Key Insights

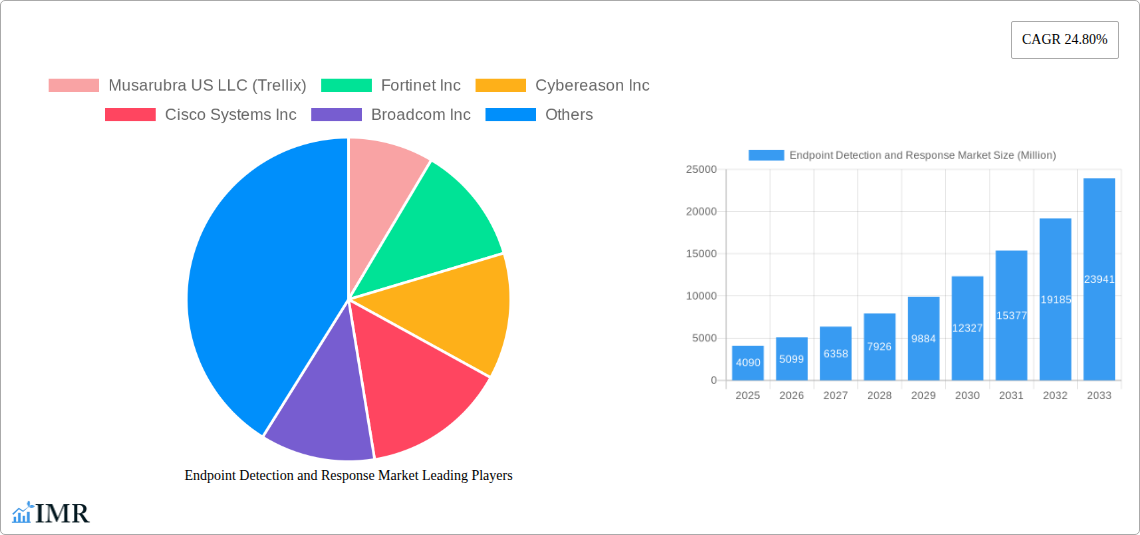

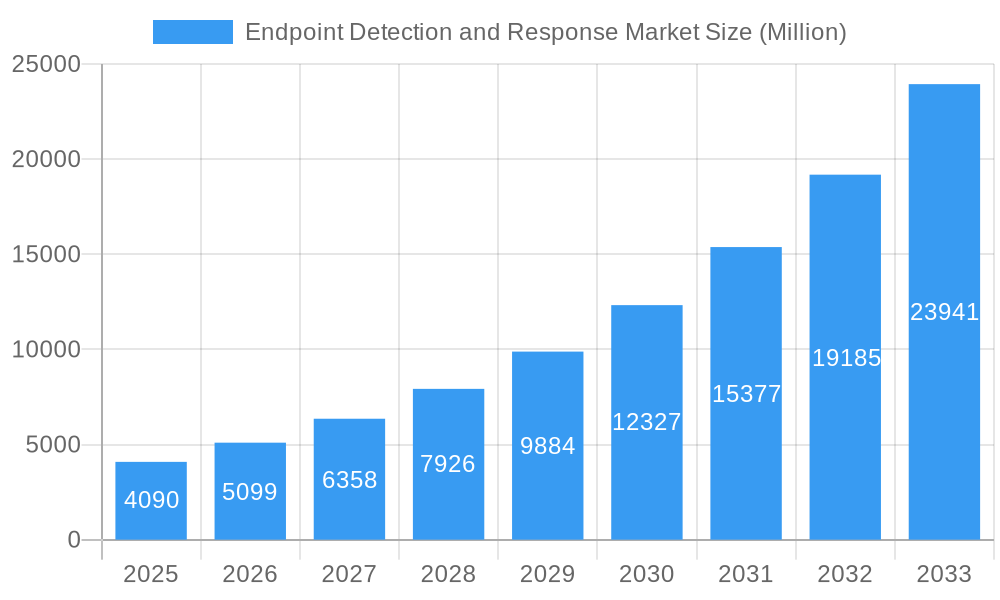

The Endpoint Detection and Response (EDR) market is experiencing robust expansion, driven by the escalating sophistication of cyber threats and the increasing adoption of cloud-based solutions across various industries. The market is projected to reach a substantial valuation of USD 4.09 Billion by 2025, fueled by an impressive Compound Annual Growth Rate (CAGR) of 24.80%. This significant growth trajectory is underpinned by the critical need for organizations to proactively identify, investigate, and respond to advanced threats that bypass traditional security measures. Key drivers include the rise in ransomware attacks, advanced persistent threats (APTs), and insider malicious activities, compelling businesses to invest in advanced security technologies. Furthermore, the proliferation of remote workforces and the growing complexity of IT infrastructures have amplified the attack surface, making EDR solutions indispensable for comprehensive endpoint security.

Endpoint Detection and Response Market Market Size (In Billion)

The EDR market is segmented across various components, deployment types, solution types, organization sizes, and end-user industries, indicating a diverse and dynamic landscape. Solutions and Services together form the core offerings, with a strong preference for Cloud-based deployments due to their scalability, flexibility, and ease of management. Workstations and Mobile Devices represent key areas of focus for EDR solutions, given their widespread use. Small and Medium Enterprises (SMEs) and Large Enterprises alike are recognizing the imperative to adopt EDR to safeguard their digital assets and maintain business continuity. Prominent players like CrowdStrike, Palo Alto Networks, and Fortinet are actively shaping the market through continuous innovation and strategic partnerships, offering advanced capabilities in threat hunting, incident response, and threat intelligence. The market's expansion is further supported by ongoing advancements in artificial intelligence and machine learning, enabling EDR solutions to detect and mitigate threats with greater accuracy and speed.

Endpoint Detection and Response Market Company Market Share

Unlock Critical Insights: Endpoint Detection and Response (EDR) Market Analysis 2019-2033

Gain a comprehensive understanding of the rapidly evolving Endpoint Detection and Response (EDR) market with this in-depth report. Navigating the complex landscape of cybersecurity threats and evolving regulatory demands, this analysis delves into market dynamics, growth trends, regional dominance, and key player strategies. Essential for cybersecurity professionals, IT decision-makers, and investors, this report provides actionable intelligence to inform your strategic planning and maximize your EDR investments.

This report provides a detailed examination of the Endpoint Detection and Response (EDR) market, meticulously covering the historical period from 2019 to 2024, the base and estimated year of 2025, and a robust forecast period extending to 2033. We dissect the market by its core components, deployment types, solution types, organization sizes, and end-user industries, offering a granular view of adoption patterns and future potential. Uncover the strategic initiatives, technological advancements, and market forces shaping the future of endpoint security.

Key Market Segments Covered:

- Component: Solutions, Services

- Deployment Type: Cloud-based, On-premise

- Solution Type: Workstations, Mobile Devices, Servers, Point of Sale Terminals

- Organization Size: Small And Medium Enterprises (SMEs), Large Enterprises

- End-user Industry: BFSI, IT and Telecom, Manufacturing, Healthcare, Retail, Other End-user Industries

Endpoint Detection and Response Market Market Dynamics & Structure

The Endpoint Detection and Response (EDR) market is characterized by a dynamic interplay of intense competition, rapid technological innovation, and evolving regulatory frameworks. Market concentration varies, with a few dominant players holding significant market share, while a growing number of specialized vendors are carving out niches. Technological innovation is the primary driver, fueled by the ever-increasing sophistication of cyber threats, pushing vendors to develop advanced AI-driven detection, automated response capabilities, and proactive threat hunting tools. Regulatory frameworks, such as GDPR and CCPA, are indirectly bolstering the EDR market by mandating stronger data protection and incident response protocols, compelling organizations to adopt robust security solutions. Competitive product substitutes, including traditional antivirus and endpoint protection platforms (EPP), are being increasingly superseded by EDR's superior threat detection and visibility capabilities. End-user demographics are shifting, with SMEs demonstrating a growing adoption of EDR solutions due to escalating threat levels and the availability of more accessible, cloud-based offerings. Mergers and acquisitions (M&A) are prevalent, as larger players seek to consolidate their market position, acquire innovative technologies, and expand their service portfolios.

- Market Concentration: While leading vendors like CrowdStrike, Microsoft, and SentinelOne dominate, the market remains fragmented with significant opportunities for niche players.

- Technological Innovation Drivers: AI and machine learning for advanced threat detection, behavioral analysis, threat intelligence integration, and automated remediation are key innovation areas.

- Regulatory Frameworks: GDPR, CCPA, and industry-specific regulations are indirectly driving demand by emphasizing data breach notification and incident response preparedness.

- Competitive Product Substitutes: Traditional antivirus and EPP solutions are increasingly seen as foundational, with EDR offering advanced capabilities for detection and response.

- End-User Demographics: SMEs are becoming a larger focus due to cloud scalability and increased cybersecurity awareness, while large enterprises demand comprehensive, integrated security platforms.

- M&A Trends: Strategic acquisitions are common for acquiring new technologies, expanding customer bases, and consolidating market leadership. The volume of M&A deals is projected to remain high as the market matures.

Endpoint Detection and Response Market Growth Trends & Insights

The Endpoint Detection and Response (EDR) market is poised for significant expansion, driven by the escalating frequency and sophistication of cyber threats globally. The market size is projected to grow from approximately $4,500 million units in 2025 to over $12,000 million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This remarkable growth is underpinned by increasing adoption rates across all organization sizes, particularly among small and medium-sized enterprises (SMEs) that are becoming more aware of their vulnerability to advanced persistent threats (APTs) and ransomware. Technological disruptions, including the integration of Extended Detection and Response (XDR) capabilities, are redefining endpoint security by providing a unified view across multiple security layers. Consumer behavior shifts are also playing a crucial role, with organizations prioritizing proactive security measures and rapid incident response over purely preventative solutions. The widespread adoption of remote work models has amplified the need for robust endpoint security, as the traditional network perimeter has dissolved. Furthermore, the increasing adoption of cloud-based EDR solutions is making advanced security more accessible and cost-effective for a wider range of businesses. This trend is enabling enhanced scalability, simplified management, and faster deployment, further accelerating market penetration. The growing attack surface, encompassing a proliferation of connected devices and the increasing utilization of mobile endpoints in enterprise environments, necessitates continuous monitoring and rapid detection of malicious activities. The integration of artificial intelligence (AI) and machine learning (ML) algorithms within EDR platforms is a critical enabler of this growth, allowing for the identification of novel and polymorphic threats that traditional signature-based methods often miss. As cybercriminals continue to evolve their tactics, techniques, and procedures (TTPs), the demand for EDR solutions that can provide real-time visibility, in-depth investigation, and automated response capabilities will only intensify, solidifying its position as a cornerstone of modern cybersecurity strategies.

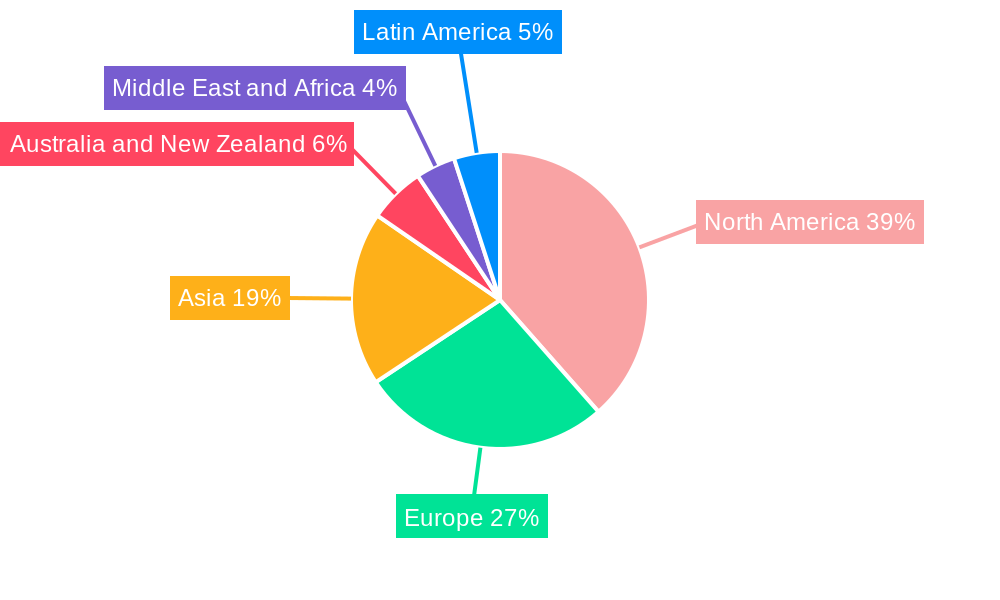

Dominant Regions, Countries, or Segments in Endpoint Detection and Response Market

The North America region is currently the dominant force in the global Endpoint Detection and Response (EDR) market, driven by a confluence of factors including a high concentration of large enterprises, a mature cybersecurity landscape, and significant investments in advanced security technologies. The United States, in particular, leads this dominance due to its robust IT infrastructure, stringent regulatory environment for data protection, and a proactive approach to cybersecurity challenges across various end-user industries.

- Key Drivers of Dominance in North America:

- High Cybersecurity Spending: North American organizations, especially those in the BFSI and IT and Telecom sectors, allocate substantial budgets to cybersecurity solutions, including EDR.

- Advanced Threat Landscape: The region experiences a high volume of sophisticated cyberattacks, necessitating advanced detection and response capabilities offered by EDR.

- Technological Innovation Hub: Proximity to leading technology companies and research institutions fosters rapid innovation and adoption of cutting-edge EDR solutions.

- Regulatory Mandates: Stringent data privacy laws (e.g., HIPAA, CCPA) compel organizations to implement comprehensive security measures.

- Presence of Key Players: A significant number of leading EDR vendors are headquartered or have substantial operations in North America, driving market development and adoption.

Among the Component segments, Solutions are the primary revenue generators, encompassing the core EDR software functionalities. However, Services, including managed detection and response (MDR) and incident response services, are experiencing rapid growth as organizations seek expert support in managing complex threats.

The Deployment Type segment is increasingly tilting towards Cloud-based solutions, offering scalability, flexibility, and reduced infrastructure overhead, especially for SMEs. While on-premise deployments remain relevant for highly regulated industries with specific data residency requirements, cloud adoption is outpacing it.

In terms of Solution Type, Workstations and Servers represent the largest market share due to their critical role in business operations and their status as primary targets for cyberattacks. However, the security of Mobile Devices and Point of Sale Terminals is gaining significant traction as the attack surface expands.

The Organization Size segment shows a balanced growth trajectory. Large Enterprises continue to be major consumers of EDR due to their extensive IT infrastructure and higher risk profiles. However, Small and Medium Enterprises (SMEs) are exhibiting the highest growth rate, driven by the availability of affordable, cloud-native EDR solutions and increasing awareness of cyber threats.

The End-user Industry analysis reveals the IT and Telecom sector as a leading adopter, driven by the constant threat landscape and the need to protect critical infrastructure. The BFSI sector also demonstrates high adoption due to the sensitive nature of financial data and stringent regulatory compliance requirements. Healthcare is a rapidly growing segment, driven by the increasing digitization of patient records and the high value of healthcare data on the dark web.

Endpoint Detection and Response Market Product Landscape

The Endpoint Detection and Response (EDR) product landscape is characterized by continuous innovation focused on enhancing threat detection accuracy, response speed, and operational efficiency. Leading solutions leverage advanced Artificial Intelligence (AI) and Machine Learning (ML) algorithms to analyze vast amounts of endpoint telemetry data, identifying anomalous behaviors indicative of sophisticated cyber threats like zero-day exploits and advanced persistent threats (APTs). Key advancements include the integration of threat intelligence feeds for proactive blocking, behavioral analytics for uncovering stealthy malware, and automated remediation capabilities to swiftly neutralize identified threats. Products are increasingly offering Extended Detection and Response (XDR) capabilities, unifying visibility and control across endpoints, networks, cloud workloads, and other security telemetry, providing a more holistic security posture. Performance metrics are measured by detection rates, false positive reduction, incident response times, and the overall reduction in an organization's attack surface and dwell time.

Key Drivers, Barriers & Challenges in Endpoint Detection and Response Market

Key Drivers:

The Endpoint Detection and Response (EDR) market is propelled by several critical factors. The escalating sophistication and frequency of cyber threats, including ransomware, advanced persistent threats (APTs), and fileless malware, are primary drivers, compelling organizations to adopt more advanced detection and response capabilities than traditional antivirus. Increasing regulatory compliance demands, such as GDPR and CCPA, which mandate robust incident response and data breach notification, further fuel EDR adoption. The growing attack surface due to remote work, cloud adoption, and the Internet of Things (IoT) necessitates continuous monitoring and rapid threat mitigation. Finally, the evolution of AI and machine learning technologies is enabling more intelligent and proactive threat detection within EDR solutions.

Barriers & Challenges:

Despite robust growth, the EDR market faces several challenges. The complexity of implementing and managing EDR solutions can be a barrier, especially for SMEs with limited IT resources and cybersecurity expertise. The cost of advanced EDR solutions can also be a constraint for smaller organizations. Integration with existing security infrastructure can sometimes be complex, leading to compatibility issues. The constant evolution of threat vectors requires continuous updates and adaptation of EDR platforms, demanding significant investment in research and development from vendors. Moreover, a shortage of skilled cybersecurity professionals capable of effectively operating and leveraging EDR tools poses a significant operational challenge for many organizations.

Emerging Opportunities in Endpoint Detection and Response Market

Emerging opportunities in the Endpoint Detection and Response (EDR) market lie in the expansion of Extended Detection and Response (XDR) capabilities, which offer a unified security approach across endpoints, networks, cloud, and email. The increasing demand for Managed Detection and Response (MDR) services presents a significant avenue for growth, catering to organizations seeking outsourced security expertise. Furthermore, the burgeoning IoT security market offers a vast untapped potential for specialized EDR solutions designed for diverse connected devices. The focus on proactive threat hunting and continuous security validation is also creating opportunities for innovative solutions that empower security teams to identify and neutralize threats before they cause damage.

Growth Accelerators in the Endpoint Detection and Response Market Industry

Several catalysts are accelerating the growth of the Endpoint Detection and Response (EDR) market. Technological breakthroughs in AI and machine learning are enabling EDR solutions to detect increasingly sophisticated and evasive threats with greater accuracy. Strategic partnerships between EDR vendors and other cybersecurity solution providers, as well as cloud service providers, are expanding market reach and offering integrated security ecosystems. Market expansion strategies, including the development of more affordable and user-friendly EDR solutions tailored for SMEs, are bringing advanced security to a broader customer base. The growing recognition of EDR as a critical component of a comprehensive cybersecurity strategy, moving beyond traditional endpoint protection, is a significant accelerator.

Key Players Shaping the Endpoint Detection and Response Market Market

- Musarubra US LLC (Trellix)

- Fortinet Inc

- Cybereason Inc

- Cisco Systems Inc

- Broadcom Inc

- Sophos Ltd

- Open Text Corporation

- CrowdStrike Inc

- Fortra LLC

- Palo Alto Networks Inc

- Deep Instinct Ltd

Notable Milestones in Endpoint Detection and Response Market Sector

- October 2023: HarfangLab, a French cybersecurity company offering endpoint detection and response (EDR) solutions to enhance the identification and neutralization of cyberattacks against companies, has closed a EUR 25 million Series A funding round, which would be used to accelerate HarfangLab's business expansion in Europe, and can support the market growth.

- August 2023: Fortinet received the Google Cloud Technology Partner of the Year Award for Security for Identity & Endpoint Protection, which recognizes the ability of its FortiEDR solution to identify and stop breaches in real time, enabling organizations to be resilient to threats and integrate endpoint security within their ecosystem, which can support its market growth in the future.

In-Depth Endpoint Detection and Response Market Market Outlook

The future of the Endpoint Detection and Response (EDR) market is exceptionally promising, driven by an unwavering demand for advanced cyber defense capabilities. Growth accelerators such as the continuous advancement of AI and machine learning will empower EDR solutions to proactively combat evolving threats. Strategic alliances and the increasing adoption of cloud-native, integrated security platforms will broaden accessibility and efficacy. The market outlook suggests a strong trajectory towards EDR becoming an indispensable element of every organization's cybersecurity arsenal, with opportunities for vendors to expand into adjacent security domains like Extended Detection and Response (XDR) and Security Orchestration, Automation, and Response (SOAR).

Endpoint Detection and Response Market Segmentation

-

1. Component

- 1.1. Solutions

- 1.2. Services

-

2. Deployment Type

- 2.1. Cloud-based

- 2.2. On-premise

-

3. Solution Type

- 3.1. Workstations

- 3.2. Mobile Devices

- 3.3. Servers

- 3.4. Point of Sale Terminals

-

4. Organization Size

- 4.1. Small And Medium Enterprises (SMES)

- 4.2. Large Enterprises

-

5. End-user Industry

- 5.1. BFSI

- 5.2. IT and Telecom

- 5.3. Manufacturing

- 5.4. Healthcare

- 5.5. Retail

- 5.6. Other End-user Industries

Endpoint Detection and Response Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 4. Australia and New Zealand

- 5. Middle East and Africa

- 6. Latin America

Endpoint Detection and Response Market Regional Market Share

Geographic Coverage of Endpoint Detection and Response Market

Endpoint Detection and Response Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Expansion of Enterprise Mobility; Bring your Own Device (BYOD) Adoption and Increased Remote Working

- 3.3. Market Restrains

- 3.3.1. Limited Development in the Field of Low-Voltage Fuses and Unorganized Aftermarket in the Fuse Market

- 3.4. Market Trends

- 3.4.1. Small and Medium Enterprises (SMEs) to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Endpoint Detection and Response Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Solutions

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment Type

- 5.2.1. Cloud-based

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by Solution Type

- 5.3.1. Workstations

- 5.3.2. Mobile Devices

- 5.3.3. Servers

- 5.3.4. Point of Sale Terminals

- 5.4. Market Analysis, Insights and Forecast - by Organization Size

- 5.4.1. Small And Medium Enterprises (SMES)

- 5.4.2. Large Enterprises

- 5.5. Market Analysis, Insights and Forecast - by End-user Industry

- 5.5.1. BFSI

- 5.5.2. IT and Telecom

- 5.5.3. Manufacturing

- 5.5.4. Healthcare

- 5.5.5. Retail

- 5.5.6. Other End-user Industries

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia

- 5.6.4. Australia and New Zealand

- 5.6.5. Middle East and Africa

- 5.6.6. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Endpoint Detection and Response Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Solutions

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Deployment Type

- 6.2.1. Cloud-based

- 6.2.2. On-premise

- 6.3. Market Analysis, Insights and Forecast - by Solution Type

- 6.3.1. Workstations

- 6.3.2. Mobile Devices

- 6.3.3. Servers

- 6.3.4. Point of Sale Terminals

- 6.4. Market Analysis, Insights and Forecast - by Organization Size

- 6.4.1. Small And Medium Enterprises (SMES)

- 6.4.2. Large Enterprises

- 6.5. Market Analysis, Insights and Forecast - by End-user Industry

- 6.5.1. BFSI

- 6.5.2. IT and Telecom

- 6.5.3. Manufacturing

- 6.5.4. Healthcare

- 6.5.5. Retail

- 6.5.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Endpoint Detection and Response Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Solutions

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Deployment Type

- 7.2.1. Cloud-based

- 7.2.2. On-premise

- 7.3. Market Analysis, Insights and Forecast - by Solution Type

- 7.3.1. Workstations

- 7.3.2. Mobile Devices

- 7.3.3. Servers

- 7.3.4. Point of Sale Terminals

- 7.4. Market Analysis, Insights and Forecast - by Organization Size

- 7.4.1. Small And Medium Enterprises (SMES)

- 7.4.2. Large Enterprises

- 7.5. Market Analysis, Insights and Forecast - by End-user Industry

- 7.5.1. BFSI

- 7.5.2. IT and Telecom

- 7.5.3. Manufacturing

- 7.5.4. Healthcare

- 7.5.5. Retail

- 7.5.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Endpoint Detection and Response Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Solutions

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Deployment Type

- 8.2.1. Cloud-based

- 8.2.2. On-premise

- 8.3. Market Analysis, Insights and Forecast - by Solution Type

- 8.3.1. Workstations

- 8.3.2. Mobile Devices

- 8.3.3. Servers

- 8.3.4. Point of Sale Terminals

- 8.4. Market Analysis, Insights and Forecast - by Organization Size

- 8.4.1. Small And Medium Enterprises (SMES)

- 8.4.2. Large Enterprises

- 8.5. Market Analysis, Insights and Forecast - by End-user Industry

- 8.5.1. BFSI

- 8.5.2. IT and Telecom

- 8.5.3. Manufacturing

- 8.5.4. Healthcare

- 8.5.5. Retail

- 8.5.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Australia and New Zealand Endpoint Detection and Response Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Solutions

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Deployment Type

- 9.2.1. Cloud-based

- 9.2.2. On-premise

- 9.3. Market Analysis, Insights and Forecast - by Solution Type

- 9.3.1. Workstations

- 9.3.2. Mobile Devices

- 9.3.3. Servers

- 9.3.4. Point of Sale Terminals

- 9.4. Market Analysis, Insights and Forecast - by Organization Size

- 9.4.1. Small And Medium Enterprises (SMES)

- 9.4.2. Large Enterprises

- 9.5. Market Analysis, Insights and Forecast - by End-user Industry

- 9.5.1. BFSI

- 9.5.2. IT and Telecom

- 9.5.3. Manufacturing

- 9.5.4. Healthcare

- 9.5.5. Retail

- 9.5.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Endpoint Detection and Response Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Solutions

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Deployment Type

- 10.2.1. Cloud-based

- 10.2.2. On-premise

- 10.3. Market Analysis, Insights and Forecast - by Solution Type

- 10.3.1. Workstations

- 10.3.2. Mobile Devices

- 10.3.3. Servers

- 10.3.4. Point of Sale Terminals

- 10.4. Market Analysis, Insights and Forecast - by Organization Size

- 10.4.1. Small And Medium Enterprises (SMES)

- 10.4.2. Large Enterprises

- 10.5. Market Analysis, Insights and Forecast - by End-user Industry

- 10.5.1. BFSI

- 10.5.2. IT and Telecom

- 10.5.3. Manufacturing

- 10.5.4. Healthcare

- 10.5.5. Retail

- 10.5.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Latin America Endpoint Detection and Response Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Component

- 11.1.1. Solutions

- 11.1.2. Services

- 11.2. Market Analysis, Insights and Forecast - by Deployment Type

- 11.2.1. Cloud-based

- 11.2.2. On-premise

- 11.3. Market Analysis, Insights and Forecast - by Solution Type

- 11.3.1. Workstations

- 11.3.2. Mobile Devices

- 11.3.3. Servers

- 11.3.4. Point of Sale Terminals

- 11.4. Market Analysis, Insights and Forecast - by Organization Size

- 11.4.1. Small And Medium Enterprises (SMES)

- 11.4.2. Large Enterprises

- 11.5. Market Analysis, Insights and Forecast - by End-user Industry

- 11.5.1. BFSI

- 11.5.2. IT and Telecom

- 11.5.3. Manufacturing

- 11.5.4. Healthcare

- 11.5.5. Retail

- 11.5.6. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Component

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Musarubra US LLC (Trellix)

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Fortinet Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Cybereason Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Cisco Systems Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Broadcom Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Sophos Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Open Text Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 CrowdStrike Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Fortra LLC

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Palo Alto Networks Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Deep Instinct Ltd

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Musarubra US LLC (Trellix)

List of Figures

- Figure 1: Global Endpoint Detection and Response Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Endpoint Detection and Response Market Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Endpoint Detection and Response Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Endpoint Detection and Response Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 5: North America Endpoint Detection and Response Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 6: North America Endpoint Detection and Response Market Revenue (Million), by Solution Type 2025 & 2033

- Figure 7: North America Endpoint Detection and Response Market Revenue Share (%), by Solution Type 2025 & 2033

- Figure 8: North America Endpoint Detection and Response Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 9: North America Endpoint Detection and Response Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 10: North America Endpoint Detection and Response Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: North America Endpoint Detection and Response Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Endpoint Detection and Response Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Endpoint Detection and Response Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Endpoint Detection and Response Market Revenue (Million), by Component 2025 & 2033

- Figure 15: Europe Endpoint Detection and Response Market Revenue Share (%), by Component 2025 & 2033

- Figure 16: Europe Endpoint Detection and Response Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 17: Europe Endpoint Detection and Response Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 18: Europe Endpoint Detection and Response Market Revenue (Million), by Solution Type 2025 & 2033

- Figure 19: Europe Endpoint Detection and Response Market Revenue Share (%), by Solution Type 2025 & 2033

- Figure 20: Europe Endpoint Detection and Response Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 21: Europe Endpoint Detection and Response Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 22: Europe Endpoint Detection and Response Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Europe Endpoint Detection and Response Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe Endpoint Detection and Response Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Endpoint Detection and Response Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Endpoint Detection and Response Market Revenue (Million), by Component 2025 & 2033

- Figure 27: Asia Endpoint Detection and Response Market Revenue Share (%), by Component 2025 & 2033

- Figure 28: Asia Endpoint Detection and Response Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 29: Asia Endpoint Detection and Response Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 30: Asia Endpoint Detection and Response Market Revenue (Million), by Solution Type 2025 & 2033

- Figure 31: Asia Endpoint Detection and Response Market Revenue Share (%), by Solution Type 2025 & 2033

- Figure 32: Asia Endpoint Detection and Response Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 33: Asia Endpoint Detection and Response Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 34: Asia Endpoint Detection and Response Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 35: Asia Endpoint Detection and Response Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 36: Asia Endpoint Detection and Response Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Asia Endpoint Detection and Response Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Australia and New Zealand Endpoint Detection and Response Market Revenue (Million), by Component 2025 & 2033

- Figure 39: Australia and New Zealand Endpoint Detection and Response Market Revenue Share (%), by Component 2025 & 2033

- Figure 40: Australia and New Zealand Endpoint Detection and Response Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 41: Australia and New Zealand Endpoint Detection and Response Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 42: Australia and New Zealand Endpoint Detection and Response Market Revenue (Million), by Solution Type 2025 & 2033

- Figure 43: Australia and New Zealand Endpoint Detection and Response Market Revenue Share (%), by Solution Type 2025 & 2033

- Figure 44: Australia and New Zealand Endpoint Detection and Response Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 45: Australia and New Zealand Endpoint Detection and Response Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 46: Australia and New Zealand Endpoint Detection and Response Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 47: Australia and New Zealand Endpoint Detection and Response Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 48: Australia and New Zealand Endpoint Detection and Response Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Australia and New Zealand Endpoint Detection and Response Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Endpoint Detection and Response Market Revenue (Million), by Component 2025 & 2033

- Figure 51: Middle East and Africa Endpoint Detection and Response Market Revenue Share (%), by Component 2025 & 2033

- Figure 52: Middle East and Africa Endpoint Detection and Response Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 53: Middle East and Africa Endpoint Detection and Response Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 54: Middle East and Africa Endpoint Detection and Response Market Revenue (Million), by Solution Type 2025 & 2033

- Figure 55: Middle East and Africa Endpoint Detection and Response Market Revenue Share (%), by Solution Type 2025 & 2033

- Figure 56: Middle East and Africa Endpoint Detection and Response Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 57: Middle East and Africa Endpoint Detection and Response Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 58: Middle East and Africa Endpoint Detection and Response Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 59: Middle East and Africa Endpoint Detection and Response Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 60: Middle East and Africa Endpoint Detection and Response Market Revenue (Million), by Country 2025 & 2033

- Figure 61: Middle East and Africa Endpoint Detection and Response Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Latin America Endpoint Detection and Response Market Revenue (Million), by Component 2025 & 2033

- Figure 63: Latin America Endpoint Detection and Response Market Revenue Share (%), by Component 2025 & 2033

- Figure 64: Latin America Endpoint Detection and Response Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 65: Latin America Endpoint Detection and Response Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 66: Latin America Endpoint Detection and Response Market Revenue (Million), by Solution Type 2025 & 2033

- Figure 67: Latin America Endpoint Detection and Response Market Revenue Share (%), by Solution Type 2025 & 2033

- Figure 68: Latin America Endpoint Detection and Response Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 69: Latin America Endpoint Detection and Response Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 70: Latin America Endpoint Detection and Response Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 71: Latin America Endpoint Detection and Response Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 72: Latin America Endpoint Detection and Response Market Revenue (Million), by Country 2025 & 2033

- Figure 73: Latin America Endpoint Detection and Response Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Endpoint Detection and Response Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Endpoint Detection and Response Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 3: Global Endpoint Detection and Response Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 4: Global Endpoint Detection and Response Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 5: Global Endpoint Detection and Response Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Endpoint Detection and Response Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Endpoint Detection and Response Market Revenue Million Forecast, by Component 2020 & 2033

- Table 8: Global Endpoint Detection and Response Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 9: Global Endpoint Detection and Response Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 10: Global Endpoint Detection and Response Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 11: Global Endpoint Detection and Response Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Endpoint Detection and Response Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Endpoint Detection and Response Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Endpoint Detection and Response Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Endpoint Detection and Response Market Revenue Million Forecast, by Component 2020 & 2033

- Table 16: Global Endpoint Detection and Response Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 17: Global Endpoint Detection and Response Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 18: Global Endpoint Detection and Response Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 19: Global Endpoint Detection and Response Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Endpoint Detection and Response Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Endpoint Detection and Response Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Endpoint Detection and Response Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: France Endpoint Detection and Response Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Endpoint Detection and Response Market Revenue Million Forecast, by Component 2020 & 2033

- Table 25: Global Endpoint Detection and Response Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 26: Global Endpoint Detection and Response Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 27: Global Endpoint Detection and Response Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 28: Global Endpoint Detection and Response Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 29: Global Endpoint Detection and Response Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: China Endpoint Detection and Response Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Japan Endpoint Detection and Response Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: India Endpoint Detection and Response Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Endpoint Detection and Response Market Revenue Million Forecast, by Component 2020 & 2033

- Table 34: Global Endpoint Detection and Response Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 35: Global Endpoint Detection and Response Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 36: Global Endpoint Detection and Response Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 37: Global Endpoint Detection and Response Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 38: Global Endpoint Detection and Response Market Revenue Million Forecast, by Country 2020 & 2033

- Table 39: Global Endpoint Detection and Response Market Revenue Million Forecast, by Component 2020 & 2033

- Table 40: Global Endpoint Detection and Response Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 41: Global Endpoint Detection and Response Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 42: Global Endpoint Detection and Response Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 43: Global Endpoint Detection and Response Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 44: Global Endpoint Detection and Response Market Revenue Million Forecast, by Country 2020 & 2033

- Table 45: Global Endpoint Detection and Response Market Revenue Million Forecast, by Component 2020 & 2033

- Table 46: Global Endpoint Detection and Response Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 47: Global Endpoint Detection and Response Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 48: Global Endpoint Detection and Response Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 49: Global Endpoint Detection and Response Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 50: Global Endpoint Detection and Response Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Endpoint Detection and Response Market?

The projected CAGR is approximately 24.80%.

2. Which companies are prominent players in the Endpoint Detection and Response Market?

Key companies in the market include Musarubra US LLC (Trellix), Fortinet Inc, Cybereason Inc, Cisco Systems Inc, Broadcom Inc, Sophos Ltd, Open Text Corporation, CrowdStrike Inc, Fortra LLC, Palo Alto Networks Inc, Deep Instinct Ltd.

3. What are the main segments of the Endpoint Detection and Response Market?

The market segments include Component, Deployment Type, Solution Type, Organization Size, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.09 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Expansion of Enterprise Mobility; Bring your Own Device (BYOD) Adoption and Increased Remote Working.

6. What are the notable trends driving market growth?

Small and Medium Enterprises (SMEs) to Witness Major Growth.

7. Are there any restraints impacting market growth?

Limited Development in the Field of Low-Voltage Fuses and Unorganized Aftermarket in the Fuse Market.

8. Can you provide examples of recent developments in the market?

October 2023: HarfangLab, a French cybersecurity company offering endpoint detection and response (EDR) solutions to enhance the identification and neutralization of cyberattacks against companies, has closed a EUR 25 million Series A funding round, which would be used to accelerate HarfangLab's business expansion in Europe, and can support the market growth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Endpoint Detection and Response Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Endpoint Detection and Response Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Endpoint Detection and Response Market?

To stay informed about further developments, trends, and reports in the Endpoint Detection and Response Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence