Key Insights

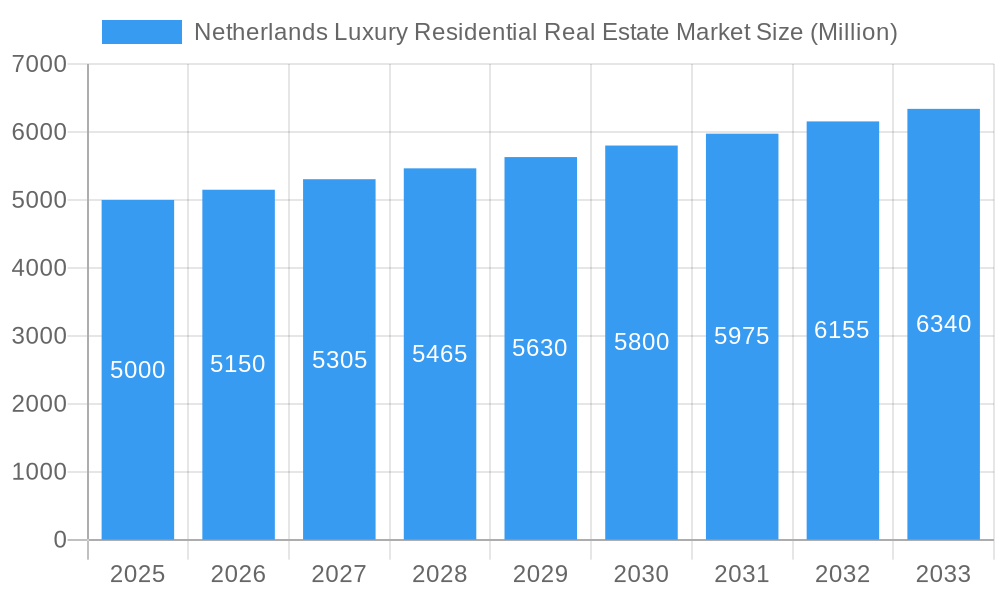

The Netherlands luxury residential real estate market, encompassing apartments, condominiums, villas, and landed houses across major cities like Amsterdam, Rotterdam, and The Hague, is experiencing robust growth. With a current market size estimated at €[Insert Estimated 2025 Market Size in Millions based on available data and reasonable estimations; e.g., €5 Billion] and a projected Compound Annual Growth Rate (CAGR) exceeding 3%, the market is poised for significant expansion through 2033. Key drivers include increasing high-net-worth individual (HNWI) populations in major Dutch cities, a strong national economy, and a preference for high-end, sustainable properties. Trends point towards rising demand for waterfront properties, smart homes equipped with advanced technology, and properties in historically significant areas. While factors such as fluctuating interest rates and overall economic uncertainty could pose some restraints, the long-term outlook remains positive, driven by sustained investor interest and a limited supply of luxury homes in prime locations.

Netherlands Luxury Residential Real Estate Market Market Size (In Billion)

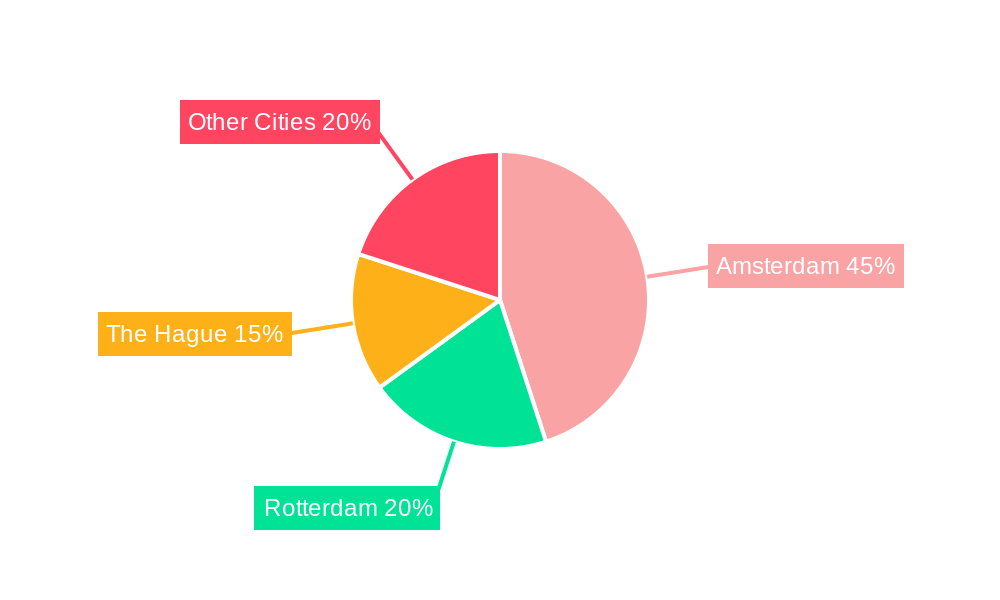

The market is segmented geographically, with Amsterdam consistently dominating due to its high concentration of HNWIs and global corporations. Rotterdam and The Hague also present attractive markets, benefiting from their own economic dynamism and appealing lifestyle offerings. Leading developers such as BPD, Christie's International Real Estate, and others play a vital role in shaping the market, contributing to the ongoing construction of new luxury residences and the revitalization of existing properties. The increasing focus on sustainability and energy efficiency within new constructions further strengthens market appeal and aligns with broader environmental concerns amongst affluent buyers. The current robust market conditions coupled with the anticipated rise in the number of HNWIs, suggest the Netherlands luxury residential real estate sector will maintain a trajectory of healthy growth in the coming years.

Netherlands Luxury Residential Real Estate Market Company Market Share

Netherlands Luxury Residential Real Estate Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Netherlands luxury residential real estate market, covering the period from 2019 to 2033. We examine market dynamics, growth trends, dominant segments, and key players, offering invaluable insights for industry professionals, investors, and developers. The report leverages extensive data analysis to forecast market size and growth, identifying key opportunities and challenges within this lucrative sector. With a focus on Amsterdam, Rotterdam, The Hague, and other key cities, this report dissects the luxury segments of apartments & condominiums and villas & landed houses.

Netherlands Luxury Residential Real Estate Market Dynamics & Structure

The Netherlands luxury residential real estate market is characterized by a moderately concentrated landscape with several prominent players and a growing number of niche developers. Market share amongst the top 5 developers is approximately 40%, with smaller players accounting for the remaining 60%. Technological innovations, such as 3D virtual home models (as implemented by BPD), are transforming the customer experience and streamlining the purchasing process. Stringent building codes and environmental regulations, including those promoting sustainable building practices, shape the market landscape. Luxury buyers are also influenced by factors such as proximity to amenities, quality of infrastructure, and access to international transportation links.

- Market Concentration: Top 5 developers hold approximately 40% market share.

- Technological Innovation: 3D model implementation by BPD exemplifies the integration of technology.

- Regulatory Framework: Stringent building codes and environmental regulations are key drivers.

- Competitive Substitutes: Limited direct substitutes due to the unique nature of luxury properties.

- End-User Demographics: High-net-worth individuals, both domestic and international, comprise the target audience.

- M&A Trends: xx M&A deals recorded in the historical period, predicting xx deals during the forecast period (2025-2033).

Netherlands Luxury Residential Real Estate Market Growth Trends & Insights

The Netherlands luxury residential real estate market experienced a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024), reaching a market size of €xx Million in 2024. The market is projected to maintain robust growth, with a projected CAGR of xx% during the forecast period (2025-2033), reaching an estimated market size of €xx Million by 2033. This growth is fueled by rising disposable incomes amongst high-net-worth individuals, increasing demand for luxury properties, and continued investment in infrastructure and urban development within key cities. The adoption of sustainable building practices and smart home technologies is also driving market expansion.

Dominant Regions, Countries, or Segments in Netherlands Luxury Residential Real Estate Market

Amsterdam consistently dominates the luxury residential market, accounting for approximately xx% of the total market value in 2024. This dominance is attributed to its strong economy, established infrastructure, cultural attractions, and high concentration of high-net-worth individuals. Rotterdam and The Hague also contribute significantly, representing xx% and xx% of the market respectively. Villas and landed houses command a premium compared to apartments and condominiums, reflecting a preference for larger, more exclusive properties.

- Amsterdam: Strong economy, high HNW population, established infrastructure drive its dominance.

- Rotterdam & The Hague: Contribute significantly, offering unique lifestyle propositions.

- Villas & Landed Houses: Higher price points demonstrate their appeal to luxury buyers.

- Apartments & Condominiums: Strong performance due to preference for city-center living.

Netherlands Luxury Residential Real Estate Market Product Landscape

The luxury residential market offers diverse products, ranging from ultra-modern apartments in prime city locations to exclusive waterfront villas. Products are differentiated by location, architectural design, interior finishes, and inclusion of smart home features. Many developers focus on energy efficiency and sustainability, aligning with growing environmental concerns. Unique selling propositions frequently include bespoke design options, private gardens or terraces, and exclusive access to amenities.

Key Drivers, Barriers & Challenges in Netherlands Luxury Residential Real Estate Market

Key Drivers:

- Strong economic growth and rising disposable incomes.

- Increasing demand for high-quality, sustainable housing.

- Government initiatives supporting urban development and infrastructure projects.

Challenges:

- Limited land availability in prime urban areas restricts supply.

- High construction costs and lengthy permitting processes increase development costs.

- Competition from other luxury markets within Europe. This results in an estimated xx% reduction in market growth during the forecast period due to increased competition.

Emerging Opportunities in Netherlands Luxury Residential Real Estate Market

Emerging opportunities include the development of luxury properties in secondary locations near major cities, leveraging the appeal of a more tranquil environment with good access to amenities. There's growing demand for bespoke, personalized design and increased focus on smart home technology integration and sustainable features. Exploring alternative construction methods to lower costs and speed up development time is another viable opportunity.

Growth Accelerators in the Netherlands Luxury Residential Real Estate Market Industry

Strategic partnerships between developers and luxury brands could enhance product positioning and appeal to a discerning clientele. Further technological advancements in design and construction could improve efficiency and affordability, opening up new market segments. Expanding into developing areas near major cities could increase supply and reach new buyers.

Key Players Shaping the Netherlands Luxury Residential Real Estate Market Market

- BPD

- Christie's International Real Estate

- Van Wanrooji Construction and Development

- Sotheby's International Realty

- Dura Vermeer Groep

- Provast

- Van Wijnen

- Volker Wessels

- Heijmans

- Vorm

Notable Milestones in Netherlands Luxury Residential Real Estate Market Sector

- April 2022: BPD introduced 3D virtual home models, enhancing the buyer experience.

- May 2022: VORM commenced construction of the Klipper district in Spijkenisse, focusing on sustainable, smart homes.

In-Depth Netherlands Luxury Residential Real Estate Market Market Outlook

The Netherlands luxury residential real estate market is poised for sustained growth, driven by robust economic fundamentals and increasing demand for high-quality, sustainable properties. Strategic investments in infrastructure development, sustainable construction, and technological innovation will further fuel market expansion. The ongoing integration of virtual reality and other technologies will reshape the sales process and enhance the customer experience. Developers that successfully integrate technology, prioritize sustainability, and offer unique value propositions are best positioned for long-term success.

Netherlands Luxury Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

-

2. City

- 2.1. Amsterdam

- 2.2. Rotterdam

- 2.3. The Hague

- 2.4. Other Cities

Netherlands Luxury Residential Real Estate Market Segmentation By Geography

- 1. Netherlands

Netherlands Luxury Residential Real Estate Market Regional Market Share

Geographic Coverage of Netherlands Luxury Residential Real Estate Market

Netherlands Luxury Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Transportation Infrastructure is increasing in Netherlands; Growth in Travel and Tourism is driving the need for Transportation Infrastructure.

- 3.3. Market Restrains

- 3.3.1. High cost of the construction projects; Limited space availability for new projects

- 3.4. Market Trends

- 3.4.1. Growing Number of High Net Worth Individuals Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by City

- 5.2.1. Amsterdam

- 5.2.2. Rotterdam

- 5.2.3. The Hague

- 5.2.4. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BPD

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Christie's International Real Estate

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Van Wanrooji Construction and Development

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sotheby's International Realty

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dura Vermeer Groep**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Provast

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Van Wijnen

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Volker Wessels

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Heijmans

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vorm

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BPD

List of Figures

- Figure 1: Netherlands Luxury Residential Real Estate Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Netherlands Luxury Residential Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Netherlands Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Netherlands Luxury Residential Real Estate Market Revenue Million Forecast, by City 2020 & 2033

- Table 3: Netherlands Luxury Residential Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Netherlands Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Netherlands Luxury Residential Real Estate Market Revenue Million Forecast, by City 2020 & 2033

- Table 6: Netherlands Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Luxury Residential Real Estate Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Netherlands Luxury Residential Real Estate Market?

Key companies in the market include BPD, Christie's International Real Estate, Van Wanrooji Construction and Development, Sotheby's International Realty, Dura Vermeer Groep**List Not Exhaustive, Provast, Van Wijnen, Volker Wessels, Heijmans, Vorm.

3. What are the main segments of the Netherlands Luxury Residential Real Estate Market?

The market segments include Type, City.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Transportation Infrastructure is increasing in Netherlands; Growth in Travel and Tourism is driving the need for Transportation Infrastructure..

6. What are the notable trends driving market growth?

Growing Number of High Net Worth Individuals Driving the Market.

7. Are there any restraints impacting market growth?

High cost of the construction projects; Limited space availability for new projects.

8. Can you provide examples of recent developments in the market?

May 2022: The construction of the new Klipper district in the port area of Spijkenisse started officially. The Rotterdam project developer and builder VORM is responsible for the construction of a total of 48 sustainable and smart homes. The energy-neutral new housing estate, with single-family homes, townhouses, and sturdy quay houses, is part of the Port, the overarching area development De Elementen. The completion of the Klipper subproject is planned for the end of 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Luxury Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Luxury Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Luxury Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the Netherlands Luxury Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence