Key Insights

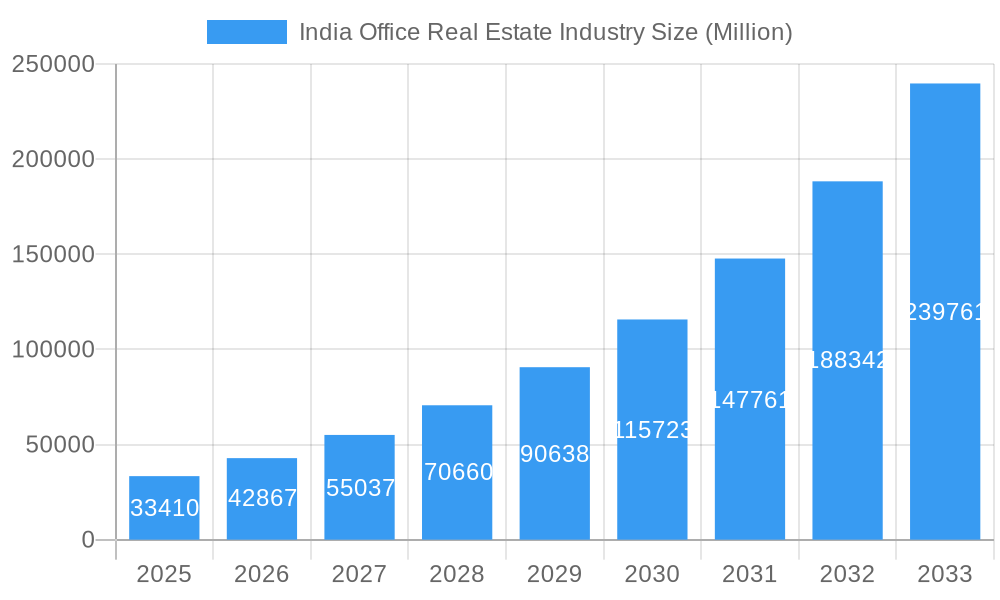

The India office real estate market, valued at ₹33.41 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 28.50% from 2025 to 2033. This surge is fueled by several key drivers. The burgeoning IT sector, particularly in major technology hubs like Bengaluru, Hyderabad, and Mumbai, is a significant contributor, demanding substantial office spaces. Furthermore, a growing number of multinational corporations establishing or expanding their presence in India, combined with increasing urbanization and a young, skilled workforce, contribute to heightened demand. Improved infrastructure development in many cities also plays a vital role in attracting investment and facilitating business expansion. While challenges exist, such as fluctuating economic conditions and potential regulatory hurdles, the overall market outlook remains positive, driven by long-term growth prospects in the Indian economy.

India Office Real Estate Industry Market Size (In Billion)

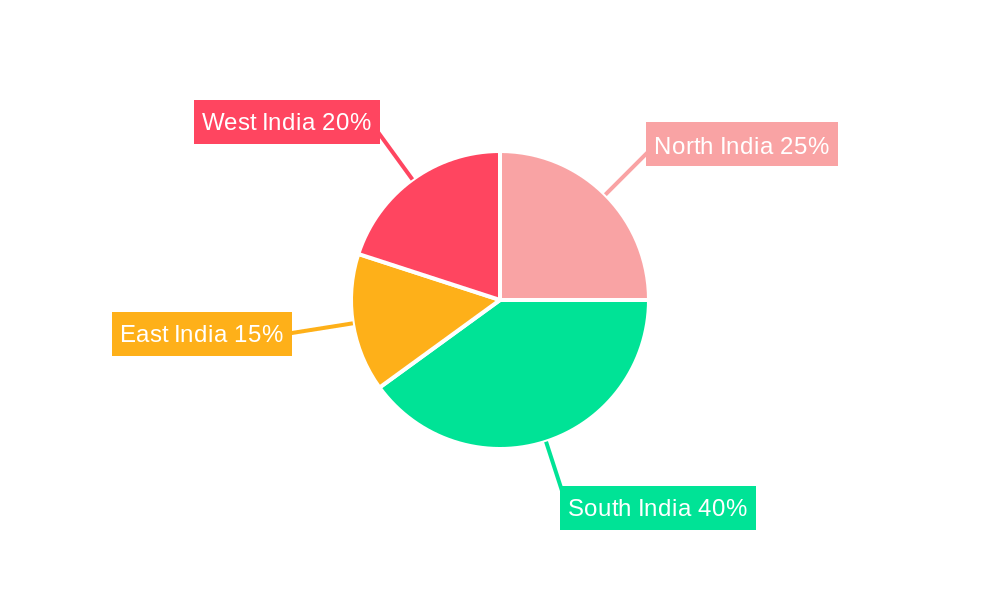

The market segmentation reveals significant concentration in major cities. Bengaluru, Hyderabad, and Mumbai together dominate the market share, attracting the lion's share of investments and leasing activities. However, other major cities are witnessing steady growth, indicative of a broader expansion beyond the traditional hubs. Prominent players like Prestige Estate Projects, DLF Limited, and Oberoi Realty are shaping the market landscape, alongside international real estate giants such as CBRE Group and JLL. Regional variations exist, with South India currently leading in terms of office space absorption, but North, East, and West India are expected to witness substantial growth in the coming years as infrastructure improves and economic activity expands across the country. The forecast period (2025-2033) promises continued expansion, largely influenced by the sustained growth trajectory of the Indian economy and the persistent demand for modern, efficient office spaces.

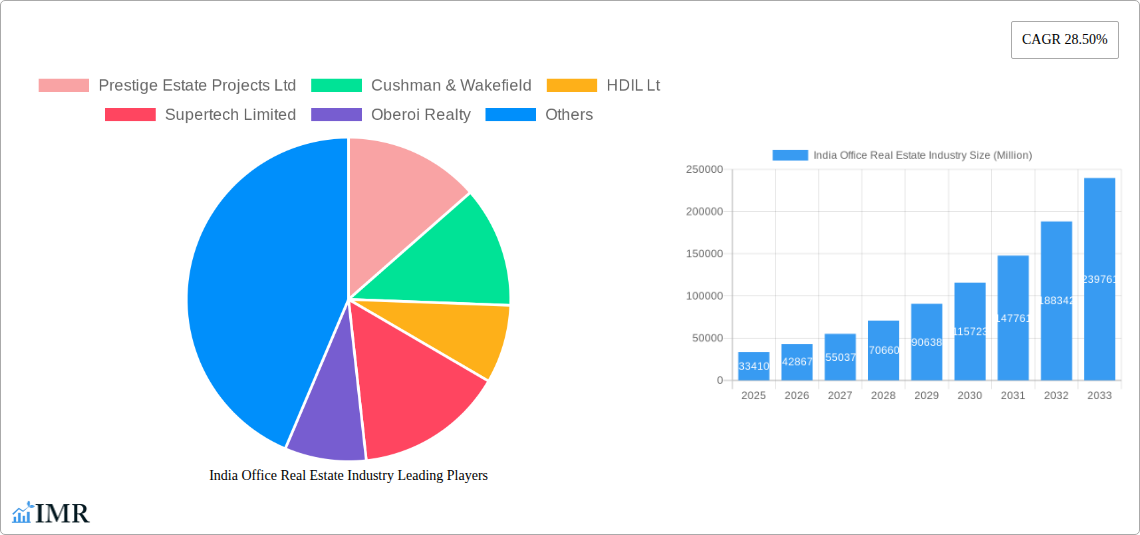

India Office Real Estate Industry Company Market Share

India Office Real Estate Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the India office real estate market, covering historical data (2019-2024), the base year (2025), and a forecast period (2025-2033). It examines market dynamics, growth trends, dominant segments, key players, and future opportunities across major cities like Bengaluru, Mumbai, Hyderabad, and others. The report is essential for investors, developers, real estate professionals, and anyone seeking to understand this dynamic sector.

India Office Real Estate Industry Market Dynamics & Structure

This section analyzes the competitive landscape, regulatory environment, and technological advancements shaping the Indian office real estate market. We delve into market concentration, examining the market share of major players like DLF Limited, Oberoi Realty, and Indiabulls Real Estate, alongside the influence of global firms such as CBRE Group and JLL. The report also assesses the impact of mergers and acquisitions (M&A) activity, quantifying deal volumes in the historical period and projecting future trends. Technological innovations, such as smart building technologies and sustainable design practices, are examined, along with their adoption rates and impact on market dynamics. Regulatory frameworks, including zoning regulations and environmental policies, are also analyzed for their influence on market growth. The section further explores the impact of competitive product substitutes and the changing demographics of end-users.

- Market Concentration: DLF Limited, Oberoi Realty, and Indiabulls Real Estate hold a combined xx% market share (2024). M&A activity showed a xx Million USD deal volume in 2024.

- Technological Innovation: Smart building technologies adoption is projected to reach xx% by 2033, driven by increasing demand for energy efficiency.

- Regulatory Framework: New building codes and environmental regulations are expected to influence construction costs and development timelines.

- Competitive Substitutes: The rise of co-working spaces presents a competitive challenge to traditional office spaces.

- End-User Demographics: The report examines shifts in end-user needs, including demand for flexible workspaces and sustainable designs.

India Office Real Estate Industry Growth Trends & Insights

Leveraging extensive market research data, this section details the evolution of the Indian office real estate market size from 2019 to 2024, projecting growth through 2033. We analyze the compound annual growth rate (CAGR) for various segments, focusing on factors influencing adoption rates of new technologies and shifts in consumer behavior, including the increasing demand for flexible and sustainable office spaces. The report examines the impact of technological disruptions, such as the rise of remote work and its influence on office space demand. The section also includes a deep dive into changes in consumer preferences regarding office locations, amenities, and sustainability. Specific CAGR projections are provided, segmented by city and building type. Market penetration rates for smart building technologies are also analyzed.

Dominant Regions, Countries, or Segments in India Office Real Estate Industry

This section identifies the leading regions driving market growth, with a detailed analysis of Bengaluru, Hyderabad, Mumbai, and other major cities. We assess the contribution of each region to overall market size and growth, highlighting key drivers such as economic policies, infrastructure development, and the presence of major technology companies. The analysis includes market share data for each city, along with projections for future growth potential.

- Bengaluru: Strong IT sector, robust infrastructure, and a large talent pool drive high demand for office space.

- Mumbai: Remains a significant financial hub, attracting substantial investments and driving continued growth.

- Hyderabad: A burgeoning IT hub with significant government investment in infrastructure.

- Other Cities: Growth driven by expanding industrial sectors and government initiatives in tier-2 and tier-3 cities.

India Office Real Estate Industry Product Landscape

This section details the range of office spaces available, highlighting product innovations and performance metrics. It covers diverse options from traditional office buildings to co-working spaces, analyzing unique selling propositions such as location, amenities, and sustainability features. The focus is on innovative designs and technological advancements that enhance efficiency and workplace experience.

Key Drivers, Barriers & Challenges in India Office Real Estate Industry

This section identifies key drivers, including strong economic growth, increasing urbanization, and the expanding IT sector. Specific examples are included, such as the government's focus on smart cities and infrastructure development. Simultaneously, we explore challenges such as regulatory hurdles, supply chain disruptions, and competitive pressures. The quantitative impact of these challenges on market growth is also assessed.

Emerging Opportunities in India Office Real Estate Industry

This section explores emerging trends and opportunities, such as the rise of flexible workspaces, the growing demand for sustainable office buildings, and expansion into untapped markets beyond major cities.

Growth Accelerators in the India Office Real Estate Industry Industry

Technological advancements, strategic partnerships, and government initiatives promoting infrastructure development are identified as key growth accelerators for the long term.

Key Players Shaping the India Office Real Estate Industry Market

- Prestige Estate Projects Ltd

- Cushman & Wakefield

- HDIL Lt

- Supertech Limited

- Oberoi Realty

- CBRE Group

- Indiabulls Real Estate

- JLL

- Savills

- DLF Limited

Notable Milestones in India Office Real Estate Industry Sector

- October 2022: Colliers International announced plans for over 300 million square feet of commercial office development across six major Indian cities.

- August 2022: Hines Ltd. announced plans for a 9 lakh square feet office building in Mumbai, adding to its existing 1.4 million square feet in Gurugram.

In-Depth India Office Real Estate Industry Market Outlook

The Indian office real estate market presents significant long-term growth potential, driven by sustained economic growth, urbanization, and technological advancements. Strategic opportunities exist in developing sustainable, technologically advanced office spaces and expanding into tier-2 and tier-3 cities.

India Office Real Estate Industry Segmentation

-

1. Major Cities

- 1.1. Bengaluru

- 1.2. Hyderabad

- 1.3. Mumbai

- 1.4. Other Cities

India Office Real Estate Industry Segmentation By Geography

- 1. India

India Office Real Estate Industry Regional Market Share

Geographic Coverage of India Office Real Estate Industry

India Office Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 28.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Improvements in Infrastructure and New Development; Population Growth and Demographic Changes

- 3.3. Market Restrains

- 3.3.1. Housing Shortages; Increasing Awareness towards Environmental Issues

- 3.4. Market Trends

- 3.4.1. Demand for Office Space Increased in 2021

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Office Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Major Cities

- 5.1.1. Bengaluru

- 5.1.2. Hyderabad

- 5.1.3. Mumbai

- 5.1.4. Other Cities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Major Cities

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Prestige Estate Projects Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cushman & Wakefield

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HDIL Lt

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Supertech Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Oberoi Realty

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CBRE Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Indiabulls Real Estate

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 JLL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Savills

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DLF Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Prestige Estate Projects Ltd

List of Figures

- Figure 1: India Office Real Estate Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Office Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: India Office Real Estate Industry Revenue Million Forecast, by Major Cities 2020 & 2033

- Table 2: India Office Real Estate Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: India Office Real Estate Industry Revenue Million Forecast, by Major Cities 2020 & 2033

- Table 4: India Office Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Office Real Estate Industry?

The projected CAGR is approximately 28.50%.

2. Which companies are prominent players in the India Office Real Estate Industry?

Key companies in the market include Prestige Estate Projects Ltd, Cushman & Wakefield, HDIL Lt, Supertech Limited, Oberoi Realty, CBRE Group, Indiabulls Real Estate, JLL, Savills, DLF Limited.

3. What are the main segments of the India Office Real Estate Industry?

The market segments include Major Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Improvements in Infrastructure and New Development; Population Growth and Demographic Changes.

6. What are the notable trends driving market growth?

Demand for Office Space Increased in 2021.

7. Are there any restraints impacting market growth?

Housing Shortages; Increasing Awareness towards Environmental Issues.

8. Can you provide examples of recent developments in the market?

October 2022: Colliers International, a global real estate consulting firm, announced that the major six cities in India (Bengaluru, Chennai, Delhi-NCR, Hyderabad, Mumbai, and Pune) planned to develop more than 300 million square feet of existing and upcoming commercial office buildings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Office Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Office Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Office Real Estate Industry?

To stay informed about further developments, trends, and reports in the India Office Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence