Key Insights

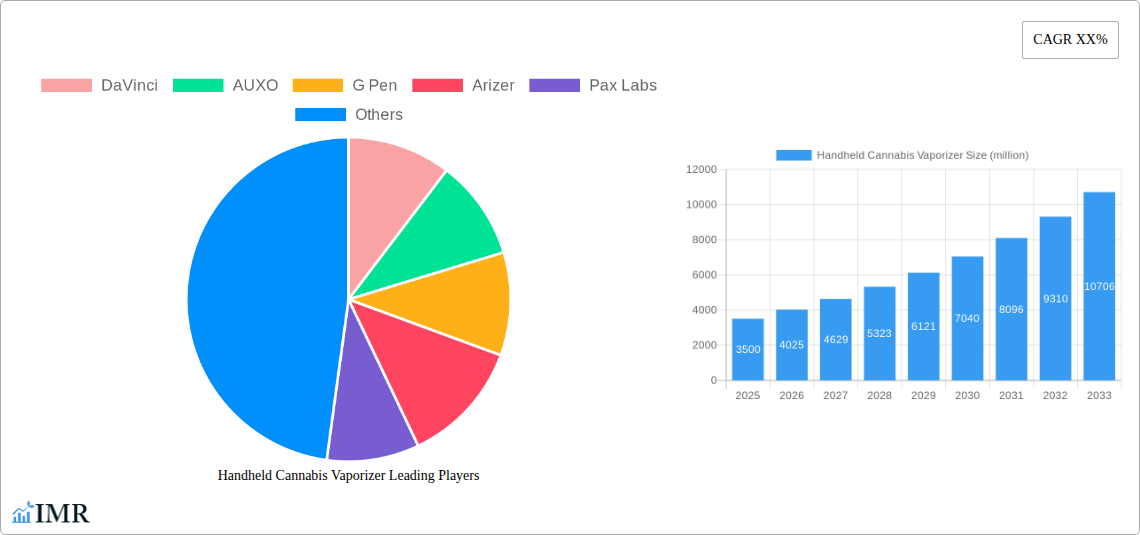

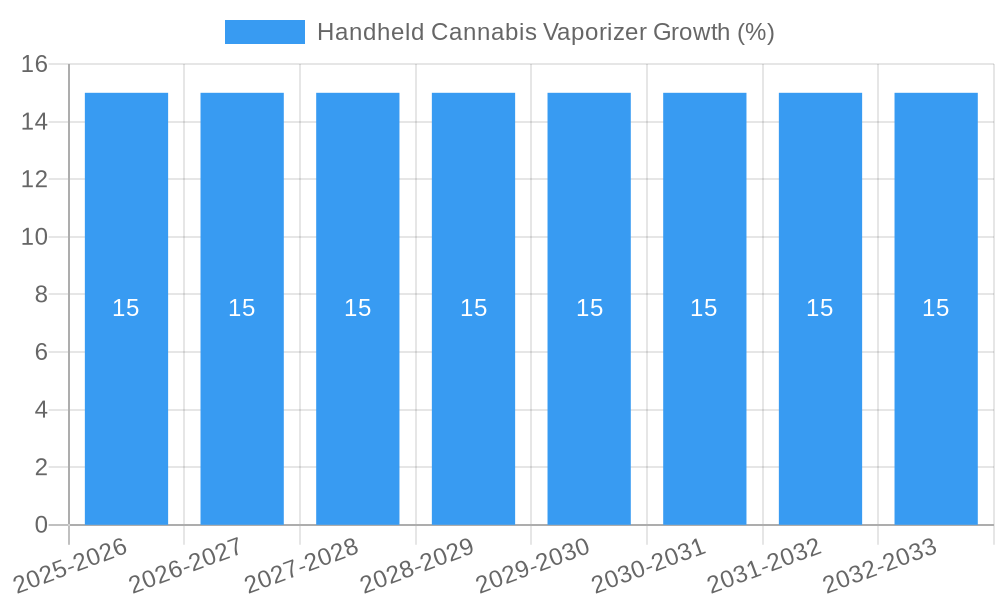

The global handheld cannabis vaporizer market is experiencing robust expansion, driven by a confluence of factors including increasing legalization of cannabis for medicinal and recreational use, a growing consumer preference for discreet and portable vaporization methods, and continuous technological advancements in vaporizer design and functionality. The market is projected to reach an estimated value of $3,500 million by the end of 2025, with a projected Compound Annual Growth Rate (CAGR) of approximately 15% over the forecast period of 2025-2033. This growth trajectory is significantly influenced by the rising adoption of cannabis for therapeutic purposes, particularly for pain management, anxiety, and other medical conditions, which necessitates sophisticated and user-friendly devices like handheld vaporizers. Furthermore, the increasing disposable income in key regions and a growing awareness about the health benefits of vaporization over combustion are also contributing to market buoyancy.

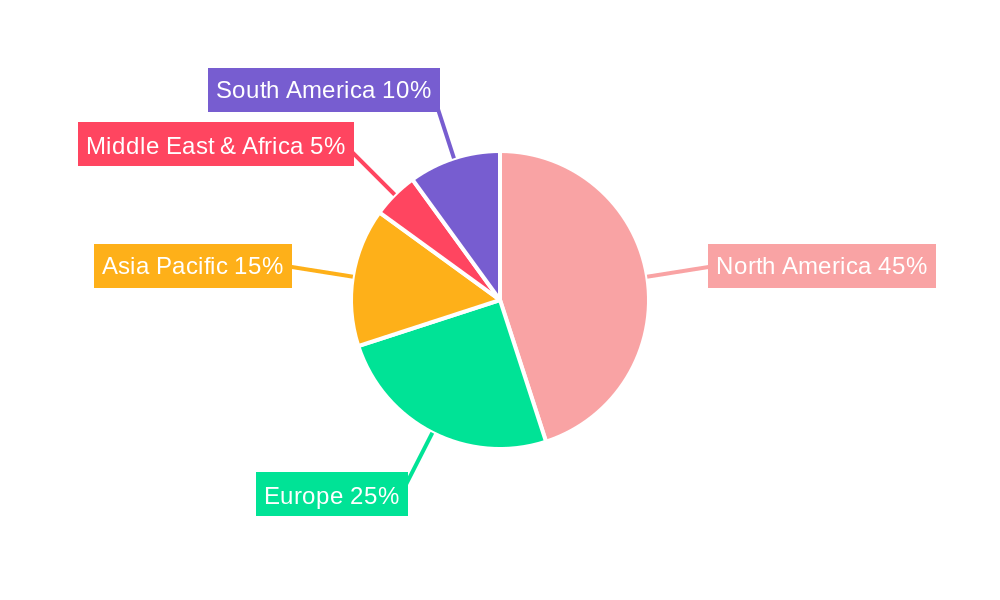

Key market drivers include the expanding legal cannabis landscape across North America and Europe, coupled with the rising demand from the leisure segment for portable and stylish vaping devices. However, stringent regulatory frameworks concerning the production, marketing, and sale of cannabis-derived products, along with potential health concerns associated with vaping, represent significant restraints. The market is segmented by application into Healthcare and Leisure, with Healthcare application expected to witness substantial growth due to the increasing integration of cannabis-based therapies. In terms of types, conduction and convection vaporization methods dominate the market, offering efficient and customizable user experiences. Geographically, North America currently leads the market share, owing to its advanced legal framework and high consumer acceptance, followed by Europe. The Asia Pacific region, however, is anticipated to emerge as a high-growth market in the coming years, propelled by evolving regulatory landscapes and increasing consumer interest.

This in-depth market research report provides an exhaustive analysis of the global handheld cannabis vaporizer market, encompassing historical performance, current trends, and future projections. Spanning the study period from 2019 to 2033, with a base year of 2025, the report offers critical insights into market dynamics, growth drivers, segmentation, key players, and emerging opportunities. It is an essential resource for industry professionals, investors, and stakeholders seeking to understand the evolving landscape of cannabis consumption devices and their integration within both parent and child market structures.

Handheld Cannabis Vaporizer Market Dynamics & Structure

The handheld cannabis vaporizer market is characterized by a dynamic interplay of technological innovation, evolving regulatory frameworks, and shifting consumer preferences. Market concentration varies significantly across regions, with established players and emerging innovators vying for market share. Key drivers of technological advancement include the pursuit of enhanced user experience, improved material efficiency, and discreet design. Regulatory landscapes, often a patchwork of state and national laws, significantly influence market access and product development. Competitive product substitutes, such as traditional smoking methods and edibles, continue to pose a challenge, though the health and convenience benefits of vaporizers are driving adoption. End-user demographics are broadening, encompassing both medical patients and recreational users across various age groups. Mergers and acquisitions (M&A) activity has been a notable trend, with larger companies acquiring innovative startups to expand their product portfolios and market reach. For instance, the last two years have seen an estimated 30 M&A deals, indicating a consolidation phase in the industry. Barriers to innovation include the cost of research and development, stringent quality control requirements, and the ongoing need to navigate complex compliance procedures.

- Market Concentration: Fragmented in some regions, consolidating in others, with a growing number of specialized brands.

- Technological Innovation Drivers: Improved battery life, precise temperature control, ceramic and quartz heating elements, and smart connectivity features.

- Regulatory Frameworks: Varying legal statuses for cannabis globally and regionally impacting product approval and sales channels.

- Competitive Product Substitutes: Traditional smoking devices, edibles, tinctures, and concentrates.

- End-User Demographics: Increasingly diverse, with a significant segment of health-conscious individuals and discerning recreational users.

- M&A Trends: Increasing consolidation as established companies seek to acquire innovative technologies and market presence.

Handheld Cannabis Vaporizer Growth Trends & Insights

The global handheld cannabis vaporizer market is poised for substantial growth, projected to reach approximately $18.5 billion in 2025, with a compound annual growth rate (CAGR) of 12.8% expected between 2025 and 2033. This impressive expansion is fueled by increasing legalization of cannabis for both medicinal and recreational purposes worldwide, a growing awareness of the health benefits associated with vaporization over smoking, and continuous product innovation. Adoption rates for handheld vaporizers have seen a steady climb, driven by their portability, discretion, and user-friendly interfaces. Technological disruptions are constantly reshaping the market, with advancements in battery technology, materials science (e.g., ceramic and quartz heating chambers), and temperature control systems enhancing the user experience. Consumer behavior is shifting towards more sophisticated and personalized consumption methods, with a preference for devices that offer precise control over vapor quality and flavor. The convenience and efficiency of handheld vaporizers, compared to traditional methods, are major contributing factors to their rising popularity. Market penetration is expected to further accelerate as regulatory landscapes become more favorable and educational initiatives highlight the advantages of vaporization. The market size evolution indicates a transition from a niche product to a mainstream consumer device within the broader cannabis ecosystem.

- Market Size Evolution: Projected to grow from an estimated $10.2 billion in 2019 to over $18.5 billion by 2025.

- Adoption Rates: Steadily increasing globally, driven by legalization and consumer preference for healthier alternatives.

- Technological Disruptions: Advancements in battery efficiency, precision temperature control, and advanced material usage in heating elements.

- Consumer Behavior Shifts: Growing demand for portable, discreet, and customizable vaporization experiences.

- Market Penetration: Expected to rise significantly as more regions legalize cannabis and as product awareness increases.

- CAGR (2025-2033): Forecasted at 12.8%, indicating robust long-term growth.

Dominant Regions, Countries, or Segments in Handheld Cannabis Vaporizer

North America, particularly the United States and Canada, currently dominates the global handheld cannabis vaporizer market, driven by widespread legalization of cannabis for medical and recreational use and a mature consumer base. The United States, with its large population and numerous states enacting favorable cannabis laws, represents the largest single market. Canada’s federal legalization has also spurred significant growth. Within the United States, states like California, Colorado, and Washington lead in terms of market size and adoption rates, supported by strong retail infrastructure and active consumer engagement.

The Leisure application segment is the primary growth engine, accounting for an estimated 70% of the market share. This is attributed to the increasing acceptance of cannabis for recreational use and the demand for portable, discreet, and convenient consumption methods for social settings and personal enjoyment. The Healthcare segment, while smaller, is exhibiting strong growth potential, driven by the therapeutic applications of cannabis and the increasing adoption of vaporizers by medical patients seeking controlled and efficient delivery of cannabinoids.

Among the product types, Convection vaporizers are gaining significant traction, representing approximately 45% of the market. Convection heating, which heats the cannabis by circulating hot air around it, is favored for its ability to provide consistent vapor production, preserve flavor, and prevent combustion, leading to a more efficient and healthier experience. Conduction vaporizers, where the material is heated directly by contact with a heated surface, hold a substantial market share of around 35%, often due to their lower price point and faster heat-up times. Induction vaporizers, a newer technology, are emerging and capturing a smaller but growing segment (around 10%) due to their precise temperature control and efficient heating.

- Dominant Region: North America (USA & Canada)

- Key Drivers: Widespread legalization, strong consumer demand, established distribution networks.

- Market Share: Estimated 65% of the global market.

- Growth Potential: Continues to be high due to ongoing legal expansions and product innovation.

- Dominant Application Segment: Leisure

- Market Share: Approximately 70%.

- Key Drivers: Growing recreational cannabis market, demand for portability and discretion.

- Dominant Product Type: Convection

- Market Share: Approximately 45%.

- Key Drivers: Superior vapor quality, flavor preservation, efficient heating.

- Key Countries: United States, Canada

- Economic Policies: Favorable cannabis legislation and taxation structures.

- Infrastructure: Robust retail and online sales channels.

Handheld Cannabis Vaporizer Product Landscape

The handheld cannabis vaporizer product landscape is characterized by a relentless pursuit of user-centric innovation, focusing on enhanced portability, discretion, and precise control. Manufacturers are integrating advanced materials like ceramic and quartz for heating chambers, ensuring cleaner vapor and superior flavor profiles. Battery technology is a critical area of development, with a push towards longer battery life and faster charging capabilities. Features such as precise temperature control, customizable session timers, and even smart connectivity for app-based control are becoming standard in premium devices. Unique selling propositions often revolve around specific heating technologies, such as the efficient convection systems offered by Arizer and STORZ & BICKEL, or the innovative designs from Pax Labs. Brands like DaVinci are known for their all-glass vapor paths, emphasizing purity, while G Pen and Dr. Dabber focus on concentrate vaporization with robust atomizers. The diversity in product offerings caters to a wide spectrum of consumer preferences and budgets, from entry-level devices to high-end, technologically advanced units.

Key Drivers, Barriers & Challenges in Handheld Cannabis Vaporizer

The handheld cannabis vaporizer market is propelled by several key drivers, including the increasing global legalization of cannabis for both medical and recreational use, leading to expanded market access and consumer adoption. Growing consumer awareness regarding the health benefits of vaporization compared to smoking, such as reduced lung irritation and avoidance of combustion byproducts, is a significant factor. Technological advancements, including improved battery efficiency, precise temperature control, and the use of premium materials in heating elements, are enhancing user experience and product appeal.

However, the market also faces significant challenges and restraints. Stringent and evolving regulatory frameworks across different jurisdictions create complexity and uncertainty for manufacturers and distributors. High research and development costs associated with innovative technologies can be a barrier. Supply chain disruptions, particularly for specialized components, can impact production and availability. Intense competition from established brands and new entrants, coupled with price sensitivity among some consumer segments, also poses a challenge. Furthermore, the perception of vaporizers as solely recreational devices in some conservative markets can limit broader adoption in the healthcare segment.

- Key Drivers:

- Global cannabis legalization trends.

- Health consciousness and preference for vaporizing over smoking.

- Technological advancements in battery life and temperature control.

- Increasing product variety and accessibility.

- Barriers & Challenges:

- Complex and evolving regulatory environments.

- High R&D and manufacturing costs.

- Supply chain vulnerabilities.

- Intense market competition and pricing pressures.

- Negative public perception in some regions.

Emerging Opportunities in Handheld Cannabis Vaporizer

Emerging opportunities within the handheld cannabis vaporizer market are abundant, particularly in the development of advanced medical-grade vaporizers for precise cannabinoid delivery under clinical supervision. The untapped potential of emerging markets in Asia and Latin America, as cannabis regulations liberalize, presents significant growth avenues. Innovations in material science, leading to more durable, efficient, and aesthetically pleasing devices, are expected to drive consumer interest. Furthermore, the integration of smart technology for personalized dosing and health tracking, catering to both medical patients and wellness-focused consumers, represents a key area for future development. Evolving consumer preferences towards sustainable and eco-friendly products are also creating opportunities for brands that prioritize responsible manufacturing practices.

Growth Accelerators in the Handheld Cannabis Vaporizer Industry

Several catalysts are accelerating the growth of the handheld cannabis vaporizer industry. Technological breakthroughs, such as the development of more efficient heating elements and longer-lasting, faster-charging batteries, are enhancing user experience and device appeal. Strategic partnerships between vaporizer manufacturers and licensed cannabis producers are creating integrated product offerings and expanding market reach. Furthermore, successful market expansion strategies into new geographical territories with favorable regulatory environments, coupled with effective consumer education campaigns highlighting the benefits of vaporization, are significant growth accelerators. The increasing trend of product personalization, allowing consumers to tailor their vaporizing experience, is also driving demand and market growth.

Key Players Shaping the Handheld Cannabis Vaporizer Market

- DaVinci

- AUXO

- G Pen

- Arizer

- Pax Labs

- STORZ & BICKEL

- Apollo Air Vape Incorporation

- Stundenglass

- Dr. Dabber

- Higher Standards

- Marley Natural

- Eyce

- Atmos RX

- Boundless Technology LLC

- Dip Devices Inc.

- Dr. Dabber Inc.

- Kandy Pens Incorporation

- Linx Vapor Incorporation

- Mig Vapor LLC

- Puff Corporation

Notable Milestones in Handheld Cannabis Vaporizer Sector

- 2019: Launch of Pax Era Pro by Pax Labs, featuring advanced temperature control and an e-ink display.

- 2020: STORZ & BICKEL introduces the VOLCANO HYBRID, integrating a hybrid heating system for both bag and hose vaporization.

- 2021: G Pen releases the Connect, a portable concentrate vaporizer designed for seamless attachment to existing water pipes.

- 2022: Arizer launches the Arizer Solo 3, focusing on improved airflow and dual-use capability for both dry herb and concentrates.

- 2023: DaVinci announces the launch of their IQ2 model, emphasizing purity, precision, and user customization.

- 2024: Increased M&A activity as larger players acquire smaller, innovative companies to consolidate market share and technology portfolios.

In-Depth Handheld Cannabis Vaporizer Market Outlook

The outlook for the handheld cannabis vaporizer market remains exceptionally bright, driven by sustained legalization trends and an increasing consumer preference for sophisticated, health-conscious consumption methods. Growth accelerators, including ongoing technological innovation in battery life, material science, and user interface design, are poised to further enhance product offerings and attract a broader consumer base. Strategic partnerships and effective market expansion into nascent legal territories will be crucial for capturing future market share. The industry is expected to witness continued product diversification, catering to both the recreational and burgeoning medical applications of cannabis. Overall, the market is projected for robust, long-term growth, presenting significant strategic opportunities for companies that can adapt to evolving regulations, embrace technological advancements, and meet the sophisticated demands of consumers worldwide.

Handheld Cannabis Vaporizer Segmentation

-

1. Application

- 1.1. Healthcare

- 1.2. Leisure

-

2. Types

- 2.1. Conduction

- 2.2. Convection

- 2.3. Induction

- 2.4. Others

Handheld Cannabis Vaporizer Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Handheld Cannabis Vaporizer REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Handheld Cannabis Vaporizer Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Healthcare

- 5.1.2. Leisure

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Conduction

- 5.2.2. Convection

- 5.2.3. Induction

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Handheld Cannabis Vaporizer Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Healthcare

- 6.1.2. Leisure

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Conduction

- 6.2.2. Convection

- 6.2.3. Induction

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Handheld Cannabis Vaporizer Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Healthcare

- 7.1.2. Leisure

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Conduction

- 7.2.2. Convection

- 7.2.3. Induction

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Handheld Cannabis Vaporizer Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Healthcare

- 8.1.2. Leisure

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Conduction

- 8.2.2. Convection

- 8.2.3. Induction

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Handheld Cannabis Vaporizer Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Healthcare

- 9.1.2. Leisure

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Conduction

- 9.2.2. Convection

- 9.2.3. Induction

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Handheld Cannabis Vaporizer Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Healthcare

- 10.1.2. Leisure

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Conduction

- 10.2.2. Convection

- 10.2.3. Induction

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 DaVinci

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AUXO

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 G Pen

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Arizer

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pax Labs

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 STORZ & BICKEL

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Apollo Air Vape Incorporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Stundenglass

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dr. Dabber

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Higher Standards

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Marley Natural

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Eyce

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Atmos RX

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Boundless Technology LLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Dip Devices Inc.

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Dr. Dabber Inc.

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Kandy Pens Incorporation

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Linx Vapor Incorporation

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Mig Vapor LLC

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Puff Corporation

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 DaVinci

List of Figures

- Figure 1: Global Handheld Cannabis Vaporizer Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Handheld Cannabis Vaporizer Revenue (million), by Application 2024 & 2032

- Figure 3: North America Handheld Cannabis Vaporizer Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Handheld Cannabis Vaporizer Revenue (million), by Types 2024 & 2032

- Figure 5: North America Handheld Cannabis Vaporizer Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Handheld Cannabis Vaporizer Revenue (million), by Country 2024 & 2032

- Figure 7: North America Handheld Cannabis Vaporizer Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Handheld Cannabis Vaporizer Revenue (million), by Application 2024 & 2032

- Figure 9: South America Handheld Cannabis Vaporizer Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Handheld Cannabis Vaporizer Revenue (million), by Types 2024 & 2032

- Figure 11: South America Handheld Cannabis Vaporizer Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Handheld Cannabis Vaporizer Revenue (million), by Country 2024 & 2032

- Figure 13: South America Handheld Cannabis Vaporizer Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Handheld Cannabis Vaporizer Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Handheld Cannabis Vaporizer Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Handheld Cannabis Vaporizer Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Handheld Cannabis Vaporizer Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Handheld Cannabis Vaporizer Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Handheld Cannabis Vaporizer Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Handheld Cannabis Vaporizer Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Handheld Cannabis Vaporizer Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Handheld Cannabis Vaporizer Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Handheld Cannabis Vaporizer Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Handheld Cannabis Vaporizer Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Handheld Cannabis Vaporizer Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Handheld Cannabis Vaporizer Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Handheld Cannabis Vaporizer Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Handheld Cannabis Vaporizer Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Handheld Cannabis Vaporizer Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Handheld Cannabis Vaporizer Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Handheld Cannabis Vaporizer Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Handheld Cannabis Vaporizer Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Handheld Cannabis Vaporizer Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Handheld Cannabis Vaporizer Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Handheld Cannabis Vaporizer Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Handheld Cannabis Vaporizer Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Handheld Cannabis Vaporizer Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Handheld Cannabis Vaporizer Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Handheld Cannabis Vaporizer Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Handheld Cannabis Vaporizer Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Handheld Cannabis Vaporizer Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Handheld Cannabis Vaporizer Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Handheld Cannabis Vaporizer Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Handheld Cannabis Vaporizer Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Handheld Cannabis Vaporizer Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Handheld Cannabis Vaporizer Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Handheld Cannabis Vaporizer Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Handheld Cannabis Vaporizer Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Handheld Cannabis Vaporizer Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Handheld Cannabis Vaporizer Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Handheld Cannabis Vaporizer Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Handheld Cannabis Vaporizer?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Handheld Cannabis Vaporizer?

Key companies in the market include DaVinci, AUXO, G Pen, Arizer, Pax Labs, STORZ & BICKEL, Apollo Air Vape Incorporation, Stundenglass, Dr. Dabber, Higher Standards, Marley Natural, Eyce, Atmos RX, Boundless Technology LLC, Dip Devices Inc., Dr. Dabber Inc., Kandy Pens Incorporation, Linx Vapor Incorporation, Mig Vapor LLC, Puff Corporation.

3. What are the main segments of the Handheld Cannabis Vaporizer?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Handheld Cannabis Vaporizer," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Handheld Cannabis Vaporizer report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Handheld Cannabis Vaporizer?

To stay informed about further developments, trends, and reports in the Handheld Cannabis Vaporizer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence