Key Insights

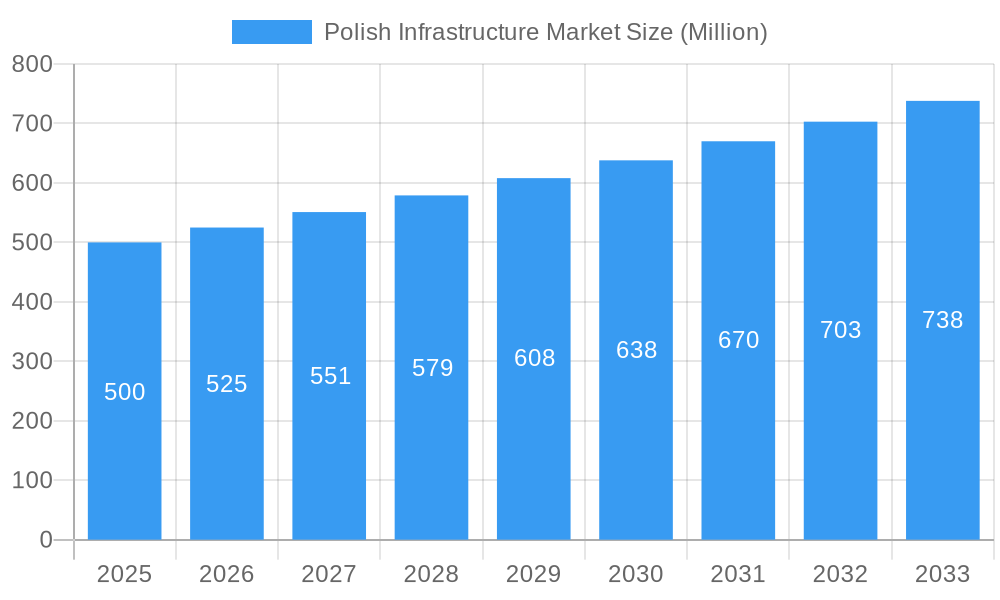

The Polish infrastructure market is poised for significant expansion, driven by robust government investment in modernization initiatives. Projects focusing on road, rail, port, and waterway enhancements are strengthening Poland's position as a crucial Central European logistics hub. The increasing emphasis on sustainable development, supported by national policies and EU funding, further fuels market growth. Leading domestic firms like Budimex SA, Strabag SP ZOO, and Torpol, alongside international participants, are actively engaged in this dynamic sector. The market size is projected to reach 54.04 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.1%. Key growth segments include roadways, railways, airways, ports, and waterways, each aligning with specific government priorities. While potential challenges such as labor shortages and supply chain disruptions exist, the long-term outlook remains highly positive due to Poland's strategic location and ongoing infrastructure commitment.

Polish Infrastructure Market Market Size (In Billion)

Sustained market growth is anticipated throughout the forecast period (2025-2033). Continued government investment in infrastructure modernization and a focus on sustainability will drive this expansion. Economic volatility and global events may introduce some uncertainty, but the fundamental demand for enhanced infrastructure and Poland's role as a regional logistics center will underpin market resilience. The competitive landscape, featuring both domestic and international players, fosters innovation. Advances in technology and sustainable practices are expected to shape future market dynamics, improving efficiency and environmental performance.

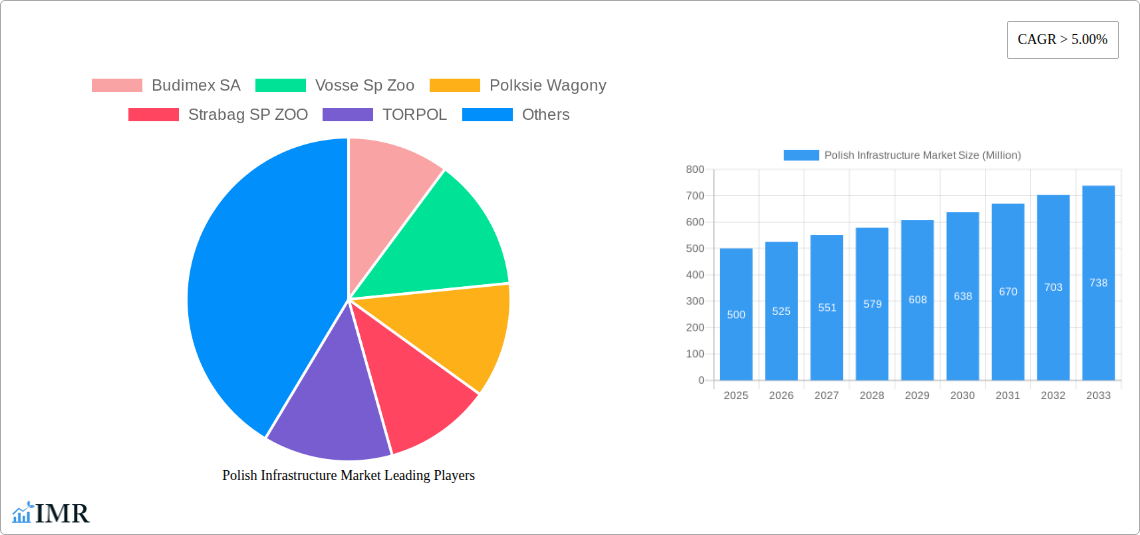

Polish Infrastructure Market Company Market Share

Polish Infrastructure Market Analysis: Size, Trends, and Forecast (2019-2033)

This comprehensive report analyzes the Polish infrastructure market, detailing dynamics, growth trajectories, key players, and future projections for the period 2019-2033. With a base year of 2025, the analysis segments the market by infrastructure type: Roadways, Railways, Airways, Ports, and Waterways, offering critical insights for investors, industry professionals, and strategic decision-makers. The market is valued at 54.04 billion in the base year of 2025, with a projected CAGR of 5.1%.

Polish Infrastructure Market Dynamics & Structure

The Polish infrastructure market is characterized by a moderate level of market concentration, with several large players competing alongside numerous smaller firms. Technological innovation is a key driver, particularly in areas such as smart city infrastructure and sustainable construction methods. The regulatory framework plays a significant role, influencing investment decisions and project timelines. Competitive product substitutes are limited, however, cost-effective materials and alternative construction techniques pose some level of competition. The end-user demographics comprise government entities, private companies, and municipalities. M&A activity is steadily increasing, with notable acquisitions shaping the competitive landscape.

- Market Concentration: Moderate, with a few dominant players and numerous smaller firms. The top 5 players hold approximately xx% market share in 2025.

- Technological Innovation: Focus on smart city solutions, sustainable materials, and advanced construction techniques. Barriers include high initial investment costs and a skills gap.

- Regulatory Framework: Significant influence on project approvals and funding mechanisms. Streamlining regulatory processes is a key area for improvement.

- M&A Activity: Increasing deal volume, reflecting consolidation trends and strategic expansions. xx M&A deals were recorded between 2019-2024.

Polish Infrastructure Market Growth Trends & Insights

The Polish infrastructure market has witnessed robust growth over the historical period (2019-2024), driven by government investments in transportation networks and urban development. The market size is projected to maintain a steady Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, such as the increasing adoption of Building Information Modeling (BIM) and digital twin technologies, are reshaping construction practices. Shifting consumer preferences towards sustainable and resilient infrastructure are also driving the market. Market penetration of smart technologies is increasing at a CAGR of xx%.

Dominant Regions, Countries, or Segments in Polish Infrastructure Market

The Roadways segment dominates the Polish infrastructure market, accounting for approximately xx% of the total market value in 2025. This is driven by continuous government investment in highway expansion and modernization. The railway sector demonstrates significant potential due to modernization plans and increased freight transport demand.

- Roadways: Dominant segment due to ongoing highway construction and expansion projects. Key drivers include economic growth, improved connectivity, and government funding.

- Railways: Strong growth potential driven by ongoing modernization programs and increasing freight traffic. Challenges include infrastructure upgrades and technological advancements.

- Airways: Relatively smaller segment, with growth driven by passenger traffic expansion and airport modernization.

- Ports and Waterways: Steady growth supported by increasing trade volume and waterway infrastructure development.

Polish Infrastructure Market Product Landscape

The Polish infrastructure market features a diverse range of products and services, from traditional construction materials to advanced technologies like intelligent transportation systems (ITS) and smart city infrastructure. Product innovation focuses on improving efficiency, sustainability, and resilience of infrastructure assets. The key value propositions emphasize cost-effectiveness, durability, and environmental compliance.

Key Drivers, Barriers & Challenges in Polish Infrastructure Market

Key Drivers:

- Government investment in large-scale infrastructure projects.

- Increasing urbanization and the need for improved infrastructure.

- EU funding and initiatives promoting infrastructure development.

Key Challenges:

- Funding constraints and bureaucratic processes.

- Shortages of skilled labor and specialized materials.

- Geopolitical and macroeconomic uncertainties influencing project timelines and costs.

Emerging Opportunities in Polish Infrastructure Market

- Growing demand for sustainable and green infrastructure solutions.

- Expansion of smart city initiatives and digitalization of infrastructure management.

- Increased private sector involvement in infrastructure projects via Public-Private Partnerships (PPPs).

Growth Accelerators in the Polish Infrastructure Market Industry

Technological advancements like the adoption of BIM, digital twins, and IoT sensors are significantly improving efficiency and project management. Strategic partnerships between public and private sectors are facilitating large-scale infrastructure developments. Further EU funding and national initiatives promoting green infrastructure will drive sustained growth in the years to come.

Key Players Shaping the Polish Infrastructure Market Market

- Budimex SA

- Vosse Sp Zoo

- Polskie Wagony

- Strabag SP ZOO

- TORPOL

- Porr SA

- EuroWagon

- STALFA SP Z O O (LLC)

- Unibep SA

- InterCargo

Notable Milestones in Polish Infrastructure Market Sector

- April 2022: Lantania's acquisitions of Balzola Polska and DSV significantly expand its capabilities in the Polish and European railway construction markets.

- October 2021: SYSTRA's acquisition of SWS strengthens its expertise in tunnel design and construction, increasing its European footprint.

- May 19, 2021: Porr SA and Unibep secure a PLN 405.6 million contract for the construction of section 19 of an international highway network.

In-Depth Polish Infrastructure Market Market Outlook

The Polish infrastructure market is poised for continued growth, driven by robust government spending, EU funding, and a strong focus on sustainable development. Strategic partnerships and technological advancements will be pivotal in accelerating this growth, unlocking significant opportunities for market players. The long-term outlook remains positive, with potential for significant expansion in key segments like roadways and railways.

Polish Infrastructure Market Segmentation

-

1. Modes

- 1.1. Roadways

- 1.2. Railways

- 1.3. Airways

- 1.4. Ports and Waterways

Polish Infrastructure Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

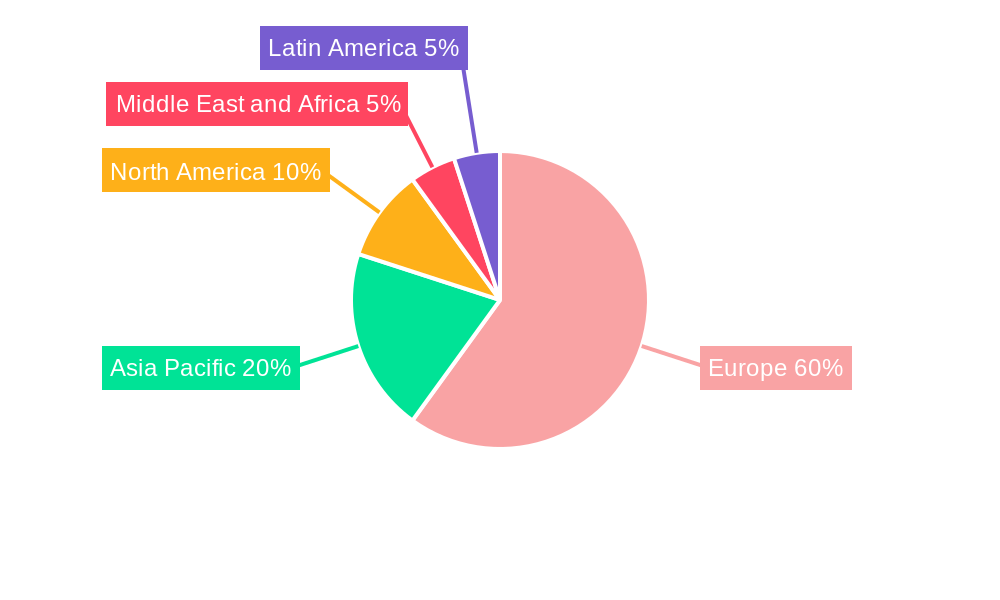

Polish Infrastructure Market Regional Market Share

Geographic Coverage of Polish Infrastructure Market

Polish Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase in Aging Population Driving the Market4.; Healthcare and Long-term Care Needs Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; High Affordability and Cost of Care Affecting the Market4.; Staffing and Workforce Challenges Affecting the Market

- 3.4. Market Trends

- 3.4.1. Increasing Government Investments for Transportation Infrastructure in Poland

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Polish Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Modes

- 5.1.1. Roadways

- 5.1.2. Railways

- 5.1.3. Airways

- 5.1.4. Ports and Waterways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Modes

- 6. North America Polish Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Modes

- 6.1.1. Roadways

- 6.1.2. Railways

- 6.1.3. Airways

- 6.1.4. Ports and Waterways

- 6.1. Market Analysis, Insights and Forecast - by Modes

- 7. South America Polish Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Modes

- 7.1.1. Roadways

- 7.1.2. Railways

- 7.1.3. Airways

- 7.1.4. Ports and Waterways

- 7.1. Market Analysis, Insights and Forecast - by Modes

- 8. Europe Polish Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Modes

- 8.1.1. Roadways

- 8.1.2. Railways

- 8.1.3. Airways

- 8.1.4. Ports and Waterways

- 8.1. Market Analysis, Insights and Forecast - by Modes

- 9. Middle East & Africa Polish Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Modes

- 9.1.1. Roadways

- 9.1.2. Railways

- 9.1.3. Airways

- 9.1.4. Ports and Waterways

- 9.1. Market Analysis, Insights and Forecast - by Modes

- 10. Asia Pacific Polish Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Modes

- 10.1.1. Roadways

- 10.1.2. Railways

- 10.1.3. Airways

- 10.1.4. Ports and Waterways

- 10.1. Market Analysis, Insights and Forecast - by Modes

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Budimex SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vosse Sp Zoo

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Polksie Wagony

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Strabag SP ZOO

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TORPOL

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Porr SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 EuroWagon**List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 STALFA SP Z O O (LLC)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Unibep SA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 InterCargo

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Budimex SA

List of Figures

- Figure 1: Global Polish Infrastructure Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Polish Infrastructure Market Revenue (billion), by Modes 2025 & 2033

- Figure 3: North America Polish Infrastructure Market Revenue Share (%), by Modes 2025 & 2033

- Figure 4: North America Polish Infrastructure Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Polish Infrastructure Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Polish Infrastructure Market Revenue (billion), by Modes 2025 & 2033

- Figure 7: South America Polish Infrastructure Market Revenue Share (%), by Modes 2025 & 2033

- Figure 8: South America Polish Infrastructure Market Revenue (billion), by Country 2025 & 2033

- Figure 9: South America Polish Infrastructure Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Polish Infrastructure Market Revenue (billion), by Modes 2025 & 2033

- Figure 11: Europe Polish Infrastructure Market Revenue Share (%), by Modes 2025 & 2033

- Figure 12: Europe Polish Infrastructure Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Polish Infrastructure Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Polish Infrastructure Market Revenue (billion), by Modes 2025 & 2033

- Figure 15: Middle East & Africa Polish Infrastructure Market Revenue Share (%), by Modes 2025 & 2033

- Figure 16: Middle East & Africa Polish Infrastructure Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa Polish Infrastructure Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Polish Infrastructure Market Revenue (billion), by Modes 2025 & 2033

- Figure 19: Asia Pacific Polish Infrastructure Market Revenue Share (%), by Modes 2025 & 2033

- Figure 20: Asia Pacific Polish Infrastructure Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific Polish Infrastructure Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Polish Infrastructure Market Revenue billion Forecast, by Modes 2020 & 2033

- Table 2: Global Polish Infrastructure Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Polish Infrastructure Market Revenue billion Forecast, by Modes 2020 & 2033

- Table 4: Global Polish Infrastructure Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Polish Infrastructure Market Revenue billion Forecast, by Modes 2020 & 2033

- Table 9: Global Polish Infrastructure Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Polish Infrastructure Market Revenue billion Forecast, by Modes 2020 & 2033

- Table 14: Global Polish Infrastructure Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Polish Infrastructure Market Revenue billion Forecast, by Modes 2020 & 2033

- Table 25: Global Polish Infrastructure Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Polish Infrastructure Market Revenue billion Forecast, by Modes 2020 & 2033

- Table 33: Global Polish Infrastructure Market Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Polish Infrastructure Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Polish Infrastructure Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the Polish Infrastructure Market?

Key companies in the market include Budimex SA, Vosse Sp Zoo, Polksie Wagony, Strabag SP ZOO, TORPOL, Porr SA, EuroWagon**List Not Exhaustive, STALFA SP Z O O (LLC), Unibep SA, InterCargo.

3. What are the main segments of the Polish Infrastructure Market?

The market segments include Modes.

4. Can you provide details about the market size?

The market size is estimated to be USD 54.04 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase in Aging Population Driving the Market4.; Healthcare and Long-term Care Needs Driving the Market.

6. What are the notable trends driving market growth?

Increasing Government Investments for Transportation Infrastructure in Poland.

7. Are there any restraints impacting market growth?

4.; High Affordability and Cost of Care Affecting the Market4.; Staffing and Workforce Challenges Affecting the Market.

8. Can you provide examples of recent developments in the market?

April 2022: Lantania grows and strengthens its dominance in the sector with the acquisitions of Balzola Polska and the Spanish railway construction company DSV. The infrastructure, water, and energy group signed the two deals, advancing its international development plan and expanding its capabilities. The acquisition of Balzola's Polish subsidiary gives the company entry into a high-potential market, while the acquisition of DSV completes and improves Lantania's capabilities in railway works.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Polish Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Polish Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Polish Infrastructure Market?

To stay informed about further developments, trends, and reports in the Polish Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence