Key Insights

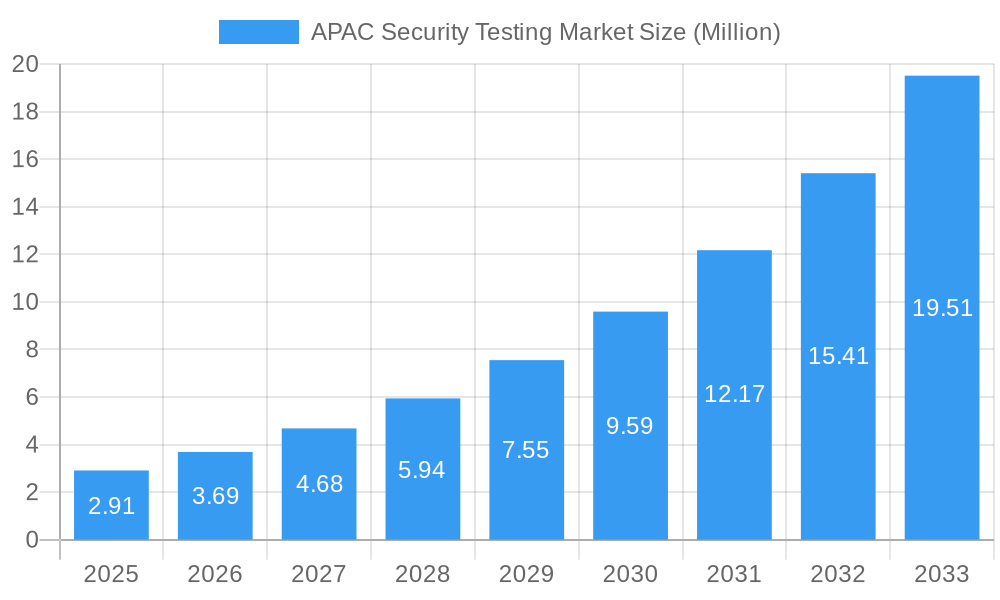

The APAC Security Testing Market is poised for substantial expansion, driven by an escalating cyber threat landscape and the increasing adoption of digital technologies across various industries. Valued at USD 2.91 million in 2025, the market is projected to witness a remarkable Compound Annual Growth Rate (CAGR) of 26.97% during the forecast period of 2025-2033. This robust growth is primarily fueled by the increasing sophistication of cyberattacks, the growing adoption of cloud-based applications, and stringent regulatory compliances, particularly in sectors like BFSI and Healthcare. The demand for comprehensive security testing solutions, encompassing application security, network security, and penetration testing, is rising as organizations strive to protect sensitive data and maintain business continuity. The shift towards agile development methodologies and the proliferation of mobile and IoT devices further necessitate continuous and rigorous security testing. Key drivers include the increasing investment in cybersecurity by governments and enterprises, the growing awareness of data privacy, and the rising complexity of IT infrastructure.

APAC Security Testing Market Market Size (In Million)

The market segmentation reveals a dynamic interplay of different services and deployment models. Application Security Testing, with its sub-segments like Mobile and Web Application Security Testing, is expected to dominate owing to the widespread use of digital platforms. Similarly, Network Security Testing, including firewall and intrusion detection testing, remains critical for safeguarding organizational networks. The increasing adoption of advanced testing methods such as Interactive Application Security Testing (IAST) and Runtime Application Self-Protection (RASP) signals a move towards more proactive and integrated security measures. While cloud-based deployment models are gaining significant traction due to their scalability and cost-effectiveness, on-premise solutions continue to hold relevance for organizations with specific data sovereignty and control requirements. The presence of major players like IBM, Accenture, and Cisco Systems Inc. underscores the competitive nature of this market, fostering innovation and driving the development of advanced security testing tools. The Asia Pacific region, with its rapidly growing economies like China and India, represents a significant growth opportunity, driven by a burgeoning IT sector and increasing cybersecurity investments.

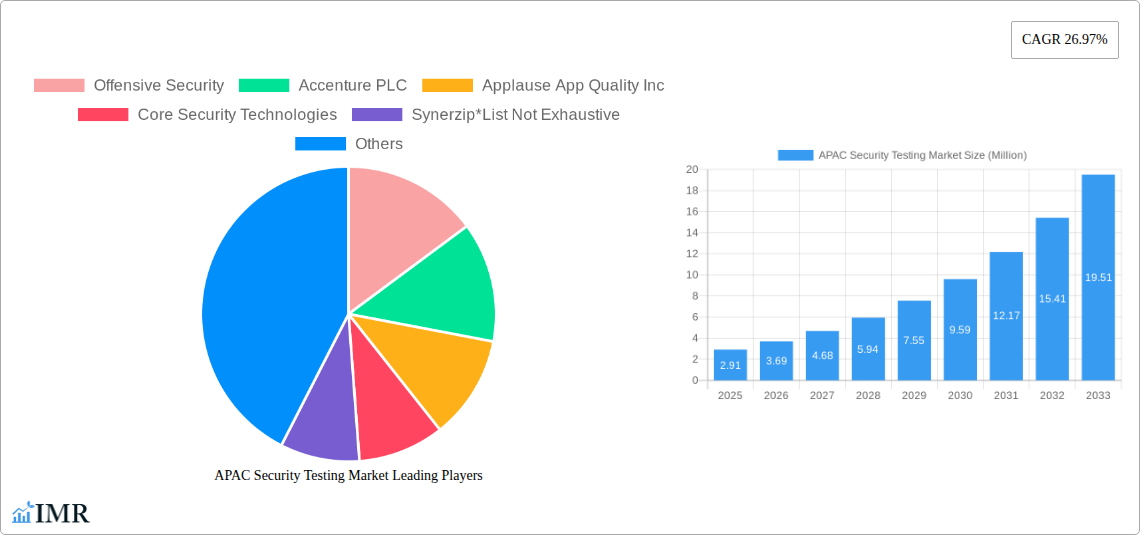

APAC Security Testing Market Company Market Share

Here's the SEO-optimized report description for the APAC Security Testing Market, designed for maximum visibility and industry engagement:

APAC Security Testing Market Report: Forecast to 2033 - Comprehensive Analysis of Application & Network Security

Unlock critical insights into the burgeoning APAC Security Testing Market with this in-depth report. Covering 2019–2033, with a base and estimated year of 2025, this study provides an exhaustive analysis of market dynamics, growth trends, and competitive landscapes. Essential for stakeholders in cybersecurity, IT, and risk management, the report delves into application security testing, network security testing, and a wide array of testing tools and methodologies. Explore dominant regions, emerging opportunities, and strategic imperatives shaping the future of cyber resilience across the Asia-Pacific region.

APAC Security Testing Market Market Dynamics & Structure

The APAC Security Testing Market is characterized by a moderately concentrated landscape, driven by increasing cyber threats and stringent regulatory compliance demands across diverse end-user industries. Technological innovation remains a paramount driver, with continuous advancements in AI, machine learning, and automated testing tools enhancing efficiency and accuracy in identifying vulnerabilities. Key regulatory frameworks, such as data protection laws and industry-specific compliance mandates, are compelling organizations to invest more heavily in robust security testing solutions. Competitive product substitutes are emerging, particularly in the form of integrated DevSecOps platforms, posing a challenge to standalone testing solutions. End-user demographics are shifting towards cloud-native solutions and an increased reliance on mobile and web applications, necessitating specialized testing approaches. Merger and acquisition (M&A) trends indicate a consolidation of market players, with larger entities acquiring specialized firms to broaden their service portfolios and geographical reach.

- Market Concentration: Moderate, with key players consolidating market share.

- Technological Innovation Drivers: AI/ML in automated testing, DevSecOps integration, cloud security testing advancements.

- Regulatory Frameworks: Growing emphasis on data privacy and compliance standards (e.g., GDPR-like regulations) across APAC.

- Competitive Product Substitutes: Rise of integrated security platforms and managed security service providers (MSSPs).

- End-User Demographics: Increasing adoption of cloud services, mobile and web applications, and IoT devices.

- M&A Trends: Strategic acquisitions to expand service offerings and market presence.

APAC Security Testing Market Growth Trends & Insights

The APAC Security Testing Market is poised for substantial expansion, projected to witness robust growth driven by a confluence of factors. The increasing sophistication and frequency of cyberattacks targeting critical infrastructure and sensitive data across the region are compelling organizations to prioritize proactive security measures. This escalating threat landscape directly fuels the demand for comprehensive security testing solutions, encompassing application security testing (AST) and network security testing. The accelerating digital transformation initiatives across various industries, including BFSI, healthcare, and IT, further amplify the need for secure digital assets. As businesses increasingly adopt cloud-based infrastructure and develop intricate web and mobile applications, the demand for specialized testing methods like SAST, DAST, and IAST is surging. Moreover, government initiatives aimed at bolstering national cybersecurity postures and promoting digital economies are creating a favorable environment for market growth. The increasing awareness among enterprises of the potential financial and reputational damage stemming from security breaches is also a significant growth catalyst, encouraging sustained investment in security testing services and tools. The estimated market size for APAC Security Testing is expected to reach $18,500 Million by 2025, with a projected CAGR of 15.8% during the forecast period of 2025–2033. This growth trajectory underscores the critical importance of robust security testing in safeguarding digital assets and ensuring business continuity in the dynamic APAC economic landscape.

Dominant Regions, Countries, or Segments in APAC Security Testing Market

The IT and Telecommunications sector is emerging as a dominant end-user industry within the APAC Security Testing Market, exhibiting significant growth and driving overall market expansion. This dominance is attributed to the sector's inherent reliance on complex digital infrastructure, vast networks, and the continuous development and deployment of cutting-edge applications. Furthermore, the high volume of sensitive customer data handled by IT and telecommunications companies makes them prime targets for cyberattacks, necessitating rigorous and continuous security testing. Countries like China and India are leading the charge due to their substantial IT service exports, robust domestic technology sectors, and increasing investments in cybersecurity infrastructure. The rapid adoption of cloud services and the proliferation of mobile devices in these nations further escalate the demand for application security testing, including mobile application security testing and cloud application security testing.

Dominant End-User Industry: IT and Telecommunications

- Market Share Contribution: Projected to account for over 25% of the total market by 2025.

- Key Drivers: High volume of data processed, rapid software development cycles, increasing cloud adoption, and the need for secure network infrastructure.

- Growth Potential: Sustained investment in 5G deployment, AI, and IoT drives continuous demand for security testing.

Leading Countries:

- China: Driven by a massive domestic technology market and significant government investment in cybersecurity.

- India: A global hub for IT services, with a growing emphasis on enhancing its cybersecurity capabilities and exports.

- Japan: Strong focus on industrial cybersecurity and critical infrastructure protection.

Dominant Deployment Model: Cloud

- Market Share: Expected to capture over 60% of the market by 2025.

- Drivers: Scalability, flexibility, cost-effectiveness, and the inherent nature of cloud-native application development.

Dominant Type of Service: Application Security Testing (AST)

- Sub-segment Dominance: Mobile Application Security Testing and Web Application Security Testing are key growth drivers.

- Testing Method Dominance: Dynamic Application Security Testing (DAST) and Static Application Security Testing (SAST) are widely adopted.

APAC Security Testing Market Product Landscape

The APAC Security Testing Market is witnessing a surge in innovative product offerings focused on enhanced automation, artificial intelligence integration, and comprehensive vulnerability management. Products are increasingly designed for seamless integration into CI/CD pipelines, enabling early detection of security flaws. Key advancements include intelligent code analysis tools that offer greater accuracy in identifying complex vulnerabilities and sophisticated penetration testing tools capable of simulating advanced persistent threats. Furthermore, the market is seeing a rise in platform-based solutions that consolidate various testing methodologies, providing a unified view of an organization's security posture. Performance metrics are improving with faster scanning times and reduced false positives, empowering security teams to respond more effectively to emerging threats.

Key Drivers, Barriers & Challenges in APAC Security Testing Market

Key Drivers:

- Escalating Cyber Threats: The increasing frequency and sophistication of cyberattacks across the APAC region are the primary drivers for robust security testing solutions.

- Regulatory Compliance: Stringent data protection laws and industry-specific regulations are compelling organizations to invest in comprehensive security testing to ensure compliance.

- Digital Transformation: The rapid adoption of cloud technologies, mobile applications, and IoT devices necessitates enhanced security testing to protect new digital frontiers.

- Growing Awareness of Financial & Reputational Risks: Businesses are increasingly aware of the significant financial and reputational damage that can result from security breaches, driving proactive investment in security testing.

Barriers & Challenges:

- Skilled Workforce Shortage: A significant challenge is the scarcity of skilled cybersecurity professionals capable of conducting advanced security testing and analysis.

- Cost of Implementation: For Small and Medium-sized Enterprises (SMEs), the initial investment in advanced security testing tools and services can be a deterrent.

- Legacy Systems Integration: Integrating modern security testing solutions with existing legacy systems can be complex and resource-intensive.

- Rapidly Evolving Threat Landscape: The constant evolution of cyber threats requires continuous updates and adaptation of testing methodologies, posing an ongoing challenge for vendors and users alike.

- Data Privacy Concerns: While driving demand, navigating diverse and evolving data privacy regulations across different APAC countries can also present compliance challenges.

Emerging Opportunities in the APAC Security Testing Market

Emerging opportunities in the APAC Security Testing Market lie in the burgeoning demand for specialized testing services for emerging technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT). The increasing adoption of DevSecOps practices presents a significant opportunity for integrated security testing platforms that offer seamless workflow integration. Furthermore, the growth of cloud-native application development is creating a niche for advanced cloud application security testing solutions. There is also untapped potential in providing tailored security testing solutions for government and critical infrastructure sectors in developing APAC economies, alongside opportunities in managed security services for SMEs seeking to outsource their security testing needs. The rising cyber awareness campaigns in the region are also creating a more receptive market for proactive security solutions.

Growth Accelerators in the APAC Security Testing Market Industry

Several catalysts are accelerating the growth of the APAC Security Testing Market. Technological breakthroughs in AI and machine learning are enabling more intelligent and automated testing solutions, improving efficiency and accuracy. Strategic partnerships between cybersecurity firms and cloud service providers are expanding the reach and accessibility of security testing services. Furthermore, government initiatives focused on bolstering national cybersecurity capabilities and promoting digital innovation are creating a supportive ecosystem for market expansion. The increasing adoption of sophisticated testing methodologies like Interactive Application Security Testing (IAST) and Runtime Application Self-Protection (RASP) are also acting as growth accelerators by offering more advanced protection.

Key Players Shaping the APAC Security Testing Market Market

- Offensive Security

- Accenture PLC

- Applause App Quality Inc

- Core Security Technologies

- Synerzip

- HP

- Maveric Systems

- Netcraft

- Paladion Networks

- Cisco Systems Inc

- Veracode

- Cigital Inc

- McAfee

- ControlCase LLC

- IBM

Notable Milestones in APAC Security Testing Market Sector

- April 2023: Harness, the Modern Software Delivery Platform company, updated its Security Testing Orchestration (STO) module, enabling earlier identification of safety concerns in software development and offering a novel approach to dedupe, identify, remediate, and prioritize software application vulnerabilities, fostering better collaboration between developers and security practitioners.

- February 2023: India, alongside Quad allies Australia, Japan, and the United States, launched a campaign to raise awareness of online hazards in the Indo-Pacific region due to increasing attacks on vital cyber infrastructure, emphasizing the importance of cybersecurity through initiatives like the Quad Cyber Challenge.

- May 2022: The Malaysian government, in collaboration with Cisco, presented an initiative to advance national digitalization, aligning with the MyDIGITAL blueprint to promote social inclusion and economic resilience through digital transformation and establishing the groundwork for Cisco's new CDA program in Malaysia.

In-Depth APAC Security Testing Market Market Outlook

The APAC Security Testing Market is poised for exceptional growth, driven by an intensifying threat landscape and proactive government initiatives. The future outlook is characterized by an increasing demand for integrated DevSecOps solutions, advanced AI-powered testing tools, and specialized testing for cloud-native applications and IoT devices. Strategic partnerships and technological advancements will further enhance the market's capabilities. The continuous evolution of regulatory frameworks across the region will necessitate ongoing investment in compliance-driven security testing, solidifying its position as a critical component of digital resilience. The market's trajectory indicates a strong future potential fueled by a commitment to robust cybersecurity practices across all sectors.

APAC Security Testing Market Segmentation

-

1. Deployment Model

- 1.1. On-premise

- 1.2. Cloud

-

2. Type of Service

-

2.1. Application Security Testing

-

2.1.1. Introduction

- 2.1.1.1. Mobile Application Security Testing

- 2.1.1.2. Web Application Security Testing

- 2.1.1.3. Cloud Application Security Testing

- 2.1.1.4. Enterprise Application Security Testing

-

2.1.2. Testing Method

- 2.1.2.1. SAST

- 2.1.2.2. DAST

- 2.1.2.3. IAST

- 2.1.2.4. RASP

-

2.1.1. Introduction

-

2.2. Network Security Testing

- 2.2.1. Firewall Testing

- 2.2.2. Intrusion Detection/Intrusion Prevention Testing

- 2.2.3. VPN Testing

- 2.2.4. URL Filtering

-

2.1. Application Security Testing

-

3. Testing Tools

- 3.1. Penetration Testing Tools

- 3.2. Software Testing Tools

- 3.3. Web Testing Tools

- 3.4. Code Review Tools

- 3.5. Other Testing Tools

-

4. End-User Industry

- 4.1. Government

- 4.2. Healthcare

- 4.3. BFSI

- 4.4. Manufacturing

- 4.5. Retail

- 4.6. IT and Telecommunications

- 4.7. Other End-User Industries

APAC Security Testing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

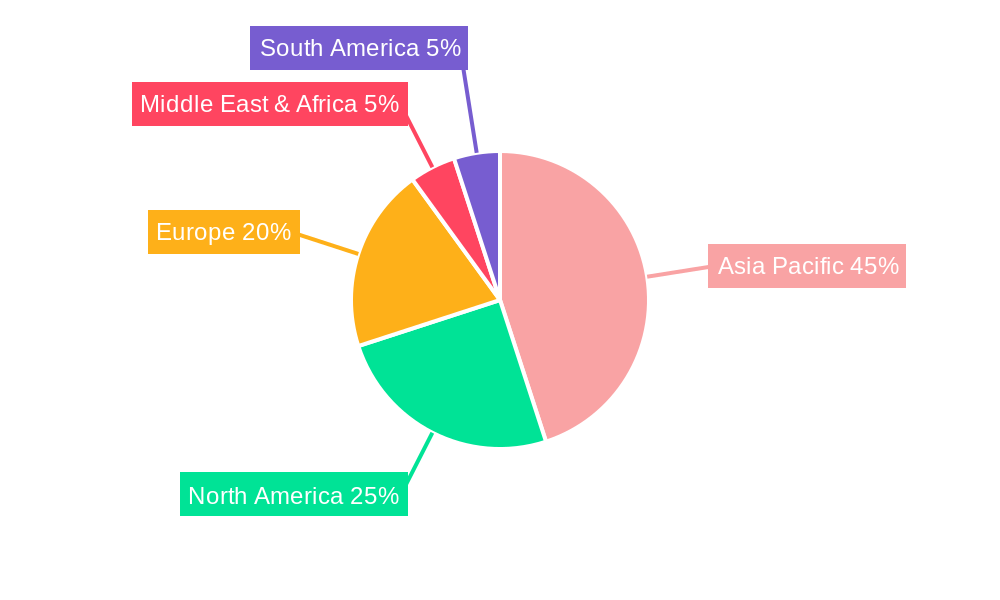

APAC Security Testing Market Regional Market Share

Geographic Coverage of APAC Security Testing Market

APAC Security Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 26.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Proliferation of Existing Malware that is Continually Attacking Devices; Increasing Number of Connected Devices; Transition to online payment methods

- 3.3. Market Restrains

- 3.3.1. Hesitation to adopt the digitization techniques

- 3.4. Market Trends

- 3.4.1. Transition to Online Payment Methods is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Security Testing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment Model

- 5.1.1. On-premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by Type of Service

- 5.2.1. Application Security Testing

- 5.2.1.1. Introduction

- 5.2.1.1.1. Mobile Application Security Testing

- 5.2.1.1.2. Web Application Security Testing

- 5.2.1.1.3. Cloud Application Security Testing

- 5.2.1.1.4. Enterprise Application Security Testing

- 5.2.1.2. Testing Method

- 5.2.1.2.1. SAST

- 5.2.1.2.2. DAST

- 5.2.1.2.3. IAST

- 5.2.1.2.4. RASP

- 5.2.1.1. Introduction

- 5.2.2. Network Security Testing

- 5.2.2.1. Firewall Testing

- 5.2.2.2. Intrusion Detection/Intrusion Prevention Testing

- 5.2.2.3. VPN Testing

- 5.2.2.4. URL Filtering

- 5.2.1. Application Security Testing

- 5.3. Market Analysis, Insights and Forecast - by Testing Tools

- 5.3.1. Penetration Testing Tools

- 5.3.2. Software Testing Tools

- 5.3.3. Web Testing Tools

- 5.3.4. Code Review Tools

- 5.3.5. Other Testing Tools

- 5.4. Market Analysis, Insights and Forecast - by End-User Industry

- 5.4.1. Government

- 5.4.2. Healthcare

- 5.4.3. BFSI

- 5.4.4. Manufacturing

- 5.4.5. Retail

- 5.4.6. IT and Telecommunications

- 5.4.7. Other End-User Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Deployment Model

- 6. North America APAC Security Testing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment Model

- 6.1.1. On-premise

- 6.1.2. Cloud

- 6.2. Market Analysis, Insights and Forecast - by Type of Service

- 6.2.1. Application Security Testing

- 6.2.1.1. Introduction

- 6.2.1.1.1. Mobile Application Security Testing

- 6.2.1.1.2. Web Application Security Testing

- 6.2.1.1.3. Cloud Application Security Testing

- 6.2.1.1.4. Enterprise Application Security Testing

- 6.2.1.2. Testing Method

- 6.2.1.2.1. SAST

- 6.2.1.2.2. DAST

- 6.2.1.2.3. IAST

- 6.2.1.2.4. RASP

- 6.2.1.1. Introduction

- 6.2.2. Network Security Testing

- 6.2.2.1. Firewall Testing

- 6.2.2.2. Intrusion Detection/Intrusion Prevention Testing

- 6.2.2.3. VPN Testing

- 6.2.2.4. URL Filtering

- 6.2.1. Application Security Testing

- 6.3. Market Analysis, Insights and Forecast - by Testing Tools

- 6.3.1. Penetration Testing Tools

- 6.3.2. Software Testing Tools

- 6.3.3. Web Testing Tools

- 6.3.4. Code Review Tools

- 6.3.5. Other Testing Tools

- 6.4. Market Analysis, Insights and Forecast - by End-User Industry

- 6.4.1. Government

- 6.4.2. Healthcare

- 6.4.3. BFSI

- 6.4.4. Manufacturing

- 6.4.5. Retail

- 6.4.6. IT and Telecommunications

- 6.4.7. Other End-User Industries

- 6.1. Market Analysis, Insights and Forecast - by Deployment Model

- 7. South America APAC Security Testing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment Model

- 7.1.1. On-premise

- 7.1.2. Cloud

- 7.2. Market Analysis, Insights and Forecast - by Type of Service

- 7.2.1. Application Security Testing

- 7.2.1.1. Introduction

- 7.2.1.1.1. Mobile Application Security Testing

- 7.2.1.1.2. Web Application Security Testing

- 7.2.1.1.3. Cloud Application Security Testing

- 7.2.1.1.4. Enterprise Application Security Testing

- 7.2.1.2. Testing Method

- 7.2.1.2.1. SAST

- 7.2.1.2.2. DAST

- 7.2.1.2.3. IAST

- 7.2.1.2.4. RASP

- 7.2.1.1. Introduction

- 7.2.2. Network Security Testing

- 7.2.2.1. Firewall Testing

- 7.2.2.2. Intrusion Detection/Intrusion Prevention Testing

- 7.2.2.3. VPN Testing

- 7.2.2.4. URL Filtering

- 7.2.1. Application Security Testing

- 7.3. Market Analysis, Insights and Forecast - by Testing Tools

- 7.3.1. Penetration Testing Tools

- 7.3.2. Software Testing Tools

- 7.3.3. Web Testing Tools

- 7.3.4. Code Review Tools

- 7.3.5. Other Testing Tools

- 7.4. Market Analysis, Insights and Forecast - by End-User Industry

- 7.4.1. Government

- 7.4.2. Healthcare

- 7.4.3. BFSI

- 7.4.4. Manufacturing

- 7.4.5. Retail

- 7.4.6. IT and Telecommunications

- 7.4.7. Other End-User Industries

- 7.1. Market Analysis, Insights and Forecast - by Deployment Model

- 8. Europe APAC Security Testing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment Model

- 8.1.1. On-premise

- 8.1.2. Cloud

- 8.2. Market Analysis, Insights and Forecast - by Type of Service

- 8.2.1. Application Security Testing

- 8.2.1.1. Introduction

- 8.2.1.1.1. Mobile Application Security Testing

- 8.2.1.1.2. Web Application Security Testing

- 8.2.1.1.3. Cloud Application Security Testing

- 8.2.1.1.4. Enterprise Application Security Testing

- 8.2.1.2. Testing Method

- 8.2.1.2.1. SAST

- 8.2.1.2.2. DAST

- 8.2.1.2.3. IAST

- 8.2.1.2.4. RASP

- 8.2.1.1. Introduction

- 8.2.2. Network Security Testing

- 8.2.2.1. Firewall Testing

- 8.2.2.2. Intrusion Detection/Intrusion Prevention Testing

- 8.2.2.3. VPN Testing

- 8.2.2.4. URL Filtering

- 8.2.1. Application Security Testing

- 8.3. Market Analysis, Insights and Forecast - by Testing Tools

- 8.3.1. Penetration Testing Tools

- 8.3.2. Software Testing Tools

- 8.3.3. Web Testing Tools

- 8.3.4. Code Review Tools

- 8.3.5. Other Testing Tools

- 8.4. Market Analysis, Insights and Forecast - by End-User Industry

- 8.4.1. Government

- 8.4.2. Healthcare

- 8.4.3. BFSI

- 8.4.4. Manufacturing

- 8.4.5. Retail

- 8.4.6. IT and Telecommunications

- 8.4.7. Other End-User Industries

- 8.1. Market Analysis, Insights and Forecast - by Deployment Model

- 9. Middle East & Africa APAC Security Testing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment Model

- 9.1.1. On-premise

- 9.1.2. Cloud

- 9.2. Market Analysis, Insights and Forecast - by Type of Service

- 9.2.1. Application Security Testing

- 9.2.1.1. Introduction

- 9.2.1.1.1. Mobile Application Security Testing

- 9.2.1.1.2. Web Application Security Testing

- 9.2.1.1.3. Cloud Application Security Testing

- 9.2.1.1.4. Enterprise Application Security Testing

- 9.2.1.2. Testing Method

- 9.2.1.2.1. SAST

- 9.2.1.2.2. DAST

- 9.2.1.2.3. IAST

- 9.2.1.2.4. RASP

- 9.2.1.1. Introduction

- 9.2.2. Network Security Testing

- 9.2.2.1. Firewall Testing

- 9.2.2.2. Intrusion Detection/Intrusion Prevention Testing

- 9.2.2.3. VPN Testing

- 9.2.2.4. URL Filtering

- 9.2.1. Application Security Testing

- 9.3. Market Analysis, Insights and Forecast - by Testing Tools

- 9.3.1. Penetration Testing Tools

- 9.3.2. Software Testing Tools

- 9.3.3. Web Testing Tools

- 9.3.4. Code Review Tools

- 9.3.5. Other Testing Tools

- 9.4. Market Analysis, Insights and Forecast - by End-User Industry

- 9.4.1. Government

- 9.4.2. Healthcare

- 9.4.3. BFSI

- 9.4.4. Manufacturing

- 9.4.5. Retail

- 9.4.6. IT and Telecommunications

- 9.4.7. Other End-User Industries

- 9.1. Market Analysis, Insights and Forecast - by Deployment Model

- 10. Asia Pacific APAC Security Testing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment Model

- 10.1.1. On-premise

- 10.1.2. Cloud

- 10.2. Market Analysis, Insights and Forecast - by Type of Service

- 10.2.1. Application Security Testing

- 10.2.1.1. Introduction

- 10.2.1.1.1. Mobile Application Security Testing

- 10.2.1.1.2. Web Application Security Testing

- 10.2.1.1.3. Cloud Application Security Testing

- 10.2.1.1.4. Enterprise Application Security Testing

- 10.2.1.2. Testing Method

- 10.2.1.2.1. SAST

- 10.2.1.2.2. DAST

- 10.2.1.2.3. IAST

- 10.2.1.2.4. RASP

- 10.2.1.1. Introduction

- 10.2.2. Network Security Testing

- 10.2.2.1. Firewall Testing

- 10.2.2.2. Intrusion Detection/Intrusion Prevention Testing

- 10.2.2.3. VPN Testing

- 10.2.2.4. URL Filtering

- 10.2.1. Application Security Testing

- 10.3. Market Analysis, Insights and Forecast - by Testing Tools

- 10.3.1. Penetration Testing Tools

- 10.3.2. Software Testing Tools

- 10.3.3. Web Testing Tools

- 10.3.4. Code Review Tools

- 10.3.5. Other Testing Tools

- 10.4. Market Analysis, Insights and Forecast - by End-User Industry

- 10.4.1. Government

- 10.4.2. Healthcare

- 10.4.3. BFSI

- 10.4.4. Manufacturing

- 10.4.5. Retail

- 10.4.6. IT and Telecommunications

- 10.4.7. Other End-User Industries

- 10.1. Market Analysis, Insights and Forecast - by Deployment Model

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Offensive Security

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Accenture PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Applause App Quality Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Core Security Technologies

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Synerzip*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 HP

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Maveric Systems

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Netcraft

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Paladion Networks

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cisco Systems Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Veracode

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cigital Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 McAfee

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ControlCase LLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 IBM

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Offensive Security

List of Figures

- Figure 1: Global APAC Security Testing Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America APAC Security Testing Market Revenue (Million), by Deployment Model 2025 & 2033

- Figure 3: North America APAC Security Testing Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 4: North America APAC Security Testing Market Revenue (Million), by Type of Service 2025 & 2033

- Figure 5: North America APAC Security Testing Market Revenue Share (%), by Type of Service 2025 & 2033

- Figure 6: North America APAC Security Testing Market Revenue (Million), by Testing Tools 2025 & 2033

- Figure 7: North America APAC Security Testing Market Revenue Share (%), by Testing Tools 2025 & 2033

- Figure 8: North America APAC Security Testing Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 9: North America APAC Security Testing Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 10: North America APAC Security Testing Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America APAC Security Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America APAC Security Testing Market Revenue (Million), by Deployment Model 2025 & 2033

- Figure 13: South America APAC Security Testing Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 14: South America APAC Security Testing Market Revenue (Million), by Type of Service 2025 & 2033

- Figure 15: South America APAC Security Testing Market Revenue Share (%), by Type of Service 2025 & 2033

- Figure 16: South America APAC Security Testing Market Revenue (Million), by Testing Tools 2025 & 2033

- Figure 17: South America APAC Security Testing Market Revenue Share (%), by Testing Tools 2025 & 2033

- Figure 18: South America APAC Security Testing Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 19: South America APAC Security Testing Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 20: South America APAC Security Testing Market Revenue (Million), by Country 2025 & 2033

- Figure 21: South America APAC Security Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe APAC Security Testing Market Revenue (Million), by Deployment Model 2025 & 2033

- Figure 23: Europe APAC Security Testing Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 24: Europe APAC Security Testing Market Revenue (Million), by Type of Service 2025 & 2033

- Figure 25: Europe APAC Security Testing Market Revenue Share (%), by Type of Service 2025 & 2033

- Figure 26: Europe APAC Security Testing Market Revenue (Million), by Testing Tools 2025 & 2033

- Figure 27: Europe APAC Security Testing Market Revenue Share (%), by Testing Tools 2025 & 2033

- Figure 28: Europe APAC Security Testing Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 29: Europe APAC Security Testing Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 30: Europe APAC Security Testing Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Europe APAC Security Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa APAC Security Testing Market Revenue (Million), by Deployment Model 2025 & 2033

- Figure 33: Middle East & Africa APAC Security Testing Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 34: Middle East & Africa APAC Security Testing Market Revenue (Million), by Type of Service 2025 & 2033

- Figure 35: Middle East & Africa APAC Security Testing Market Revenue Share (%), by Type of Service 2025 & 2033

- Figure 36: Middle East & Africa APAC Security Testing Market Revenue (Million), by Testing Tools 2025 & 2033

- Figure 37: Middle East & Africa APAC Security Testing Market Revenue Share (%), by Testing Tools 2025 & 2033

- Figure 38: Middle East & Africa APAC Security Testing Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 39: Middle East & Africa APAC Security Testing Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 40: Middle East & Africa APAC Security Testing Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East & Africa APAC Security Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific APAC Security Testing Market Revenue (Million), by Deployment Model 2025 & 2033

- Figure 43: Asia Pacific APAC Security Testing Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 44: Asia Pacific APAC Security Testing Market Revenue (Million), by Type of Service 2025 & 2033

- Figure 45: Asia Pacific APAC Security Testing Market Revenue Share (%), by Type of Service 2025 & 2033

- Figure 46: Asia Pacific APAC Security Testing Market Revenue (Million), by Testing Tools 2025 & 2033

- Figure 47: Asia Pacific APAC Security Testing Market Revenue Share (%), by Testing Tools 2025 & 2033

- Figure 48: Asia Pacific APAC Security Testing Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 49: Asia Pacific APAC Security Testing Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 50: Asia Pacific APAC Security Testing Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Asia Pacific APAC Security Testing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Security Testing Market Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 2: Global APAC Security Testing Market Revenue Million Forecast, by Type of Service 2020 & 2033

- Table 3: Global APAC Security Testing Market Revenue Million Forecast, by Testing Tools 2020 & 2033

- Table 4: Global APAC Security Testing Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 5: Global APAC Security Testing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global APAC Security Testing Market Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 7: Global APAC Security Testing Market Revenue Million Forecast, by Type of Service 2020 & 2033

- Table 8: Global APAC Security Testing Market Revenue Million Forecast, by Testing Tools 2020 & 2033

- Table 9: Global APAC Security Testing Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 10: Global APAC Security Testing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global APAC Security Testing Market Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 15: Global APAC Security Testing Market Revenue Million Forecast, by Type of Service 2020 & 2033

- Table 16: Global APAC Security Testing Market Revenue Million Forecast, by Testing Tools 2020 & 2033

- Table 17: Global APAC Security Testing Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 18: Global APAC Security Testing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Brazil APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global APAC Security Testing Market Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 23: Global APAC Security Testing Market Revenue Million Forecast, by Type of Service 2020 & 2033

- Table 24: Global APAC Security Testing Market Revenue Million Forecast, by Testing Tools 2020 & 2033

- Table 25: Global APAC Security Testing Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 26: Global APAC Security Testing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Kingdom APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: France APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Spain APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Benelux APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Nordics APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global APAC Security Testing Market Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 37: Global APAC Security Testing Market Revenue Million Forecast, by Type of Service 2020 & 2033

- Table 38: Global APAC Security Testing Market Revenue Million Forecast, by Testing Tools 2020 & 2033

- Table 39: Global APAC Security Testing Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 40: Global APAC Security Testing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Turkey APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Israel APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: GCC APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: North Africa APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: South Africa APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Global APAC Security Testing Market Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 48: Global APAC Security Testing Market Revenue Million Forecast, by Type of Service 2020 & 2033

- Table 49: Global APAC Security Testing Market Revenue Million Forecast, by Testing Tools 2020 & 2033

- Table 50: Global APAC Security Testing Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 51: Global APAC Security Testing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 52: China APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: India APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Korea APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: ASEAN APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Oceania APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific APAC Security Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Security Testing Market?

The projected CAGR is approximately 26.97%.

2. Which companies are prominent players in the APAC Security Testing Market?

Key companies in the market include Offensive Security, Accenture PLC, Applause App Quality Inc, Core Security Technologies, Synerzip*List Not Exhaustive, HP, Maveric Systems, Netcraft, Paladion Networks, Cisco Systems Inc, Veracode, Cigital Inc, McAfee, ControlCase LLC, IBM.

3. What are the main segments of the APAC Security Testing Market?

The market segments include Deployment Model, Type of Service, Testing Tools, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Proliferation of Existing Malware that is Continually Attacking Devices; Increasing Number of Connected Devices; Transition to online payment methods.

6. What are the notable trends driving market growth?

Transition to Online Payment Methods is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Hesitation to adopt the digitization techniques.

8. Can you provide examples of recent developments in the market?

April 2023: Harness, the Modern Software Delivery Platform company, revealed the most recent update of its Security Testing Orchestration (STO) module, allowing creators to identify safety concerns earlier in the process of developing software while offering a novel approach to ensure software application vulnerabilities are deduped, identified, remediated, and prioritized. With the help of these new tools, developers can collaborate more effectively with security practitioners and save their company time, energy, and resources while lowering risk.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Security Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Security Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Security Testing Market?

To stay informed about further developments, trends, and reports in the APAC Security Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence