Key Insights

The Passive Biometrics Verification market is poised for substantial growth, projected to reach a significant market size of approximately USD 5,500 million by the end of 2025. This expansion is driven by a robust Compound Annual Growth Rate (CAGR) of 23.65%, indicating a rapid adoption of these advanced security solutions across various industries. The primary catalysts for this surge include the escalating need for sophisticated fraud prevention, the increasing demand for seamless and user-friendly authentication processes, and the growing awareness of the limitations and vulnerabilities associated with traditional security methods. Industries such as BFSI, Retail, and IT & Telecom are leading the charge in adopting passive biometrics for enhanced customer experiences and fortified security postures. The market is characterized by a strong emphasis on software and services, with cloud-based deployments rapidly gaining traction over on-premises solutions, reflecting the broader IT trend towards scalable and accessible cloud infrastructure. This shift is enabling businesses to implement advanced biometric verification without significant upfront capital expenditure.

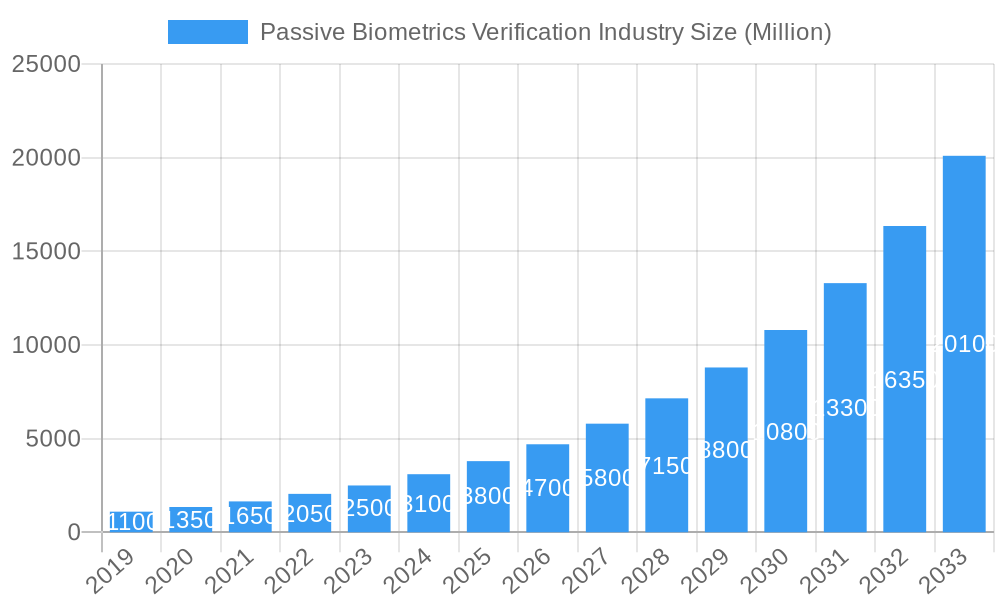

Passive Biometrics Verification Industry Market Size (In Billion)

Looking ahead, the forecast period from 2025 to 2033 anticipates continued strong performance, building upon the momentum established in recent years. Emerging trends such as the integration of artificial intelligence and machine learning for more accurate and adaptive biometric analysis, alongside the development of multimodal biometrics combining various physiological and behavioral traits, will further propel market expansion. While the market is generally favorable, potential restraints could include evolving privacy regulations, the need for significant investment in initial setup and ongoing maintenance for some solutions, and the challenge of public perception and trust regarding biometric data usage. However, the overwhelming benefits in terms of enhanced security, improved operational efficiency, and superior customer experience are expected to outweigh these challenges, ensuring sustained growth and innovation within the passive biometrics verification industry. Regions like North America and Europe are expected to dominate early adoption due to their established technological infrastructure and stringent regulatory environments demanding robust security.

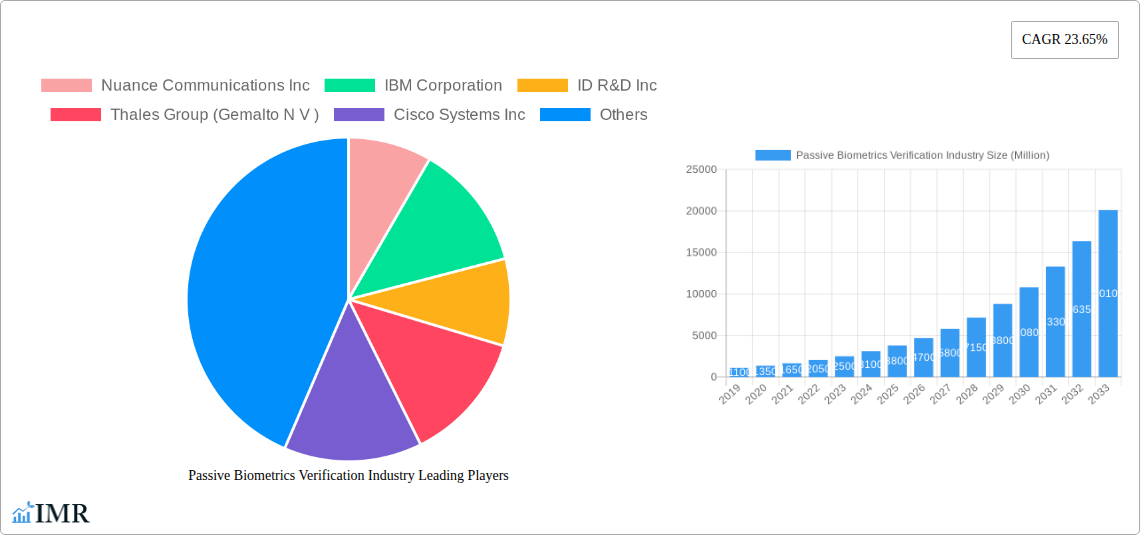

Passive Biometrics Verification Industry Company Market Share

This comprehensive report delves into the dynamic Passive Biometrics Verification Industry, a rapidly expanding sector focused on continuous, unobtrusive identity authentication. Covering the study period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this analysis provides unparalleled insights for industry professionals, investors, and stakeholders. We examine market dynamics, growth trends, key players, and emerging opportunities, offering a detailed outlook on this critical technology.

The report is meticulously structured to deliver actionable intelligence, utilizing high-traffic keywords such as "passive biometrics," "continuous authentication," "behavioral biometrics," "voice biometrics," "gait recognition," "mouse dynamics," "typing biometrics," "identity verification," "fraud prevention," "cybersecurity," "BFSI biometrics," "retail biometrics," and "healthcare biometrics." We also explore parent and child markets, including the broader biometrics market and niche segments within passive biometrics, to provide a holistic view. All quantitative values are presented in Million units for clarity and comparability.

Passive Biometrics Verification Industry Market Dynamics & Structure

The Passive Biometrics Verification Industry exhibits a moderately consolidated market structure, driven by a high degree of technological innovation in continuous authentication methods. Key drivers include the escalating need for robust fraud prevention, enhanced user experience, and compliance with stringent data privacy regulations. Competitive product substitutes, such as traditional multi-factor authentication (MFA) and less sophisticated biometric systems, are increasingly being outperformed by passive solutions due to their seamless integration and lower friction. End-user demographics are broadening, with significant adoption across BFSI, retail, IT & Telecom, and healthcare sectors, all seeking to secure digital interactions without impeding user workflows. Mergers and acquisitions (M&A) activity is on the rise as larger technology firms seek to integrate advanced passive biometric capabilities into their existing portfolios. Barriers to innovation are primarily centered on achieving near-perfect accuracy across diverse environmental conditions and overcoming user privacy concerns regarding continuous data collection.

- Market Concentration: Moderately consolidated, with key players investing heavily in R&D.

- Technological Innovation Drivers: Demand for frictionless security, AI advancements in pattern recognition, and the rise of connected devices.

- Regulatory Frameworks: Evolving compliance requirements for data protection and privacy are shaping deployment strategies.

- Competitive Product Substitutes: Traditional MFA and active biometrics face challenges from passive methods' user experience advantages.

- End-User Demographics: BFSI, Retail, IT & Telecom, and Healthcare are leading adoption, with growing interest from Government and Other End-User Industries.

- M&A Trends: Strategic acquisitions to bolster passive biometric offerings and expand market reach are prevalent.

Passive Biometrics Verification Industry Growth Trends & Insights

The global passive biometrics verification market is poised for substantial expansion, driven by the escalating demand for seamless and secure authentication solutions across a myriad of digital touchpoints. From 2019 to 2024, the market witnessed steady growth, catalyzed by the increasing sophistication of cyber threats and the growing awareness among enterprises regarding the vulnerabilities of traditional security measures. The base year of 2025 marks a significant inflection point, with the market size projected to reach approximately \$7,500 million. This growth trajectory is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 18.5% forecast between 2025 and 2033. This robust CAGR reflects the accelerating adoption rates of passive biometric technologies, including voice recognition, keystroke dynamics, mouse movements, and gait analysis, as businesses prioritize frictionless user experiences without compromising on security.

Technological disruptions are a constant feature, with advancements in artificial intelligence (AI) and machine learning (ML) enabling passive biometric systems to achieve unprecedented levels of accuracy and adaptability. These sophisticated algorithms can analyze subtle behavioral patterns, distinguishing legitimate users from malicious actors with remarkable precision, even amidst varying environmental conditions or device usage. Consumer behavior shifts are also playing a crucial role, with individuals increasingly expecting intuitive and unobtrusive authentication processes. The convenience offered by passive biometrics aligns perfectly with this evolving preference, reducing login friction and improving overall customer satisfaction. Market penetration is expanding beyond early adopters in the BFSI sector to encompass retail, IT and telecom, healthcare, and government organizations, all recognizing the critical need for continuous identity assurance in an interconnected digital landscape. The integration of passive biometrics into mobile devices, IoT ecosystems, and enterprise applications further fuels adoption.

- Market Size Evolution: Projected to grow from \$7,500 million in 2025 to an estimated \$25,500 million by 2033.

- Adoption Rates: Steadily increasing across BFSI, Retail, IT & Telecom, and Healthcare sectors.

- Technological Disruptions: AI and ML advancements are enhancing accuracy and reducing false positives/negatives.

- Consumer Behavior Shifts: Growing preference for seamless, frictionless authentication experiences.

- Market Penetration: Expanding beyond BFSI into other key industries, including Government and Other End-User Industries.

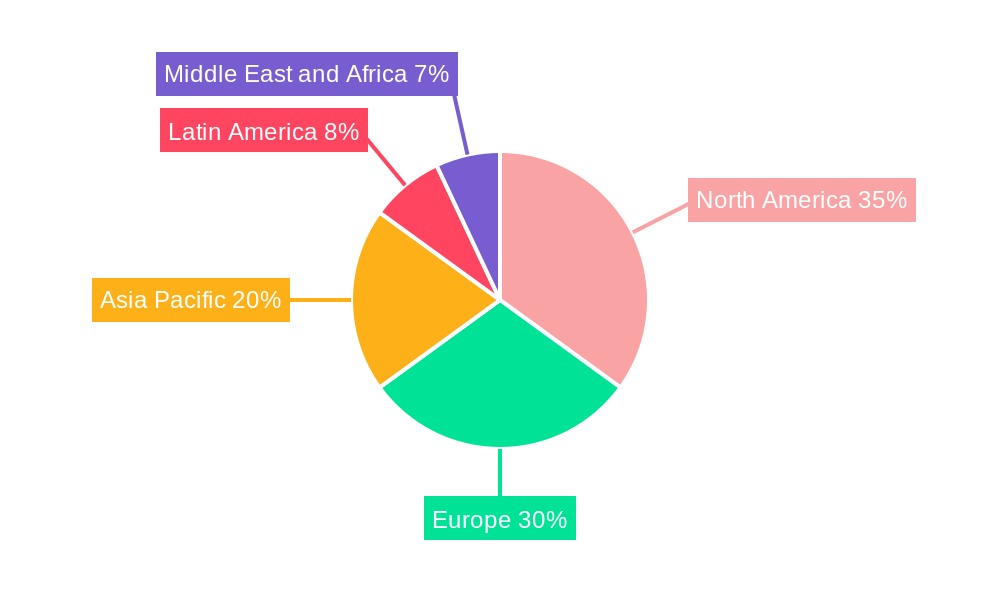

Dominant Regions, Countries, or Segments in Passive Biometrics Verification Industry

North America currently dominates the Passive Biometrics Verification Industry, driven by a strong technological infrastructure, a mature cybersecurity market, and proactive government initiatives promoting digital security. The region's BFSI sector, a significant early adopter of advanced security technologies, has heavily invested in passive biometrics for fraud prevention and customer authentication, contributing to market dominance. In terms of components, the Software segment is the largest, valued at approximately \$3,200 million in 2025, due to the increasing demand for advanced analytics, AI-powered recognition engines, and cloud-based deployment solutions. The Services segment, including integration, consulting, and maintenance, is also experiencing robust growth, expected to reach \$2,100 million in 2025, as businesses require specialized expertise to implement and manage these complex systems.

The Cloud deployment type is rapidly overtaking on-premises solutions, projected to capture over 65% of the market by 2025, valued at \$4,875 million. This shift is attributed to the scalability, cost-effectiveness, and ease of deployment offered by cloud platforms. Geographically, the United States remains the largest market within North America, supported by major technology hubs and a high concentration of businesses prioritizing cybersecurity. Asia-Pacific is emerging as a significant growth region, fueled by rapid digital transformation, increasing smartphone penetration, and a growing awareness of cybersecurity threats in countries like China, India, and South Korea. The IT and Telecom sector, along with BFSI, are the primary end-user industries driving this regional growth, with healthcare also showing substantial potential. Key drivers for this regional dominance include favorable economic policies supporting technological adoption, robust IT infrastructure development, and a growing need for secure online transactions and digital identity management.

- Dominant Region: North America leads, with Europe and Asia-Pacific showing strong growth.

- Leading Country: United States holds the largest market share, followed by the UK and Germany.

- Dominant Component: Software segment leads, driven by AI and analytics.

- Dominant Deployment Type: Cloud-based solutions are preferred for scalability and flexibility.

- Key End-User Industries: BFSI, Retail, and IT & Telecom are the primary adoption drivers.

- Growth Potential: Asia-Pacific and emerging economies present significant untapped market opportunities.

Passive Biometrics Verification Industry Product Landscape

The passive biometrics verification product landscape is characterized by continuous innovation in AI-driven behavioral analysis, voice recognition, and keystroke dynamics. Solutions are designed for seamless integration into existing workflows, offering unobtrusive authentication. Key product advancements include improved accuracy rates in recognizing unique user patterns, such as gait, mouse movements, and typing cadence, even under varying conditions. Voice biometrics are evolving to distinguish between natural speech and synthesized voices, enhancing security against spoofing attempts. Manufacturers are focusing on developing lightweight, efficient algorithms that can be deployed on edge devices and mobile platforms, expanding the reach of passive authentication. The emphasis is on creating user-friendly interfaces that require no conscious user effort, thereby enhancing the overall customer experience.

Key Drivers, Barriers & Challenges in Passive Biometrics Verification Industry

The Passive Biometrics Verification Industry is propelled by several key drivers, including the escalating need for advanced cybersecurity to combat sophisticated cyber threats and fraud. The increasing adoption of remote work and digital services necessitates continuous and friction-less authentication, making passive biometrics an attractive solution. Technological advancements in AI and machine learning have significantly improved the accuracy and reliability of these systems. Furthermore, the growing demand for enhanced customer experience, by eliminating the need for manual authentication steps, is a major growth accelerator.

However, the market also faces significant barriers and challenges. User privacy concerns regarding the continuous collection of behavioral data remain a critical hurdle, requiring robust data protection policies and transparent communication. The accuracy of passive biometrics can still be affected by environmental factors, device variations, and changes in user behavior, leading to potential false positives or negatives. High implementation costs and the need for specialized integration expertise can also deter smaller organizations. Moreover, the evolving regulatory landscape surrounding data privacy and biometric data handling presents a continuous challenge for compliance.

Emerging Opportunities in Passive Biometrics Verification Industry

Emerging opportunities within the Passive Biometrics Verification Industry lie in expanding its application into new sectors and refining existing functionalities. The healthcare industry presents a significant untapped market for securing patient data and ensuring the integrity of remote patient monitoring. The burgeoning Internet of Things (IoT) ecosystem offers vast potential for passive authentication of connected devices, enhancing the security of smart homes, smart cities, and industrial IoT environments. Furthermore, advancements in analyzing subtle physiological cues, such as heart rate variability and thermal patterns, could open new avenues for multi-modal passive authentication. Evolving consumer preferences for personalized and secure digital experiences will continue to drive demand for innovative passive biometric solutions across all industries.

Growth Accelerators in the Passive Biometrics Verification Industry Industry

Several catalysts are accelerating the growth of the Passive Biometrics Verification Industry. Technological breakthroughs in AI and deep learning are continuously improving the accuracy and reliability of behavioral and physiological pattern recognition. Strategic partnerships between biometric technology providers and established software vendors, particularly in the cybersecurity and cloud services space, are expanding market reach and integration capabilities. Market expansion strategies, focusing on emerging economies with rapidly digitizing economies and increasing cybersecurity concerns, are also driving growth. The growing demand for zero-trust security architectures further bolsters the adoption of continuous authentication methods like passive biometrics.

Key Players Shaping the Passive Biometrics Verification Industry Market

- Nuance Communications Inc

- IBM Corporation

- ID R&D Inc

- Thales Group (Gemalto N V)

- Cisco Systems Inc

- Aware Inc

- Pindrop Security Inc

- Verint Systems Inc

- OneSpan Inc

- NEC Corporation

- Fortress Identity

- Equifax Inc

- BioCatch Ltd

Notable Milestones in Passive Biometrics Verification Industry Sector

- 2021: Nuance Communications launches advanced voice biometrics for customer service interactions.

- 2021: ID R&D releases AI-powered behavioral biometrics for fraud detection.

- 2022: Pindrop Security enhances its voice biometric platform to combat deepfake audio threats.

- 2022: OneSpan acquires certain assets of Expin, strengthening its digital identity solutions.

- 2023: Thales Group (Gemalto N V) expands its portfolio with enhanced passive biometric authentication capabilities.

- 2023: BioCatch Ltd secures significant funding to scale its behavioral biometrics solutions.

- 2024: Major cloud providers announce deeper integration of passive biometric authentication services.

- 2024: Increased regulatory focus on continuous authentication frameworks in key markets.

In-Depth Passive Biometrics Verification Industry Market Outlook

The Passive Biometrics Verification Industry is set for a period of robust expansion, driven by the indispensable need for enhanced digital security and seamless user experiences. Growth accelerators such as advancements in AI, strategic partnerships, and market expansion into emerging economies will continue to fuel adoption. The increasing integration of passive biometrics into mobile devices, IoT ecosystems, and enterprise applications will further broaden its reach. Future market potential lies in the development of multi-modal passive authentication systems that combine various biometric modalities for unparalleled accuracy and resilience against spoofing. Strategic opportunities include addressing the evolving privacy concerns with transparent data handling practices and focusing on delivering value-added services that augment existing security infrastructures.

Passive Biometrics Verification Industry Segmentation

-

1. Component

- 1.1. Software

- 1.2. Services

-

2. Deployment Type

- 2.1. On-premises

- 2.2. Cloud

-

3. End-User Industry

- 3.1. BFSI

- 3.2. Retail

- 3.3. IT and Telecom

- 3.4. Helathcare

- 3.5. Government

- 3.6. Other End-User Inustries

Passive Biometrics Verification Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Passive Biometrics Verification Industry Regional Market Share

Geographic Coverage of Passive Biometrics Verification Industry

Passive Biometrics Verification Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Growing incidents related of fraud

- 3.2.2 scams

- 3.2.3 and data breach attacks; Rising need for better authentication systems to enhance the user experience

- 3.3. Market Restrains

- 3.3.1. ; Concerns related to privacy regarding actions running in the background

- 3.4. Market Trends

- 3.4.1. BFSI is Expected Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Passive Biometrics Verification Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Software

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment Type

- 5.2.1. On-premises

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. BFSI

- 5.3.2. Retail

- 5.3.3. IT and Telecom

- 5.3.4. Helathcare

- 5.3.5. Government

- 5.3.6. Other End-User Inustries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Passive Biometrics Verification Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Software

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Deployment Type

- 6.2.1. On-premises

- 6.2.2. Cloud

- 6.3. Market Analysis, Insights and Forecast - by End-User Industry

- 6.3.1. BFSI

- 6.3.2. Retail

- 6.3.3. IT and Telecom

- 6.3.4. Helathcare

- 6.3.5. Government

- 6.3.6. Other End-User Inustries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Passive Biometrics Verification Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Software

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Deployment Type

- 7.2.1. On-premises

- 7.2.2. Cloud

- 7.3. Market Analysis, Insights and Forecast - by End-User Industry

- 7.3.1. BFSI

- 7.3.2. Retail

- 7.3.3. IT and Telecom

- 7.3.4. Helathcare

- 7.3.5. Government

- 7.3.6. Other End-User Inustries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Passive Biometrics Verification Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Software

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Deployment Type

- 8.2.1. On-premises

- 8.2.2. Cloud

- 8.3. Market Analysis, Insights and Forecast - by End-User Industry

- 8.3.1. BFSI

- 8.3.2. Retail

- 8.3.3. IT and Telecom

- 8.3.4. Helathcare

- 8.3.5. Government

- 8.3.6. Other End-User Inustries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Passive Biometrics Verification Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Software

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Deployment Type

- 9.2.1. On-premises

- 9.2.2. Cloud

- 9.3. Market Analysis, Insights and Forecast - by End-User Industry

- 9.3.1. BFSI

- 9.3.2. Retail

- 9.3.3. IT and Telecom

- 9.3.4. Helathcare

- 9.3.5. Government

- 9.3.6. Other End-User Inustries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Passive Biometrics Verification Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Software

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Deployment Type

- 10.2.1. On-premises

- 10.2.2. Cloud

- 10.3. Market Analysis, Insights and Forecast - by End-User Industry

- 10.3.1. BFSI

- 10.3.2. Retail

- 10.3.3. IT and Telecom

- 10.3.4. Helathcare

- 10.3.5. Government

- 10.3.6. Other End-User Inustries

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nuance Communications Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IBM Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ID R&D Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Thales Group (Gemalto N V )

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cisco Systems Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aware Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pindrop Security Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Verint Systems Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 OneSpan Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 NEC Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Fortress Identity*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Equifax Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 BioCatch Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Nuance Communications Inc

List of Figures

- Figure 1: Global Passive Biometrics Verification Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Passive Biometrics Verification Industry Revenue (undefined), by Component 2025 & 2033

- Figure 3: North America Passive Biometrics Verification Industry Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Passive Biometrics Verification Industry Revenue (undefined), by Deployment Type 2025 & 2033

- Figure 5: North America Passive Biometrics Verification Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 6: North America Passive Biometrics Verification Industry Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 7: North America Passive Biometrics Verification Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 8: North America Passive Biometrics Verification Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Passive Biometrics Verification Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Passive Biometrics Verification Industry Revenue (undefined), by Component 2025 & 2033

- Figure 11: Europe Passive Biometrics Verification Industry Revenue Share (%), by Component 2025 & 2033

- Figure 12: Europe Passive Biometrics Verification Industry Revenue (undefined), by Deployment Type 2025 & 2033

- Figure 13: Europe Passive Biometrics Verification Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 14: Europe Passive Biometrics Verification Industry Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 15: Europe Passive Biometrics Verification Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 16: Europe Passive Biometrics Verification Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Passive Biometrics Verification Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Passive Biometrics Verification Industry Revenue (undefined), by Component 2025 & 2033

- Figure 19: Asia Pacific Passive Biometrics Verification Industry Revenue Share (%), by Component 2025 & 2033

- Figure 20: Asia Pacific Passive Biometrics Verification Industry Revenue (undefined), by Deployment Type 2025 & 2033

- Figure 21: Asia Pacific Passive Biometrics Verification Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 22: Asia Pacific Passive Biometrics Verification Industry Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 23: Asia Pacific Passive Biometrics Verification Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Asia Pacific Passive Biometrics Verification Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Passive Biometrics Verification Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Passive Biometrics Verification Industry Revenue (undefined), by Component 2025 & 2033

- Figure 27: Latin America Passive Biometrics Verification Industry Revenue Share (%), by Component 2025 & 2033

- Figure 28: Latin America Passive Biometrics Verification Industry Revenue (undefined), by Deployment Type 2025 & 2033

- Figure 29: Latin America Passive Biometrics Verification Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 30: Latin America Passive Biometrics Verification Industry Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 31: Latin America Passive Biometrics Verification Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 32: Latin America Passive Biometrics Verification Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: Latin America Passive Biometrics Verification Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Passive Biometrics Verification Industry Revenue (undefined), by Component 2025 & 2033

- Figure 35: Middle East and Africa Passive Biometrics Verification Industry Revenue Share (%), by Component 2025 & 2033

- Figure 36: Middle East and Africa Passive Biometrics Verification Industry Revenue (undefined), by Deployment Type 2025 & 2033

- Figure 37: Middle East and Africa Passive Biometrics Verification Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 38: Middle East and Africa Passive Biometrics Verification Industry Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 39: Middle East and Africa Passive Biometrics Verification Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 40: Middle East and Africa Passive Biometrics Verification Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East and Africa Passive Biometrics Verification Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Passive Biometrics Verification Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 2: Global Passive Biometrics Verification Industry Revenue undefined Forecast, by Deployment Type 2020 & 2033

- Table 3: Global Passive Biometrics Verification Industry Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 4: Global Passive Biometrics Verification Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Passive Biometrics Verification Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 6: Global Passive Biometrics Verification Industry Revenue undefined Forecast, by Deployment Type 2020 & 2033

- Table 7: Global Passive Biometrics Verification Industry Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 8: Global Passive Biometrics Verification Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Passive Biometrics Verification Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 10: Global Passive Biometrics Verification Industry Revenue undefined Forecast, by Deployment Type 2020 & 2033

- Table 11: Global Passive Biometrics Verification Industry Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 12: Global Passive Biometrics Verification Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Passive Biometrics Verification Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 14: Global Passive Biometrics Verification Industry Revenue undefined Forecast, by Deployment Type 2020 & 2033

- Table 15: Global Passive Biometrics Verification Industry Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 16: Global Passive Biometrics Verification Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global Passive Biometrics Verification Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 18: Global Passive Biometrics Verification Industry Revenue undefined Forecast, by Deployment Type 2020 & 2033

- Table 19: Global Passive Biometrics Verification Industry Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 20: Global Passive Biometrics Verification Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Passive Biometrics Verification Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 22: Global Passive Biometrics Verification Industry Revenue undefined Forecast, by Deployment Type 2020 & 2033

- Table 23: Global Passive Biometrics Verification Industry Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 24: Global Passive Biometrics Verification Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Passive Biometrics Verification Industry?

The projected CAGR is approximately 16.6%.

2. Which companies are prominent players in the Passive Biometrics Verification Industry?

Key companies in the market include Nuance Communications Inc, IBM Corporation, ID R&D Inc, Thales Group (Gemalto N V ), Cisco Systems Inc, Aware Inc, Pindrop Security Inc, Verint Systems Inc, OneSpan Inc, NEC Corporation, Fortress Identity*List Not Exhaustive, Equifax Inc, BioCatch Ltd.

3. What are the main segments of the Passive Biometrics Verification Industry?

The market segments include Component, Deployment Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Growing incidents related of fraud. scams. and data breach attacks; Rising need for better authentication systems to enhance the user experience.

6. What are the notable trends driving market growth?

BFSI is Expected Hold Significant Share.

7. Are there any restraints impacting market growth?

; Concerns related to privacy regarding actions running in the background.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Passive Biometrics Verification Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Passive Biometrics Verification Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Passive Biometrics Verification Industry?

To stay informed about further developments, trends, and reports in the Passive Biometrics Verification Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence