Key Insights

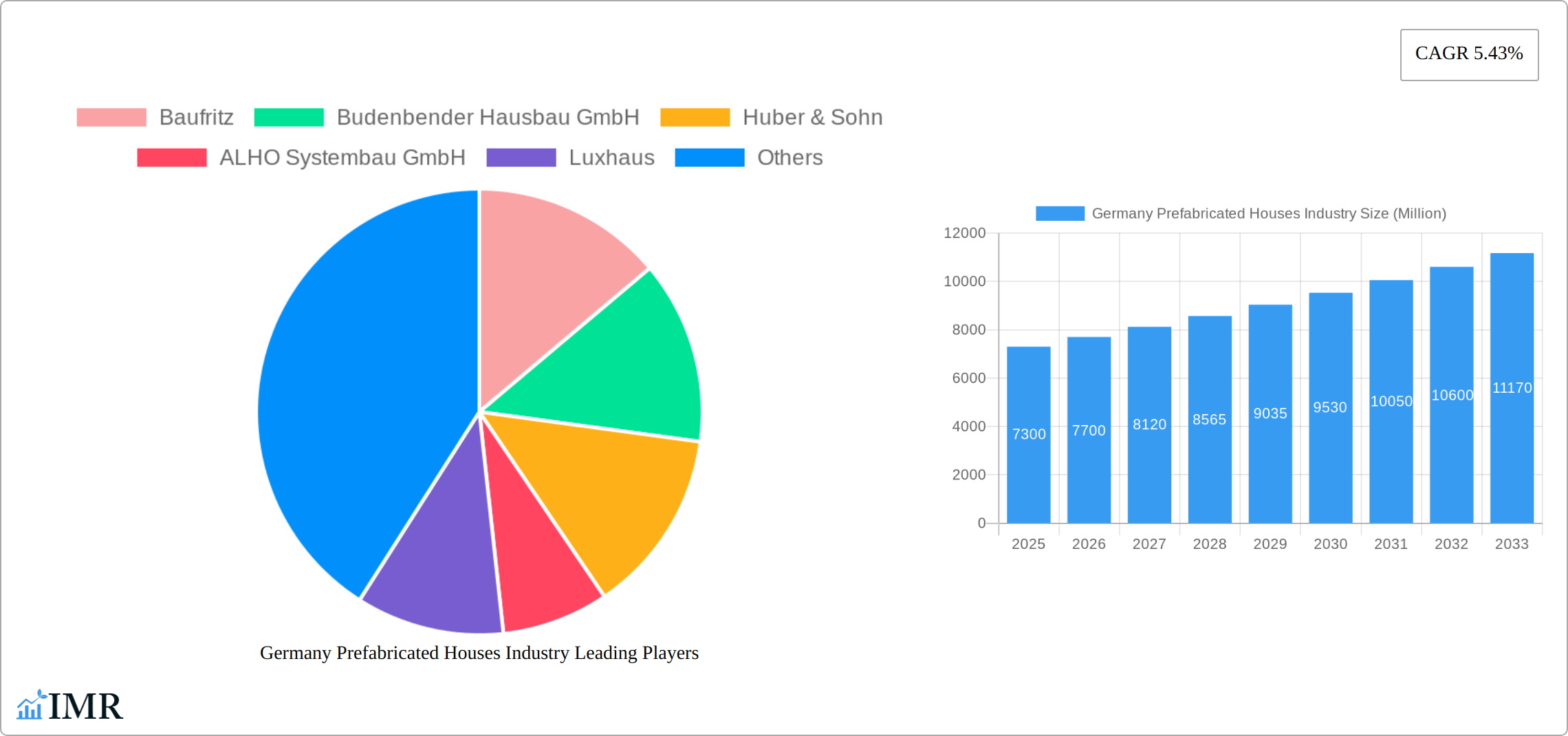

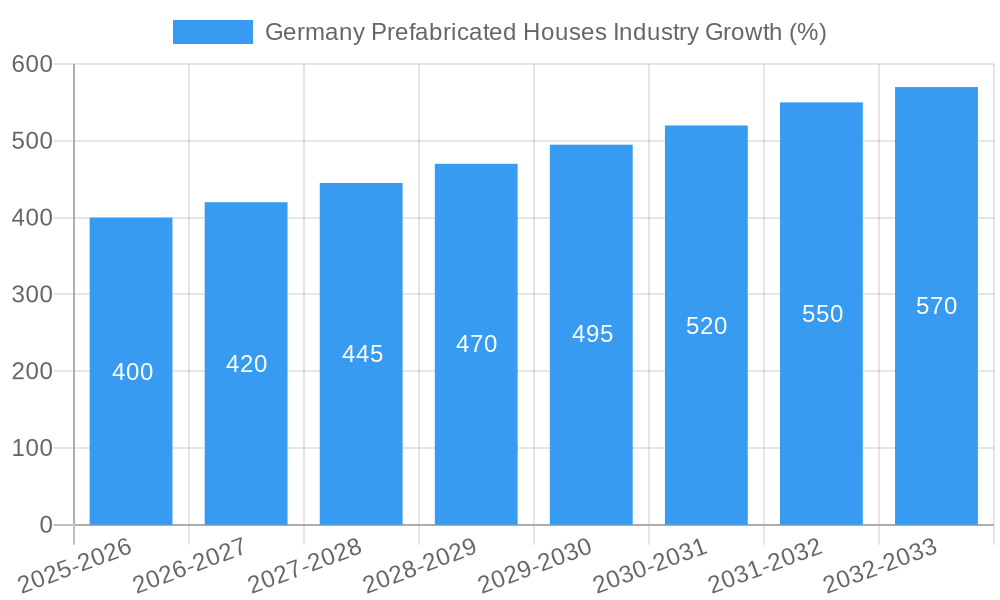

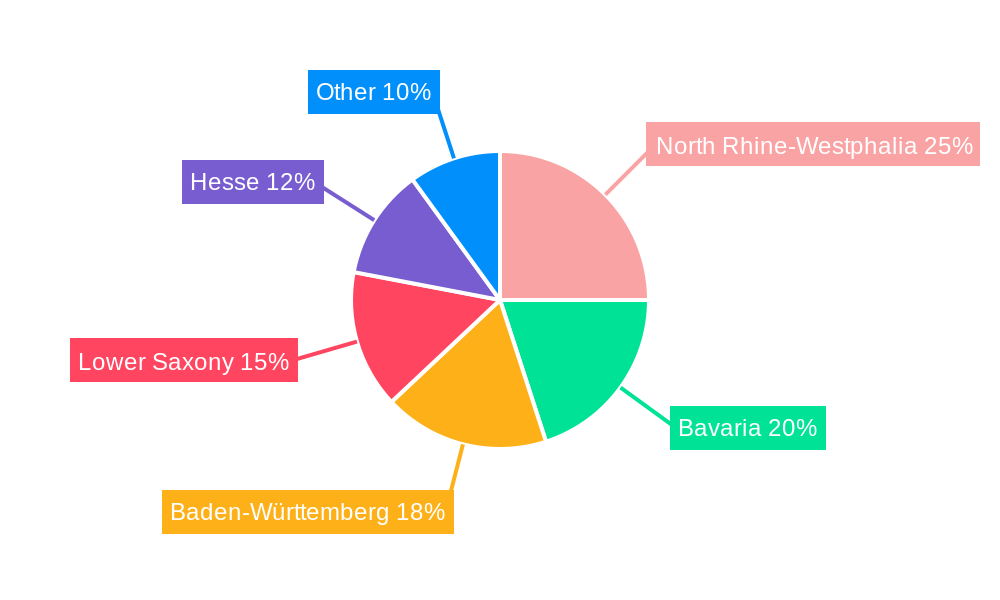

The German prefabricated houses market, valued at €7.3 billion in 2025, is projected to experience robust growth, driven by increasing demand for sustainable and cost-effective housing solutions. A compound annual growth rate (CAGR) of 5.43% from 2025 to 2033 indicates a significant expansion of the market to approximately €11.5 billion by 2033. Key drivers include rising urbanization, government initiatives promoting sustainable building practices, and shorter construction times compared to traditional methods. The market is segmented by house type, with single-family homes dominating, followed by multi-family units. Strong regional variations exist, with North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse representing major markets due to high population density and robust economies. Leading companies like Baufritz, Budenbender Hausbau GmbH, and others leverage technological advancements and innovative designs to cater to evolving consumer preferences. However, challenges remain, including potential material cost fluctuations and the need to address public perceptions regarding the quality and aesthetics of prefabricated homes, which is being mitigated by companies' focus on high-end designs and eco-friendly materials. The market's future hinges on sustained economic growth, further regulatory support for sustainable construction, and the continued innovation within the prefabricated housing sector.

The German prefabricated housing sector benefits from a well-established supply chain, skilled workforce, and a growing acceptance of modern construction methods. The market is further strengthened by the increasing awareness of environmentally friendly building options, which are often a core component of prefabricated homes. While competition among established players like Bien Zenker and Deutsche Fertighaus Holding is intense, the market’s overall growth trajectory remains positive, presenting opportunities for both large and small-scale companies. Future growth will likely be influenced by factors such as the overall health of the German housing market, interest rates, and evolving consumer preferences regarding home design and sustainability features. The industry is expected to further consolidate as companies invest in research and development to enhance their offerings and gain market share.

Germany Prefabricated Houses Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the German prefabricated houses market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is invaluable for industry professionals, investors, and anyone seeking to understand this dynamic sector.

Germany Prefabricated Houses Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the German prefabricated housing market (parent market: Construction; child market: Residential Construction). The analysis covers the period 2019-2024, providing a historical context for future projections.

Market Concentration & Competition: The German prefabricated house market exhibits a moderately concentrated structure, with several major players holding significant market share. Market share data for 2024 indicates that the top five players (Baufritz, Budenbender Hausbau GmbH, Huber & Sohn, ALHO Systembau GmbH, and Luxhaus) collectively account for approximately xx% of the total market. However, numerous smaller and regional players also contribute significantly to the overall market volume.

- Market Leaders (2024): Baufritz (xx%), Budenbender Hausbau GmbH (xx%), Huber & Sohn (xx%), ALHO Systembau GmbH (xx%), Luxhaus (xx%).

- Competitive Intensity: High, driven by price competition, product differentiation (design, sustainability features), and marketing strategies.

- M&A Activity: A moderate level of mergers and acquisitions (M&A) activity has been observed over the past five years, with xx deals recorded between 2019 and 2024. Consolidation is expected to continue, particularly among smaller players.

Technological Innovation: Technological innovation is a key driver of market growth. Advancements in building materials, design software, and construction techniques are leading to improved energy efficiency, faster construction times, and greater customization options. However, the adoption of innovative technologies faces challenges including high initial investment costs and a lack of skilled labor.

- Key Innovations: Modular construction, sustainable building materials (e.g., timber, recycled materials), smart home integration, 3D printing.

- Innovation Barriers: High initial investment costs for new technologies, resistance to change among established players, lack of skilled labor.

Regulatory Framework: Building codes and regulations in Germany significantly impact the prefabricated housing sector. Stringent energy efficiency standards are driving demand for sustainable and energy-efficient prefabricated homes. However, complex permitting processes and bureaucratic hurdles can slow down project development.

Competitive Substitutes: Traditional construction methods remain the primary substitute for prefabricated housing. However, the growing awareness of the benefits of prefabrication (cost efficiency, speed, quality control) is gradually shifting consumer preferences towards prefabricated homes.

Germany Prefabricated Houses Industry Growth Trends & Insights

The German prefabricated houses market experienced significant growth during the historical period (2019-2024). Driven by increasing demand for affordable housing, rising urbanization, and the aforementioned technological advancements, the market witnessed a compound annual growth rate (CAGR) of xx% between 2019 and 2024. Market size expanded from xx million units in 2019 to xx million units in 2024. The forecast period (2025-2033) projects continued growth, albeit at a slightly slower pace, with a projected CAGR of xx%. Several factors contribute to this continued growth, including:

- Government Incentives: Government initiatives promoting sustainable housing and energy efficiency are boosting market demand for prefabricated homes with enhanced sustainability features.

- Demographic Trends: Aging population and changing household sizes influence the demand for various housing types.

- Technological Advancements: Continuous innovation in building materials and construction methods.

- Consumer Preferences: Increasing consumer awareness of the benefits of prefabrication is driving adoption rates.

- Economic Factors: Overall economic performance and housing market conditions impact purchasing power and market expansion.

Dominant Regions, Countries, or Segments in Germany Prefabricated Houses Industry

The German prefabricated housing market is geographically dispersed, with no single region dominating the overall market share. However, specific segments show higher growth rates and influence.

By Type:

The single-family segment represents the largest share of the German prefabricated house market. Its dominance is attributable to:

- High Demand: Strong demand for individual homes amongst German households.

- Customization Options: Prefabricated houses offer high levels of customization, appealing to individual preferences.

- Faster Construction Time: Prefabricated construction processes shorten the timeline for building single-family homes.

The multi-family segment exhibits a strong growth outlook due to:

- Urbanization: The increasing trend of urbanization leads to higher demand for multi-family housing units.

- Government Initiatives: Government support for affordable multi-family housing projects.

- Efficiency Advantages: Prefabrication techniques lead to significant cost and time savings in the construction of multi-family buildings.

While both segments contribute significantly to the overall market, the single-family segment is projected to maintain a larger share in the forecast period due to its continuing popularity among consumers. The multi-family segment, however, is projected to exhibit higher growth rates due to urbanization and government support.

Germany Prefabricated Houses Industry Product Landscape

The German prefabricated house market showcases a diverse range of products, encompassing various designs, sizes, and functionalities. Innovation in materials like cross-laminated timber (CLT) and sustainable alternatives reduces environmental impact and enhances energy efficiency. Prefabricated homes now incorporate smart home technology, including energy management systems and automated features, increasing their appeal. The focus is on delivering high-quality, customizable, and energy-efficient homes that cater to diverse consumer needs and preferences. Unique selling propositions include rapid construction, superior energy efficiency, customization potential, and overall cost-effectiveness compared to traditional methods.

Key Drivers, Barriers & Challenges in Germany Prefabricated Houses Industry

Key Drivers:

- Increasing demand for affordable housing.

- Government initiatives promoting sustainable construction.

- Technological advancements leading to faster and more efficient construction.

- Growing consumer preference for customized homes.

Key Challenges and Restraints:

- Supply chain disruptions: fluctuations in material costs and availability can impact project timelines and profitability.

- Regulatory hurdles: Complex building codes and approval processes can delay projects.

- Competition from traditional construction methods: Traditional construction still holds a significant market share.

- Skilled labor shortages: A shortage of skilled labor can hinder the timely completion of projects. This issue could cause a xx% delay in project completion by 2030.

Emerging Opportunities in Germany Prefabricated Houses Industry

- Sustainable and eco-friendly housing: Growing environmental awareness is driving demand for prefabricated homes built with sustainable materials and energy-efficient designs.

- Smart home integration: Integrating smart home technology into prefabricated houses enhances their value proposition and appeal.

- Modular and adaptable designs: Modular designs allow for greater flexibility and adaptability to changing consumer needs.

- Expansion into rural markets: Targeting untapped markets in rural areas offers significant growth potential.

Growth Accelerators in the Germany Prefabricated Houses Industry

Long-term growth is driven by the convergence of technological progress, supportive government policies, and shifting consumer preferences. Strategic partnerships between prefabricated housing companies and technology providers are accelerating innovation and expanding market reach. Investments in research and development, focusing on sustainable materials and construction techniques, will further enhance the sector's competitiveness. Expanding into new markets and segments will diversify revenue streams and ensure long-term sustainability.

Key Players Shaping the Germany Prefabricated Houses Industry Market

- Baufritz

- Budenbender Hausbau GmbH

- Huber & Sohn

- ALHO Systembau GmbH

- Luxhaus

- Deutsche Fertighaus Holding

- Daiwa House Modular Europe Ltd

- Regnauer Fertigbau GmbH

- Bien Zenker

- Living Haus

- Fertighaus Weiss GmbH

Notable Milestones in Germany Prefabricated Houses Industry Sector

- 2021: Introduction of new energy-efficient building codes, influencing the design and materials used in prefabricated homes.

- 2022: Several major players launched new product lines incorporating smart home technology.

- 2023: A significant merger between two medium-sized prefabricated house companies resulted in increased market consolidation.

- 2024: Government announced increased funding for sustainable housing initiatives.

In-Depth Germany Prefabricated Houses Industry Market Outlook

The German prefabricated houses market is poised for continued growth over the forecast period (2025-2033). Technological advancements, supportive government policies, and evolving consumer preferences will drive market expansion. Strategic partnerships, investments in research and development, and diversification into new markets will enhance the sector's long-term competitiveness and resilience. The market presents significant opportunities for companies that can adapt to changing market conditions, embrace technological advancements, and deliver high-quality, sustainable, and cost-effective housing solutions.

Germany Prefabricated Houses Industry Segmentation

-

1. Type

- 1.1. Single-family

- 1.2. Multi-family

Germany Prefabricated Houses Industry Segmentation By Geography

- 1. Germany

Germany Prefabricated Houses Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.43% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives Promoting Affordable Housing; Economic Growth and Rising Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labor; Fluctuating Construction Materials Costs

- 3.4. Market Trends

- 3.4.1. Prefabricated Buildings are Witnessing Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single-family

- 5.1.2. Multi-family

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North Rhine-Westphalia Germany Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Baufritz

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Budenbender Hausbau GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Huber & Sohn

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ALHO Systembau GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Luxhaus

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Deutsche Fertighaus Holding

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Daiwa House Modular Europe Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Regnauer Fertigbau GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bien Zenker

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Living Haus**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Fertighaus Weiss GmbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Baufritz

List of Figures

- Figure 1: Germany Prefabricated Houses Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Prefabricated Houses Industry Share (%) by Company 2024

List of Tables

- Table 1: Germany Prefabricated Houses Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Prefabricated Houses Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Germany Prefabricated Houses Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Germany Prefabricated Houses Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: North Rhine-Westphalia Germany Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Bavaria Germany Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Baden-Württemberg Germany Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Lower Saxony Germany Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Hesse Germany Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Prefabricated Houses Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 11: Germany Prefabricated Houses Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Prefabricated Houses Industry?

The projected CAGR is approximately 5.43%.

2. Which companies are prominent players in the Germany Prefabricated Houses Industry?

Key companies in the market include Baufritz, Budenbender Hausbau GmbH, Huber & Sohn, ALHO Systembau GmbH, Luxhaus, Deutsche Fertighaus Holding, Daiwa House Modular Europe Ltd, Regnauer Fertigbau GmbH, Bien Zenker, Living Haus**List Not Exhaustive, Fertighaus Weiss GmbH.

3. What are the main segments of the Germany Prefabricated Houses Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives Promoting Affordable Housing; Economic Growth and Rising Disposable Incomes.

6. What are the notable trends driving market growth?

Prefabricated Buildings are Witnessing Significant Growth.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labor; Fluctuating Construction Materials Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Prefabricated Houses Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Prefabricated Houses Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Prefabricated Houses Industry?

To stay informed about further developments, trends, and reports in the Germany Prefabricated Houses Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence