Key Insights

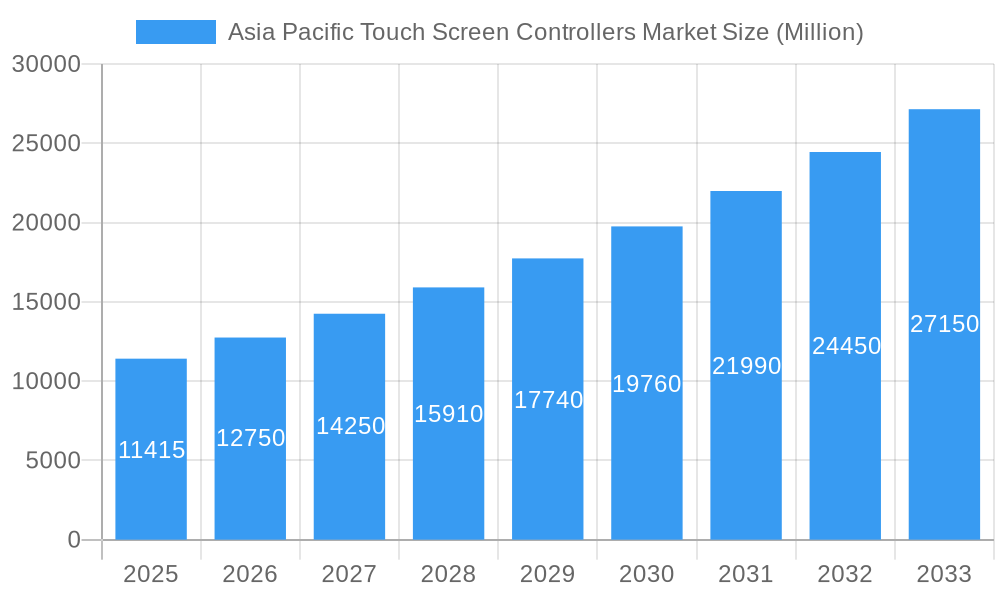

The Asia Pacific Touch Screen Controllers Market is projected to reach USD 11,415 million by 2025, exhibiting a strong Compound Annual Growth Rate (CAGR) of 11.5% from the base year 2025 through 2033. This significant expansion is propelled by the increasing demand for intuitive user interfaces across a wide spectrum of electronic devices.

Asia Pacific Touch Screen Controllers Market Market Size (In Billion)

Key growth drivers include the widespread adoption of smartphones and tablets, the integration of touch screens in automotive infotainment and industrial automation, and the growing use of touch-enabled medical devices. The consumer electronics segment, encompassing smart home devices, wearables, and gaming consoles, also significantly contributes to this market's upward trend. Emerging economies in the region, notably China, India, and Southeast Asian nations, are expected to lead this growth, supported by their large populations, rising disposable incomes, and robust electronics manufacturing capabilities.

Asia Pacific Touch Screen Controllers Market Company Market Share

Technological advancements, such as enhanced capacitive touch technology offering superior sensitivity and multi-touch functionality, are shaping market dynamics. Advancements in touch screen controller precision and durability are vital for applications in retail point-of-sale systems and BFSI terminals. While supply chain considerations and the need for continuous innovation present challenges, the pervasive digitization and integration of touch interfaces across daily and professional life indicate a promising future for the Asia Pacific Touch Screen Controllers Market, with substantial opportunities in industrial, healthcare, and consumer electronics sectors.

Asia Pacific Touch Screen Controllers Market: Comprehensive Market Analysis & Forecast (2019–2033)

This in-depth report provides an exhaustive analysis of the Asia Pacific touch screen controllers market, offering critical insights into its dynamics, growth trajectories, and future potential. Covering the historical period from 2019 to 2024, the base year of 2025, and a robust forecast period extending to 2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on market opportunities. We delve into the intricacies of parent and child markets, exploring how the broader touch screen controller landscape influences specific application segments and regional demands. With a focus on high-traffic keywords and detailed segment analysis, this report is optimized for maximum search engine visibility and designed to engage industry professionals, including manufacturers, suppliers, investors, and technology developers. All quantitative values are presented in million units.

Asia Pacific Touch Screen Controllers Market Dynamics & Structure

The Asia Pacific touch screen controllers market is characterized by a dynamic interplay of technological innovation, evolving end-user demands, and a moderately concentrated competitive landscape. Key drivers include the rapid adoption of advanced displays in consumer electronics, the growing sophistication of industrial automation, and the increasing demand for intuitive interfaces in healthcare and automotive applications. Regulatory frameworks, particularly concerning data privacy and device certifications, play a crucial role in shaping market entry and product development strategies. While technological innovation, particularly in areas like projective capacitive sensing and multi-touch capabilities, is a significant differentiator, the presence of established players and the ongoing development of advanced algorithms present barriers to entry for new entrants. Competitive product substitutes, though evolving, have not significantly eroded the core demand for dedicated touch screen controllers due to their specialized performance and integration benefits. End-user demographics are increasingly favoring touch-enabled devices across all age groups, pushing manufacturers to develop more responsive and durable solutions. Mergers and acquisitions (M&A) trends are moderate, with companies consolidating their portfolios to enhance market reach and technological capabilities.

- Market Concentration: Moderately concentrated, with a few key players holding significant market share, but with ample room for innovation and niche market specialization.

- Technological Innovation Drivers: Increasing demand for multi-touch functionality, gesture recognition, higher resolution support, power efficiency, and integration of advanced sensor technologies.

- Regulatory Frameworks: Focus on compliance with regional electronic device standards, cybersecurity, and safety regulations, particularly in healthcare and automotive sectors.

- Competitive Product Substitutes: While advancements in direct screen integration exist, dedicated controllers offer superior performance, reliability, and feature sets for complex applications.

- End-User Demographics: Growing tech-savviness across all demographics, leading to higher expectations for user interface interactivity and ease of use.

- M&A Trends: Strategic acquisitions aimed at expanding product portfolios, gaining access to new technologies, and consolidating market presence.

Asia Pacific Touch Screen Controllers Market Growth Trends & Insights

The Asia Pacific touch screen controllers market is poised for substantial growth, driven by the ubiquitous integration of touch technology across diverse applications. The market size is projected to expand significantly from approximately 450 million units in 2025 to an estimated 800 million units by 2033, reflecting a compound annual growth rate (CAGR) of around 7.5% during the forecast period. This robust expansion is fueled by increasing disposable incomes, a burgeoning middle class, and government initiatives promoting digitalization across the region. Adoption rates for touch-enabled devices are soaring, particularly in emerging economies, where consumers are rapidly embracing smartphones, tablets, and smart home devices. Technological disruptions, such as the development of thinner, more flexible, and energy-efficient touch screen controllers, are further accelerating market penetration. Consumer behavior shifts are strongly favoring intuitive, gesture-based interactions over traditional button interfaces, creating sustained demand for advanced touch solutions. The proliferation of the Internet of Things (IoT) ecosystem, coupled with the increasing sophistication of smart manufacturing and the demand for immersive user experiences in entertainment and gaming, will act as powerful catalysts for market evolution. Furthermore, the growing emphasis on digitalization in sectors like retail, banking, and healthcare, leading to the widespread adoption of interactive kiosks, point-of-sale (POS) systems, and medical diagnostic equipment, will contribute significantly to the market's upward trajectory. The continuous innovation in sensor technology and controller architecture ensures that touch screen controllers remain at the forefront of human-computer interaction.

Dominant Regions, Countries, or Segments in Asia Pacific Touch Screen Controllers Market

The Capacitive segment, specifically Projected Capacitive (PCAP) touch screen controllers, is the dominant force within the Asia Pacific market, driven by its superior performance, multi-touch capabilities, and widespread adoption in high-growth end-user applications. This dominance is underpinned by its extensive use in Consumer Electronics, which represents the largest and fastest-growing end-user application segment. Countries like China, Japan, South Korea, and Taiwan are at the forefront of this dominance, not only as massive consumption hubs but also as key manufacturing centers for electronic devices. China, in particular, with its vast manufacturing ecosystem and a rapidly growing domestic market for smartphones, tablets, wearables, and smart home devices, stands out as the leading country driving the demand for capacitive touch screen controllers.

Dominant Segment (Type): Capacitive Touch Screen Controllers

- Key Driver: Superior multi-touch functionality, high accuracy, durability, and energy efficiency, making them ideal for modern user interfaces.

- Market Share: Projected to account for over 85% of the total touch screen controller market in the Asia Pacific region by 2025.

- Growth Potential: Continued innovation in sensor density, thinner form factors, and integration with flexible displays will sustain its growth.

Dominant Segment (End User Application): Consumer Electronics

- Key Driver: Insatiable demand for smartphones, tablets, laptops, wearables, and smart home devices.

- Market Share: Estimated to command approximately 40% of the total end-user application market by 2025.

- Growth Potential: The rapid pace of product refresh cycles and the increasing integration of touch interfaces in new product categories will fuel demand.

Leading Country: China

- Key Driver: World's largest manufacturing hub for consumer electronics, significant domestic demand for smart devices, and government support for technology adoption.

- Market Share: Expected to contribute over 50% of the total Asia Pacific touch screen controller market by 2025.

- Growth Potential: Continued urbanization, rising disposable incomes, and the expansion of the IoT ecosystem will further bolster its position.

The Industrial and Healthcare segments, while smaller in volume, are exhibiting impressive growth rates, driven by the need for robust, reliable, and often specialized touch interfaces in critical applications. Advancements in industrial automation, the proliferation of smart factory concepts, and the increasing use of touch-enabled diagnostic equipment and patient monitoring systems are key contributors. The retail sector is also seeing a significant uptake of touch screen solutions for POS systems, interactive kiosks, and digital signage, further diversifying the market landscape.

Asia Pacific Touch Screen Controllers Market Product Landscape

The Asia Pacific touch screen controllers market is defined by continuous innovation in product design and functionality. Manufacturers are focusing on developing controllers that offer enhanced touch sensitivity, faster response times, superior noise immunity, and lower power consumption to meet the stringent demands of evolving applications. Innovations include single-chip solutions that integrate sensing and control functions, advanced algorithms for gesture recognition and haptic feedback, and controllers designed for flexible and curved displays. The focus is on delivering precise, reliable touch experiences across a wide range of environmental conditions, from extreme temperatures to wet or dirty surfaces. Microchip Technology Inc.'s maXTouch MXT1296M1T, designed for automotive applications, exemplifies this trend with its ability to handle unique aspect ratios and waterproof environments, ensuring seamless multi-touch detection.

Key Drivers, Barriers & Challenges in Asia Pacific Touch Screen Controllers Market

Key Drivers:

- Technological Advancements: Continuous innovation in sensor technology, such as projected capacitive (PCAP), and the development of sophisticated control algorithms drive performance enhancements and new application possibilities.

- Growing Consumer Electronics Demand: The insatiable appetite for smartphones, tablets, wearables, and smart home devices across the Asia Pacific region remains a primary growth catalyst.

- Digitalization Across Industries: The widespread adoption of touch interfaces in industrial automation, healthcare, retail, and BFSI sectors fuels demand for robust and feature-rich controllers.

- Miniaturization and Power Efficiency: The trend towards thinner, lighter, and more power-efficient devices necessitates controllers that can meet these specifications without compromising performance.

Barriers & Challenges:

- Supply Chain Disruptions: Geopolitical factors and unforeseen events can lead to component shortages and price volatility, impacting production timelines and costs.

- Intensifying Competition: The presence of numerous global and regional players leads to pricing pressures and necessitates continuous investment in R&D to maintain a competitive edge.

- Evolving Technical Standards: The rapid pace of technological evolution requires constant adaptation to new standards and protocols, posing a challenge for manufacturers to keep their products relevant.

- Cost Sensitivity in Certain Segments: While premium applications can absorb higher costs, price-sensitive markets require cost-effective solutions, creating a balancing act for manufacturers.

Emerging Opportunities in Asia Pacific Touch Screen Controllers Market

Emerging opportunities in the Asia Pacific touch screen controllers market lie in the rapidly growing segments of the Internet of Things (IoT), smart home devices, and the automotive sector. The increasing demand for advanced driver-assistance systems (ADAS) and in-car infotainment systems presents a significant opportunity for specialized automotive-grade touch screen controllers. Furthermore, the expansion of augmented reality (AR) and virtual reality (VR) applications, which rely heavily on intuitive touch interactions, opens up new avenues for innovative controller designs. The burgeoning e-mobility sector and the need for robust touch interfaces in electric vehicle charging stations also represent untapped potential. The growing adoption of smart wearables for health and fitness tracking will continue to drive demand for compact and energy-efficient controllers.

Growth Accelerators in the Asia Pacific Touch Screen Controllers Market Industry

The Asia Pacific touch screen controllers market is propelled by several growth accelerators. Technological breakthroughs, such as the development of self-healing touch surfaces and the integration of haptic feedback technologies, are poised to revolutionize user experiences and drive demand for next-generation controllers. Strategic partnerships between semiconductor manufacturers, display makers, and device OEMs are crucial for co-developing integrated solutions and accelerating market adoption. Furthermore, expansion strategies focused on emerging economies within Southeast Asia and South Asia, where the adoption of smart devices is rapidly increasing, will unlock significant growth potential. The continued government support for digitalization initiatives and the development of smart cities across the region will also act as powerful catalysts for sustained market expansion.

Key Players Shaping the Asia Pacific Touch Screen Controllers Market Market

- Semtech Corporation

- Infineon Technologies AG

- Honeywell International Inc

- Microchip Technology Inc

- Cypress Semiconductor Corporation

- Silicon Laboratories Inc

- Texas Instruments Inc

- Rohm Company Limited

- STMicroelectronics N V

- Future Electronics Inc

- Atmel Corporation

- Analog Devices Inc

- Maxim Integrated Products Inc

- Freescale Semiconductor Inc

Notable Milestones in Asia Pacific Touch Screen Controllers Market Sector

- November 2021: Microchip Technology Inc. declared the release of its new maXTouch MXT1296M1T touchscreen controllers, which will provide extensive flexibility to meet unique display aspect ratios in automobiles and waterproof automobiles with fast and accurate multi-touch detection.

In-Depth Asia Pacific Touch Screen Controllers Market Market Outlook

The future outlook for the Asia Pacific touch screen controllers market is exceptionally promising, driven by a confluence of technological advancements and expanding application landscapes. Growth accelerators such as the pervasive integration of touch interfaces in the burgeoning IoT ecosystem, coupled with the increasing demand for sophisticated human-machine interfaces in automotive, healthcare, and industrial automation, will continue to fuel market expansion. Strategic opportunities lie in the development of controllers optimized for flexible, foldable, and transparent displays, catering to the evolving design preferences in consumer electronics. The continued push towards miniaturization, power efficiency, and enhanced user experience will necessitate ongoing innovation, creating a fertile ground for market leaders and agile new entrants alike to capture significant market share.

Asia Pacific Touch Screen Controllers Market Segmentation

-

1. Type

- 1.1. Resistive

- 1.2. Capacitive

-

2. End User Application

- 2.1. Industrial

- 2.2. Healthcare

- 2.3. Consumer Electronics

- 2.4. Retail

- 2.5. BFSI

- 2.6. Other End Users Applications

Asia Pacific Touch Screen Controllers Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Touch Screen Controllers Market Regional Market Share

Geographic Coverage of Asia Pacific Touch Screen Controllers Market

Asia Pacific Touch Screen Controllers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Number of Smart Devices; Increased Usage across Various Industries

- 3.3. Market Restrains

- 3.3.1 Limitations in Operations due to constraints like temperature

- 3.3.2 frequency

- 3.4. Market Trends

- 3.4.1. Consumer Electronics is Expected to Hold the Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Touch Screen Controllers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Resistive

- 5.1.2. Capacitive

- 5.2. Market Analysis, Insights and Forecast - by End User Application

- 5.2.1. Industrial

- 5.2.2. Healthcare

- 5.2.3. Consumer Electronics

- 5.2.4. Retail

- 5.2.5. BFSI

- 5.2.6. Other End Users Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Semtech Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Infineon Technologies AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Honeywell International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Microchip Technology Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cypress Semiconductor Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Silicon Laboratories Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Texas Instruments Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rohm Company Limited*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 STMicroelectronics N V

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Future Electronics Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Atmel Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Analog Devices Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Maxim Integrated Products Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Freescale Semiconductor Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Semtech Corporation

List of Figures

- Figure 1: Asia Pacific Touch Screen Controllers Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Touch Screen Controllers Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Touch Screen Controllers Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Touch Screen Controllers Market Revenue million Forecast, by End User Application 2020 & 2033

- Table 3: Asia Pacific Touch Screen Controllers Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Touch Screen Controllers Market Revenue million Forecast, by Type 2020 & 2033

- Table 5: Asia Pacific Touch Screen Controllers Market Revenue million Forecast, by End User Application 2020 & 2033

- Table 6: Asia Pacific Touch Screen Controllers Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Touch Screen Controllers Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Touch Screen Controllers Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific Touch Screen Controllers Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Touch Screen Controllers Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Touch Screen Controllers Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific Touch Screen Controllers Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific Touch Screen Controllers Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific Touch Screen Controllers Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific Touch Screen Controllers Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific Touch Screen Controllers Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific Touch Screen Controllers Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific Touch Screen Controllers Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Touch Screen Controllers Market?

The projected CAGR is approximately 11.5%.

2. Which companies are prominent players in the Asia Pacific Touch Screen Controllers Market?

Key companies in the market include Semtech Corporation, Infineon Technologies AG, Honeywell International Inc, Microchip Technology Inc, Cypress Semiconductor Corporation, Silicon Laboratories Inc, Texas Instruments Inc, Rohm Company Limited*List Not Exhaustive, STMicroelectronics N V, Future Electronics Inc, Atmel Corporation, Analog Devices Inc, Maxim Integrated Products Inc, Freescale Semiconductor Inc.

3. What are the main segments of the Asia Pacific Touch Screen Controllers Market?

The market segments include Type, End User Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 11415 million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Number of Smart Devices; Increased Usage across Various Industries.

6. What are the notable trends driving market growth?

Consumer Electronics is Expected to Hold the Major Share.

7. Are there any restraints impacting market growth?

Limitations in Operations due to constraints like temperature. frequency.

8. Can you provide examples of recent developments in the market?

November 2021- Microchip Technology Inc. declared the release of its new maXTouch MXT1296M1T touchscreen controllers, which will provide extensive flexibility to meet unique display aspect ratios in automobiles and waterproof automobiles with fast and accurate multi-touch detection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Touch Screen Controllers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Touch Screen Controllers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Touch Screen Controllers Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Touch Screen Controllers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence