Key Insights

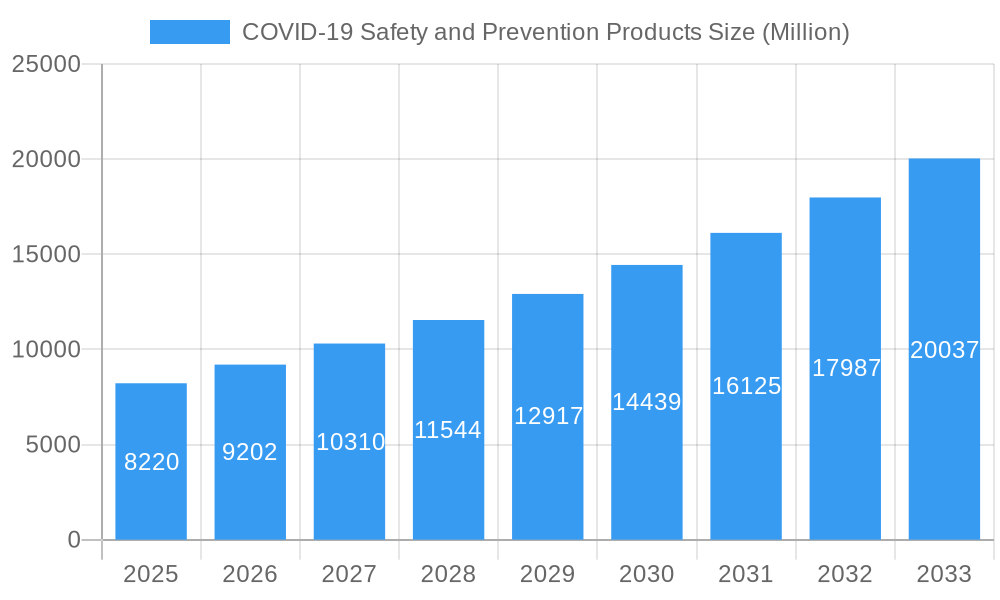

The global market for COVID-19 Safety and Prevention Products is projected to experience robust growth, reaching an estimated $8.22 billion in 2025 with a compound annual growth rate (CAGR) of 11.8% through 2033. This significant expansion is fueled by a heightened global awareness of hygiene and disease prevention, driven by ongoing public health concerns and the lingering impact of the pandemic. Key market drivers include the continuous need for personal protective equipment (PPE) in healthcare settings and for general public use, the increasing demand for advanced diagnostic and monitoring devices like infrared thermometers and thermal imagers, and the sustained focus on effective sanitation solutions. The market is also being shaped by evolving consumer behavior, with a greater emphasis on proactive health measures and a willingness to invest in products that offer protection and peace of mind.

COVID-19 Safety and Prevention Products Market Size (In Billion)

The market's trajectory is further influenced by emerging trends such as the development of more sustainable and eco-friendly PPE options, the integration of smart technologies in safety devices for enhanced monitoring and compliance, and the expanding availability of these products through diverse retail and online channels. While the market demonstrates strong growth potential, certain restraints, such as fluctuating raw material costs and the potential for market saturation in some product categories, need to be carefully managed. The product segmentation highlights a diverse range of offerings, from essential items like protective face masks, sanitizers, and gloves to more sophisticated equipment such as ventilators and isolation chambers, catering to a broad spectrum of needs across individuals, businesses, and healthcare institutions. Leading companies are actively innovating and expanding their portfolios to capture a significant share of this dynamic and critical market.

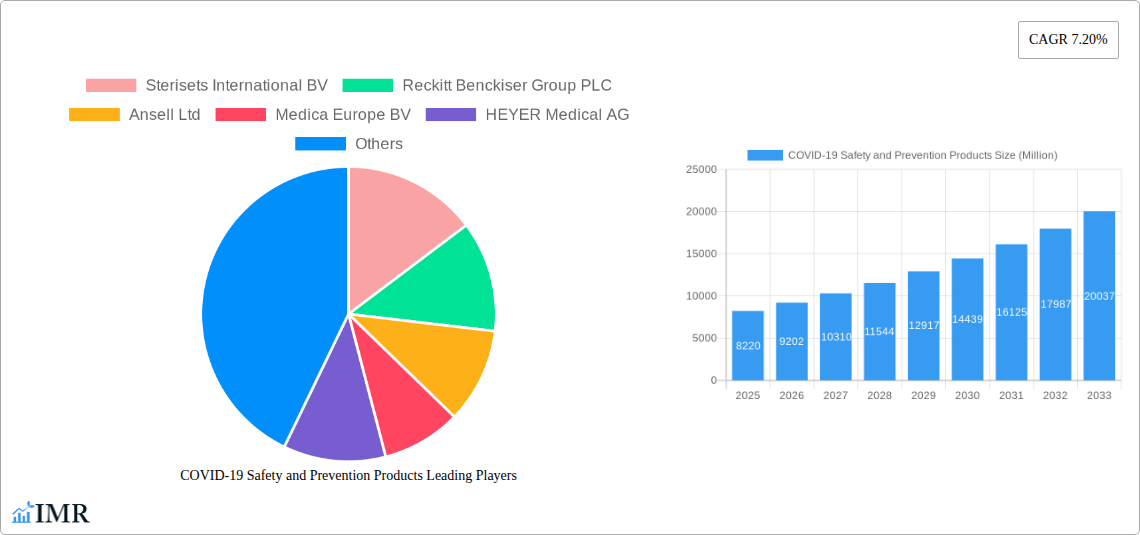

COVID-19 Safety and Prevention Products Company Market Share

Comprehensive Report: COVID-19 Safety and Prevention Products Market Analysis (2019-2033)

This in-depth report provides a definitive analysis of the global COVID-19 safety and prevention products market, a critical sector that has undergone unprecedented growth and evolution. With a study period spanning from 2019 to 2033, encompassing a historical overview (2019-2024), a base year of 2025, an estimated year also in 2025, and a robust forecast period from 2025 to 2033, this report offers unparalleled insights for industry professionals. Our analysis delves into market dynamics, growth trends, regional dominance, product innovation, key drivers, barriers, challenges, emerging opportunities, growth accelerators, and the competitive landscape, all while integrating high-traffic SEO keywords to maximize visibility. We examine the parent and child market structures to provide a holistic view of the sector's trajectory.

COVID-19 Safety and Prevention Products Market Dynamics & Structure

The global COVID-19 safety products market is characterized by a dynamic interplay of factors shaping its structure. Technological innovation, particularly in rapid diagnostic tools and advanced personal protective equipment (PPE), continues to drive market evolution. Regulatory frameworks, established by bodies such as the FDA and EMA, play a crucial role in ensuring product efficacy and safety, influencing market entry and adoption rates. The competitive landscape features a mix of established multinational corporations and agile new entrants, vying for market share through product differentiation and supply chain resilience. PPE market growth is significantly influenced by evolving public health guidelines and the demand for hygiene products. Mergers and acquisitions (M&A) are on the rise as companies seek to expand their product portfolios and geographical reach. For instance, the last five years have seen an estimated 75 M&A deals, consolidating market share among key players. End-user demographics range from healthcare institutions and government agencies to individual consumers and businesses, all contributing to the diversified demand for sanitizers, masks, and gloves. Innovation barriers include the high cost of research and development for novel solutions and the lengthy approval processes for medical-grade devices.

- Market Concentration: Moderately concentrated, with a few key players holding significant market share, but with a growing number of specialized manufacturers.

- Technological Innovation Drivers: Development of antimicrobial coatings, advanced filtration technologies for respirators, and smart temperature monitoring devices.

- Regulatory Frameworks: Strict compliance with international standards for medical devices and hygiene products.

- Competitive Product Substitutes: While direct substitutes are limited for critical PPE, advancements in reusable materials and sustainable alternatives are emerging.

- End-User Demographics: Healthcare providers, industrial sectors, retail, education, and public transit agencies.

- M&A Trends: Strategic acquisitions to broaden product offerings, gain access to new markets, and enhance manufacturing capabilities.

COVID-19 Safety and Prevention Products Growth Trends & Insights

The COVID-19 prevention products market has witnessed an extraordinary surge, driven by the global pandemic and its lingering effects. The market size, valued at an estimated $75 billion in 2023, is projected to reach $120 billion by 2025, demonstrating a robust CAGR of XX% during the forecast period. This significant expansion is attributed to sustained demand for disinfectants, face masks, and medical gowns, fueled by heightened public health awareness and the implementation of stringent hygiene protocols across industries. Adoption rates for sanitizers and disposable gloves have reached near-universal levels in many regions. Technological disruptions, such as the development of self-sanitizing surfaces and advanced air purification systems, are beginning to shape consumer preferences and investment strategies. Consumer behavior shifts are evident, with a permanent integration of hygiene practices into daily routines, thereby sustaining the demand for these products beyond the immediate crisis. The market penetration of infrared thermometers and other temperature devices has also seen a considerable uptick, becoming standard in public spaces and workplaces. The sustained need for ventilators in critical care settings continues to be a significant segment, contributing to the overall market growth.

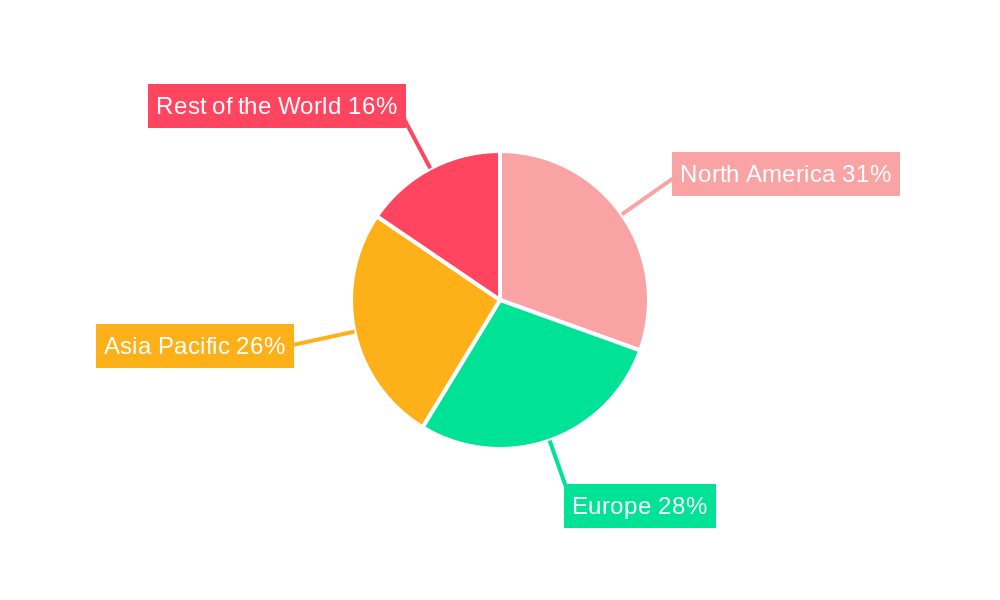

Dominant Regions, Countries, or Segments in COVID-19 Safety and Prevention Products

North America, particularly the United States, has emerged as a dominant force in the COVID-19 safety and prevention products market. This dominance is underpinned by substantial government investments in public health infrastructure, proactive procurement policies for essential supplies, and a high level of consumer awareness regarding health and safety. The region's robust healthcare system and its rapid adoption of technological advancements further solidify its leadership. Within product segments, Protective Face Masks, specifically Respirators (N-Series and FFP2/FFP3), have consistently driven market growth. The United States leads in the demand for N-Series respirators, while Europe shows a strong preference for FFP2 and FFP3 variants, reflecting regional regulatory standards and occupational safety requirements. The market for Sanitizers, particularly Gel and Liquid formats, also remains exceptionally strong across North America, owing to widespread public and commercial use. The demand for Gloves, especially Nitrile variants, remains high across all segments, from healthcare to food service. The presence of major manufacturers like 3M Company and Cardinal Health Inc. within the region also contributes to its market power. Furthermore, the increasing focus on infection control in healthcare settings and the growing awareness of workplace safety are accelerating the demand for Medical Gowns and Isolation Chambers.

- Dominant Region: North America

- Key Country: United States

- Leading Product Segment: Protective Face Masks (Respirators)

- Key Drivers in North America:

- Strong government initiatives and funding for public health.

- High disposable income enabling consumer spending on safety products.

- Advanced healthcare infrastructure with high demand for medical-grade PPE.

- Widespread adoption of new technologies in health monitoring.

- Strict occupational safety regulations across various industries.

- Market Share & Growth Potential: North America is estimated to hold approximately 35% of the global market share, with a projected growth potential of XX% in the next five years, driven by continuous upgrades in safety protocols and recurring outbreaks.

COVID-19 Safety and Prevention Products Product Landscape

The product landscape for COVID-19 safety and prevention is characterized by rapid innovation and a widening array of specialized solutions. Temperature Devices, including highly accurate Infrared Thermometers and advanced Thermal Imagers, are now integral for contactless screening. In respiratory protection, Respirators with enhanced filtration capabilities (N95, FFP2, FFP3) continue to be paramount, alongside the widespread use of Surgical Masks. The market also features innovative Sanitizers in various formats, including long-lasting formulations and eco-friendly options. Gloves made from Nitrile and other advanced materials offer superior protection and comfort. Medical Gowns and Coveralls, both disposable and re-usable, are crucial for healthcare professionals and frontline workers. Companies are focusing on improving material science, ergonomic design, and user-friendliness to enhance product performance and compliance.

Key Drivers, Barriers & Challenges in COVID-19 Safety and Prevention Products

The COVID-19 safety and prevention products market is propelled by several key drivers. Escalating public health concerns, governmental mandates for infection control, and the continuous threat of new viral variants create sustained demand. Technological advancements in material science and manufacturing processes enable the development of more effective and cost-efficient products.

- Key Drivers:

- Persistent global health threats and pandemic preparedness.

- Government regulations and procurement of essential supplies.

- Increased consumer awareness and adoption of hygiene practices.

- Technological innovations in PPE and diagnostic tools.

- Growth of the healthcare sector and demand for hospital-grade supplies.

Conversely, the market faces significant barriers and challenges. Supply chain disruptions, exacerbated by geopolitical events and raw material shortages, can lead to price volatility and product scarcity. Stringent and evolving regulatory approvals for new medical-grade products can hinder market entry. Intense competition and the potential for oversupply in certain product categories can also put pressure on profit margins.

- Key Barriers & Challenges:

- Supply chain volatility and raw material sourcing challenges.

- Complex and evolving regulatory landscapes.

- Intense market competition and potential for price wars.

- Counterfeiting and substandard product prevalence.

- Sustainability concerns and the environmental impact of disposable products.

Emerging Opportunities in COVID-19 Safety and Prevention Products

Emerging opportunities lie in the development of sustainable and reusable PPE, addressing environmental concerns. The integration of smart technologies for real-time health monitoring, such as connected thermometers and advanced respiratory trackers, presents a significant growth avenue. Untapped markets in developing nations, with increasing awareness and improving healthcare infrastructure, offer substantial expansion potential. Furthermore, niche applications like specialized antimicrobial coatings for high-touch surfaces and personalized infection control solutions are gaining traction.

Growth Accelerators in the COVID-19 Safety and Prevention Products Industry

Long-term growth in the COVID-19 safety and prevention products industry will be accelerated by continuous investment in research and development for next-generation protective technologies and diagnostics. Strategic partnerships between manufacturers, technology providers, and healthcare institutions will foster innovation and broaden market reach. Market expansion into emerging economies, driven by increasing disposable incomes and a greater focus on public health, will also play a crucial role. The development of adaptable and modular safety solutions that can cater to diverse outbreak scenarios will further solidify market resilience.

Key Players Shaping the COVID-19 Safety and Prevention Products Market

- Sterisets International BV

- Reckitt Benckiser Group PLC

- Ansell Ltd

- Medica Europe BV

- HEYER Medical AG

- Guangzhou Pidegree Medical Technology Co Ltd

- Dynarex Corporation

- Koninklijke Philips N V

- Cardinal Health Inc

- DUPONT de Nemours Inc

- 3M Company

- Medtronic PLC

- A&D Company Limited

- Shandong Yuyuan Latex Gloves Co Ltd

- Shield Scientific

- Microgen Hygiene Pvt Ltd

- Procter & Gamble (P&G) Company

- ResMed Inc

- Smiths Medical Inc

- Kimberly Clark Corporation

Notable Milestones in COVID-19 Safety and Prevention Products Sector

- Early 2020: Rapid scaling of surgical mask and respirator production globally in response to the pandemic.

- Mid-2020: Widespread adoption and innovation in hand sanitizer formulations and distribution.

- Late 2020: Introduction and increased availability of infrared thermometers for mass screening.

- 2021: Advancements in filtration technology for respirators leading to higher protection levels.

- 2022: Increased focus on reusable and sustainable PPE options by various manufacturers.

- 2023: Development of smart temperature devices with connectivity features for public health monitoring.

- Early 2024: Expansion of disposable glove production capacity to meet sustained demand.

In-Depth COVID-19 Safety and Prevention Products Market Outlook

The future outlook for the COVID-19 safety and prevention products market remains exceptionally strong, driven by a paradigm shift towards proactive health and safety measures. Growth accelerators such as ongoing investments in pandemic preparedness, the integration of advanced materials and antimicrobial technologies, and the expansion into underserved markets will continue to fuel demand. Strategic alliances and the pursuit of innovative product applications, especially in the realm of smart health monitoring and sustainable solutions, will define the market's trajectory. The sustained recognition of the importance of hygiene products and PPE ensures a robust market presence for the foreseeable future.

COVID-19 Safety and Prevention Products Segmentation

-

1. Product/Equipment Type

-

1.1. Temperature Device

-

1.1.1. By Type

- 1.1.1.1. Infrared Thermometer

- 1.1.1.2. Thermal Imagers

-

1.1.1. By Type

-

1.2. Ventilators

- 1.2.1. Invasive/Mechanical Ventilators

- 1.2.2. Non-invasive Ventilators

- 1.3. Isolation Chambers

-

1.4. Protective Face Masks

- 1.4.1. Cloth Based Face Masks

- 1.4.2. Surgical Masks

-

1.4.3. Respirators

-

1.4.3.1. By Filter Standard

-

1.4.3.1.1. US Based Filter Class

- 1.4.3.1.1.1. N - Series

- 1.4.3.1.1.2. P - Series

- 1.4.3.1.1.3. R - Series

-

1.4.3.1.2. European Based Filter Class

- 1.4.3.1.2.1. FFP1

- 1.4.3.1.2.2. FFP2

- 1.4.3.1.2.3. FFP3

-

1.4.3.1.1. US Based Filter Class

-

1.4.3.1. By Filter Standard

-

1.5. Sanitizers

-

1.5.1. By Format

- 1.5.1.1. Gel

- 1.5.1.2. Foam

- 1.5.1.3. Liquid

- 1.5.1.4. Wipe

- 1.5.1.5. Spray

-

1.5.1. By Format

-

1.6. Gloves

-

1.6.1. By Material Type

- 1.6.1.1. Rubber

- 1.6.1.2. Poly(vinyl Chloride)

- 1.6.1.3. Poly Chloroprene

- 1.6.1.4. Nitrile

-

1.6.1. By Material Type

-

1.7. Medical Gowns (Coveralls)

-

1.7.1. By Usage

- 1.7.1.1. Disposable

- 1.7.1.2. Re-usable

-

1.7.1. By Usage

- 1.8. Others (

-

1.1. Temperature Device

COVID-19 Safety and Prevention Products Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

COVID-19 Safety and Prevention Products Regional Market Share

Geographic Coverage of COVID-19 Safety and Prevention Products

COVID-19 Safety and Prevention Products REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising EXIM of Medical Grade Supplies; Reduced Tariff on Protective Equipment

- 3.3. Market Restrains

- 3.3.1. ; Inadequate Supply of Safety Products Creating a Price Pressure

- 3.4. Market Trends

- 3.4.1. Ventilators to Record a Major Share of the Market Studied

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global COVID-19 Safety and Prevention Products Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product/Equipment Type

- 5.1.1. Temperature Device

- 5.1.1.1. By Type

- 5.1.1.1.1. Infrared Thermometer

- 5.1.1.1.2. Thermal Imagers

- 5.1.1.1. By Type

- 5.1.2. Ventilators

- 5.1.2.1. Invasive/Mechanical Ventilators

- 5.1.2.2. Non-invasive Ventilators

- 5.1.3. Isolation Chambers

- 5.1.4. Protective Face Masks

- 5.1.4.1. Cloth Based Face Masks

- 5.1.4.2. Surgical Masks

- 5.1.4.3. Respirators

- 5.1.4.3.1. By Filter Standard

- 5.1.4.3.1.1. US Based Filter Class

- 5.1.4.3.1.1.1. N - Series

- 5.1.4.3.1.1.2. P - Series

- 5.1.4.3.1.1.3. R - Series

- 5.1.4.3.1.2. European Based Filter Class

- 5.1.4.3.1.2.1. FFP1

- 5.1.4.3.1.2.2. FFP2

- 5.1.4.3.1.2.3. FFP3

- 5.1.4.3.1.1. US Based Filter Class

- 5.1.4.3.1. By Filter Standard

- 5.1.5. Sanitizers

- 5.1.5.1. By Format

- 5.1.5.1.1. Gel

- 5.1.5.1.2. Foam

- 5.1.5.1.3. Liquid

- 5.1.5.1.4. Wipe

- 5.1.5.1.5. Spray

- 5.1.5.1. By Format

- 5.1.6. Gloves

- 5.1.6.1. By Material Type

- 5.1.6.1.1. Rubber

- 5.1.6.1.2. Poly(vinyl Chloride)

- 5.1.6.1.3. Poly Chloroprene

- 5.1.6.1.4. Nitrile

- 5.1.6.1. By Material Type

- 5.1.7. Medical Gowns (Coveralls)

- 5.1.7.1. By Usage

- 5.1.7.1.1. Disposable

- 5.1.7.1.2. Re-usable

- 5.1.7.1. By Usage

- 5.1.8. Others (

- 5.1.1. Temperature Device

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product/Equipment Type

- 6. North America COVID-19 Safety and Prevention Products Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product/Equipment Type

- 6.1.1. Temperature Device

- 6.1.1.1. By Type

- 6.1.1.1.1. Infrared Thermometer

- 6.1.1.1.2. Thermal Imagers

- 6.1.1.1. By Type

- 6.1.2. Ventilators

- 6.1.2.1. Invasive/Mechanical Ventilators

- 6.1.2.2. Non-invasive Ventilators

- 6.1.3. Isolation Chambers

- 6.1.4. Protective Face Masks

- 6.1.4.1. Cloth Based Face Masks

- 6.1.4.2. Surgical Masks

- 6.1.4.3. Respirators

- 6.1.4.3.1. By Filter Standard

- 6.1.4.3.1.1. US Based Filter Class

- 6.1.4.3.1.1.1. N - Series

- 6.1.4.3.1.1.2. P - Series

- 6.1.4.3.1.1.3. R - Series

- 6.1.4.3.1.2. European Based Filter Class

- 6.1.4.3.1.2.1. FFP1

- 6.1.4.3.1.2.2. FFP2

- 6.1.4.3.1.2.3. FFP3

- 6.1.4.3.1.1. US Based Filter Class

- 6.1.4.3.1. By Filter Standard

- 6.1.5. Sanitizers

- 6.1.5.1. By Format

- 6.1.5.1.1. Gel

- 6.1.5.1.2. Foam

- 6.1.5.1.3. Liquid

- 6.1.5.1.4. Wipe

- 6.1.5.1.5. Spray

- 6.1.5.1. By Format

- 6.1.6. Gloves

- 6.1.6.1. By Material Type

- 6.1.6.1.1. Rubber

- 6.1.6.1.2. Poly(vinyl Chloride)

- 6.1.6.1.3. Poly Chloroprene

- 6.1.6.1.4. Nitrile

- 6.1.6.1. By Material Type

- 6.1.7. Medical Gowns (Coveralls)

- 6.1.7.1. By Usage

- 6.1.7.1.1. Disposable

- 6.1.7.1.2. Re-usable

- 6.1.7.1. By Usage

- 6.1.8. Others (

- 6.1.1. Temperature Device

- 6.1. Market Analysis, Insights and Forecast - by Product/Equipment Type

- 7. Europe COVID-19 Safety and Prevention Products Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product/Equipment Type

- 7.1.1. Temperature Device

- 7.1.1.1. By Type

- 7.1.1.1.1. Infrared Thermometer

- 7.1.1.1.2. Thermal Imagers

- 7.1.1.1. By Type

- 7.1.2. Ventilators

- 7.1.2.1. Invasive/Mechanical Ventilators

- 7.1.2.2. Non-invasive Ventilators

- 7.1.3. Isolation Chambers

- 7.1.4. Protective Face Masks

- 7.1.4.1. Cloth Based Face Masks

- 7.1.4.2. Surgical Masks

- 7.1.4.3. Respirators

- 7.1.4.3.1. By Filter Standard

- 7.1.4.3.1.1. US Based Filter Class

- 7.1.4.3.1.1.1. N - Series

- 7.1.4.3.1.1.2. P - Series

- 7.1.4.3.1.1.3. R - Series

- 7.1.4.3.1.2. European Based Filter Class

- 7.1.4.3.1.2.1. FFP1

- 7.1.4.3.1.2.2. FFP2

- 7.1.4.3.1.2.3. FFP3

- 7.1.4.3.1.1. US Based Filter Class

- 7.1.4.3.1. By Filter Standard

- 7.1.5. Sanitizers

- 7.1.5.1. By Format

- 7.1.5.1.1. Gel

- 7.1.5.1.2. Foam

- 7.1.5.1.3. Liquid

- 7.1.5.1.4. Wipe

- 7.1.5.1.5. Spray

- 7.1.5.1. By Format

- 7.1.6. Gloves

- 7.1.6.1. By Material Type

- 7.1.6.1.1. Rubber

- 7.1.6.1.2. Poly(vinyl Chloride)

- 7.1.6.1.3. Poly Chloroprene

- 7.1.6.1.4. Nitrile

- 7.1.6.1. By Material Type

- 7.1.7. Medical Gowns (Coveralls)

- 7.1.7.1. By Usage

- 7.1.7.1.1. Disposable

- 7.1.7.1.2. Re-usable

- 7.1.7.1. By Usage

- 7.1.8. Others (

- 7.1.1. Temperature Device

- 7.1. Market Analysis, Insights and Forecast - by Product/Equipment Type

- 8. Asia Pacific COVID-19 Safety and Prevention Products Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product/Equipment Type

- 8.1.1. Temperature Device

- 8.1.1.1. By Type

- 8.1.1.1.1. Infrared Thermometer

- 8.1.1.1.2. Thermal Imagers

- 8.1.1.1. By Type

- 8.1.2. Ventilators

- 8.1.2.1. Invasive/Mechanical Ventilators

- 8.1.2.2. Non-invasive Ventilators

- 8.1.3. Isolation Chambers

- 8.1.4. Protective Face Masks

- 8.1.4.1. Cloth Based Face Masks

- 8.1.4.2. Surgical Masks

- 8.1.4.3. Respirators

- 8.1.4.3.1. By Filter Standard

- 8.1.4.3.1.1. US Based Filter Class

- 8.1.4.3.1.1.1. N - Series

- 8.1.4.3.1.1.2. P - Series

- 8.1.4.3.1.1.3. R - Series

- 8.1.4.3.1.2. European Based Filter Class

- 8.1.4.3.1.2.1. FFP1

- 8.1.4.3.1.2.2. FFP2

- 8.1.4.3.1.2.3. FFP3

- 8.1.4.3.1.1. US Based Filter Class

- 8.1.4.3.1. By Filter Standard

- 8.1.5. Sanitizers

- 8.1.5.1. By Format

- 8.1.5.1.1. Gel

- 8.1.5.1.2. Foam

- 8.1.5.1.3. Liquid

- 8.1.5.1.4. Wipe

- 8.1.5.1.5. Spray

- 8.1.5.1. By Format

- 8.1.6. Gloves

- 8.1.6.1. By Material Type

- 8.1.6.1.1. Rubber

- 8.1.6.1.2. Poly(vinyl Chloride)

- 8.1.6.1.3. Poly Chloroprene

- 8.1.6.1.4. Nitrile

- 8.1.6.1. By Material Type

- 8.1.7. Medical Gowns (Coveralls)

- 8.1.7.1. By Usage

- 8.1.7.1.1. Disposable

- 8.1.7.1.2. Re-usable

- 8.1.7.1. By Usage

- 8.1.8. Others (

- 8.1.1. Temperature Device

- 8.1. Market Analysis, Insights and Forecast - by Product/Equipment Type

- 9. Rest of the World COVID-19 Safety and Prevention Products Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product/Equipment Type

- 9.1.1. Temperature Device

- 9.1.1.1. By Type

- 9.1.1.1.1. Infrared Thermometer

- 9.1.1.1.2. Thermal Imagers

- 9.1.1.1. By Type

- 9.1.2. Ventilators

- 9.1.2.1. Invasive/Mechanical Ventilators

- 9.1.2.2. Non-invasive Ventilators

- 9.1.3. Isolation Chambers

- 9.1.4. Protective Face Masks

- 9.1.4.1. Cloth Based Face Masks

- 9.1.4.2. Surgical Masks

- 9.1.4.3. Respirators

- 9.1.4.3.1. By Filter Standard

- 9.1.4.3.1.1. US Based Filter Class

- 9.1.4.3.1.1.1. N - Series

- 9.1.4.3.1.1.2. P - Series

- 9.1.4.3.1.1.3. R - Series

- 9.1.4.3.1.2. European Based Filter Class

- 9.1.4.3.1.2.1. FFP1

- 9.1.4.3.1.2.2. FFP2

- 9.1.4.3.1.2.3. FFP3

- 9.1.4.3.1.1. US Based Filter Class

- 9.1.4.3.1. By Filter Standard

- 9.1.5. Sanitizers

- 9.1.5.1. By Format

- 9.1.5.1.1. Gel

- 9.1.5.1.2. Foam

- 9.1.5.1.3. Liquid

- 9.1.5.1.4. Wipe

- 9.1.5.1.5. Spray

- 9.1.5.1. By Format

- 9.1.6. Gloves

- 9.1.6.1. By Material Type

- 9.1.6.1.1. Rubber

- 9.1.6.1.2. Poly(vinyl Chloride)

- 9.1.6.1.3. Poly Chloroprene

- 9.1.6.1.4. Nitrile

- 9.1.6.1. By Material Type

- 9.1.7. Medical Gowns (Coveralls)

- 9.1.7.1. By Usage

- 9.1.7.1.1. Disposable

- 9.1.7.1.2. Re-usable

- 9.1.7.1. By Usage

- 9.1.8. Others (

- 9.1.1. Temperature Device

- 9.1. Market Analysis, Insights and Forecast - by Product/Equipment Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Sterisets International BV

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Reckitt Benckiser Group PLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Ansell Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Medica Europe BV

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 HEYER Medical AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Guangzhou Pidegree Medical Technology Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Dynarex Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Koninklijke Philips N V

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Cardinal Health Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 DUPONT de Nemours Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 3M Company

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Medtronic PLC

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 A&D Company Limited*List Not Exhaustive

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Shandong Yuyuan Latex Gloves Co Ltd

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Shield Scientific

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Microgen Hygiene Pvt Ltd

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Procter & Gamble (P&G) Company

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 ResMed Inc

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 Smiths Medical Inc

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 Kimberly Clark Corporation

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.1 Sterisets International BV

List of Figures

- Figure 1: Global COVID-19 Safety and Prevention Products Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America COVID-19 Safety and Prevention Products Revenue (undefined), by Product/Equipment Type 2025 & 2033

- Figure 3: North America COVID-19 Safety and Prevention Products Revenue Share (%), by Product/Equipment Type 2025 & 2033

- Figure 4: North America COVID-19 Safety and Prevention Products Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America COVID-19 Safety and Prevention Products Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe COVID-19 Safety and Prevention Products Revenue (undefined), by Product/Equipment Type 2025 & 2033

- Figure 7: Europe COVID-19 Safety and Prevention Products Revenue Share (%), by Product/Equipment Type 2025 & 2033

- Figure 8: Europe COVID-19 Safety and Prevention Products Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe COVID-19 Safety and Prevention Products Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific COVID-19 Safety and Prevention Products Revenue (undefined), by Product/Equipment Type 2025 & 2033

- Figure 11: Asia Pacific COVID-19 Safety and Prevention Products Revenue Share (%), by Product/Equipment Type 2025 & 2033

- Figure 12: Asia Pacific COVID-19 Safety and Prevention Products Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific COVID-19 Safety and Prevention Products Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World COVID-19 Safety and Prevention Products Revenue (undefined), by Product/Equipment Type 2025 & 2033

- Figure 15: Rest of the World COVID-19 Safety and Prevention Products Revenue Share (%), by Product/Equipment Type 2025 & 2033

- Figure 16: Rest of the World COVID-19 Safety and Prevention Products Revenue (undefined), by Country 2025 & 2033

- Figure 17: Rest of the World COVID-19 Safety and Prevention Products Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global COVID-19 Safety and Prevention Products Revenue undefined Forecast, by Product/Equipment Type 2020 & 2033

- Table 2: Global COVID-19 Safety and Prevention Products Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global COVID-19 Safety and Prevention Products Revenue undefined Forecast, by Product/Equipment Type 2020 & 2033

- Table 4: Global COVID-19 Safety and Prevention Products Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Global COVID-19 Safety and Prevention Products Revenue undefined Forecast, by Product/Equipment Type 2020 & 2033

- Table 6: Global COVID-19 Safety and Prevention Products Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global COVID-19 Safety and Prevention Products Revenue undefined Forecast, by Product/Equipment Type 2020 & 2033

- Table 8: Global COVID-19 Safety and Prevention Products Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global COVID-19 Safety and Prevention Products Revenue undefined Forecast, by Product/Equipment Type 2020 & 2033

- Table 10: Global COVID-19 Safety and Prevention Products Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the COVID-19 Safety and Prevention Products?

The projected CAGR is approximately 11.8%.

2. Which companies are prominent players in the COVID-19 Safety and Prevention Products?

Key companies in the market include Sterisets International BV, Reckitt Benckiser Group PLC, Ansell Ltd, Medica Europe BV, HEYER Medical AG, Guangzhou Pidegree Medical Technology Co Ltd, Dynarex Corporation, Koninklijke Philips N V, Cardinal Health Inc, DUPONT de Nemours Inc, 3M Company, Medtronic PLC, A&D Company Limited*List Not Exhaustive, Shandong Yuyuan Latex Gloves Co Ltd, Shield Scientific, Microgen Hygiene Pvt Ltd, Procter & Gamble (P&G) Company, ResMed Inc, Smiths Medical Inc, Kimberly Clark Corporation.

3. What are the main segments of the COVID-19 Safety and Prevention Products?

The market segments include Product/Equipment Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Rising EXIM of Medical Grade Supplies; Reduced Tariff on Protective Equipment.

6. What are the notable trends driving market growth?

Ventilators to Record a Major Share of the Market Studied.

7. Are there any restraints impacting market growth?

; Inadequate Supply of Safety Products Creating a Price Pressure.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "COVID-19 Safety and Prevention Products," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the COVID-19 Safety and Prevention Products report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the COVID-19 Safety and Prevention Products?

To stay informed about further developments, trends, and reports in the COVID-19 Safety and Prevention Products, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence