Key Insights

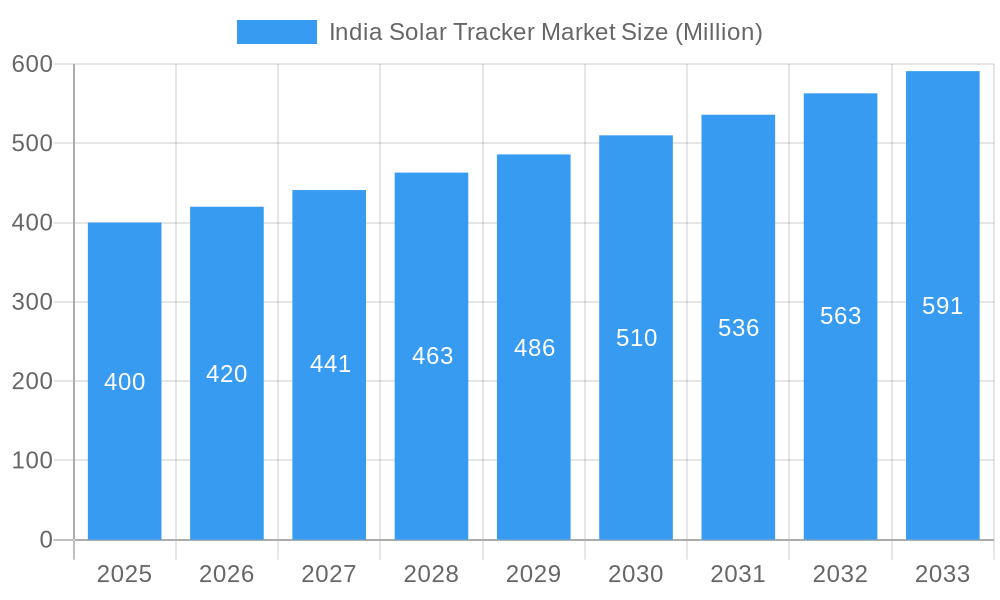

The India solar tracker market is poised for significant expansion, driven by the nation's robust renewable energy objectives and escalating solar power deployment across residential, commercial, and utility-scale applications. The market, currently valued at 286.8 million and projected to grow at a Compound Annual Growth Rate (CAGR) of 5.21% from the base year 2024 to 2033, is underpinned by government incentives, decreasing solar panel costs, and the imperative for efficient land utilization. A key trend is the increasing preference for dual-axis trackers due to their superior energy yield. Despite challenges like high initial investment and grid infrastructure constraints, the outlook for solar trackers in India is exceptionally positive. Utility-scale projects are currently the primary market driver, with all application sectors demonstrating strong demand. Leading entities such as NexTracker Inc and Valmont Industries Inc are actively shaping this growth through competition and innovation. Opportunities for expansion are present nationwide, particularly in regions with ample sunlight and available land.

India Solar Tracker Market Market Size (In Million)

The market encompasses diverse tracker types, including photovoltaic and concentrated solar power, catering to varied project needs. The emphasis on maximizing energy generation efficiency is accelerating the adoption of advanced tracking technologies. Ongoing research into durable and cost-effective materials and designs will further bolster the competitiveness of solar trackers in India. Strategic collaborations between tracker manufacturers and solar power developers are crucial for market acceleration and establishing a resilient supply chain. Streamlined government policies to simplify installation and reduce regulatory barriers will be instrumental in realizing the full potential of this dynamic sector.

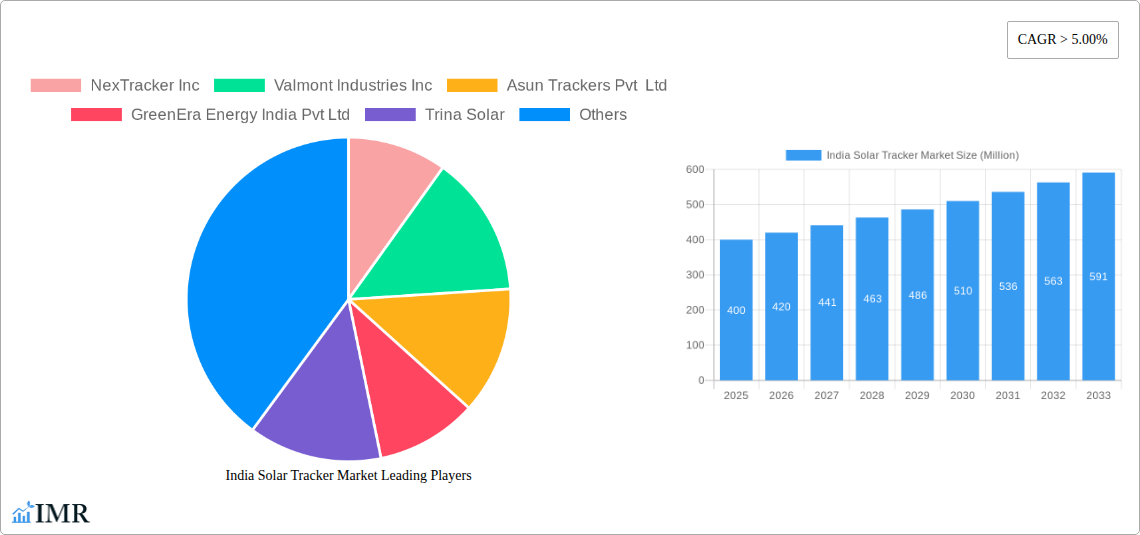

India Solar Tracker Market Company Market Share

India Solar Tracker Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Solar Tracker Market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The report examines the parent market of renewable energy and the child market of solar power tracking systems in India. The market size is projected to reach xx Million units by 2033.

India Solar Tracker Market Dynamics & Structure

The Indian solar tracker market is characterized by increasing market concentration, driven by technological advancements and strategic mergers and acquisitions (M&A). The market is witnessing a shift towards advanced single and dual-axis trackers, spurred by government initiatives promoting renewable energy. Regulatory frameworks, including the Jawaharlal Nehru National Solar Mission (JNNSM), play a significant role in shaping market growth. However, high initial investment costs and land availability remain challenges. Competitive pressure from established players and new entrants is also intensifying.

- Market Concentration: The top five players hold approximately xx% of the market share in 2025 (estimated).

- Technological Innovation: Focus on increasing efficiency, durability, and cost-effectiveness of trackers, particularly in dual-axis systems.

- Regulatory Framework: Government policies and subsidies are driving adoption, but inconsistencies in regulations across states pose challenges.

- Competitive Landscape: Intense competition among domestic and international players. M&A activity is expected to further consolidate the market. xx M&A deals were recorded between 2019 and 2024.

- End-User Demographics: Significant growth is expected from utility-scale projects, followed by commercial and residential segments.

India Solar Tracker Market Growth Trends & Insights

The India solar tracker market exhibits substantial growth potential, fueled by the government's ambitious renewable energy targets and the increasing demand for solar power. The market size experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). This growth is driven by factors such as decreasing tracker costs, technological advancements, and supportive government policies. Market penetration is expected to increase from xx% in 2024 to xx% by 2033. Consumer behavior is shifting towards more efficient and cost-effective solutions, emphasizing the importance of long-term performance and maintenance. Technological disruptions, including AI-powered trackers and improved software integration, are expected to further boost market growth.

Dominant Regions, Countries, or Segments in India Solar Tracker Market

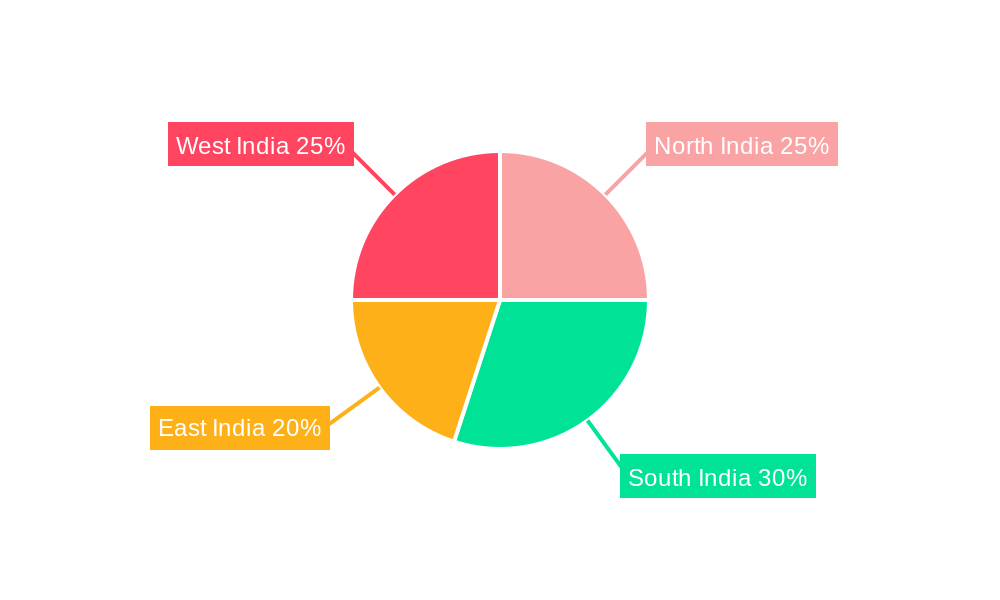

The utility-scale segment dominates the India solar tracker market, driven by large-scale solar power project installations across states like Gujarat, Rajasthan, and Karnataka. These states benefit from high solar irradiance and supportive government policies. Single-axis trackers represent the majority of the market share, given their cost-effectiveness compared to dual-axis trackers. Photovoltaic (PV) technology is the primary application for solar trackers, although Concentrated Solar Power (CSP) is emerging as a niche segment.

- Key Drivers:

- Government policies: JNNSM and other initiatives promoting renewable energy adoption.

- Infrastructure development: Investments in transmission and distribution networks are facilitating solar power project installations.

- Decreasing costs: Improved manufacturing processes and economies of scale are making solar trackers more affordable.

- Dominance Factors:

- Utility-scale projects: Large-scale projects contribute significantly to overall market demand.

- Single-axis trackers: Cost-effective solution with acceptable performance levels.

- Geographical distribution: Favorable solar irradiation in certain states.

India Solar Tracker Market Product Landscape

The India solar tracker market offers a range of products, including single-axis and dual-axis trackers, designed for various applications, from residential to utility-scale projects. Innovation focuses on enhancing tracking accuracy, increasing energy yield, and improving durability in harsh environmental conditions. Key features include advanced control systems, robust construction, and easy installation. Unique selling propositions include AI-powered optimization algorithms and remote monitoring capabilities.

Key Drivers, Barriers & Challenges in India Solar Tracker Market

Key Drivers: Government incentives, increasing demand for solar energy, falling tracker prices, and technological advancements.

Key Challenges: High initial investment costs, land acquisition challenges, grid integration issues, and supply chain disruptions. The impact of these issues can be quantified by a potential xx% reduction in market growth if not effectively addressed.

Emerging Opportunities in India Solar Tracker Market

Emerging opportunities lie in the growing demand for large-scale solar farms, the increasing adoption of hybrid solar-wind projects, and the exploration of innovative tracking technologies such as floating solar trackers and agri-photovoltaics. Untapped markets exist in rural and remote areas with high solar irradiance.

Growth Accelerators in the India Solar Tracker Market Industry

Technological breakthroughs in tracker design, such as lighter materials and improved sensors, coupled with strategic partnerships between tracker manufacturers and solar power developers, are crucial growth accelerators. Expanding into new market segments and exploring innovative financing models can further boost market expansion.

Key Players Shaping the India Solar Tracker Market

- NexTracker Inc

- Valmont Industries Inc

- Asun Trackers Pvt Ltd

- GreenEra Energy India Pvt Ltd

- Trina Solar

- Tata Power Solar Systems Limited

- PV Hardware Solutions SLU

- Arctech Solar Holding Co Ltd

Notable Milestones in India Solar Tracker Market Sector

- April 2022: Tata Power Solar Systems commissioned India's largest single-axis solar tracker system (300 MW Dholera Solar Power Plant), generating 774 Million Units (MUs) annually and reducing approximately 704,340 MT/year of carbon emissions.

- August 2021: GameChange Solar supplied single-axis Genius Tracker equipment to a 394 MW PV project set up by Tata Power in Gujarat.

In-Depth India Solar Tracker Market Outlook

The India solar tracker market holds significant long-term potential, driven by sustained government support, increasing energy demand, and technological advancements. Strategic investments in R&D, coupled with effective supply chain management, will be crucial for realizing this potential. The market is poised for significant growth, with opportunities for both established players and new entrants to capture market share.

India Solar Tracker Market Segmentation

-

1. Type

- 1.1. Photovoltaic

- 1.2. Concentrated Solar Power

-

2. Movement

- 2.1. Single Axis

- 2.2. Dual Axis

-

3. Application

- 3.1. Residential

- 3.2. Commercial

- 3.3. Utility

India Solar Tracker Market Segmentation By Geography

- 1. India

India Solar Tracker Market Regional Market Share

Geographic Coverage of India Solar Tracker Market

India Solar Tracker Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand to Develop the Natural Gas Infrastructure4.; Increase in Offshore Oil and Gas Exploration and Production (E&P) Activities

- 3.3. Market Restrains

- 3.3.1. 4.; High Volatility of Oil and Gas Prices

- 3.4. Market Trends

- 3.4.1. Photovoltaic Segment to Dominate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Solar Tracker Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Photovoltaic

- 5.1.2. Concentrated Solar Power

- 5.2. Market Analysis, Insights and Forecast - by Movement

- 5.2.1. Single Axis

- 5.2.2. Dual Axis

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Utility

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NexTracker Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Valmont Industries Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Asun Trackers Pvt Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GreenEra Energy India Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Trina Solar

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tata Power Solar Systems Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PV Hardware Solutions SLU

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Arctech Solar Holding Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 NexTracker Inc

List of Figures

- Figure 1: India Solar Tracker Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Solar Tracker Market Share (%) by Company 2025

List of Tables

- Table 1: India Solar Tracker Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: India Solar Tracker Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 3: India Solar Tracker Market Revenue million Forecast, by Movement 2020 & 2033

- Table 4: India Solar Tracker Market Volume Gigawatt Forecast, by Movement 2020 & 2033

- Table 5: India Solar Tracker Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: India Solar Tracker Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 7: India Solar Tracker Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: India Solar Tracker Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 9: India Solar Tracker Market Revenue million Forecast, by Type 2020 & 2033

- Table 10: India Solar Tracker Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 11: India Solar Tracker Market Revenue million Forecast, by Movement 2020 & 2033

- Table 12: India Solar Tracker Market Volume Gigawatt Forecast, by Movement 2020 & 2033

- Table 13: India Solar Tracker Market Revenue million Forecast, by Application 2020 & 2033

- Table 14: India Solar Tracker Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 15: India Solar Tracker Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: India Solar Tracker Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Solar Tracker Market?

The projected CAGR is approximately 5.21%.

2. Which companies are prominent players in the India Solar Tracker Market?

Key companies in the market include NexTracker Inc, Valmont Industries Inc, Asun Trackers Pvt Ltd, GreenEra Energy India Pvt Ltd, Trina Solar, Tata Power Solar Systems Limited, PV Hardware Solutions SLU, Arctech Solar Holding Co Ltd.

3. What are the main segments of the India Solar Tracker Market?

The market segments include Type, Movement, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 286.8 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand to Develop the Natural Gas Infrastructure4.; Increase in Offshore Oil and Gas Exploration and Production (E&P) Activities.

6. What are the notable trends driving market growth?

Photovoltaic Segment to Dominate.

7. Are there any restraints impacting market growth?

4.; High Volatility of Oil and Gas Prices.

8. Can you provide examples of recent developments in the market?

In April 2022, Tata Power Solar Systems commissioned India's largest single axis solar tracker system in the 300 MW Dholera Solar Power Plant. This project will generate 774 MUs annually. Along with this it will reduce approximately 704340 MT/year of carbon emissions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Solar Tracker Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Solar Tracker Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Solar Tracker Market?

To stay informed about further developments, trends, and reports in the India Solar Tracker Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence