Key Insights

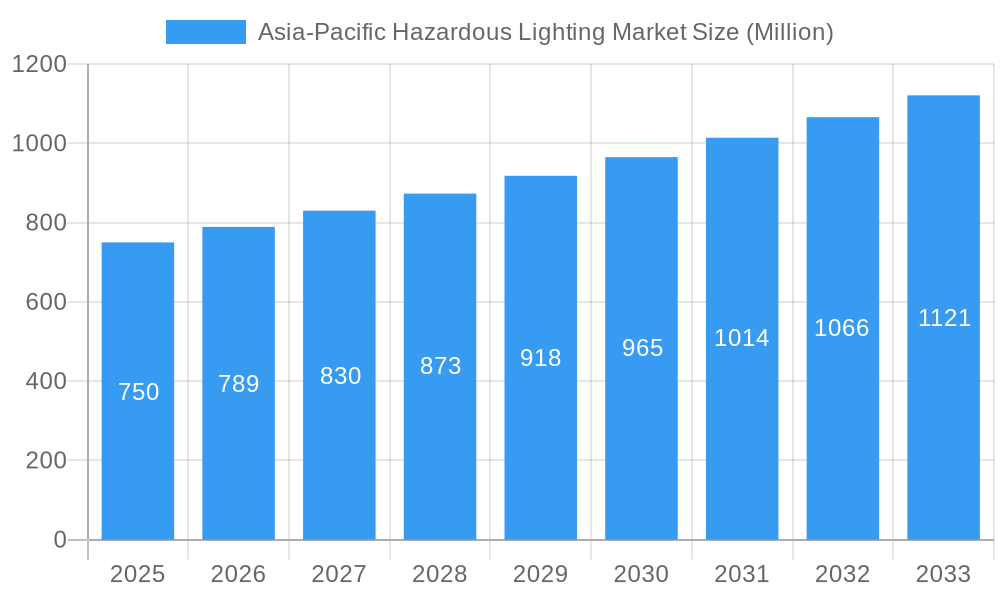

The Asia-Pacific Hazardous Lighting Market is projected to experience robust growth, reaching an estimated market size of USD 980 Million by the end of the forecast period in 2033. This expansion is fueled by a CAGR of 5.14% from the base year 2025, indicating a steady and significant upward trajectory. Key drivers propelling this market include the increasing demand for enhanced safety in hazardous environments across vital industries like Oil & Gas, Power Generation, and Petrochemical. Stringent government regulations and a growing emphasis on worker safety are compelling organizations to invest in advanced hazardous lighting solutions. Furthermore, the rapid industrialization and infrastructure development across Asia-Pacific, particularly in emerging economies, are creating substantial opportunities for market players. The adoption of energy-efficient LED lighting technologies is a major trend, offering longer lifespans, reduced energy consumption, and improved illumination quality compared to traditional lighting types. This shift towards sustainable and cost-effective solutions aligns with global environmental initiatives and industry best practices.

Asia-Pacific Hazardous Lighting Market Market Size (In Million)

Despite the positive outlook, certain restraints could impact the market's pace. High initial investment costs for sophisticated hazardous lighting systems might pose a challenge for smaller enterprises. Additionally, the availability of counterfeit products and the need for specialized installation and maintenance expertise could present hurdles. However, the market is likely to overcome these challenges due to continuous technological advancements, including smart lighting solutions with integrated monitoring and control features, and increasing awareness about the long-term cost savings associated with energy-efficient and durable hazardous lighting. The market segments show a strong preference for LED Lighting due to its inherent advantages in hazardous zones. The Class I and Class II segments are expected to dominate due to their widespread application in the oil and gas and industrial sectors, respectively. Geographically, China is anticipated to be the largest contributor within the Asia Pacific region, followed by other rapidly industrializing nations.

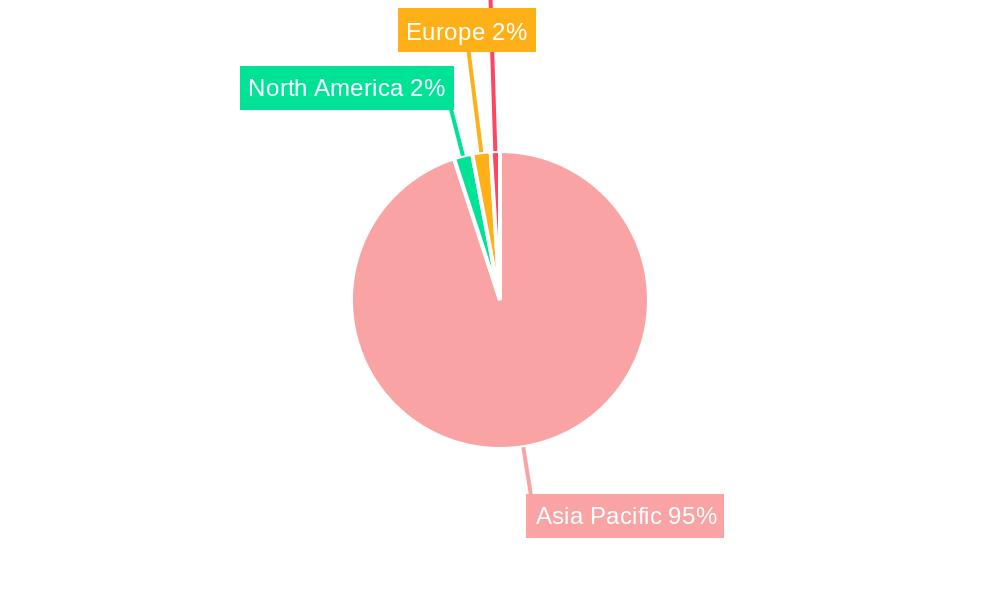

Asia-Pacific Hazardous Lighting Market Company Market Share

Asia-Pacific Hazardous Lighting Market Report Description

Unlock critical insights into the rapidly evolving Asia-Pacific Hazardous Lighting Market with this comprehensive report. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this study provides an in-depth analysis of market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, challenges, emerging opportunities, growth accelerators, and the competitive environment. Designed for industry professionals, investors, and stakeholders, this report leverages high-traffic keywords such as "hazardous lighting," "explosion-proof lighting," "industrial lighting," "oil and gas lighting," "petrochemical lighting," and "LED hazardous lighting" to maximize SEO visibility and reach a targeted audience. Discover unparalleled intelligence on market segmentation by Type (LED Lighting, Incandescent Lighting, HID Lighting, Fluorescent Lighting, Other Types), Class (Class I, Class II, Class III), and End-user Vertical (Oil & Gas, Power Generation, Industrial, Petrochemical, Pharmaceutical, Other End-User Verticals). All quantitative data is presented in Million units.

Asia-Pacific Hazardous Lighting Market Market Dynamics & Structure

The Asia-Pacific hazardous lighting market exhibits a moderately concentrated structure, driven by intense technological innovation, particularly in LED solutions designed for intrinsically safe environments. Regulatory frameworks, increasingly stringent across the region, play a pivotal role in dictating product standards and adoption rates, with countries like China and India leading in the implementation of enhanced safety compliances. Competitive product substitutes are emerging, though the inherent safety requirements of hazardous locations limit rapid shifts away from specialized explosion-proof and intrinsically safe luminaires. End-user demographics are predominantly industrial, with the oil & gas and petrochemical sectors representing substantial demand. Mergers and acquisitions (M&A) activity, while not as prevalent as in broader lighting markets, are strategically focused on expanding technological capabilities and market reach within niche hazardous lighting segments. The market is characterized by significant investment in R&D to enhance energy efficiency and operational lifespan of hazardous lighting solutions.

- Market Concentration: Moderately concentrated, with key global and regional players.

- Technological Innovation Drivers: Advancements in LED technology, smart lighting integration, and improved thermal management for extreme environments.

- Regulatory Frameworks: Increasingly stringent safety standards and certifications (e.g., ATEX, IECEx) driving demand for compliant products.

- Competitive Product Substitutes: Limited due to high safety requirements, but advanced LED solutions are gradually replacing older technologies.

- End-user Demographics: Dominated by industrial sectors, particularly Oil & Gas, Petrochemical, and Power Generation.

- M&A Trends: Strategic acquisitions to enhance product portfolios and geographical presence within specialized hazardous lighting.

Asia-Pacific Hazardous Lighting Market Growth Trends & Insights

The Asia-Pacific hazardous lighting market is poised for robust expansion, propelled by escalating industrialization, heightened safety consciousness, and government initiatives promoting infrastructure development across the region. The study period of 2019-2033, with a base year of 2025, forecasts significant market size evolution, driven by the accelerated adoption of LED hazardous lighting solutions. These advanced luminaires offer superior energy efficiency, extended lifespan, and enhanced performance in challenging environments compared to traditional incandescent, HID, and fluorescent lighting. The market penetration of LED technology within the hazardous lighting sector is rapidly increasing, projected to capture a dominant share by 2033. Technological disruptions are primarily centered on improving the reliability and safety features of lighting systems in explosive atmospheres. Consumer behavior is shifting towards prioritizing total cost of ownership, which favors the long-term economic benefits of LED installations, including reduced maintenance and energy expenditure. The demand for hazardous lighting is intricately linked to the growth of key end-user industries such as oil & gas exploration and production, petrochemical refining, and power generation facilities, all of which are experiencing significant expansion in Asia-Pacific. Furthermore, the increasing focus on operational safety and compliance with international standards like IECEx and ATEX is a critical factor driving the adoption of certified hazardous lighting solutions. The market is expected to witness a compound annual growth rate (CAGR) of approximately 7.5% during the forecast period.

Dominant Regions, Countries, or Segments in Asia-Pacific Hazardous Lighting Market

Within the Asia-Pacific hazardous lighting market, China stands out as the dominant country, driven by its massive industrial base, extensive oil & gas and petrochemical infrastructure, and significant government investments in manufacturing and safety upgrades. The LED Lighting segment, under the Type category, is unequivocally the fastest-growing and most dominant segment, accounting for over 65% of the market share in 2025, due to its superior energy efficiency, durability, and adaptability to various hazardous classifications. The Class I segment, encompassing areas where flammable gases or vapors are present, represents the largest market share within the Class category, driven by the prevalence of oil & gas and petrochemical operations. The Oil & Gas sector, as an End-user Vertical, is the primary market driver, fueled by ongoing exploration, extraction, and refining activities across the region. Economic policies that support industrial growth and stringent enforcement of safety regulations are key drivers of this dominance. Infrastructure development in countries like India and Southeast Asian nations also contributes significantly to the demand for hazardous lighting solutions. The projected growth in these segments and regions is substantial, with China alone expected to contribute over 40% of the total market revenue by 2033. The inherent safety requirements and the increasing need for reliable illumination in potentially explosive environments make these segments and regions crucial for market players.

Asia-Pacific Hazardous Lighting Market Product Landscape

The product landscape of the Asia-Pacific hazardous lighting market is characterized by a strong emphasis on innovation, safety, and reliability. Leading manufacturers are focusing on developing advanced LED hazardous lighting solutions that offer superior lumen output, extended operational life, and enhanced resistance to extreme temperatures, corrosive environments, and physical impact. Applications span across various hazardous zones within the oil & gas, petrochemical, chemical, and power generation industries, requiring specialized luminaires for potentially explosive atmospheres. Performance metrics such as high ingress protection (IP) ratings, robust construction materials (e.g., corrosion-resistant aluminum alloys), and advanced thermal management systems are critical selling propositions. Technological advancements include integrated smart features for remote monitoring and diagnostics, energy-efficient drivers, and customizable beam patterns to suit specific operational needs.

Key Drivers, Barriers & Challenges in Asia-Pacific Hazardous Lighting Market

Key Drivers: The Asia-Pacific hazardous lighting market is propelled by several key drivers. Foremost among these is the escalating industrialization and expansion of critical infrastructure, particularly in the oil & gas, petrochemical, and power generation sectors, which inherently require explosion-proof lighting. Increasing awareness and stringent enforcement of safety regulations and international standards (e.g., ATEX, IECEx) mandate the use of certified hazardous lighting, driving demand for compliant products. Technological advancements in LED lighting, offering superior energy efficiency, longer lifespan, and improved performance in harsh environments, are also significant growth catalysts. Government initiatives promoting industrial safety and energy conservation further bolster market expansion.

Barriers & Challenges: Despite the positive outlook, the market faces several barriers and challenges. The high initial cost of specialized hazardous lighting solutions compared to conventional lighting can be a deterrent for some smaller enterprises. Fluctuations in raw material prices, particularly for components used in explosion-proof enclosures, can impact manufacturing costs and profitability. The complex and stringent certification processes for hazardous lighting products can lead to extended lead times and increased regulatory burdens for manufacturers. Furthermore, the availability of counterfeit or non-compliant products in certain markets poses a threat to established players and compromises safety standards. Supply chain disruptions, particularly in the wake of global events, can also affect the timely delivery of essential components and finished goods.

Emerging Opportunities in Asia-Pacific Hazardous Lighting Market

Emerging opportunities in the Asia-Pacific hazardous lighting market lie in the growing demand for smart and connected lighting solutions for hazardous environments. The integration of IoT capabilities allows for remote monitoring, predictive maintenance, and energy optimization, which are highly valued in remote or difficult-to-access industrial sites. The expansion of renewable energy projects, such as offshore wind farms and solar power plants, which often involve hazardous conditions during installation and maintenance, presents a significant untapped market. Furthermore, the increasing adoption of stricter environmental regulations and a focus on sustainable industrial practices are driving the demand for energy-efficient and long-lasting LED hazardous lighting solutions. Growing investments in mining operations in countries like Australia and Indonesia also offer new avenues for market penetration.

Growth Accelerators in the Asia-Pacific Hazardous Lighting Market Industry

The Asia-Pacific hazardous lighting market's long-term growth is significantly accelerated by continuous technological breakthroughs in LED efficiency and durability, enabling luminaires to perform reliably in extreme conditions. Strategic partnerships between lighting manufacturers and industrial conglomerates, focused on developing integrated safety solutions, are expanding market reach and customer adoption. Furthermore, aggressive market expansion strategies by key players into emerging economies within Southeast Asia and the Indian subcontinent are unlocking new growth potentials. The increasing focus on digitalization and the adoption of Industry 4.0 principles within industrial sectors are creating a demand for intelligent lighting systems that can contribute to overall plant efficiency and safety management, further accelerating growth.

Key Players Shaping the Asia-Pacific Hazardous Lighting Market Market

- Shenzhen CESP Co Ltd

- Dialight Asia Pte Ltd

- Wolf Safety Lamp Co Ltd

- Hubbell Asia Ltd

- Supermec Pte Ltd

- Shenzhen Cary Technology Co Ltd

- Glamox Pte Ltd

- TOP HI-TECH CO LTD

- ABB Asia Pte Ltd

Notable Milestones in Asia-Pacific Hazardous Lighting Market Sector

- 2021: Shenzhen CESP Co Ltd launched a new series of ATEX-certified LED floodlights, enhancing illumination for oil and gas platforms.

- 2022: Dialight Asia Pte Ltd secured a major contract to supply explosion-proof lighting for a new petrochemical complex in Vietnam.

- 2023: Wolf Safety Lamp Co Ltd introduced an intrinsically safe portable LED work light with extended battery life, catering to the mining sector.

- Q1 2024: Hubbell Asia Ltd expanded its hazardous location lighting portfolio with new high-bay LED fixtures for industrial facilities.

- Q2 2024: Supermec Pte Ltd announced strategic partnerships to enhance distribution networks for hazardous lighting in Southeast Asia.

- Q3 2024: Glamox Pte Ltd unveiled advanced Arctic-grade LED hazardous lighting solutions designed for extreme cold environments in Northern Asia.

- Q4 2024: ABB Asia Pte Ltd integrated smart control capabilities into its explosion-proof lighting range, enabling remote monitoring and diagnostics.

In-Depth Asia-Pacific Hazardous Lighting Market Market Outlook

The Asia-Pacific hazardous lighting market is poised for sustained growth, driven by an unyielding commitment to industrial safety and the accelerating adoption of advanced LED technologies. Growth accelerators include the ongoing expansion of critical industrial sectors like oil & gas and petrochemicals, coupled with proactive government regulations that mandate safer working environments. Strategic partnerships and market expansion into developing economies will continue to unlock new revenue streams. The increasing integration of smart technologies and the demand for energy-efficient, durable lighting solutions in hazardous zones present significant future potential and strategic opportunities for market players aiming to capitalize on this dynamic and safety-critical industry.

Asia-Pacific Hazardous Lighting Market Segmentation

-

1. Type

- 1.1. LED Lighting

- 1.2. Incandescent Lighting

- 1.3. HID Lighting

- 1.4. Fluorescent Lighting

- 1.5. Other Types

-

2. Class

- 2.1. Class I

- 2.2. Class II

- 2.3. Class III

-

3. End-user Vertical

- 3.1. Oil & Gas

- 3.2. Power Generation

- 3.3. Industrial

- 3.4. Petrochemical

- 3.5. Pharmaceutical

- 3.6. Other End-User Verticals

Asia-Pacific Hazardous Lighting Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Hazardous Lighting Market Regional Market Share

Geographic Coverage of Asia-Pacific Hazardous Lighting Market

Asia-Pacific Hazardous Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Regulations Promoting LED Lighting for Worker Safety in Hazardous Locations; Rising Demand for Cost-effective LED Lighting Solutions

- 3.3. Market Restrains

- 3.3.1. Growing Availability of Alternative Technologies in the Field of Process Automation

- 3.4. Market Trends

- 3.4.1. Rising Demand for Cost-effective LED Lighting Solutions

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Hazardous Lighting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. LED Lighting

- 5.1.2. Incandescent Lighting

- 5.1.3. HID Lighting

- 5.1.4. Fluorescent Lighting

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Class

- 5.2.1. Class I

- 5.2.2. Class II

- 5.2.3. Class III

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Oil & Gas

- 5.3.2. Power Generation

- 5.3.3. Industrial

- 5.3.4. Petrochemical

- 5.3.5. Pharmaceutical

- 5.3.6. Other End-User Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shenzhen CESP Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dialight Asia Pte Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wolf Safety Lamp Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hubbell Asia Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Supermec Pte Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shenzhen Cary Technology Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Glamox Pte Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TOP HI-TECH CO LTD

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ABB Asia Pte Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Shenzhen CESP Co Ltd

List of Figures

- Figure 1: Asia-Pacific Hazardous Lighting Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Hazardous Lighting Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Hazardous Lighting Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Hazardous Lighting Market Revenue Million Forecast, by Class 2020 & 2033

- Table 3: Asia-Pacific Hazardous Lighting Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Asia-Pacific Hazardous Lighting Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Hazardous Lighting Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Asia-Pacific Hazardous Lighting Market Revenue Million Forecast, by Class 2020 & 2033

- Table 7: Asia-Pacific Hazardous Lighting Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Asia-Pacific Hazardous Lighting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Hazardous Lighting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific Hazardous Lighting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Hazardous Lighting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific Hazardous Lighting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Hazardous Lighting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia-Pacific Hazardous Lighting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia-Pacific Hazardous Lighting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia-Pacific Hazardous Lighting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia-Pacific Hazardous Lighting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia-Pacific Hazardous Lighting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia-Pacific Hazardous Lighting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia-Pacific Hazardous Lighting Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Hazardous Lighting Market?

The projected CAGR is approximately 5.14%.

2. Which companies are prominent players in the Asia-Pacific Hazardous Lighting Market?

Key companies in the market include Shenzhen CESP Co Ltd, Dialight Asia Pte Ltd, Wolf Safety Lamp Co Ltd, Hubbell Asia Ltd, Supermec Pte Ltd, Shenzhen Cary Technology Co Ltd, Glamox Pte Ltd, TOP HI-TECH CO LTD, ABB Asia Pte Ltd.

3. What are the main segments of the Asia-Pacific Hazardous Lighting Market?

The market segments include Type, Class, End-user Vertical .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Regulations Promoting LED Lighting for Worker Safety in Hazardous Locations; Rising Demand for Cost-effective LED Lighting Solutions.

6. What are the notable trends driving market growth?

Rising Demand for Cost-effective LED Lighting Solutions.

7. Are there any restraints impacting market growth?

Growing Availability of Alternative Technologies in the Field of Process Automation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Hazardous Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Hazardous Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Hazardous Lighting Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Hazardous Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence