Key Insights

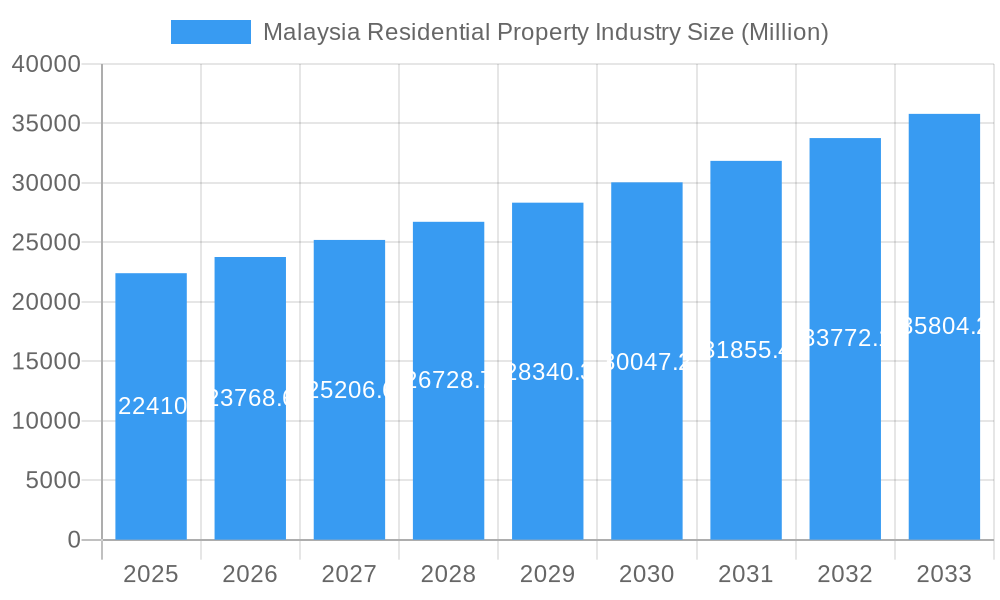

The Malaysian residential property market, valued at RM 22.41 billion in 2025, exhibits a robust growth trajectory, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.90% from 2025 to 2033. This growth is driven by several key factors. Firstly, sustained urbanization and population growth, particularly in major cities like Kuala Lumpur, Johor Bahru, George Town, and Seberang Perai, fuel consistent demand for housing. Secondly, improving economic conditions and rising disposable incomes contribute to increased purchasing power among prospective homeowners. Furthermore, government initiatives aimed at affordable housing and infrastructure development further stimulate market activity. The market is segmented by property type (apartments/condominiums, landed houses/villas) and location, reflecting varied price points and consumer preferences. Leading developers such as Platinum Victory, Matrix Concepts Holdings Bhd, Mah Sing Group Bhd, Sime Darby Property, IGB Berhad, IOI Properties, Glomac Bhd, S P Setia, UEM Sunrise, and Eco World Development Group Berhad, contribute significantly to the market's supply.

Malaysia Residential Property Industry Market Size (In Billion)

However, the market also faces certain challenges. Rising construction costs and material prices pose a constraint on affordability and profitability for developers. Furthermore, fluctuating interest rates and mortgage availability can influence buyer sentiment and purchasing decisions. Government regulations and policies regarding land use and development approvals can also impact the overall market dynamics. Despite these challenges, the long-term outlook for the Malaysian residential property market remains positive, supported by a growing population, economic progress, and ongoing infrastructural investments. The market's diverse segments cater to varying needs and budgets, ensuring continued dynamism and growth opportunities in the coming years. Strategic location and innovative property designs will likely be crucial factors for success within this competitive landscape.

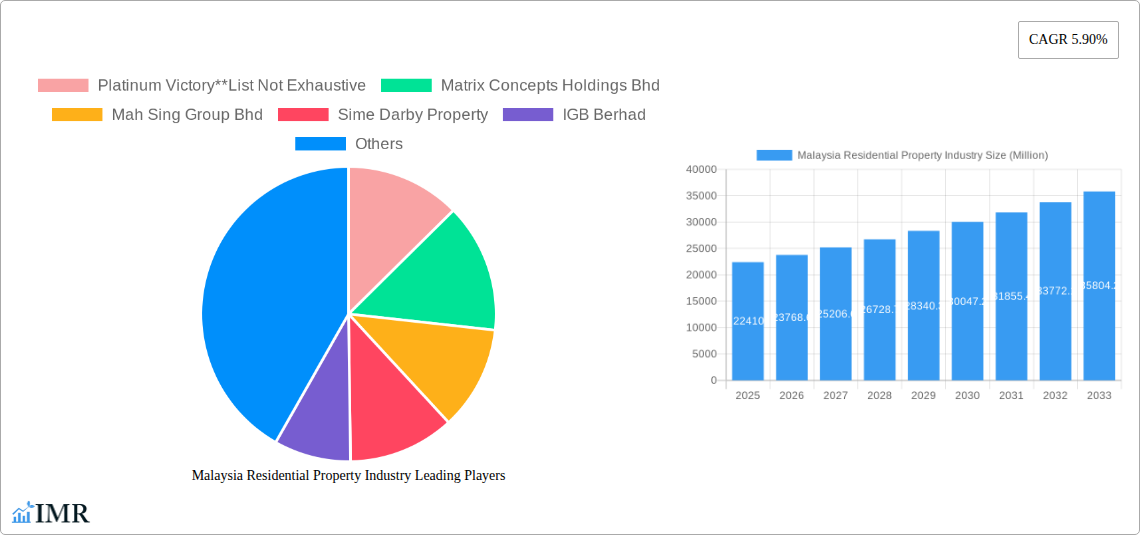

Malaysia Residential Property Industry Company Market Share

Malaysia Residential Property Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Malaysian residential property market, covering the period 2019-2033, with a focus on 2025. It examines market dynamics, growth trends, dominant segments, key players, and future opportunities, offering invaluable insights for industry professionals, investors, and policymakers. The report leverages extensive data and analysis to deliver a clear understanding of this dynamic market.

Keywords: Malaysia residential property, real estate market Malaysia, Malaysian property market analysis, Kuala Lumpur property market, Johor Bahru property, Seberang Perai property, George Town property, property investment Malaysia, apartment market Malaysia, condominium market Malaysia, landed property Malaysia, PropertyGuru, iProperty Malaysia, Knight Frank Malaysia, Matrix Concepts Holdings Bhd, Mah Sing Group Bhd, Sime Darby Property

Malaysia Residential Property Industry Market Dynamics & Structure

This section analyzes the Malaysian residential property market's structure, encompassing market concentration, technological advancements, regulatory landscape, competitive dynamics, and demographic trends. We also examine mergers and acquisitions (M&A) activity within the industry. The Malaysian residential property market is characterized by a moderately concentrated landscape, with several large players alongside numerous smaller developers.

- Market Concentration: The top 10 developers hold approximately xx% of the market share (2024).

- Technological Innovation: PropTech adoption is increasing, driving efficiency and transparency (e.g., virtual tours, online property portals). However, barriers to entry remain for smaller players due to investment costs.

- Regulatory Framework: Government policies and regulations significantly influence supply and demand, impacting affordability and investment sentiment.

- Competitive Substitutes: The availability of rental properties and alternative housing options exerts competitive pressure on the market.

- End-User Demographics: The growing millennial and Gen Z populations, alongside shifting family structures, are shaping demand for specific property types and locations.

- M&A Trends: Recent acquisitions, such as PropertyGuru's purchase of iProperty Malaysia (Dec 2022) and Knight Frank's acquisition of Property Hub Sdn Bhd (April 2022), signal consolidation and increased competition. The total M&A deal volume in the period 2019-2024 was approximately xx Million units.

Malaysia Residential Property Industry Growth Trends & Insights

This section analyzes the historical and projected growth of the Malaysian residential property market. Using comprehensive data analysis, we present a detailed picture of market size evolution, adoption rates of new technologies, and evolving consumer behavior. This section provides key performance indicators such as Compound Annual Growth Rate (CAGR) and market penetration rates to provide a clear picture of the market's trajectory.

The Malaysian residential property market experienced a CAGR of xx% during the historical period (2019-2024), driven by factors such as urbanization, population growth, and increased disposable incomes. However, growth slowed in recent years due to economic uncertainty and regulatory changes. The forecast period (2025-2033) projects a CAGR of xx%, influenced by government initiatives to boost affordability and infrastructure development. Technological disruptions, such as the rise of PropTech, are accelerating market transformation, impacting property transactions, marketing, and management. Consumer behavior is evolving, with a growing preference for sustainable and technologically advanced properties. The market penetration of online property portals has increased significantly in recent years, exceeding xx% in 2024.

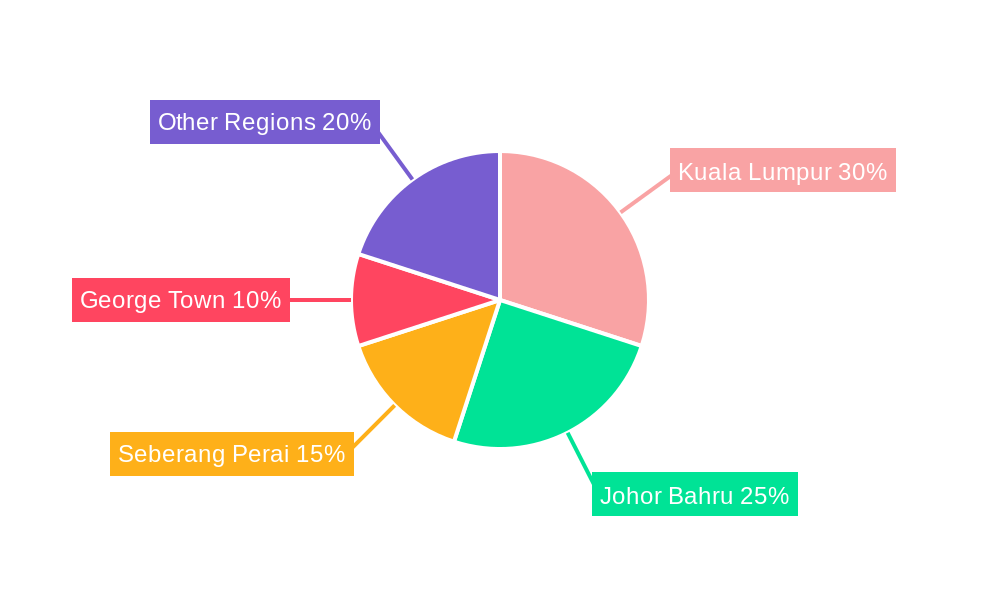

Dominant Regions, Countries, or Segments in Malaysia Residential Property Industry

This section identifies the leading regions and segments driving market growth. We analyze factors contributing to their dominance, including market share, growth potential, economic policies, and infrastructure development.

By Type:

Apartments and Condominiums: This segment remains the dominant type, holding a xx% market share in 2024, driven by affordability and location advantages in urban areas. Kuala Lumpur and Johor Bahru are key markets for this type of residential property.

Landed Houses and Villas: This segment constitutes xx% of the market, showing strong demand in suburban and rural areas, particularly in locations with established amenities and good infrastructure connectivity.

By Key Cities:

- Kuala Lumpur: Remains the most dominant market, representing xx% of the overall market in 2024, driven by high population density, employment opportunities, and strong infrastructure.

- Johor Bahru: Shows significant growth potential, fuelled by economic development and cross-border investments. Market share in 2024: xx%.

- Seberang Perai and George Town: These regions exhibit steady growth with significant potential for future expansion based on affordability and proximity to industrial centers. Their combined market share in 2024 is approximately xx%.

Malaysia Residential Property Industry Product Landscape

The Malaysian residential property market offers a diverse range of products, from high-rise apartments and condominiums to landed properties and luxury villas. Recent innovations include incorporating smart home technology, sustainable building materials, and co-living spaces. This reflects changing preferences and focuses on environmental sustainability and energy efficiency. Developers are increasingly using virtual reality and augmented reality to enhance marketing efforts and provide potential buyers with immersive property experiences.

Key Drivers, Barriers & Challenges in Malaysia Residential Property Industry

Key Drivers:

- Urbanization and Population Growth: Continued migration to urban areas is fueling demand.

- Economic Growth: Rising disposable incomes contribute to increased purchasing power.

- Government Initiatives: Affordable housing programs stimulate market activity.

Key Challenges:

- Affordability: High property prices remain a significant barrier for many potential buyers.

- Regulatory Hurdles: Complex approval processes and regulations can slow down development.

- Supply Chain Disruptions: Global supply chain issues impacting construction materials have caused price volatility and delays. This has resulted in an estimated xx% increase in construction costs in 2024.

Emerging Opportunities in Malaysia Residential Property Industry

Emerging opportunities include:

- Sustainable and Green Developments: Growing consumer demand for eco-friendly properties.

- Smart Home Technology Integration: Increased adoption of smart home features in new developments.

- Co-living Spaces: Growing popularity of shared living arrangements, particularly among young professionals.

- Development in secondary cities: Expansion to cities beyond major hubs to cater to expanding populations.

Growth Accelerators in the Malaysia Residential Property Industry

Long-term growth will be accelerated by:

Technological advancements, such as the implementation of Building Information Modeling (BIM) and the utilization of data analytics for improved project planning and cost management, will help streamline construction and boost efficiency. Strategic partnerships between developers and technology companies will further drive innovation and increase the market’s overall efficiency. Expanding into underserved markets and focusing on sustainable housing solutions will create new opportunities for growth in the long term.

Key Players Shaping the Malaysia Residential Property Industry Market

- Platinum Victory

- Matrix Concepts Holdings Bhd

- Mah Sing Group Bhd

- Sime Darby Property

- IGB Berhad

- IOI Properties

- Glomac Bhd

- S P Setia

- UEM Sunrise

- Eco World Development Group Berhad

Notable Milestones in Malaysia Residential Property Industry Sector

- December 2022: PropertyGuru acquires iProperty Malaysia, leading to market consolidation and potential service enhancements.

- April 2022: Knight Frank Malaysia expands its residential market presence through the acquisition of Property Hub Sdn Bhd, increasing competition.

In-Depth Malaysia Residential Property Industry Market Outlook

The Malaysian residential property market is poised for continued growth, driven by long-term demographic trends, urbanization, and supportive government policies. Strategic opportunities exist for developers focusing on sustainable development, technological integration, and catering to evolving consumer preferences. The focus on affordable housing initiatives and infrastructure improvements will be key factors shaping the market’s future. The market is anticipated to reach a value of xx Million units by 2033.

Malaysia Residential Property Industry Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

-

2. Key Cities

- 2.1. Kuala Lumpur

- 2.2. Seberang Perai

- 2.3. George Town

- 2.4. Johor Bahru

Malaysia Residential Property Industry Segmentation By Geography

- 1. Malaysia

Malaysia Residential Property Industry Regional Market Share

Geographic Coverage of Malaysia Residential Property Industry

Malaysia Residential Property Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Residential Real Estate Demand by Young People4.; Increase in Average Housing Price in Mexico

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Affordable Housing Inhibiting the Growth of the Market4.; Economic Instability Affecting the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Increase in Urbanization Boosting Demand for Residential Real Estate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Residential Property Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Kuala Lumpur

- 5.2.2. Seberang Perai

- 5.2.3. George Town

- 5.2.4. Johor Bahru

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Platinum Victory**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Matrix Concepts Holdings Bhd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mah Sing Group Bhd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sime Darby Property

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IGB Berhad

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IOI Properties

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Glomac Bhd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 S P Setia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 UEM Sunrise

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Eco World Development Group Berhad

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Platinum Victory**List Not Exhaustive

List of Figures

- Figure 1: Malaysia Residential Property Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Malaysia Residential Property Industry Share (%) by Company 2025

List of Tables

- Table 1: Malaysia Residential Property Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Malaysia Residential Property Industry Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 3: Malaysia Residential Property Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Malaysia Residential Property Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Malaysia Residential Property Industry Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 6: Malaysia Residential Property Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Residential Property Industry?

The projected CAGR is approximately 5.90%.

2. Which companies are prominent players in the Malaysia Residential Property Industry?

Key companies in the market include Platinum Victory**List Not Exhaustive, Matrix Concepts Holdings Bhd, Mah Sing Group Bhd, Sime Darby Property, IGB Berhad, IOI Properties, Glomac Bhd, S P Setia, UEM Sunrise, Eco World Development Group Berhad.

3. What are the main segments of the Malaysia Residential Property Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.41 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Residential Real Estate Demand by Young People4.; Increase in Average Housing Price in Mexico.

6. What are the notable trends driving market growth?

Increase in Urbanization Boosting Demand for Residential Real Estate.

7. Are there any restraints impacting market growth?

4.; Lack of Affordable Housing Inhibiting the Growth of the Market4.; Economic Instability Affecting the Growth of the Market.

8. Can you provide examples of recent developments in the market?

December 2022: The south-east Asian real estate technology company, The PropertyGuru Group, has finalized the acquisition of iProperty Malaysia. Given that two brands (PropertyGuru and iProperty) are merging, they currently have a huge duty. The acquisition enables them to concentrate on what they believe is necessary to support their clients, and they aim to provide them with even more value.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Residential Property Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Residential Property Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Residential Property Industry?

To stay informed about further developments, trends, and reports in the Malaysia Residential Property Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence