Key Insights

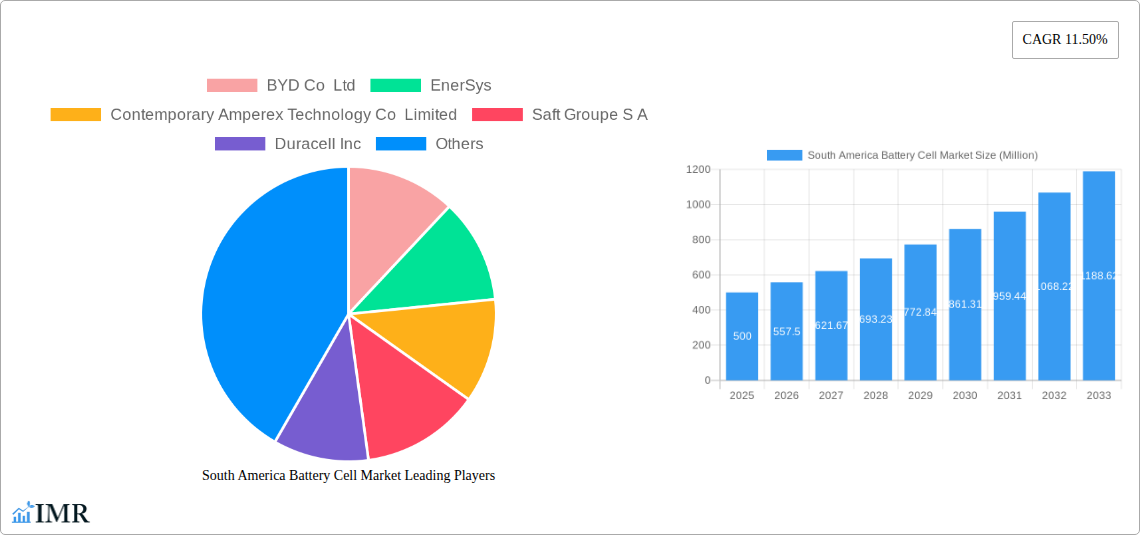

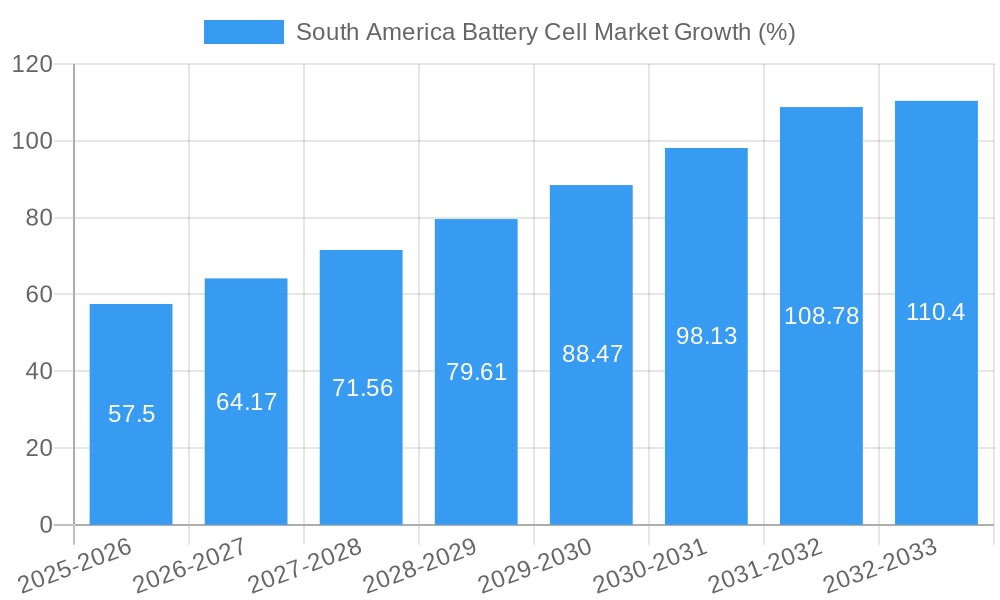

The South American battery cell market, currently experiencing robust growth, is projected to expand significantly over the next decade. Driven by increasing demand for electric vehicles (EVs), renewable energy storage solutions, and portable electronic devices, the market is poised for substantial expansion. The CAGR of 11.50% indicates a healthy growth trajectory, with the market size in 2025 estimated to be around $X million (This value needs to be estimated based on the provided market size and growth rate, but further information is required to do so accurately. For instance, the current market size is needed). This growth is further fueled by government initiatives promoting sustainable energy and the increasing adoption of battery-powered technologies across various sectors. Brazil and Argentina represent the largest markets within South America, owing to their relatively advanced economies and expanding industrial sectors.

The market segmentation reveals a diverse landscape. Prismatic cells dominate the market due to their cost-effectiveness and suitability for various applications. However, cylindrical and pouch cells are experiencing rapid growth, driven by their higher energy density and suitability for specific applications like EVs and power tools. In terms of application, automotive batteries are a major driver of market growth, followed by industrial batteries and portable batteries. The expanding EV market in South America is expected to propel the demand for automotive batteries significantly. While restraints exist, such as the high initial investment costs associated with battery production and concerns regarding battery recycling and disposal, technological advancements and governmental support are mitigating these challenges. Key players like BYD, EnerSys, and CATL are actively investing in the region, further bolstering market growth and competition. The forecast period of 2025-2033 presents substantial opportunities for market expansion and the emergence of new players, especially those focused on sustainable and innovative battery technologies.

South America Battery Cell Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South America Battery Cell Market, encompassing market dynamics, growth trends, dominant segments, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this rapidly expanding market. The report’s parent market is the broader South American Energy Storage market, while the child market focuses specifically on battery cell production and distribution.

South America Battery Cell Market Dynamics & Structure

This section analyzes the competitive landscape of the South American battery cell market, considering market concentration, technological innovation, regulatory influences, substitute products, end-user demographics, and merger & acquisition (M&A) activity. The analysis incorporates both quantitative data (market share, M&A deal volumes) and qualitative assessments (innovation barriers).

- Market Concentration: The South American battery cell market exhibits a moderately concentrated structure, with a few major players holding significant market share (xx%). However, the emergence of new players and increasing competition are expected to moderately decrease this concentration over the forecast period.

- Technological Innovation: Significant investments in R&D are driving innovation in battery cell technology, focusing on improving energy density, lifespan, and safety. However, challenges remain in securing reliable lithium supplies and scaling up manufacturing capabilities to meet increasing demand.

- Regulatory Framework: Government policies and incentives supporting electric vehicle adoption and renewable energy integration are positively influencing market growth. However, inconsistencies in regulations across different South American countries create complexities for market participants.

- Competitive Substitutes: While battery cells are currently the dominant technology for energy storage, alternative technologies like fuel cells and flow batteries present potential competition, especially in niche applications.

- End-User Demographics: The primary end-users are automotive, industrial, and portable device manufacturers. The growth of the electric vehicle market and industrial automation is expected to significantly drive demand for battery cells.

- M&A Trends: The number of M&A deals in the South American battery cell market has been steadily increasing over the past few years (xx deals in 2024, projected xx% increase in 2025), reflecting the strategic importance of this sector and the consolidation efforts of key players.

South America Battery Cell Market Growth Trends & Insights

This section details the market size evolution, adoption rates, technological disruptions, and consumer behavior shifts within the South American battery cell market. Quantitative metrics like Compound Annual Growth Rate (CAGR) and market penetration are used to provide a deeper understanding of market growth dynamics.

(XXX - This section would contain a detailed 600-word analysis leveraging specific data. This would include CAGR figures for the historical period and forecast, specific numbers on market penetration in various sectors, and analysis of trends such as the adoption of different battery chemistries.) For example, the market is projected to grow at a CAGR of xx% from 2025 to 2033, reaching a market size of xx Million units by 2033.

Dominant Regions, Countries, or Segments in South America Battery Cell Market

This section pinpoints the leading regions, countries, and segments (by type and application) that are driving market growth. It identifies key drivers like economic policies and infrastructure development.

- Leading Region/Country: Brazil is projected to remain the dominant market in South America due to its substantial automotive industry, expanding renewable energy sector, and favorable government policies. Argentina and Chile show considerable potential, driven by their significant lithium reserves.

- Dominant Battery Type: Prismatic battery cells currently hold the largest market share due to their versatility and suitability for various applications. However, pouch cells are projected to experience faster growth due to their high energy density and cost-effectiveness.

- Dominant Application: Automotive batteries currently dominate the market, driven by the increasing electric vehicle adoption. However, industrial batteries and energy storage systems are also showing significant growth potential.

(This section would be expanded to 600 words, detailing the factors contributing to the dominance of specific regions, countries, and segments with specific market share data and growth projections.)

South America Battery Cell Market Product Landscape

The South American battery cell market offers a diverse range of products, characterized by continuous innovation in battery chemistries, cell designs (prismatic, cylindrical, pouch), and energy storage capabilities. Key advancements include improved energy density, longer lifespans, enhanced safety features, and faster charging times. These innovations are driven by the increasing demand for high-performance and cost-effective battery cells across various applications.

Key Drivers, Barriers & Challenges in South America Battery Cell Market

Key Drivers:

- Growing demand for electric vehicles (EVs): The rising adoption of EVs is a major driver, pushing up the demand for battery cells.

- Government support for renewable energy: Government initiatives promoting renewable energy sources are indirectly boosting the demand.

- Technological advancements: Improvements in battery technology are making them more efficient and cost-effective.

Key Challenges & Restraints:

- Supply chain disruptions: The reliance on imported materials and components creates vulnerability to global supply chain disruptions.

- High initial investment costs: The significant upfront investment required to establish battery cell manufacturing facilities can be a barrier for smaller companies.

- Lack of skilled labor: A shortage of skilled workers in the battery manufacturing industry hampers production capacity.

Emerging Opportunities in South America Battery Cell Market

- Untapped markets in rural areas: Expanding the reach of battery-powered solutions to underserved communities offers significant growth potential.

- Innovative applications in energy storage: Exploring new applications in grid-scale energy storage, microgrids, and off-grid power solutions opens up new market avenues.

- Growing demand for second-life batteries: Developing effective recycling and reuse strategies for spent battery cells can create economic opportunities and minimize environmental impact.

Growth Accelerators in the South America Battery Cell Market Industry

The long-term growth of the South American battery cell market will be fueled by a combination of factors, including technological breakthroughs in battery chemistries (like solid-state batteries), strategic partnerships between battery manufacturers and automotive companies, and government policies promoting local manufacturing and sustainable energy solutions. These initiatives will collectively create a robust and sustainable ecosystem for battery cell production and adoption in the region.

Key Players Shaping the South America Battery Cell Market Market

- BYD Co Ltd

- EnerSys

- Contemporary Amperex Technology Co Limited

- Saft Groupe S A

- Duracell Inc

- ElringKlinger AG

- Panasonic Corporation

- Maxell Ltd

- List Not Exhaustive

Notable Milestones in South America Battery Cell Market Sector

- July 2022: YPF Tecnología (Y-TEC) and YLB signed a scientific-technological cooperation agreement to manufacture lithium cells and batteries in Argentina and Bolivia. This collaboration significantly boosts regional lithium-ion battery production capacity and reduces reliance on imports.

- March 2022: CBMM (Brazil) partnered with Toshiba and Horwin (China) to supply niobium battery cells for electric motorcycles, demonstrating the potential of novel battery chemistries and cross-border collaborations in the South American market. This initiative showcases the potential of niobium in fast-charging battery technology.

In-Depth South America Battery Cell Market Market Outlook

The future of the South American battery cell market is exceptionally bright, driven by the escalating demand for electric vehicles, the rising adoption of renewable energy technologies, and the ongoing advancements in battery technology. Strategic partnerships between international players and local companies, along with supportive government policies, will further fuel the market's expansion. The market’s growth will be underpinned by strong economic growth, infrastructure development, and increasing consumer awareness of environmental sustainability. This translates into significant opportunities for both established and emerging players seeking to capitalize on this burgeoning market.

South America Battery Cell Market Segmentation

-

1. Type

- 1.1. Prismatic

- 1.2. Cylindrical

- 1.3. Pouch

-

2. Application

- 2.1. Automotive Batteries

- 2.2. Industrial Batteries

- 2.3. Portable Batteries

- 2.4. Power Tools Batteries

- 2.5. SLI Batteries

- 2.6. Others

-

3. Geography

- 3.1. Brazil

- 3.2. Chile

- 3.3. Argentina

- 3.4. Rest of South America

South America Battery Cell Market Segmentation By Geography

- 1. Brazil

- 2. Chile

- 3. Argentina

- 4. Rest of South America

South America Battery Cell Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Natural Gas and Developing Gas Infrastructure 4.; Increasing Offshore Oil & Gas Exploration Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Adoption of Cleaner Alternatives4.; High Volatility of Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Automobile Batteries Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Battery Cell Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Prismatic

- 5.1.2. Cylindrical

- 5.1.3. Pouch

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive Batteries

- 5.2.2. Industrial Batteries

- 5.2.3. Portable Batteries

- 5.2.4. Power Tools Batteries

- 5.2.5. SLI Batteries

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Chile

- 5.3.3. Argentina

- 5.3.4. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Chile

- 5.4.3. Argentina

- 5.4.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Battery Cell Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Prismatic

- 6.1.2. Cylindrical

- 6.1.3. Pouch

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Automotive Batteries

- 6.2.2. Industrial Batteries

- 6.2.3. Portable Batteries

- 6.2.4. Power Tools Batteries

- 6.2.5. SLI Batteries

- 6.2.6. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Chile

- 6.3.3. Argentina

- 6.3.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Chile South America Battery Cell Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Prismatic

- 7.1.2. Cylindrical

- 7.1.3. Pouch

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Automotive Batteries

- 7.2.2. Industrial Batteries

- 7.2.3. Portable Batteries

- 7.2.4. Power Tools Batteries

- 7.2.5. SLI Batteries

- 7.2.6. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Chile

- 7.3.3. Argentina

- 7.3.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Argentina South America Battery Cell Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Prismatic

- 8.1.2. Cylindrical

- 8.1.3. Pouch

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Automotive Batteries

- 8.2.2. Industrial Batteries

- 8.2.3. Portable Batteries

- 8.2.4. Power Tools Batteries

- 8.2.5. SLI Batteries

- 8.2.6. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Chile

- 8.3.3. Argentina

- 8.3.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of South America South America Battery Cell Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Prismatic

- 9.1.2. Cylindrical

- 9.1.3. Pouch

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Automotive Batteries

- 9.2.2. Industrial Batteries

- 9.2.3. Portable Batteries

- 9.2.4. Power Tools Batteries

- 9.2.5. SLI Batteries

- 9.2.6. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Chile

- 9.3.3. Argentina

- 9.3.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Brazil South America Battery Cell Market Analysis, Insights and Forecast, 2019-2031

- 11. Argentina South America Battery Cell Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of South America South America Battery Cell Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 BYD Co Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 EnerSys

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Contemporary Amperex Technology Co Limited

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Saft Groupe S A

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Duracell Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 ElringKlinger AG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Panasonic Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Maxell Ltd *List Not Exhaustive

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 BYD Co Ltd

List of Figures

- Figure 1: South America Battery Cell Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Battery Cell Market Share (%) by Company 2024

List of Tables

- Table 1: South America Battery Cell Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Battery Cell Market Volume K Units Forecast, by Region 2019 & 2032

- Table 3: South America Battery Cell Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: South America Battery Cell Market Volume K Units Forecast, by Type 2019 & 2032

- Table 5: South America Battery Cell Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: South America Battery Cell Market Volume K Units Forecast, by Application 2019 & 2032

- Table 7: South America Battery Cell Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: South America Battery Cell Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 9: South America Battery Cell Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: South America Battery Cell Market Volume K Units Forecast, by Region 2019 & 2032

- Table 11: South America Battery Cell Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: South America Battery Cell Market Volume K Units Forecast, by Country 2019 & 2032

- Table 13: Brazil South America Battery Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Brazil South America Battery Cell Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: Argentina South America Battery Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina South America Battery Cell Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America South America Battery Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of South America South America Battery Cell Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: South America Battery Cell Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: South America Battery Cell Market Volume K Units Forecast, by Type 2019 & 2032

- Table 21: South America Battery Cell Market Revenue Million Forecast, by Application 2019 & 2032

- Table 22: South America Battery Cell Market Volume K Units Forecast, by Application 2019 & 2032

- Table 23: South America Battery Cell Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: South America Battery Cell Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 25: South America Battery Cell Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: South America Battery Cell Market Volume K Units Forecast, by Country 2019 & 2032

- Table 27: South America Battery Cell Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: South America Battery Cell Market Volume K Units Forecast, by Type 2019 & 2032

- Table 29: South America Battery Cell Market Revenue Million Forecast, by Application 2019 & 2032

- Table 30: South America Battery Cell Market Volume K Units Forecast, by Application 2019 & 2032

- Table 31: South America Battery Cell Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: South America Battery Cell Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 33: South America Battery Cell Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: South America Battery Cell Market Volume K Units Forecast, by Country 2019 & 2032

- Table 35: South America Battery Cell Market Revenue Million Forecast, by Type 2019 & 2032

- Table 36: South America Battery Cell Market Volume K Units Forecast, by Type 2019 & 2032

- Table 37: South America Battery Cell Market Revenue Million Forecast, by Application 2019 & 2032

- Table 38: South America Battery Cell Market Volume K Units Forecast, by Application 2019 & 2032

- Table 39: South America Battery Cell Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: South America Battery Cell Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 41: South America Battery Cell Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: South America Battery Cell Market Volume K Units Forecast, by Country 2019 & 2032

- Table 43: South America Battery Cell Market Revenue Million Forecast, by Type 2019 & 2032

- Table 44: South America Battery Cell Market Volume K Units Forecast, by Type 2019 & 2032

- Table 45: South America Battery Cell Market Revenue Million Forecast, by Application 2019 & 2032

- Table 46: South America Battery Cell Market Volume K Units Forecast, by Application 2019 & 2032

- Table 47: South America Battery Cell Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 48: South America Battery Cell Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 49: South America Battery Cell Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: South America Battery Cell Market Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Battery Cell Market?

The projected CAGR is approximately 11.50%.

2. Which companies are prominent players in the South America Battery Cell Market?

Key companies in the market include BYD Co Ltd, EnerSys, Contemporary Amperex Technology Co Limited, Saft Groupe S A, Duracell Inc, ElringKlinger AG, Panasonic Corporation, Maxell Ltd *List Not Exhaustive.

3. What are the main segments of the South America Battery Cell Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Natural Gas and Developing Gas Infrastructure 4.; Increasing Offshore Oil & Gas Exploration Activities.

6. What are the notable trends driving market growth?

Automobile Batteries Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Adoption of Cleaner Alternatives4.; High Volatility of Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

In July 2022, YPF Tecnología (Y-TEC) of Argentina and the National Strategic Public Company for Bolivian Lithium Deposits (YLB) signed a scientific-technological cooperation agreement to manufacture lithium cells and batteries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Battery Cell Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Battery Cell Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Battery Cell Market?

To stay informed about further developments, trends, and reports in the South America Battery Cell Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence