Key Insights

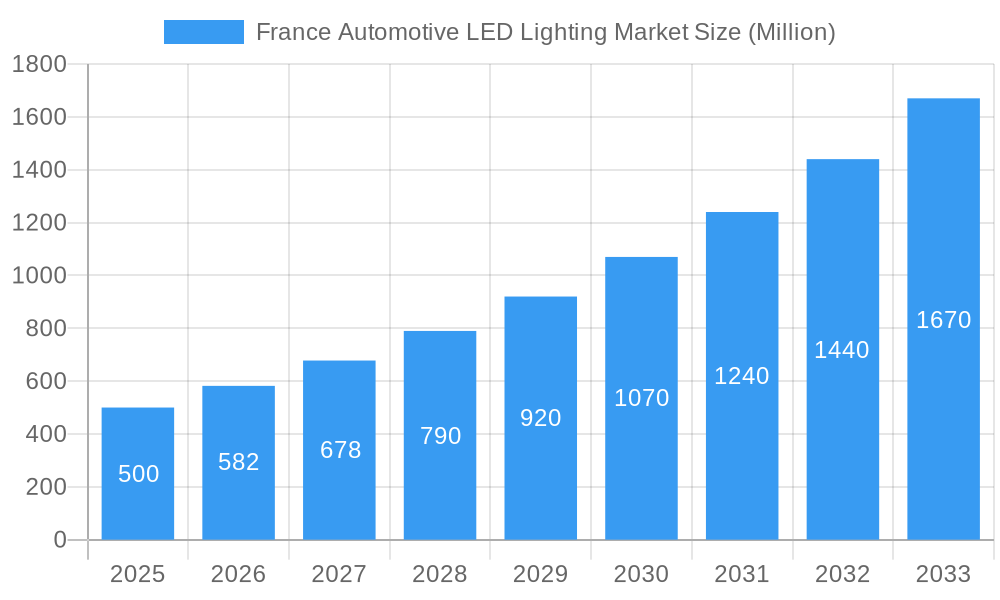

The French automotive LED lighting market is experiencing significant expansion, propelled by rising vehicle production, stringent regulations mandating energy efficiency and enhanced safety, and increasing consumer demand for advanced lighting technologies. The market is projected for robust growth, with a projected Compound Annual Growth Rate (CAGR) of 7.78%. The market size, estimated at $2.11 billion in the base year 2025, is expected to grow substantially through 2033. Key segments include vehicle lighting (two-wheelers, commercial vehicles, passenger cars) and utility lighting (daytime running lights, turn signals, headlights, taillights, and more). Leading companies such as Osram, Valeo, and Hella are leveraging technological innovation and strategic alliances to capture market share.

France Automotive LED Lighting Market Market Size (In Billion)

The increasing integration of advanced driver-assistance systems (ADAS), which rely on sophisticated lighting, alongside a strong emphasis on automotive safety regulations, is a key driver. Consumer preference for enhanced aesthetics and superior visibility, particularly in premium vehicle segments, further fuels market momentum. The ongoing transition to electric and hybrid vehicles necessitates advanced, energy-efficient lighting solutions, contributing to sustained growth. Continuous technological advancements in LED brightness, durability, and energy efficiency will drive further adoption. While the initial cost of LED systems may present a hurdle, long-term benefits in energy savings and reduced maintenance are expected to outweigh this, ensuring consistent market expansion. Strategic partnerships and a focus on innovation are crucial for market leaders in this competitive landscape. France's automotive sector's commitment to technological progress and safety standards creates a favorable environment for the automotive LED lighting market's continued development.

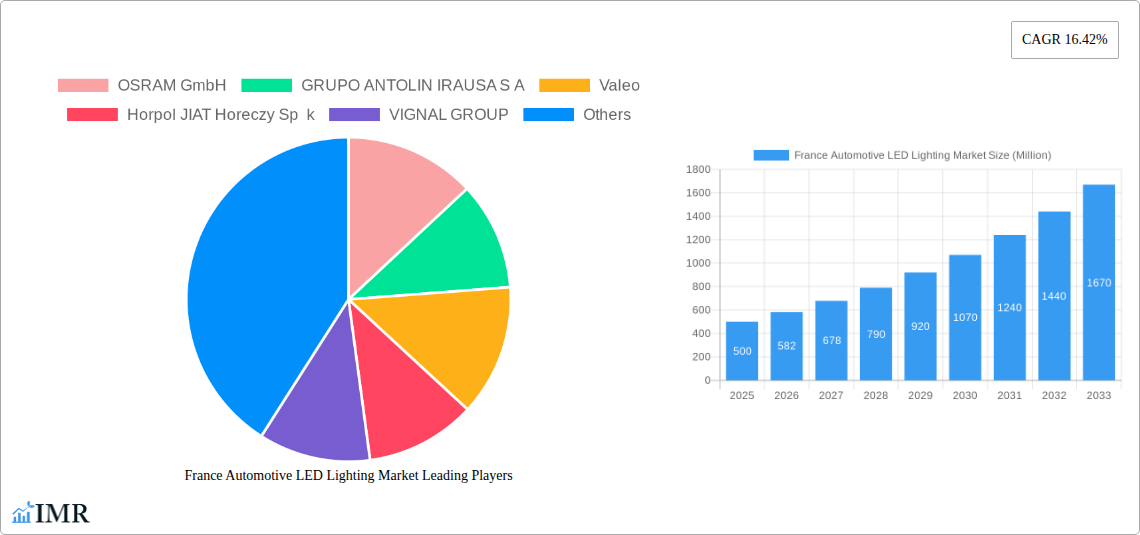

France Automotive LED Lighting Market Company Market Share

France Automotive LED Lighting Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the France automotive LED lighting market, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on both the parent market (Automotive Lighting) and child markets (2-Wheelers, Passenger Cars, Commercial Vehicles, and specific utility lighting segments), this report is an essential resource for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year. The market size is presented in million units.

France Automotive LED Lighting Market Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the French automotive LED lighting sector. The analysis considers market concentration, assessing the market share of key players like Valeo, Osram, and HELLA. We examine the impact of technological innovations such as high-definition lighting systems and their influence on market growth. Regulatory frameworks impacting LED adoption, including safety and emission standards, are also explored. The report further investigates the presence and influence of substitute products and the evolving end-user demographics, focusing on the shift towards safer and more technologically advanced vehicles. Finally, the report includes a comprehensive overview of recent mergers and acquisitions (M&A) activities, including deal volumes and their impact on market structure.

- Market Concentration: xx% market share held by top 5 players (2024).

- Technological Innovation: Focus on high-definition lighting, adaptive driving beam systems, and energy efficiency improvements.

- Regulatory Framework: Analysis of EU regulations on automotive lighting and their impact on market adoption.

- Competitive Substitutes: Assessment of the competitive pressure from traditional lighting technologies and their market share.

- M&A Activity: Review of recent significant mergers and acquisitions, including HELLA's merger with Faurecia. xx M&A deals recorded in the period 2019-2024.

France Automotive LED Lighting Market Growth Trends & Insights

This section delves into the historical and projected growth of the French automotive LED lighting market, examining key trends and drivers. We analyze market size evolution from 2019 to 2024, providing detailed insights into the compound annual growth rate (CAGR) and market penetration rates for various segments. Technological disruptions and consumer behavior shifts towards premium features are also analyzed. The impact of factors such as increasing vehicle production, rising consumer disposable income, and government initiatives promoting energy-efficient vehicles are examined in detail.

- Market Size (Million Units): 2019: xx, 2020: xx, 2021: xx, 2022: xx, 2023: xx, 2024: xx, 2025 (Estimated): xx, 2033 (Forecast): xx

- CAGR (2019-2024): xx%

- CAGR (2025-2033): xx%

- Market Penetration: xx% in 2024, projected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in France Automotive LED Lighting Market

This section identifies the leading segments and geographical areas driving growth within the French automotive LED lighting market. We analyze market share and growth potential for each segment (Automotive Vehicle Lighting: 2-Wheelers, Commercial Vehicles, Passenger Cars; and Automotive Utility Lighting: Daytime Running Lights (DRL), Directional Signal Lights, Headlights, Reverse Light, Stop Light, Tail Light, Others). Key factors driving the dominance of specific segments are explored, including economic policies, infrastructure development, and consumer preferences. The analysis will consider regional variations in market adoption and growth.

- Leading Segment: Passenger Cars, followed by Commercial Vehicles (Market Share Breakdown Provided)

- Key Growth Drivers: Increasing vehicle production, rising consumer preference for advanced safety features, and stringent government regulations.

- Regional Variations: Analysis of regional disparities in adoption rates and growth potential within France.

France Automotive LED Lighting Market Product Landscape

This section provides an overview of the product innovations, applications, and performance metrics within the French automotive LED lighting market. We detail the unique selling propositions (USPs) of various LED lighting products, highlighting advancements in technology, design, and functionality. The focus is on energy efficiency, brightness, and durability. The analysis also considers the impact of technological advancements on the performance and longevity of automotive LED lighting.

Key Drivers, Barriers & Challenges in France Automotive LED Lighting Market

This section identifies the key factors driving the growth of the French automotive LED lighting market, including technological advancements (e.g., higher lumen output LEDs, improved heat dissipation), economic factors (e.g., increasing disposable income, government incentives for fuel-efficient vehicles), and supportive policy frameworks (e.g., regulations mandating advanced safety features). It also examines the key challenges and restraints, such as supply chain disruptions, regulatory hurdles (e.g., stringent testing and certification requirements), and intense competition from both domestic and international players. The quantitative impact of these challenges on market growth is assessed.

Emerging Opportunities in France Automotive LED Lighting Market

This section highlights emerging trends and opportunities within the French automotive LED lighting market. We explore untapped market segments (e.g., specialized automotive lighting applications), innovative applications (e.g., integrated smart lighting systems), and the evolution of consumer preferences (e.g., demand for personalized lighting features). The potential for growth in these areas is analyzed.

Growth Accelerators in the France Automotive LED Lighting Market Industry

This section examines catalysts that will accelerate long-term growth in the French automotive LED lighting market. It emphasizes technological breakthroughs (e.g., advancements in micro-LED technology), strategic partnerships (e.g., collaborations between lighting manufacturers and automotive OEMs), and market expansion strategies (e.g., targeting new market segments).

Key Players Shaping the France Automotive LED Lighting Market Market

- OSRAM GmbH

- GRUPO ANTOLIN IRAUSA S A

- Valeo

- Horpol JIAT Horeczy Sp k

- VIGNAL GROUP

- Marelli Holdings Co Ltd

- Stanley Electric Co Ltd

- ZKW Grou

- Luxor Lighting

- HELLA GmbH & Co KGaA

Notable Milestones in France Automotive LED Lighting Market Sector

- March 2023: Valeo files 588 patent applications in 2022, showcasing its leadership in high-definition lighting technology. Valeo's R&D expenditure amounted to 10.4% of its turnover in 2022.

- August 2021: HELLA and Faurecia merge, creating a top-7 global automotive supplier with enhanced market reach and capabilities.

- August 2021: Magneti Marelli acquires SmartMeUp, strengthening its position in autonomous driving and safety technologies.

In-Depth France Automotive LED Lighting Market Market Outlook

This section summarizes the key growth drivers and opportunities within the French automotive LED lighting market, providing a forward-looking perspective on future market potential. The analysis emphasizes strategic opportunities for market participants, including technological advancements, strategic partnerships, and the exploration of new market segments. The long-term outlook is positive, driven by continuous innovation, increasing vehicle production, and rising consumer demand for advanced lighting systems.

France Automotive LED Lighting Market Segmentation

-

1. Automotive Utility Lighting

- 1.1. Daytime Running Lights (DRL)

- 1.2. Directional Signal Lights

- 1.3. Headlights

- 1.4. Reverse Light

- 1.5. Stop Light

- 1.6. Tail Light

- 1.7. Others

-

2. Automotive Vehicle Lighting

- 2.1. 2 Wheelers

- 2.2. Commercial Vehicles

- 2.3. Passenger Cars

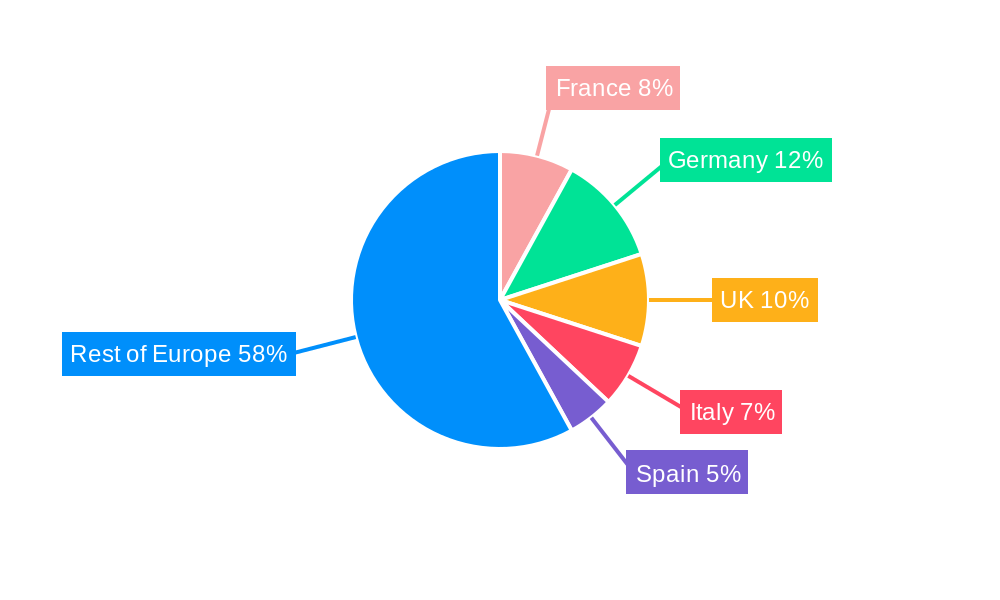

France Automotive LED Lighting Market Segmentation By Geography

- 1. France

France Automotive LED Lighting Market Regional Market Share

Geographic Coverage of France Automotive LED Lighting Market

France Automotive LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Internet Penetration and Growing M-commerce Market; Increasing Number of Loyality Benefits in Mobile Environment

- 3.3. Market Restrains

- 3.3.1. Security Issues Associated with Mobile Payments

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Automotive LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 5.1.1. Daytime Running Lights (DRL)

- 5.1.2. Directional Signal Lights

- 5.1.3. Headlights

- 5.1.4. Reverse Light

- 5.1.5. Stop Light

- 5.1.6. Tail Light

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Automotive Vehicle Lighting

- 5.2.1. 2 Wheelers

- 5.2.2. Commercial Vehicles

- 5.2.3. Passenger Cars

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 OSRAM GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GRUPO ANTOLIN IRAUSA S A

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Valeo

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Horpol JIAT Horeczy Sp k

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 VIGNAL GROUP

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Marelli Holdings Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Stanley Electric Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ZKW Grou

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Luxor Lighting

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 HELLA GmbH & Co KGaA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 OSRAM GmbH

List of Figures

- Figure 1: France Automotive LED Lighting Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Automotive LED Lighting Market Share (%) by Company 2025

List of Tables

- Table 1: France Automotive LED Lighting Market Revenue billion Forecast, by Automotive Utility Lighting 2020 & 2033

- Table 2: France Automotive LED Lighting Market Revenue billion Forecast, by Automotive Vehicle Lighting 2020 & 2033

- Table 3: France Automotive LED Lighting Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: France Automotive LED Lighting Market Revenue billion Forecast, by Automotive Utility Lighting 2020 & 2033

- Table 5: France Automotive LED Lighting Market Revenue billion Forecast, by Automotive Vehicle Lighting 2020 & 2033

- Table 6: France Automotive LED Lighting Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Automotive LED Lighting Market?

The projected CAGR is approximately 7.78%.

2. Which companies are prominent players in the France Automotive LED Lighting Market?

Key companies in the market include OSRAM GmbH, GRUPO ANTOLIN IRAUSA S A, Valeo, Horpol JIAT Horeczy Sp k, VIGNAL GROUP, Marelli Holdings Co Ltd, Stanley Electric Co Ltd, ZKW Grou, Luxor Lighting, HELLA GmbH & Co KGaA.

3. What are the main segments of the France Automotive LED Lighting Market?

The market segments include Automotive Utility Lighting, Automotive Vehicle Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.11 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Internet Penetration and Growing M-commerce Market; Increasing Number of Loyality Benefits in Mobile Environment.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Security Issues Associated with Mobile Payments.

8. Can you provide examples of recent developments in the market?

March 2023: With 588 patent applications filed in 2022, Valeo is the prominent French patent filer at the European Patent Office. Valeo's patents in 2022 included the creation of technology to provide enhanced safety to road users through high-definition lighting systems. In 2022, Valeo’s R&D effort amounted to 10.4% of the Group’s turnover.August 2021: HELLA and French automotive supplier Faurecia agreed to merge the two firms. By integrating their operations, HELLA and Faurecia will become the world's 7th largest automotive supplier. This provides significant potential for further profitable growth.August 2021: Magneti Marelli announced signing an agreement to acquire 100% of SmartMeUp. This French start-up specializes in "perception software" for autonomous driving, smart cities, and safety technology applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Automotive LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Automotive LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Automotive LED Lighting Market?

To stay informed about further developments, trends, and reports in the France Automotive LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence