Key Insights

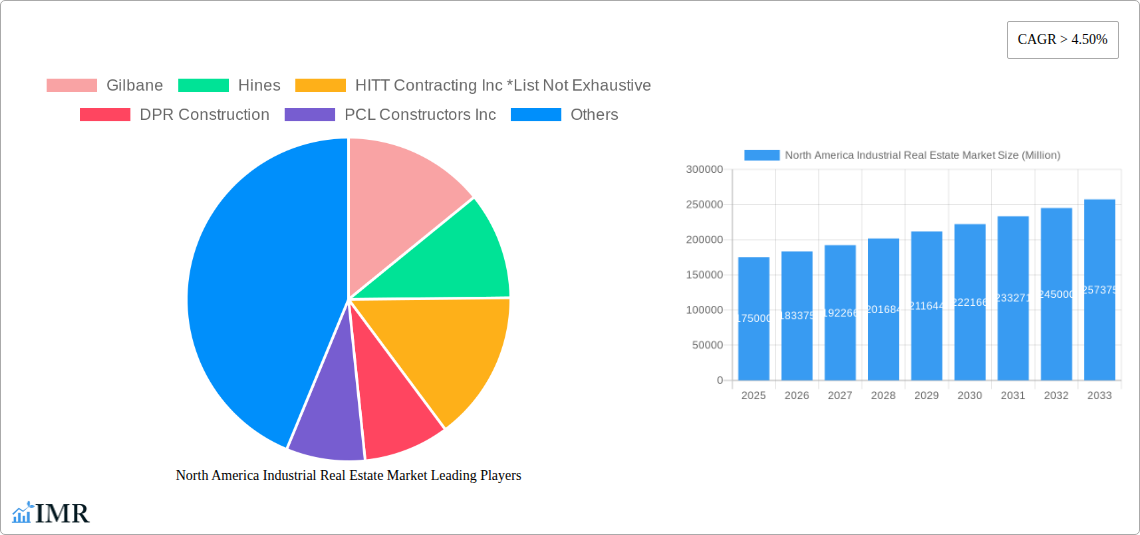

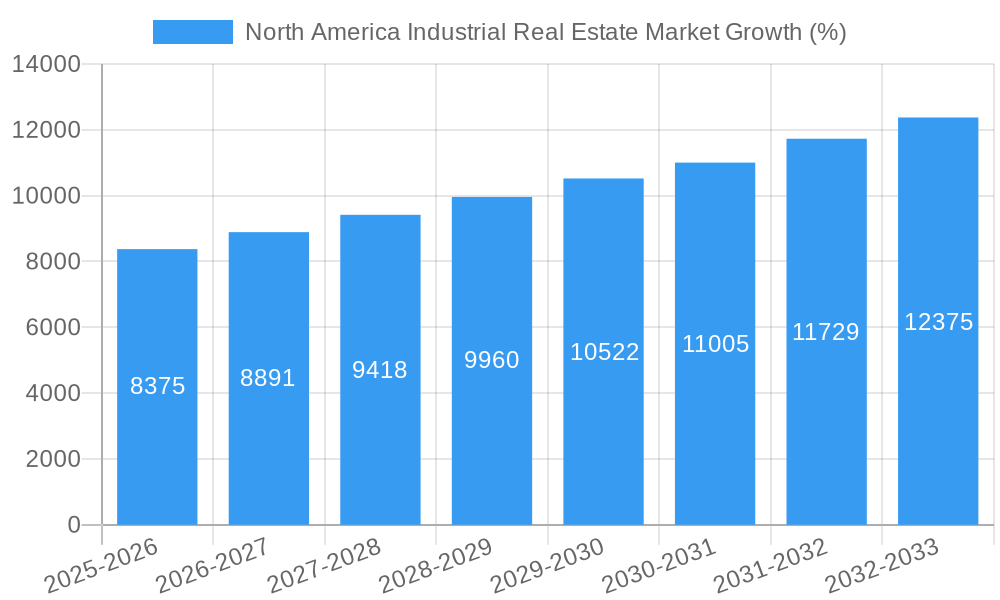

The North American industrial real estate market is experiencing robust growth, fueled by a confluence of factors. The market's expansion, indicated by a Compound Annual Growth Rate (CAGR) exceeding 4.50%, reflects the surging demand for warehousing and distribution centers driven by the e-commerce boom. Logistics companies require vast spaces to manage inventory and streamline delivery networks, significantly impacting property values. Manufacturing facilities also contribute to this growth, as companies seek efficient production spaces to meet increasing consumer demand. The rise of flexible industrial spaces, adaptable to various needs, further diversifies the market and enhances its resilience. While specific market size figures for 2025 are unavailable, extrapolating from the given CAGR and considering the market's current momentum, a reasonable estimate for the 2025 market size in North America would likely fall within the range of $150 billion to $200 billion (USD). This estimate takes into account the significant investment by major players like Gilbane, Hines, and DPR Construction, among others, indicating strong market confidence. Further growth will be driven by technological advancements in supply chain management, increasing automation in warehouses, and continued expansion of e-commerce.

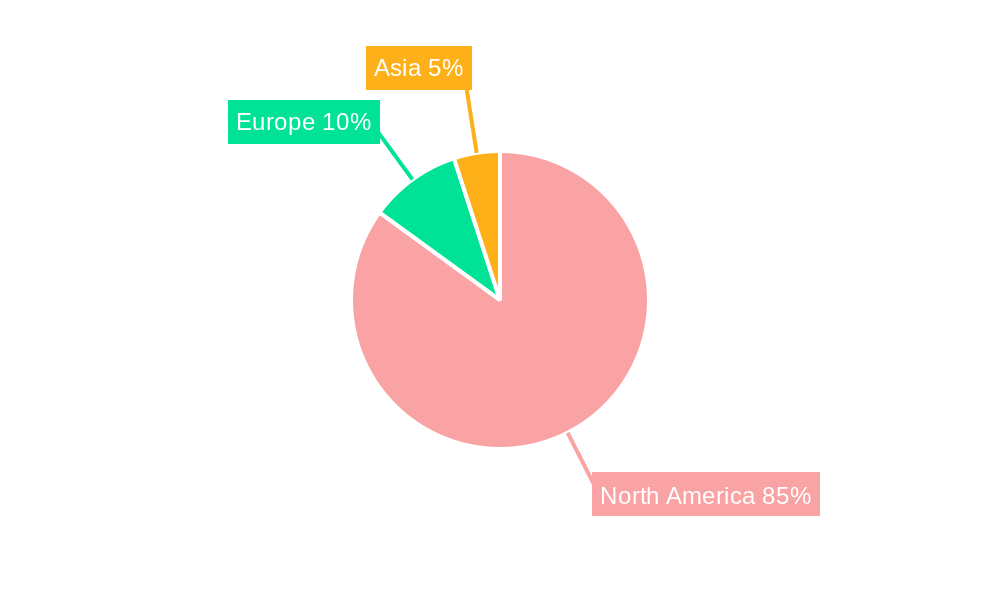

Growth within specific segments like e-commerce logistics is expected to outpace the overall market average, driven by a continued shift to online retail. However, potential restraints exist, including rising construction costs, labor shortages in the construction industry, and potential economic slowdowns that could impact demand. Regional variations within North America are likely, with the United States dominating the market share, followed by Canada and Mexico, reflecting existing infrastructure and economic activity levels. The market's positive trajectory is expected to persist through 2033, offering promising prospects for investors and businesses operating within the industrial real estate sector. The ongoing development of sustainable and technologically advanced industrial spaces will also be a crucial driver of future growth.

North America Industrial Real Estate Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North American industrial real estate market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, growth trends, key players, and future opportunities, specifically focusing on the parent market of Commercial Real Estate and its child market segments of Warehousing, Distribution Centers, Manufacturing Facilities, and Flex Industrial spaces. The report utilizes a base year of 2025 and forecasts market performance through 2033. This data is crucial for investors, developers, and industry professionals seeking to navigate the complexities of this dynamic sector.

North America Industrial Real Estate Market Dynamics & Structure

The North American industrial real estate market is characterized by a moderately concentrated landscape with several large players dominating specific segments. Technological innovation, driven by automation and data analytics, significantly impacts operational efficiency and demand. Regulatory frameworks, including zoning laws and environmental regulations, influence development patterns and costs. Competitive pressures from alternative property types (e.g., office conversions) and evolving end-user needs shape market dynamics. Mergers and acquisitions (M&A) activity remains robust, reflecting consolidation and strategic expansion by major players. The market is experiencing significant growth fueled by e-commerce expansion and reshoring trends.

- Market Concentration: Top 5 players hold approximately xx% market share in 2025 (Estimated).

- M&A Activity: An estimated xx million USD in M&A deals occurred between 2019 and 2024.

- Technological Innovation: Adoption of automation (e.g., robotics) is driving efficiency gains across distribution centers.

- Regulatory Landscape: Stringent environmental regulations influence the development of sustainable industrial properties.

- End-User Demographics: E-commerce growth fuels demand for large-scale warehousing and distribution space.

North America Industrial Real Estate Market Growth Trends & Insights

The North American industrial real estate market experienced robust growth during the historical period (2019-2024), driven primarily by the expansion of e-commerce and reshoring initiatives. The market size witnessed a CAGR of xx% during this period, reaching xx million USD in 2024. The forecast period (2025-2033) projects continued growth, albeit at a slightly moderated pace. This moderation stems from factors such as increased construction costs and potential economic slowdown. Technological disruptions, particularly the adoption of automation and data analytics, are reshaping operational strategies and increasing demand for modern, technologically advanced facilities. Consumer behavior shifts towards online shopping continue to drive demand for warehousing and distribution space. The market is expected to reach xx million USD by 2033, exhibiting a CAGR of xx% during the forecast period.

Dominant Regions, Countries, or Segments in North America Industrial Real Estate Market

The South-Central region of the US currently dominates the North American industrial real estate market, driven by strong economic growth, robust infrastructure, and a favorable business environment. Texas and other Sun Belt states are particularly prominent. This growth is significantly propelled by the rapid expansion of e-commerce logistics, warehousing, and distribution. Warehousing and distribution centers represent the largest segment by market share, accounting for approximately xx% of the total market in 2025 (Estimated).

- Key Drivers in South Central US:

- Strong population growth.

- Extensive highway networks and logistics hubs.

- Lower land costs compared to coastal regions.

- Pro-business regulatory environment.

- Warehousing and Distribution Center Dominance:

- High demand from e-commerce giants.

- Increased focus on supply chain optimization.

- Demand for larger, more efficient facilities.

North America Industrial Real Estate Market Product Landscape

The industrial real estate market offers a diverse range of products tailored to specific end-user needs. Innovations include the development of highly automated distribution centers, incorporating advanced robotics and AI-powered systems. Emphasis is placed on sustainable building practices, incorporating energy-efficient technologies and green building certifications. Performance metrics increasingly focus on operational efficiency, energy consumption, and environmental impact, reflecting a growing concern for sustainability. The increasing demand for build-to-suit options further adds to the complexity of the product landscape.

Key Drivers, Barriers & Challenges in North America Industrial Real Estate Market

Key Drivers:

- E-commerce expansion driving demand for warehousing and distribution space.

- Reshoring initiatives increasing manufacturing facility construction.

- Government incentives promoting industrial development.

Key Challenges & Restraints:

- Rising construction costs impacting project feasibility. (Increase of xx% in 2025 compared to 2019)

- Supply chain disruptions delaying projects.

- Labor shortages impacting construction and operations.

- Competition for available land in desirable locations.

Emerging Opportunities in North America Industrial Real Estate Market

Emerging opportunities lie in the development of sustainable industrial properties, the adoption of advanced technologies like AI and robotics for warehouse automation, and the expansion into underserved markets within the US. Focus on last-mile delivery solutions and the growth of specialized facilities (e.g., cold storage) offer additional avenues for growth. The integration of renewable energy sources and smart building technologies present significant opportunities for innovation and differentiation.

Growth Accelerators in the North America Industrial Real Estate Market Industry

Long-term growth will be driven by technological advancements in automation and logistics, strategic partnerships between developers and end-users, and the expansion of industrial real estate into new markets and geographic regions. The continued growth of e-commerce will serve as a major catalyst, driving the demand for modern, efficient warehouse and distribution facilities.

Key Players Shaping the North America Industrial Real Estate Market Market

- Gilbane

- Hines

- HITT Contracting Inc

- DPR Construction

- PCL Constructors Inc

- BXP

- Brookfield Asset Management Inc

- Hensel Phelps

- SHANNON WALTCHACK LLC

- Turner Construction Company

- JBG SMITH Properties

- Trammell Crow Company

Notable Milestones in North America Industrial Real Estate Market Sector

- 2021 Q3: Increased adoption of sustainable building practices in new industrial developments.

- 2022 Q4: Significant M&A activity among major industrial developers.

- 2023 Q1: Launch of several large-scale automated distribution centers.

- 2024 Q2: Growing focus on last-mile delivery solutions and urban logistics.

In-Depth North America Industrial Real Estate Market Outlook

The North American industrial real estate market is poised for continued growth throughout the forecast period (2025-2033). This growth will be driven by long-term trends in e-commerce, reshoring, and technological innovation. Strategic opportunities exist for developers and investors who can capitalize on emerging technologies, meet the increasing demand for sustainable industrial spaces, and effectively navigate supply chain challenges. The market's future potential is significant, offering substantial returns for those who can adapt to the evolving landscape.

North America Industrial Real Estate Market Segmentation

-

1. Geography

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Sector

- 2.1. Information Technology (IT and ITES)

- 2.2. Manufacturing

- 2.3. BFSI (Banking, Financial Services, and Insurance)

- 2.4. Consulting

- 2.5. Other Sectors

North America Industrial Real Estate Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Industrial Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material

- 3.3. Market Restrains

- 3.3.1. 4.; High cost of purchasing the equipment for development and manufacturing of various construction material

- 3.4. Market Trends

- 3.4.1. Increasing Rental Prices of Office Spaces

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Industrial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 5.1.1. United States

- 5.1.2. Canada

- 5.1.3. Mexico

- 5.2. Market Analysis, Insights and Forecast - by Sector

- 5.2.1. Information Technology (IT and ITES)

- 5.2.2. Manufacturing

- 5.2.3. BFSI (Banking, Financial Services, and Insurance)

- 5.2.4. Consulting

- 5.2.5. Other Sectors

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 6. United States North America Industrial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 6.1.1. United States

- 6.1.2. Canada

- 6.1.3. Mexico

- 6.2. Market Analysis, Insights and Forecast - by Sector

- 6.2.1. Information Technology (IT and ITES)

- 6.2.2. Manufacturing

- 6.2.3. BFSI (Banking, Financial Services, and Insurance)

- 6.2.4. Consulting

- 6.2.5. Other Sectors

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 7. Canada North America Industrial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 7.1.1. United States

- 7.1.2. Canada

- 7.1.3. Mexico

- 7.2. Market Analysis, Insights and Forecast - by Sector

- 7.2.1. Information Technology (IT and ITES)

- 7.2.2. Manufacturing

- 7.2.3. BFSI (Banking, Financial Services, and Insurance)

- 7.2.4. Consulting

- 7.2.5. Other Sectors

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 8. Mexico North America Industrial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 8.1.1. United States

- 8.1.2. Canada

- 8.1.3. Mexico

- 8.2. Market Analysis, Insights and Forecast - by Sector

- 8.2.1. Information Technology (IT and ITES)

- 8.2.2. Manufacturing

- 8.2.3. BFSI (Banking, Financial Services, and Insurance)

- 8.2.4. Consulting

- 8.2.5. Other Sectors

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 9. United States North America Industrial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Industrial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Industrial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Industrial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Gilbane

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hines

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 HITT Contracting Inc *List Not Exhaustive

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 DPR Construction

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 PCL Constructors Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 BXP

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Brookfield Asset Management Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Hensel Phelps

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 SHANNON WALTCHACK LLC

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Turner Construction Company

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 JBG SMITH Properties

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Trammell Crow Company

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Gilbane

List of Figures

- Figure 1: North America Industrial Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Industrial Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: North America Industrial Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Industrial Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 3: North America Industrial Real Estate Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 4: North America Industrial Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Industrial Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Industrial Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Industrial Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Industrial Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Industrial Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Industrial Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 11: North America Industrial Real Estate Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 12: North America Industrial Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: North America Industrial Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Industrial Real Estate Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 15: North America Industrial Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North America Industrial Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: North America Industrial Real Estate Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 18: North America Industrial Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Industrial Real Estate Market?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the North America Industrial Real Estate Market?

Key companies in the market include Gilbane, Hines, HITT Contracting Inc *List Not Exhaustive, DPR Construction, PCL Constructors Inc, BXP, Brookfield Asset Management Inc, Hensel Phelps, SHANNON WALTCHACK LLC, Turner Construction Company, JBG SMITH Properties, Trammell Crow Company.

3. What are the main segments of the North America Industrial Real Estate Market?

The market segments include Geography, Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material.

6. What are the notable trends driving market growth?

Increasing Rental Prices of Office Spaces.

7. Are there any restraints impacting market growth?

4.; High cost of purchasing the equipment for development and manufacturing of various construction material.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Industrial Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Industrial Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Industrial Real Estate Market?

To stay informed about further developments, trends, and reports in the North America Industrial Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence