Key Insights

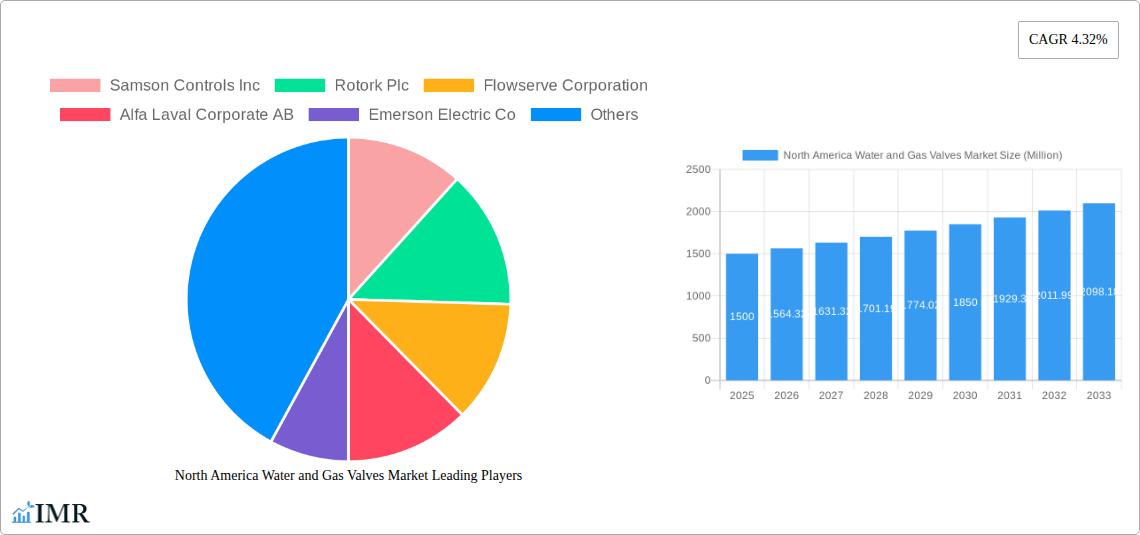

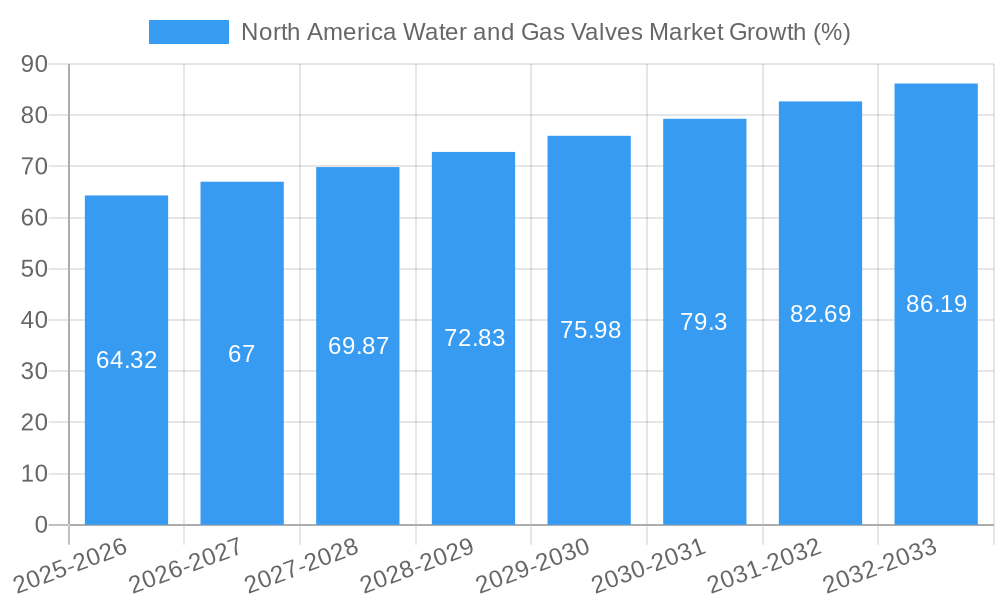

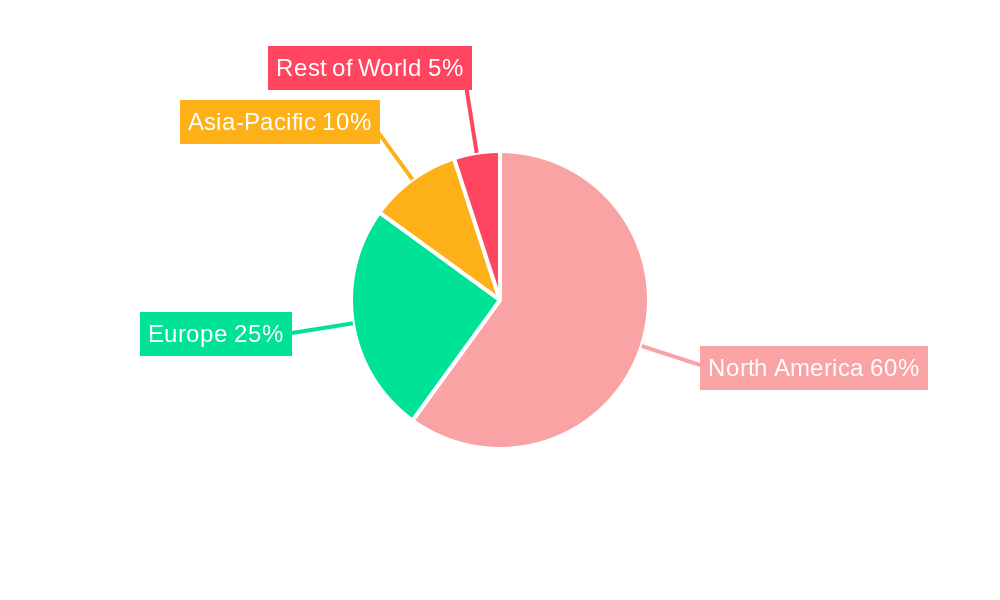

The North American water and gas valves market, encompassing the United States and Canada, is experiencing steady growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 4.32% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing demand for efficient and reliable water management infrastructure, driven by population growth and urbanization, is a significant driver. Aging water and gas pipelines necessitate extensive refurbishment and upgrades, creating substantial demand for replacement valves. Furthermore, stringent government regulations promoting water conservation and reducing pipeline leakages are spurring investment in advanced valve technologies. The oil and gas sector, a major end-user, is also contributing to market growth, with ongoing exploration and production activities requiring robust and reliable valve systems. While the market faces potential restraints such as fluctuating raw material prices and economic downturns, the overall outlook remains positive, particularly within the water and wastewater segment, where sustainable infrastructure development is gaining momentum. Specific growth within sub-segments like butterfly and gate valves is anticipated due to their widespread application in various pipeline systems. The market's competitive landscape features both established global players like Flowserve Corporation and Emerson Electric Co, and regional players, fostering innovation and competition.

The market segmentation further reveals significant opportunities. Within the end-user vertical, the water and wastewater sector is showing considerable promise due to increasing investment in water infrastructure projects aimed at improving efficiency and reliability. The United States, being a larger market compared to Canada, holds a substantial share of the North American market. The forecast period (2025-2033) presents significant opportunities for companies offering technologically advanced, energy-efficient, and sustainable valve solutions. Companies are focusing on developing smart valves with remote monitoring capabilities to enhance operational efficiency and reduce maintenance costs. The focus on improving infrastructure resilience against extreme weather events further boosts market growth, as these events underscore the importance of reliable valve systems. Overall, the North American water and gas valves market is poised for continued expansion driven by robust infrastructure development and stringent environmental regulations.

North America Water and Gas Valves Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America water and gas valves market, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The market is segmented by type (ball, butterfly, gate/globe/check, plug, control, other), end-user vertical (oil and gas, power generation, chemical, water and wastewater, mining, other), and country (United States, Canada). The market size is presented in million units.

North America Water and Gas Valves Market Dynamics & Structure

The North American water and gas valves market is characterized by a moderately concentrated landscape with several major players holding significant market share. Technological innovation, particularly in smart valves and automation, is a key growth driver. Stringent regulatory frameworks concerning environmental protection and safety standards heavily influence market dynamics. The market also witnesses competition from substitute products, primarily in niche applications. End-user demographics, particularly in the water and wastewater sector, significantly impact demand. The market has seen a moderate level of M&A activity in recent years, with strategic acquisitions aiming to expand product portfolios and geographical reach.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Technological Innovation: Focus on smart valves, automation, and remote monitoring is driving growth.

- Regulatory Framework: Compliance with EPA and other safety regulations is paramount.

- Competitive Substitutes: Presence of alternative technologies in specific niche applications.

- M&A Activity: xx major M&A deals were recorded between 2019 and 2024.

- Innovation Barriers: High R&D costs and the need for rigorous testing pose challenges to innovation.

North America Water and Gas Valves Market Growth Trends & Insights

The North America water and gas valves market is projected to experience robust growth during the forecast period (2025-2033). Driven by increasing infrastructure development, particularly in water and wastewater treatment, and expanding industrial activities across various sectors, the market is expected to achieve a CAGR of xx% between 2025 and 2033. Technological advancements, such as the introduction of smart valves and remote monitoring systems, are further accelerating adoption rates. Consumer behavior is shifting towards energy-efficient and sustainable solutions, creating opportunities for advanced valve technologies. Market penetration is currently estimated at xx%, expected to increase to xx% by 2033.

(This section will be expanded to 600 words with specific data as per the XXX data source.)

Dominant Regions, Countries, or Segments in North America Water and Gas Valves Market

The United States dominates the North American water and gas valves market, driven by extensive infrastructure projects, robust industrial activity, and a significant oil and gas sector. Within the segmentation, the ball valve segment holds the largest market share due to its versatility and cost-effectiveness. The water and wastewater treatment sector presents a significant end-user segment for the market, while the oil and gas segment is another major driver of growth, due to sustained investment in exploration and production.

- United States: Strong industrial base, extensive infrastructure projects, and significant oil and gas activities.

- Canada: Growth driven by investments in renewable energy and resource extraction.

- Ball Valves: Largest market share due to cost-effectiveness and versatility.

- Water and Wastewater: Significant growth due to increasing investments in infrastructure.

- Oil and Gas: Major segment driven by exploration and production activities.

(This section will be expanded to 600 words with detailed data on market share and growth projections for each region and segment.)

North America Water and Gas Valves Market Product Landscape

The market features a diverse range of valves, incorporating advanced materials, designs, and automation capabilities. Smart valves with integrated sensors and communication protocols are gaining prominence, offering remote monitoring, predictive maintenance, and optimized control. Innovative designs focus on improved efficiency, reduced leakage, and enhanced durability to address stringent environmental regulations and operational demands. Unique selling propositions include enhanced safety features, improved operational efficiency, and minimized environmental impact.

Key Drivers, Barriers & Challenges in North America Water and Gas Valves Market

Key Drivers: Stringent environmental regulations promoting leak reduction and efficient water management; increasing investments in infrastructure projects, notably in water and wastewater treatment and oil & gas; the growing adoption of smart valve technologies for enhanced automation and control; and the rising demand for energy-efficient industrial processes.

Challenges: Supply chain disruptions impacting material availability and production costs; increasing competition from international manufacturers; and regulatory hurdles related to certifications and standards compliance. These challenges could lead to an xx% increase in production costs by 2030.

Emerging Opportunities in North America Water and Gas Valves Market

Emerging opportunities include the growing demand for smart and connected valves in various applications, particularly for remote monitoring and predictive maintenance. The expanding renewable energy sector and increasing focus on water conservation present significant opportunities for specialized valves. Moreover, untapped markets in smaller municipalities and rural areas offer potential for growth.

Growth Accelerators in the North America Water and Gas Valves Market Industry

Long-term growth will be fueled by technological advancements in valve design and materials, enhancing durability, efficiency, and safety. Strategic partnerships between valve manufacturers and technology providers will drive innovation and expand market reach. Investments in infrastructure modernization and the ongoing shift toward sustainable practices in industrial and municipal applications are key growth catalysts.

Key Players Shaping the North America Water and Gas Valves Market Market

- Samson Controls Inc

- Rotork Plc

- Flowserve Corporation

- Alfa Laval Corporate AB

- Emerson Electric Co

- IMI Critical Engineering

- Crane Co

- Valmet Oyj

- Schlumberger Limited

- KITZ Corporation

Notable Milestones in North America Water and Gas Valves Market Sector

- April 2022: Emerson launched the TopWorx™ PD Series Smart Valve Positioner, enhancing valve control capabilities.

- June 2021: ValvTechnologies and Severn Glocon collaborated to develop innovative severe service valves.

In-Depth North America Water and Gas Valves Market Outlook

The North America water and gas valves market is poised for sustained growth driven by ongoing infrastructure development, increasing demand for efficient and sustainable solutions, and the continued adoption of smart technologies. Strategic partnerships, technological breakthroughs, and expansion into emerging markets will shape future market dynamics. The market's potential is significant, presenting considerable opportunities for players who can leverage technological advancements and address the evolving needs of end-users across diverse sectors.

North America Water and Gas Valves Market Segmentation

-

1. Type

- 1.1. Ball

- 1.2. Butterfly

- 1.3. Gate/Globe/Check

- 1.4. Plug

- 1.5. Control

- 1.6. Other Types

-

2. End-User Vertical

- 2.1. Oil and Gas

- 2.2. Power Generation

- 2.3. Chemical

- 2.4. Water and Wastewater

- 2.5. Mining

- 2.6. Other End User Verticals

North America Water and Gas Valves Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Water and Gas Valves Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising adoption of automation technologies in process industries; Expansion of refineries and petrochemical plants; Need for replacement of outdated valves and adoption of smart valves

- 3.3. Market Restrains

- 3.3.1. Lack of standardized policies

- 3.4. Market Trends

- 3.4.1. Water and Wastewater is Expected to Grow at Significant Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Water and Gas Valves Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ball

- 5.1.2. Butterfly

- 5.1.3. Gate/Globe/Check

- 5.1.4. Plug

- 5.1.5. Control

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 5.2.1. Oil and Gas

- 5.2.2. Power Generation

- 5.2.3. Chemical

- 5.2.4. Water and Wastewater

- 5.2.5. Mining

- 5.2.6. Other End User Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Water and Gas Valves Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Water and Gas Valves Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Water and Gas Valves Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Water and Gas Valves Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Samson Controls Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Rotork Plc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Flowserve Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Alfa Laval Corporate AB

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Emerson Electric Co

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 IMI Critical Engineering

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Crane Co

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Valmet Oyj

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Schlumberger Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 KITZ Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Samson Controls Inc

List of Figures

- Figure 1: North America Water and Gas Valves Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Water and Gas Valves Market Share (%) by Company 2024

List of Tables

- Table 1: North America Water and Gas Valves Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Water and Gas Valves Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Water and Gas Valves Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America Water and Gas Valves Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: North America Water and Gas Valves Market Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 6: North America Water and Gas Valves Market Volume K Unit Forecast, by End-User Vertical 2019 & 2032

- Table 7: North America Water and Gas Valves Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Water and Gas Valves Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: North America Water and Gas Valves Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America Water and Gas Valves Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: United States North America Water and Gas Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North America Water and Gas Valves Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Canada North America Water and Gas Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Water and Gas Valves Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Water and Gas Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Water and Gas Valves Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North America Water and Gas Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America Water and Gas Valves Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: North America Water and Gas Valves Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: North America Water and Gas Valves Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 21: North America Water and Gas Valves Market Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 22: North America Water and Gas Valves Market Volume K Unit Forecast, by End-User Vertical 2019 & 2032

- Table 23: North America Water and Gas Valves Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North America Water and Gas Valves Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: United States North America Water and Gas Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United States North America Water and Gas Valves Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Canada North America Water and Gas Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Canada North America Water and Gas Valves Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Mexico North America Water and Gas Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Mexico North America Water and Gas Valves Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Water and Gas Valves Market?

The projected CAGR is approximately 4.32%.

2. Which companies are prominent players in the North America Water and Gas Valves Market?

Key companies in the market include Samson Controls Inc, Rotork Plc, Flowserve Corporation, Alfa Laval Corporate AB, Emerson Electric Co, IMI Critical Engineering, Crane Co, Valmet Oyj, Schlumberger Limited, KITZ Corporation.

3. What are the main segments of the North America Water and Gas Valves Market?

The market segments include Type, End-User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising adoption of automation technologies in process industries; Expansion of refineries and petrochemical plants; Need for replacement of outdated valves and adoption of smart valves.

6. What are the notable trends driving market growth?

Water and Wastewater is Expected to Grow at Significant Rate.

7. Are there any restraints impacting market growth?

Lack of standardized policies.

8. Can you provide examples of recent developments in the market?

April 2022 - Emerson launched the TopWorxTM PD Series Smart Valve Positioner. The PD Series adds intelligence, dependability, and versatility to valve control, expanding Emerson's current line of TopWorx sensing and control devices. The PD Series improves the current TopWorx range of discrete valve controllers by integrating communication through a 4-20 mA loop signal and HART protocols, enabling complete control over valve position.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Water and Gas Valves Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Water and Gas Valves Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Water and Gas Valves Market?

To stay informed about further developments, trends, and reports in the North America Water and Gas Valves Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence