Key Insights

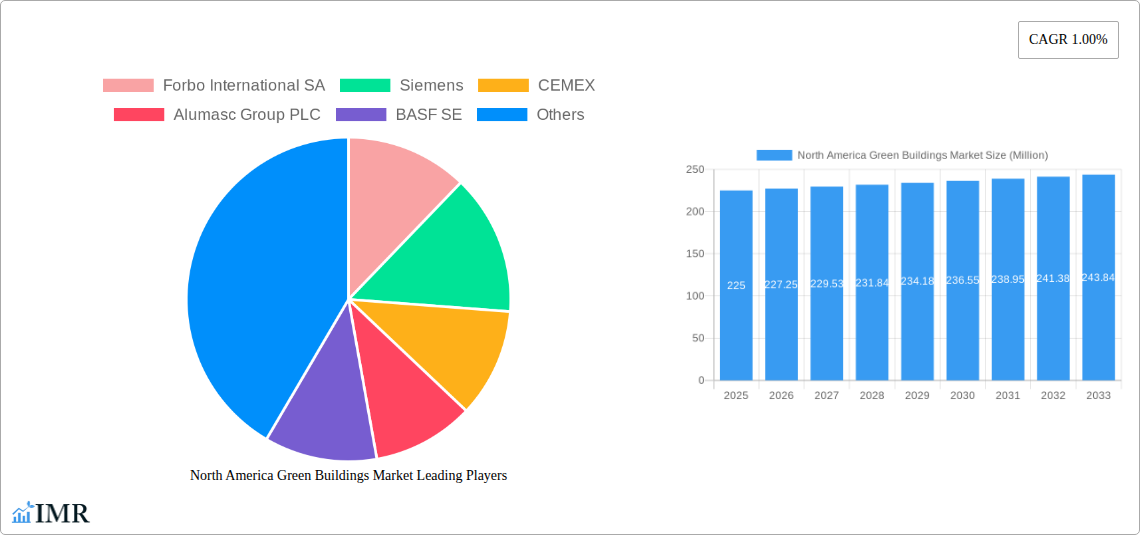

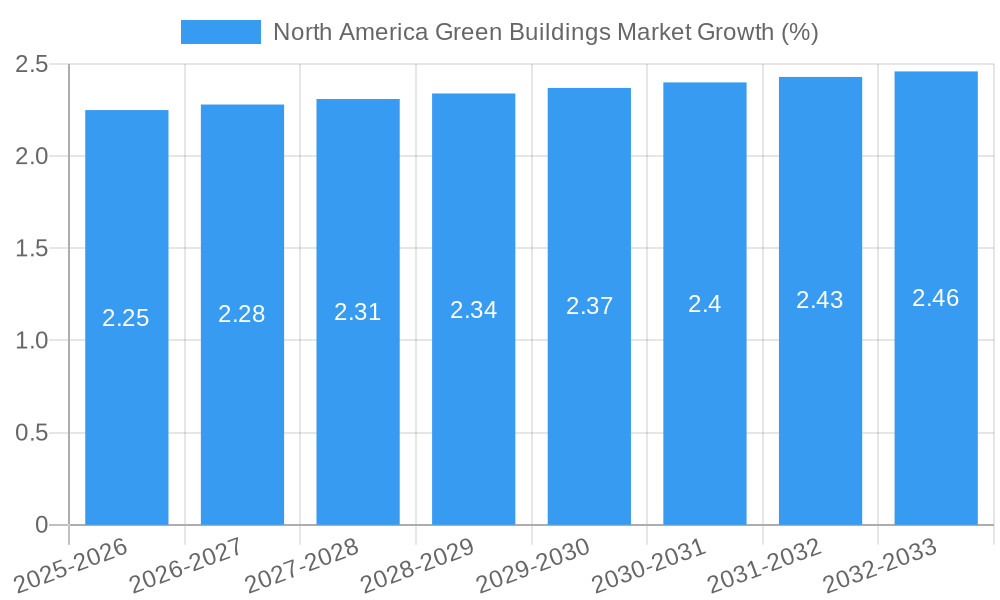

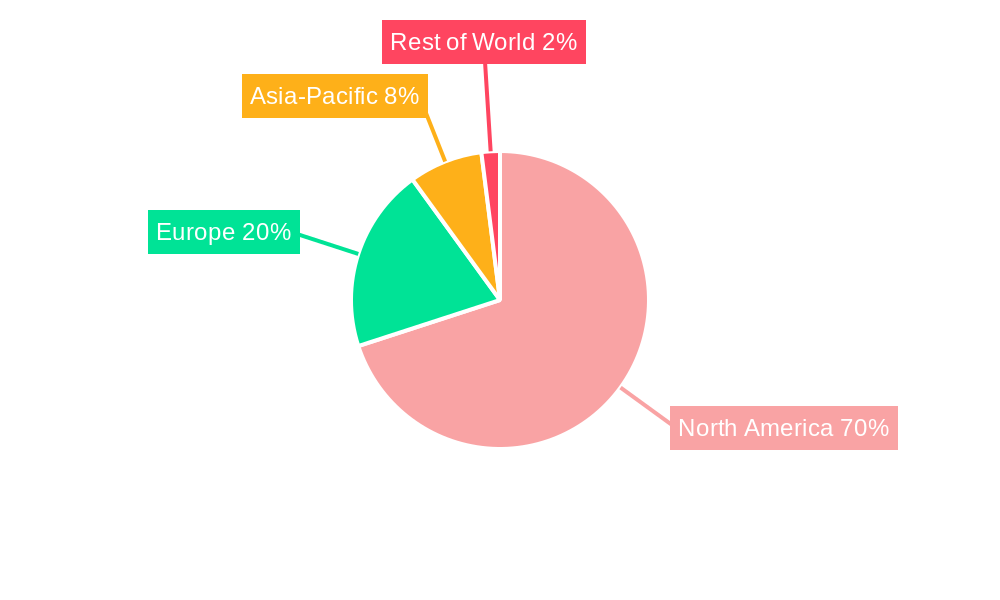

The North American green building market, while currently experiencing a period of moderate growth, presents a significant opportunity for investors and stakeholders. While the provided data lacks a specific 2025 market size, considering a conservative CAGR of 1.00% and the substantial investment in sustainable infrastructure across the US, Canada, and Mexico, we can project a 2025 market value in the range of $200-250 million. This projection is supported by the strong drivers within the sector: increasing government regulations promoting energy efficiency and reduced carbon footprints, growing consumer awareness of environmental sustainability, and advancements in green building technologies leading to cost-effective solutions. Key trends include the rising adoption of smart building technologies, integrated renewable energy systems (solar, wind), and the utilization of sustainable materials like recycled content and locally sourced timber. However, restraining factors include the high initial investment costs associated with green building construction and a potential skills gap in the workforce necessary for implementing these technologies. The market is segmented by product type (exterior, interior, and building systems like solar) and end-user (residential, commercial, institutional). Major players like Forbo, Siemens, CEMEX, and BASF are strategically positioned to capitalize on this expanding market, focusing on product innovation and strategic partnerships.

The forecast period from 2025 to 2033 suggests continued, albeit gradual, expansion. The projected growth will likely be driven by increasing government incentives, technological innovations further lowering the cost barrier to entry, and growing consumer demand for environmentally responsible housing and commercial spaces. Regional variations within North America will likely be influenced by factors such as varying levels of government support, regional building codes, and the availability of skilled labor. The continued focus on sustainable development within the region presents ample opportunities for expansion into adjacent markets, including retrofitting existing structures to improve their sustainability performance and developing new green infrastructure projects within smart cities.

North America Green Buildings Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America green buildings market, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on both parent and child markets, this report is essential for industry professionals, investors, and anyone seeking to understand the evolving landscape of sustainable construction in North America. The report covers the period 2019-2033, with 2025 as the base year. The market size is presented in million units.

North America Green Buildings Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the North American green building sector. We delve into market concentration, examining the market share held by major players like Forbo International SA, Siemens, CEMEX, Alumasc Group PLC, BASF SE, Bauder Limited, Owens Corning SA, PPG Industries, Amvic Inc, and Cold Mix Inc, along with 73 other companies. The report also assesses the impact of mergers and acquisitions (M&A) activity on market structure.

- Market Concentration: The North American green building market exhibits a [xx]% market concentration with the top 10 players holding approximately [xx]% of the market share in 2025. (Further breakdown by segment available in the full report).

- Technological Innovation: Key drivers include advancements in energy-efficient building materials, smart building technologies, and renewable energy integration. Barriers include high initial investment costs and lack of standardization across different technologies.

- Regulatory Frameworks: Government regulations, such as LEED certification and increasingly stringent building codes, significantly influence market growth. The impact of these regulations on market adoption is quantified in the report.

- Competitive Product Substitutes: The emergence of cost-effective alternatives and improved traditional materials pose a challenge to some green building products. This competitive landscape is thoroughly analyzed.

- End-User Demographics: The report segments the market by end-user (residential, office, retail, institutional, and other) and analyzes the varying adoption rates and preferences across each segment.

- M&A Trends: The report analyzes recent M&A activities in the sector, highlighting their impact on market consolidation and technological advancements. [xx] M&A deals were recorded between 2019-2024, with an estimated [xx] deals projected for 2025-2033.

North America Green Buildings Market Growth Trends & Insights

This section provides a detailed analysis of the North America green buildings market growth trajectory, using [XXX – specify data source e.g., proprietary data, market research reports] to project future market expansion. We examine factors such as market size evolution, adoption rates across different segments, and the influence of technological disruptions and consumer preferences. The analysis considers both historical data (2019-2024) and future projections (2025-2033).

The market is projected to experience a Compound Annual Growth Rate (CAGR) of [xx]% during the forecast period (2025-2033), reaching a market size of [xx] million units by 2033. Market penetration is expected to increase from [xx]% in 2025 to [xx]% by 2033, driven by factors such as increasing awareness of environmental sustainability and government incentives. Detailed analysis of consumer behavior shifts towards green buildings is also included.

Dominant Regions, Countries, or Segments in North America Green Buildings Market

This section identifies the leading regions, countries, and segments within the North American green building market, focusing on market share, growth potential, and key drivers. We analyze performance across different product categories (Exterior Products, Interior Products, Other Products) and end-user segments (Residential, Office, Retail, Institutional, Other).

- Leading Segment: [Specify leading segment based on data analysis, e.g., Residential segment] is projected to dominate the market due to [reasons, e.g., increasing government incentives for green home construction].

- Key Regional Drivers: [Specify leading region/country, e.g., California] shows strong growth due to [factors, e.g., stringent environmental regulations and robust renewable energy infrastructure].

- Growth Potential: [Specify high-growth segments/regions and rationale].

North America Green Buildings Market Product Landscape

The North American green building market offers a diverse range of innovative products, each characterized by unique features and technological advancements designed to improve energy efficiency, reduce environmental impact, and enhance building performance. These products range from high-performance insulation materials and sustainable building systems to energy-efficient windows and smart building technologies. The market is characterized by continuous innovation, with new materials and technologies constantly emerging to meet the growing demand for sustainable construction.

Key Drivers, Barriers & Challenges in North America Green Buildings Market

Key Drivers: The growth of the North American green buildings market is driven by several factors, including increasing environmental awareness, stringent government regulations, and the growing demand for energy-efficient buildings. Government incentives and tax credits further stimulate market growth. Technological advancements in building materials and renewable energy integration are also key drivers.

Challenges & Restraints: High upfront costs associated with green building construction, supply chain disruptions affecting the availability of sustainable materials, and a lack of skilled labor specializing in green building technologies pose significant challenges. Furthermore, regulatory hurdles and intense competition among market players influence the rate of market expansion. The report quantifies the impact of these challenges on market growth.

Emerging Opportunities in North America Green Buildings Market

Emerging opportunities within the North American green buildings market include the expanding demand for net-zero energy buildings, the growing adoption of smart building technologies, and the increasing use of sustainable building materials in infrastructure projects. Untapped markets in rural areas and the potential for innovative applications of green building technologies in existing buildings present further opportunities.

Growth Accelerators in the North America Green Buildings Market Industry

Long-term growth in the North American green buildings market will be accelerated by technological advancements such as improvements in energy storage, breakthroughs in building materials, and the integration of artificial intelligence in building management systems. Strategic partnerships between building material manufacturers, technology companies, and government agencies will be crucial in driving further adoption and innovation. Market expansion into previously underserved segments and regions also promises substantial growth.

Key Players Shaping the North America Green Buildings Market Market

- Forbo International SA

- Siemens

- CEMEX

- Alumasc Group PLC

- BASF SE

- Bauder Limited

- Owens Corning SA

- PPG Industries

- Amvic Inc

- Cold Mix Inc

- 73 Other Companies

Notable Milestones in North America Green Buildings Market Sector

- June 2023: Announcement of significant changes to Canada's 2025 national building code, including technical requirements for existing buildings and the inclusion of GHG emissions. This signifies a major regulatory shift impacting the market.

- May 2023: The Biden Administration's announcement of new building energy standards for federally funded homes, promising significant energy savings and affecting approximately 170,000 new homes annually. This policy change is a key driver of market growth.

In-Depth North America Green Buildings Market Market Outlook

The future of the North American green buildings market is promising, driven by strong government support, technological advancements, and a growing awareness of environmental sustainability. Strategic opportunities exist for companies to capitalize on the increasing demand for sustainable construction solutions by focusing on innovation, expanding market reach, and forging strategic partnerships. The market is poised for significant expansion over the next decade, presenting substantial opportunities for growth and investment.

North America Green Buildings Market Segmentation

-

1. Product

- 1.1. Exterior Products

- 1.2. Interior products

- 1.3. Other Pr

-

2. End User

- 2.1. Residential

- 2.2. Office

- 2.3. Retail

- 2.4. Institutional

- 2.5. Other End Users

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Green Buildings Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Green Buildings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Energy Efficiency in Construction; Flexibility and Customization Options

- 3.3. Market Restrains

- 3.3.1. Limited Availability of Suitable Land for Construction; Lower Quality Compared to Traditional Construction

- 3.4. Market Trends

- 3.4.1. Leveraging Smart Buildings and IoT Integration for Enhanced Efficiency and Performance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Exterior Products

- 5.1.2. Interior products

- 5.1.3. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Office

- 5.2.3. Retail

- 5.2.4. Institutional

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Exterior Products

- 6.1.2. Interior products

- 6.1.3. Other Pr

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Office

- 6.2.3. Retail

- 6.2.4. Institutional

- 6.2.5. Other End Users

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Canada North America Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Exterior Products

- 7.1.2. Interior products

- 7.1.3. Other Pr

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Office

- 7.2.3. Retail

- 7.2.4. Institutional

- 7.2.5. Other End Users

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Mexico North America Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Exterior Products

- 8.1.2. Interior products

- 8.1.3. Other Pr

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Office

- 8.2.3. Retail

- 8.2.4. Institutional

- 8.2.5. Other End Users

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. United States North America Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Forbo International SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Siemens

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 CEMEX

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Alumasc Group PLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 BASF SE

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Bauder Limited

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Owens Corning SA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 PPG Industries

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Amvic Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Cold Mix Inc **List Not Exhaustive 7 3 Other Companie

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Forbo International SA

List of Figures

- Figure 1: North America Green Buildings Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Green Buildings Market Share (%) by Company 2024

List of Tables

- Table 1: North America Green Buildings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Green Buildings Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: North America Green Buildings Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: North America Green Buildings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Green Buildings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Green Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Green Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Green Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Green Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Green Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Green Buildings Market Revenue Million Forecast, by Product 2019 & 2032

- Table 12: North America Green Buildings Market Revenue Million Forecast, by End User 2019 & 2032

- Table 13: North America Green Buildings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Green Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Green Buildings Market Revenue Million Forecast, by Product 2019 & 2032

- Table 16: North America Green Buildings Market Revenue Million Forecast, by End User 2019 & 2032

- Table 17: North America Green Buildings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Green Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Green Buildings Market Revenue Million Forecast, by Product 2019 & 2032

- Table 20: North America Green Buildings Market Revenue Million Forecast, by End User 2019 & 2032

- Table 21: North America Green Buildings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Green Buildings Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Green Buildings Market?

The projected CAGR is approximately 1.00%.

2. Which companies are prominent players in the North America Green Buildings Market?

Key companies in the market include Forbo International SA, Siemens, CEMEX, Alumasc Group PLC, BASF SE, Bauder Limited, Owens Corning SA, PPG Industries, Amvic Inc, Cold Mix Inc **List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the North America Green Buildings Market?

The market segments include Product, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0 Million as of 2022.

5. What are some drivers contributing to market growth?

Energy Efficiency in Construction; Flexibility and Customization Options.

6. What are the notable trends driving market growth?

Leveraging Smart Buildings and IoT Integration for Enhanced Efficiency and Performance.

7. Are there any restraints impacting market growth?

Limited Availability of Suitable Land for Construction; Lower Quality Compared to Traditional Construction.

8. Can you provide examples of recent developments in the market?

June 2023: In 2025, a new version of Canada's national building code will be published, allowing builders to learn about two significant changes. At the Canada Green Building Council's 2023 Building Lasting Change conference in Vancouver, officials addressed the changes drafters of the 2025 code. The two significant changes coming to the code are introducing technical requirements for existing building stock and including GHG emissions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Green Buildings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Green Buildings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Green Buildings Market?

To stay informed about further developments, trends, and reports in the North America Green Buildings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence