Key Insights

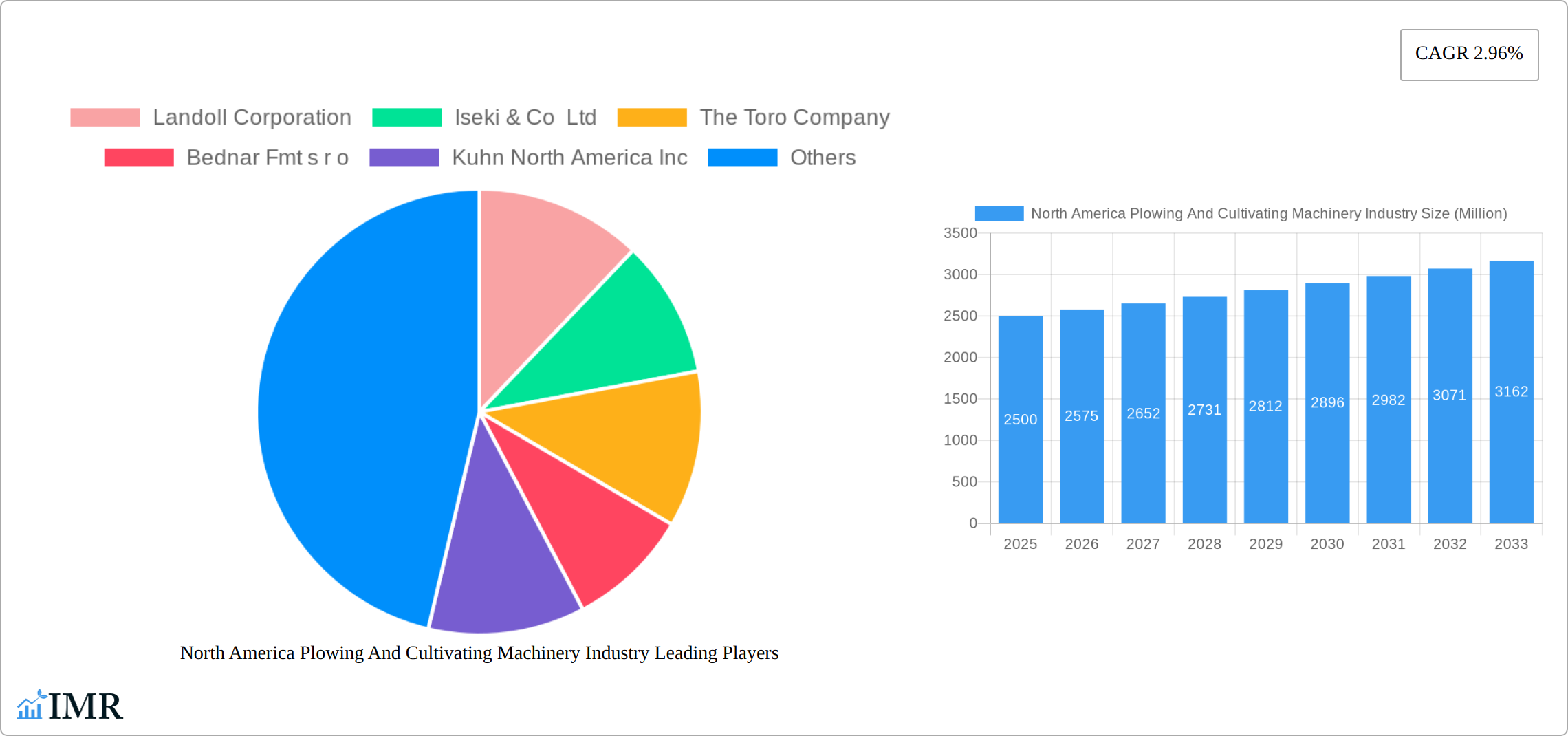

The North American plowing and cultivating machinery market, valued at approximately $2.5 billion in 2025, is projected to experience steady growth, driven by several key factors. Increasing demand for efficient and technologically advanced agricultural equipment to meet rising global food demands is a primary driver. Precision farming techniques, including GPS-guided machinery and automated systems, are gaining traction, enhancing productivity and reducing operational costs. Furthermore, the growing adoption of no-till farming practices, which minimize soil disturbance, is bolstering the demand for specialized cultivating machinery designed for these methods. Government initiatives promoting sustainable agricultural practices and technological advancements also contribute positively to market expansion. However, the market faces challenges including fluctuating commodity prices, high initial investment costs for advanced machinery, and the availability of skilled labor to operate and maintain sophisticated equipment. Competition among established players and the emergence of innovative start-ups further shapes the market landscape.

Segment-wise, the plows and harrows segment currently holds the largest market share, attributed to their widespread use in conventional tillage practices. However, the cultivators and tillers segment is anticipated to witness significant growth due to rising adoption of conservation tillage methods. Similarly, the soil loosening application type dominates the market, followed by clod size reduction. The market is witnessing increasing demand for technologically advanced equipment such as automated steering systems and variable-rate technology, improving efficiency and reducing input costs. Key players are focusing on product innovation, strategic partnerships, and mergers & acquisitions to expand their market reach and solidify their position. The continued growth of the North American agricultural sector, coupled with technological advancements in farming techniques, will support the positive outlook for the plowing and cultivating machinery market in the forecast period.

North America Plowing and Cultivating Machinery Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America plowing and cultivating machinery industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is an essential resource for industry professionals, investors, and anyone seeking to understand this vital segment of the agricultural machinery market. The report segments the market by product type (plows, harrows, cultivators and tillers, other product types) and application type (soil loosening, clod size reduction, clod sorting, other application types).

North America Plowing And Cultivating Machinery Industry Market Dynamics & Structure

The North American plowing and cultivating machinery market presents a moderately consolidated structure, dominated by several large multinational corporations and a cohort of regional players. Market dynamics are significantly influenced by several key factors:

Technological Innovation: Precision farming technologies, including GPS-guided implements, automated steering systems, and sensor-driven data analytics, are revolutionizing efficiency and productivity, thereby fueling market growth. However, high initial capital investment and the demand for specialized expertise create barriers to broader adoption, particularly among smaller farming operations.

Regulatory Landscape and Sustainability: Stringent environmental regulations emphasizing soil conservation and reduced tillage practices are shaping machinery design and market demand. Government subsidies and incentives promoting sustainable agricultural practices play a crucial role in incentivizing the adoption of eco-friendly technologies and methods.

Competitive Landscape and Alternative Tillage Methods: While no direct substitutes exist for the core functionalities of plows and cultivators, alternative tillage methods, such as no-till farming and conservation tillage, exert indirect competitive pressure by reducing the demand for certain types of machinery. This necessitates manufacturers to innovate and offer solutions compatible with these evolving farming techniques.

End-User Segmentation and Demographic Shifts: The market caters primarily to large-scale commercial farms, but small and medium-sized farms constitute a substantial segment, driving demand for a diverse range of machinery sizes and functionalities. The aging farmer population presents a challenge in terms of technology adoption and necessitates user-friendly interfaces and robust training programs.

Mergers, Acquisitions, and Industry Consolidation: The industry has experienced a moderate level of mergers and acquisitions (M&A) activity in recent years, driven by strategic expansion and efforts to consolidate market share. While precise figures for M&A activity between 2019-2024 require further detailed research, the trend indicates a gradual increase in market concentration and the emergence of larger, more integrated players.

Preliminary market share analysis suggests that Deere & Co and CNH Industrial NV hold a substantial combined market share. Other major players, including AGCO Corporation and Kubota Corporation, also command significant market presence. (Specific percentage figures require further detailed market research and analysis).

North America Plowing And Cultivating Machinery Industry Growth Trends & Insights

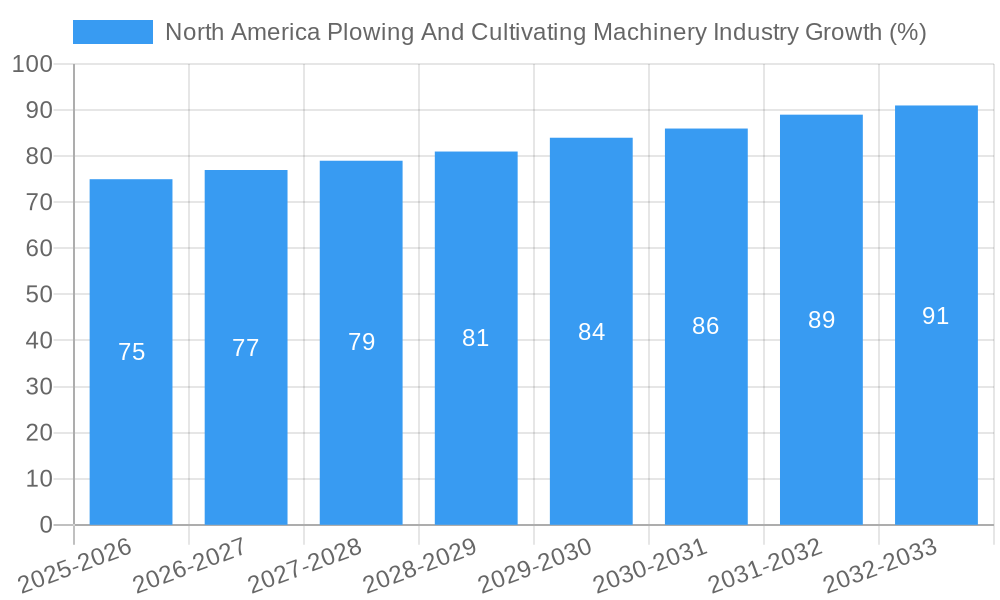

The North American plowing and cultivating machinery market experienced a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024). The market size reached xx million units in 2024. This growth is attributed to several factors: increasing farm sizes, rising demand for efficient agricultural practices, and technological advancements. However, fluctuating commodity prices and economic downturns have occasionally impacted market growth. Adoption rates for advanced technologies remain moderate, constrained by factors such as cost, accessibility and farmers' technological literacy. Consumer behavior shifts towards precision farming and sustainable agriculture practices continue to drive the demand for advanced and environmentally friendly machinery. The forecast period (2025-2033) is expected to see a CAGR of xx%, driven by the adoption of precision agriculture techniques and government initiatives promoting sustainable farming methods. Market penetration of advanced technologies is projected to reach xx% by 2033.

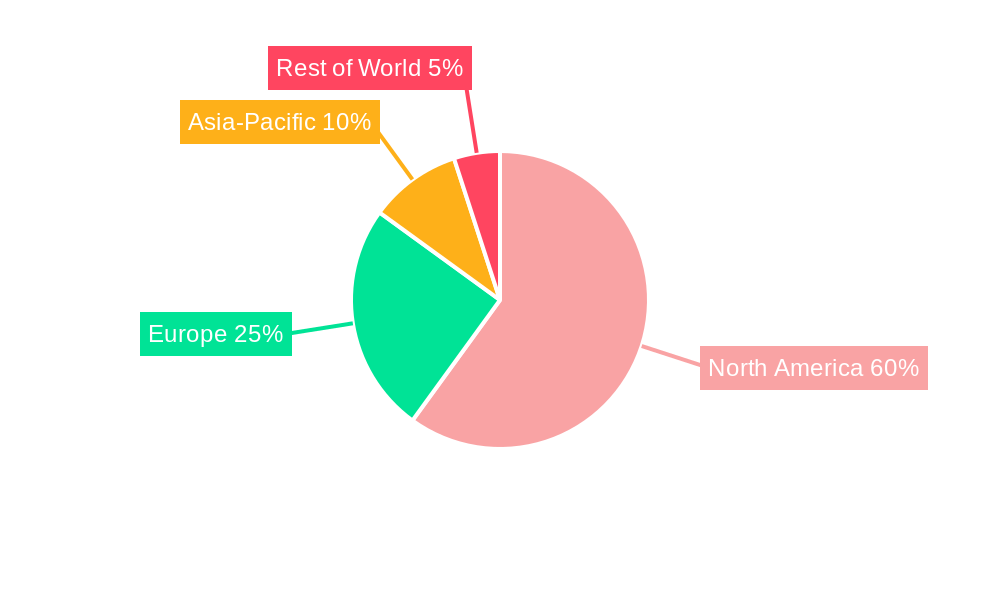

Dominant Regions, Countries, or Segments in North America Plowing And Cultivating Machinery Industry

The Midwest region of the United States, particularly states like Iowa, Illinois, and Nebraska, dominates the North American plowing and cultivating machinery market. This dominance is driven by several factors:

High Concentration of Agricultural Land: This region boasts extensive arable land ideal for large-scale farming operations.

Favorable Climatic Conditions: The region enjoys suitable weather patterns conducive to various crops, creating strong demand for machinery.

Well-Developed Agricultural Infrastructure: Robust transportation and distribution networks facilitate efficient machinery sales and maintenance.

Government Support and Subsidies: The US government provides various incentives and programs that promote agricultural modernization and mechanization.

Within the product segments, plows and cultivators account for the largest market share, driven by their essential role in primary soil tillage. The application segment focusing on soil loosening is the largest, reflecting the fundamental importance of soil preparation in agricultural productivity. Canada and Mexico exhibit moderate growth potential, driven by expansion of agricultural areas and increasing adoption of mechanized farming practices.

North America Plowing And Cultivating Machinery Industry Product Landscape

The product landscape is characterized by continuous innovation focused on improved efficiency, reduced fuel consumption, and enhanced precision. Recent advancements include the incorporation of GPS-guided systems, variable-rate technology, and sensors for real-time soil monitoring. These innovations are targeted at reducing operational costs, minimizing environmental impact, and maximizing crop yields. Unique selling propositions often center around improved durability, ease of operation, and advanced technological features.

Key Drivers, Barriers & Challenges in North America Plowing And Cultivating Machinery Industry

Key Drivers: Increased demand for efficient and precise farming operations, government incentives for adopting advanced technologies, and favorable weather conditions in key agricultural regions propel market growth. Technological advancements, such as autonomous tractors and precision planting systems, further increase productivity. Growing global demand for food and increasing land scarcity motivate investment in advanced machinery.

Key Barriers & Challenges: High initial investment costs for sophisticated machinery, fluctuations in commodity prices impacting farmer's purchasing power, and the complexity of implementing and managing advanced technologies pose significant challenges. Supply chain disruptions caused by global events could negatively impact the availability of components and machinery, potentially leading to price increases. Regulatory hurdles related to emissions standards also influence machinery design and costs. Intense competition among established players and the emergence of new entrants also creates competitive pressures.

Emerging Opportunities in North America Plowing And Cultivating Machinery Industry

Significant emerging opportunities abound, driven by several key trends: increased adoption of precision farming technologies among smaller farms; rising demand for machinery integrated with advanced data analytics capabilities for improved decision-making; and the expanding market for sustainable and environmentally friendly agricultural practices. Untapped market potential exists in promoting and supporting the widespread adoption of no-till and conservation tillage practices. Furthermore, innovative applications, such as automated weed control systems seamlessly integrated with plowing and cultivating machinery, represent substantial growth opportunities.

Growth Accelerators in the North America Plowing And Cultivating Machinery Industry Industry

Long-term growth will be accelerated by the continuous development of precision farming technologies, strategic partnerships between machinery manufacturers and agricultural technology companies, and the expansion of agricultural operations into new regions. Technological breakthroughs, such as the development of more sustainable and efficient power sources for farm equipment, will be crucial drivers.

Key Players Shaping the North America Plowing And Cultivating Machinery Industry Market

- Landoll Corporation

- Iseki & Co Ltd

- The Toro Company

- Bednar Fmt s r o

- Kuhn North America Inc

- Horsch L L C

- Deere & Co

- Lemken GmbH & Co KG

- CNH Industrial NV

- Titan Machinery

- Bush Hog Inc

- Great Plains Manufacturing Inc

- Dewulf B V

- Kubota Corporation

- Opico Corporation

- Kverneland AS

- McFarlane Mfg Co

- Gregoire-Besson S A S

- Poettinger US Inc

- AGCO Corporation

Notable Milestones in North America Plowing And Cultivating Machinery Industry Sector

- 2021: Deere & Co launched its fully autonomous tractor, marking a significant advancement in precision agriculture and setting a new benchmark for automation in the sector.

- 2022: CNH Industrial NV announced a strategic partnership with a technology company to integrate advanced data analytics into its farm machinery, enhancing data-driven decision-making capabilities for farmers.

- 2023: AGCO Corporation introduced a new line of environmentally friendly cultivators, demonstrating a commitment to sustainable agriculture and catering to the growing demand for eco-conscious farming practices.

- 2024: Several smaller machinery manufacturers merged, enhancing their competitive standing and potentially leading to increased efficiency and innovation within the industry. (Specific details regarding these mergers are subject to further research and verification.)

In-Depth North America Plowing And Cultivating Machinery Industry Market Outlook

The North American plowing and cultivating machinery market is poised for sustained growth in the coming years. Technological advancements, the increasing demand for efficient and sustainable farming practices, and supportive government initiatives promoting sustainable agriculture are key drivers of market expansion. Strategic partnerships and ongoing M&A activity will continue to reshape the industry landscape. Manufacturers who successfully adapt to the evolving technological landscape and cater to the diverse needs of both large-scale and small-scale farming operations are best positioned to capitalize on the significant opportunities presented by this dynamic market. The ongoing focus on precision agriculture, sophisticated data analytics, and environmentally friendly solutions will remain major catalysts for innovation and sustained growth.

North America Plowing And Cultivating Machinery Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Plowing And Cultivating Machinery Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Plowing And Cultivating Machinery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.96% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization

- 3.3. Market Restrains

- 3.3.1. Heavy Initial Procurement Cost and High Expenditure on Maintenance

- 3.4. Market Trends

- 3.4.1. Scarcity of Low Cost Labor influencing Increased Adoption of Farm Mechanization

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Plowing And Cultivating Machinery Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United States North America Plowing And Cultivating Machinery Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Plowing And Cultivating Machinery Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Plowing And Cultivating Machinery Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Plowing And Cultivating Machinery Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Landoll Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Iseki & Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 The Toro Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Bednar Fmt s r o

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kuhn North America Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Horsch L L C

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Deere & Co

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Lemken GmbH & Co KG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 CNH Industrial NV

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Titan Machinery

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Bush Hog Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Great Plains Manufacturing Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Dewulf B V

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Kubota Corporation

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Opico Corporation

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Kverneland AS

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 McFarlane Mfg Co

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 Gregoire-Besson S A S

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 Poettinger US Inc *List Not Exhaustive

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 AGCO Corporation

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.1 Landoll Corporation

List of Figures

- Figure 1: North America Plowing And Cultivating Machinery Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Plowing And Cultivating Machinery Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States North America Plowing And Cultivating Machinery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada North America Plowing And Cultivating Machinery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico North America Plowing And Cultivating Machinery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of North America North America Plowing And Cultivating Machinery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 14: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 15: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 16: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 17: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 18: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: United States North America Plowing And Cultivating Machinery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada North America Plowing And Cultivating Machinery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico North America Plowing And Cultivating Machinery Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Plowing And Cultivating Machinery Industry?

The projected CAGR is approximately 2.96%.

2. Which companies are prominent players in the North America Plowing And Cultivating Machinery Industry?

Key companies in the market include Landoll Corporation, Iseki & Co Ltd, The Toro Company, Bednar Fmt s r o, Kuhn North America Inc, Horsch L L C, Deere & Co, Lemken GmbH & Co KG, CNH Industrial NV, Titan Machinery, Bush Hog Inc, Great Plains Manufacturing Inc, Dewulf B V, Kubota Corporation, Opico Corporation, Kverneland AS, McFarlane Mfg Co, Gregoire-Besson S A S, Poettinger US Inc *List Not Exhaustive, AGCO Corporation.

3. What are the main segments of the North America Plowing And Cultivating Machinery Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization.

6. What are the notable trends driving market growth?

Scarcity of Low Cost Labor influencing Increased Adoption of Farm Mechanization.

7. Are there any restraints impacting market growth?

Heavy Initial Procurement Cost and High Expenditure on Maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Plowing And Cultivating Machinery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Plowing And Cultivating Machinery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Plowing And Cultivating Machinery Industry?

To stay informed about further developments, trends, and reports in the North America Plowing And Cultivating Machinery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence