Key Insights

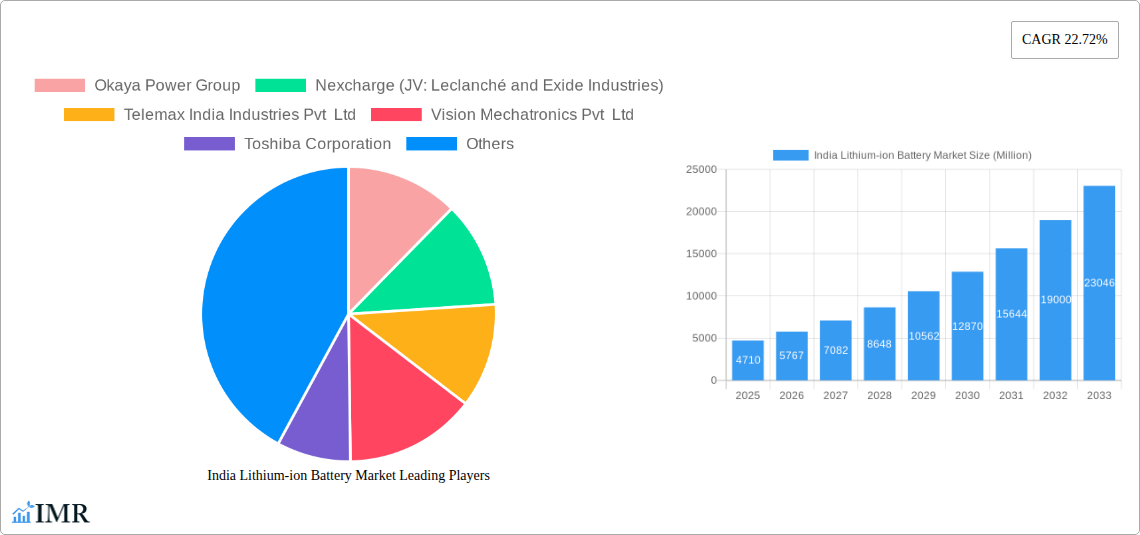

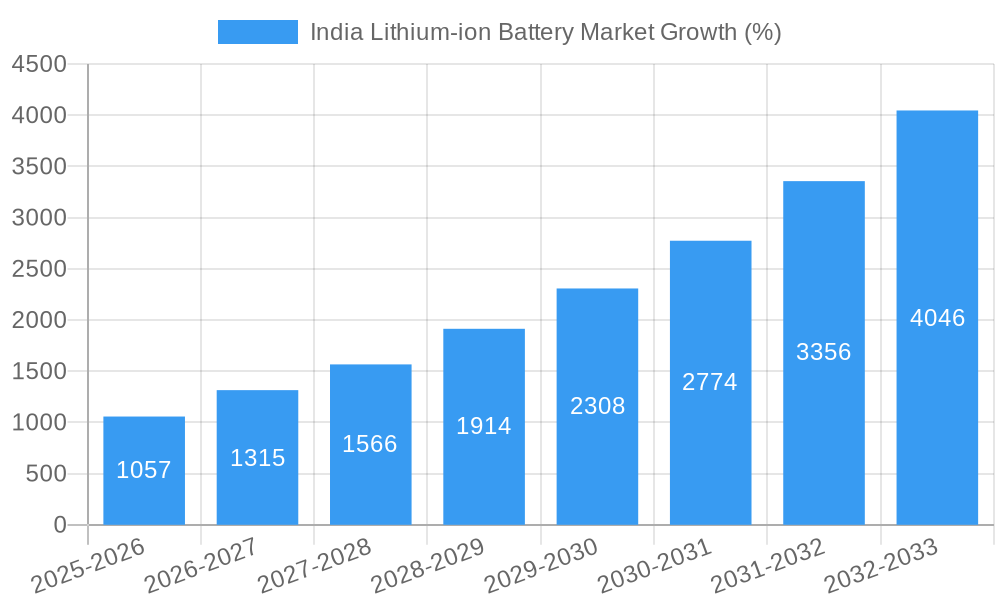

The India lithium-ion battery market is experiencing robust growth, projected to reach \$4.71 billion in 2025 and maintain a significant Compound Annual Growth Rate (CAGR) of 22.72% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning electric vehicle (EV) sector in India is a primary catalyst, fueling demand for high-performance, reliable lithium-ion batteries for both two-wheelers and four-wheelers. Furthermore, the increasing adoption of portable electronic devices, coupled with the government's push for renewable energy storage solutions and initiatives promoting energy independence, significantly contributes to market growth. Growth in the automotive segment is likely outpacing other applications due to the scale of EV adoption. Key players such as Okaya Power Group, Nexcharge, and Toshiba Corporation are actively shaping the market landscape through technological advancements and strategic partnerships. However, challenges remain, including the high initial cost of lithium-ion batteries compared to other battery technologies, and concerns regarding raw material sourcing and supply chain resilience. Regional variations in market penetration are expected, with regions experiencing faster EV adoption likely showing more significant growth. The market's competitive landscape is characterized by a mix of established international players and domestic manufacturers, driving innovation and fostering competition. The next decade will see continued consolidation as companies seek to establish market leadership and capitalize on the long-term growth opportunities within the sector.

The forecast period (2025-2033) suggests an even more substantial market expansion, with the cumulative effect of the growth drivers outlined above accelerating market penetration. Continued government support for the EV industry and renewable energy initiatives will be vital for sustaining this growth trajectory. However, addressing challenges relating to raw material costs, battery recycling infrastructure, and addressing potential environmental concerns will be crucial to ensure the sustainable and responsible growth of the India lithium-ion battery market. Specific focus on developing a robust domestic supply chain for raw materials will be critical for long-term market stability and minimizing reliance on imports. The market segmentation by application (portable, automotive, other) will continue to evolve, with the automotive segment likely dominating in terms of value and volume due to the significant growth of the EV sector.

India Lithium-ion Battery Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning India lithium-ion battery market, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with 2025 as the base year and a forecast period extending to 2033, this report dissects market dynamics, growth trends, and future prospects. The analysis spans various segments including portable, automotive, and other applications, providing a granular understanding of this rapidly evolving sector. The report utilizes a blend of quantitative and qualitative data to paint a holistic picture of the Indian lithium-ion battery landscape.

India Lithium-ion Battery Market Dynamics & Structure

The Indian lithium-ion battery market is characterized by a dynamic interplay of factors influencing its structure and growth trajectory. Market concentration is currently moderate, with a few key players holding significant market share, but a fragmented landscape exists due to the entrance of numerous startups and smaller companies. Technological innovation, particularly in battery chemistry and energy density, is a major driver, fueled by government initiatives promoting electric mobility and renewable energy storage. Stringent regulatory frameworks are being implemented to ensure safety and environmental standards, shaping the market’s development. The presence of competitive product substitutes, such as lead-acid batteries, poses a challenge, particularly in price-sensitive segments. End-user demographics are shifting towards increasing adoption in the automotive and energy storage sectors. M&A activity is on the rise, reflecting consolidation and strategic expansion within the industry.

- Market Concentration: Moderate, with xx% market share held by the top 5 players.

- Technological Innovation: Driven by advancements in battery chemistry (e.g., Lithium Iron Phosphate - LFP) and energy density improvements.

- Regulatory Framework: Stringent safety and environmental standards impacting product development and market entry.

- Competitive Substitutes: Lead-acid batteries remain a competitive substitute in certain applications.

- End-User Demographics: Increasing demand from the automotive and energy storage sectors.

- M&A Activity: xx M&A deals recorded in the past 5 years, indicating industry consolidation.

India Lithium-ion Battery Market Growth Trends & Insights

The Indian lithium-ion battery market exhibits robust growth, fueled by increasing demand for electric vehicles (EVs), energy storage systems (ESS), and portable electronic devices. The market size experienced significant expansion between 2019 and 2024, with a Compound Annual Growth Rate (CAGR) of xx%. This growth trajectory is expected to continue throughout the forecast period (2025-2033), driven by factors such as government incentives for EV adoption, the expanding renewable energy sector, and growing consumer preference for portable electronics. Technological disruptions, including advancements in battery chemistry and manufacturing processes, further contribute to market growth. Consumer behavior is shifting towards environmentally friendly products, bolstering the demand for lithium-ion batteries as a sustainable alternative. Market penetration is expected to rise from xx% in 2025 to xx% by 2033.

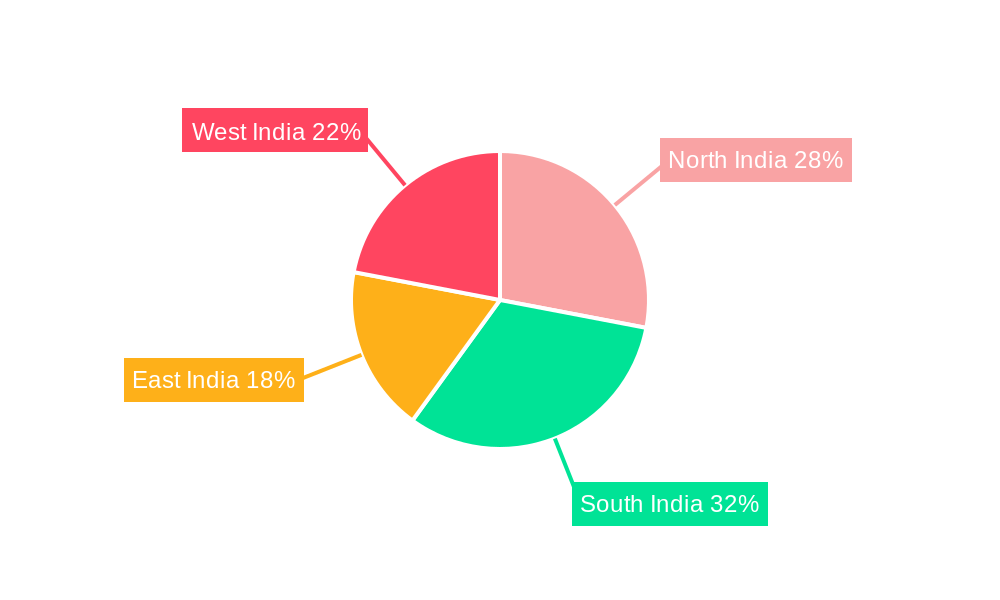

Dominant Regions, Countries, or Segments in India Lithium-ion Battery Market

The automotive segment is currently the dominant driver of growth within the Indian lithium-ion battery market, followed by the portable electronics segment. This is largely attributable to the government’s strong push towards electric vehicle adoption and the increasing demand for smartphones and other portable devices. The other applications segment, encompassing energy storage systems and industrial applications, also exhibits significant potential for future growth. Specific regions like Gujarat and Telangana are emerging as manufacturing hubs, driven by favorable government policies, infrastructure development, and incentives for attracting investments in the EV and battery sector.

- Key Drivers for Automotive Segment: Government incentives for EV adoption, growing urban populations, and rising disposable income.

- Key Drivers for Portable Segment: High demand for smartphones and other portable electronic gadgets.

- Key Drivers for Other Applications Segment: Growth of renewable energy sector and increasing demand for industrial applications.

- Dominant Region: Gujarat and Telangana are emerging as key manufacturing hubs.

India Lithium-ion Battery Market Product Landscape

The Indian lithium-ion battery market showcases a diverse range of products, encompassing various chemistries, form factors, and energy densities. Innovations focus on enhancing energy density, improving lifespan, and ensuring safety. Unique selling propositions often revolve around cost-effectiveness, performance, and suitability for specific applications. Advancements include the development of advanced battery management systems (BMS), fast-charging technologies, and improved thermal management solutions.

Key Drivers, Barriers & Challenges in India Lithium-ion Battery Market

Key Drivers:

- Government initiatives: Policies promoting electric mobility and renewable energy are significantly boosting demand.

- Technological advancements: Improvements in battery chemistry, energy density, and manufacturing processes.

- Economic growth: Rising disposable incomes and increased spending on electronic devices.

Key Challenges:

- Raw material dependence: India's reliance on imports for crucial raw materials poses a supply chain vulnerability.

- Regulatory hurdles: Complex regulatory approvals and compliance requirements can slow down market growth.

- High initial costs: The high initial investment for lithium-ion batteries remains a barrier for adoption in price-sensitive markets. This impacts market penetration by xx%.

Emerging Opportunities in India Lithium-ion Battery Market

- Untapped rural markets: Expanding access to electricity and electronics in rural areas presents significant growth potential.

- Innovation in battery storage solutions: Development of advanced energy storage systems for grid stabilization and renewable energy integration.

- Growth of the electric two-wheeler and three-wheeler segments: This offers immense potential for lithium-ion battery adoption.

Growth Accelerators in the India Lithium-ion Battery Market Industry

Technological breakthroughs, such as improvements in solid-state battery technology and advanced battery management systems (BMS), are key catalysts driving long-term growth. Strategic partnerships between Indian and international companies are facilitating technology transfer and capacity building. Market expansion strategies focusing on underserved regions and developing new applications for lithium-ion batteries will further propel market growth.

Key Players Shaping the India Lithium-ion Battery Market Market

- Okaya Power Group

- Nexcharge (JV: Leclanché and Exide Industries)

- Telemax India Industries Pvt Ltd

- Vision Mechatronics Pvt Ltd

- Toshiba Corporation

- Amperex Technology Limited

- Future Hi-Tech Batteries

- Exicom Tele-Systems Limited

- iPower Batteries Pvt Ltd

- Trontek Group

- TDS Lithium-Ion Battery Gujarat Private Limited (TDSG)

- Inverted Energy Private Limited

- Bharat Electronics Limited (BEL)

Notable Milestones in India Lithium-ion Battery Market Sector

- December 2023: Himadri Speciality Chemical Ltd announced a INR 48.00 billion (USD 576 million) investment for a lithium iron phosphate plant, boosting domestic raw material supply.

- January 2024: Amara Raja Batteries Ltd announced plans for a gigafactory with a capacity of up to 16 GWh for lithium cells and 5 GWh for battery packs.

- March 2024: Panasonic Energy Co Ltd and Indian Oil Corporation Ltd formed a joint venture to manufacture cylindrical lithium-ion batteries.

In-Depth India Lithium-ion Battery Market Market Outlook

The future of the Indian lithium-ion battery market is exceptionally promising, driven by a confluence of factors including government support, technological innovation, and increasing consumer demand. Strategic opportunities exist for companies focusing on cost reduction, enhancing battery performance, and developing innovative applications. The market is poised for significant expansion, with substantial growth anticipated across all segments. The continued development of domestic manufacturing capabilities and a strengthened supply chain will play a crucial role in shaping the future landscape.

India Lithium-ion Battery Market Segmentation

-

1. Application

- 1.1. Portable

- 1.2. Automotive

- 1.3. Other Applications

India Lithium-ion Battery Market Segmentation By Geography

- 1. India

India Lithium-ion Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 22.72% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost Of Lithium-ion Batteries4.; Increasing Adoption of Electric Vehicles

- 3.3. Market Restrains

- 3.3.1. 4.; Demand and Supply of Raw Materials for Battery Manufacturing

- 3.4. Market Trends

- 3.4.1. The Automotive Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Lithium-ion Battery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Portable

- 5.1.2. Automotive

- 5.1.3. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North India India Lithium-ion Battery Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Lithium-ion Battery Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Lithium-ion Battery Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Lithium-ion Battery Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Okaya Power Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nexcharge (JV

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.1 Okaya Power Group

List of Figures

- Figure 1: India Lithium-ion Battery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Lithium-ion Battery Market Share (%) by Company 2024

List of Tables

- Table 1: India Lithium-ion Battery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Lithium-ion Battery Market Volume K Units Forecast, by Region 2019 & 2032

- Table 3: India Lithium-ion Battery Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: India Lithium-ion Battery Market Volume K Units Forecast, by Application 2019 & 2032

- Table 5: India Lithium-ion Battery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Lithium-ion Battery Market Volume K Units Forecast, by Region 2019 & 2032

- Table 7: India Lithium-ion Battery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: India Lithium-ion Battery Market Volume K Units Forecast, by Country 2019 & 2032

- Table 9: North India India Lithium-ion Battery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North India India Lithium-ion Battery Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 11: South India India Lithium-ion Battery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South India India Lithium-ion Battery Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 13: East India India Lithium-ion Battery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: East India India Lithium-ion Battery Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: West India India Lithium-ion Battery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: West India India Lithium-ion Battery Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: India Lithium-ion Battery Market Revenue Million Forecast, by Application 2019 & 2032

- Table 18: India Lithium-ion Battery Market Volume K Units Forecast, by Application 2019 & 2032

- Table 19: India Lithium-ion Battery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: India Lithium-ion Battery Market Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Lithium-ion Battery Market?

The projected CAGR is approximately 22.72%.

2. Which companies are prominent players in the India Lithium-ion Battery Market?

Key companies in the market include Okaya Power Group, Nexcharge (JV: Leclanché and Exide Industries), Telemax India Industries Pvt Ltd, Vision Mechatronics Pvt Ltd, Toshiba Corporation, Amperex Technology Limited, Future Hi-Tech Batteries, Exicom Tele-Systems Limited, iPower Batteries Pvt Ltd *List Not Exhaustive 6 4 Market Ranking Analysi, Trontek Group, TDS Lithium-Ion Battery Gujarat Private Limited (TDSG), Inverted Energy Private Limited, Bharat Electronics Limited (BEL).

3. What are the main segments of the India Lithium-ion Battery Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.71 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost Of Lithium-ion Batteries4.; Increasing Adoption of Electric Vehicles.

6. What are the notable trends driving market growth?

The Automotive Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Demand and Supply of Raw Materials for Battery Manufacturing.

8. Can you provide examples of recent developments in the market?

March 2024: Panasonic Energy Co Ltd, a subsidiary of Panasonic Group, a Japan-based multinational electronics company, will form a joint venture with Maharatna PSU Indian Oil Corporation Ltd, the nation's biggest oil firm, to manufacture cylindrical lithium-ion batteries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Lithium-ion Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Lithium-ion Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Lithium-ion Battery Market?

To stay informed about further developments, trends, and reports in the India Lithium-ion Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence