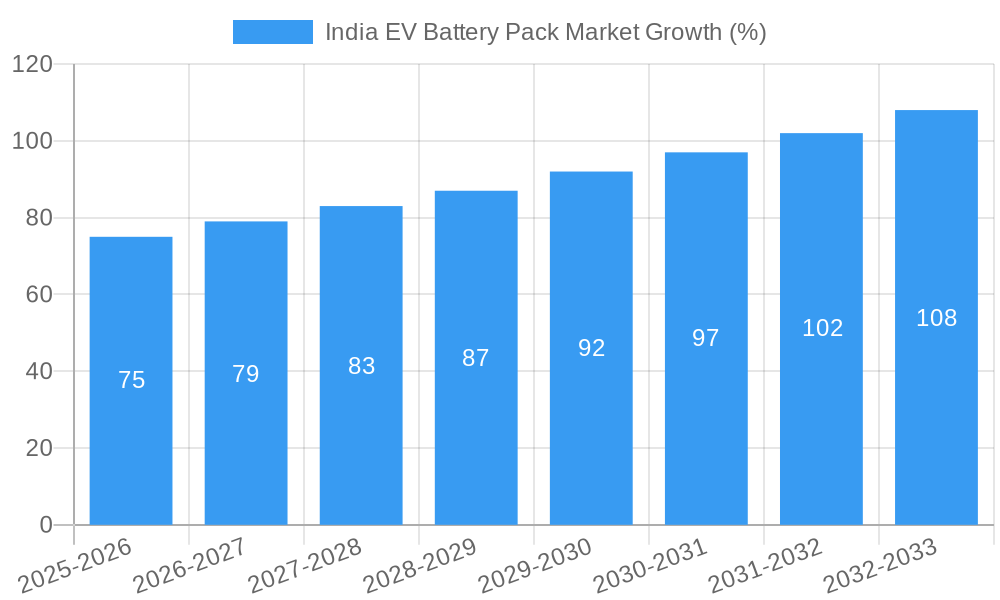

The India EV Battery Pack Market is experiencing robust growth, driven by the government's strong push towards electric mobility and increasing environmental concerns. With a CAGR of 4.90% from 2019-2024, the market is projected to continue its upward trajectory, reaching significant value by 2033. Several factors contribute to this growth, including increasing adoption of electric vehicles across segments (passenger cars, buses, light commercial vehicles), a burgeoning domestic manufacturing ecosystem, and declining battery costs. The market is segmented by propulsion type (BEV, PHEV), battery chemistry (LFP, NCM, NMC), capacity (various kWh ranges), battery form factor (cylindrical, pouch, prismatic), manufacturing methods, component type (anode, cathode, etc.), material type (lithium, cobalt, nickel, etc.), and vehicle type. The dominance of specific segments will likely shift over the forecast period, reflecting advancements in battery technology and evolving consumer preferences. While challenges remain, such as the need for enhanced charging infrastructure and the price sensitivity of the market, the long-term outlook for the India EV battery pack market remains positive.

The competitive landscape is dynamic, with both international and domestic players vying for market share. Companies like Tata Autocomp Systems, Amara Raja Batteries, Samsung SDI, LG Energy Solution, and CATL are key participants, leveraging their expertise in battery technology and manufacturing capabilities. Regional variations in market growth are expected, with potential higher growth rates in urban centers and states with supportive government policies. The increasing focus on localization of battery production, coupled with advancements in battery technology, is likely to influence pricing and overall market dynamics. This is fostering innovation and competition, ultimately accelerating the adoption of EVs and solidifying India's position as a key player in the global EV battery market. Sustained government incentives, focused research and development initiatives, and continued improvements in battery performance and affordability are critical for maintaining this growth trajectory.

India EV Battery Pack Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India EV Battery Pack Market, encompassing market dynamics, growth trends, regional dominance, product landscape, challenges, opportunities, and key players. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report segments the market by propulsion type (BEV, PHEV), battery chemistry (LFP, NCM, NMC, Others), capacity (Less than 15 kWh, 15 kWh to 40 kWh, 40 kWh to 80 kWh, Above 80 kWh), battery form (Cylindrical, Pouch, Prismatic), method (Laser, Wire), component (Anode, Cathode, Electrolyte, Separator), material type (Cobalt, Lithium, Manganese, Natural Graphite, Nickel, Other Materials), and body type (Passenger Car, LCV, M&HDT, Bus).

India EV Battery Pack Market Dynamics & Structure

The Indian EV battery pack market is experiencing significant growth, driven by government initiatives promoting electric mobility and increasing environmental concerns. Market concentration is moderate, with a few dominant players and several emerging companies. Technological innovation, particularly in battery chemistry and energy density, is a key driver. Stringent regulatory frameworks, including emission norms and battery safety standards, are shaping market development. The market faces competition from internal combustion engine (ICE) vehicles, but the cost advantage of EVs is becoming increasingly compelling. End-user demographics are shifting towards younger, environmentally conscious consumers in urban areas. M&A activity is increasing, with strategic partnerships and joint ventures becoming common.

- Market Concentration: Moderate, with xx% market share held by top 5 players in 2024.

- Technological Innovation: Focus on LFP and NMC chemistries, improved energy density, and fast-charging capabilities.

- Regulatory Framework: Stringent safety and performance standards drive higher quality and safety.

- Competitive Substitutes: ICE vehicles remain a significant competitor, but government incentives are shifting the landscape.

- End-User Demographics: Growing adoption among urban, younger, and environmentally conscious consumers.

- M&A Trends: Increasing strategic partnerships and joint ventures to enhance technology and market reach. xx M&A deals recorded in 2024.

India EV Battery Pack Market Growth Trends & Insights

The Indian EV battery pack market is projected to witness robust growth during the forecast period (2025-2033). The market size, currently valued at xx million units in 2025, is expected to reach xx million units by 2033, exhibiting a CAGR of xx%. This growth is fueled by several factors, including increasing government support for electric vehicles, rising consumer awareness of environmental issues, decreasing battery costs, and technological advancements leading to improved battery performance and range. The adoption rate is accelerating, with a significant increase in EV sales in recent years, particularly in the two-wheeler and passenger car segments. Technological disruptions, such as the emergence of solid-state batteries and improved battery management systems (BMS), are further enhancing market growth. Consumer behavior is shifting towards a preference for electric vehicles due to factors such as lower running costs and environmental benefits.

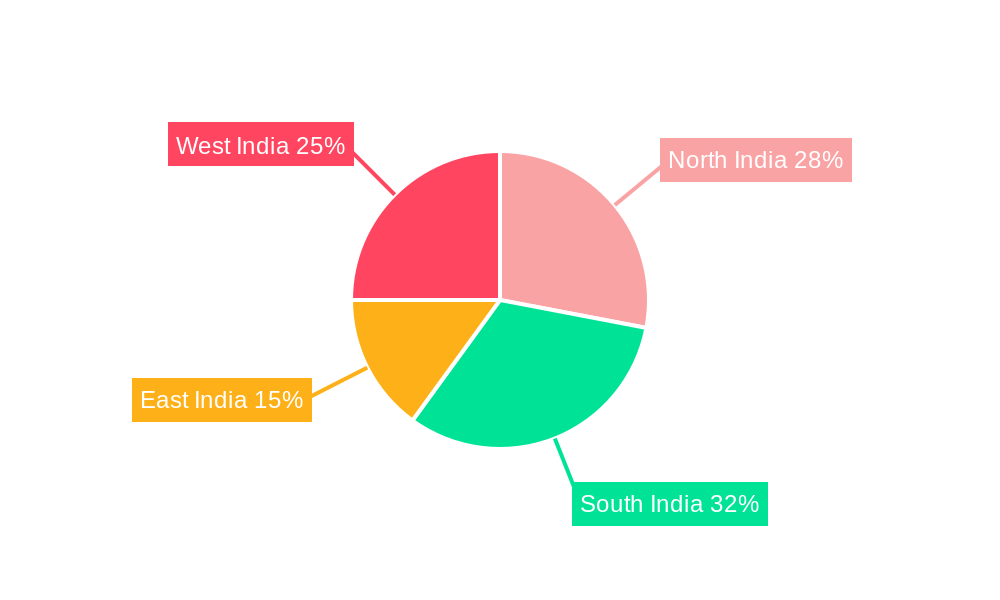

Dominant Regions, Countries, or Segments in India EV Battery Pack Market

The passenger car segment dominates the India EV battery pack market, accounting for xx% of the total market share in 2024, followed by the two-wheeler segment with xx%. Among battery chemistries, LFP batteries hold a significant share due to their cost-effectiveness, while NMC and NCM chemistries are gaining traction due to their higher energy density. The 15 kWh to 40 kWh capacity segment is currently the largest, but the higher capacity segments (40 kWh to 80 kWh and above 80 kWh) are expected to grow rapidly in the coming years. Maharashtra and Tamil Nadu are currently the leading states in terms of EV battery pack production and adoption.

- Key Drivers: Government incentives (FAME II, PLI schemes), expanding charging infrastructure, decreasing battery prices.

- Dominance Factors: Passenger car segment's large market share, LFP battery cost-effectiveness, favorable government policies in key states.

- Growth Potential: Higher capacity segments (above 40 kWh), improved battery chemistries (NMC, solid-state), expanding charging infrastructure.

India EV Battery Pack Market Product Landscape

The Indian EV battery pack market offers a diverse range of products catering to different vehicle types and applications. Innovations focus on enhancing energy density, improving safety features, extending battery lifespan, and reducing costs. Battery packs are designed with advanced thermal management systems to optimize performance and safety. Key selling propositions include high energy density, long lifespan, safety features, and compatibility with various vehicle platforms. Technological advancements include the use of advanced battery chemistries, improved battery management systems, and advanced manufacturing techniques.

Key Drivers, Barriers & Challenges in India EV Battery Pack Market

Key Drivers: Government initiatives promoting EV adoption (e.g., FAME-II), increasing environmental awareness, declining battery prices, technological advancements improving battery performance and range.

Challenges: High initial cost of EVs, limited charging infrastructure in certain regions, concerns about battery lifespan and safety, dependence on raw material imports, and supply chain vulnerabilities. The lack of skilled labor and manufacturing capacity also poses a challenge. Current import dependence on raw materials for battery production presents a significant challenge, potentially impacting cost and supply chain reliability.

Emerging Opportunities in India EV Battery Pack Market

Emerging opportunities include the expansion of the EV market into rural areas, the growth of the commercial vehicle segment (buses, LCVs), and the development of innovative battery solutions for specialized applications (e.g., e-rickshaws, three-wheelers). The increasing demand for energy storage solutions beyond EVs presents an opportunity for battery pack manufacturers to diversify. Growth in the two-wheeler and three-wheeler segments presents significant untapped potential.

Growth Accelerators in the India EV Battery Pack Market Industry

The long-term growth of the Indian EV battery pack market will be driven by continued technological breakthroughs in battery chemistry and energy density, strategic partnerships between battery manufacturers and vehicle manufacturers, and expansion of the EV charging infrastructure across the country. Government policies supporting domestic manufacturing and raw material sourcing will further accelerate market growth.

Key Players Shaping the India EV Battery Pack Market Market

- Denso Corporation

- Tata Autocomp Systems Ltd

- Amara Raja Batteries Ltd

- Samsung SDI Co Ltd

- LG Energy Solution Ltd

- Exide Industries Ltd

- Manikaran Power Ltd

- TOSHIBA Corp

- Contemporary Amperex Technology Co Ltd (CATL)

- Nexcharge

- Exicom Tele-Systems Ltd

- Panasonic Holdings Corporation

Notable Milestones in India EV Battery Pack Market Sector

- March 2023: Contemporary Amperex Technology Co., Ltd. (CATL) established a joint venture (JV) with FAW Jiefang Automotive Co., Ltd., signifying increased investment in the Indian EV battery market.

- March 2023: CATL signed a strategic cooperation agreement with BAIC Group, further strengthening its presence and partnerships within the Indian market.

- April 2023: CATL announced the launch of its sodium-ion battery in Chery models and the joint creation of the ENER-Q battery brand, indicating innovation and market expansion strategies.

In-Depth India EV Battery Pack Market Market Outlook

The future of the Indian EV battery pack market is bright, driven by strong government support, increasing consumer demand, and continuous technological advancements. Strategic partnerships and investments in domestic manufacturing will play a critical role in securing the long-term growth trajectory. The market presents significant opportunities for both established and emerging players. Focus on innovative battery chemistries, advanced manufacturing techniques, and the development of a robust charging infrastructure will be key factors determining future market success.

India EV Battery Pack Market Segmentation

-

1. Body Type

- 1.1. Bus

- 1.2. LCV

- 1.3. M&HDT

- 1.4. Passenger Car

-

2. Propulsion Type

- 2.1. BEV

- 2.2. PHEV

-

3. Battery Chemistry

- 3.1. LFP

- 3.2. NCM

- 3.3. NMC

- 3.4. Others

-

4. Capacity

- 4.1. 15 kWh to 40 kWh

- 4.2. 40 kWh to 80 kWh

- 4.3. Above 80 kWh

- 4.4. Less than 15 kWh

-

5. Battery Form

- 5.1. Cylindrical

- 5.2. Pouch

- 5.3. Prismatic

-

6. Method

- 6.1. Laser

- 6.2. Wire

-

7. Component

- 7.1. Anode

- 7.2. Cathode

- 7.3. Electrolyte

- 7.4. Separator

-

8. Material Type

- 8.1. Cobalt

- 8.2. Lithium

- 8.3. Manganese

- 8.4. Natural Graphite

- 8.5. Nickel

- 8.6. Other Materials

India EV Battery Pack Market Segmentation By Geography

- 1. India

India EV Battery Pack Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rise of Trade Agreements Between Nations; Increasing Volume of International Trade

- 3.3. Market Restrains

- 3.3.1. Surge in Fuel Costs Affecting the Market

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India EV Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 5.1.1. Bus

- 5.1.2. LCV

- 5.1.3. M&HDT

- 5.1.4. Passenger Car

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. BEV

- 5.2.2. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Battery Chemistry

- 5.3.1. LFP

- 5.3.2. NCM

- 5.3.3. NMC

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Capacity

- 5.4.1. 15 kWh to 40 kWh

- 5.4.2. 40 kWh to 80 kWh

- 5.4.3. Above 80 kWh

- 5.4.4. Less than 15 kWh

- 5.5. Market Analysis, Insights and Forecast - by Battery Form

- 5.5.1. Cylindrical

- 5.5.2. Pouch

- 5.5.3. Prismatic

- 5.6. Market Analysis, Insights and Forecast - by Method

- 5.6.1. Laser

- 5.6.2. Wire

- 5.7. Market Analysis, Insights and Forecast - by Component

- 5.7.1. Anode

- 5.7.2. Cathode

- 5.7.3. Electrolyte

- 5.7.4. Separator

- 5.8. Market Analysis, Insights and Forecast - by Material Type

- 5.8.1. Cobalt

- 5.8.2. Lithium

- 5.8.3. Manganese

- 5.8.4. Natural Graphite

- 5.8.5. Nickel

- 5.8.6. Other Materials

- 5.9. Market Analysis, Insights and Forecast - by Region

- 5.9.1. India

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 6. North India India EV Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India EV Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India EV Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India EV Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Denso Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Tata Autocomp Systems Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Amara Raja Batteries Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Samsung SDI Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 LG Energy Solution Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Exide Industries Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Manikaran Power Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 TOSHIBA Corp

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Contemporary Amperex Technology Co Ltd (CATL)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Nexcharge

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Exicom Tele-Systems Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Panasonic Holdings Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Denso Corporation

List of Figures

- Figure 1: India EV Battery Pack Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India EV Battery Pack Market Share (%) by Company 2024

List of Tables

- Table 1: India EV Battery Pack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India EV Battery Pack Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 3: India EV Battery Pack Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 4: India EV Battery Pack Market Revenue Million Forecast, by Battery Chemistry 2019 & 2032

- Table 5: India EV Battery Pack Market Revenue Million Forecast, by Capacity 2019 & 2032

- Table 6: India EV Battery Pack Market Revenue Million Forecast, by Battery Form 2019 & 2032

- Table 7: India EV Battery Pack Market Revenue Million Forecast, by Method 2019 & 2032

- Table 8: India EV Battery Pack Market Revenue Million Forecast, by Component 2019 & 2032

- Table 9: India EV Battery Pack Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 10: India EV Battery Pack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 11: India EV Battery Pack Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North India India EV Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: South India India EV Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: East India India EV Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: West India India EV Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India EV Battery Pack Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 17: India EV Battery Pack Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 18: India EV Battery Pack Market Revenue Million Forecast, by Battery Chemistry 2019 & 2032

- Table 19: India EV Battery Pack Market Revenue Million Forecast, by Capacity 2019 & 2032

- Table 20: India EV Battery Pack Market Revenue Million Forecast, by Battery Form 2019 & 2032

- Table 21: India EV Battery Pack Market Revenue Million Forecast, by Method 2019 & 2032

- Table 22: India EV Battery Pack Market Revenue Million Forecast, by Component 2019 & 2032

- Table 23: India EV Battery Pack Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 24: India EV Battery Pack Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India EV Battery Pack Market?

The projected CAGR is approximately 4.90%.

2. Which companies are prominent players in the India EV Battery Pack Market?

Key companies in the market include Denso Corporation, Tata Autocomp Systems Ltd, Amara Raja Batteries Ltd, Samsung SDI Co Ltd, LG Energy Solution Ltd, Exide Industries Ltd, Manikaran Power Ltd, TOSHIBA Corp, Contemporary Amperex Technology Co Ltd (CATL), Nexcharge, Exicom Tele-Systems Ltd, Panasonic Holdings Corporation.

3. What are the main segments of the India EV Battery Pack Market?

The market segments include Body Type, Propulsion Type, Battery Chemistry, Capacity, Battery Form, Method, Component, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Rise of Trade Agreements Between Nations; Increasing Volume of International Trade.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Surge in Fuel Costs Affecting the Market.

8. Can you provide examples of recent developments in the market?

April 2023: CATL announced that it will launch its sodium-ion battery in Chery models first. In addition, the two parties will jointly build the new ENER-Q battery brand, covering all application scenarios of all power types and all material systems.March 2023: Contemporary Amperex Technology Co., Ltd. (CATL) announced that it signed a strategic cooperation agreement on business cooperation and advanced technology development with Beijing Automotive Group Co., Ltd. (BAIC Group).March 2023: Contemporary Amperex Technology Co., Ltd. (CATL) announced that it has established a joint venture (JV) named Jiefang Shidai New Energy Technology Co., Ltd. with FAW Jiefang Automotive Co., Ltd. (FAW Jiefang). The JV has a registered capital of CNY 90 million, with CATL and FAW Jiefang each holding a 50% share.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India EV Battery Pack Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India EV Battery Pack Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India EV Battery Pack Market?

To stay informed about further developments, trends, and reports in the India EV Battery Pack Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence