Key Insights

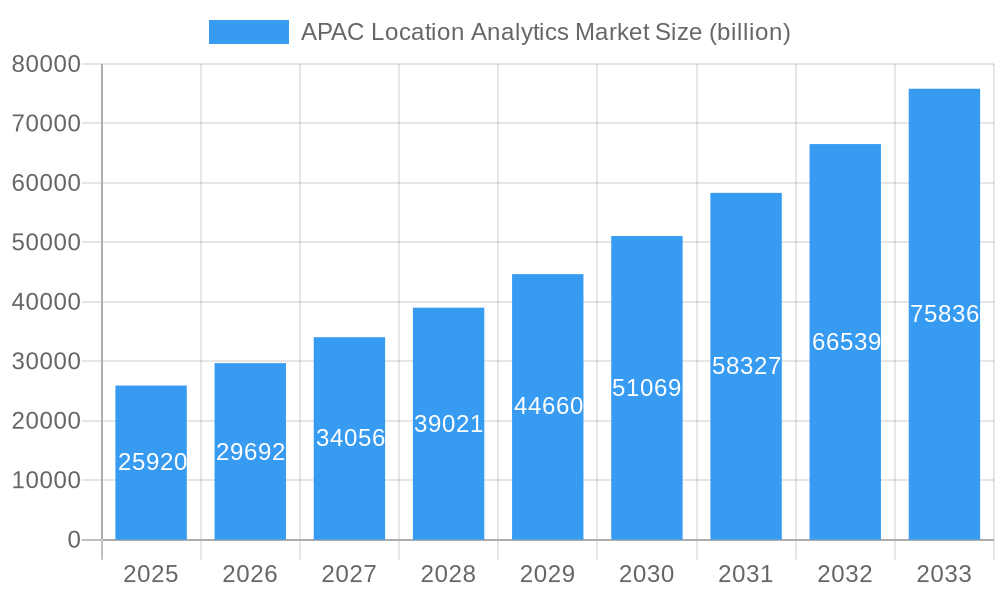

The Asia Pacific (APAC) Location Analytics Market is poised for substantial expansion, projected to reach USD 25.92 billion by 2025, driven by an impressive CAGR of 14.52%. This robust growth is fueled by the increasing adoption of location-based services across diverse industries, including retail, banking, and transportation, as businesses leverage granular insights to optimize operations, enhance customer experiences, and make data-driven decisions. The burgeoning digital transformation across APAC economies, coupled with the widespread availability of mobile devices and the increasing sophistication of IoT technologies, are key catalysts. Furthermore, government initiatives promoting smart city development and the imperative for efficient resource management in sectors like energy and utilities are significantly contributing to market acceleration. The demand for sophisticated analytical tools that can process and interpret vast amounts of geospatial data is intensifying, enabling businesses to gain a competitive edge through precise targeting, predictive modeling, and real-time situational awareness.

APAC Location Analytics Market Market Size (In Billion)

The market dynamics are further shaped by the interplay of various factors. On-demand deployment models are gaining traction due to their flexibility and cost-effectiveness, particularly for small and medium-sized enterprises. While on-premise solutions continue to cater to organizations with stringent data security and regulatory requirements, the cloud-based approach offers scalability and accessibility. Key growth drivers include the need for enhanced supply chain visibility in manufacturing and transportation, personalized customer engagement strategies in retail, and fraud detection and risk management in the banking sector. However, challenges such as data privacy concerns and the need for skilled personnel to effectively utilize advanced location analytics tools may present moderate headwinds. Despite these, the overarching trend points towards a highly dynamic and expanding APAC Location Analytics Market, with significant opportunities for innovation and market penetration.

APAC Location Analytics Market Company Market Share

APAC Location Analytics Market: Comprehensive Market Analysis and Forecast (2019-2033)

This in-depth report provides an exhaustive analysis of the APAC Location Analytics Market, exploring its dynamics, growth trends, key players, and future outlook. With a focus on high-traffic keywords such as "location intelligence," "geospatial analytics," "indoor location tracking," "outdoor location services," and "APAC market growth," this report is optimized for search engine visibility and designed to engage industry professionals. We delve into parent and child market segments, offering a holistic view of the market's evolution and potential. All monetary values are presented in billion units.

APAC Location Analytics Market Market Dynamics & Structure

The APAC Location Analytics Market is characterized by a moderate to high degree of market concentration, with a few key players dominating the landscape. Technological innovation serves as a primary driver, fueled by advancements in AI, IoT, and big data analytics, enabling more sophisticated location intelligence solutions. Regulatory frameworks, while evolving, are increasingly supportive of data privacy and security, influencing deployment strategies. Competitive product substitutes are emerging, particularly in the realm of specialized mapping and navigation tools, though comprehensive location analytics platforms retain a significant advantage. End-user demographics are diverse, spanning industries from retail and banking to transportation and healthcare, each with unique data utilization needs. Mergers and acquisitions (M&A) are a notable trend, with companies seeking to expand their technological capabilities and market reach. For instance, the historical period (2019-2024) has seen several strategic acquisitions aimed at consolidating market share and acquiring innovative technologies, with approximately 5-7 significant M&A deals annually. Barriers to innovation include high implementation costs for advanced solutions and a need for specialized skillsets among end-users. The market is projected to reach $25.50 billion by 2025, with a projected CAGR of 18.2% during the forecast period of 2025–2033.

APAC Location Analytics Market Growth Trends & Insights

The APAC Location Analytics Market is poised for substantial expansion, driven by the escalating adoption of location-based services across a multitude of industries. The market size is anticipated to grow from an estimated $25.50 billion in 2025 to $65.75 billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 18.2% during the forecast period (2025–2033). This impressive growth trajectory is underpinned by several key trends. The proliferation of smartphones and connected devices has created a vast ecosystem for location data generation, powering increasingly sophisticated analytics. Businesses are recognizing the immense value of location intelligence in optimizing operations, enhancing customer experiences, and driving revenue. In the retail sector, for example, location analytics are instrumental in understanding foot traffic patterns, personalizing marketing campaigns, and optimizing store layouts, leading to a projected 15% year-on-year increase in adoption for these use cases. Similarly, the transportation industry is leveraging location data for route optimization, fleet management, and predictive maintenance, significantly improving efficiency and reducing costs. The banking and financial services sector is utilizing location insights for fraud detection, risk assessment, and personalized customer offerings. The burgeoning smart city initiatives across APAC countries are also a significant growth catalyst, demanding advanced location analytics for urban planning, traffic management, and public safety. Consumer behavior is increasingly influenced by location-aware applications and services, further driving demand for businesses to integrate location intelligence into their offerings. The shift towards on-demand deployment models further democratizes access to these powerful tools, enabling smaller businesses to leverage advanced analytics without significant upfront infrastructure investment. The historical period (2019-2024) witnessed a steady increase in market penetration, with adoption rates for basic location services exceeding 60% across major APAC economies.

Dominant Regions, Countries, or Segments in APAC Location Analytics Market

Within the APAC Location Analytics Market, China emerges as a dominant country, spearheading growth due to its vast market size, rapid technological adoption, and significant investments in smart city infrastructure and digital transformation initiatives. Its expansive manufacturing sector and burgeoning e-commerce landscape create an insatiable demand for sophisticated location intelligence to optimize supply chains, manage logistics, and enhance last-mile delivery. The government's proactive stance on technological innovation, coupled with substantial R&D funding, further propels the adoption of advanced geospatial analytics. China's market share is estimated to be approximately 30% of the overall APAC market.

Key Drivers and Dominance Factors in China:

- Smart City Initiatives: Extensive government investment in smart city projects, encompassing intelligent transportation systems, public safety, and environmental monitoring, heavily relies on location analytics.

- E-commerce and Logistics: The world's largest e-commerce market demands highly efficient logistics networks, driving the adoption of route optimization, delivery tracking, and predictive analytics.

- Manufacturing Prowess: China's manufacturing hub benefits from location analytics for supply chain visibility, workforce management, and optimizing factory operations.

- Technological Advancement: Rapid adoption of AI, IoT, and 5G technologies creates a fertile ground for advanced location-based services.

- Consumer Behavior: A large and digitally-savvy population readily embraces location-aware applications and services, creating a strong demand signal.

Among the Verticals, the Retail sector is a significant driver, with an estimated market share of 25% within the overall APAC location analytics market. Retailers are leveraging location data to understand customer behavior, optimize store placement, personalize promotions, and manage inventory efficiently. This includes in-store analytics for foot traffic and dwell time, as well as outdoor analytics for understanding catchment areas and competitor analysis.

Regarding Deployment Models, On-demand solutions are gaining significant traction, estimated to account for 55% of the market by 2025. This is due to their scalability, cost-effectiveness, and ease of implementation, making advanced location analytics accessible to a wider range of businesses.

In terms of Location, Outdoor location analytics currently holds a larger market share, estimated at 65%, driven by applications in navigation, logistics, and outdoor asset tracking. However, Indoor location analytics is rapidly growing, fueled by the increasing need for precise location data within retail stores, warehouses, and large public spaces.

APAC Location Analytics Market Product Landscape

The APAC Location Analytics Market product landscape is characterized by innovative solutions encompassing real-time data processing, predictive modeling, and advanced visualization tools. Key product innovations include AI-powered geospatial intelligence platforms that integrate diverse data sources like satellite imagery, sensor data, and mobile device location. Applications range from hyper-local marketing and personalized customer engagement in retail to optimizing fleet management and enhancing autonomous driving capabilities in transportation. Performance metrics are increasingly focused on accuracy, latency, and the ability to derive actionable insights from vast datasets, with leading products offering sub-meter accuracy and real-time analytics capabilities. Unique selling propositions often lie in the integration of sophisticated algorithms for predictive analytics and the provision of intuitive user interfaces for non-technical users.

Key Drivers, Barriers & Challenges in APAC Location Analytics Market

Key Drivers:

- Increasing Demand for Data-Driven Decision Making: Businesses across all verticals are seeking to leverage data for improved operational efficiency, enhanced customer experiences, and strategic growth.

- Advancements in IoT and AI Technologies: The proliferation of IoT devices and the growing sophistication of AI are enabling more precise and powerful location analytics.

- Growth of Smart Cities and Connected Infrastructure: Government initiatives and urban development projects are creating a strong demand for location-based solutions.

- Proliferation of Mobile Devices and Location-Aware Applications: A vast user base generating location data fuels the market for location analytics.

Barriers & Challenges:

- Data Privacy and Security Concerns: Stringent data protection regulations and public apprehension surrounding data privacy can hinder widespread adoption.

- High Implementation Costs and Need for Skilled Workforce: Deploying and managing advanced location analytics solutions can be expensive, and a shortage of skilled professionals poses a challenge.

- Data Integration and Standardization Issues: Combining data from disparate sources and ensuring data quality and interoperability can be complex.

- Regulatory Hurdles and Compliance: Navigating varying regulatory landscapes across different APAC countries can be challenging for global providers.

Emerging Opportunities in APAC Location Analytics Market

Emerging opportunities in the APAC Location Analytics Market are abundant, particularly in the realm of hyper-personalization and advanced predictive analytics. The increasing adoption of 5G technology promises to unlock new possibilities for real-time location tracking and data transmission, enabling more sophisticated applications in augmented reality (AR) and virtual reality (VR) experiences. The healthcare sector presents a significant untapped market, with opportunities in patient tracking, remote monitoring, and optimizing hospital resource allocation. Furthermore, the growing demand for sustainable solutions is creating a niche for location analytics in environmental monitoring, smart energy management, and optimizing agricultural practices. The "Other Verticals" segment, encompassing industries like real estate, tourism, and entertainment, is also ripe for innovation, with businesses seeking to leverage location intelligence for enhanced customer engagement and operational efficiency.

Growth Accelerators in the APAC Location Analytics Market Industry

Several catalysts are accelerating the growth of the APAC Location Analytics Market. Technological breakthroughs in areas such as edge computing, allowing for local processing of location data, and enhanced mapping technologies are significantly improving the speed and accuracy of analytics. Strategic partnerships between technology providers, data providers, and industry-specific solution developers are fostering innovation and expanding market reach. For instance, collaborations focused on developing specialized location analytics for autonomous vehicles or precision agriculture are gaining momentum. Furthermore, the increasing investment in research and development by both established players and emerging startups is driving the creation of novel applications and services that cater to evolving market demands. The continuous expansion of cloud infrastructure is also a key accelerator, providing scalable and cost-effective platforms for delivering location analytics solutions across the region.

Key Players Shaping the APAC Location Analytics Market Market

- SAS Institute Inc

- Tibco Software Inc

- HERE

- Pitney Bowes

- Microsoft Corporation

- Galigeo

- ESRI (Environmental Systems Research Institute)

- Oracle Corporation

- Cisco Systems

- SAP SE

Notable Milestones in APAC Location Analytics Market Sector

- September 2022: HERE Technologies launched HERE SDK Navigate (Software Development Kit) in Japan. This initiative provides businesses access to a seamless map experience and a rich portfolio of location features, including multiple map view instances, 3D camera control, and an integrated toolchain for map customization, featuring car and truck turn-by-turn (TBT) navigation, advanced routing, geocoding, and search. This will significantly benefit global and local businesses in enhancing their mobile application user experience.

- October 2022: Innoviz Technology announced its partnership with Kudan to develop 3D digital mapping solutions leveraging "Simultaneous Localization and Mapping" (SLAM) technology. This collaboration aims to generate 3D maps of surrounding environments and enable autonomous mobility through Innoviz LiDARs, with applications in HD mapping for autonomous driving, robotics, geospatial mapping, and surveying within the Asia Pacific region.

In-Depth APAC Location Analytics Market Market Outlook

The future outlook for the APAC Location Analytics Market is exceptionally promising, driven by a confluence of accelerating factors. The continued advancements in AI, IoT, and 5G technologies will unlock unprecedented capabilities in real-time data analysis and hyper-localized insights. Strategic partnerships and ecosystem development will foster innovation and broaden the accessibility of sophisticated location intelligence solutions. Emerging opportunities in sectors like healthcare, sustainable development, and niche industry verticals present significant avenues for growth. Furthermore, the ongoing digital transformation across the region, coupled with a growing demand for data-driven decision-making, will ensure a sustained and robust market expansion. The forecast period (2025–2033) anticipates continued strong CAGR, solidifying the region's position as a global leader in location analytics innovation and adoption.

APAC Location Analytics Market Segmentation

-

1. Location

- 1.1. Indoor

- 1.2. Outdoor

-

2. Deployment Model

- 2.1. On-premise

- 2.2. On-demand

-

3. Verticals

- 3.1. Retail

- 3.2. Banking

- 3.3. Manufacturing

- 3.4. Transportation

- 3.5. Healthcare

- 3.6. Government

- 3.7. Energy and Power

- 3.8. Other Verticals

-

4. Countries

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. Australia

- 4.5. Other Countries

APAC Location Analytics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

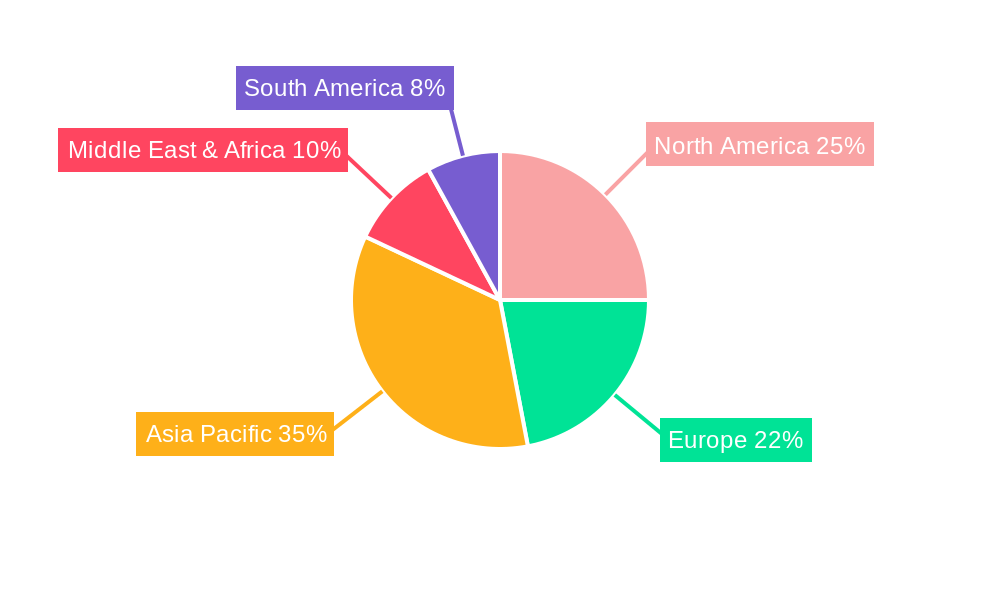

APAC Location Analytics Market Regional Market Share

Geographic Coverage of APAC Location Analytics Market

APAC Location Analytics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Retail Market; Increasing adoption of analytical business intelligence and geographic information systems technology; Increasing Usage of Internet of Things

- 3.3. Market Restrains

- 3.3.1 Concerns about security and privacy; Systems are error prone In cases like incomplete business information

- 3.3.2 out-of-date information and limitation of place databases

- 3.4. Market Trends

- 3.4.1. In-vehicle connectivity is driving growth in the Automotive sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Location Analytics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location

- 5.1.1. Indoor

- 5.1.2. Outdoor

- 5.2. Market Analysis, Insights and Forecast - by Deployment Model

- 5.2.1. On-premise

- 5.2.2. On-demand

- 5.3. Market Analysis, Insights and Forecast - by Verticals

- 5.3.1. Retail

- 5.3.2. Banking

- 5.3.3. Manufacturing

- 5.3.4. Transportation

- 5.3.5. Healthcare

- 5.3.6. Government

- 5.3.7. Energy and Power

- 5.3.8. Other Verticals

- 5.4. Market Analysis, Insights and Forecast - by Countries

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Other Countries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Location

- 6. North America APAC Location Analytics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Location

- 6.1.1. Indoor

- 6.1.2. Outdoor

- 6.2. Market Analysis, Insights and Forecast - by Deployment Model

- 6.2.1. On-premise

- 6.2.2. On-demand

- 6.3. Market Analysis, Insights and Forecast - by Verticals

- 6.3.1. Retail

- 6.3.2. Banking

- 6.3.3. Manufacturing

- 6.3.4. Transportation

- 6.3.5. Healthcare

- 6.3.6. Government

- 6.3.7. Energy and Power

- 6.3.8. Other Verticals

- 6.4. Market Analysis, Insights and Forecast - by Countries

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Japan

- 6.4.4. Australia

- 6.4.5. Other Countries

- 6.1. Market Analysis, Insights and Forecast - by Location

- 7. South America APAC Location Analytics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Location

- 7.1.1. Indoor

- 7.1.2. Outdoor

- 7.2. Market Analysis, Insights and Forecast - by Deployment Model

- 7.2.1. On-premise

- 7.2.2. On-demand

- 7.3. Market Analysis, Insights and Forecast - by Verticals

- 7.3.1. Retail

- 7.3.2. Banking

- 7.3.3. Manufacturing

- 7.3.4. Transportation

- 7.3.5. Healthcare

- 7.3.6. Government

- 7.3.7. Energy and Power

- 7.3.8. Other Verticals

- 7.4. Market Analysis, Insights and Forecast - by Countries

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Japan

- 7.4.4. Australia

- 7.4.5. Other Countries

- 7.1. Market Analysis, Insights and Forecast - by Location

- 8. Europe APAC Location Analytics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Location

- 8.1.1. Indoor

- 8.1.2. Outdoor

- 8.2. Market Analysis, Insights and Forecast - by Deployment Model

- 8.2.1. On-premise

- 8.2.2. On-demand

- 8.3. Market Analysis, Insights and Forecast - by Verticals

- 8.3.1. Retail

- 8.3.2. Banking

- 8.3.3. Manufacturing

- 8.3.4. Transportation

- 8.3.5. Healthcare

- 8.3.6. Government

- 8.3.7. Energy and Power

- 8.3.8. Other Verticals

- 8.4. Market Analysis, Insights and Forecast - by Countries

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Japan

- 8.4.4. Australia

- 8.4.5. Other Countries

- 8.1. Market Analysis, Insights and Forecast - by Location

- 9. Middle East & Africa APAC Location Analytics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Location

- 9.1.1. Indoor

- 9.1.2. Outdoor

- 9.2. Market Analysis, Insights and Forecast - by Deployment Model

- 9.2.1. On-premise

- 9.2.2. On-demand

- 9.3. Market Analysis, Insights and Forecast - by Verticals

- 9.3.1. Retail

- 9.3.2. Banking

- 9.3.3. Manufacturing

- 9.3.4. Transportation

- 9.3.5. Healthcare

- 9.3.6. Government

- 9.3.7. Energy and Power

- 9.3.8. Other Verticals

- 9.4. Market Analysis, Insights and Forecast - by Countries

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Japan

- 9.4.4. Australia

- 9.4.5. Other Countries

- 9.1. Market Analysis, Insights and Forecast - by Location

- 10. Asia Pacific APAC Location Analytics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Location

- 10.1.1. Indoor

- 10.1.2. Outdoor

- 10.2. Market Analysis, Insights and Forecast - by Deployment Model

- 10.2.1. On-premise

- 10.2.2. On-demand

- 10.3. Market Analysis, Insights and Forecast - by Verticals

- 10.3.1. Retail

- 10.3.2. Banking

- 10.3.3. Manufacturing

- 10.3.4. Transportation

- 10.3.5. Healthcare

- 10.3.6. Government

- 10.3.7. Energy and Power

- 10.3.8. Other Verticals

- 10.4. Market Analysis, Insights and Forecast - by Countries

- 10.4.1. China

- 10.4.2. India

- 10.4.3. Japan

- 10.4.4. Australia

- 10.4.5. Other Countries

- 10.1. Market Analysis, Insights and Forecast - by Location

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SAS Institute Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tibco Software Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 HERE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pitney Bowes

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Microsoft Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Galigeo

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ESRI (Environmental Systems Research Institute)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Oracle Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cisco Systems

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SAP SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 SAS Institute Inc

List of Figures

- Figure 1: Global APAC Location Analytics Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America APAC Location Analytics Market Revenue (billion), by Location 2025 & 2033

- Figure 3: North America APAC Location Analytics Market Revenue Share (%), by Location 2025 & 2033

- Figure 4: North America APAC Location Analytics Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 5: North America APAC Location Analytics Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 6: North America APAC Location Analytics Market Revenue (billion), by Verticals 2025 & 2033

- Figure 7: North America APAC Location Analytics Market Revenue Share (%), by Verticals 2025 & 2033

- Figure 8: North America APAC Location Analytics Market Revenue (billion), by Countries 2025 & 2033

- Figure 9: North America APAC Location Analytics Market Revenue Share (%), by Countries 2025 & 2033

- Figure 10: North America APAC Location Analytics Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America APAC Location Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America APAC Location Analytics Market Revenue (billion), by Location 2025 & 2033

- Figure 13: South America APAC Location Analytics Market Revenue Share (%), by Location 2025 & 2033

- Figure 14: South America APAC Location Analytics Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 15: South America APAC Location Analytics Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 16: South America APAC Location Analytics Market Revenue (billion), by Verticals 2025 & 2033

- Figure 17: South America APAC Location Analytics Market Revenue Share (%), by Verticals 2025 & 2033

- Figure 18: South America APAC Location Analytics Market Revenue (billion), by Countries 2025 & 2033

- Figure 19: South America APAC Location Analytics Market Revenue Share (%), by Countries 2025 & 2033

- Figure 20: South America APAC Location Analytics Market Revenue (billion), by Country 2025 & 2033

- Figure 21: South America APAC Location Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe APAC Location Analytics Market Revenue (billion), by Location 2025 & 2033

- Figure 23: Europe APAC Location Analytics Market Revenue Share (%), by Location 2025 & 2033

- Figure 24: Europe APAC Location Analytics Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 25: Europe APAC Location Analytics Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 26: Europe APAC Location Analytics Market Revenue (billion), by Verticals 2025 & 2033

- Figure 27: Europe APAC Location Analytics Market Revenue Share (%), by Verticals 2025 & 2033

- Figure 28: Europe APAC Location Analytics Market Revenue (billion), by Countries 2025 & 2033

- Figure 29: Europe APAC Location Analytics Market Revenue Share (%), by Countries 2025 & 2033

- Figure 30: Europe APAC Location Analytics Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe APAC Location Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa APAC Location Analytics Market Revenue (billion), by Location 2025 & 2033

- Figure 33: Middle East & Africa APAC Location Analytics Market Revenue Share (%), by Location 2025 & 2033

- Figure 34: Middle East & Africa APAC Location Analytics Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 35: Middle East & Africa APAC Location Analytics Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 36: Middle East & Africa APAC Location Analytics Market Revenue (billion), by Verticals 2025 & 2033

- Figure 37: Middle East & Africa APAC Location Analytics Market Revenue Share (%), by Verticals 2025 & 2033

- Figure 38: Middle East & Africa APAC Location Analytics Market Revenue (billion), by Countries 2025 & 2033

- Figure 39: Middle East & Africa APAC Location Analytics Market Revenue Share (%), by Countries 2025 & 2033

- Figure 40: Middle East & Africa APAC Location Analytics Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa APAC Location Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific APAC Location Analytics Market Revenue (billion), by Location 2025 & 2033

- Figure 43: Asia Pacific APAC Location Analytics Market Revenue Share (%), by Location 2025 & 2033

- Figure 44: Asia Pacific APAC Location Analytics Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 45: Asia Pacific APAC Location Analytics Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 46: Asia Pacific APAC Location Analytics Market Revenue (billion), by Verticals 2025 & 2033

- Figure 47: Asia Pacific APAC Location Analytics Market Revenue Share (%), by Verticals 2025 & 2033

- Figure 48: Asia Pacific APAC Location Analytics Market Revenue (billion), by Countries 2025 & 2033

- Figure 49: Asia Pacific APAC Location Analytics Market Revenue Share (%), by Countries 2025 & 2033

- Figure 50: Asia Pacific APAC Location Analytics Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific APAC Location Analytics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Location Analytics Market Revenue billion Forecast, by Location 2020 & 2033

- Table 2: Global APAC Location Analytics Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 3: Global APAC Location Analytics Market Revenue billion Forecast, by Verticals 2020 & 2033

- Table 4: Global APAC Location Analytics Market Revenue billion Forecast, by Countries 2020 & 2033

- Table 5: Global APAC Location Analytics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global APAC Location Analytics Market Revenue billion Forecast, by Location 2020 & 2033

- Table 7: Global APAC Location Analytics Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 8: Global APAC Location Analytics Market Revenue billion Forecast, by Verticals 2020 & 2033

- Table 9: Global APAC Location Analytics Market Revenue billion Forecast, by Countries 2020 & 2033

- Table 10: Global APAC Location Analytics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global APAC Location Analytics Market Revenue billion Forecast, by Location 2020 & 2033

- Table 15: Global APAC Location Analytics Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 16: Global APAC Location Analytics Market Revenue billion Forecast, by Verticals 2020 & 2033

- Table 17: Global APAC Location Analytics Market Revenue billion Forecast, by Countries 2020 & 2033

- Table 18: Global APAC Location Analytics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global APAC Location Analytics Market Revenue billion Forecast, by Location 2020 & 2033

- Table 23: Global APAC Location Analytics Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 24: Global APAC Location Analytics Market Revenue billion Forecast, by Verticals 2020 & 2033

- Table 25: Global APAC Location Analytics Market Revenue billion Forecast, by Countries 2020 & 2033

- Table 26: Global APAC Location Analytics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Kingdom APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Italy APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Spain APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Benelux APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Nordics APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global APAC Location Analytics Market Revenue billion Forecast, by Location 2020 & 2033

- Table 37: Global APAC Location Analytics Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 38: Global APAC Location Analytics Market Revenue billion Forecast, by Verticals 2020 & 2033

- Table 39: Global APAC Location Analytics Market Revenue billion Forecast, by Countries 2020 & 2033

- Table 40: Global APAC Location Analytics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Turkey APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Israel APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: GCC APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: North Africa APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Global APAC Location Analytics Market Revenue billion Forecast, by Location 2020 & 2033

- Table 48: Global APAC Location Analytics Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 49: Global APAC Location Analytics Market Revenue billion Forecast, by Verticals 2020 & 2033

- Table 50: Global APAC Location Analytics Market Revenue billion Forecast, by Countries 2020 & 2033

- Table 51: Global APAC Location Analytics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 52: China APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: India APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: ASEAN APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Oceania APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Location Analytics Market?

The projected CAGR is approximately 14.52%.

2. Which companies are prominent players in the APAC Location Analytics Market?

Key companies in the market include SAS Institute Inc, Tibco Software Inc, HERE, Pitney Bowes, Microsoft Corporation, Galigeo, ESRI (Environmental Systems Research Institute), Oracle Corporation, Cisco Systems, SAP SE.

3. What are the main segments of the APAC Location Analytics Market?

The market segments include Location, Deployment Model, Verticals, Countries.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.92 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth in Retail Market; Increasing adoption of analytical business intelligence and geographic information systems technology; Increasing Usage of Internet of Things.

6. What are the notable trends driving market growth?

In-vehicle connectivity is driving growth in the Automotive sector.

7. Are there any restraints impacting market growth?

Concerns about security and privacy; Systems are error prone In cases like incomplete business information. out-of-date information and limitation of place databases.

8. Can you provide examples of recent developments in the market?

September 2022: HERE Technologies launched HERE SDK Navigate (Software Development Kit) in Japan. That provides businesses access to a smooth map experience and a rich portfolio of location features, such as multiple map view instances, 3D camera control, and an integrated toolchain for map customization, including car and truck turn-by-turn (TBT) navigation, advanced routing, geocoding, and search, that will benefit global and local businesses to improve their mobile application user experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Location Analytics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Location Analytics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Location Analytics Market?

To stay informed about further developments, trends, and reports in the APAC Location Analytics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence