Key Insights

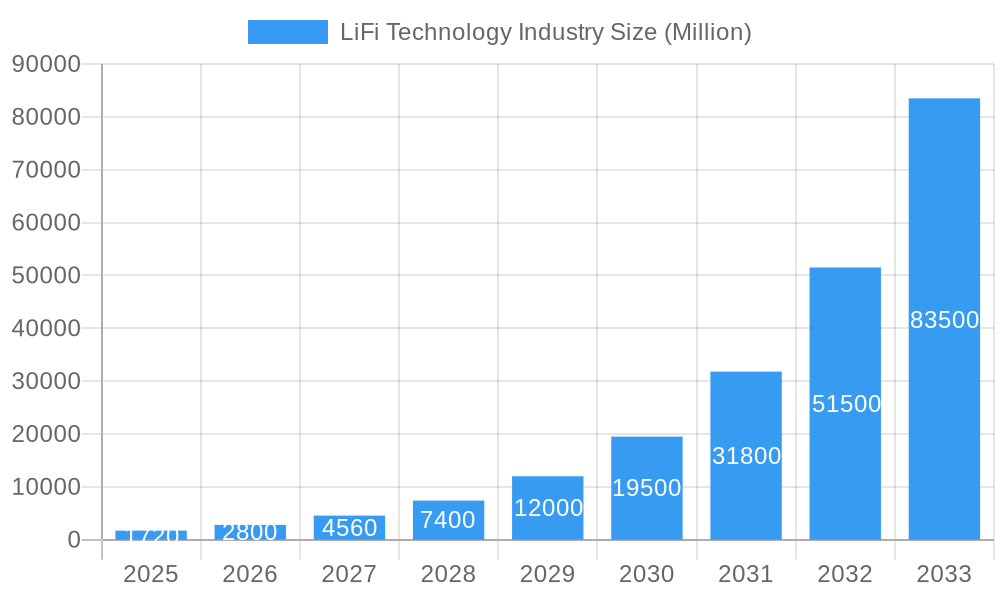

The LiFi technology market is experiencing explosive growth, projected to reach $1.72 billion in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 62.90%. This rapid expansion is driven by several key factors. Firstly, the increasing demand for high-speed, secure, and energy-efficient wireless communication solutions across diverse sectors fuels adoption. Industries like healthcare (requiring secure data transmission in sensitive environments), industrial automation (needing reliable, interference-free connectivity), and corporate buildings (seeking enhanced network capacity) are significant drivers. Furthermore, the growing concerns surrounding cybersecurity and the limitations of Wi-Fi in certain environments are pushing the adoption of LiFi's superior security features and immunity to radio frequency interference. The diverse range of end-user industries – including retail, education, residential, aerospace & defense, and automotive – presents a vast and expanding market opportunity. Technological advancements in LED lighting and LiFi chipsets are further contributing to cost reductions and improved performance, making LiFi a more attractive alternative to traditional wireless technologies.

LiFi Technology Industry Market Size (In Billion)

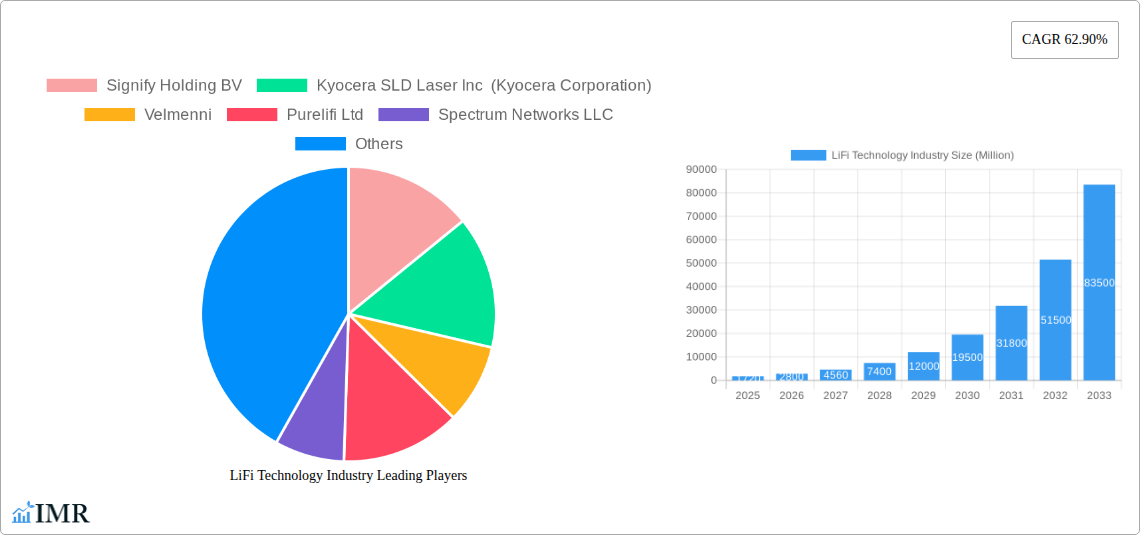

The market's growth trajectory is expected to continue throughout the forecast period (2025-2033). However, certain restraints might influence the pace of adoption. High initial infrastructure costs for LiFi implementation, especially in large-scale deployments, could present a barrier to entry for some businesses. Moreover, the need for line-of-sight between the light source and the receiver limits its applications in certain scenarios. Nevertheless, ongoing innovation in LiFi technology, including the development of more affordable and versatile solutions, is likely to mitigate these challenges and unlock further market potential. Competition among key players like Signify Holding BV, Kyocera SLD Laser Inc, and Velmenni is fostering innovation and driving down costs, ensuring a dynamic and competitive landscape that benefits end-users. The Asia-Pacific region, with its burgeoning technological advancements and high population density, is projected to lead the market growth in the coming years.

LiFi Technology Industry Company Market Share

LiFi Technology Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the LiFi technology industry, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report utilizes data from both historical (2019-2024) and forecast (2025-2033) periods to offer a complete picture of this burgeoning market. The analysis encompasses various segments, including key players like Signify Holding BV, Kyocera SLD Laser Inc, and Velmenni, and examines the parent market of optical wireless communication and its child market of LiFi technology. Expect detailed insights into market size (in millions of units), CAGR, market penetration, and regional dominance.

LiFi Technology Industry Market Dynamics & Structure

The LiFi technology market is characterized by moderate concentration, with a few key players holding significant market share. However, the landscape is dynamic, with ongoing technological advancements and new entrants driving competition. The market is fueled by increasing demand for high-speed, secure, and energy-efficient wireless communication solutions. Regulatory frameworks, while still evolving, are increasingly supportive of LiFi technology adoption. The industry faces competition from established technologies like Wi-Fi, but LiFi's unique advantages, particularly in high-interference environments, offer a compelling alternative.

- Market Concentration: Moderate, with the top 5 players holding approximately xx% of the market share in 2025.

- Technological Innovation: Rapid advancements in LED technology, light modulation techniques, and receiver sensitivity are key drivers.

- Regulatory Framework: Favorable regulations in several regions are accelerating adoption, although standardization efforts are ongoing.

- Competitive Substitutes: Primarily Wi-Fi and other wireless technologies, but LiFi offers advantages in specific applications.

- End-User Demographics: Diverse, ranging from industrial settings to residential use, with significant potential across sectors.

- M&A Trends: A moderate number of mergers and acquisitions (xx deals in 2019-2024) have consolidated the market and fostered innovation.

LiFi Technology Industry Growth Trends & Insights

The LiFi technology market experienced significant growth during the historical period (2019-2024), with a CAGR of xx%. This growth is projected to continue throughout the forecast period (2025-2033), driven by factors such as increasing data traffic, demand for secure communication, and the deployment of smart lighting infrastructure. Market penetration in key sectors, such as healthcare and industrial settings, is expected to rise considerably. Technological disruptions, including advancements in LED technology and improved receiver sensitivity, are further accelerating market expansion. Consumer behavior shifts, towards greater adoption of smart devices and the IoT, are creating favorable conditions for LiFi technology adoption. The global market size is projected to reach xx million units by 2033.

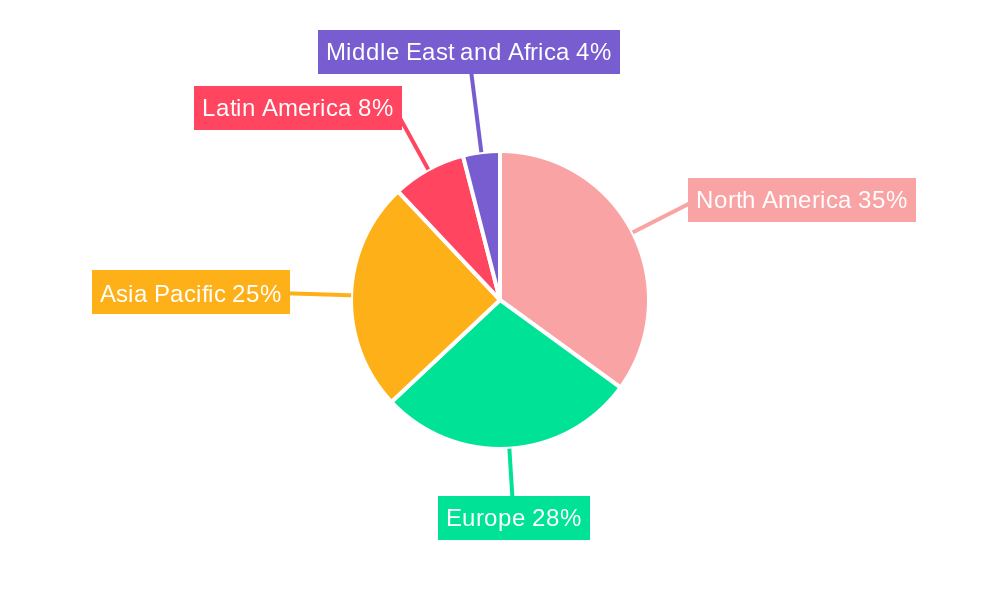

Dominant Regions, Countries, or Segments in LiFi Technology Industry

North America and Europe are currently leading the LiFi technology market, driven by early adoption in corporate buildings and industrial settings. However, Asia-Pacific is projected to experience the fastest growth due to increasing investments in infrastructure and rising demand for high-speed internet access.

- North America: High adoption in corporate and industrial sectors; strong regulatory support.

- Europe: Significant growth potential in residential and retail segments.

- Asia-Pacific: Fastest-growing region, driven by infrastructure development and rising smartphone penetration.

- By End-user Industry: Corporate Buildings and Industrial segments currently lead, but Healthcare and Retail show high growth potential.

LiFi Technology Industry Product Landscape

LiFi products range from simple LED-based light fixtures integrated with communication capabilities to complex systems incorporating multiple light sources and advanced receiver technologies. Key advancements include increased data transfer rates, improved reliability, and enhanced security features. The unique selling propositions of LiFi include high bandwidth, secure communication, and immunity to radio frequency interference. These advancements have expanded LiFi applications into diverse sectors such as healthcare, industrial automation, and smart homes.

Key Drivers, Barriers & Challenges in LiFi Technology Industry

Key Drivers:

- Increasing demand for high-speed, secure wireless communication.

- Growing adoption of smart lighting infrastructure.

- Advancements in LED technology and light modulation techniques.

- Favorable government regulations and initiatives.

Key Challenges:

- High initial investment costs for infrastructure deployment.

- Line-of-sight requirement for data transmission.

- Limited standardization and interoperability among different LiFi systems.

- Competition from established wireless technologies like Wi-Fi. This reduces market share by an estimated xx% annually.

Emerging Opportunities in LiFi Technology Industry

Emerging opportunities lie in untapped markets such as developing countries, new applications in the automotive industry and the Internet of Things (IoT), and integration with other technologies like 5G and 6G networks. The increasing demand for secure communication in critical infrastructure and sensitive environments presents a significant growth opportunity.

Growth Accelerators in the LiFi Technology Industry Industry

Strategic partnerships between LiFi technology providers and lighting manufacturers are accelerating market penetration. Technological breakthroughs, particularly in the areas of power efficiency and data transfer rates, are expanding application possibilities. Expansion into new markets, such as the automotive and healthcare sectors, is further fueling market growth.

Key Players Shaping the LiFi Technology Industry Market

- Signify Holding BV

- Kyocera SLD Laser Inc (Kyocera Corporation)

- Velmenni

- Purelifi Ltd

- Spectrum Networks LLC

- IDRO Co Ltd

- Zero

- LVX System

- Renesas Electronics Corporation

- To Be Sr

- Slux

- Oledcomm SAS

- Lightbee Corp

- Panasonic Corporation

Notable Milestones in LiFi Technology Industry Sector

- September 2023: Getac successfully integrated LiFi technology into its rugged devices in collaboration with Signify, highlighting the growing adoption of LiFi in industrial applications.

- August 2023: India's Bharat 6G Vision underscores the potential for LiFi to play a role in future 6G networks, signifying long-term growth opportunities.

In-Depth LiFi Technology Industry Market Outlook

The LiFi technology market is poised for significant growth in the coming years, driven by a confluence of factors. Continued technological advancements, coupled with increasing demand for secure and high-speed wireless communication, will fuel market expansion across various sectors. Strategic partnerships and market expansion into new geographic regions will further contribute to the growth trajectory. The long-term outlook is extremely positive, indicating a substantial market potential for LiFi technology.

LiFi Technology Industry Segmentation

-

1. End-user Industry

- 1.1. Industrial

- 1.2. Healthcare

- 1.3. Retail

- 1.4. Corporate Buildings

- 1.5. Education

- 1.6. Residential

- 1.7. Aerospace and Defense

- 1.8. Automotive and Transportation

- 1.9. Other En

LiFi Technology Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

LiFi Technology Industry Regional Market Share

Geographic Coverage of LiFi Technology Industry

LiFi Technology Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 62.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand For High-Speed Network; Increasing Demand for Energy-efficient Solutions

- 3.3. Market Restrains

- 3.3.1. Limited Range and Connectivity and Lack of Awareness about the Technology

- 3.4. Market Trends

- 3.4.1. Automotive and Transportation to be the Fastest Growing End-user Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LiFi Technology Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Industrial

- 5.1.2. Healthcare

- 5.1.3. Retail

- 5.1.4. Corporate Buildings

- 5.1.5. Education

- 5.1.6. Residential

- 5.1.7. Aerospace and Defense

- 5.1.8. Automotive and Transportation

- 5.1.9. Other En

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North America LiFi Technology Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Industrial

- 6.1.2. Healthcare

- 6.1.3. Retail

- 6.1.4. Corporate Buildings

- 6.1.5. Education

- 6.1.6. Residential

- 6.1.7. Aerospace and Defense

- 6.1.8. Automotive and Transportation

- 6.1.9. Other En

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. Europe LiFi Technology Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Industrial

- 7.1.2. Healthcare

- 7.1.3. Retail

- 7.1.4. Corporate Buildings

- 7.1.5. Education

- 7.1.6. Residential

- 7.1.7. Aerospace and Defense

- 7.1.8. Automotive and Transportation

- 7.1.9. Other En

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Asia Pacific LiFi Technology Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Industrial

- 8.1.2. Healthcare

- 8.1.3. Retail

- 8.1.4. Corporate Buildings

- 8.1.5. Education

- 8.1.6. Residential

- 8.1.7. Aerospace and Defense

- 8.1.8. Automotive and Transportation

- 8.1.9. Other En

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Latin America LiFi Technology Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Industrial

- 9.1.2. Healthcare

- 9.1.3. Retail

- 9.1.4. Corporate Buildings

- 9.1.5. Education

- 9.1.6. Residential

- 9.1.7. Aerospace and Defense

- 9.1.8. Automotive and Transportation

- 9.1.9. Other En

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Middle East and Africa LiFi Technology Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Industrial

- 10.1.2. Healthcare

- 10.1.3. Retail

- 10.1.4. Corporate Buildings

- 10.1.5. Education

- 10.1.6. Residential

- 10.1.7. Aerospace and Defense

- 10.1.8. Automotive and Transportation

- 10.1.9. Other En

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Signify Holding BV

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kyocera SLD Laser Inc (Kyocera Corporation)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Velmenni

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Purelifi Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Spectrum Networks LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IDRO Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Zero

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LVX System

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Renesas Electronics Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 To Be Sr

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Slux

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Oledcomm SAS

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Lightbee Corp

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Panasonic Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Signify Holding BV

List of Figures

- Figure 1: Global LiFi Technology Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America LiFi Technology Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 3: North America LiFi Technology Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: North America LiFi Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America LiFi Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe LiFi Technology Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: Europe LiFi Technology Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Europe LiFi Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe LiFi Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific LiFi Technology Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Asia Pacific LiFi Technology Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Asia Pacific LiFi Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific LiFi Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America LiFi Technology Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Latin America LiFi Technology Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Latin America LiFi Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America LiFi Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa LiFi Technology Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 19: Middle East and Africa LiFi Technology Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Middle East and Africa LiFi Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa LiFi Technology Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global LiFi Technology Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 2: Global LiFi Technology Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global LiFi Technology Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global LiFi Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global LiFi Technology Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global LiFi Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global LiFi Technology Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global LiFi Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global LiFi Technology Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global LiFi Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global LiFi Technology Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global LiFi Technology Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LiFi Technology Industry?

The projected CAGR is approximately 62.90%.

2. Which companies are prominent players in the LiFi Technology Industry?

Key companies in the market include Signify Holding BV, Kyocera SLD Laser Inc (Kyocera Corporation), Velmenni, Purelifi Ltd, Spectrum Networks LLC, IDRO Co Ltd, Zero, LVX System, Renesas Electronics Corporation, To Be Sr, Slux, Oledcomm SAS, Lightbee Corp, Panasonic Corporation.

3. What are the main segments of the LiFi Technology Industry?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand For High-Speed Network; Increasing Demand for Energy-efficient Solutions.

6. What are the notable trends driving market growth?

Automotive and Transportation to be the Fastest Growing End-user Industry.

7. Are there any restraints impacting market growth?

Limited Range and Connectivity and Lack of Awareness about the Technology.

8. Can you provide examples of recent developments in the market?

September 2023 - Getac announced it had successfully implanted LiFi technology into its rugged devices as part of a recent innovation project with Signify, the global player in lighting. Signify and Getac is part of the Light Communication Alliance (LCA), a community of industry players, researchers, and innovators who feel in Optical Wireless Communication's power to transform how organizations connect and communicate.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LiFi Technology Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LiFi Technology Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LiFi Technology Industry?

To stay informed about further developments, trends, and reports in the LiFi Technology Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence