Key Insights

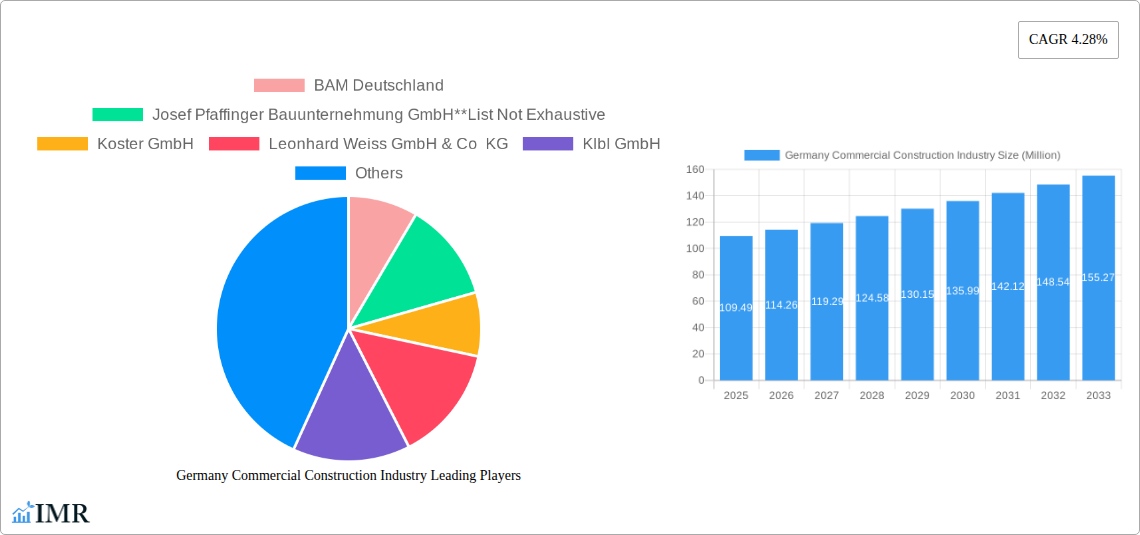

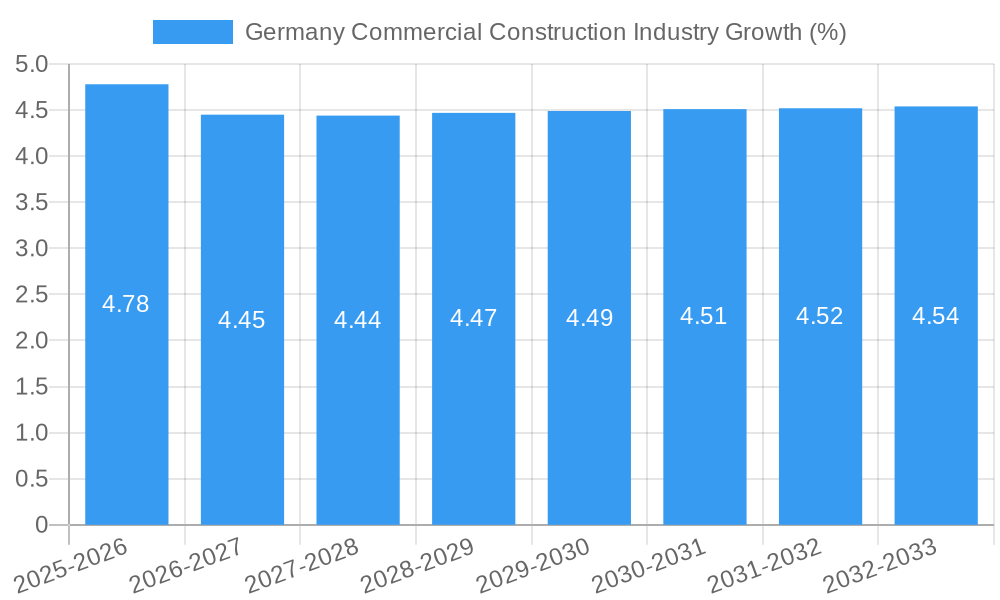

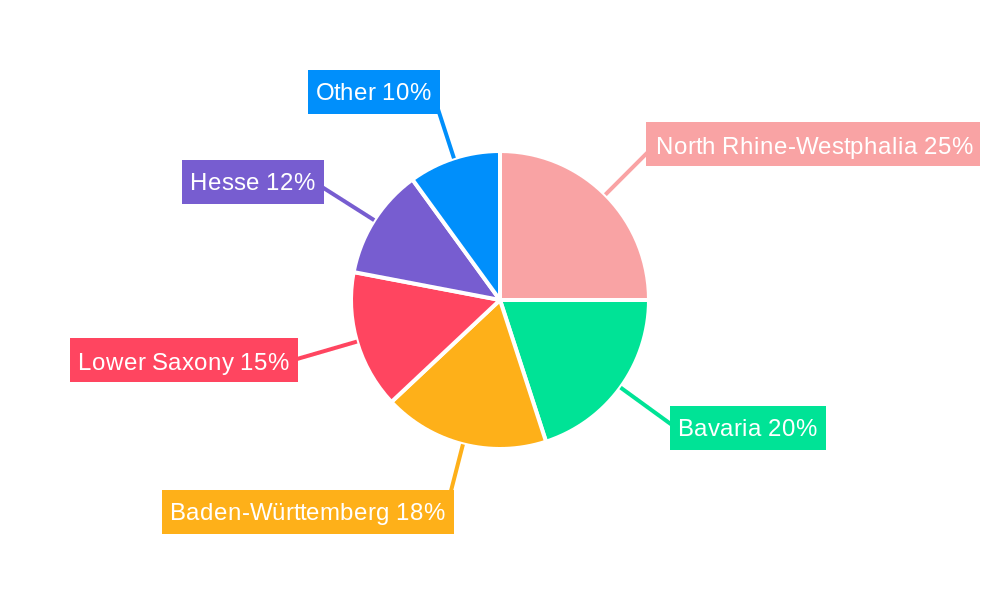

The German commercial construction industry, valued at €109.49 million in 2025, is projected to experience steady growth, with a compound annual growth rate (CAGR) of 4.28% from 2025 to 2033. This growth is driven by several factors. Firstly, increasing urbanization and population density in major German cities like Berlin, Munich, and Frankfurt necessitate the expansion of office spaces, retail outlets, and hospitality infrastructure. Secondly, government initiatives aimed at modernizing infrastructure and promoting sustainable building practices are fueling investment in new construction projects. Furthermore, the robust German economy, particularly in sectors like technology and manufacturing, supports continued demand for commercial real estate. The industry is segmented by type, including office building construction, retail construction, hospitality construction, institutional construction, and other types. Leading players like BAM Deutschland, Strabag AG, and Goldbeck Ost GmbH are key contributors to this market. Regional variations exist, with North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse representing significant regional hubs for commercial construction activity. While potential restraints such as material cost fluctuations and skilled labor shortages exist, the overall outlook for the German commercial construction industry remains positive over the forecast period.

The industry's performance will be influenced by several dynamic factors. Fluctuations in interest rates and borrowing costs can impact investment decisions. Moreover, the industry's sustainability trajectory will be shaped by evolving building codes and regulations, promoting environmentally friendly construction methods. Competition among established players and emerging firms will also influence market dynamics. Successfully navigating these challenges and capitalizing on growth opportunities will be key to achieving sustained success in this sector. The continued focus on innovative construction techniques, technological advancements, and sustainable building materials will likely contribute to the industry's evolution and overall growth. The forecast period of 2025-2033 presents opportunities for growth despite potential headwinds.

Germany Commercial Construction Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the German commercial construction industry, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, growth trends, key players, and emerging opportunities within this dynamic sector. The report examines parent markets (Construction) and child markets (Office, Retail, Hospitality, Institutional Construction), providing a granular understanding of market segmentation and performance.

Germany Commercial Construction Industry Market Dynamics & Structure

The German commercial construction market is characterized by a moderately concentrated landscape, with a few large players commanding significant market share. Technological innovation, driven by digitalization and sustainable building practices, is reshaping the industry, while a robust regulatory framework influences project development. The market faces competition from alternative construction methods and materials, impacting material choices and project timelines. End-user demographics, including corporate real estate strategies and evolving consumer preferences, significantly influence demand across various segments. Mergers and acquisitions (M&A) activity is moderate, with strategic consolidation aiming to enhance market reach and expertise.

- Market Concentration: Strabag AG and other major players hold approximately xx% of the market share in 2025.

- Technological Innovation: Adoption of Building Information Modeling (BIM) and prefabrication methods is increasing, although implementation faces challenges in terms of cost and skill availability.

- Regulatory Framework: Stringent building codes and environmental regulations influence project costs and timelines.

- Competitive Substitutes: Modular construction and alternative building materials are emerging as competitive substitutes, putting pressure on traditional methods.

- M&A Activity: An estimated xx M&A deals were concluded in the historical period (2019-2024), with a projected xx deals for the forecast period (2025-2033).

Germany Commercial Construction Industry Growth Trends & Insights

The German commercial construction market experienced a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024). Market size is expected to reach xx Million in 2025 and continue to grow at a CAGR of xx% during the forecast period (2025-2033), reaching xx Million by 2033. Factors driving growth include sustained economic activity, government investment in infrastructure, and the need for modern commercial spaces. Technological disruptions, such as the increased use of BIM and sustainable construction materials, contribute to efficiency gains and market expansion. However, factors such as rising material costs and labor shortages pose challenges to market growth and could moderate expansion in certain areas. Market penetration of sustainable construction practices is estimated at xx% in 2025, projected to rise to xx% by 2033, driven by government incentives and growing environmental awareness.

Dominant Regions, Countries, or Segments in Germany Commercial Construction Industry

The Office Building Construction segment currently dominates the German commercial construction market, followed by Retail and Hospitality Construction. This dominance is attributed to strong demand from businesses seeking modern and efficient office spaces, along with the sustained growth of e-commerce driving the retail sector. Further, investments in hospitality construction are fueled by both domestic and international tourism, leading to a steady growth outlook. The Institutional Construction segment also shows considerable promise due to sustained investment in public infrastructure projects and healthcare facilities.

- Key Drivers for Office Building Construction: Strong corporate investment, urban renewal projects, and increasing demand for flexible workspaces.

- Key Drivers for Retail Construction: Growth of e-commerce requiring fulfillment centers and evolving retail strategies impacting physical store footprint.

- Key Drivers for Hospitality Construction: Increased tourism, business travel, and a rising demand for budget-friendly accommodation (as evidenced by Premier Inn's expansion).

- Key Drivers for Institutional Construction: Government spending on public infrastructure projects and healthcare facilities.

- Market Share: Office Building Construction holds approximately xx% of the market share in 2025.

Germany Commercial Construction Industry Product Landscape

The German commercial construction product landscape is evolving with innovations in materials, construction methods, and technological integrations. Prefabricated modules, sustainable building materials, and smart building technologies are gaining traction, offering enhanced efficiency, reduced construction time, and improved energy performance. These innovations are accompanied by an increased emphasis on building lifecycle assessment and the adoption of digital tools for project management and collaboration.

Key Drivers, Barriers & Challenges in Germany Commercial Construction Industry

Key Drivers:

- Strong economic growth and increasing investment in infrastructure projects fuel demand.

- Government initiatives promoting sustainable construction practices stimulate market innovation.

- Urbanization and population growth in major cities increase the need for new commercial spaces.

Key Challenges:

- Rising material costs due to global supply chain disruptions and inflation impact project profitability. This is estimated to have a xx% impact on project costs in 2025.

- Labor shortages and skill gaps hinder project completion and increase timelines. This is predicted to cause a xx% delay in project completion for certain projects in 2025.

- Stringent regulations and permitting processes can increase project complexities and delays.

Emerging Opportunities in Germany Commercial Construction Industry

- Growing demand for sustainable and energy-efficient buildings offers opportunities for green construction technologies and materials.

- The adoption of digital technologies presents opportunities for improved project management and efficiency gains.

- Urban renewal projects in major cities create opportunities for large-scale developments.

Growth Accelerators in the Germany Commercial Construction Industry Industry

Technological advancements, particularly in prefabrication and Building Information Modeling (BIM), are significantly streamlining construction processes and reducing project delivery times. Strategic partnerships between construction companies and technology providers are fostering innovation and enhancing productivity. Expansion into new markets and diversification of service offerings are key strategies for growth among companies operating in the sector.

Key Players Shaping the Germany Commercial Construction Industry Market

- BAM Deutschland

- Josef Pfaffinger Bauunternehmung GmbH

- Koster GmbH

- Leonhard Weiss GmbH & Co KG

- Klbl GmbH

- Strabag AG

- AUG PRIEN Bauunternehmung (GmbH & Co KG)

- Goldbeck Ost GmbH Niederlassung Sachsen-Plauen

- Gottlob Brodbeck GmbH & Co KG

- Dechant hoch- und ingenieurbau gmbh

Notable Milestones in Germany Commercial Construction Industry Sector

- August 2023: Schuttflix secures EUR 45 million in funding to enhance technology, expand into new markets, and boost sustainability efforts. This signifies a shift towards digitalization and sustainable practices within the industry.

- April 2023: Premier Inn's acquisition of six hotels and plans to add 1,000-1,500 rooms showcase significant investment in the German hospitality sector and indicates increasing demand for budget-friendly accommodations.

In-Depth Germany Commercial Construction Industry Market Outlook

The German commercial construction industry is poised for sustained growth in the coming years. Technological advancements, coupled with government investments and growing demand across key segments, will continue to drive market expansion. Strategic partnerships, focusing on sustainable construction practices and digital innovations, will prove crucial for companies seeking to capture significant market share and capitalize on the sector's considerable potential.

Germany Commercial Construction Industry Segmentation

-

1. Type

- 1.1. Office Building Construction

- 1.2. Retail Construction

- 1.3. Hospitality Construction

- 1.4. Institutional Construction

- 1.5. Other Types

Germany Commercial Construction Industry Segmentation By Geography

- 1. Germany

Germany Commercial Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.28% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Commercial Property Development; Rapid Digitalization of Commercial Construction

- 3.3. Market Restrains

- 3.3.1. Emerging Safety and Labour Issues; Rise in Cost of Construction

- 3.4. Market Trends

- 3.4.1. Increasing Investments in Green buildings is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Office Building Construction

- 5.1.2. Retail Construction

- 5.1.3. Hospitality Construction

- 5.1.4. Institutional Construction

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North Rhine-Westphalia Germany Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BAM Deutschland

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Josef Pfaffinger Bauunternehmung GmbH**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Koster GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Leonhard Weiss GmbH & Co KG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Klbl GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Strabag AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AUG PRIEN Bauunternehmung (GmbH & Co KG)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Goldbeck Ost GmbH Niederlassung Sachsen-Plauen

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Gottlob Brodbeck GmbH & Co KG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dechant hoch- und ingenieurbau gmbh

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 BAM Deutschland

List of Figures

- Figure 1: Germany Commercial Construction Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Commercial Construction Industry Share (%) by Company 2024

List of Tables

- Table 1: Germany Commercial Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Commercial Construction Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Germany Commercial Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Germany Commercial Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: North Rhine-Westphalia Germany Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Bavaria Germany Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Baden-Württemberg Germany Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Lower Saxony Germany Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Hesse Germany Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Commercial Construction Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 11: Germany Commercial Construction Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Commercial Construction Industry?

The projected CAGR is approximately 4.28%.

2. Which companies are prominent players in the Germany Commercial Construction Industry?

Key companies in the market include BAM Deutschland, Josef Pfaffinger Bauunternehmung GmbH**List Not Exhaustive, Koster GmbH, Leonhard Weiss GmbH & Co KG, Klbl GmbH, Strabag AG, AUG PRIEN Bauunternehmung (GmbH & Co KG), Goldbeck Ost GmbH Niederlassung Sachsen-Plauen, Gottlob Brodbeck GmbH & Co KG, Dechant hoch- und ingenieurbau gmbh.

3. What are the main segments of the Germany Commercial Construction Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 109.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Commercial Property Development; Rapid Digitalization of Commercial Construction.

6. What are the notable trends driving market growth?

Increasing Investments in Green buildings is Driving the Market Growth.

7. Are there any restraints impacting market growth?

Emerging Safety and Labour Issues; Rise in Cost of Construction.

8. Can you provide examples of recent developments in the market?

August 2023: Gutersloh-based Schuttflix, a German digital marketplace and delivery platform for bulk construction supplies, announced that it had secured EUR 45 million (USD 47.37 million) in a fresh round of funding. Schuttflix says it will use the funds to enhance its technology, expand into new markets, diversify services, form partnerships, attract top talent, invest in marketing, prioritize customer support, and contribute to sustainability efforts in the construction sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Commercial Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Commercial Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Commercial Construction Industry?

To stay informed about further developments, trends, and reports in the Germany Commercial Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence