Key Insights

The Middle East Industrial Gases market, valued at approximately $9907.04 million in 2024, is poised for significant expansion. It is projected to grow at a compound annual growth rate (CAGR) of 6.4% between 2024 and 2032. This robust growth is underpinned by several key drivers. The region's expanding petrochemical and manufacturing industries are substantially increasing the demand for essential industrial gases such as nitrogen, oxygen, and hydrogen. Major infrastructure developments across the Middle East, including enhancements in oil and gas extraction, refinery operations, and metal fabrication facilities, are directly contributing to this demand. Concurrently, a heightened emphasis on operational efficiency and technological progress within regional industries is accelerating the adoption of sophisticated gas processing and distribution systems. Government-driven initiatives aimed at fostering industrial diversification and economic advancement are also indirectly stimulating market growth. The chemical processing, refining, and oil and gas sectors currently represent the primary end-use segments. However, increasing adoption in the healthcare, food and beverage, and automotive industries signals considerable growth potential in these emerging segments. The market is characterized by a competitive environment featuring both global corporations and local enterprises, with key players including Linde PLC, Air Products and Chemicals Inc., and Air Liquide.

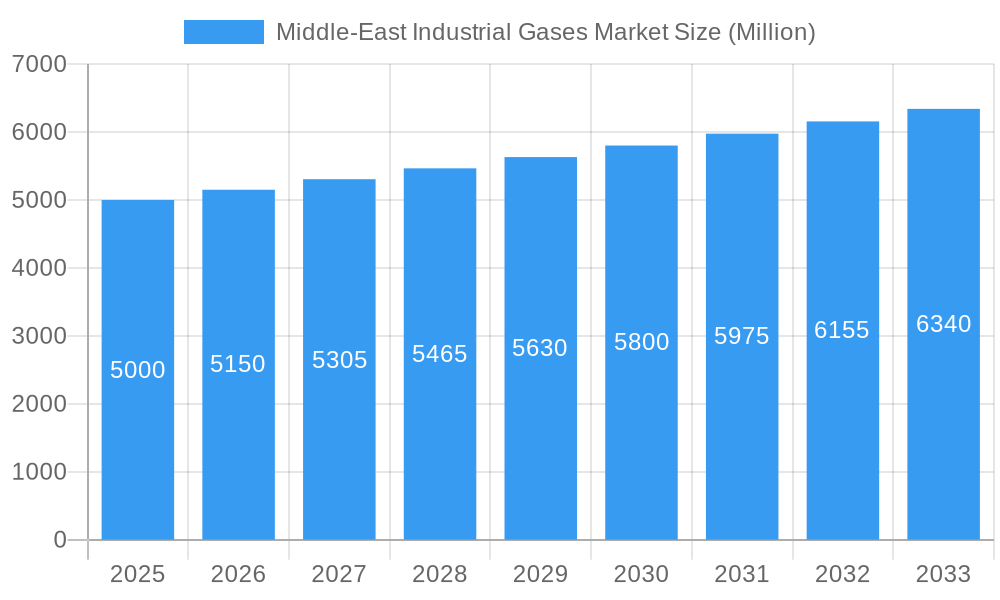

Middle-East Industrial Gases Market Market Size (In Billion)

Nevertheless, market expansion is subject to specific constraints. Volatility in global energy prices and raw material costs directly influences the production costs and pricing of industrial gases. Moreover, evolving environmental regulations and the imperative for sustainable operations are compelling companies to invest in eco-friendly production methodologies and technologies. These investments, while crucial for long-term viability, may impact short-term profitability. Despite these challenges, the long-term outlook for the Middle East industrial gases market remains optimistic, propelled by sustained economic development and industrialization across the region, presenting substantial opportunities for stakeholders. Growth is anticipated to be particularly vigorous in nations undergoing rapid industrial transformation and those prioritizing infrastructure enhancements.

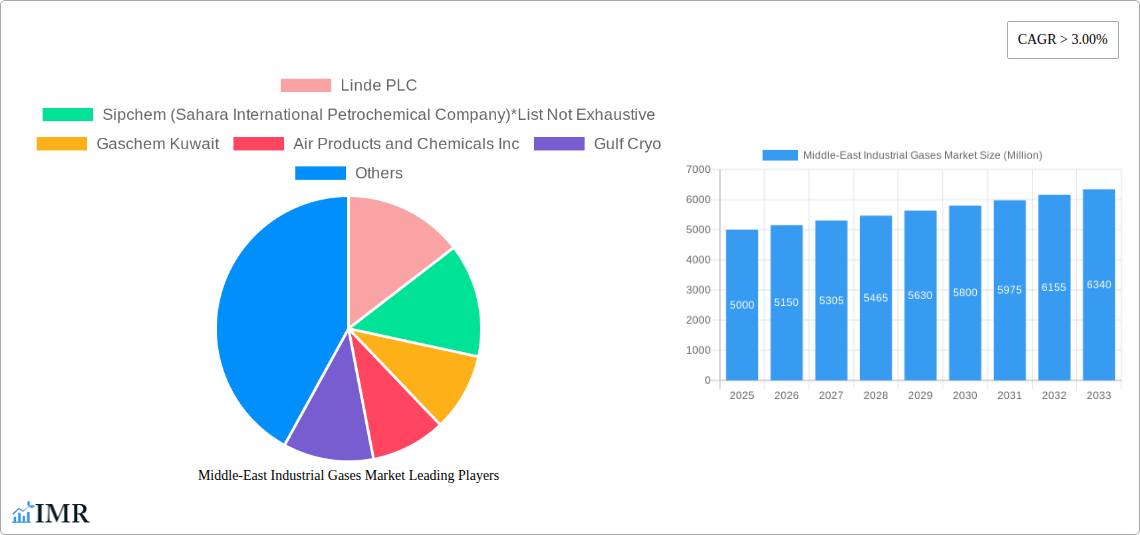

Middle-East Industrial Gases Market Company Market Share

Middle East Industrial Gases Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East industrial gases market, encompassing market dynamics, growth trends, dominant segments, and key players. With a detailed forecast from 2025 to 2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year.

Study Period: 2019-2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025-2033 Historical Period: 2019-2024

Middle-East Industrial Gases Market Market Dynamics & Structure

The Middle East industrial gases market is characterized by a moderately concentrated landscape, with several major players and numerous regional operators competing for market share. Technological innovation, driven by increasing demand for high-purity gases and sustainable practices, is a key driver. Stringent regulatory frameworks concerning safety, emissions, and environmental impact significantly influence market operations. The presence of competitive product substitutes, including alternative energy sources and processes, poses a challenge to market growth. End-user demographics, particularly in rapidly developing sectors like petrochemicals and manufacturing, significantly impact demand. The market has witnessed a moderate number of mergers and acquisitions (M&A) in recent years, reflecting consolidation trends and efforts to expand market reach.

- Market Concentration: Moderately concentrated, with a few large players holding significant market share (xx%).

- Technological Innovation: Focus on energy efficiency, advanced purification technologies, and sustainable production methods.

- Regulatory Framework: Stringent safety and environmental regulations impacting operational costs and market entry.

- Competitive Substitutes: Presence of alternative technologies and processes in specific applications.

- M&A Activity: Moderate level of M&A activity, with xx deals recorded between 2019 and 2024. (Average deal value: xx Million)

- End-User Demographics: Rapid growth in key sectors like oil & gas, petrochemicals, and manufacturing fuels demand.

Middle-East Industrial Gases Market Growth Trends & Insights

The Middle East industrial gases market exhibits robust growth, propelled by the region's expanding industrial base, particularly in the chemical, refining, and manufacturing sectors. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, registering a CAGR of xx% during the forecast period. Technological disruptions, such as the adoption of on-site gas generation and advanced purification systems, are significantly altering market dynamics. Consumer behavior shifts towards sustainable and environmentally friendly industrial practices drive the demand for eco-conscious production methods.

(Detailed 600-word analysis would follow here, including specific data points and trend projections)

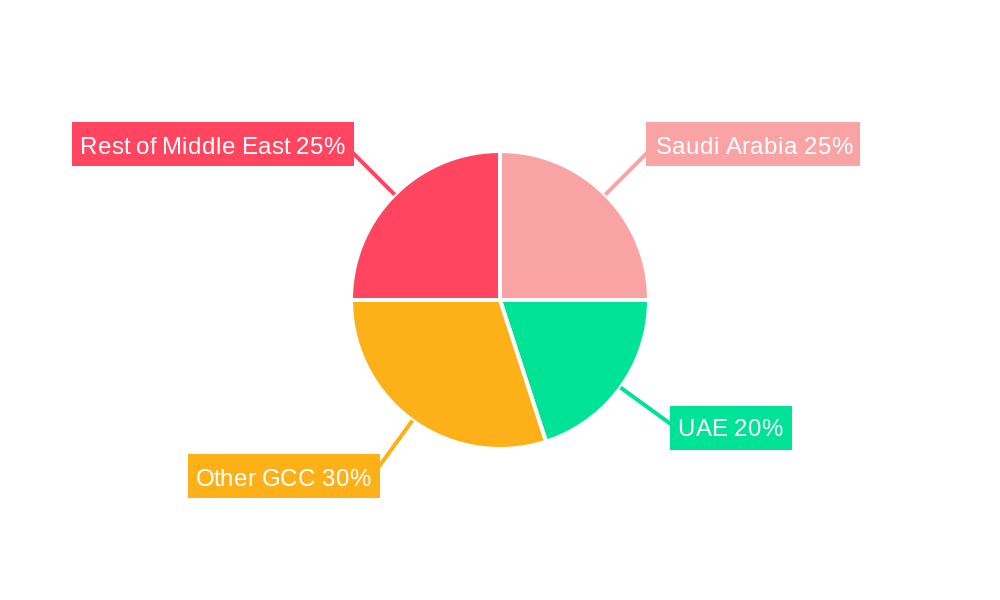

Dominant Regions, Countries, or Segments in Middle-East Industrial Gases Market

Within the Middle East industrial gases market, Saudi Arabia and the UAE dominate in terms of market size and growth. The Chemical Processing and Refining segment constitutes the largest end-user industry, followed by the Oil and Gas sector. Among product types, Nitrogen and Oxygen are the dominant gases, with substantial demand across various applications.

- Leading Regions: Saudi Arabia and the UAE.

- Dominant End-User Industry: Chemical Processing and Refining (xx% market share) followed by Oil & Gas (xx% market share).

- Leading Product Types: Nitrogen (xx Million) and Oxygen (xx Million).

- Key Growth Drivers: Robust industrial growth, government investment in infrastructure, and expanding petrochemical sector.

(Detailed 600-word analysis including market share breakdowns and growth potential projections for each segment and region would be included here.)

Middle-East Industrial Gases Market Product Landscape

The industrial gases market features a wide array of products, including high-purity gases, specialty gases, and gas mixtures. Product innovation focuses on enhancing purity levels, improving efficiency, and developing environmentally friendly production methods. Key performance metrics include gas purity, delivery efficiency, and cost-effectiveness. Companies are increasingly focusing on developing customized gas solutions to meet specific industry requirements and emphasizing sustainable packaging and delivery systems.

Key Drivers, Barriers & Challenges in Middle-East Industrial Gases Market

Key Drivers: Rapid industrialization, expanding petrochemical industry, increasing demand from various end-use sectors, and government support for industrial development. Technological advancements, like the rise of on-site generation, are further pushing market growth.

Challenges & Restraints: Fluctuations in energy prices, stringent regulatory compliance costs, competition from regional and international players, and potential supply chain disruptions due to geopolitical events. Furthermore, the need to comply with increasingly stringent environmental regulations adds complexity and cost.

Emerging Opportunities in Middle-East Industrial Gases Market

Emerging opportunities include the growing demand for hydrogen in transportation and energy sectors, the increasing adoption of sustainable gas production methods, and the expanding needs of specialized industries like electronics and pharmaceuticals. Untapped markets in smaller economies within the region also represent significant growth potential. The focus on developing green and sustainable industrial processes opens opportunities for companies that can provide eco-friendly solutions.

Growth Accelerators in the Middle-East Industrial Gases Market Industry

Technological advancements in gas production and delivery, coupled with strategic partnerships aimed at expanding market reach and optimizing supply chains, are pivotal growth accelerators. Government initiatives promoting industrial diversification and sustainable development further fuel market expansion. The ongoing diversification of the region's economy and increased focus on downstream industries promise further growth.

Key Players Shaping the Middle-East Industrial Gases Market Market

- Linde PLC

- Sipchem (Sahara International Petrochemical Company)

- Gaschem Kuwait

- Air Products and Chemicals Inc

- Gulf Cryo

- Abdullah Hashim Industrial Gases & Equipment (AHG)

- BASF SE

- SABIC

- Buzwair Industrial Gases Factories

- Air Liquide

- Dubai Industrial Gases

Notable Milestones in Middle-East Industrial Gases Market Sector

- January 2022: Air Products completed the acquisition of Air Liquide's industrial merchant gases business in the UAE, significantly expanding its market presence.

- December 2022: Air Products signed an agreement with Saudi Ground Services (SGS) to demonstrate hydrogen mobility at Dammam Airport, highlighting the growing interest in hydrogen applications.

In-Depth Middle-East Industrial Gases Market Market Outlook

The Middle East industrial gases market is poised for sustained growth, driven by ongoing industrialization and government initiatives. Strategic partnerships, technological innovations, and focus on sustainability will shape the market landscape. Companies investing in advanced technologies and expanding their regional presence are well-positioned to capitalize on emerging opportunities.

Middle-East Industrial Gases Market Segmentation

-

1. Product Type

- 1.1. Nitrogen

- 1.2. Oxygen

- 1.3. Carbon dioxide

- 1.4. Hydrogen

- 1.5. Helium

- 1.6. Argon

- 1.7. Ammonia

- 1.8. Methane

- 1.9. Propane

- 1.10. Butane

- 1.11. Other Product Types (Fluorine and Nitrous oxide)

-

2. End-user Industry

- 2.1. Chemical Processing and Refining

- 2.2. Electronics

- 2.3. Food and Beverage

- 2.4. Oil and Gas

- 2.5. Metal Manufacturing and Fabrication

- 2.6. Medical and Pharmaceutical

- 2.7. Automotive and Transportation

- 2.8. Energy and Power

- 2.9. Other En

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. Qatar

- 3.4. Rest of Middle East

Middle-East Industrial Gases Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Qatar

- 4. Rest of Middle East

Middle-East Industrial Gases Market Regional Market Share

Geographic Coverage of Middle-East Industrial Gases Market

Middle-East Industrial Gases Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Oil and Gas Industry; Growing Need for Alternate Energy Sources; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Environmental Regulations and Safety Issues; Other Restraints

- 3.4. Market Trends

- 3.4.1. Oil and Gas Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Middle-East Industrial Gases Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Nitrogen

- 5.1.2. Oxygen

- 5.1.3. Carbon dioxide

- 5.1.4. Hydrogen

- 5.1.5. Helium

- 5.1.6. Argon

- 5.1.7. Ammonia

- 5.1.8. Methane

- 5.1.9. Propane

- 5.1.10. Butane

- 5.1.11. Other Product Types (Fluorine and Nitrous oxide)

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Chemical Processing and Refining

- 5.2.2. Electronics

- 5.2.3. Food and Beverage

- 5.2.4. Oil and Gas

- 5.2.5. Metal Manufacturing and Fabrication

- 5.2.6. Medical and Pharmaceutical

- 5.2.7. Automotive and Transportation

- 5.2.8. Energy and Power

- 5.2.9. Other En

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. Qatar

- 5.3.4. Rest of Middle East

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Qatar

- 5.4.4. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia Middle-East Industrial Gases Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Nitrogen

- 6.1.2. Oxygen

- 6.1.3. Carbon dioxide

- 6.1.4. Hydrogen

- 6.1.5. Helium

- 6.1.6. Argon

- 6.1.7. Ammonia

- 6.1.8. Methane

- 6.1.9. Propane

- 6.1.10. Butane

- 6.1.11. Other Product Types (Fluorine and Nitrous oxide)

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Chemical Processing and Refining

- 6.2.2. Electronics

- 6.2.3. Food and Beverage

- 6.2.4. Oil and Gas

- 6.2.5. Metal Manufacturing and Fabrication

- 6.2.6. Medical and Pharmaceutical

- 6.2.7. Automotive and Transportation

- 6.2.8. Energy and Power

- 6.2.9. Other En

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. Qatar

- 6.3.4. Rest of Middle East

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Arab Emirates Middle-East Industrial Gases Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Nitrogen

- 7.1.2. Oxygen

- 7.1.3. Carbon dioxide

- 7.1.4. Hydrogen

- 7.1.5. Helium

- 7.1.6. Argon

- 7.1.7. Ammonia

- 7.1.8. Methane

- 7.1.9. Propane

- 7.1.10. Butane

- 7.1.11. Other Product Types (Fluorine and Nitrous oxide)

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Chemical Processing and Refining

- 7.2.2. Electronics

- 7.2.3. Food and Beverage

- 7.2.4. Oil and Gas

- 7.2.5. Metal Manufacturing and Fabrication

- 7.2.6. Medical and Pharmaceutical

- 7.2.7. Automotive and Transportation

- 7.2.8. Energy and Power

- 7.2.9. Other En

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. Qatar

- 7.3.4. Rest of Middle East

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Qatar Middle-East Industrial Gases Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Nitrogen

- 8.1.2. Oxygen

- 8.1.3. Carbon dioxide

- 8.1.4. Hydrogen

- 8.1.5. Helium

- 8.1.6. Argon

- 8.1.7. Ammonia

- 8.1.8. Methane

- 8.1.9. Propane

- 8.1.10. Butane

- 8.1.11. Other Product Types (Fluorine and Nitrous oxide)

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Chemical Processing and Refining

- 8.2.2. Electronics

- 8.2.3. Food and Beverage

- 8.2.4. Oil and Gas

- 8.2.5. Metal Manufacturing and Fabrication

- 8.2.6. Medical and Pharmaceutical

- 8.2.7. Automotive and Transportation

- 8.2.8. Energy and Power

- 8.2.9. Other En

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. Qatar

- 8.3.4. Rest of Middle East

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Middle East Middle-East Industrial Gases Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Nitrogen

- 9.1.2. Oxygen

- 9.1.3. Carbon dioxide

- 9.1.4. Hydrogen

- 9.1.5. Helium

- 9.1.6. Argon

- 9.1.7. Ammonia

- 9.1.8. Methane

- 9.1.9. Propane

- 9.1.10. Butane

- 9.1.11. Other Product Types (Fluorine and Nitrous oxide)

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Chemical Processing and Refining

- 9.2.2. Electronics

- 9.2.3. Food and Beverage

- 9.2.4. Oil and Gas

- 9.2.5. Metal Manufacturing and Fabrication

- 9.2.6. Medical and Pharmaceutical

- 9.2.7. Automotive and Transportation

- 9.2.8. Energy and Power

- 9.2.9. Other En

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. Qatar

- 9.3.4. Rest of Middle East

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Linde PLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sipchem (Sahara International Petrochemical Company)*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Gaschem Kuwait

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Air Products and Chemicals Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Gulf Cryo

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Abdullah Hashim Industrial Gases & Equipment (AHG)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 BASF SE

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 SABIC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Buzwair Industrial Gases Factories

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Air Liquide

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Dubai Industrial Gases

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Linde PLC

List of Figures

- Figure 1: Global Middle-East Industrial Gases Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Saudi Arabia Middle-East Industrial Gases Market Revenue (million), by Product Type 2025 & 2033

- Figure 3: Saudi Arabia Middle-East Industrial Gases Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Saudi Arabia Middle-East Industrial Gases Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 5: Saudi Arabia Middle-East Industrial Gases Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Saudi Arabia Middle-East Industrial Gases Market Revenue (million), by Geography 2025 & 2033

- Figure 7: Saudi Arabia Middle-East Industrial Gases Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Saudi Arabia Middle-East Industrial Gases Market Revenue (million), by Country 2025 & 2033

- Figure 9: Saudi Arabia Middle-East Industrial Gases Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: United Arab Emirates Middle-East Industrial Gases Market Revenue (million), by Product Type 2025 & 2033

- Figure 11: United Arab Emirates Middle-East Industrial Gases Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: United Arab Emirates Middle-East Industrial Gases Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 13: United Arab Emirates Middle-East Industrial Gases Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: United Arab Emirates Middle-East Industrial Gases Market Revenue (million), by Geography 2025 & 2033

- Figure 15: United Arab Emirates Middle-East Industrial Gases Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: United Arab Emirates Middle-East Industrial Gases Market Revenue (million), by Country 2025 & 2033

- Figure 17: United Arab Emirates Middle-East Industrial Gases Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Qatar Middle-East Industrial Gases Market Revenue (million), by Product Type 2025 & 2033

- Figure 19: Qatar Middle-East Industrial Gases Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Qatar Middle-East Industrial Gases Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 21: Qatar Middle-East Industrial Gases Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Qatar Middle-East Industrial Gases Market Revenue (million), by Geography 2025 & 2033

- Figure 23: Qatar Middle-East Industrial Gases Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Qatar Middle-East Industrial Gases Market Revenue (million), by Country 2025 & 2033

- Figure 25: Qatar Middle-East Industrial Gases Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of Middle East Middle-East Industrial Gases Market Revenue (million), by Product Type 2025 & 2033

- Figure 27: Rest of Middle East Middle-East Industrial Gases Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Rest of Middle East Middle-East Industrial Gases Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 29: Rest of Middle East Middle-East Industrial Gases Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Rest of Middle East Middle-East Industrial Gases Market Revenue (million), by Geography 2025 & 2033

- Figure 31: Rest of Middle East Middle-East Industrial Gases Market Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Rest of Middle East Middle-East Industrial Gases Market Revenue (million), by Country 2025 & 2033

- Figure 33: Rest of Middle East Middle-East Industrial Gases Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Middle-East Industrial Gases Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Global Middle-East Industrial Gases Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Middle-East Industrial Gases Market Revenue million Forecast, by Geography 2020 & 2033

- Table 4: Global Middle-East Industrial Gases Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Middle-East Industrial Gases Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 6: Global Middle-East Industrial Gases Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Middle-East Industrial Gases Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: Global Middle-East Industrial Gases Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: Global Middle-East Industrial Gases Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 10: Global Middle-East Industrial Gases Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Middle-East Industrial Gases Market Revenue million Forecast, by Geography 2020 & 2033

- Table 12: Global Middle-East Industrial Gases Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Global Middle-East Industrial Gases Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 14: Global Middle-East Industrial Gases Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Middle-East Industrial Gases Market Revenue million Forecast, by Geography 2020 & 2033

- Table 16: Global Middle-East Industrial Gases Market Revenue million Forecast, by Country 2020 & 2033

- Table 17: Global Middle-East Industrial Gases Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 18: Global Middle-East Industrial Gases Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 19: Global Middle-East Industrial Gases Market Revenue million Forecast, by Geography 2020 & 2033

- Table 20: Global Middle-East Industrial Gases Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East Industrial Gases Market?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Middle-East Industrial Gases Market?

Key companies in the market include Linde PLC, Sipchem (Sahara International Petrochemical Company)*List Not Exhaustive, Gaschem Kuwait, Air Products and Chemicals Inc, Gulf Cryo, Abdullah Hashim Industrial Gases & Equipment (AHG), BASF SE, SABIC, Buzwair Industrial Gases Factories, Air Liquide, Dubai Industrial Gases.

3. What are the main segments of the Middle-East Industrial Gases Market?

The market segments include Product Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 9907.04 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Oil and Gas Industry; Growing Need for Alternate Energy Sources; Other Drivers.

6. What are the notable trends driving market growth?

Oil and Gas Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Environmental Regulations and Safety Issues; Other Restraints.

8. Can you provide examples of recent developments in the market?

December 2022: Air Products announced that it had signed an agreement with Saudi Ground Services (SGS) to demonstrate Hydrogen for Mobility at Dammam Airport, Saudi Arabia. Saudi Ground Services provides a wide range of ground handling services throughout the entire network of airlines in Saudi Arabia, from passenger services and baggage handling to fleet solutions and cargo services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East Industrial Gases Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East Industrial Gases Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East Industrial Gases Market?

To stay informed about further developments, trends, and reports in the Middle-East Industrial Gases Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence