Key Insights

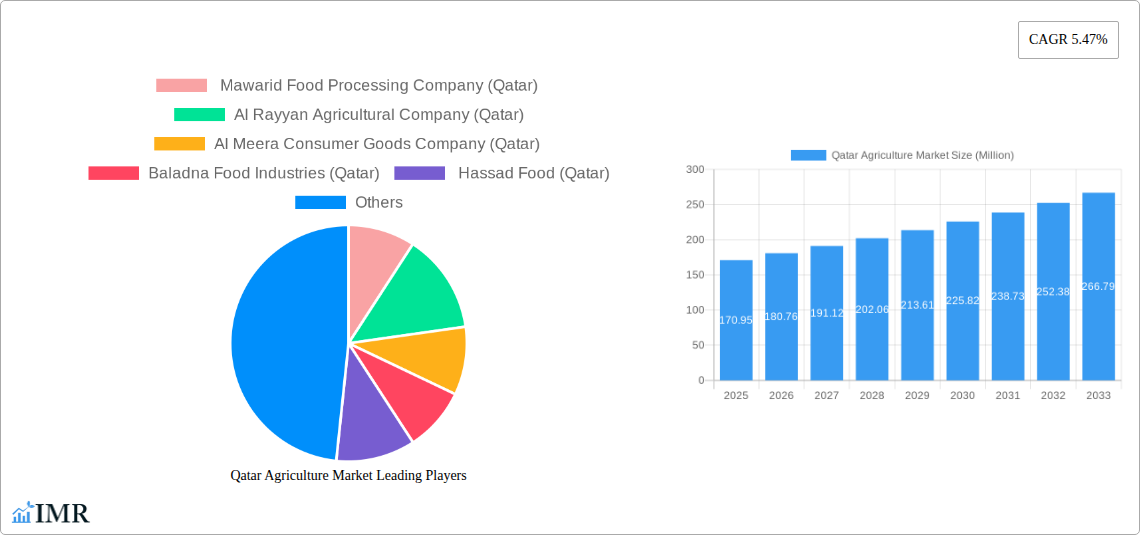

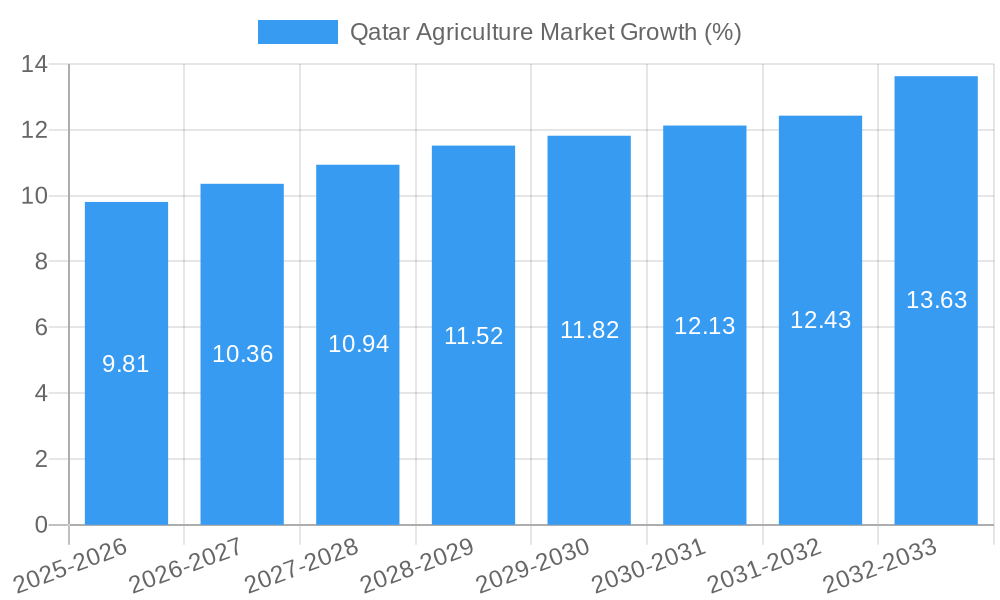

The Qatar agricultural market, valued at $170.95 million in 2025, is projected to experience robust growth, driven by increasing government initiatives promoting food security and self-sufficiency. The country's strategic focus on modernizing agricultural practices, including investments in advanced technologies like hydroponics and vertical farming, is expected to significantly contribute to the market's expansion. Furthermore, a rising population and a growing preference for fresh, locally sourced produce are fueling demand. Key segments like fresh produce (fruits, vegetables, herbs), dairy & poultry, and fish & seafood are witnessing substantial growth, propelled by both human consumption and the animal feed sector. While challenges such as water scarcity and climate change remain, the government's commitment to sustainable agricultural practices and diversification strategies is mitigating these risks. Major players like Mawarid Food Processing Company, Al Rayyan Agricultural Company, Al Meera Consumer Goods Company, Baladna Food Industries, and Hassad Food are actively shaping the market landscape through innovation and expansion. The market's growth is further supported by increasing tourism and a rising expatriate population, creating a larger consumer base for locally produced agricultural goods.

The 5.47% CAGR projected through 2033 indicates a steadily expanding market. This growth will likely be uneven across segments, with high-value produce and specialized products possibly outpacing the overall average. The Middle East and Africa region, particularly the UAE and Saudi Arabia, presents significant opportunities for cross-border trade and collaboration, potentially leading to further market expansion for Qatari agricultural products. The focus on enhancing agricultural infrastructure, including improved irrigation systems and storage facilities, will also positively impact the market's trajectory in the coming years. However, maintaining competitiveness through efficient production and cost management will be crucial for the long-term success of Qatari agricultural businesses.

Qatar Agriculture Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Qatar agriculture market, encompassing market dynamics, growth trends, dominant segments, and key players. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. This report is essential for industry professionals, investors, and stakeholders seeking to understand the opportunities and challenges within this dynamic market. The report analyzes parent markets like fresh produce, dairy & poultry, and fish & seafood, and child markets such as human consumption and animal feed, offering granular insights into market segmentation.

Qatar Agriculture Market Market Dynamics & Structure

The Qatar agriculture market exhibits a moderately concentrated structure, with key players such as Mawarid Food Processing Company (Qatar), Al Rayyan Agricultural Company (Qatar), Al Meera Consumer Goods Company (Qatar), Baladna Food Industries (Qatar), and Hassad Food (Qatar) holding significant market share. The market is driven by technological innovations in areas like vertical farming and AI-powered greenhouse management, as seen in recent partnerships between iFarm and Sadarah Partners. The regulatory framework, while supportive of agricultural development, presents certain challenges related to land usage and water resource management. The market faces competition from imported agricultural products, creating a need for local producers to enhance efficiency and quality. M&A activity in the sector has been relatively moderate, with a recorded xx million USD in deal volume during the historical period (2019-2024), expected to increase to xx million USD during the forecast period (2025-2033). Innovation barriers include high initial investment costs for advanced technologies and a skilled labor shortage.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Driven by vertical farming, AI, and automation in greenhouse operations.

- Regulatory Framework: Supportive but presents challenges regarding land and water resources.

- Competitive Substitutes: Primarily imported agricultural products.

- End-User Demographics: Growing population and increasing demand for fresh and high-quality produce.

- M&A Trends: Moderate activity historically, with projected increase during the forecast period.

Qatar Agriculture Market Growth Trends & Insights

The Qatar agriculture market witnessed a CAGR of xx% during the historical period (2019-2024), driven by factors such as government initiatives to boost food security, rising disposable incomes, and increasing health consciousness among consumers. The market size reached xx million USD in 2024 and is projected to reach xx million USD by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, particularly in vertical farming and precision agriculture, are accelerating market growth and improving efficiency. Consumer behavior is shifting towards preference for locally sourced, sustainable, and high-quality products. Market penetration of technologically advanced farming practices remains relatively low but is expected to increase significantly in the coming years, fueled by government support and private investments.

Dominant Regions, Countries, or Segments in Qatar Agriculture Market

The dominant segment within the Qatar agriculture market is fresh produce, specifically fruits and vegetables, driven by high consumer demand and government support for local production. The human consumption application segment accounts for the largest share, fueled by a growing population and increasing per capita consumption of agricultural products. Key drivers for growth include supportive government policies aiming for food security, substantial investments in agricultural infrastructure, and a commitment to promoting sustainable agricultural practices.

- Key Drivers:

- Government initiatives promoting food security and local production.

- Investments in agricultural infrastructure and technology.

- Growing consumer demand for fresh, high-quality produce.

- Increasing disposable incomes and health consciousness.

- Dominance Factors:

- High consumer demand for fresh produce.

- Government incentives and subsidies for local farmers.

- Favorable climatic conditions for certain crops (with advancements in controlled-environment agriculture).

Qatar Agriculture Market Product Landscape

The Qatar agriculture market is witnessing significant product innovation, with a focus on developing high-yielding, climate-resilient crop varieties. Vertical farming technologies are gaining traction, offering year-round production capabilities and reduced reliance on traditional land-based agriculture. Unique selling propositions emphasize local sourcing, superior quality, and sustainable farming practices. Technological advancements include AI-powered precision agriculture solutions that optimize resource utilization and enhance crop yields.

Key Drivers, Barriers & Challenges in Qatar Agriculture Market

Key Drivers:

- Government initiatives to enhance food security and reduce reliance on imports.

- Growing population and increasing demand for agricultural products.

- Technological advancements in precision agriculture and vertical farming.

Challenges & Restraints:

- Limited arable land and water scarcity, impacting production capacity. This constraint reduces potential output by an estimated xx% annually.

- High input costs, including energy and labor, impacting profitability.

- Competition from imported agricultural products, potentially affecting market share for local producers. Imports account for approximately xx% of the market.

Emerging Opportunities in Qatar Agriculture Market

- Untapped Markets: Expansion into niche markets like organic produce and specialty crops presents significant growth potential.

- Innovative Applications: Exploring the use of vertical farming and hydroponics to overcome land constraints.

- Evolving Consumer Preferences: Catering to increased demand for sustainable, locally sourced, and high-quality products.

Growth Accelerators in the Qatar Agriculture Market Industry

Technological breakthroughs in areas like precision agriculture, vertical farming, and AI-powered solutions are accelerating market growth. Strategic partnerships between local and international companies are fostering technology transfer and knowledge sharing. The government's commitment to investing in agricultural infrastructure and supporting local producers creates a favorable environment for market expansion.

Key Players Shaping the Qatar Agriculture Market Market

- Mawarid Food Processing Company (Qatar)

- Al Rayyan Agricultural Company (Qatar)

- Al Meera Consumer Goods Company (Qatar)

- Baladna Food Industries (Qatar)

- Hassad Food (Qatar)

Notable Milestones in Qatar Agriculture Market Sector

- August 2022: Carnegie Mellon University-Qatar (CMU-Q) launched a research project using AI and machine learning to optimize greenhouse operations.

- June 2021: iFarm partnered with Sadarah Partners to establish a large-scale indoor vertical farm.

In-Depth Qatar Agriculture Market Market Outlook

The Qatar agriculture market is poised for significant growth over the forecast period, driven by technological advancements, supportive government policies, and evolving consumer preferences. Strategic opportunities exist for companies focusing on sustainable agriculture, technology adoption, and value-added products. The market's future potential is substantial, offering attractive returns for investors and opportunities for innovation and expansion within the agricultural sector.

Qatar Agriculture Market Segmentation

- 1. Food Crops/Cereals

- 2. Fruits

- 3. Vegetables

- 4. Food Crops/Cereals

- 5. Fruits

- 6. Vegetables

Qatar Agriculture Market Segmentation By Geography

- 1. Qatar

Qatar Agriculture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.47% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Indian Rice; Enhancing Production Capacities; Increasing Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Abiotic and Biotic Stresses in Rice Cultivation; High Market Entry Costs

- 3.4. Market Trends

- 3.4.1. Increase in Adoption of High Technology Farming Practices

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Agriculture Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Food Crops/Cereals

- 5.2. Market Analysis, Insights and Forecast - by Fruits

- 5.3. Market Analysis, Insights and Forecast - by Vegetables

- 5.4. Market Analysis, Insights and Forecast - by Food Crops/Cereals

- 5.5. Market Analysis, Insights and Forecast - by Fruits

- 5.6. Market Analysis, Insights and Forecast - by Vegetables

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Food Crops/Cereals

- 6. UAE Qatar Agriculture Market Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Qatar Agriculture Market Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Qatar Agriculture Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Qatar Agriculture Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Mawarid Food Processing Company (Qatar)

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Al Rayyan Agricultural Company (Qatar)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Al Meera Consumer Goods Company (Qatar)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Baladna Food Industries (Qatar)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hassad Food (Qatar)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.1 Mawarid Food Processing Company (Qatar)

List of Figures

- Figure 1: Qatar Agriculture Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Qatar Agriculture Market Share (%) by Company 2024

List of Tables

- Table 1: Qatar Agriculture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Qatar Agriculture Market Revenue Million Forecast, by Food Crops/Cereals 2019 & 2032

- Table 3: Qatar Agriculture Market Revenue Million Forecast, by Fruits 2019 & 2032

- Table 4: Qatar Agriculture Market Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 5: Qatar Agriculture Market Revenue Million Forecast, by Food Crops/Cereals 2019 & 2032

- Table 6: Qatar Agriculture Market Revenue Million Forecast, by Fruits 2019 & 2032

- Table 7: Qatar Agriculture Market Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 8: Qatar Agriculture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 9: Qatar Agriculture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: UAE Qatar Agriculture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Africa Qatar Agriculture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Saudi Arabia Qatar Agriculture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of MEA Qatar Agriculture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Qatar Agriculture Market Revenue Million Forecast, by Food Crops/Cereals 2019 & 2032

- Table 15: Qatar Agriculture Market Revenue Million Forecast, by Fruits 2019 & 2032

- Table 16: Qatar Agriculture Market Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 17: Qatar Agriculture Market Revenue Million Forecast, by Food Crops/Cereals 2019 & 2032

- Table 18: Qatar Agriculture Market Revenue Million Forecast, by Fruits 2019 & 2032

- Table 19: Qatar Agriculture Market Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 20: Qatar Agriculture Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Agriculture Market?

The projected CAGR is approximately 5.47%.

2. Which companies are prominent players in the Qatar Agriculture Market?

Key companies in the market include Mawarid Food Processing Company (Qatar) , Al Rayyan Agricultural Company (Qatar), Al Meera Consumer Goods Company (Qatar) , Baladna Food Industries (Qatar), Hassad Food (Qatar).

3. What are the main segments of the Qatar Agriculture Market?

The market segments include Food Crops/Cereals, Fruits, Vegetables, Food Crops/Cereals, Fruits, Vegetables.

4. Can you provide details about the market size?

The market size is estimated to be USD 170.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Indian Rice; Enhancing Production Capacities; Increasing Government Initiatives.

6. What are the notable trends driving market growth?

Increase in Adoption of High Technology Farming Practices.

7. Are there any restraints impacting market growth?

Abiotic and Biotic Stresses in Rice Cultivation; High Market Entry Costs.

8. Can you provide examples of recent developments in the market?

August 2022: Carnegie Mellon University has launched a new research project in Qatar (CMU-Q), a Qatar Foundation (QF) partner university, to optimize the operations of greenhouses in Qatar. This project is funded by the Qatar National Research Fund through the National Priorities Research Program (QNRF) and will use machine learning (ML) to coordinate a fleet of mobile robots to collect visual data from Qatar greenhouse plants autonomously and use AI and machine learning to create predictive models of the crop's development status, quality, health, and expected yield.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Agriculture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Agriculture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Agriculture Market?

To stay informed about further developments, trends, and reports in the Qatar Agriculture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence