Key Insights

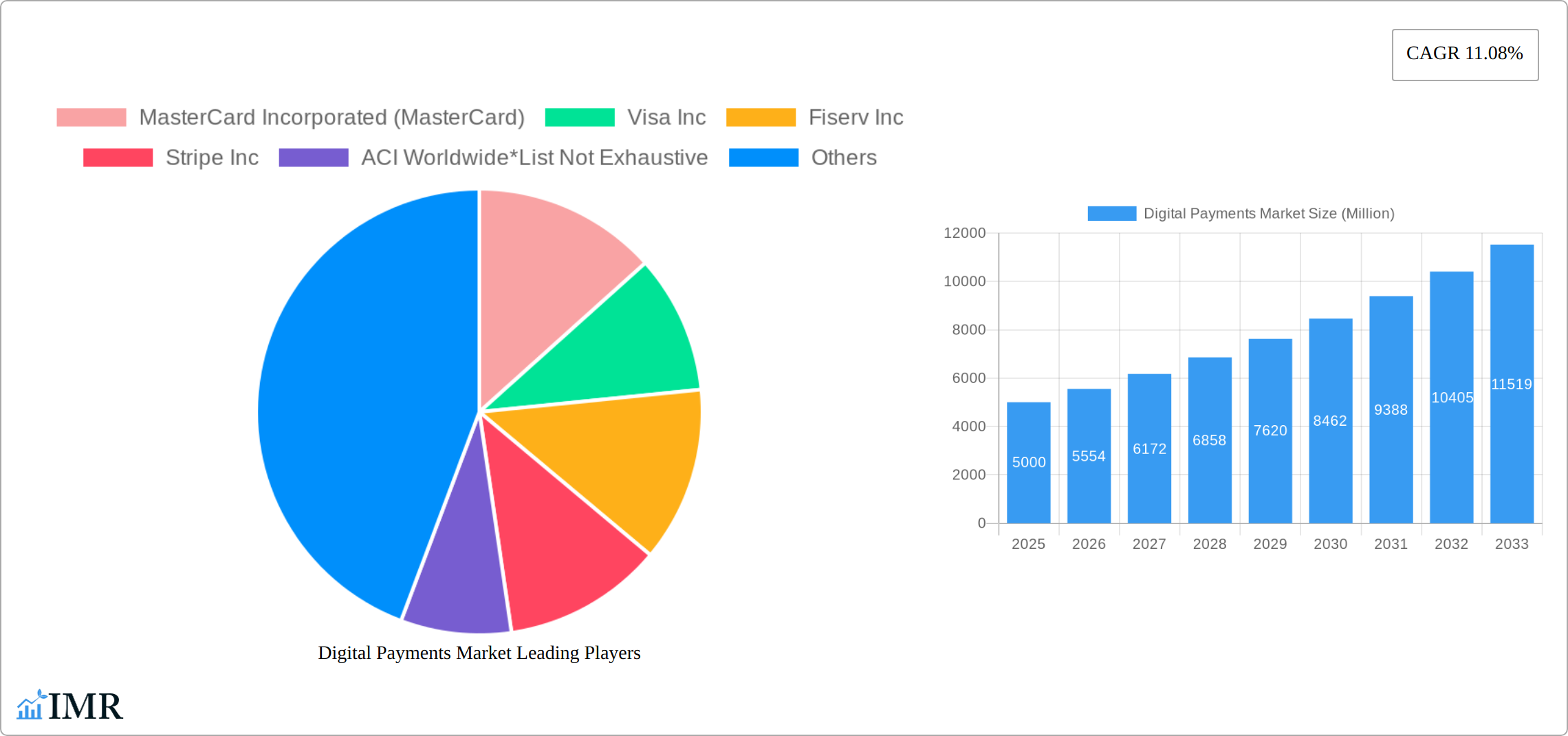

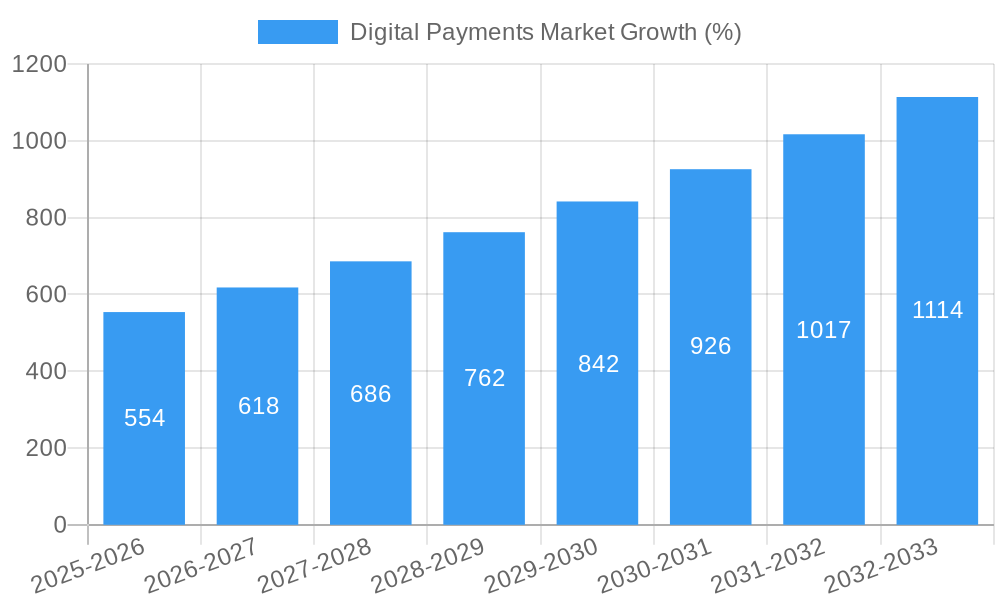

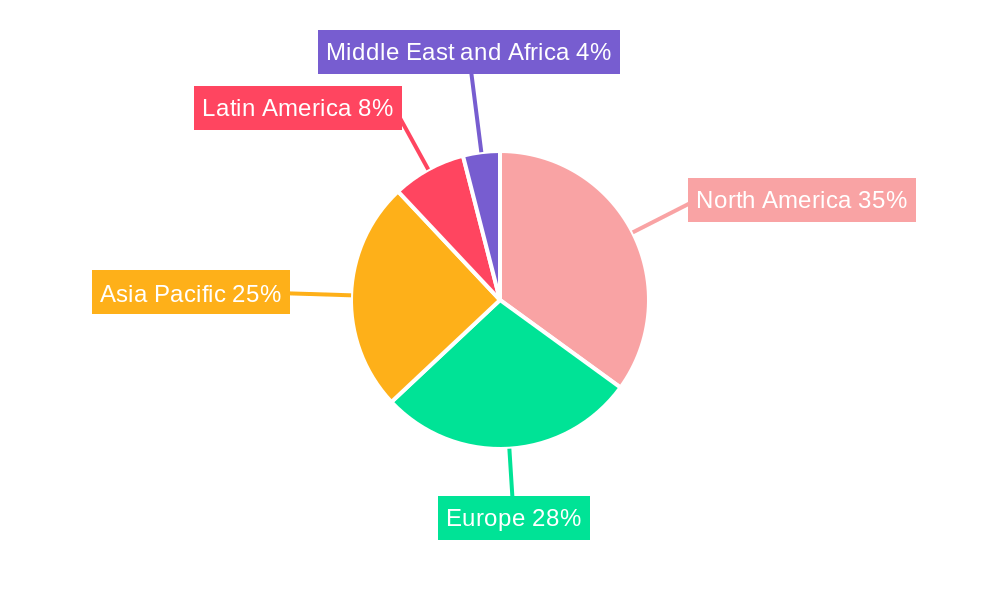

The global digital payments market is experiencing robust growth, projected to reach a substantial size driven by the increasing adoption of smartphones, e-commerce expansion, and a global shift towards cashless transactions. The compound annual growth rate (CAGR) of 11.08% from 2019 to 2033 indicates a significant upward trajectory. Key drivers include the rising preference for contactless payments, enhanced security features offered by digital platforms, and the proliferation of mobile wallets and Buy Now Pay Later (BNPL) services. Furthermore, government initiatives promoting digital financial inclusion in developing economies are significantly boosting market expansion. The market is segmented by payment mode (Point of Sale and Online Sale) and end-user industry (Retail, Entertainment, Healthcare, Hospitality, and Others). The Retail and e-commerce sectors are the largest contributors, while the Healthcare and Hospitality sectors are exhibiting strong growth potential. While regulatory hurdles and security concerns represent challenges, ongoing technological advancements such as biometrics and artificial intelligence are mitigating these risks and driving further innovation. Competition is fierce, with major players like Mastercard, Visa, PayPal, and emerging fintech companies vying for market share through strategic partnerships, acquisitions, and technological advancements. The geographical distribution shows strong growth in the Asia-Pacific region, driven by its large and rapidly expanding digital economy. North America and Europe maintain significant market share due to established digital infrastructure and high adoption rates.

The forecast period of 2025-2033 anticipates continued market expansion, influenced by factors such as increasing internet and smartphone penetration globally, rising consumer confidence in digital payment systems, and the development of innovative payment solutions. The integration of digital payments with other technologies like blockchain and the Internet of Things (IoT) is set to further revolutionize the industry. While the competitive landscape remains dynamic, established players and new entrants are continuously investing in research and development to enhance user experience, security, and the overall efficiency of digital payment systems. This continuous innovation will ensure the sustained growth of the digital payments market throughout the forecast period, making it a lucrative sector for investors and stakeholders alike.

Digital Payments Market Report: 2019-2033

This comprehensive report provides a deep dive into the dynamic Digital Payments Market, analyzing its current state, future trajectory, and key players shaping its evolution. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategists. The market is segmented by mode of payment (Point of Sale, Online Sale) and end-user industry (Retail, Entertainment, Healthcare, Hospitality, Other End-user Industries), providing a granular understanding of market dynamics. The total market size is projected to reach xx Million by 2033.

Digital Payments Market Dynamics & Structure

The Digital Payments Market is characterized by high competition, rapid technological innovation, and evolving regulatory landscapes. Market concentration is moderate, with a few dominant players like Visa Inc and Mastercard Incorporated (MasterCard) holding significant market share, yet numerous smaller players and niche providers adding dynamism. Technological innovation, driven by advancements in mobile technology, artificial intelligence, and blockchain, is a primary growth driver. However, regulatory changes, including data privacy regulations and cybersecurity mandates, impose both opportunities and challenges. The market also witnesses significant M&A activity, reflecting the pursuit of scale and technological capabilities.

- Market Concentration: Visa and Mastercard hold approximately xx% combined market share in 2025. Smaller players account for the remaining xx%.

- Technological Innovation Drivers: The rise of mobile wallets, contactless payments, and biometric authentication are transforming the landscape.

- Regulatory Frameworks: Payment processing regulations vary across different jurisdictions, presenting compliance challenges and opportunities for specialized providers.

- Competitive Product Substitutes: Cash and traditional check payments remain competitive, though their usage is declining. The emergence of cryptocurrencies presents a potentially disruptive alternative.

- End-User Demographics: Younger demographics are early adopters of digital payment technologies, driving growth.

- M&A Trends: The number of M&A deals in the Digital Payments Market reached xx in 2024, demonstrating consolidation and expansion efforts.

Digital Payments Market Growth Trends & Insights

The Digital Payments Market has experienced substantial growth over the past few years, driven by increasing smartphone penetration, rising internet usage, and a shift towards cashless transactions. The market is projected to experience a CAGR of xx% during the forecast period (2025-2033), reaching an estimated value of xx Million by 2033. This growth is fuelled by expanding e-commerce penetration, the adoption of innovative payment solutions, and government initiatives promoting digitalization. Consumer behavior shifts towards greater convenience and security in payment methods, coupled with technological disruptions like the rise of BNPL services, contribute significantly to the market's expansion. Market penetration for digital payments is expected to increase from xx% in 2025 to xx% by 2033.

Dominant Regions, Countries, or Segments in Digital Payments Market

North America and Europe currently dominate the Digital Payments Market due to high levels of technological adoption and robust regulatory frameworks. However, the Asia-Pacific region is expected to witness the fastest growth during the forecast period, driven by rapid urbanization, increasing smartphone penetration, and a burgeoning e-commerce sector.

By Mode of Payment:

- Point of Sale (POS): This segment is experiencing healthy growth driven by the adoption of contactless payment technologies and the expansion of POS infrastructure. The market value is projected at xx Million in 2025.

- Online Sale: This segment exhibits the highest growth, fueled by the rapid expansion of e-commerce and the increasing preference for online shopping. Market value in 2025 is estimated at xx Million.

By End-user Industry:

- Retail: This sector is the largest contributor to market growth due to the high volume of transactions and the adoption of advanced POS systems. Market size in 2025 is projected at xx Million.

- Other End-user Industries: This segment shows promising growth driven by adoption in sectors like healthcare and hospitality that are gradually digitizing payment processes.

Key Drivers:

- Favorable government policies promoting digital payments.

- Improved internet and mobile infrastructure.

- Rising consumer preference for convenient and secure digital payment methods.

Digital Payments Market Product Landscape

The Digital Payments Market offers a diverse range of products and services, including mobile wallets, contactless payment systems, online payment gateways, and BNPL solutions. These products vary in terms of features, security protocols, and user interfaces, catering to diverse consumer preferences and business needs. Innovation focuses on enhanced security features, user-friendly interfaces, and seamless integration across various platforms. The adoption of AI and machine learning is also improving fraud detection and personalized payment experiences.

Key Drivers, Barriers & Challenges in Digital Payments Market

Key Drivers:

- Increasing smartphone and internet penetration.

- Government initiatives promoting digital payments.

- Growth of e-commerce.

- The emergence of innovative payment solutions.

Key Challenges:

- Cybersecurity threats and data breaches.

- Regulatory hurdles and compliance issues.

- Concerns over data privacy and consumer protection.

- Integration challenges across different payment systems. The lack of interoperability in certain markets limits adoption and presents a hurdle.

Emerging Opportunities in Digital Payments Market

Untapped markets in developing economies offer significant growth potential. The increasing adoption of biometric authentication and AI-powered fraud detection systems presents opportunities for innovation and differentiation. The integration of digital payments with other services, such as loyalty programs and rewards schemes, enhances customer engagement and drives adoption. The continued growth of BNPL options creates new market segments.

Growth Accelerators in the Digital Payments Market Industry

Strategic partnerships between technology providers and financial institutions are accelerating market growth by facilitating the development and deployment of innovative payment solutions. Technological advancements in areas such as blockchain and AI are continually enhancing security and efficiency. Market expansion strategies focused on emerging economies and untapped market segments are creating further growth opportunities.

Key Players Shaping the Digital Payments Market Market

- MasterCard Incorporated (MasterCard)

- Visa Inc

- Fiserv Inc

- Stripe Inc

- ACI Worldwide

- Mobiamo Inc

- PayPal Holdings Inc

- Wordplay Inc (Fidelity National Information Services)

- Amazon Payments Inc (Amazon com Inc )

- Alphabet Inc

- Paytm (One97 Communications Limited)

- Alipay com Co Ltd

- Apple Inc

Notable Milestones in Digital Payments Market Sector

- November 2022: Mastercard partners with Arab African International Bank (AAIB) to accelerate Egypt's digital transformation.

- February 2023: HDFC Bank pilots offline digital payments with Crunchfish under RBI's Regulatory Sandbox.

- June 2023: PayPal and KKR sign a EUR 3 billion (USD 3.37 billion) agreement for BNPL loan receivables.

In-Depth Digital Payments Market Market Outlook

The Digital Payments Market is poised for continued robust growth, driven by the convergence of technological innovation, evolving consumer preferences, and supportive regulatory environments. Strategic partnerships, expansion into untapped markets, and the development of innovative payment solutions will shape the industry's future. The market's long-term potential is significant, and companies that can effectively adapt to emerging trends and meet evolving consumer needs are best positioned to capture a larger share of this expanding market.

Digital Payments Market Segmentation

-

1. Mode of Payment

- 1.1. Point of Sale

- 1.2. Online Sale

-

2. End-user Industry

- 2.1. Retail

- 2.2. Entertainment

- 2.3. Healthcare

- 2.4. Hospitality

- 2.5. Other End-user Industries

Digital Payments Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Digital Payments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.08% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Proliferation of Smartphones and Digital Initiatives; Favorable Changes in Regulatory Frameworks Across the World

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulations in the Payments Industry

- 3.4. Market Trends

- 3.4.1. Retail End User Industry is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Payments Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 5.1.1. Point of Sale

- 5.1.2. Online Sale

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Retail

- 5.2.2. Entertainment

- 5.2.3. Healthcare

- 5.2.4. Hospitality

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6. North America Digital Payments Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6.1.1. Point of Sale

- 6.1.2. Online Sale

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Retail

- 6.2.2. Entertainment

- 6.2.3. Healthcare

- 6.2.4. Hospitality

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 7. Europe Digital Payments Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 7.1.1. Point of Sale

- 7.1.2. Online Sale

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Retail

- 7.2.2. Entertainment

- 7.2.3. Healthcare

- 7.2.4. Hospitality

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 8. Asia Pacific Digital Payments Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 8.1.1. Point of Sale

- 8.1.2. Online Sale

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Retail

- 8.2.2. Entertainment

- 8.2.3. Healthcare

- 8.2.4. Hospitality

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 9. Latin America Digital Payments Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 9.1.1. Point of Sale

- 9.1.2. Online Sale

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Retail

- 9.2.2. Entertainment

- 9.2.3. Healthcare

- 9.2.4. Hospitality

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 10. Middle East and Africa Digital Payments Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 10.1.1. Point of Sale

- 10.1.2. Online Sale

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Retail

- 10.2.2. Entertainment

- 10.2.3. Healthcare

- 10.2.4. Hospitality

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 11. North America Digital Payments Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Digital Payments Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Digital Payments Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Digital Payments Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Digital Payments Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 MasterCard Incorporated (MasterCard)

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Visa Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Fiserv Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Stripe Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 ACI Worldwide*List Not Exhaustive

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Mobiamo Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 PayPal Holdings Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Wordplay Inc (Fidelity National Information Services)

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Amazon Payments Inc (Amazon com Inc )

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Alphabet Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Paytm (One97 Communications Limited)

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Alipay com Co Ltd

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Apple Inc

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 MasterCard Incorporated (MasterCard)

List of Figures

- Figure 1: Global Digital Payments Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Digital Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Digital Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Digital Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Digital Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Digital Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Digital Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Digital Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Digital Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Digital Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Digital Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Digital Payments Market Revenue (Million), by Mode of Payment 2024 & 2032

- Figure 13: North America Digital Payments Market Revenue Share (%), by Mode of Payment 2024 & 2032

- Figure 14: North America Digital Payments Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: North America Digital Payments Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: North America Digital Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Digital Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Digital Payments Market Revenue (Million), by Mode of Payment 2024 & 2032

- Figure 19: Europe Digital Payments Market Revenue Share (%), by Mode of Payment 2024 & 2032

- Figure 20: Europe Digital Payments Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: Europe Digital Payments Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: Europe Digital Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Digital Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Digital Payments Market Revenue (Million), by Mode of Payment 2024 & 2032

- Figure 25: Asia Pacific Digital Payments Market Revenue Share (%), by Mode of Payment 2024 & 2032

- Figure 26: Asia Pacific Digital Payments Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Asia Pacific Digital Payments Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Asia Pacific Digital Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Digital Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Digital Payments Market Revenue (Million), by Mode of Payment 2024 & 2032

- Figure 31: Latin America Digital Payments Market Revenue Share (%), by Mode of Payment 2024 & 2032

- Figure 32: Latin America Digital Payments Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Latin America Digital Payments Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Latin America Digital Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Digital Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Digital Payments Market Revenue (Million), by Mode of Payment 2024 & 2032

- Figure 37: Middle East and Africa Digital Payments Market Revenue Share (%), by Mode of Payment 2024 & 2032

- Figure 38: Middle East and Africa Digital Payments Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Middle East and Africa Digital Payments Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Middle East and Africa Digital Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Digital Payments Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Digital Payments Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Digital Payments Market Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 3: Global Digital Payments Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Digital Payments Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Digital Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Digital Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Digital Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Digital Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Digital Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Digital Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Digital Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Digital Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Digital Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Digital Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Digital Payments Market Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 16: Global Digital Payments Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global Digital Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Digital Payments Market Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 19: Global Digital Payments Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 20: Global Digital Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Digital Payments Market Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 22: Global Digital Payments Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 23: Global Digital Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Digital Payments Market Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 25: Global Digital Payments Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 26: Global Digital Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Digital Payments Market Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 28: Global Digital Payments Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global Digital Payments Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Payments Market?

The projected CAGR is approximately 11.08%.

2. Which companies are prominent players in the Digital Payments Market?

Key companies in the market include MasterCard Incorporated (MasterCard), Visa Inc, Fiserv Inc, Stripe Inc, ACI Worldwide*List Not Exhaustive, Mobiamo Inc, PayPal Holdings Inc, Wordplay Inc (Fidelity National Information Services), Amazon Payments Inc (Amazon com Inc ), Alphabet Inc, Paytm (One97 Communications Limited), Alipay com Co Ltd, Apple Inc.

3. What are the main segments of the Digital Payments Market?

The market segments include Mode of Payment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Proliferation of Smartphones and Digital Initiatives; Favorable Changes in Regulatory Frameworks Across the World.

6. What are the notable trends driving market growth?

Retail End User Industry is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

; Stringent Regulations in the Payments Industry.

8. Can you provide examples of recent developments in the market?

June 2023: PayPal Holdings, Inc. and KKR, one of the leading global investment firms, announced the signing of an exclusive multi-year agreement for a EUR 3 billion (USD 3.37 billion) replenishing loan commitment under which private credit funds and accounts managed by KKR will purchase up to EUR 40 billion (USD 44.87 billion) of buy now, pay later (BNPL) loan receivables originated by PayPal in Italy, France, United Kingdom, Spain, and Germany.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Payments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Payments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Payments Market?

To stay informed about further developments, trends, and reports in the Digital Payments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence