Key Insights

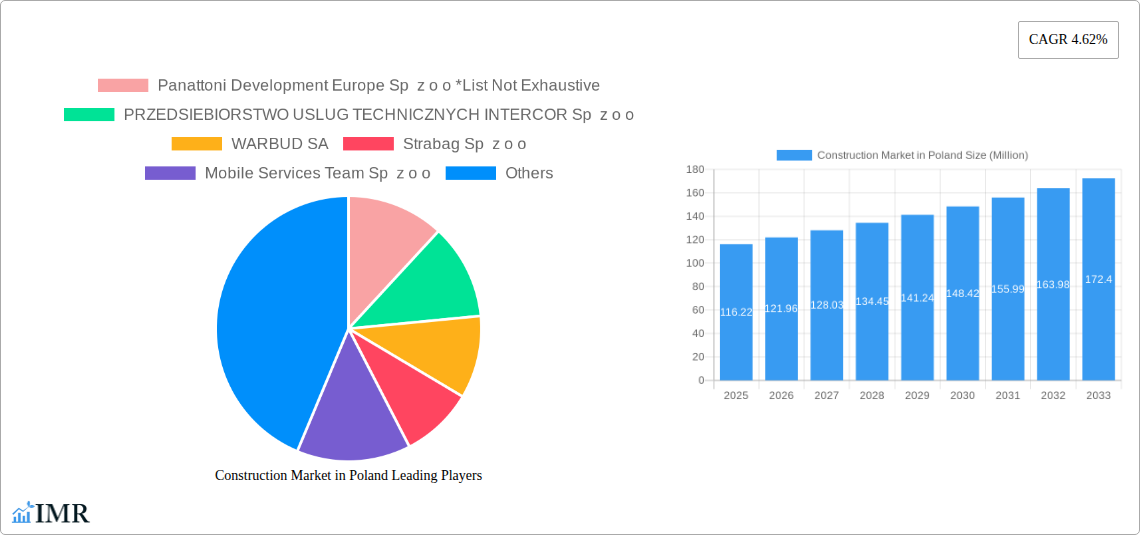

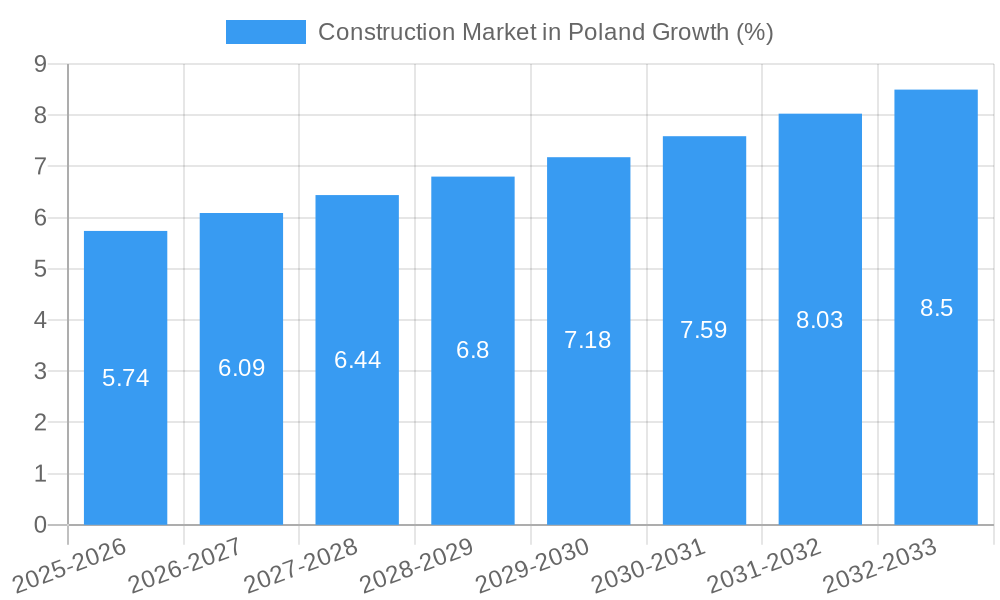

The Polish construction market, valued at €116.22 million in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 4.62% from 2025 to 2033. This growth is fueled by several key factors. Significant investments in infrastructure projects, driven by EU funds and national initiatives, are stimulating demand across various sectors, including transportation, energy, and utilities. The residential sector remains a strong driver, bolstered by a growing population and increasing urbanization, particularly in major cities like Warsaw and Krakow. Furthermore, the commercial sector is witnessing expansion, fueled by the growth of e-commerce and the increasing need for modern office spaces and logistics hubs. While rising material costs and skilled labor shortages present challenges, government initiatives aimed at streamlining construction processes and fostering sustainable building practices are mitigating these constraints. The market is segmented into residential, commercial, industrial, infrastructure, and energy & utilities, with significant activity across all segments. Leading players such as Panattoni Development Europe, WARBUD SA, Strabag Sp z o o, and others, contribute to the market's dynamism and competitiveness.

The forecast period (2025-2033) promises continued growth, albeit potentially at a slightly moderated pace as some of the current infrastructure projects near completion. However, long-term prospects remain positive due to Poland's ongoing economic development, its strategic geographical location within the EU, and the continued need for modernizing its infrastructure to support future growth. The market's resilience is likely to be tested by global economic fluctuations, but the inherent demand within the various sectors indicates continued, albeit potentially fluctuating, growth over the forecast period. Further analysis focusing on individual segment growth trajectories, investment trends, and specific regulatory changes would yield a more granular understanding of future market dynamics.

This comprehensive report provides an in-depth analysis of the Polish construction market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report uses data from the historical period (2019-2024) to project future market values in million units.

Construction Market in Poland Market Dynamics & Structure

The Polish construction market, valued at xx million in 2024, exhibits a complex interplay of factors shaping its structure and dynamics. Market concentration is moderate, with several large players alongside numerous smaller firms. Technological innovation, driven by BIM adoption and prefabrication techniques, is gradually improving efficiency. However, a shortage of skilled labor and bureaucratic hurdles pose significant challenges. The regulatory framework, while evolving, can be complex and presents varying degrees of ease for different segments. Competitive product substitutes are limited, particularly in specialized areas. End-user demographics are shifting, with a growing demand for sustainable and energy-efficient construction. M&A activity remains moderate, with xx deals recorded in the past five years, representing a combined value of xx million.

- Market Concentration: Moderate, with a Herfindahl-Hirschman Index (HHI) of xx.

- Technological Innovation: BIM adoption is increasing, but full implementation faces challenges. Prefabrication is gaining traction but faces initial investment barriers.

- Regulatory Framework: Complex permitting processes and regulations impact project timelines and costs.

- Competitive Product Substitutes: Limited availability of substitutes in specialized construction sectors.

- End-User Demographics: Growing demand for sustainable and energy-efficient buildings.

- M&A Trends: Moderate activity, driven primarily by consolidation and expansion strategies.

Construction Market in Poland Growth Trends & Insights

The Polish construction market has experienced fluctuating growth over the past five years. Driven by [Insert specific driving factors, e.g., government infrastructure projects, EU funding, private investment], the market exhibited a CAGR of xx% from 2019-2024, reaching a value of xx million in 2024. Adoption rates for new technologies vary across segments. The residential sector shows high adoption of energy-efficient materials, while infrastructure projects demonstrate slower BIM implementation. Consumer behavior is shifting towards sustainable and smart building solutions, pushing market players to adapt. Technological disruptions, such as 3D printing and robotics, are creating new possibilities, although widespread implementation remains limited by cost and expertise. The market is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching xx million by 2033.

Dominant Regions, Countries, or Segments in Construction Market in Poland

The industrial segment holds the dominant position in the Polish construction market, driving overall growth. This dominance is attributed to robust manufacturing activity and foreign direct investment (FDI) in various sectors. The growing demand for warehousing and logistics facilities further fuels expansion in this area. Residential construction remains a substantial segment but experiences cyclical fluctuations based on economic conditions and lending rates. Infrastructure projects, although experiencing significant investment, show slower growth due to complex approval processes and potential project delays. The energy and utilities sector is undergoing a transition driven by EU policies promoting renewable energy sources and the need for grid modernization, resulting in sustained, yet perhaps slower, growth compared to industrial projects.

- Industrial Sector Drivers: High FDI, increasing demand for warehouse space, robust manufacturing.

- Residential Sector Drivers: Growing population, increasing urbanization, government housing programs.

- Infrastructure Sector Drivers: EU funding, national infrastructure development plans, road and rail projects.

- Energy and Utilities Sector Drivers: Transition to renewable energy, grid modernization, energy efficiency upgrades.

Construction Market in Poland Product Landscape

The Polish construction market showcases a diverse product landscape, incorporating traditional materials alongside innovative solutions. Advancements in prefabricated components, sustainable materials (e.g., cross-laminated timber), and smart building technologies are gaining traction. These innovations enhance construction speed, efficiency, and environmental performance, although adoption remains uneven across different segments. Key performance indicators (KPIs) for products include cost-effectiveness, durability, sustainability, and energy efficiency. Unique selling propositions often revolve around speed of construction, reduced environmental impact, and enhanced building performance.

Key Drivers, Barriers & Challenges in Construction Market in Poland

Key Drivers:

- Robust economic growth.

- Increasing urbanization and population growth.

- Government investments in infrastructure.

- EU funding for infrastructure and energy projects.

Key Challenges and Restraints:

- Shortages of skilled labor, leading to increased labor costs and project delays. (Impact: xx% increase in project costs).

- Complex bureaucratic processes and permit approvals. (Impact: xx% increase in project timelines).

- Fluctuations in construction material prices, driven by global supply chain issues. (Impact: xx% price volatility).

- Intense competition among construction firms, leading to price pressure.

Emerging Opportunities in Construction Market in Poland

Emerging opportunities include the growing demand for sustainable and energy-efficient buildings, the adoption of advanced construction technologies (BIM, 3D printing), and the expansion of the renewable energy sector. Untapped markets exist in rural areas and smaller cities, while the development of smart cities presents additional growth potential. Evolving consumer preferences toward flexible and personalized living spaces also create niche market opportunities within the residential sector.

Growth Accelerators in the Construction Market in Poland Industry

Long-term growth in the Polish construction market is propelled by several key factors. Continued government investments in infrastructure, particularly in transportation and energy, will support expansion. Technological advancements, such as BIM adoption and prefabrication, will improve efficiency and reduce costs. Strategic partnerships between construction firms and technology providers will further fuel innovation and growth. Finally, the increasing focus on sustainability and energy efficiency in the construction sector presents significant opportunities for growth and expansion.

Key Players Shaping the Construction Market in Poland Market

- Panattoni Development Europe Sp z o o

- PRZEDSIEBIORSTWO USLUG TECHNICZNYCH INTERCOR Sp z o o

- WARBUD SA

- Strabag Sp z o o

- Mobile Services Team Sp z o o

- ERBUD SA

- EUROVIA POLSKA SA

- UNIBEP SA

- SKANSKA SA

- PORR SA

- TORPOL SA

- BUDIMEX SA

Notable Milestones in Construction Market in Poland Sector

- 2020: Government launches a large-scale infrastructure development program.

- 2021: Significant increase in FDI in the industrial sector, leading to surge in warehouse construction.

- 2022: Introduction of new regulations promoting sustainable construction practices.

- 2023: Several major mergers and acquisitions within the construction industry.

In-Depth Construction Market in Poland Market Outlook

The Polish construction market exhibits strong growth potential, driven by robust economic fundamentals, supportive government policies, and technological advancements. Strategic opportunities lie in embracing sustainable construction practices, leveraging technological innovation, and capitalizing on the growing demand for specialized building types. The market's future success hinges on addressing labor shortages, streamlining regulatory processes, and fostering collaboration within the industry. The forecast suggests continued growth, with the market exceeding xx million by 2033, providing considerable opportunities for established players and new entrants.

Construction Market in Poland Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastructure

- 1.5. Energy and Utilities

Construction Market in Poland Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Construction Market in Poland REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.62% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Transportation Infrastructure is increasing in Netherlands; Growth in Travel and Tourism is driving the need for Transportation Infrastructure.

- 3.3. Market Restrains

- 3.3.1. High cost of the construction projects; Limited space availability for new projects

- 3.4. Market Trends

- 3.4.1. Demand for Infrastructure to Boost the Construction Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Market in Poland Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastructure

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America Construction Market in Poland Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Industrial

- 6.1.4. Infrastructure

- 6.1.5. Energy and Utilities

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America Construction Market in Poland Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Industrial

- 7.1.4. Infrastructure

- 7.1.5. Energy and Utilities

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe Construction Market in Poland Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Industrial

- 8.1.4. Infrastructure

- 8.1.5. Energy and Utilities

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa Construction Market in Poland Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Industrial

- 9.1.4. Infrastructure

- 9.1.5. Energy and Utilities

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific Construction Market in Poland Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Industrial

- 10.1.4. Infrastructure

- 10.1.5. Energy and Utilities

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Panattoni Development Europe Sp z o o *List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PRZEDSIEBIORSTWO USLUG TECHNICZNYCH INTERCOR Sp z o o

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 WARBUD SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Strabag Sp z o o

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mobile Services Team Sp z o o

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ERBUD SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 EUROVIA POLSKA SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 UNIBEP SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SKANSKA SA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 PORR SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 TORPOL SA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BUDIMEX SA

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Panattoni Development Europe Sp z o o *List Not Exhaustive

List of Figures

- Figure 1: Global Construction Market in Poland Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Poland Construction Market in Poland Revenue (Million), by Country 2024 & 2032

- Figure 3: Poland Construction Market in Poland Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Construction Market in Poland Revenue (Million), by Sector 2024 & 2032

- Figure 5: North America Construction Market in Poland Revenue Share (%), by Sector 2024 & 2032

- Figure 6: North America Construction Market in Poland Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Construction Market in Poland Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Construction Market in Poland Revenue (Million), by Sector 2024 & 2032

- Figure 9: South America Construction Market in Poland Revenue Share (%), by Sector 2024 & 2032

- Figure 10: South America Construction Market in Poland Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Construction Market in Poland Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Construction Market in Poland Revenue (Million), by Sector 2024 & 2032

- Figure 13: Europe Construction Market in Poland Revenue Share (%), by Sector 2024 & 2032

- Figure 14: Europe Construction Market in Poland Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe Construction Market in Poland Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa Construction Market in Poland Revenue (Million), by Sector 2024 & 2032

- Figure 17: Middle East & Africa Construction Market in Poland Revenue Share (%), by Sector 2024 & 2032

- Figure 18: Middle East & Africa Construction Market in Poland Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa Construction Market in Poland Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Construction Market in Poland Revenue (Million), by Sector 2024 & 2032

- Figure 21: Asia Pacific Construction Market in Poland Revenue Share (%), by Sector 2024 & 2032

- Figure 22: Asia Pacific Construction Market in Poland Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Construction Market in Poland Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Construction Market in Poland Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Construction Market in Poland Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Global Construction Market in Poland Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Construction Market in Poland Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Global Construction Market in Poland Revenue Million Forecast, by Sector 2019 & 2032

- Table 6: Global Construction Market in Poland Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Construction Market in Poland Revenue Million Forecast, by Sector 2019 & 2032

- Table 11: Global Construction Market in Poland Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of South America Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Construction Market in Poland Revenue Million Forecast, by Sector 2019 & 2032

- Table 16: Global Construction Market in Poland Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United Kingdom Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Spain Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Russia Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Benelux Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Nordics Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Construction Market in Poland Revenue Million Forecast, by Sector 2019 & 2032

- Table 27: Global Construction Market in Poland Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Turkey Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Israel Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: GCC Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: North Africa Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: South Africa Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Middle East & Africa Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Construction Market in Poland Revenue Million Forecast, by Sector 2019 & 2032

- Table 35: Global Construction Market in Poland Revenue Million Forecast, by Country 2019 & 2032

- Table 36: China Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: India Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: South Korea Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: ASEAN Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Oceania Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Asia Pacific Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Market in Poland?

The projected CAGR is approximately 4.62%.

2. Which companies are prominent players in the Construction Market in Poland?

Key companies in the market include Panattoni Development Europe Sp z o o *List Not Exhaustive, PRZEDSIEBIORSTWO USLUG TECHNICZNYCH INTERCOR Sp z o o, WARBUD SA, Strabag Sp z o o, Mobile Services Team Sp z o o, ERBUD SA, EUROVIA POLSKA SA, UNIBEP SA, SKANSKA SA, PORR SA, TORPOL SA, BUDIMEX SA.

3. What are the main segments of the Construction Market in Poland?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 116.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Transportation Infrastructure is increasing in Netherlands; Growth in Travel and Tourism is driving the need for Transportation Infrastructure..

6. What are the notable trends driving market growth?

Demand for Infrastructure to Boost the Construction Sector.

7. Are there any restraints impacting market growth?

High cost of the construction projects; Limited space availability for new projects.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Market in Poland," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Market in Poland report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Market in Poland?

To stay informed about further developments, trends, and reports in the Construction Market in Poland, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence