Key Insights

The Middle East and Africa (MEA) Carbon Black market is projected to reach 532.8 million by 2024, with a Compound Annual Growth Rate (CAGR) of 2.3%. This growth is propelled by several key drivers. The expanding automotive sector across the region, notably in South Africa, Egypt, and the UAE, is increasing demand for carbon black in tire production. Concurrently, the burgeoning plastics and construction industries are significant contributors, utilizing carbon black for pigmentation and reinforcement. The adoption of advanced materials, including high-performance polymers and composites, is also creating opportunities for specialized carbon black applications. However, market expansion faces headwinds from volatile crude oil prices, environmental considerations surrounding emissions, and competition from alternative materials.

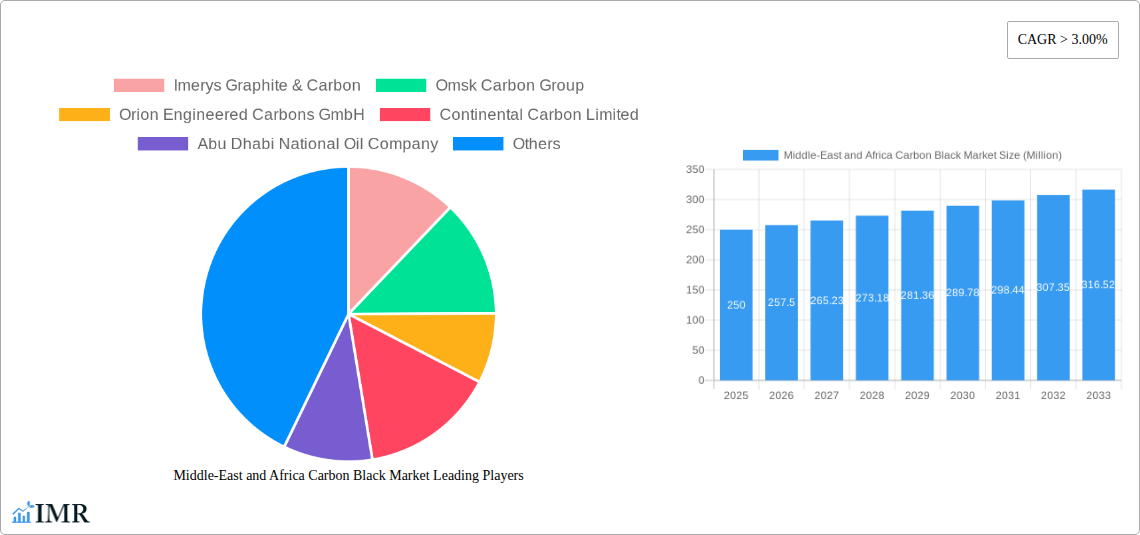

Middle-East and Africa Carbon Black Market Market Size (In Million)

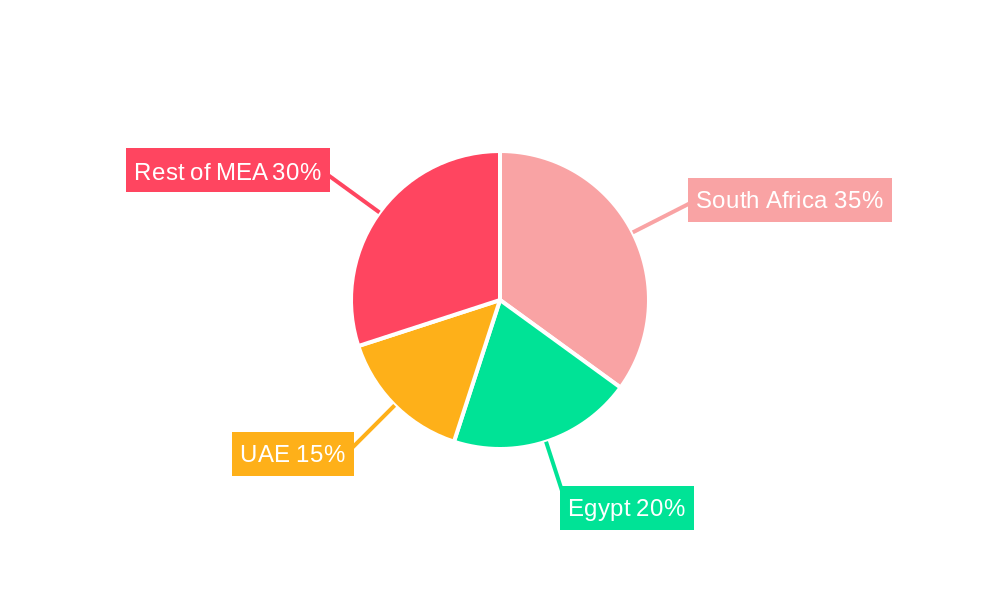

Significant regional market dynamics are evident within MEA. South Africa, with its established automotive and industrial infrastructure, is expected to command the largest market share, followed by key economies such as Egypt and the UAE. North African nations are experiencing moderate growth fueled by infrastructure development. While currently smaller, the East African market shows substantial future growth potential as economies develop and industrial output rises. The competitive landscape is characterized by a blend of global leaders like Cabot Corporation and Orion Engineered Carbons, alongside regional manufacturers. Strategic alliances, technological innovation, and a focus on sustainable production will likely define future competition.

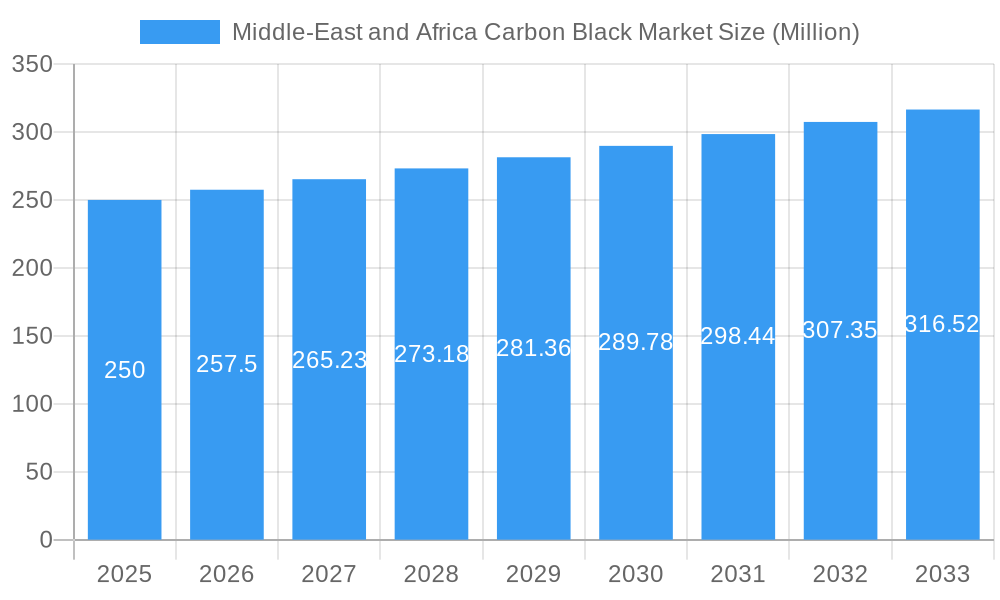

Middle-East and Africa Carbon Black Market Company Market Share

Middle East & Africa Carbon Black Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East & Africa Carbon Black market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report dissects market dynamics, growth trends, dominant segments, and key players shaping this dynamic industry. The report utilizes a robust methodology to deliver accurate market sizing and forecasting, crucial for navigating the complexities of this evolving landscape.

Keywords: Carbon Black Market, Middle East Carbon Black, Africa Carbon Black, Furnace Black, Gas Black, Lamp Black, Tires, Rubber, Plastics, Paints, Coatings, SABIC, Orion Engineered Carbons, Imerys Graphite & Carbon, Market Size, Market Share, CAGR, Market Forecast, Industry Analysis, Market Research.

Middle-East and Africa Carbon Black Market Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Middle East and Africa Carbon Black market. The market is characterized by a moderate level of concentration, with several major players and a number of smaller regional producers. Technological innovation is driven by the need for sustainable and high-performance carbon black products.

Market Structure:

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Driven by demand for sustainable feedstocks (e.g., plant-based oils) and improved performance characteristics.

- Regulatory Framework: Varies across countries, impacting production and environmental compliance. Stringent regulations regarding emissions are driving the adoption of cleaner production technologies.

- Competitive Product Substitutes: Limited, with carbon black maintaining its dominant position due to its superior properties in many applications.

- End-User Demographics: Primarily driven by the growth of the automotive, construction, and plastics industries across the region.

- M&A Trends: A moderate level of M&A activity observed in recent years, primarily focused on expanding regional presence and product portfolios. Approximately xx M&A deals were recorded between 2019 and 2024.

Middle-East and Africa Carbon Black Market Growth Trends & Insights

The Middle East and Africa Carbon Black market experienced significant growth between 2019 and 2024, driven by increasing demand from key end-use sectors. The market is projected to continue its expansion throughout the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx% during this timeframe. This growth is primarily fueled by increasing industrialization, infrastructural development, and automotive production across the region. The rising disposable incomes and urbanization are creating a surge in demand for consumer goods, further stimulating market growth.

- Market size in 2024: xx Million

- Market size in 2033 (projected): xx Million

- CAGR (2025-2033): xx%

Dominant Regions, Countries, or Segments in Middle-East and Africa Carbon Black Market

The Middle East and Africa Carbon Black market is geographically diverse, with varying growth rates across different regions and countries. The key segments within the market are categorized by process type and application. Within Process Type, Furnace Black holds the largest market share due to its wide applicability and cost-effectiveness. In terms of applications, the Tires and Industrial Rubber Products segment demonstrates the highest demand, followed by Plastics.

- Leading Region: xx (market share: xx%)

- Leading Country: xx (market share: xx%)

- Leading Process Type: Furnace Black (market share: xx%)

- Leading Application: Tires and Industrial Rubber Products (market share: xx%)

Key Growth Drivers:

- Rapid industrialization and infrastructure development across several Middle Eastern and African nations.

- Growth of the automotive sector and increased vehicle production.

- Expanding plastics and construction industries.

- Government initiatives and policies promoting economic diversification and industrial growth.

Middle-East and Africa Carbon Black Market Product Landscape

The Middle East and Africa Carbon Black market offers a diverse range of products, categorized by process type and tailored to meet specific application requirements. Recent innovations focus on enhancing performance, sustainability, and cost-effectiveness. Key product differentiators include particle size distribution, surface area, structure, and level of reinforcement provided. The ongoing development of sustainable, plant-based feedstock options is a notable trend shaping the future of this market.

Key Drivers, Barriers & Challenges in Middle-East and Africa Carbon Black Market

Key Drivers:

- Rapid industrialization and urbanization driving demand for carbon black in multiple applications.

- Growing automotive sector boosting demand for high-performance tires and rubber products.

- Government infrastructure projects increasing the use of carbon black in construction materials.

Key Challenges & Restraints:

- Fluctuating raw material prices impacting production costs.

- Stringent environmental regulations necessitating investments in cleaner technologies.

- Competition from substitute materials in specific applications.

- Supply chain disruptions potentially leading to price volatility and shortages.

Emerging Opportunities in Middle-East and Africa Carbon Black Market

Significant opportunities exist for growth in the Middle East and Africa Carbon Black market. This includes the potential for growth in untapped markets, particularly across the rapidly developing economies of the region. Developing more sustainable manufacturing processes will attract significant investment, which is further fueled by the demand for environmentally friendly products. The increasing demand for high-performance materials in specialized applications, such as advanced composite materials and high-tech electronics, provides further growth potential.

Growth Accelerators in the Middle-East and Africa Carbon Black Market Industry

Long-term growth will be driven by continued industrialization, infrastructural development, and the rise of the automotive sector. Strategic partnerships between carbon black producers and end-use industries will play a crucial role in expanding market reach and developing innovative applications. Investments in research and development will be critical in improving product performance, sustainability, and cost-effectiveness.

Key Players Shaping the Middle-East and Africa Carbon Black Market Market

- Imerys Graphite & Carbon

- Omsk Carbon Group

- Orion Engineered Carbons GmbH

- Continental Carbon Limited

- Abu Dhabi National Oil Company

- Cabot Corporation

- Epsilon Carbon Private Limited

- SABIC

- PCBL Limited

- Aditya Birla Group

Notable Milestones in Middle-East and Africa Carbon Black Market Sector

- June 2021: Orion Engineered Carbons GmbH launched ECORAX Nature, a sustainable carbon black product line using plant-based oils.

- April 2022: SABIC introduced carbon black grade N330, enhancing the quality of concrete constructions in the Kingdom.

In-Depth Middle-East and Africa Carbon Black Market Market Outlook

The Middle East and Africa Carbon Black market is poised for significant growth driven by continued industrial expansion and infrastructural development across the region. Strategic partnerships and investments in sustainable production technologies will be key factors influencing future market dynamics. The emergence of new applications for carbon black in specialized industries also presents lucrative opportunities for market expansion. The long-term outlook remains positive, with consistent growth projected throughout the forecast period.

Middle-East and Africa Carbon Black Market Segmentation

-

1. Process Type

- 1.1. Furnace Black

- 1.2. Gas Black

- 1.3. Lamp Black

- 1.4. Hexamine

- 1.5. Thermal Black

-

2. Application

- 2.1. Tires and Industrial Rubber Products

-

2.2. Plastics

- 2.2.1. Films and Sheets

- 2.2.2. Pressure Pipes

- 2.2.3. Molded Parts

- 2.3. Toners and Printing Inks

- 2.4. Paints and Coatings

-

2.5. Textile Fibers

- 2.5.1. Nylon

- 2.5.2. Polyester

- 2.5.3. Acrylic

- 2.6. Other Applications

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. South Africa

- 3.3. United Arab Emirates

- 3.4. Rest of Middle East and Africa

Middle-East and Africa Carbon Black Market Segmentation By Geography

- 1. Saudi Arabia

- 2. South Africa

- 3. United Arab Emirates

- 4. Rest of Middle East and Africa

Middle-East and Africa Carbon Black Market Regional Market Share

Geographic Coverage of Middle-East and Africa Carbon Black Market

Middle-East and Africa Carbon Black Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Application in Fiber and Textile Industries; Increasing Market Penetration of Specialty Black

- 3.3. Market Restrains

- 3.3.1. Increasing Usage of Green Tires; Availability of Substitutes

- 3.4. Market Trends

- 3.4.1. Tires and Industrial Rubber products to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Carbon Black Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 5.1.1. Furnace Black

- 5.1.2. Gas Black

- 5.1.3. Lamp Black

- 5.1.4. Hexamine

- 5.1.5. Thermal Black

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Tires and Industrial Rubber Products

- 5.2.2. Plastics

- 5.2.2.1. Films and Sheets

- 5.2.2.2. Pressure Pipes

- 5.2.2.3. Molded Parts

- 5.2.3. Toners and Printing Inks

- 5.2.4. Paints and Coatings

- 5.2.5. Textile Fibers

- 5.2.5.1. Nylon

- 5.2.5.2. Polyester

- 5.2.5.3. Acrylic

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. South Africa

- 5.3.3. United Arab Emirates

- 5.3.4. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. South Africa

- 5.4.3. United Arab Emirates

- 5.4.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 6. Saudi Arabia Middle-East and Africa Carbon Black Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Process Type

- 6.1.1. Furnace Black

- 6.1.2. Gas Black

- 6.1.3. Lamp Black

- 6.1.4. Hexamine

- 6.1.5. Thermal Black

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Tires and Industrial Rubber Products

- 6.2.2. Plastics

- 6.2.2.1. Films and Sheets

- 6.2.2.2. Pressure Pipes

- 6.2.2.3. Molded Parts

- 6.2.3. Toners and Printing Inks

- 6.2.4. Paints and Coatings

- 6.2.5. Textile Fibers

- 6.2.5.1. Nylon

- 6.2.5.2. Polyester

- 6.2.5.3. Acrylic

- 6.2.6. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. South Africa

- 6.3.3. United Arab Emirates

- 6.3.4. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Process Type

- 7. South Africa Middle-East and Africa Carbon Black Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Process Type

- 7.1.1. Furnace Black

- 7.1.2. Gas Black

- 7.1.3. Lamp Black

- 7.1.4. Hexamine

- 7.1.5. Thermal Black

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Tires and Industrial Rubber Products

- 7.2.2. Plastics

- 7.2.2.1. Films and Sheets

- 7.2.2.2. Pressure Pipes

- 7.2.2.3. Molded Parts

- 7.2.3. Toners and Printing Inks

- 7.2.4. Paints and Coatings

- 7.2.5. Textile Fibers

- 7.2.5.1. Nylon

- 7.2.5.2. Polyester

- 7.2.5.3. Acrylic

- 7.2.6. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. South Africa

- 7.3.3. United Arab Emirates

- 7.3.4. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Process Type

- 8. United Arab Emirates Middle-East and Africa Carbon Black Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Process Type

- 8.1.1. Furnace Black

- 8.1.2. Gas Black

- 8.1.3. Lamp Black

- 8.1.4. Hexamine

- 8.1.5. Thermal Black

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Tires and Industrial Rubber Products

- 8.2.2. Plastics

- 8.2.2.1. Films and Sheets

- 8.2.2.2. Pressure Pipes

- 8.2.2.3. Molded Parts

- 8.2.3. Toners and Printing Inks

- 8.2.4. Paints and Coatings

- 8.2.5. Textile Fibers

- 8.2.5.1. Nylon

- 8.2.5.2. Polyester

- 8.2.5.3. Acrylic

- 8.2.6. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. South Africa

- 8.3.3. United Arab Emirates

- 8.3.4. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Process Type

- 9. Rest of Middle East and Africa Middle-East and Africa Carbon Black Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Process Type

- 9.1.1. Furnace Black

- 9.1.2. Gas Black

- 9.1.3. Lamp Black

- 9.1.4. Hexamine

- 9.1.5. Thermal Black

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Tires and Industrial Rubber Products

- 9.2.2. Plastics

- 9.2.2.1. Films and Sheets

- 9.2.2.2. Pressure Pipes

- 9.2.2.3. Molded Parts

- 9.2.3. Toners and Printing Inks

- 9.2.4. Paints and Coatings

- 9.2.5. Textile Fibers

- 9.2.5.1. Nylon

- 9.2.5.2. Polyester

- 9.2.5.3. Acrylic

- 9.2.6. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. South Africa

- 9.3.3. United Arab Emirates

- 9.3.4. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Process Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Imerys Graphite & Carbon

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Omsk Carbon Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Orion Engineered Carbons GmbH

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Continental Carbon Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Abu Dhabi National Oil Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Cabot Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Epsilon Carbon Private Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Sabic*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 PCBL Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Aditya Birla Group

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Imerys Graphite & Carbon

List of Figures

- Figure 1: Middle-East and Africa Carbon Black Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Carbon Black Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Carbon Black Market Revenue million Forecast, by Process Type 2020 & 2033

- Table 2: Middle-East and Africa Carbon Black Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Middle-East and Africa Carbon Black Market Revenue million Forecast, by Geography 2020 & 2033

- Table 4: Middle-East and Africa Carbon Black Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Middle-East and Africa Carbon Black Market Revenue million Forecast, by Process Type 2020 & 2033

- Table 6: Middle-East and Africa Carbon Black Market Revenue million Forecast, by Application 2020 & 2033

- Table 7: Middle-East and Africa Carbon Black Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: Middle-East and Africa Carbon Black Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: Middle-East and Africa Carbon Black Market Revenue million Forecast, by Process Type 2020 & 2033

- Table 10: Middle-East and Africa Carbon Black Market Revenue million Forecast, by Application 2020 & 2033

- Table 11: Middle-East and Africa Carbon Black Market Revenue million Forecast, by Geography 2020 & 2033

- Table 12: Middle-East and Africa Carbon Black Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Middle-East and Africa Carbon Black Market Revenue million Forecast, by Process Type 2020 & 2033

- Table 14: Middle-East and Africa Carbon Black Market Revenue million Forecast, by Application 2020 & 2033

- Table 15: Middle-East and Africa Carbon Black Market Revenue million Forecast, by Geography 2020 & 2033

- Table 16: Middle-East and Africa Carbon Black Market Revenue million Forecast, by Country 2020 & 2033

- Table 17: Middle-East and Africa Carbon Black Market Revenue million Forecast, by Process Type 2020 & 2033

- Table 18: Middle-East and Africa Carbon Black Market Revenue million Forecast, by Application 2020 & 2033

- Table 19: Middle-East and Africa Carbon Black Market Revenue million Forecast, by Geography 2020 & 2033

- Table 20: Middle-East and Africa Carbon Black Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Carbon Black Market?

The projected CAGR is approximately 2.3%.

2. Which companies are prominent players in the Middle-East and Africa Carbon Black Market?

Key companies in the market include Imerys Graphite & Carbon, Omsk Carbon Group, Orion Engineered Carbons GmbH, Continental Carbon Limited, Abu Dhabi National Oil Company, Cabot Corporation, Epsilon Carbon Private Limited, Sabic*List Not Exhaustive, PCBL Limited, Aditya Birla Group.

3. What are the main segments of the Middle-East and Africa Carbon Black Market?

The market segments include Process Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 532.8 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Application in Fiber and Textile Industries; Increasing Market Penetration of Specialty Black.

6. What are the notable trends driving market growth?

Tires and Industrial Rubber products to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Usage of Green Tires; Availability of Substitutes.

8. Can you provide examples of recent developments in the market?

In April 2022, SABIC introduced carbon black grade N330 as a new market option for the Kingdom's building and construction sector to improve the quality of cast-in-place concrete constructions that require an early drying process and greater strength. Premium hollow blocks from SABIC concrete mix have higher power, shorter settings, and a better look. The approach reduced casting time by more than 40% while increasing strength by 7%.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Carbon Black Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Carbon Black Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Carbon Black Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Carbon Black Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence