Key Insights

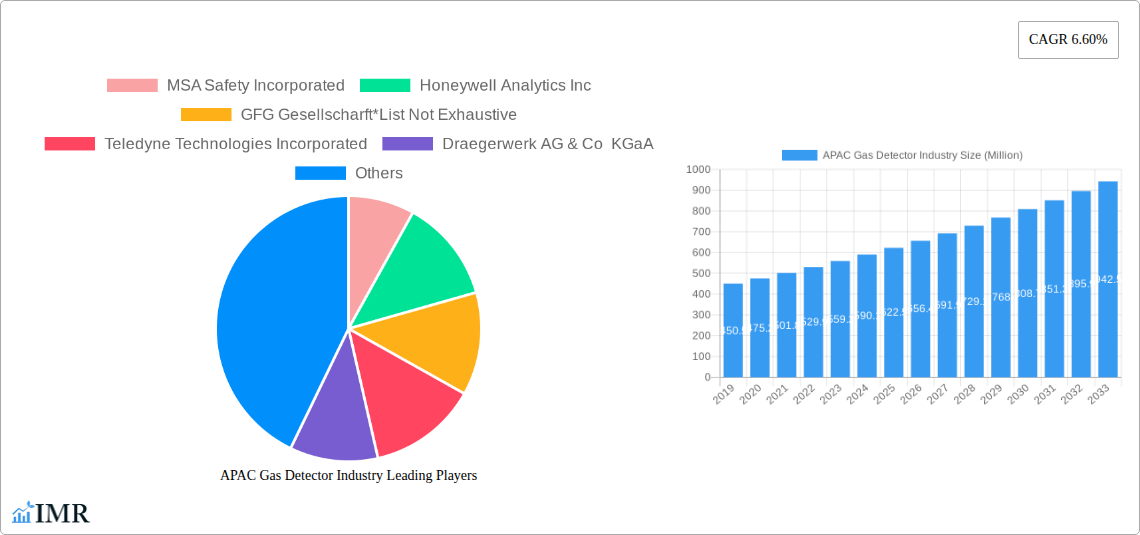

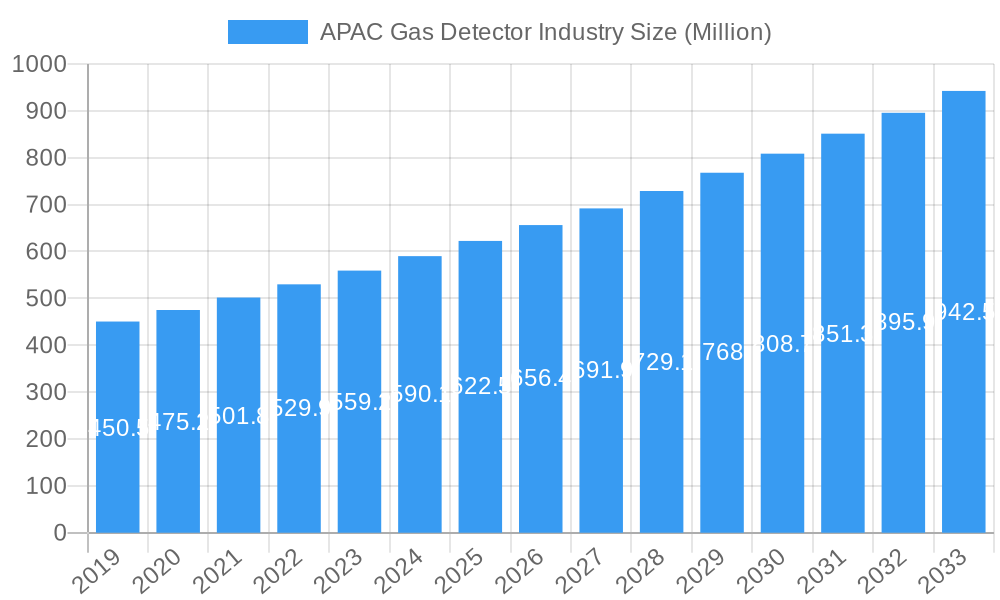

The Asia Pacific (APAC) gas detector market is poised for significant expansion, driven by increasing industrialization, stringent safety regulations, and a growing awareness of workplace hazards. With a substantial market size of approximately $599.44 million and a projected Compound Annual Growth Rate (CAGR) of 6.60%, the region is demonstrating robust demand for both fixed and portable gas detection solutions. The oil and gas, chemical, and petrochemical sectors remain dominant end-user verticals, fueled by their inherent risks and the critical need for continuous monitoring. However, other segments like water and wastewater treatment, power generation, and food and beverage are also contributing to market growth as safety standards evolve across diverse industries. The increasing adoption of advanced technologies, including smart sensors and connected devices, further enhances the market’s trajectory, offering real-time data and improved response capabilities.

APAC Gas Detector Industry Market Size (In Million)

The competitive landscape in the APAC gas detector market is characterized by the presence of both established global players and emerging regional manufacturers, leading to innovation and competitive pricing. Key companies like Honeywell Analytics, MSA Safety, and Draegerwerk are actively expanding their presence, while local manufacturers are focusing on catering to specific regional needs and price points. The market is segmented into fixed and portable detectors, with fixed systems dominating due to their suitability for continuous monitoring in industrial environments, while portable detectors are gaining traction for their flexibility in diverse applications and personnel safety. Geographically, China and India are expected to be the largest contributors to market growth, owing to their large industrial bases and increasing investments in safety infrastructure. The trend towards digitalization and the integration of IoT in gas detection systems will likely shape future market dynamics, enabling predictive maintenance and enhanced operational efficiency.

APAC Gas Detector Industry Company Market Share

Here is a compelling, SEO-optimized report description for the APAC Gas Detector Industry, integrating high-traffic keywords and structured as requested:

APAC Gas Detector Market: Comprehensive Analysis 2025-2033 with Segmented Growth & Industry Innovations

This in-depth market research report provides a definitive analysis of the APAC Gas Detector Industry, meticulously detailing market dynamics, growth trends, regional dominance, and future outlook from 2019 to 2033. Covering Fixed Gas Detectors (including Toxic Gas Detectors and Combustible Gas Detectors) and Portable Gas Detectors (both Single-gas and Multi-gas), this report offers granular insights into the Oil and Gas, Chemical and Petrochemical, Water and Wastewater, Power Generation, Metals and Mining, and Food and Beverage end-user verticals. With a base year of 2025, the analysis pinpoints key drivers, emerging opportunities, and growth accelerators shaping this vital industrial safety market.

APAC Gas Detector Industry Market Dynamics & Structure

The APAC Gas Detector Industry is characterized by a moderate market concentration, with several key players vying for market share. Technological innovation is a significant driver, fueled by increasing demand for sophisticated monitoring solutions and advancements in sensor technology. Stringent regulatory frameworks across various APAC nations are mandating the use of gas detection systems, thereby bolstering market growth. Competitive product substitutes, though present, are gradually being overshadowed by the superior accuracy and reliability of modern gas detectors. End-user demographics are shifting towards higher adoption rates in developing economies, driven by industrial expansion and a growing awareness of workplace safety. Mergers and acquisitions (M&A) trends are observed, albeit at a moderate pace, as companies seek to expand their product portfolios and geographical reach. Innovation barriers include the high cost of R&D for advanced sensor technologies and the complex certification processes in different regions.

- Market Concentration: Moderate, with leading companies holding significant shares.

- Technological Innovation Drivers: Demand for advanced sensing, miniaturization, and IoT integration.

- Regulatory Frameworks: Increasing enforcement of safety standards across key APAC countries.

- Competitive Product Substitutes: Limited impact due to technological advancements in gas detection.

- End-User Demographics: Expanding adoption in developing economies and critical industries.

- M&A Trends: Strategic acquisitions to enhance product offerings and market presence.

- Innovation Barriers: High R&D costs, complex regulatory compliance.

APAC Gas Detector Industry Growth Trends & Insights

The APAC Gas Detector Industry is poised for robust growth, projected to expand significantly between 2025 and 2033. Market size evolution is intrinsically linked to the region's rapid industrialization and infrastructure development, particularly in emerging economies. Adoption rates of advanced gas detection systems are accelerating, driven by a heightened focus on worker safety, environmental protection, and regulatory compliance. Technological disruptions, such as the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) in gas detectors, are transforming the market by enabling real-time data analytics and predictive maintenance. Consumer behavior shifts are evident, with end-users increasingly demanding intelligent, connected, and cost-effective solutions that offer enhanced monitoring capabilities and reduced operational risks. The market penetration of both fixed and portable gas detectors is on an upward trajectory, supported by a growing understanding of the potential hazards associated with various industrial processes. Specific metrics such as a Compound Annual Growth Rate (CAGR) of approximately 7.5% are anticipated over the forecast period, with market penetration expected to reach new heights as safety regulations become more stringent and cost-effective solutions become more accessible. The historical period (2019-2024) laid the groundwork for this expansion, witnessing early adoption trends and foundational technological advancements. The estimated market value for 2025 is projected to be around $2,200 Million units, with a forecast to exceed $3,800 Million units by 2033.

Dominant Regions, Countries, or Segments in APAC Gas Detector Industry

The Oil and Gas sector stands out as a dominant end-user vertical within the APAC Gas Detector Industry, driven by the inherent risks associated with exploration, extraction, refining, and transportation of hydrocarbons. Stringent safety regulations, the need for continuous monitoring in hazardous environments, and the high value of assets protected by gas detection systems contribute to its leading position. Countries like China, India, and Southeast Asian nations, with their expanding energy infrastructure, represent significant demand centers. The Chemical and Petrochemical industry also exhibits substantial growth, driven by the increasing production of chemicals and the inherent risks of handling flammable and toxic substances.

- Dominant End-User Verticals:

- Oil and Gas: Extensive use in upstream, midstream, and downstream operations for leak detection and safety.

- Chemical and Petrochemical: Critical for monitoring hazardous gas releases in production facilities.

- Key Regional Drivers:

- China: Largest market due to extensive industrial base and stringent safety regulations.

- India: Rapidly growing demand driven by infrastructure development and manufacturing.

- Southeast Asia: Increasing adoption in oil and gas exploration and manufacturing sectors.

- Market Share & Growth Potential: The Oil and Gas segment is estimated to hold a market share of approximately 30% in 2025, with a projected CAGR of 8%. The Chemical and Petrochemical segment follows closely, with an estimated 25% market share and a CAGR of 7%.

- Economic Policies & Infrastructure: Government initiatives promoting industrial safety and investments in new infrastructure projects are key growth enablers.

- Technological Adoption: Advanced fixed and portable gas detectors are being increasingly adopted in these sectors to ensure compliance and minimize risks.

APAC Gas Detector Industry Product Landscape

The APAC Gas Detector Industry is witnessing a surge in product innovations, focusing on enhanced accuracy, portability, and smart connectivity. Fixed gas detectors are increasingly incorporating advanced sensor technologies for reliable detection of toxic and combustible gases in industrial settings, offering continuous monitoring and early warning systems. Portable gas detectors, including single-gas and multi-gas variants, are becoming more sophisticated, featuring improved battery life, user-friendly interfaces, and data logging capabilities for comprehensive safety management. Innovations in sensor materials and miniaturization are driving the development of compact yet powerful devices suitable for confined space entry and personal safety. Applications span across diverse industries, from ensuring worker safety in oil rigs and chemical plants to monitoring air quality in food processing facilities and detecting leaks in water treatment plants. Performance metrics are improving with faster response times, wider detection ranges, and enhanced resistance to environmental interference.

Key Drivers, Barriers & Challenges in APAC Gas Detector Industry

Key Drivers:

- Stringent Safety Regulations: Increasing government mandates for industrial safety and environmental protection are a primary growth catalyst.

- Industrial Growth & Expansion: Rapid industrialization across APAC, particularly in manufacturing, oil and gas, and chemicals, fuels demand.

- Technological Advancements: Development of smarter, more accurate, and connected gas detection solutions.

- Growing Safety Awareness: Increased understanding of the risks associated with hazardous gases and the importance of prevention.

Barriers & Challenges:

- High Initial Investment: The cost of advanced gas detection systems can be a barrier for smaller enterprises.

- Skilled Workforce Shortage: Lack of trained personnel for installation, calibration, and maintenance.

- Counterfeit Products: Presence of low-quality, uncertified detectors impacting market integrity.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of components.

- Regulatory Harmonization: Diverse and sometimes conflicting regulatory standards across different APAC countries.

- Market Penetration in Emerging Markets: Reaching remote areas and smaller industries with limited awareness and budget. The estimated market value for 2025 for portable gas detectors is approximately $800 Million units, and for fixed gas detectors, it is around $1,400 Million units.

Emerging Opportunities in APAC Gas Detector Industry

Emerging opportunities in the APAC Gas Detector Industry lie in the burgeoning demand for smart, IoT-enabled devices that offer real-time data monitoring and predictive analytics. The increasing focus on worker safety in the gig economy and construction sectors presents a significant untapped market. Furthermore, the growing adoption of renewable energy sources like hydrogen presents new applications for specialized hydrogen gas detectors. The development of advanced sensor technologies for detecting novel or emerging hazardous gases will also create niche market opportunities. The "Other" end-user vertical, encompassing sectors like pharmaceuticals and construction, is expected to witness substantial growth as awareness of gas detection benefits spreads.

Growth Accelerators in the APAC Gas Detector Industry Industry

Technological breakthroughs, such as the miniaturization of sensors and the integration of AI for intelligent diagnostics, are key growth accelerators. Strategic partnerships between gas detector manufacturers and industrial automation companies are fostering the development of integrated safety solutions. Market expansion strategies, including the establishment of local manufacturing facilities and distribution networks in high-growth economies, are further propelling the industry forward. The increasing adoption of cloud-based platforms for data management and remote monitoring of gas detection systems is also a significant catalyst for sustained growth.

Key Players Shaping the APAC Gas Detector Industry Market

- MSA Safety Incorporated

- Honeywell Analytics Inc

- GFG Gesellschaft

- Teledyne Technologies Incorporated

- Draegerwerk AG & Co KGaA

- RKI Instruments Inc

- Crowncon Detection Instruments Limited

- Industrial Scientific Corporation

- Det-Tronics (a Carrier Company)

Notable Milestones in APAC Gas Detector Industry Sector

- June 2022: Industrial Scientific announced that the Radius BZ1 Area Monitor now supports hydrogen chloride (HCl), chlorine dioxide (ClO2), and infrared (IR) sensors within the removable SafeCore module. With these new sensor offerings, the Radius BZ1 can now be used more extensively to detect hazardous gases in fence line and perimeter monitoring, hot work, and other area monitoring applications.

- February 2022: Figaro Engineering, Japan-based Gas Sensors company, announced its new upcoming Lead-free Oxygen sensors. The sensors are Galvanic type Oxygen Sensors and Potentiostatic Electrolysis type Oxygen Sensors, which are in final development and yet to release in the coming future.

- April 2022: Dräger released a new acoustic gas leak detector with an ultrasonic sensor. The Dräger Polytron 8900 ultrasonic gas leak detector (UGLD) transmitter is an early warning area monitor for detecting high-pressure gas leaks in outdoor industrial process environments. The ultrasonic acoustic sensor responds better than conventional gas detectors because it registers the sound of leaking gas instead of measuring the concentration of accumulated gas clouds.

In-Depth APAC Gas Detector Industry Market Outlook

The future outlook for the APAC Gas Detector Industry is exceptionally promising, driven by a confluence of factors including escalating safety regulations, rapid industrial expansion, and continuous technological innovation. The integration of the Internet of Things (IoT) and Artificial Intelligence (AI) into gas detection systems will unlock new avenues for predictive maintenance and advanced risk management. The market's growth will be further accelerated by strategic collaborations and geographical expansion into underserved regions. Untapped markets within the Food and Beverage and Water and Wastewater sectors, coupled with emerging applications in areas like hydrogen safety, represent significant future growth potential. The industry is on track for substantial expansion, with an estimated market value of $3,800 Million units by 2033.

APAC Gas Detector Industry Segmentation

-

1. Type

-

1.1. Fixed

- 1.1.1. Toxic Gas Detectors

- 1.1.2. Combustible Gas Detectors

-

1.2. Portable

- 1.2.1. Single-gas

- 1.2.2. Multi-gas

-

1.1. Fixed

-

2. End-user Verticals

- 2.1. Oil and Gas

- 2.2. Chemical and Petrochemical

- 2.3. Water and Wastewater

- 2.4. Power Generation

- 2.5. Metals and Mining

- 2.6. Food and Beverage

- 2.7. Other En

APAC Gas Detector Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Gas Detector Industry Regional Market Share

Geographic Coverage of APAC Gas Detector Industry

APAC Gas Detector Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Awareness on Worker Safety and Stringent Regulations; Steady Increase in the Industrial Sector in Key Emerging Countries in Asia-Pacific

- 3.2.2 Coupled with Expansion Projects

- 3.3. Market Restrains

- 3.3.1. Challenges Relating to Digital Transformation

- 3.4. Market Trends

- 3.4.1. Oil & Gas to Register Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Gas Detector Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed

- 5.1.1.1. Toxic Gas Detectors

- 5.1.1.2. Combustible Gas Detectors

- 5.1.2. Portable

- 5.1.2.1. Single-gas

- 5.1.2.2. Multi-gas

- 5.1.1. Fixed

- 5.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 5.2.1. Oil and Gas

- 5.2.2. Chemical and Petrochemical

- 5.2.3. Water and Wastewater

- 5.2.4. Power Generation

- 5.2.5. Metals and Mining

- 5.2.6. Food and Beverage

- 5.2.7. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America APAC Gas Detector Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fixed

- 6.1.1.1. Toxic Gas Detectors

- 6.1.1.2. Combustible Gas Detectors

- 6.1.2. Portable

- 6.1.2.1. Single-gas

- 6.1.2.2. Multi-gas

- 6.1.1. Fixed

- 6.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 6.2.1. Oil and Gas

- 6.2.2. Chemical and Petrochemical

- 6.2.3. Water and Wastewater

- 6.2.4. Power Generation

- 6.2.5. Metals and Mining

- 6.2.6. Food and Beverage

- 6.2.7. Other En

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America APAC Gas Detector Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fixed

- 7.1.1.1. Toxic Gas Detectors

- 7.1.1.2. Combustible Gas Detectors

- 7.1.2. Portable

- 7.1.2.1. Single-gas

- 7.1.2.2. Multi-gas

- 7.1.1. Fixed

- 7.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 7.2.1. Oil and Gas

- 7.2.2. Chemical and Petrochemical

- 7.2.3. Water and Wastewater

- 7.2.4. Power Generation

- 7.2.5. Metals and Mining

- 7.2.6. Food and Beverage

- 7.2.7. Other En

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe APAC Gas Detector Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fixed

- 8.1.1.1. Toxic Gas Detectors

- 8.1.1.2. Combustible Gas Detectors

- 8.1.2. Portable

- 8.1.2.1. Single-gas

- 8.1.2.2. Multi-gas

- 8.1.1. Fixed

- 8.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 8.2.1. Oil and Gas

- 8.2.2. Chemical and Petrochemical

- 8.2.3. Water and Wastewater

- 8.2.4. Power Generation

- 8.2.5. Metals and Mining

- 8.2.6. Food and Beverage

- 8.2.7. Other En

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa APAC Gas Detector Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fixed

- 9.1.1.1. Toxic Gas Detectors

- 9.1.1.2. Combustible Gas Detectors

- 9.1.2. Portable

- 9.1.2.1. Single-gas

- 9.1.2.2. Multi-gas

- 9.1.1. Fixed

- 9.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 9.2.1. Oil and Gas

- 9.2.2. Chemical and Petrochemical

- 9.2.3. Water and Wastewater

- 9.2.4. Power Generation

- 9.2.5. Metals and Mining

- 9.2.6. Food and Beverage

- 9.2.7. Other En

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific APAC Gas Detector Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Fixed

- 10.1.1.1. Toxic Gas Detectors

- 10.1.1.2. Combustible Gas Detectors

- 10.1.2. Portable

- 10.1.2.1. Single-gas

- 10.1.2.2. Multi-gas

- 10.1.1. Fixed

- 10.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 10.2.1. Oil and Gas

- 10.2.2. Chemical and Petrochemical

- 10.2.3. Water and Wastewater

- 10.2.4. Power Generation

- 10.2.5. Metals and Mining

- 10.2.6. Food and Beverage

- 10.2.7. Other En

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 MSA Safety Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell Analytics Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GFG Gesellscharft*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Teledyne Technologies Incorporated

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Draegerwerk AG & Co KGaA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 RKI Instruments Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Crowncon Detection Instruments Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Industrial Scientific Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Det-Tronics (a Carrier Company)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 MSA Safety Incorporated

List of Figures

- Figure 1: Global APAC Gas Detector Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America APAC Gas Detector Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America APAC Gas Detector Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America APAC Gas Detector Industry Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 5: North America APAC Gas Detector Industry Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 6: North America APAC Gas Detector Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America APAC Gas Detector Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America APAC Gas Detector Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: South America APAC Gas Detector Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America APAC Gas Detector Industry Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 11: South America APAC Gas Detector Industry Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 12: South America APAC Gas Detector Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: South America APAC Gas Detector Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe APAC Gas Detector Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe APAC Gas Detector Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe APAC Gas Detector Industry Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 17: Europe APAC Gas Detector Industry Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 18: Europe APAC Gas Detector Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe APAC Gas Detector Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa APAC Gas Detector Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa APAC Gas Detector Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa APAC Gas Detector Industry Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 23: Middle East & Africa APAC Gas Detector Industry Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 24: Middle East & Africa APAC Gas Detector Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa APAC Gas Detector Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific APAC Gas Detector Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific APAC Gas Detector Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific APAC Gas Detector Industry Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 29: Asia Pacific APAC Gas Detector Industry Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 30: Asia Pacific APAC Gas Detector Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific APAC Gas Detector Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Gas Detector Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global APAC Gas Detector Industry Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 3: Global APAC Gas Detector Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global APAC Gas Detector Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global APAC Gas Detector Industry Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 6: Global APAC Gas Detector Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global APAC Gas Detector Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global APAC Gas Detector Industry Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 12: Global APAC Gas Detector Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global APAC Gas Detector Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global APAC Gas Detector Industry Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 18: Global APAC Gas Detector Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global APAC Gas Detector Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global APAC Gas Detector Industry Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 30: Global APAC Gas Detector Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global APAC Gas Detector Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global APAC Gas Detector Industry Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 39: Global APAC Gas Detector Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific APAC Gas Detector Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Gas Detector Industry?

The projected CAGR is approximately 6.60%.

2. Which companies are prominent players in the APAC Gas Detector Industry?

Key companies in the market include MSA Safety Incorporated, Honeywell Analytics Inc, GFG Gesellscharft*List Not Exhaustive, Teledyne Technologies Incorporated, Draegerwerk AG & Co KGaA, RKI Instruments Inc, Crowncon Detection Instruments Limited, Industrial Scientific Corporation, Det-Tronics (a Carrier Company).

3. What are the main segments of the APAC Gas Detector Industry?

The market segments include Type, End-user Verticals.

4. Can you provide details about the market size?

The market size is estimated to be USD 599.44 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Awareness on Worker Safety and Stringent Regulations; Steady Increase in the Industrial Sector in Key Emerging Countries in Asia-Pacific. Coupled with Expansion Projects.

6. What are the notable trends driving market growth?

Oil & Gas to Register Significant Growth.

7. Are there any restraints impacting market growth?

Challenges Relating to Digital Transformation.

8. Can you provide examples of recent developments in the market?

June 2022 - Industrial Scientificannounced that the Radius BZ1 Area Monitor now supports hydrogen chloride (HCl), chlorine dioxide (ClO2), and infrared (IR) sensors within the removable SafeCore module. With these new sensor offerings, the Radius BZ1 can now be used more extensively to detect hazardous gases in the fence line and perimeter monitoring, hot work, and other area monitoring applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Gas Detector Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Gas Detector Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Gas Detector Industry?

To stay informed about further developments, trends, and reports in the APAC Gas Detector Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence