Key Insights

The APAC Media and Entertainment Market is poised for exceptional growth, projected to reach a substantial USD 2870.56 billion in 2025, driven by an impressive CAGR of 26.7% over the forecast period. This robust expansion is fueled by several key factors, including the burgeoning digital transformation across the region, the increasing penetration of high-speed internet, and the rapidly growing middle class with greater disposable income. The proliferation of smartphones and digital devices has created a fertile ground for content consumption across diverse segments like video games and e-sports, digital advertising, and streaming services. Emerging economies within APAC are particularly contributing to this surge, with a rising demand for localized and engaging content across traditional and digital platforms. Furthermore, significant investments in content creation and distribution infrastructure are solidifying the region's position as a global media powerhouse.

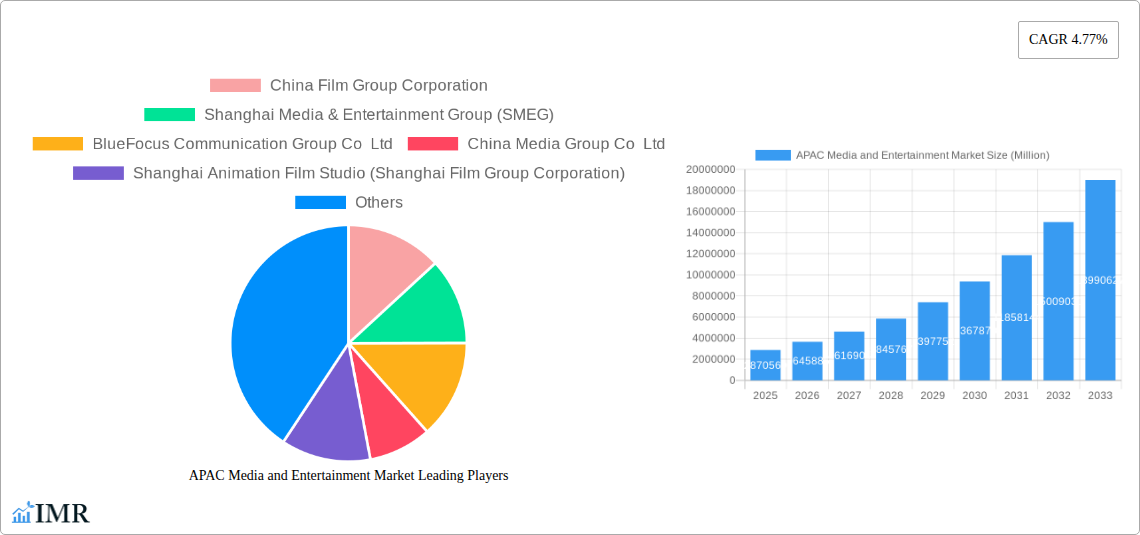

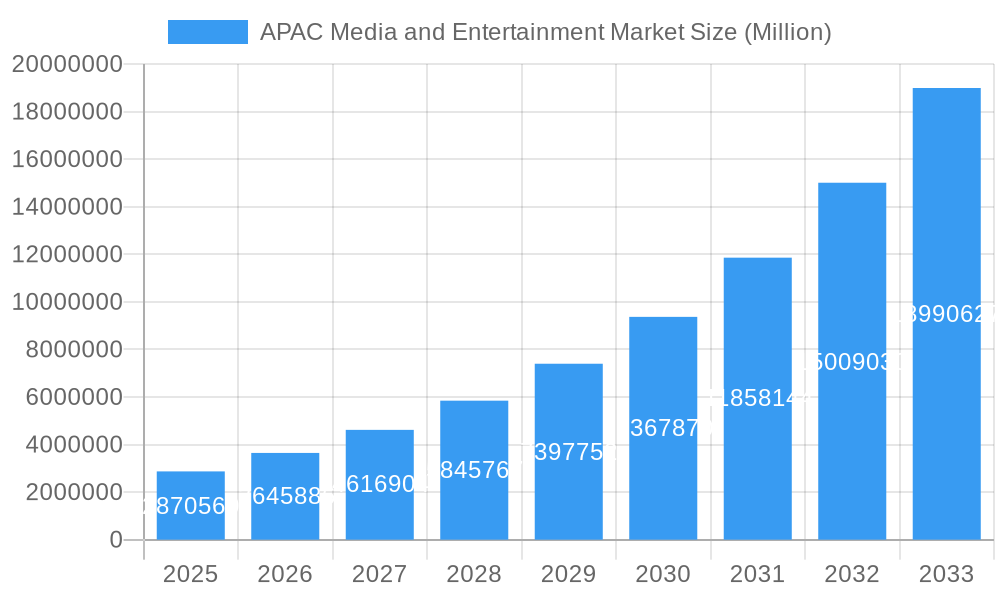

APAC Media and Entertainment Market Market Size (In Million)

The market's dynamism is further accentuated by ongoing technological advancements, such as the integration of AI in content personalization and the expansion of 5G networks, which are expected to unlock new avenues for immersive experiences. While the market is characterized by intense competition among established players and emerging digital-native companies, strategic collaborations and mergers & acquisitions are shaping the competitive landscape. Key segments like filmed entertainment, digital advertising, and internet access are leading the charge, supported by innovative business models and a strong consumer appetite for diverse entertainment options. Companies are increasingly focusing on data analytics to understand consumer behavior and tailor offerings, ensuring sustained engagement and market leadership in this rapidly evolving sector. The region's diverse cultural tapestry provides a unique opportunity for niche content creation and global expansion.

APAC Media and Entertainment Market Company Market Share

Comprehensive Report: APAC Media and Entertainment Market (2019–2033)

This in-depth report provides a holistic analysis of the APAC Media and Entertainment Market, offering critical insights into its dynamics, growth trajectories, and competitive landscape. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this study is an indispensable resource for industry stakeholders seeking to navigate this rapidly evolving sector. We dissect key segments such as Filmed Entertainment, TV Subscription and Licence Fees, and Video Games and e-sports, alongside parent markets like Broadcasting and Digital Media, and child markets such as Streaming Services and Influencer Marketing, to deliver a nuanced understanding of market opportunities.

APAC Media and Entertainment Market Market Dynamics & Structure

The APAC Media and Entertainment Market is characterized by dynamic forces shaping its structure and future. Market concentration varies significantly across regions, with some sectors exhibiting consolidation among major players while others remain fragmented. Technological innovation, particularly in areas like AI-driven content creation, immersive technologies (AR/VR), and advanced data analytics for personalized content delivery, serves as a primary driver. However, these innovations also present barriers to entry for smaller players. Regulatory frameworks, including content moderation policies, data privacy laws, and licensing requirements, play a crucial role in dictating market access and operational strategies. The competitive landscape is robust, with increasing substitution between traditional and digital media formats. End-user demographics are shifting, with a growing, tech-savvy youth population in emerging economies driving demand for digital content and interactive entertainment. Mergers and acquisitions (M&A) activity remains a key trend, as companies seek to expand their market reach, acquire new technologies, and consolidate their positions. For instance, the historical period (2019–2024) has witnessed substantial M&A deals aimed at bolstering digital streaming capabilities and expanding content libraries.

- Market Concentration: Varies by segment; high in broadcast and streaming, fragmented in niche publishing.

- Technological Innovation: AI in content, AR/VR for immersive experiences, data analytics for personalization.

- Regulatory Frameworks: Content moderation, data privacy, licensing are critical influences.

- Competitive Product Substitutes: Digital streaming challenging linear TV, online news impacting print.

- End-User Demographics: Growing young, digitally native population driving demand.

- M&A Trends: Strategic acquisitions for digital expansion and content diversification.

APAC Media and Entertainment Market Growth Trends & Insights

The APAC Media and Entertainment Market is poised for substantial growth, driven by a confluence of expanding internet penetration, increasing disposable incomes, and a burgeoning demand for diverse content. The estimated market size for the base year 2025 is projected to be USD 350 billion, with a projected CAGR of 7.5% during the forecast period 2025–2033. Adoption rates for digital services, including video-on-demand (VOD) and online gaming, are escalating rapidly across key markets like China, India, and Southeast Asian nations. Technological disruptions, such as the widespread availability of high-speed mobile internet and the increasing adoption of smart devices, are fundamentally altering how consumers access and consume media. This has led to significant shifts in consumer behavior, with a marked preference for on-demand, personalized, and interactive entertainment experiences. The rise of the creator economy and influencer marketing further exemplifies these behavioral changes. The market penetration for paid streaming services is expected to reach 65% by 2033, underscoring the shift from traditional media consumption.

The historical period (2019–2024) saw initial impacts of the COVID-19 pandemic, accelerating digital adoption, particularly in streaming and online gaming, with the market size growing from an estimated USD 280 billion in 2019 to USD 335 billion in 2024. This period also highlighted the resilience and adaptability of the media and entertainment sector. Looking ahead, the integration of 5G technology will unlock new opportunities for immersive content and real-time interactive experiences, further fuelling market growth. The increasing affluence in emerging economies within APAC will continue to drive higher spending on entertainment services, from blockbuster films and premium TV subscriptions to mobile gaming and e-sports.

Dominant Regions, Countries, or Segments in APAC Media and Entertainment Market

The Filmed Entertainment segment is emerging as a dominant force within the APAC Media and Entertainment Market, showcasing remarkable growth and innovation. This dominance is driven by several key factors, including a burgeoning middle class with increased disposable income, a rapidly expanding digital infrastructure, and a growing appetite for diverse cinematic content. China, with its massive population and a highly developed film industry, stands as a significant contributor to this segment's growth. The country's robust box office revenues and its increasing global influence in film production and distribution are pivotal. Furthermore, the widespread adoption of streaming platforms across the region has democratized access to films, allowing both local and international productions to reach a wider audience.

In addition to China, India's Filmed Entertainment sector, particularly Bollywood and regional cinema, continues to be a powerhouse, with a massive domestic market and a growing diaspora viewership. The strategic expansion of Indian film content into global markets further bolsters its significance. The segment's growth potential is further amplified by technological advancements in production, such as CGI and visual effects, and in distribution, with the proliferation of online streaming services like iQiyi, Tencent Video, and regional players. These platforms are not only catering to existing demand but also fostering new viewing habits and preferences.

- Key Drivers for Filmed Entertainment Dominance:

- Economic Policies: Government support for cultural industries and film production incentives.

- Infrastructure: Widespread internet access and high-density smartphone ownership facilitating digital distribution.

- Consumer Behavior: Growing demand for high-quality visual content and immersive cinematic experiences.

- Technological Advancements: Innovations in production techniques and digital streaming platforms.

- Market Share: Filmed entertainment is projected to capture approximately 25% of the total APAC Media and Entertainment market by 2033.

The parent market of Digital Media and its child market of Internet Advertising also exert considerable influence, with internet advertising expected to reach USD 95 billion by 2025, reflecting the increasing shift of advertising budgets towards digital channels. This digital shift indirectly fuels filmed entertainment by providing new avenues for promotion and content distribution.

APAC Media and Entertainment Market Product Landscape

The APAC Media and Entertainment Market is defined by a diverse and innovative product landscape. Key innovations include the rise of AI-powered content recommendation engines that personalize user experiences, immersive virtual reality (VR) and augmented reality (AR) applications for gaming and entertainment, and advanced streaming technologies offering higher fidelity audio-visual content. Companies are actively developing interactive storytelling formats and leveraging big data analytics to create more engaging content. The performance metrics of these products are increasingly measured by user engagement, retention rates, and subscription conversions. Unique selling propositions often revolve around exclusive content libraries, seamless user interfaces, and cutting-edge technological integration. For example, the integration of 5G technology is enabling low-latency streaming for live events and interactive gaming, setting new benchmarks for performance and user satisfaction in the region.

Key Drivers, Barriers & Challenges in APAC Media and Entertainment Market

Key Drivers:

- Technological Advancements: Widespread internet penetration, 5G rollout, and smart device adoption are key enablers.

- Growing Disposable Incomes: Rising middle class in emerging economies fuels increased spending on entertainment.

- Demographic Shifts: A large, young, and tech-savvy population driving demand for digital content.

- Content Diversification: Increasing production of localized and diverse content catering to varied tastes.

Barriers & Challenges:

- Piracy and Copyright Infringement: A persistent issue impacting revenue streams.

- Regulatory Hurdles: Varying content regulations and censorship laws across different countries.

- Infrastructure Gaps: Uneven internet access and affordability in rural or less developed areas.

- Intense Competition: Saturated markets and aggressive pricing strategies from global and local players.

- Monetization Models: Evolving and sometimes challenging subscription and advertising models.

- Supply Chain Issues: For physical media and certain hardware components, though less prominent for digital content.

- Quantifiable Impact: Piracy is estimated to cost the industry billions annually, while regulatory changes can lead to revenue fluctuations.

Emerging Opportunities in APAC Media and Entertainment Market

Emerging opportunities in the APAC Media and Entertainment Market lie in the untapped potential of tier-2 and tier-3 cities, where digital adoption is rapidly accelerating. The growth of niche content platforms catering to specific interests, such as educational entertainment, wellness content, and localized short-form video, presents significant avenues for expansion. The increasing adoption of blockchain technology for content rights management and digital collectibles (NFTs) also offers new monetization and engagement models. Furthermore, the burgeoning e-sports sector, with its massive youth following, continues to be a fertile ground for sponsorships, live event broadcasting, and in-game advertising. The development of localized metaverse experiences tailored to regional cultures and preferences also represents a nascent but promising area.

Growth Accelerators in the APAC Media and Entertainment Market Industry

Several catalysts are accelerating long-term growth in the APAC Media and Entertainment Market. The continued investment in high-speed internet infrastructure, including fiber optic networks and 5G deployment, is a fundamental growth accelerator, enabling richer and more interactive content experiences. Strategic partnerships between content creators, technology providers, and distribution platforms are crucial for market expansion, allowing for wider reach and innovative product offerings. Market expansion strategies focused on emerging economies within Southeast Asia and South Asia, coupled with the localization of content to cater to diverse cultural nuances, are unlocking significant new customer bases. The increasing integration of artificial intelligence in content creation and personalized delivery is enhancing user engagement and driving subscription growth.

Key Players Shaping the APAC Media and Entertainment Market Market

- China Film Group Corporation

- Shanghai Media & Entertainment Group (SMEG)

- BlueFocus Communication Group Co Ltd

- China Media Group Co Ltd

- Shanghai Animation Film Studio (Shanghai Film Group Corporation)

- DB Corp Ltd

- Sun TV Network Limited

- Dish TV India Limited

- HT Media Limited

- Eros International PLC*List Not Exhaustive

- Zee Entertainment Enterprises Limited

Notable Milestones in APAC Media and Entertainment Market Sector

- November 2022: The Telecom Regulatory Authority of India (TRAI) introduced amendments to the new tariff order (NTO 2.0) for the broadcasting sector. This set a ceiling of INR 19 per MRP for TV channels within bouquets, limited channel bundling discounts to 45%, and maintained MRP restraints for TV channels, significantly impacting broadcast revenue models and consumer pricing.

- October 2022: Taiwan launched its inaugural English-language news, lifestyle, and entertainment television channel. This strategic move aimed to bolster Taiwan's international presence, foster deeper relationships with democratic nations, and enhance its global profile.

In-Depth APAC Media and Entertainment Market Market Outlook

The outlook for the APAC Media and Entertainment Market remains exceptionally robust, fueled by a potent combination of technological innovation, evolving consumer preferences, and favorable demographic trends. Growth accelerators such as the widespread adoption of 5G, the continuous development of AI for personalized content delivery, and strategic market expansion into underserved regions will continue to drive revenue streams. The increasing demand for localized and diverse content, coupled with the rise of interactive and immersive entertainment formats, presents significant strategic opportunities for stakeholders. By capitalizing on these trends and navigating the competitive landscape effectively, companies can expect sustained growth and profitability in this dynamic market. The estimated market size for 2033 is projected to exceed USD 600 billion.

APAC Media and Entertainment Market Segmentation

-

1. Type

- 1.1. Business-to-business (B2B)

- 1.2. Book Publishing

- 1.3. Filmed Entertainment

- 1.4. Internet Access

- 1.5. Internet Advertising

- 1.6. Magazine Publishing

- 1.7. Music

- 1.8. Newspaper Publishing

- 1.9. Out-of-Home (OOH) Advertising

- 1.10. Radio

- 1.11. TV Advertising

- 1.12. TV Subscription and Licence Fees

- 1.13. Video Games and e-sports

APAC Media and Entertainment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

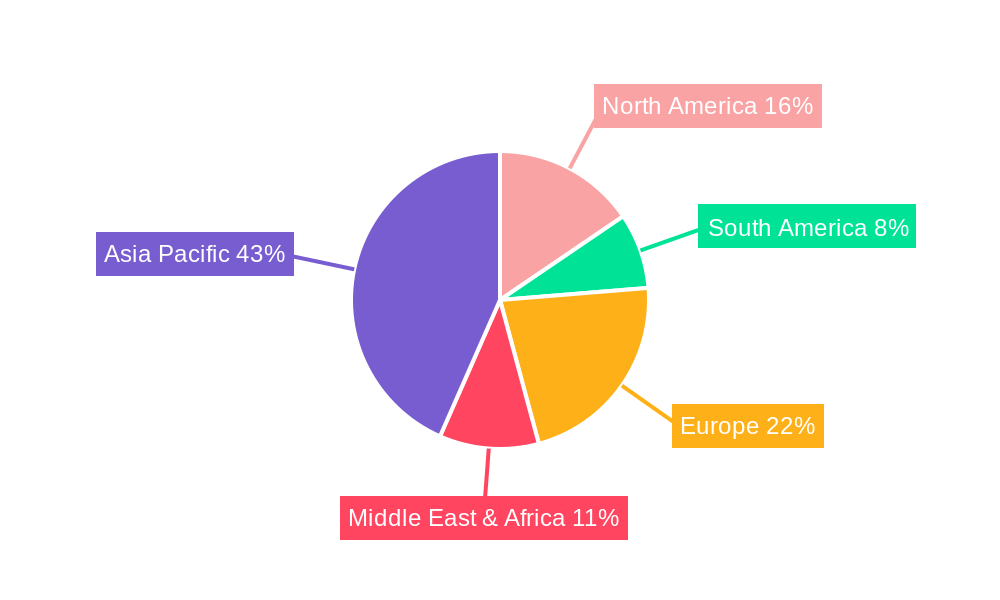

APAC Media and Entertainment Market Regional Market Share

Geographic Coverage of APAC Media and Entertainment Market

APAC Media and Entertainment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 26.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Trends Around Personalization and Increased Digitalization; Significant Growth in Online Gaming

- 3.2.2 OTT

- 3.2.3 and Internet Advertising; Smart Utilization of Data Algorithms and AI Leading to Enhanced Digital Products and Services

- 3.3. Market Restrains

- 3.3.1. Significant Increase in Piracy Leading to Loss of Revenue

- 3.4. Market Trends

- 3.4.1. Increasing Trends Around Personalization and Increased Digitalization is expected to Drive the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Media and Entertainment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Business-to-business (B2B)

- 5.1.2. Book Publishing

- 5.1.3. Filmed Entertainment

- 5.1.4. Internet Access

- 5.1.5. Internet Advertising

- 5.1.6. Magazine Publishing

- 5.1.7. Music

- 5.1.8. Newspaper Publishing

- 5.1.9. Out-of-Home (OOH) Advertising

- 5.1.10. Radio

- 5.1.11. TV Advertising

- 5.1.12. TV Subscription and Licence Fees

- 5.1.13. Video Games and e-sports

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America APAC Media and Entertainment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Business-to-business (B2B)

- 6.1.2. Book Publishing

- 6.1.3. Filmed Entertainment

- 6.1.4. Internet Access

- 6.1.5. Internet Advertising

- 6.1.6. Magazine Publishing

- 6.1.7. Music

- 6.1.8. Newspaper Publishing

- 6.1.9. Out-of-Home (OOH) Advertising

- 6.1.10. Radio

- 6.1.11. TV Advertising

- 6.1.12. TV Subscription and Licence Fees

- 6.1.13. Video Games and e-sports

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America APAC Media and Entertainment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Business-to-business (B2B)

- 7.1.2. Book Publishing

- 7.1.3. Filmed Entertainment

- 7.1.4. Internet Access

- 7.1.5. Internet Advertising

- 7.1.6. Magazine Publishing

- 7.1.7. Music

- 7.1.8. Newspaper Publishing

- 7.1.9. Out-of-Home (OOH) Advertising

- 7.1.10. Radio

- 7.1.11. TV Advertising

- 7.1.12. TV Subscription and Licence Fees

- 7.1.13. Video Games and e-sports

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe APAC Media and Entertainment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Business-to-business (B2B)

- 8.1.2. Book Publishing

- 8.1.3. Filmed Entertainment

- 8.1.4. Internet Access

- 8.1.5. Internet Advertising

- 8.1.6. Magazine Publishing

- 8.1.7. Music

- 8.1.8. Newspaper Publishing

- 8.1.9. Out-of-Home (OOH) Advertising

- 8.1.10. Radio

- 8.1.11. TV Advertising

- 8.1.12. TV Subscription and Licence Fees

- 8.1.13. Video Games and e-sports

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa APAC Media and Entertainment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Business-to-business (B2B)

- 9.1.2. Book Publishing

- 9.1.3. Filmed Entertainment

- 9.1.4. Internet Access

- 9.1.5. Internet Advertising

- 9.1.6. Magazine Publishing

- 9.1.7. Music

- 9.1.8. Newspaper Publishing

- 9.1.9. Out-of-Home (OOH) Advertising

- 9.1.10. Radio

- 9.1.11. TV Advertising

- 9.1.12. TV Subscription and Licence Fees

- 9.1.13. Video Games and e-sports

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific APAC Media and Entertainment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Business-to-business (B2B)

- 10.1.2. Book Publishing

- 10.1.3. Filmed Entertainment

- 10.1.4. Internet Access

- 10.1.5. Internet Advertising

- 10.1.6. Magazine Publishing

- 10.1.7. Music

- 10.1.8. Newspaper Publishing

- 10.1.9. Out-of-Home (OOH) Advertising

- 10.1.10. Radio

- 10.1.11. TV Advertising

- 10.1.12. TV Subscription and Licence Fees

- 10.1.13. Video Games and e-sports

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 China Film Group Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shanghai Media & Entertainment Group (SMEG)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BlueFocus Communication Group Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Media Group Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Shanghai Animation Film Studio (Shanghai Film Group Corporation)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DB Corp Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sun TV Network Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dish TV India Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 HT Media Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eros International PLC*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Zee Entertainment Enterprises Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 China Film Group Corporation

List of Figures

- Figure 1: Global APAC Media and Entertainment Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America APAC Media and Entertainment Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America APAC Media and Entertainment Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America APAC Media and Entertainment Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America APAC Media and Entertainment Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America APAC Media and Entertainment Market Revenue (undefined), by Type 2025 & 2033

- Figure 7: South America APAC Media and Entertainment Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: South America APAC Media and Entertainment Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: South America APAC Media and Entertainment Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe APAC Media and Entertainment Market Revenue (undefined), by Type 2025 & 2033

- Figure 11: Europe APAC Media and Entertainment Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe APAC Media and Entertainment Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe APAC Media and Entertainment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa APAC Media and Entertainment Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Middle East & Africa APAC Media and Entertainment Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Middle East & Africa APAC Media and Entertainment Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Middle East & Africa APAC Media and Entertainment Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific APAC Media and Entertainment Market Revenue (undefined), by Type 2025 & 2033

- Figure 19: Asia Pacific APAC Media and Entertainment Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific APAC Media and Entertainment Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Asia Pacific APAC Media and Entertainment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 4: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 9: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Brazil APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Argentina APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United Kingdom APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Germany APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Italy APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Spain APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Russia APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Benelux APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Nordics APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 25: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Turkey APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Israel APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: GCC APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: North Africa APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Africa APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 33: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: China APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: India APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Japan APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Korea APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: ASEAN APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Oceania APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Media and Entertainment Market?

The projected CAGR is approximately 26.7%.

2. Which companies are prominent players in the APAC Media and Entertainment Market?

Key companies in the market include China Film Group Corporation, Shanghai Media & Entertainment Group (SMEG), BlueFocus Communication Group Co Ltd, China Media Group Co Ltd, Shanghai Animation Film Studio (Shanghai Film Group Corporation), DB Corp Ltd, Sun TV Network Limited, Dish TV India Limited, HT Media Limited, Eros International PLC*List Not Exhaustive, Zee Entertainment Enterprises Limited.

3. What are the main segments of the APAC Media and Entertainment Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trends Around Personalization and Increased Digitalization; Significant Growth in Online Gaming. OTT. and Internet Advertising; Smart Utilization of Data Algorithms and AI Leading to Enhanced Digital Products and Services.

6. What are the notable trends driving market growth?

Increasing Trends Around Personalization and Increased Digitalization is expected to Drive the Growth of the Market.

7. Are there any restraints impacting market growth?

Significant Increase in Piracy Leading to Loss of Revenue.

8. Can you provide examples of recent developments in the market?

November 2022: The Telecom Regulatory Authority of India (TRAI) announced amendments to the new tariff order (NTO 2.0) in the broadcasting sector. The regulator has set a ceiling of INR 19 per MRP for TV channels that can be part of the bouquet. It is now limiting channel bundling discounts to 45%, while at the same time, it continues its restraint of MRPs for TV channels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Media and Entertainment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Media and Entertainment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Media and Entertainment Market?

To stay informed about further developments, trends, and reports in the APAC Media and Entertainment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence