Key Insights

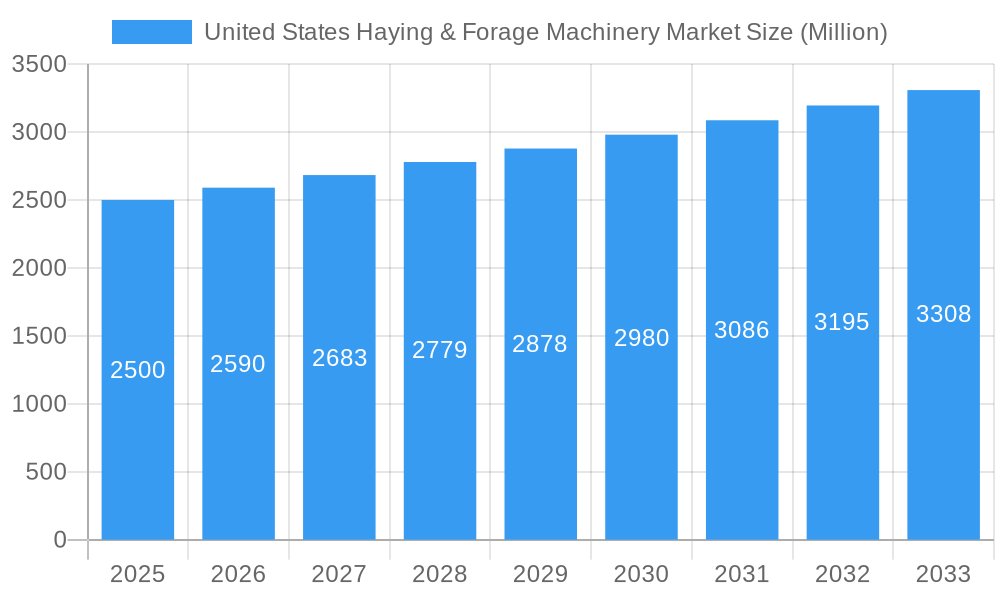

The United States Haying & Forage Machinery market, valued at approximately $2.5 billion in 2025, is projected to experience steady growth, driven by several key factors. Increasing demand for livestock feed, coupled with rising agricultural productivity needs, fuels the market's expansion. Technological advancements in machinery, such as automated balers and improved forage harvesters, enhance efficiency and reduce labor costs, further stimulating market growth. The prevalence of large-scale farming operations and the adoption of precision agriculture techniques contribute significantly to the market's expansion. However, fluctuating hay prices and the impact of weather patterns on forage yield represent significant restraints. The market is segmented by machinery type, with mowers, balers, and forage harvesters commanding the largest shares. Key players like Deere & Company, CLAAS, and Kubota dominate the market through technological innovation, strong distribution networks, and established brand recognition. Regional variations exist within the United States, with the Midwest and West likely experiencing higher growth due to their significant agricultural output. The market's growth trajectory is expected to be influenced by government policies supporting agricultural modernization and the broader macroeconomic conditions affecting the farming sector.

United States Haying & Forage Machinery Market Market Size (In Billion)

The forecast period (2025-2033) anticipates a continuation of this growth, albeit at a moderated pace. The projected 3.6% Compound Annual Growth Rate (CAGR) indicates a gradual expansion, influenced by factors such as technological adoption rates, changing farming practices, and environmental considerations. While challenges such as fluctuating commodity prices and potential labor shortages persist, the overall outlook remains positive, driven by the fundamental need for efficient and reliable haying and forage machinery in modern agriculture. The competitive landscape is characterized by both established multinational corporations and specialized regional manufacturers, leading to innovation and competitive pricing within various segments of the market. Future market trends suggest a growing focus on sustainability, including reduced fuel consumption and environmentally friendly materials in machinery design.

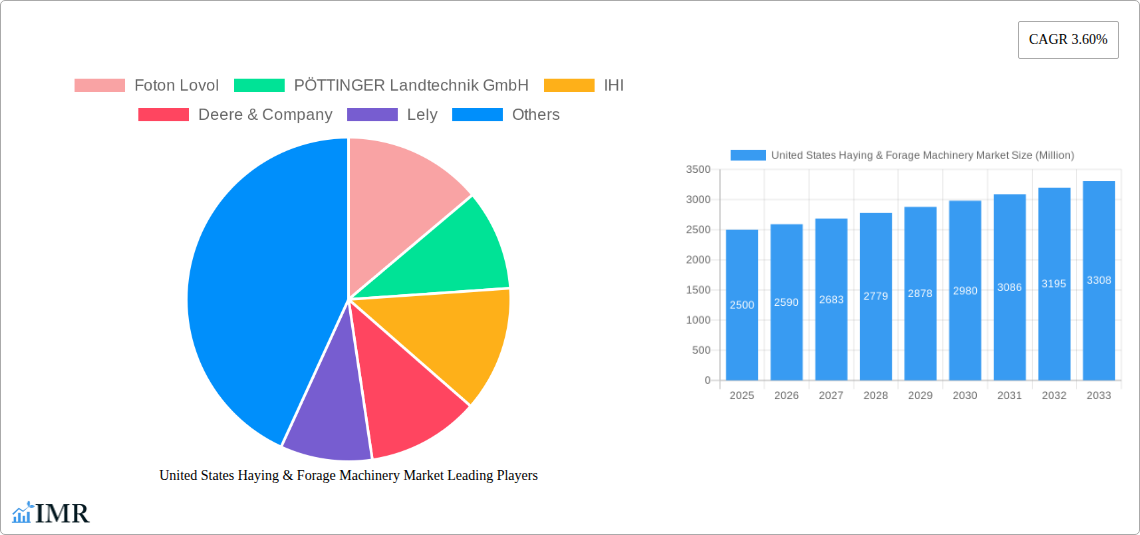

United States Haying & Forage Machinery Market Company Market Share

United States Haying & Forage Machinery Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Haying & Forage Machinery Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and forecast period spanning 2025-2033. This report is essential for manufacturers, distributors, investors, and anyone seeking to understand this vital segment of the agricultural machinery industry. The market is segmented by type: Mowers, Balers, Forage Harvesters, and Others.

United States Haying & Forage Machinery Market Market Dynamics & Structure

The US Haying & Forage Machinery market is characterized by a moderately concentrated structure with several key players holding significant market share. Technological innovation, particularly in automation and precision agriculture, is a major driver. Stringent regulatory frameworks concerning emissions and safety standards also influence market dynamics. Competitive product substitutes are limited, primarily focused on alternative harvesting methods. End-user demographics consist mainly of large-scale farms and agricultural cooperatives, with increasing adoption by smaller operations driven by technological advancements. M&A activity has been moderate, with a focus on consolidating market share and expanding product portfolios.

- Market Concentration: Top 5 players hold approximately xx% market share (2025).

- Technological Innovation: Focus on automation (autonomous balers, GPS-guided mowers), improved efficiency (reduced fuel consumption), and data analytics.

- Regulatory Framework: Compliance with EPA emissions standards and safety regulations influences product design and market entry.

- Competitive Substitutes: Limited substitutes exist; primarily alternative harvesting techniques.

- M&A Activity: xx major deals concluded in the last 5 years, primarily focused on strategic acquisitions.

- Innovation Barriers: High R&D costs, stringent regulations, and integration challenges hinder innovation.

United States Haying & Forage Machinery Market Growth Trends & Insights

The US Haying & Forage Machinery market has witnessed steady growth during the historical period (2019-2024), driven by increasing demand for efficient and technologically advanced equipment. The market size reached xx million units in 2024, exhibiting a CAGR of xx% during this period. Adoption rates are particularly high in regions with large-scale farming operations and favorable climatic conditions. Technological disruptions, such as the introduction of autonomous systems and precision farming technologies, are accelerating market growth. Consumer behavior shifts toward increased adoption of technologically advanced equipment to improve efficiency and reduce labor costs. We project the market to reach xx million units by 2033, with a forecast CAGR of xx% during the forecast period (2025-2033). Market penetration is expected to increase significantly in smaller farms due to cost-effective technology advancements.

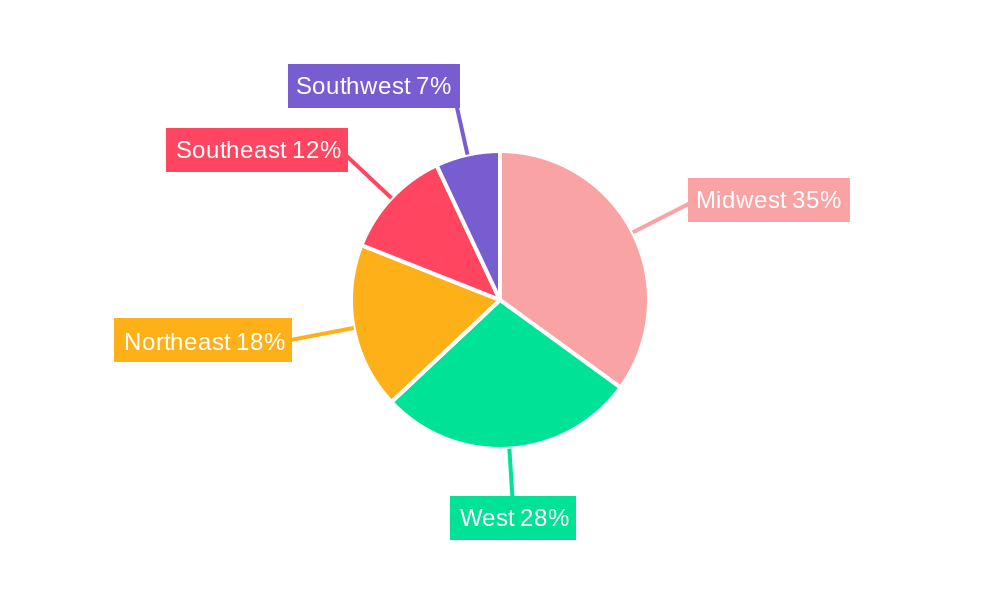

Dominant Regions, Countries, or Segments in United States Haying & Forage Machinery Market

The Midwest region dominates the US Haying & Forage Machinery market due to its extensive agricultural land, high hay and forage production, and a large concentration of farms. Within this region, states like Iowa, Nebraska, and Wisconsin are key contributors. The "Mowers" segment currently holds the largest market share, followed by "Balers" and "Forage Harvesters." This is primarily due to the high demand for efficient mowing solutions across varying farm sizes.

- Key Drivers (Midwest Region): Large agricultural land area, high hay and forage yield, significant concentration of farms, and government support for agricultural modernization.

- Dominance Factors (Mowers Segment): High demand for efficient mowing across farm sizes, continuous technological advancements improving mowing efficiency and yield.

- Growth Potential (Forage Harvesters): Increasing adoption driven by the demand for high-quality silage and improved feed efficiency for livestock.

United States Haying & Forage Machinery Market Product Landscape

Recent product innovations include advanced cutting systems for mowers, high-density baling technologies for balers, and improved chopping mechanisms for forage harvesters. These advancements enhance efficiency, reduce operational costs, and improve forage quality. Key features include GPS-guided operation, automated bale ejection, and real-time data monitoring. Unique selling propositions focus on improved productivity, reduced labor needs, and enhanced forage quality.

Key Drivers, Barriers & Challenges in United States Haying & Forage Machinery Market

Key Drivers: Increasing demand for efficient and technologically advanced equipment, rising labor costs, growing focus on precision agriculture, and government incentives promoting agricultural modernization.

Challenges & Restraints: High initial investment costs for advanced machinery, fluctuating commodity prices impacting farmer investment, potential supply chain disruptions due to global events, and intense competition among established players and emerging competitors. Increased regulatory scrutiny and stricter emission norms also pose challenges.

Emerging Opportunities in United States Haying & Forage Machinery Market

Emerging opportunities include the increasing demand for autonomous and remotely operated machinery, the growing adoption of precision agriculture technologies, and the development of more sustainable and environmentally friendly equipment. Untapped markets include smaller farms and organic farming operations that can benefit from cost-effective and sustainable harvesting solutions.

Growth Accelerators in the United States Haying & Forage Machinery Market Industry

Technological breakthroughs in automation, precision agriculture, and data analytics are driving market growth. Strategic partnerships between machinery manufacturers and technology companies are facilitating innovation. Market expansion strategies, including targeted marketing to smaller farms and focusing on emerging markets, are playing a vital role.

Key Players Shaping the United States Haying & Forage Machinery Market Market

- Foton Lovol

- PÖTTINGER Landtechnik GmbH

- IHI

- Deere & Company

- Lely

- CLAAS KGaA mbH

- Vermee

- Kverneland Group

- CNH Industrial

- Krone North America Inc

- KUHN Group

- AGCO Corporation

- Kubota

Notable Milestones in United States Haying & Forage Machinery Sector

- 2021: Deere & Company launches a fully autonomous tractor.

- 2022: Claas introduces a new forage harvester with improved chopping efficiency.

- 2023: Kubota acquires a smaller hay equipment manufacturer, expanding its market presence.

- 2024: A significant merger between two medium-sized hay equipment manufacturers takes place.

In-Depth United States Haying & Forage Machinery Market Market Outlook

The US Haying & Forage Machinery market is poised for continued growth, driven by technological advancements and increasing demand for efficient harvesting solutions. Strategic opportunities exist for companies focusing on automation, precision agriculture, and sustainability. The market's future potential is significant, particularly in segments focused on smaller farms and organic agriculture. Companies that effectively leverage technological innovation and cater to evolving farmer needs are expected to experience substantial growth in the coming years.

United States Haying & Forage Machinery Market Segmentation

-

1. Type

- 1.1. Mowers

- 1.2. Balers

- 1.3. Forage Harvesters

- 1.4. Others

-

2. Type

- 2.1. Mowers

- 2.2. Balers

- 2.3. Forage Harvesters

- 2.4. Others

United States Haying & Forage Machinery Market Segmentation By Geography

- 1. United States

United States Haying & Forage Machinery Market Regional Market Share

Geographic Coverage of United States Haying & Forage Machinery Market

United States Haying & Forage Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Increase in Forage Cultivation Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Haying & Forage Machinery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mowers

- 5.1.2. Balers

- 5.1.3. Forage Harvesters

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Mowers

- 5.2.2. Balers

- 5.2.3. Forage Harvesters

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Foton Lovol

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PÖTTINGER Landtechnik GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IHI

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Deere & Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lely

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CLAAS KGaA mbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vermee

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kverneland Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CNH Industrial

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Krone North America Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 KUHN Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 AGCO Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Kubota

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Foton Lovol

List of Figures

- Figure 1: United States Haying & Forage Machinery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Haying & Forage Machinery Market Share (%) by Company 2025

List of Tables

- Table 1: United States Haying & Forage Machinery Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: United States Haying & Forage Machinery Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: United States Haying & Forage Machinery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United States Haying & Forage Machinery Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: United States Haying & Forage Machinery Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: United States Haying & Forage Machinery Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Haying & Forage Machinery Market?

The projected CAGR is approximately 3.60%.

2. Which companies are prominent players in the United States Haying & Forage Machinery Market?

Key companies in the market include Foton Lovol, PÖTTINGER Landtechnik GmbH, IHI, Deere & Company, Lely, CLAAS KGaA mbH, Vermee, Kverneland Group, CNH Industrial, Krone North America Inc, KUHN Group, AGCO Corporation, Kubota.

3. What are the main segments of the United States Haying & Forage Machinery Market?

The market segments include Type, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Increase in Forage Cultivation Drives the Market.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Haying & Forage Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Haying & Forage Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Haying & Forage Machinery Market?

To stay informed about further developments, trends, and reports in the United States Haying & Forage Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence