Key Insights

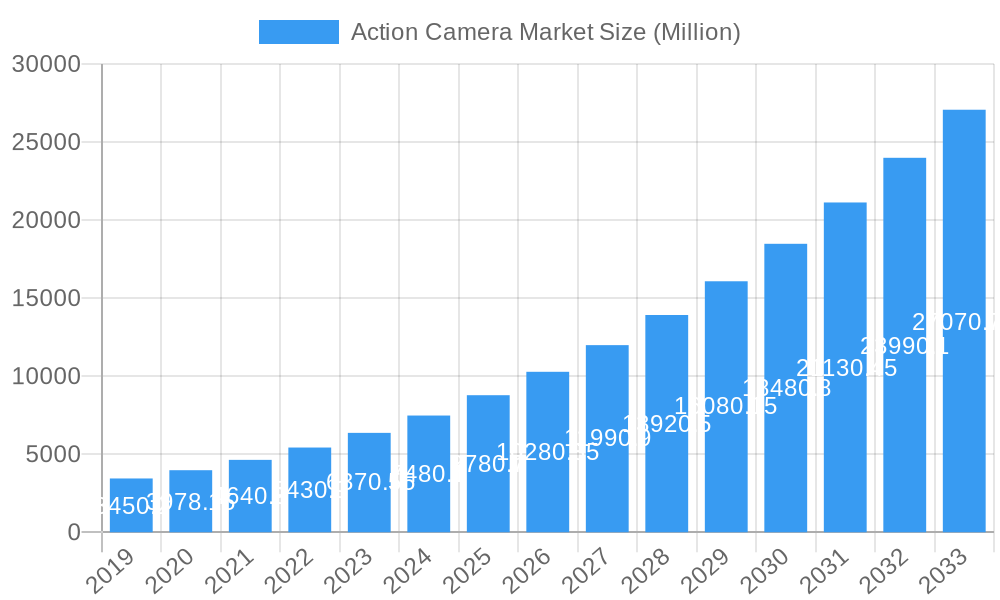

The global Action Camera Market is poised for remarkable expansion, projected to reach $10,495.23 Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 15.80%. This dynamic growth trajectory is propelled by a confluence of factors including the increasing adoption of action cameras by adventure enthusiasts, sports professionals, and content creators who seek high-quality, durable, and compact imaging solutions. The burgeoning popularity of extreme sports, outdoor recreational activities, and vlogging has created a sustained demand for these specialized devices. Furthermore, technological advancements, such as enhanced image stabilization, superior resolution capabilities (including Ultra HD and Full-HD), improved battery life, and ruggedized designs, are continuously pushing the boundaries of what action cameras can achieve, thereby attracting a wider consumer base. The integration of smart features, wireless connectivity, and advanced editing software further enhances the user experience and accessibility of action camera technology, fueling market penetration.

Action Camera Market Market Size (In Billion)

The market's upward momentum is further supported by strategic initiatives from leading companies like GoPro Inc., Sony Corporation, and SZ DJI Technology Co. Limited, who are actively investing in research and development to introduce innovative products that cater to evolving consumer preferences. Key drivers include the growing interest in drone-mounted cameras for aerial photography and videography, and the increasing use of action cameras in automotive and industrial applications for recording critical data and events. While the market is characterized by intense competition and rapid technological obsolescence, the persistent demand from the consumer electronics sector, coupled with expanding distribution channels and a growing e-commerce presence, ensures sustained growth. Emerging trends also point towards a greater emphasis on wearable technology integration and AI-powered features for automated content creation, promising an exciting future for the action camera landscape.

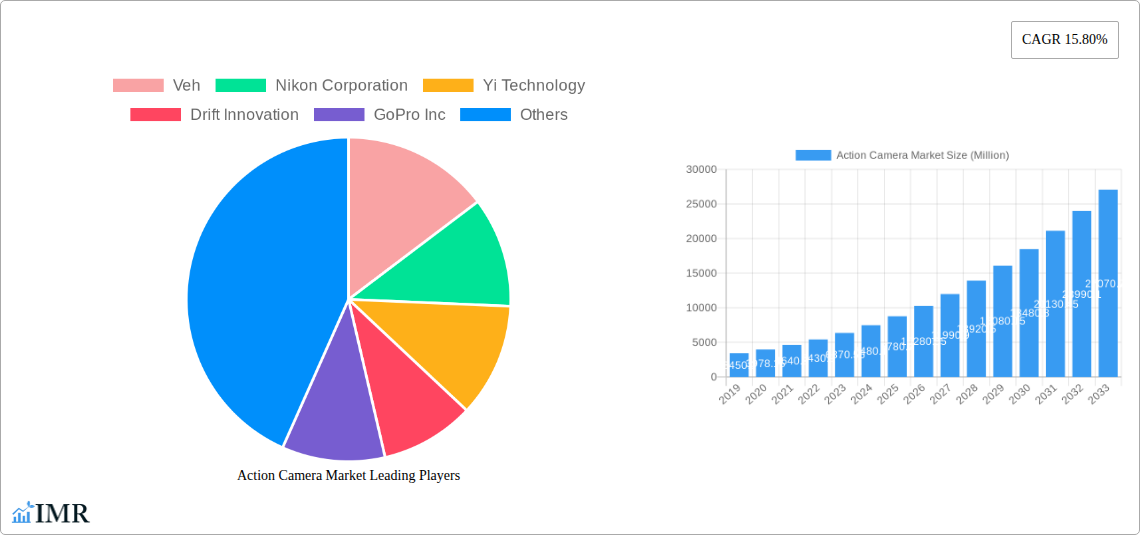

Action Camera Market Company Market Share

Action Camera Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the global action camera market, delving into its intricate dynamics, growth trajectories, and future potential. Covering the historical period of 2019-2024 and projecting to 2033 with a base and estimated year of 2025, this study offers unparalleled insights for industry stakeholders. We meticulously examine market segmentation by Resolution (Ultra HD, Full-HD, Other Resolutions) and analyze the impact of parent and child markets on overall industry evolution. Leveraging high-traffic keywords, this report ensures maximum visibility for professionals seeking to understand market concentration, technological innovation drivers, regulatory frameworks, competitive landscapes, and end-user demographics. Quantifiable data, including market share percentages and M&A volumes, alongside qualitative factors like innovation barriers, are presented to deliver actionable intelligence.

Action Camera Market Market Dynamics & Structure

The global action camera market exhibits a moderately concentrated structure, with key players like GoPro Inc., SZ DJI Technology Co Limited, and Sony Corporation dominating significant market share. Technological innovation remains a primary driver, fueled by advancements in sensor technology, image stabilization, and connectivity features, enabling cameras to capture higher resolution footage in extreme conditions. Regulatory frameworks are relatively light, primarily focusing on product safety and electromagnetic compatibility. Competitive product substitutes include high-end smartphones with advanced camera capabilities and professional camcorders, though dedicated action cameras retain their edge in durability, portability, and specialized features for adventure sports. End-user demographics are diverse, spanning adventure enthusiasts, content creators, professional athletes, and outdoor hobbyists. Mergers and acquisitions (M&A) trends, while not as prevalent as in broader consumer electronics, are observed as companies seek to expand their product portfolios and geographical reach. For instance, acquisitions of smaller tech firms specializing in AI-powered editing or advanced lens technology are strategically important. Innovation barriers include the high cost of research and development for cutting-edge features and the increasing commoditization of basic functionalities.

- Market Concentration: Moderately concentrated, with top players holding substantial market share.

- Technological Innovation Drivers: Advancements in 4K/8K recording, advanced image stabilization (e.g., HyperSmooth), AI-powered editing, and ruggedized designs.

- Regulatory Frameworks: Primarily focused on safety certifications and data privacy.

- Competitive Product Substitutes: High-end smartphones, professional camcorders, and drones with integrated cameras.

- End-User Demographics: Adventure sports participants, vloggers, content creators, travelers, and extreme sports athletes.

- M&A Trends: Strategic acquisitions of specialized technology providers to enhance product offerings.

- Innovation Barriers: High R&D costs, rapid technological obsolescence, and price sensitivity for certain market segments.

Action Camera Market Growth Trends & Insights

The action camera market is poised for robust growth, driven by an evolving consumer demand for capturing and sharing high-quality visual content from their adventures and daily lives. The market size is projected to witness a substantial expansion from approximately 3,800 Million units in 2019 to an estimated 6,500 Million units by 2033, reflecting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This growth is underpinned by increasing adoption rates among amateur content creators and a rising interest in outdoor recreational activities worldwide. Technological disruptions, such as the integration of AI for intelligent scene recognition and automated video editing, are significantly enhancing user experience and pushing the boundaries of what action cameras can achieve. Consumer behavior is shifting towards a greater desire for immersive experiences, leading to a higher demand for cameras capable of capturing Ultra HD resolution and advanced stabilization. The penetration of action cameras into emerging markets, coupled with declining average selling prices for entry-level models, is further accelerating adoption. Furthermore, the proliferation of social media platforms and the creator economy incentivizes individuals to invest in reliable and high-performance action cameras to produce engaging content. The continued miniaturization and ruggedization of devices ensure their suitability for a wide array of challenging environments. The increasing popularity of sports like mountain biking, surfing, skiing, and drone videography directly translates to a sustained demand for action cameras as essential gear. The integration of advanced connectivity features, enabling seamless live-streaming and rapid file transfer, also contributes to their appeal.

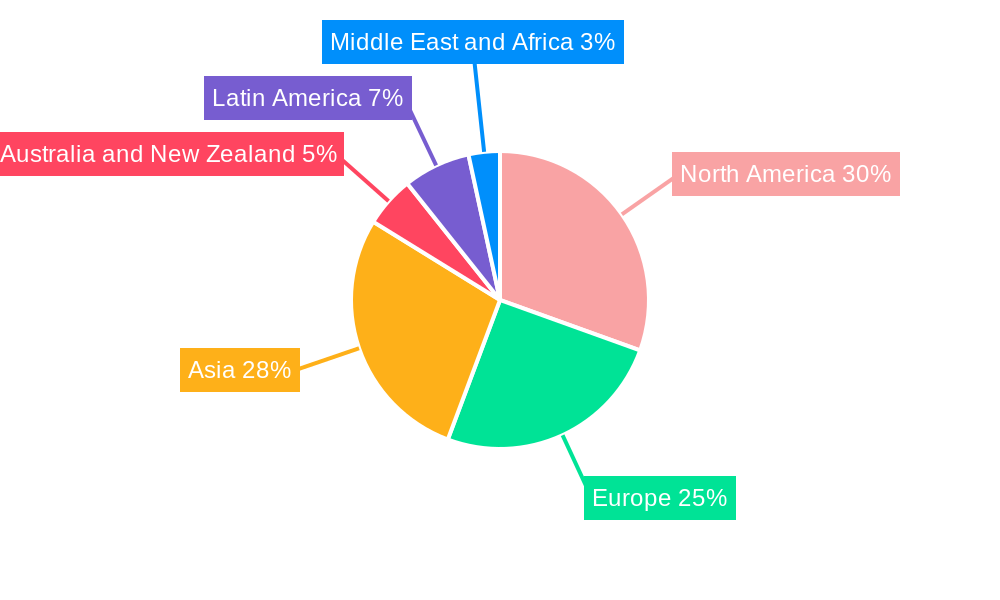

Dominant Regions, Countries, or Segments in Action Camera Market

The Ultra HD resolution segment is emerging as the dominant force driving growth within the global action camera market. This segment's ascendancy is attributed to the escalating demand for high-fidelity video content, fueled by the proliferation of 4K and 8K displays across televisions, monitors, and mobile devices. Consumers increasingly expect lifelike detail and clarity in their recorded footage, making Ultra HD capabilities a crucial differentiating factor. The widespread adoption of this resolution is particularly pronounced in North America and Europe, where disposable incomes are higher and there is a strong culture of outdoor recreation and content creation. In these regions, economic policies often support technological advancements and consumer spending on premium electronics. Infrastructure, such as widespread high-speed internet connectivity, facilitates the sharing and viewing of large Ultra HD files, further bolstering demand.

The market share within the Ultra HD segment is substantial and growing, projected to capture over XX% of the total market by 2033. Growth potential remains exceptionally high, driven by continuous innovation in sensor technology and processing power that enables more affordable and accessible Ultra HD recording. Key countries like the United States, Canada, Germany, and the United Kingdom are leading this trend, with a significant number of adventure sports enthusiasts and professional content creators opting for cameras that deliver superior visual quality.

- Dominant Segment: Ultra HD Resolution.

- Key Drivers: Demand for high-fidelity visual content, proliferation of 4K/8K displays, consumer desire for lifelike detail.

- Leading Regions: North America, Europe.

- Economic Policies: Support for technological adoption and consumer spending.

- Infrastructure: High-speed internet for content sharing and viewing.

- Market Share: Projected to exceed XX% by 2033 within the action camera market.

- Growth Potential: High, driven by ongoing technological advancements and increasing affordability.

- Key Countries: United States, Canada, Germany, United Kingdom.

Action Camera Market Product Landscape

The action camera market is characterized by a relentless pace of product innovation, focusing on enhancing capturing capabilities and user experience. Key advancements include the integration of higher-resolution sensors (up to 8K), sophisticated image stabilization technologies like HyperSmooth and Horizon Lock, improved low-light performance, and expanded fields of view. Product applications span a wide spectrum, from extreme sports documentation and vlogging to underwater photography and professional videography. Unique selling propositions often revolve around ruggedness, waterproof capabilities without housings, compact form factors, and specialized mounting options. Technological advancements are also seen in battery life, intuitive user interfaces, and built-in AI features for intelligent scene detection and editing assistance.

Key Drivers, Barriers & Challenges in Action Camera Market

The action camera market is propelled by several key drivers, primarily the burgeoning creator economy and the increasing popularity of outdoor and adventure sports. Technological advancements in resolution, stabilization, and durability continue to enhance product appeal. Furthermore, the growing demand for high-quality visual content for social media and digital platforms directly fuels market expansion.

However, the market faces significant barriers and challenges. The increasingly sophisticated capabilities of high-end smartphones pose a competitive threat, offering users a convenient all-in-one solution. Price sensitivity, particularly in developing economies, can limit adoption. Supply chain disruptions, as evidenced by recent global events, can impact manufacturing and distribution, leading to stockouts and increased costs. Regulatory hurdles related to data privacy and product certifications can also pose challenges. Intense competition among established players and emerging brands can lead to price wars and pressure on profit margins.

Emerging Opportunities in Action Camera Market

Emerging opportunities in the action camera market lie in several key areas. The integration of advanced AI and machine learning for automated video editing and content curation presents a significant avenue for innovation. Untapped markets in regions with growing adventure tourism and outdoor recreational activities, such as Southeast Asia and parts of South America, offer substantial growth potential. Evolving consumer preferences towards more immersive content are driving demand for 360-degree cameras and advanced virtual reality (VR) integration. Furthermore, the development of specialized action cameras for niche applications, such as professional sports analysis or wildlife monitoring, could unlock new market segments.

Growth Accelerators in the Action Camera Market Industry

Several catalysts are accelerating long-term growth in the action camera industry. Technological breakthroughs in sensor technology, enabling higher resolutions and improved low-light performance, continue to be a primary driver. Strategic partnerships between action camera manufacturers and complementary technology providers (e.g., drone manufacturers, software developers) are expanding product ecosystems and market reach. Market expansion strategies, including aggressive penetration into emerging economies and the development of more affordable product lines, are also contributing to sustained growth. The increasing focus on sustainability and eco-friendly manufacturing processes is another emerging accelerator, appealing to a growing segment of environmentally conscious consumers.

Key Players Shaping the Action Camera Market Market

- Veh

- Nikon Corporation

- Yi Technology

- Drift Innovation

- GoPro Inc

- Rollei GmbH & Co KG

- Garmin Limited

- Insta

- SZ DJI Technology Co Limited

- Olympus Corporation

- TomTom NV

- Sony Corporation

Notable Milestones in Action Camera Market Sector

- October 2023: GoPro launched the HERO 12 Black, a compact waterproof action camera with enhanced quality for photos and videos, available on major e-commerce platforms like Amazon, Flipkart, Reliance Digital, and Croma. This launch aimed to capitalize on the demand for reliable cameras in extreme conditions, with various discounted models offered.

- May 2024: Insta360 announced a partnership with Motovan, significantly increasing the accessibility of Insta360 action cameras for Canadian riders, adventurers, and outdoor enthusiasts. This collaboration aims to leverage the strong synergy between action cameras and the powersports segment, aiding Insta360's continuous growth and providing dealers with opportunities.

In-Depth Action Camera Market Market Outlook

The future outlook for the action camera market remains exceptionally bright, driven by ongoing technological advancements and a persistent global appetite for capturing and sharing experiences. Growth accelerators, including the proliferation of AI-driven features for enhanced content creation and the expansion into untapped geographical markets, will continue to fuel expansion. Strategic partnerships and a focus on niche applications will unlock new revenue streams. The increasing affordability of advanced features will democratize access to high-quality recording, further solidifying the market's robust trajectory. The market is poised for sustained innovation and growth, offering significant strategic opportunities for players who can adapt to evolving consumer demands and technological shifts.

Action Camera Market Segmentation

-

1. Resolution

- 1.1. Ultra HD

- 1.2. Full-HD

- 1.3. Other Resolutions

Action Camera Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Action Camera Market Regional Market Share

Geographic Coverage of Action Camera Market

Action Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 High-demand Markets

- 3.2.2 such as Aerospace and Automotive; Hardware Advancements Have Played a Role in Enhancing Portability and Use in Rugged Environments; Increasing Use of Smart Devices and Advancements in Consumer Electronics

- 3.3. Market Restrains

- 3.3.1. Incremental Advancements in Smartphones

- 3.4. Market Trends

- 3.4.1. Increased Use of Action Cameras Among Adventure Enthusiasts Expected to Aid Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Action Camera Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resolution

- 5.1.1. Ultra HD

- 5.1.2. Full-HD

- 5.1.3. Other Resolutions

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Resolution

- 6. North America Action Camera Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resolution

- 6.1.1. Ultra HD

- 6.1.2. Full-HD

- 6.1.3. Other Resolutions

- 6.1. Market Analysis, Insights and Forecast - by Resolution

- 7. Europe Action Camera Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resolution

- 7.1.1. Ultra HD

- 7.1.2. Full-HD

- 7.1.3. Other Resolutions

- 7.1. Market Analysis, Insights and Forecast - by Resolution

- 8. Asia Action Camera Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resolution

- 8.1.1. Ultra HD

- 8.1.2. Full-HD

- 8.1.3. Other Resolutions

- 8.1. Market Analysis, Insights and Forecast - by Resolution

- 9. Australia and New Zealand Action Camera Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Resolution

- 9.1.1. Ultra HD

- 9.1.2. Full-HD

- 9.1.3. Other Resolutions

- 9.1. Market Analysis, Insights and Forecast - by Resolution

- 10. Latin America Action Camera Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Resolution

- 10.1.1. Ultra HD

- 10.1.2. Full-HD

- 10.1.3. Other Resolutions

- 10.1. Market Analysis, Insights and Forecast - by Resolution

- 11. Middle East and Africa Action Camera Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Resolution

- 11.1.1. Ultra HD

- 11.1.2. Full-HD

- 11.1.3. Other Resolutions

- 11.1. Market Analysis, Insights and Forecast - by Resolution

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Veh

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Nikon Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Yi Technology

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Drift Innovation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 GoPro Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Rollei GmbH & Co KG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Garmin Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 insta

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 SZ DJI Technology Co Limited

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Olympus Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 TomTom NV

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Sony Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Veh

List of Figures

- Figure 1: Global Action Camera Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Action Camera Market Revenue (Million), by Resolution 2025 & 2033

- Figure 3: North America Action Camera Market Revenue Share (%), by Resolution 2025 & 2033

- Figure 4: North America Action Camera Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Action Camera Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Action Camera Market Revenue (Million), by Resolution 2025 & 2033

- Figure 7: Europe Action Camera Market Revenue Share (%), by Resolution 2025 & 2033

- Figure 8: Europe Action Camera Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Action Camera Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Action Camera Market Revenue (Million), by Resolution 2025 & 2033

- Figure 11: Asia Action Camera Market Revenue Share (%), by Resolution 2025 & 2033

- Figure 12: Asia Action Camera Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Action Camera Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Australia and New Zealand Action Camera Market Revenue (Million), by Resolution 2025 & 2033

- Figure 15: Australia and New Zealand Action Camera Market Revenue Share (%), by Resolution 2025 & 2033

- Figure 16: Australia and New Zealand Action Camera Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Australia and New Zealand Action Camera Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Latin America Action Camera Market Revenue (Million), by Resolution 2025 & 2033

- Figure 19: Latin America Action Camera Market Revenue Share (%), by Resolution 2025 & 2033

- Figure 20: Latin America Action Camera Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Latin America Action Camera Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Middle East and Africa Action Camera Market Revenue (Million), by Resolution 2025 & 2033

- Figure 23: Middle East and Africa Action Camera Market Revenue Share (%), by Resolution 2025 & 2033

- Figure 24: Middle East and Africa Action Camera Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Action Camera Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Action Camera Market Revenue Million Forecast, by Resolution 2020 & 2033

- Table 2: Global Action Camera Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Action Camera Market Revenue Million Forecast, by Resolution 2020 & 2033

- Table 4: Global Action Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Action Camera Market Revenue Million Forecast, by Resolution 2020 & 2033

- Table 6: Global Action Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Action Camera Market Revenue Million Forecast, by Resolution 2020 & 2033

- Table 8: Global Action Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Action Camera Market Revenue Million Forecast, by Resolution 2020 & 2033

- Table 10: Global Action Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Action Camera Market Revenue Million Forecast, by Resolution 2020 & 2033

- Table 12: Global Action Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Action Camera Market Revenue Million Forecast, by Resolution 2020 & 2033

- Table 14: Global Action Camera Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Action Camera Market?

The projected CAGR is approximately 15.80%.

2. Which companies are prominent players in the Action Camera Market?

Key companies in the market include Veh, Nikon Corporation, Yi Technology, Drift Innovation, GoPro Inc, Rollei GmbH & Co KG, Garmin Limited, insta, SZ DJI Technology Co Limited, Olympus Corporation, TomTom NV, Sony Corporation.

3. What are the main segments of the Action Camera Market?

The market segments include Resolution.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.41 Million as of 2022.

5. What are some drivers contributing to market growth?

High-demand Markets. such as Aerospace and Automotive; Hardware Advancements Have Played a Role in Enhancing Portability and Use in Rugged Environments; Increasing Use of Smart Devices and Advancements in Consumer Electronics.

6. What are the notable trends driving market growth?

Increased Use of Action Cameras Among Adventure Enthusiasts Expected to Aid Market Growth.

7. Are there any restraints impacting market growth?

Incremental Advancements in Smartphones.

8. Can you provide examples of recent developments in the market?

October 2023: GoPro, has recently launched Go PRO HERO 12 Black . If an compact waterproof action camera that can click photos or record videos without compromising on quality and works in extreme conditions, and availed on popular e-commerce platforms like Amazon, Flip cart Reliance Digital, Croma, and other authorised sellers. Here are some details about the GoPro camera models along with their discounted prices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Action Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Action Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Action Camera Market?

To stay informed about further developments, trends, and reports in the Action Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence