Key Insights

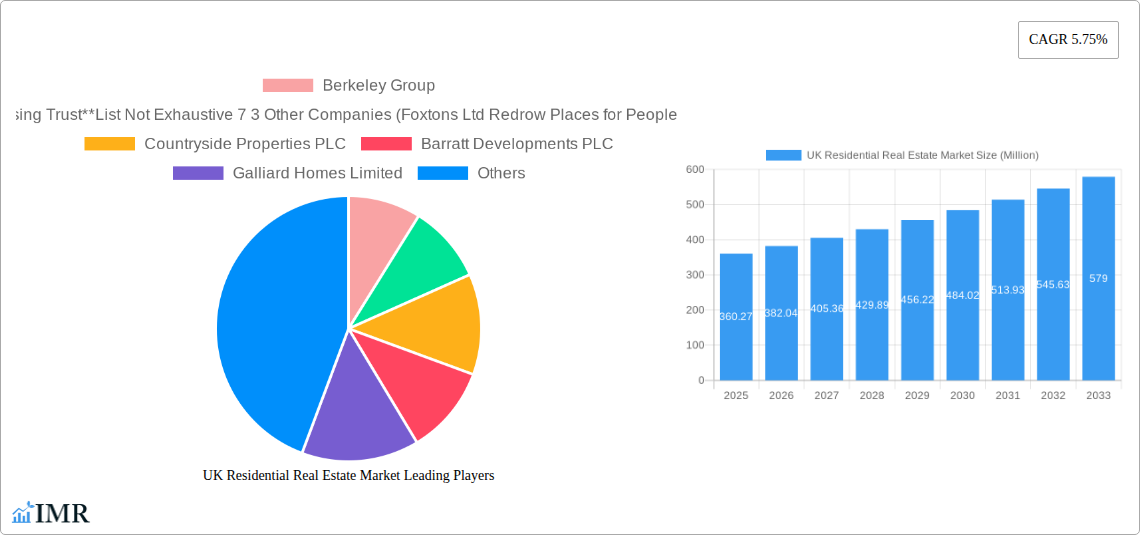

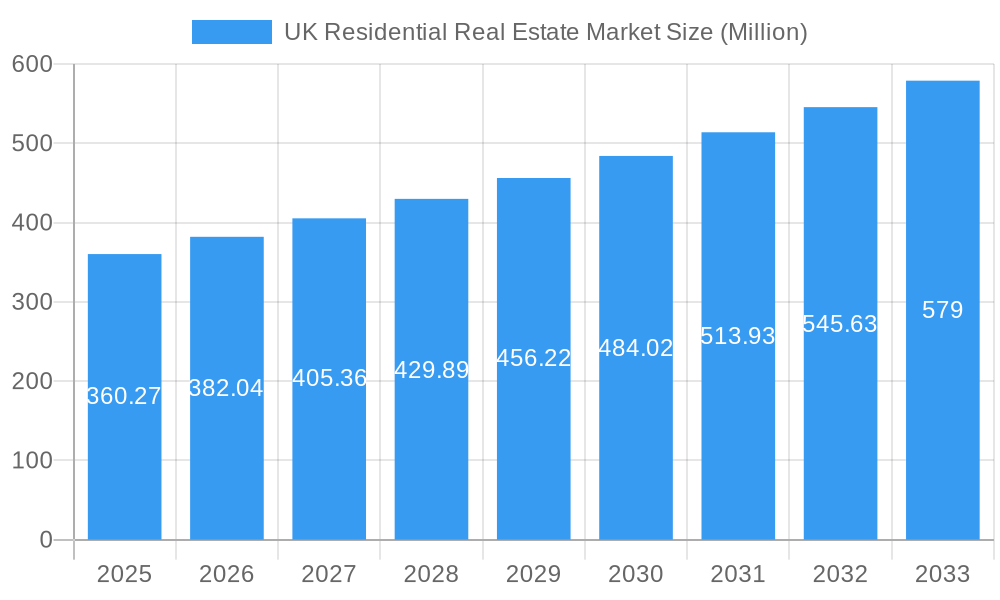

The UK residential real estate market, valued at £360.27 million in 2025, is projected to experience robust growth, driven by factors such as increasing urbanization, a growing population, and government initiatives aimed at boosting homeownership. The compound annual growth rate (CAGR) of 5.75% from 2025 to 2033 indicates a significant expansion of the market over the forecast period. Demand is particularly strong in key regions like England and Scotland, with apartments and condominiums witnessing higher transaction volumes compared to landed houses and villas, reflecting evolving lifestyle preferences and affordability concerns. However, challenges remain, including limited housing supply, rising construction costs, and potential interest rate fluctuations which could temper market growth. The competitive landscape includes established players like Berkeley Group and Barratt Developments alongside smaller developers and housing trusts, indicating a diversified market structure. Analysis suggests that the market will continue to see consolidation as larger firms acquire smaller players to increase their market share. The continued growth of the rental market, particularly in urban areas, also shapes the overall market dynamics. Government policies regarding mortgage lending and planning permissions will play a crucial role in shaping future market trajectory.

UK Residential Real Estate Market Market Size (In Million)

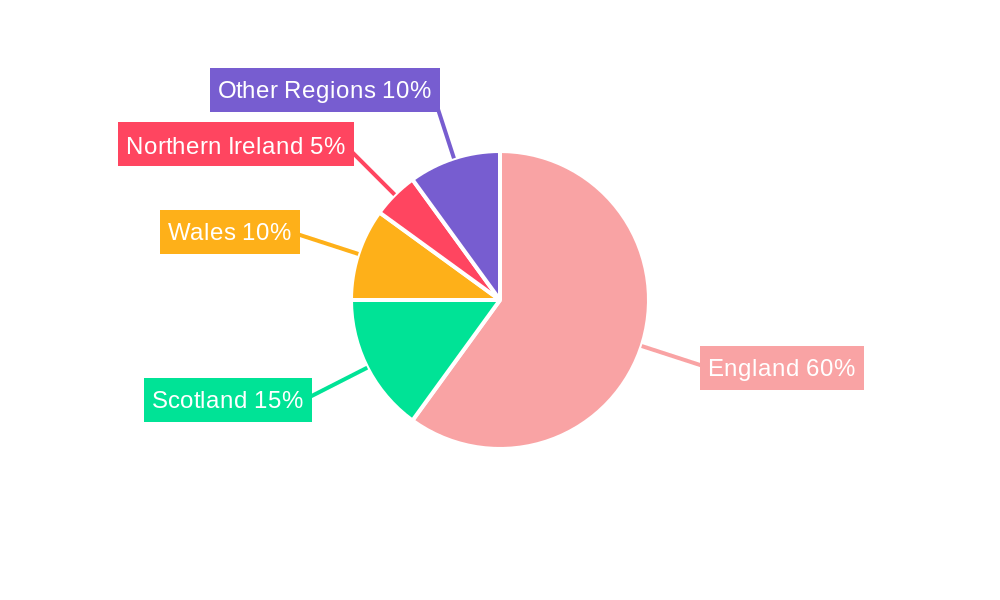

The segmentation of the UK residential real estate market reveals distinct opportunities and challenges across different property types and regions. While England dominates the market share, the other regions, particularly Scotland, are expected to see significant growth fueled by investment in infrastructure and economic development. The “Landed Houses and Villas” segment, although smaller, is expected to hold its value through premium pricing and limited supply, while the "Apartments and Condominiums" segment is poised for expansion due to affordability and location advantages. The presence of diverse players, from large publicly listed companies to smaller boutique developers and housing associations, creates a dynamic and competitive market. Understanding the interplay of these factors is crucial for investors, developers, and policymakers seeking to navigate this evolving landscape.

UK Residential Real Estate Market Company Market Share

UK Residential Real Estate Market: 2019-2033 Forecast Report

This comprehensive report delivers an in-depth analysis of the UK residential real estate market, covering the period 2019-2033, with a focus on 2025. It provides invaluable insights for investors, developers, and industry professionals seeking to navigate this dynamic market. The report segments the market by key regions (England, Wales, Scotland, Northern Ireland, Other Regions) and property types (Apartments & Condominiums, Landed Houses & Villas), offering granular data and future projections.

UK Residential Real Estate Market Dynamics & Structure

This section analyzes the market's competitive landscape, technological influences, regulatory environment, and key trends impacting the sector. The UK residential market shows a moderately concentrated structure, with a few large players holding significant market share, alongside a multitude of smaller firms. The market share of the top 5 developers (including Berkeley Group, Barratt Developments, and Redrow) constitutes approximately xx% of the total market value (Million Units). The remaining share is distributed across numerous smaller developers and independent builders.

- Market Concentration: High in certain segments (e.g., London apartments), fragmented in others (e.g., regional landed properties).

- Technological Innovation: Adoption of PropTech solutions (e.g., virtual tours, online platforms) is increasing, but faces barriers such as integration challenges and data security concerns.

- Regulatory Frameworks: Government policies, planning permissions, and building regulations significantly influence development and investment decisions. Recent changes in regulations have resulted in a xx% decrease in new build starts in certain areas.

- Competitive Product Substitutes: Rental markets and alternative accommodation options present competition, impacting demand for ownership.

- End-User Demographics: Shifting population trends, particularly in urban centers, are driving demand in specific geographic locations. The growth of the millennial homebuyer segment is driving demand for smaller, more sustainable homes.

- M&A Trends: The past five years have witnessed xx M&A deals, predominantly focused on consolidation within the developer segment and expansion into new geographic areas.

UK Residential Real Estate Market Growth Trends & Insights

The UK residential real estate market experienced fluctuating growth between 2019 and 2024. However, the market is predicted to demonstrate a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This growth is driven by factors such as increasing urbanization, population growth, and evolving consumer preferences for specific property types. Technological disruptions, particularly within the PropTech sector, are significantly impacting market efficiency and transaction processes. The market penetration of online property portals and virtual viewings has increased from xx% in 2019 to an estimated xx% in 2025, improving transparency and accessibility. Consumer behavior shifts show a growing preference for sustainable and energy-efficient homes, driving a higher demand for properties with green certifications. The total market size in 2025 is estimated to be xx million units, projected to reach xx million units by 2033.

Dominant Regions, Countries, or Segments in UK Residential Real Estate Market

England dominates the UK residential real estate market, accounting for approximately xx% of the total market value (Million Units) in 2025. Within England, London and the South East continue to experience robust growth driven by strong employment prospects and high levels of inward migration.

- Key Drivers for England's Dominance: Stronger regional economy, higher concentration of employment opportunities, extensive infrastructure, and favorable investment climate.

- Apartments and Condominiums: This segment is experiencing the highest growth due to urbanization and demand for smaller, more affordable housing options in major cities. The segment is predicted to capture xx% of the market by 2033.

- Landed Houses and Villas: This segment remains significant, particularly in suburban and rural areas. Demand remains strong, particularly in areas with good access to green spaces and schools. The segment is expected to reach xx million units in 2033.

- Scotland, Wales and Northern Ireland: While smaller markets, these regions showcase growth potential driven by specific regional economic drivers and government initiatives aimed at boosting housing supply.

UK Residential Real Estate Market Product Landscape

The UK residential property market showcases diverse offerings, ranging from affordable apartments in urban centers to luxury villas in rural areas. Recent innovations focus on sustainable design, smart home technology integration, and flexible living spaces catering to changing lifestyles. The increasing adoption of energy-efficient building materials and renewable energy technologies further enhances the market's product landscape, appealing to environmentally conscious buyers.

Key Drivers, Barriers & Challenges in UK Residential Real Estate Market

Key Drivers:

- Strong population growth and urbanization.

- Increasing demand for housing due to economic growth.

- Government initiatives to stimulate housing development (e.g., Help to Buy schemes, though effectiveness varies regionally).

Challenges:

- Limited land availability in prime locations, leading to supply constraints. This constraint directly impacts pricing, with a xx% increase noted in specific areas between 2019 and 2024.

- Rising construction costs and material shortages affecting affordability and project timelines.

- Stringent planning regulations and lengthy approval processes.

Emerging Opportunities in UK Residential Real Estate Market

- Growing demand for sustainable and energy-efficient housing.

- Rise of Build-to-Rent (BTR) and co-living models.

- Opportunities in regeneration projects and brownfield development.

Growth Accelerators in the UK Residential Real Estate Market Industry

Technological advancements in construction, such as modular building, and strategic partnerships between developers and technology companies will be significant growth catalysts. Further expansion into underserved markets and a focus on creating diverse and inclusive housing options will also stimulate growth.

Key Players Shaping the UK Residential Real Estate Market Market

- Berkeley Group

- London and Quadrant Housing Trust

- Foxtons Ltd

- Redrow

- Places for People

- Mears Group

- Kier Group

- Countrywide PLC

- Countryside Properties PLC

- Barratt Developments PLC

- Galliard Homes Limited

- Native Land Limited

- Bellway PLC

- Crest Nicholson PLC

- Miller Homes

Notable Milestones in UK Residential Real Estate Market Sector

- May 2023: Launch of a USD 2bn UK multifamily investment strategy by Rasmala Investment Bank, focusing on serviced apartments and BTR in London.

- November 2022: ValuStrat's acquisition of an interest in Capital Value Surveyors, expanding its UK presence.

In-Depth UK Residential Real Estate Market Market Outlook

The UK residential real estate market shows strong potential for continued growth driven by long-term demographic trends, technological innovation, and ongoing government investment in infrastructure. Strategic partnerships, focus on sustainable development, and effective management of supply chain challenges will be crucial for long-term success within this dynamic sector. The market's future growth trajectory will depend significantly on effective policy implementation, economic stability, and continued investment in the housing sector.

UK Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

UK Residential Real Estate Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Residential Real Estate Market Regional Market Share

Geographic Coverage of UK Residential Real Estate Market

UK Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for New Dwellings Units; Government Initiatives are driving the market

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions; Lack of Skilled Labour

- 3.4. Market Trends

- 3.4.1. Increasing in the United Kingdom House Prices

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UK Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Apartments and Condominiums

- 6.1.2. Landed Houses and Villas

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UK Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Apartments and Condominiums

- 7.1.2. Landed Houses and Villas

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UK Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Apartments and Condominiums

- 8.1.2. Landed Houses and Villas

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UK Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Apartments and Condominiums

- 9.1.2. Landed Houses and Villas

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UK Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Apartments and Condominiums

- 10.1.2. Landed Houses and Villas

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Berkeley Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 London and Quadrant Housing Trust**List Not Exhaustive 7 3 Other Companies (Foxtons Ltd Redrow Places for People Mears Kier Group Countrywide PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Countryside Properties PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Barratt Developments PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Galliard Homes Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Native Land Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bellway PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Crest Nicholson PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Miler homes

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Berkeley Group

List of Figures

- Figure 1: Global UK Residential Real Estate Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UK Residential Real Estate Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America UK Residential Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America UK Residential Real Estate Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America UK Residential Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America UK Residential Real Estate Market Revenue (Million), by Type 2025 & 2033

- Figure 7: South America UK Residential Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: South America UK Residential Real Estate Market Revenue (Million), by Country 2025 & 2033

- Figure 9: South America UK Residential Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe UK Residential Real Estate Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe UK Residential Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe UK Residential Real Estate Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe UK Residential Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa UK Residential Real Estate Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Middle East & Africa UK Residential Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Middle East & Africa UK Residential Real Estate Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa UK Residential Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific UK Residential Real Estate Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific UK Residential Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific UK Residential Real Estate Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific UK Residential Real Estate Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global UK Residential Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global UK Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global UK Residential Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global UK Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 9: Global UK Residential Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global UK Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global UK Residential Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global UK Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 25: Global UK Residential Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global UK Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global UK Residential Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Residential Real Estate Market?

The projected CAGR is approximately 5.75%.

2. Which companies are prominent players in the UK Residential Real Estate Market?

Key companies in the market include Berkeley Group, London and Quadrant Housing Trust**List Not Exhaustive 7 3 Other Companies (Foxtons Ltd Redrow Places for People Mears Kier Group Countrywide PLC, Countryside Properties PLC, Barratt Developments PLC, Galliard Homes Limited, Native Land Limited, Bellway PLC, Crest Nicholson PLC, Miler homes.

3. What are the main segments of the UK Residential Real Estate Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 360.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for New Dwellings Units; Government Initiatives are driving the market.

6. What are the notable trends driving market growth?

Increasing in the United Kingdom House Prices.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions; Lack of Skilled Labour.

8. Can you provide examples of recent developments in the market?

May 2023: A UAE-based investment manager, Rasmala Investment Bank, has launched a USD 2bn ( €1.8bn) UK multifamily strategy for a five-year period to build a USD 2bn portfolio of UK residential properties. The strategy is focused on the UK market for multifamily properties through a Shariah-compliant investment vehicle, initially targeting the serviced apartment (SAP) and BTR (build-to-rent) subsectors within and around London. Seeded by Rasmala Group, the strategy is backed by an active investment pipeline for the next 12 – 18 months.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the UK Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence