Key Insights

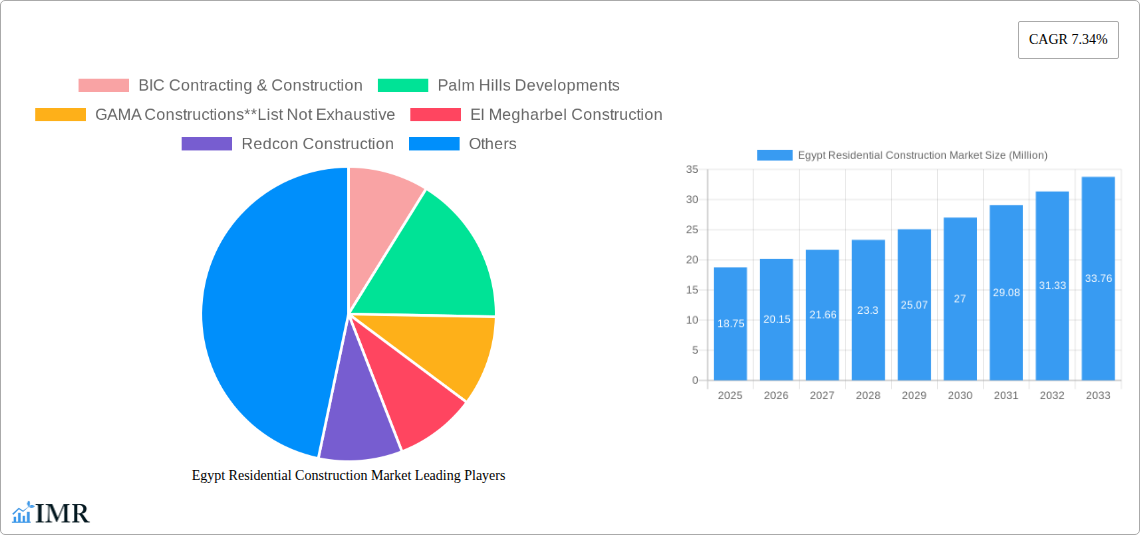

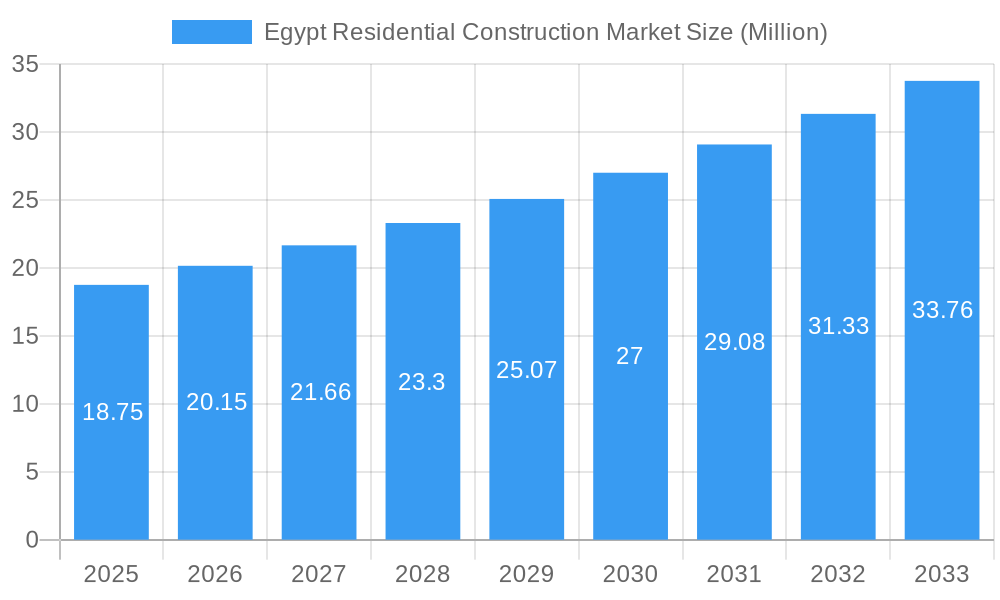

The Egypt residential construction market, valued at $18.75 million in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 7.34% from 2025 to 2033. This growth is fueled by several key factors. A burgeoning population, particularly in urban centers, necessitates increased housing supply. Government initiatives aimed at affordable housing and infrastructure development further stimulate market activity. Furthermore, rising disposable incomes and changing lifestyles, leading to a preference for modern and larger living spaces, drive demand. The market segmentation reveals a diverse landscape, with apartments and condominiums constituting a significant portion, followed by villas and other residential types. New construction projects dominate, although renovation activity also contributes significantly, particularly in older urban areas. Key players like BIC Contracting & Construction, Palm Hills Developments, and GAMA Constructions are shaping the market landscape, though competition remains dynamic. The historical period (2019-2024) likely experienced fluctuations influenced by economic conditions and policy changes, influencing the current market dynamics.

Egypt Residential Construction Market Market Size (In Million)

Looking ahead, the market's continued expansion hinges on several factors. Sustained economic growth, coupled with favorable government policies and investment in infrastructure, are crucial. The availability of financing options for both developers and homebuyers will significantly influence growth trajectories. Furthermore, addressing challenges such as land scarcity and rising construction material costs will be critical for achieving sustainable growth. The market's performance over the forecast period (2025-2033) will be sensitive to macroeconomic conditions and government regulations. While the current estimate for 2025 is provided, ongoing market monitoring and analysis are necessary to precisely track and predict the market's evolution.

Egypt Residential Construction Market Company Market Share

Egypt Residential Construction Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Egypt residential construction market, encompassing market dynamics, growth trends, dominant segments, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period from 2025 to 2033. This detailed analysis will equip industry professionals, investors, and stakeholders with the critical insights needed to navigate this dynamic market. The report segments the market by Type (Apartment & Condominiums, Villas, Other Types) and Construction Type (New Construction, Renovation), providing granular data for informed decision-making.

Egypt Residential Construction Market Dynamics & Structure

The Egyptian residential construction market is characterized by a moderately concentrated landscape with several large players and a significant number of smaller firms. Market concentration is influenced by factors such as access to capital, project scale, and established relationships with government agencies. Technological innovation, while gaining traction, faces certain barriers including limited skilled labor, cost constraints, and regulatory complexities. The regulatory framework governing construction plays a critical role, impacting project timelines and costs. The market sees competition from alternative housing solutions, such as leasing and shared accommodations, though these remain relatively niche. End-user demographics are crucial, with a growing young population and urbanization driving demand. Mergers and acquisitions (M&A) activity in the sector has been moderate in recent years, with xx Million units deals completed in the historical period (2019-2024), reflecting a relatively stable consolidation trend.

- Market Concentration: Moderately concentrated, with a few dominant players holding significant market share (estimated at xx% for the top 3 players in 2025).

- Technological Innovation: Growing adoption of Building Information Modeling (BIM) and prefabricated construction methods, although uptake is slow due to cost and skill gaps.

- Regulatory Framework: Complex and evolving regulations impact project approvals and timelines, creating both opportunities and challenges.

- Competitive Substitutes: Limited but growing competition from alternative housing solutions, primarily rental properties.

- End-User Demographics: A young and rapidly growing population coupled with urbanization is driving significant demand for housing.

- M&A Trends: Moderate M&A activity in the historical period (2019-2024) with xx Million units deals.

Egypt Residential Construction Market Growth Trends & Insights

The Egyptian residential construction market exhibited [Describe growth trend - e.g., steady growth, fluctuating growth etc.] during the historical period (2019-2024). Market size reached xx Million units in 2024. Adoption rates of new construction technologies and materials have been gradual, influenced by factors such as cost and familiarity with established methods. However, there's a growing trend towards sustainable and eco-friendly construction practices. Consumer behavior reflects a shift towards higher-quality, more sustainable housing options, with increased demand for amenities and location convenience. Significant growth is projected over the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) estimated at xx%. Market penetration of sustainable construction techniques is expected to rise to xx% by 2033, driven by governmental initiatives and rising consumer awareness.

Dominant Regions, Countries, or Segments in Egypt Residential Construction Market

The Greater Cairo region remains the dominant driver of growth within the Egypt residential construction market, accounting for an estimated xx% of the total market size in 2025. This dominance is attributed to a higher population density, economic activity, and infrastructure development. The Apartment & Condominium segment represents the largest portion of the market (approximately xx% in 2025), driven by affordability and space efficiency in urban areas. New construction significantly outweighs renovation projects, accounting for roughly xx% of the market in 2025, primarily fueled by population growth and increasing urbanization.

- Key Drivers in Greater Cairo: High population density, robust economic activity, significant infrastructure investment, and government initiatives promoting housing development.

- Apartment & Condominium Dominance: High demand due to affordability, space efficiency, and location convenience within urban centers.

- New Construction Preeminence: Driven by population growth, urbanization, and the need for new housing units to meet increased demand.

- Government Policies: Initiatives focused on affordable housing, infrastructure development, and urban planning significantly influence regional and segmental growth.

Egypt Residential Construction Market Product Landscape

The Egyptian residential construction market shows a diverse product landscape, including a range of apartment types, villa designs, and other housing solutions. Recent innovations focus on improving energy efficiency, using locally sourced materials, and integrating smart home technology. Product differentiation strategies emphasize quality construction, enhanced amenities (e.g., swimming pools, gyms), and prime location. Technological advancements, such as prefabrication and 3D printing, are slowly gaining traction, offering increased efficiency and cost savings.

Key Drivers, Barriers & Challenges in Egypt Residential Construction Market

Key Drivers: Increasing population, urbanization, government investment in infrastructure, rising disposable incomes, and government initiatives promoting affordable housing.

Challenges & Restraints: High construction costs, land scarcity in urban areas, fluctuating material prices, bureaucratic hurdles in obtaining permits and approvals, and a shortage of skilled labor which impacts project timelines and budgets by approximately xx%. Supply chain disruptions occasionally impact project schedules and cost, although the impact is generally less severe compared to global trends.

Emerging Opportunities in Egypt Residential Construction Market

Emerging opportunities lie in the affordable housing sector, catering to the growing middle class. Green building and sustainable construction practices represent a significant opportunity, driven by increasing environmental awareness and government support. Integration of smart home technology and the development of mixed-use residential complexes offer further avenues for growth.

Growth Accelerators in the Egypt Residential Construction Market Industry

Long-term growth is expected to be driven by sustained government investment in infrastructure, supportive economic policies focused on housing development, and increasing private sector participation. Technological advancements in construction methods and materials, coupled with a focus on sustainable development, will further accelerate market expansion. Strategic partnerships between developers, technology providers, and financial institutions will play a vital role in fostering innovation and growth.

Key Players Shaping the Egypt Residential Construction Market Market

- BIC Contracting & Construction

- Palm Hills Developments

- GAMA Constructions

- El Megharbel Construction

- Redcon Construction

- Consolidated Contractors Company

- Detac

- The Arab Contractors

- Orascom Construction

- H A Construction (H A C)

Notable Milestones in Egypt Residential Construction Market Sector

- 2020: Launch of the government's affordable housing initiative, leading to increased construction activity.

- 2022: Significant investment in infrastructure projects in Greater Cairo boosting residential development.

- 2023: Introduction of new building codes promoting sustainable construction practices. (Specific details on these milestones would need further research.)

In-Depth Egypt Residential Construction Market Market Outlook

The Egyptian residential construction market presents significant long-term growth potential, fueled by a combination of demographic trends, economic development, and supportive government policies. Strategic opportunities exist for companies focusing on affordable housing, sustainable construction, and technological innovation. The market is expected to experience steady growth, with continued expansion in major urban centers and increasing diversification into new regions. The ongoing focus on infrastructure development will further stimulate the residential construction sector's growth throughout the forecast period.

Egypt Residential Construction Market Segmentation

-

1. Type

- 1.1. Apartment & Condominiums

- 1.2. Villas

- 1.3. Other Types

-

2. Construction Type

- 2.1. New Construction

- 2.2. Renovation

Egypt Residential Construction Market Segmentation By Geography

- 1. Egypt

Egypt Residential Construction Market Regional Market Share

Geographic Coverage of Egypt Residential Construction Market

Egypt Residential Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Development of sustainable and energy-efficient transportation infrastructure4.; Growth in demand for new road and railway construction projects

- 3.3. Market Restrains

- 3.3.1. 4.; Funding is a major challenge for infrastructure construction and maintenance

- 3.4. Market Trends

- 3.4.1. Government Investment and Initiatives in the Residential Sector is Supporting the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Residential Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartment & Condominiums

- 5.1.2. Villas

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Construction Type

- 5.2.1. New Construction

- 5.2.2. Renovation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BIC Contracting & Construction

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Palm Hills Developments

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GAMA Constructions**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 El Megharbel Construction

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Redcon Construction

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Consolidated Contractors Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Detac

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Arab Contractors

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Orascom Construction

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 H A Construction (H A C)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BIC Contracting & Construction

List of Figures

- Figure 1: Egypt Residential Construction Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Egypt Residential Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Egypt Residential Construction Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Egypt Residential Construction Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 3: Egypt Residential Construction Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Egypt Residential Construction Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Egypt Residential Construction Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 6: Egypt Residential Construction Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Residential Construction Market?

The projected CAGR is approximately 7.34%.

2. Which companies are prominent players in the Egypt Residential Construction Market?

Key companies in the market include BIC Contracting & Construction, Palm Hills Developments, GAMA Constructions**List Not Exhaustive, El Megharbel Construction, Redcon Construction, Consolidated Contractors Company, Detac, The Arab Contractors, Orascom Construction, H A Construction (H A C).

3. What are the main segments of the Egypt Residential Construction Market?

The market segments include Type, Construction Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.75 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Development of sustainable and energy-efficient transportation infrastructure4.; Growth in demand for new road and railway construction projects.

6. What are the notable trends driving market growth?

Government Investment and Initiatives in the Residential Sector is Supporting the Market.

7. Are there any restraints impacting market growth?

4.; Funding is a major challenge for infrastructure construction and maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Residential Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Residential Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Residential Construction Market?

To stay informed about further developments, trends, and reports in the Egypt Residential Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence