Key Insights

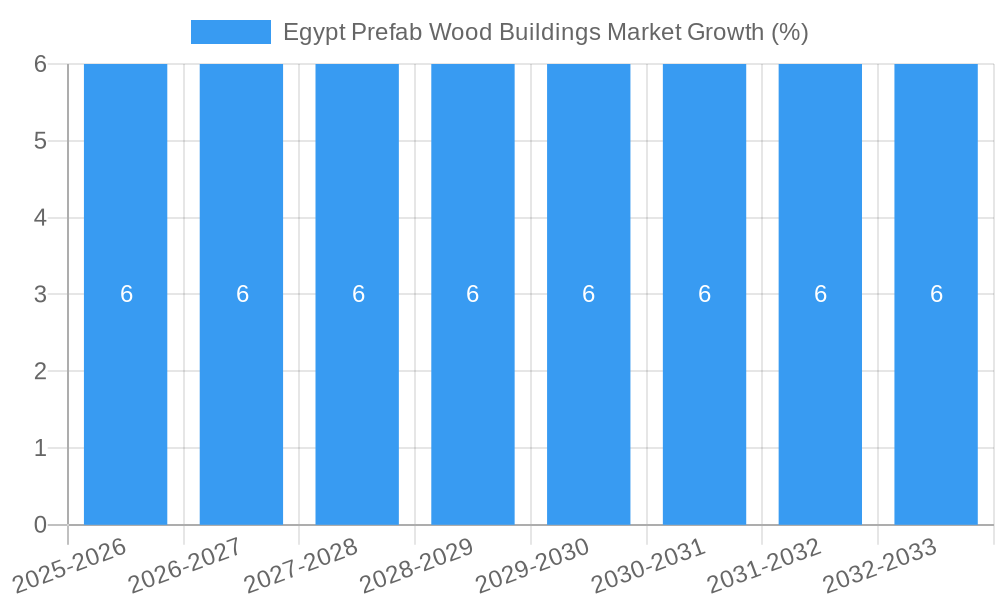

The Egypt prefab wood buildings market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.00% from 2025 to 2033. This expansion is driven by several key factors. The Egyptian government's initiatives promoting sustainable construction practices and affordable housing solutions create a favorable environment for prefab wood structures. Rapid urbanization and a growing population are significantly increasing demand for housing and commercial spaces, fueling the market's growth. Furthermore, the inherent advantages of prefab wood buildings—faster construction times, cost-effectiveness, and reduced environmental impact compared to traditional concrete structures—are attracting both developers and consumers. The market segmentation reveals strong potential across various applications, including single-family and multi-family residential projects, as well as commercial sectors like offices and hospitality. Key players like Arabian Construction House, Stora Enso, and Bouygues Construction are actively shaping the market landscape through innovative designs and construction techniques. However, challenges such as the availability of skilled labor for prefab construction and potential limitations in the supply chain for certain wood panel systems could pose some restraints to market growth. Despite these challenges, the long-term outlook remains positive, underpinned by Egypt's sustained infrastructure development and the increasing adoption of sustainable building materials. The diverse range of wood panel systems available, including CLT, NLT, DLT, and GLT, caters to various project needs and contributes to the market's dynamism.

The market's growth trajectory is expected to remain consistent throughout the forecast period, with a potential acceleration in certain segments. For instance, the multi-family residential sector is likely to witness significant expansion due to the increasing demand for affordable housing in urban centers. The adoption of innovative techniques and designs in prefab wood construction will further fuel growth. The continued investment by both domestic and international companies further strengthens the market's future prospects. Addressing the challenges related to labor availability and supply chain management will be crucial for maximizing the market's potential. Overall, the Egyptian prefab wood buildings market presents a lucrative opportunity for investors and companies involved in the construction and building materials sectors. Continuous innovation and strategic partnerships will be key success factors in navigating the market's complexities and capturing the growing market share.

This comprehensive report provides a detailed analysis of the Egypt Prefab Wood Buildings Market, offering invaluable insights for industry professionals, investors, and stakeholders. We delve into market dynamics, growth trends, key players, and emerging opportunities, providing a 360-degree view of this rapidly evolving sector. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and forecast period 2025-2033. The market is segmented by panel systems (CLT, NLT, DLT, GLT) and application (single-family residential, multi-family residential, office, hospitality, others). The total market size in 2025 is estimated at XX Million units.

Egypt Prefab Wood Buildings Market Dynamics & Structure

The Egyptian prefab wood buildings market exhibits a moderately concentrated structure, with key players like Arabian Construction House, Ideal EV Prefabrik Evim, Stora Enso, Bouygues Construction, Lida Group, SIKA Group, ICON Egypt, DTH Prefabricated Buildings, Karmod Prefabricated Technologies, and Derix holding significant market share. However, the market is witnessing increased competition from new entrants, fueled by technological advancements and government initiatives.

- Market Concentration: The top 5 players account for approximately XX% of the market share in 2025.

- Technological Innovation: CLT and GLT panel systems are driving innovation, offering improved structural performance and sustainability. However, high initial investment costs pose a barrier to wider adoption.

- Regulatory Framework: Government regulations regarding building codes and sustainable construction practices are influencing market growth. Streamlined approval processes could accelerate market expansion.

- Competitive Substitutes: Traditional construction methods remain a significant competitor, though prefab wood buildings offer advantages in speed, cost-effectiveness, and sustainability.

- End-User Demographics: The increasing urbanization and rising demand for affordable housing are key drivers of market growth, particularly in the single-family and multi-family residential segments.

- M&A Trends: The market has witnessed a moderate level of M&A activity in recent years, with approximately XX deals recorded between 2019 and 2024. Consolidation is expected to continue as larger players seek to expand their market share.

Egypt Prefab Wood Buildings Market Growth Trends & Insights

The Egyptian prefab wood buildings market is projected to experience significant growth during the forecast period (2025-2033), driven by factors such as increasing government support for sustainable construction, rising demand for affordable housing, and advancements in prefabrication technologies. The market size is anticipated to reach XX Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX%. This growth is further fueled by increasing awareness of environmental concerns and the advantages of sustainable building materials. Technological disruptions, such as the introduction of advanced panel systems and automated manufacturing processes, are accelerating adoption rates and enhancing efficiency. Changing consumer preferences toward eco-friendly and cost-effective housing solutions are also contributing to market expansion. Market penetration is expected to increase from XX% in 2025 to XX% by 2033.

Dominant Regions, Countries, or Segments in Egypt Prefab Wood Buildings Market

The Greater Cairo area and other major urban centers are leading the market growth, driven by high population density and infrastructure development. The single-family residential segment currently dominates the market, accounting for approximately XX% of the total market size in 2025. However, the multi-family residential segment is expected to witness rapid growth in the coming years.

- Key Drivers:

- Increasing urbanization and population growth in major cities.

- Government initiatives promoting sustainable and affordable housing.

- Development of large-scale infrastructure projects.

- Rising demand for eco-friendly building materials.

- Dominance Factors:

- High population density in urban areas.

- Robust infrastructure development.

- Favorable government policies.

- Growing awareness of environmental sustainability.

The CLT panel system currently holds the largest market share within the panel systems segment, owing to its superior structural performance and versatility. However, the adoption of other panel systems like GLT is expected to increase due to cost-effectiveness.

Egypt Prefab Wood Buildings Market Product Landscape

Prefab wood buildings in Egypt are increasingly incorporating advanced technologies, such as innovative panel systems (CLT, GLT), and sustainable materials, offering improved structural integrity, energy efficiency, and reduced construction time. Unique selling propositions include faster construction timelines, reduced labor costs, and enhanced sustainability compared to traditional construction methods.

Key Drivers, Barriers & Challenges in Egypt Prefab Wood Buildings Market

Key Drivers:

- Government support for sustainable construction: Initiatives promoting green building practices are boosting market growth.

- Rising demand for affordable housing: Prefab construction offers a cost-effective solution to meet the housing needs of a growing population.

- Technological advancements: Innovations in panel systems and manufacturing processes are improving efficiency and quality.

Challenges and Restraints:

- High initial investment costs: The upfront cost of prefab wood buildings can be higher than traditional methods, limiting adoption by some consumers.

- Limited skilled labor: A shortage of skilled labor familiar with prefab construction techniques can hinder project implementation.

- Supply chain disruptions: Global supply chain disruptions can impact the availability of raw materials and components. This factor reduced market growth by an estimated XX% in 2022.

Emerging Opportunities in Egypt Prefab Wood Buildings Market

- Untapped markets in rural areas: Expanding into less developed regions presents significant growth potential.

- Innovative applications in commercial and industrial sectors: Prefab wood buildings are increasingly being used for offices, hotels, and other commercial spaces.

- Government incentives for sustainable construction: Incentives and subsidies can stimulate market growth.

Growth Accelerators in the Egypt Prefab Wood Buildings Market Industry

The Egyptian prefab wood buildings market is poised for sustained growth driven by continued technological innovation, strategic collaborations between manufacturers and construction firms, and expansion into new geographic markets. Government initiatives promoting sustainable building practices will further accelerate this growth.

Key Players Shaping the Egypt Prefab Wood Buildings Market Market

- Arabian Construction House

- Ideal EV Prefabrik Evim

- Stora Enso

- Bouygues Construction

- Lida Group

- SIKA Group

- ICON Egypt

- DTH Prefabricated Buildings

- Karmod Prefabricated Technologies

- Derix

Notable Milestones in Egypt Prefab Wood Buildings Market Sector

- November 2023: ICON Egypt's subsidiary secures a $10.66 million contract for a prefabricated buildings project in Saudi Arabia, signaling expansion into regional markets.

- December 2022: Modulex Modular Buildings secures USD 600 million in funding through a SPAC deal, including plans for a new facility in Egypt, boosting the potential for increased competition and capacity in the Egyptian market.

In-Depth Egypt Prefab Wood Buildings Market Market Outlook

The future of the Egyptian prefab wood buildings market appears promising, with continued growth driven by favorable government policies, technological innovation, and increasing demand for sustainable and affordable housing. Strategic partnerships and investments in research and development will further propel market expansion, unlocking significant opportunities for both established players and new entrants. The market is poised for substantial growth, presenting attractive opportunities for investors and businesses.

Egypt Prefab Wood Buildings Market Segmentation

-

1. Panel Systems

- 1.1. Cross-laminated timber (CLT) panels

- 1.2. Nail-laminated timber (NLT) panels

- 1.3. Dowel-laminated timber (DLT) panels

- 1.4. Glue-laminated timber (GLT) columns and beams

-

2. Application

- 2.1. Single Family Residential

- 2.2. Multi-family Residential

- 2.3. Office

- 2.4. Hospitality

- 2.5. Others

Egypt Prefab Wood Buildings Market Segmentation By Geography

- 1. Egypt

Egypt Prefab Wood Buildings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges

- 3.4. Market Trends

- 3.4.1. Growing Construction Activities in Egypt

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Prefab Wood Buildings Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Panel Systems

- 5.1.1. Cross-laminated timber (CLT) panels

- 5.1.2. Nail-laminated timber (NLT) panels

- 5.1.3. Dowel-laminated timber (DLT) panels

- 5.1.4. Glue-laminated timber (GLT) columns and beams

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Single Family Residential

- 5.2.2. Multi-family Residential

- 5.2.3. Office

- 5.2.4. Hospitality

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Panel Systems

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Arabian Construction House

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ideal EV Prefabrik Evim

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Stora Enso

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bouygues Construction**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lida Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SIKA Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ICON Egypt

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DTH Prefabricated Buildings

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Karmod Prefabricated Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Derix

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Arabian Construction House

List of Figures

- Figure 1: Egypt Prefab Wood Buildings Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Egypt Prefab Wood Buildings Market Share (%) by Company 2024

List of Tables

- Table 1: Egypt Prefab Wood Buildings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Egypt Prefab Wood Buildings Market Revenue Million Forecast, by Panel Systems 2019 & 2032

- Table 3: Egypt Prefab Wood Buildings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Egypt Prefab Wood Buildings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Egypt Prefab Wood Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Egypt Prefab Wood Buildings Market Revenue Million Forecast, by Panel Systems 2019 & 2032

- Table 7: Egypt Prefab Wood Buildings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Egypt Prefab Wood Buildings Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Prefab Wood Buildings Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Egypt Prefab Wood Buildings Market?

Key companies in the market include Arabian Construction House, Ideal EV Prefabrik Evim, Stora Enso, Bouygues Construction**List Not Exhaustive, Lida Group, SIKA Group, ICON Egypt, DTH Prefabricated Buildings, Karmod Prefabricated Technologies, Derix.

3. What are the main segments of the Egypt Prefab Wood Buildings Market?

The market segments include Panel Systems, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units.

6. What are the notable trends driving market growth?

Growing Construction Activities in Egypt.

7. Are there any restraints impacting market growth?

4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges.

8. Can you provide examples of recent developments in the market?

November 2023: Egyptian ICON’s unit signs contract for $10.66mln Gulf-focused project in Saudi Arabia. The factory aims to cover the Saudi market as well as the Gulf region with all its needs for prefabricated buildings, according to Elwan. Prefabricated Buildings Development Industrial Company, a 100%-owned subsidiary of the Egypt-based listed Industrial Engineering Company for Construction and Development (ICON), has penned a contract to develop a project in Saudi Arabia. Prefabricated Buildings will build a factory in Tabuk at investments worth SAR 40 million to produce prefabricated units and light metal sections (LGS), according to a bourse filing

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Prefab Wood Buildings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Prefab Wood Buildings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Prefab Wood Buildings Market?

To stay informed about further developments, trends, and reports in the Egypt Prefab Wood Buildings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence