Key Insights

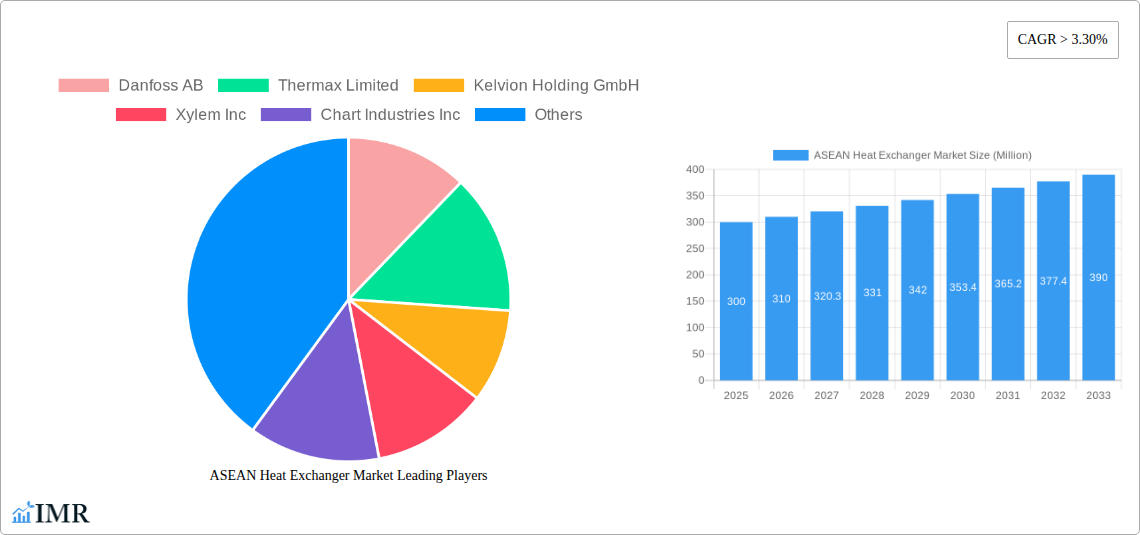

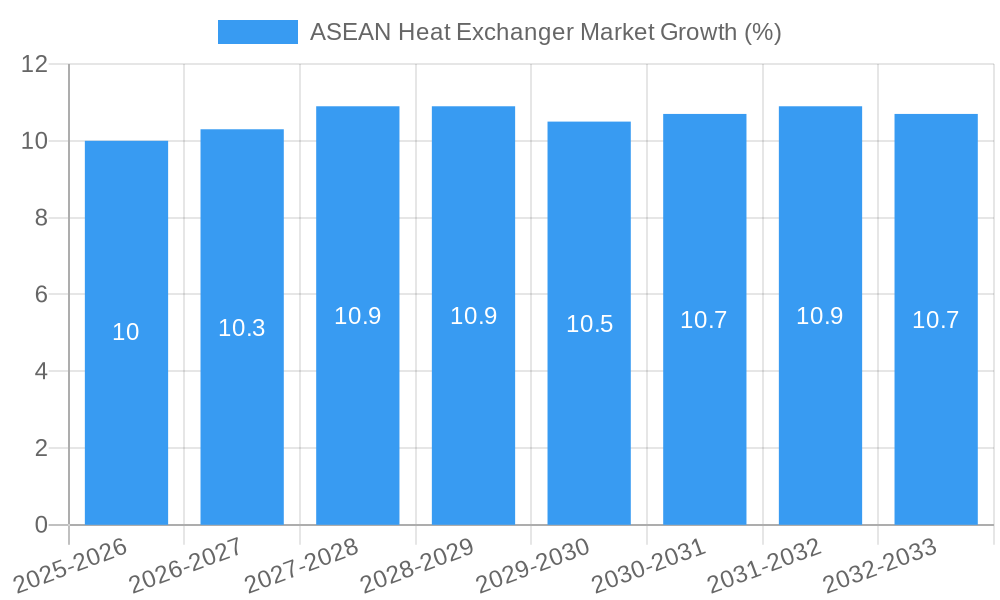

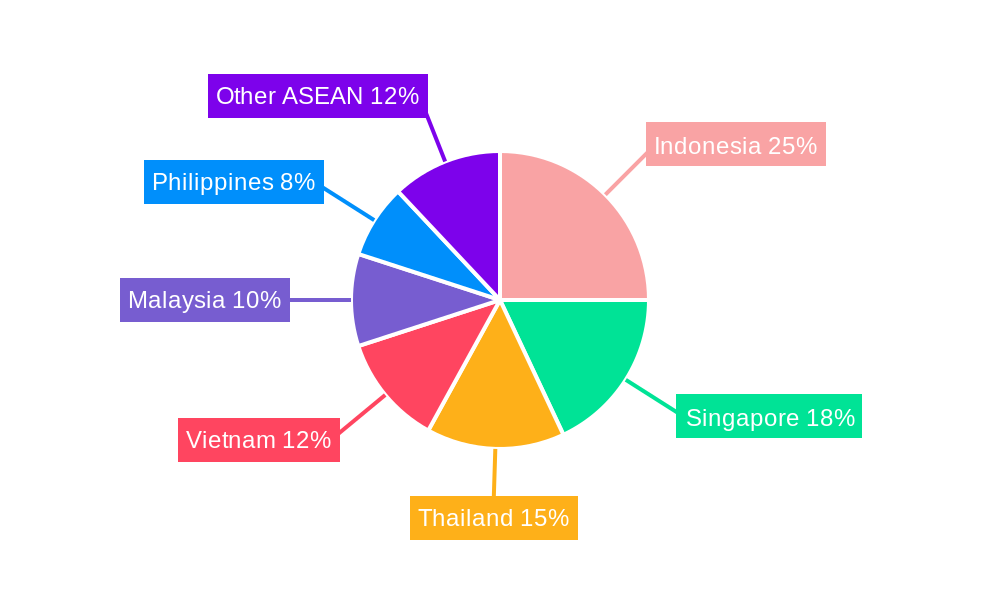

The ASEAN heat exchanger market is experiencing robust growth, fueled by the region's rapid industrialization and expanding energy sector. The market's Compound Annual Growth Rate (CAGR) exceeding 3.30% indicates a significant upward trajectory, driven primarily by increased demand from the oil and gas, power generation, and chemical industries. Rising investments in infrastructure projects across the ASEAN nations, particularly in power generation and petrochemical plants, are key catalysts for this growth. Furthermore, stringent environmental regulations promoting energy efficiency are driving the adoption of advanced heat exchanger technologies, such as plate and frame exchangers, known for their compact design and high efficiency. While a precise market size for ASEAN is unavailable, extrapolating from global trends and considering the region's economic dynamism, a conservative estimate would place the 2025 market value at approximately $300 million, with a projected increase to over $400 million by 2033. The segment breakdown likely shows a significant share held by shell and tube exchangers due to their prevalence in large-scale industrial applications, complemented by a growing share for plate and frame exchangers due to their efficiency benefits and suitability for smaller capacities. Growth is expected to be uneven across ASEAN nations, with major economies like Indonesia, Singapore, Thailand, and Vietnam contributing most significantly to overall market expansion. Competitive pressures are expected to intensify with established global players and regional manufacturers vying for market share. Challenges include managing material costs, ensuring consistent supply chains, and adapting to evolving technological advancements.

The future outlook for the ASEAN heat exchanger market remains positive, with continued growth anticipated throughout the forecast period. The sustained focus on industrial development, energy security, and environmental sustainability will create significant opportunities for heat exchanger manufacturers and suppliers. However, potential economic fluctuations and geopolitical factors need to be considered for accurate forecasting. The market will likely witness further technological advancements, including the adoption of innovative materials and designs to enhance performance and efficiency while reducing environmental impact. This will necessitate continuous investment in research and development, strategic partnerships, and a keen understanding of evolving customer needs to ensure sustainable growth in this dynamic market.

ASEAN Heat Exchanger Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the ASEAN heat exchanger market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The report covers the period 2019-2033, with 2025 as the base and estimated year. It offers invaluable insights for industry professionals, investors, and strategic decision-makers seeking to navigate this dynamic market. The market is segmented by construction type (shell and tube, plate and frame, other construction types) and end-user (oil and gas, power generation, chemical, others). The total market size is projected at xx Million units by 2033.

ASEAN Heat Exchanger Market Dynamics & Structure

The ASEAN heat exchanger market is characterized by a moderately concentrated landscape, with key players like Danfoss AB, Thermax Limited, Kelvion Holding GmbH, Xylem Inc, Chart Industries Inc, SPX FLOW Inc, Barriquand Technologies Thermiques SAS, General Electric Company, Hisaka Works Ltd, and Alfa Laval AB holding significant market share. However, the presence of several smaller, regional players indicates a competitive environment.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025.

- Technological Innovation: Advancements in materials science, heat transfer efficiency, and automation are driving innovation. However, high R&D costs and the need for specialized expertise present barriers to entry for new players.

- Regulatory Framework: Stringent environmental regulations regarding emissions and energy efficiency are shaping market demand, particularly in the oil and gas and power generation sectors.

- Competitive Product Substitutes: Alternative technologies, such as thermoelectric coolers, are emerging but have limited applicability in certain high-temperature applications.

- End-User Demographics: The expanding industrial sector, particularly in manufacturing, petrochemicals and power generation, fuels market growth. Government initiatives focused on infrastructure development also contribute positively.

- M&A Trends: The past five years have witnessed xx M&A deals in the ASEAN heat exchanger market, primarily focused on expanding geographical reach and technological capabilities. This trend is expected to continue, with an estimated xx deals anticipated in the forecast period.

ASEAN Heat Exchanger Market Growth Trends & Insights

The ASEAN heat exchanger market has witnessed substantial growth over the historical period (2019-2024), driven by robust industrial expansion, rising energy demand, and government investments in infrastructure projects. The market size expanded from xx Million units in 2019 to xx Million units in 2024, registering a CAGR of xx%. This positive trajectory is projected to continue throughout the forecast period (2025-2033), with an anticipated CAGR of xx%, reaching xx Million units by 2033. The adoption rate of high-efficiency heat exchangers is also increasing, driven by factors such as stringent emission norms and rising energy costs. Technological disruptions, like the integration of IoT sensors for predictive maintenance and the development of advanced materials for enhanced heat transfer, further contribute to market growth. Consumer behavior shifts towards environmentally sustainable solutions are creating new demand for energy-efficient heat exchanger technologies.

Dominant Regions, Countries, or Segments in ASEAN Heat Exchanger Market

Indonesia and Singapore are currently the leading markets within ASEAN, driven by robust industrial activity and significant investments in infrastructure development. The oil and gas sector, particularly in Indonesia and Malaysia, represents a dominant end-user segment, followed by the power generation sector. Within construction types, shell and tube heat exchangers hold the largest market share due to their versatility and suitability for various applications.

- Key Drivers in Indonesia: Government initiatives promoting industrialization and energy sector development are key drivers.

- Key Drivers in Singapore: Strong economic growth, advanced manufacturing, and emphasis on energy efficiency contribute to the market's dominance.

- Oil and Gas Sector Dominance: High demand for heat exchangers in refineries and processing plants fuels segment growth.

- Shell and Tube Heat Exchanger Dominance: Robust performance, adaptability, and established technological maturity contribute to market leadership.

ASEAN Heat Exchanger Market Product Landscape

The ASEAN heat exchanger market features a diverse range of products, including shell and tube, plate and frame, and other specialized designs. Recent innovations include the incorporation of advanced materials like graphene for enhanced thermal conductivity and the integration of smart sensors for improved performance monitoring and predictive maintenance. These advancements are designed to improve energy efficiency, reduce operational costs, and extend the lifespan of the equipment. Unique selling propositions include customized designs to meet specific application requirements, optimized heat transfer performance, and ease of maintenance.

Key Drivers, Barriers & Challenges in ASEAN Heat Exchanger Market

Key Drivers: Rising industrialization, increasing energy demand, stringent emission regulations, and government investments in infrastructure projects are driving market growth. The need for efficient heat transfer in various industries, including oil & gas, power generation, and chemicals, is also a significant driver.

Challenges: High initial investment costs for advanced heat exchangers, supply chain disruptions, and intense competition from established and emerging players pose challenges. Furthermore, fluctuations in raw material prices and technological advancements can impact market dynamics. The complexity of maintaining heat exchanger units also affects the market, especially in regions with limited technical expertise.

Emerging Opportunities in ASEAN Heat Exchanger Market

Growing demand from renewable energy sectors (geothermal, solar thermal) presents significant opportunities. The increasing adoption of energy-efficient technologies, driven by environmental concerns and cost savings, creates further opportunities. The need for specialized heat exchangers in emerging applications, such as waste heat recovery and industrial process optimization, opens new avenues for market expansion.

Growth Accelerators in the ASEAN Heat Exchanger Market Industry

Technological advancements in materials science and manufacturing processes continue to improve efficiency and reduce costs. Strategic partnerships between manufacturers and end-users to develop customized solutions are also accelerating growth. Government support for energy efficiency initiatives and infrastructure projects further boosts market expansion.

Key Players Shaping the ASEAN Heat Exchanger Market Market

- Danfoss AB

- Thermax Limited

- Kelvion Holding GmbH

- Xylem Inc

- Chart Industries Inc

- SPX FLOW Inc

- Barriquand Technologies Thermiques SAS

- General Electric Company

- Hisaka Works Ltd

- Alfa Laval AB

Notable Milestones in ASEAN Heat Exchanger Market Sector

- June 2021: Leakage issues at an Indonesian oil refinery highlighted the need for robust flange joint solutions, leading to increased demand for advanced gasket technologies.

- May 2021: Vitherm secured a replacement order for a steam condenser in a Malaysian oil and gas plant, demonstrating the market's ongoing need for high-performance heat exchangers in the energy sector.

In-Depth ASEAN Heat Exchanger Market Market Outlook

The ASEAN heat exchanger market is poised for continued growth, driven by ongoing industrialization, rising energy demand, and supportive government policies. Strategic investments in research and development, along with the adoption of innovative technologies, will further propel market expansion. Opportunities exist in emerging sectors like renewable energy and specialized industrial applications. The focus on energy efficiency and sustainable practices will continue to shape the market landscape, presenting lucrative opportunities for manufacturers and investors alike.

ASEAN Heat Exchanger Market Segmentation

-

1. Construction Type

- 1.1. Shell and Tube

- 1.2. Plate and Frame

- 1.3. Other Construction Types

-

2. End-User

- 2.1. Oil and Gas

- 2.2. Power Generation

- 2.3. Chemical

- 2.4. Others End-Users

-

3. Geography

- 3.1. Singapore

- 3.2. Malaysia

- 3.3. Thailand

- 3.4. Indonesia

- 3.5. Rest of ASEAN Countries

ASEAN Heat Exchanger Market Segmentation By Geography

- 1. Singapore

- 2. Malaysia

- 3. Thailand

- 4. Indonesia

- 5. Rest of ASEAN Countries

ASEAN Heat Exchanger Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Industrialization across the World4.; Expansion and Development of New Power Plants

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Shell and Tube Heat Exchangers Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Heat Exchanger Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Construction Type

- 5.1.1. Shell and Tube

- 5.1.2. Plate and Frame

- 5.1.3. Other Construction Types

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Oil and Gas

- 5.2.2. Power Generation

- 5.2.3. Chemical

- 5.2.4. Others End-Users

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Singapore

- 5.3.2. Malaysia

- 5.3.3. Thailand

- 5.3.4. Indonesia

- 5.3.5. Rest of ASEAN Countries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Singapore

- 5.4.2. Malaysia

- 5.4.3. Thailand

- 5.4.4. Indonesia

- 5.4.5. Rest of ASEAN Countries

- 5.1. Market Analysis, Insights and Forecast - by Construction Type

- 6. Singapore ASEAN Heat Exchanger Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Construction Type

- 6.1.1. Shell and Tube

- 6.1.2. Plate and Frame

- 6.1.3. Other Construction Types

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Oil and Gas

- 6.2.2. Power Generation

- 6.2.3. Chemical

- 6.2.4. Others End-Users

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Singapore

- 6.3.2. Malaysia

- 6.3.3. Thailand

- 6.3.4. Indonesia

- 6.3.5. Rest of ASEAN Countries

- 6.1. Market Analysis, Insights and Forecast - by Construction Type

- 7. Malaysia ASEAN Heat Exchanger Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Construction Type

- 7.1.1. Shell and Tube

- 7.1.2. Plate and Frame

- 7.1.3. Other Construction Types

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Oil and Gas

- 7.2.2. Power Generation

- 7.2.3. Chemical

- 7.2.4. Others End-Users

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Singapore

- 7.3.2. Malaysia

- 7.3.3. Thailand

- 7.3.4. Indonesia

- 7.3.5. Rest of ASEAN Countries

- 7.1. Market Analysis, Insights and Forecast - by Construction Type

- 8. Thailand ASEAN Heat Exchanger Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Construction Type

- 8.1.1. Shell and Tube

- 8.1.2. Plate and Frame

- 8.1.3. Other Construction Types

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Oil and Gas

- 8.2.2. Power Generation

- 8.2.3. Chemical

- 8.2.4. Others End-Users

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Singapore

- 8.3.2. Malaysia

- 8.3.3. Thailand

- 8.3.4. Indonesia

- 8.3.5. Rest of ASEAN Countries

- 8.1. Market Analysis, Insights and Forecast - by Construction Type

- 9. Indonesia ASEAN Heat Exchanger Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Construction Type

- 9.1.1. Shell and Tube

- 9.1.2. Plate and Frame

- 9.1.3. Other Construction Types

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Oil and Gas

- 9.2.2. Power Generation

- 9.2.3. Chemical

- 9.2.4. Others End-Users

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Singapore

- 9.3.2. Malaysia

- 9.3.3. Thailand

- 9.3.4. Indonesia

- 9.3.5. Rest of ASEAN Countries

- 9.1. Market Analysis, Insights and Forecast - by Construction Type

- 10. Rest of ASEAN Countries ASEAN Heat Exchanger Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Construction Type

- 10.1.1. Shell and Tube

- 10.1.2. Plate and Frame

- 10.1.3. Other Construction Types

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Oil and Gas

- 10.2.2. Power Generation

- 10.2.3. Chemical

- 10.2.4. Others End-Users

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Singapore

- 10.3.2. Malaysia

- 10.3.3. Thailand

- 10.3.4. Indonesia

- 10.3.5. Rest of ASEAN Countries

- 10.1. Market Analysis, Insights and Forecast - by Construction Type

- 11. North America ASEAN Heat Exchanger Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe ASEAN Heat Exchanger Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific ASEAN Heat Exchanger Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America ASEAN Heat Exchanger Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America ASEAN Heat Exchanger Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA ASEAN Heat Exchanger Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Danfoss AB

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Thermax Limited

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Kelvion Holding GmbH

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Xylem Inc

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Chart Industries Inc

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 SPX FLOW Inc

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Barriquand Technologies Thermiques SAS*List Not Exhaustive

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 General Electric Company

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Hisaka Works Ltd

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Alfa Laval AB

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 Danfoss AB

List of Figures

- Figure 1: Global ASEAN Heat Exchanger Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America ASEAN Heat Exchanger Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America ASEAN Heat Exchanger Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe ASEAN Heat Exchanger Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe ASEAN Heat Exchanger Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific ASEAN Heat Exchanger Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific ASEAN Heat Exchanger Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America ASEAN Heat Exchanger Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America ASEAN Heat Exchanger Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America ASEAN Heat Exchanger Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America ASEAN Heat Exchanger Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA ASEAN Heat Exchanger Market Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA ASEAN Heat Exchanger Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Singapore ASEAN Heat Exchanger Market Revenue (Million), by Construction Type 2024 & 2032

- Figure 15: Singapore ASEAN Heat Exchanger Market Revenue Share (%), by Construction Type 2024 & 2032

- Figure 16: Singapore ASEAN Heat Exchanger Market Revenue (Million), by End-User 2024 & 2032

- Figure 17: Singapore ASEAN Heat Exchanger Market Revenue Share (%), by End-User 2024 & 2032

- Figure 18: Singapore ASEAN Heat Exchanger Market Revenue (Million), by Geography 2024 & 2032

- Figure 19: Singapore ASEAN Heat Exchanger Market Revenue Share (%), by Geography 2024 & 2032

- Figure 20: Singapore ASEAN Heat Exchanger Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Singapore ASEAN Heat Exchanger Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Malaysia ASEAN Heat Exchanger Market Revenue (Million), by Construction Type 2024 & 2032

- Figure 23: Malaysia ASEAN Heat Exchanger Market Revenue Share (%), by Construction Type 2024 & 2032

- Figure 24: Malaysia ASEAN Heat Exchanger Market Revenue (Million), by End-User 2024 & 2032

- Figure 25: Malaysia ASEAN Heat Exchanger Market Revenue Share (%), by End-User 2024 & 2032

- Figure 26: Malaysia ASEAN Heat Exchanger Market Revenue (Million), by Geography 2024 & 2032

- Figure 27: Malaysia ASEAN Heat Exchanger Market Revenue Share (%), by Geography 2024 & 2032

- Figure 28: Malaysia ASEAN Heat Exchanger Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Malaysia ASEAN Heat Exchanger Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Thailand ASEAN Heat Exchanger Market Revenue (Million), by Construction Type 2024 & 2032

- Figure 31: Thailand ASEAN Heat Exchanger Market Revenue Share (%), by Construction Type 2024 & 2032

- Figure 32: Thailand ASEAN Heat Exchanger Market Revenue (Million), by End-User 2024 & 2032

- Figure 33: Thailand ASEAN Heat Exchanger Market Revenue Share (%), by End-User 2024 & 2032

- Figure 34: Thailand ASEAN Heat Exchanger Market Revenue (Million), by Geography 2024 & 2032

- Figure 35: Thailand ASEAN Heat Exchanger Market Revenue Share (%), by Geography 2024 & 2032

- Figure 36: Thailand ASEAN Heat Exchanger Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Thailand ASEAN Heat Exchanger Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Indonesia ASEAN Heat Exchanger Market Revenue (Million), by Construction Type 2024 & 2032

- Figure 39: Indonesia ASEAN Heat Exchanger Market Revenue Share (%), by Construction Type 2024 & 2032

- Figure 40: Indonesia ASEAN Heat Exchanger Market Revenue (Million), by End-User 2024 & 2032

- Figure 41: Indonesia ASEAN Heat Exchanger Market Revenue Share (%), by End-User 2024 & 2032

- Figure 42: Indonesia ASEAN Heat Exchanger Market Revenue (Million), by Geography 2024 & 2032

- Figure 43: Indonesia ASEAN Heat Exchanger Market Revenue Share (%), by Geography 2024 & 2032

- Figure 44: Indonesia ASEAN Heat Exchanger Market Revenue (Million), by Country 2024 & 2032

- Figure 45: Indonesia ASEAN Heat Exchanger Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: Rest of ASEAN Countries ASEAN Heat Exchanger Market Revenue (Million), by Construction Type 2024 & 2032

- Figure 47: Rest of ASEAN Countries ASEAN Heat Exchanger Market Revenue Share (%), by Construction Type 2024 & 2032

- Figure 48: Rest of ASEAN Countries ASEAN Heat Exchanger Market Revenue (Million), by End-User 2024 & 2032

- Figure 49: Rest of ASEAN Countries ASEAN Heat Exchanger Market Revenue Share (%), by End-User 2024 & 2032

- Figure 50: Rest of ASEAN Countries ASEAN Heat Exchanger Market Revenue (Million), by Geography 2024 & 2032

- Figure 51: Rest of ASEAN Countries ASEAN Heat Exchanger Market Revenue Share (%), by Geography 2024 & 2032

- Figure 52: Rest of ASEAN Countries ASEAN Heat Exchanger Market Revenue (Million), by Country 2024 & 2032

- Figure 53: Rest of ASEAN Countries ASEAN Heat Exchanger Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 3: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Belgium ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Netherland ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Nordics ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: India ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Korea ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Southeast Asia ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Australia ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Indonesia ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Phillipes ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Singapore ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Thailandc ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Asia Pacific ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Brazil ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Argentina ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Peru ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Chile ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Colombia ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Ecuador ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Venezuela ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of South America ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: United States ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Canada ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Mexico ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: United Arab Emirates ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Saudi Arabia ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Africa ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Middle East and Africa ASEAN Heat Exchanger Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 52: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 53: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 54: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Country 2019 & 2032

- Table 55: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 56: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 57: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 58: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 60: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 61: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 62: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Country 2019 & 2032

- Table 63: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 64: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 65: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 66: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Country 2019 & 2032

- Table 67: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 68: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 69: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 70: Global ASEAN Heat Exchanger Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Heat Exchanger Market?

The projected CAGR is approximately > 3.30%.

2. Which companies are prominent players in the ASEAN Heat Exchanger Market?

Key companies in the market include Danfoss AB, Thermax Limited, Kelvion Holding GmbH, Xylem Inc, Chart Industries Inc, SPX FLOW Inc, Barriquand Technologies Thermiques SAS*List Not Exhaustive, General Electric Company, Hisaka Works Ltd, Alfa Laval AB.

3. What are the main segments of the ASEAN Heat Exchanger Market?

The market segments include Construction Type, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Industrialization across the World4.; Expansion and Development of New Power Plants.

6. What are the notable trends driving market growth?

Shell and Tube Heat Exchangers Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

In June 2021, field engineers at an oil refinery in Indonesia were working to resolve issues (certain industries that utilize piping flange joint assemblies, such as petrochemical, dictate a low tolerance for leaks, or fugitive emissions. Areas subject to high temperatures and thermal cycling can cause stress to flange joints, causing the bolted connections to lose tension and leak fugitive emissions) with leaking heat exchangers. Hence, the team approached Solon Manufacturing Co. about live loading Solon Flange Washers or Belleville springs with higher loads designed to be used in flange applications, onto the gasket in order to maintain sufficient bolt tension and resultant gasket stresses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Heat Exchanger Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Heat Exchanger Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Heat Exchanger Market?

To stay informed about further developments, trends, and reports in the ASEAN Heat Exchanger Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence