Key Insights

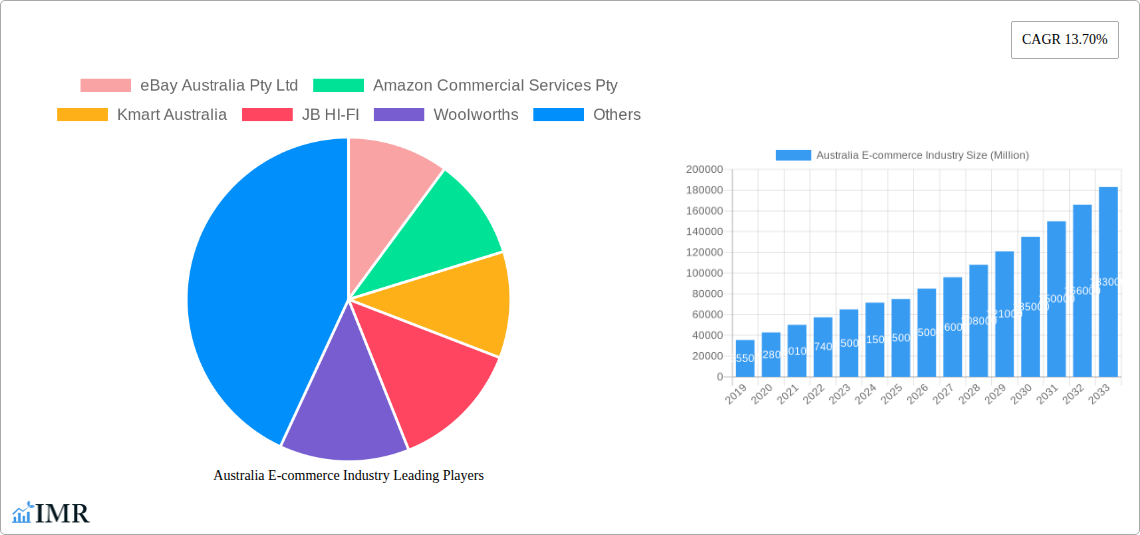

The Australian e-commerce industry is poised for remarkable expansion, projected to reach a substantial market size of approximately AU$75,000 million by 2025. This growth trajectory is fueled by a robust Compound Annual Growth Rate (CAGR) of 13.70% between 2019 and 2033. Key drivers of this surge include the increasing digital savviness of Australian consumers, a growing preference for the convenience and wider selection offered by online retail, and the continuous innovation in payment gateways and logistics infrastructure. The COVID-19 pandemic acted as a significant accelerator, normalizing online shopping habits across demographics and driving greater adoption, particularly in sectors like groceries and essential goods. Furthermore, the expansion of mobile commerce and the integration of social media platforms into the purchasing journey are creating new avenues for engagement and sales.

Australia E-commerce Industry Market Size (In Billion)

The Australian e-commerce landscape is characterized by dynamic segmentation and intense competition among both established retail giants and agile online-only players. The "Beauty and Personal Care" and "Fashion and Apparel" segments are anticipated to remain strong performers, driven by influencer marketing and personalized online experiences. "Consumer Electronics" continues to be a vital category, with consumers seeking the latest gadgets and competitive pricing readily available online. The "Food and Beverages" sector is experiencing a significant digital transformation, with online grocery sales gaining substantial traction. Looking ahead, ongoing trends such as the rise of cross-border e-commerce, the increasing adoption of Buy Now, Pay Later (BNPL) services, and the demand for sustainable and ethically sourced products will shape the market. However, challenges such as rising logistics costs, cybersecurity concerns, and the need for robust data privacy measures present potential restraints that companies must strategically address to maintain growth and consumer trust in this evolving digital marketplace.

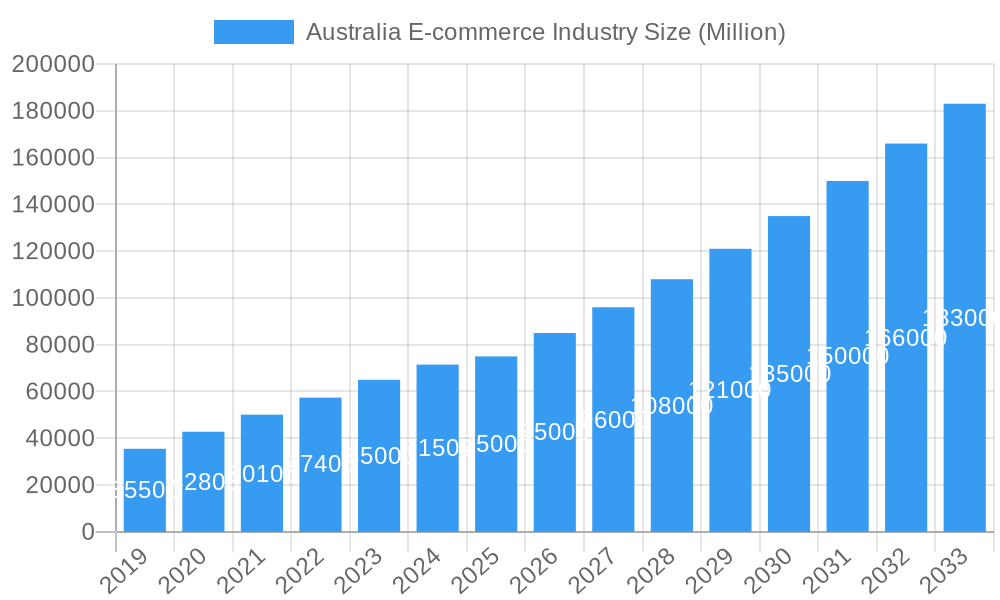

Australia E-commerce Industry Company Market Share

This comprehensive report provides an in-depth analysis of the Australian E-commerce industry, offering critical insights for stakeholders navigating this rapidly evolving digital marketplace. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025, this report delves into market dynamics, growth trends, dominant segments, product innovations, key drivers, emerging opportunities, and the competitive landscape. We present all values in Million units to ensure clarity and industry relevance.

Australia E-commerce Industry Market Dynamics & Structure

The Australian e-commerce market is characterized by a moderate level of concentration, with major players like Amazon Commercial Services Pty, eBay Australia Pty Ltd, Woolworths, and Coles holding significant shares. Technological innovation is a primary driver, fueled by advancements in artificial intelligence (AI) for personalized recommendations, augmented reality (AR) for virtual try-ons, and blockchain for enhanced supply chain transparency. Regulatory frameworks, while evolving, aim to balance consumer protection with fostering innovation, impacting areas like data privacy and cross-border trade. Competitive product substitutes are abundant, with traditional retail increasingly integrating online channels, and social commerce platforms offering new avenues for discovery and purchase. End-user demographics are diverse, with a growing tech-savvy younger population and an increasing adoption rate among older demographics seeking convenience. Mergers and acquisitions (M&A) trends indicate a consolidation of smaller players and strategic acquisitions by larger entities to expand market reach and acquire innovative technologies. For instance, in the historical period 2019-2024, an estimated 25 M&A deals were completed, with an average deal value of approximately AUD 50 Million units.

- Market Concentration: Dominated by a few large players, but with room for niche specialists.

- Technological Innovation: AI-powered personalization, AR for enhanced shopping experiences, and blockchain for trust.

- Regulatory Frameworks: Focus on data privacy, consumer rights, and fair competition.

- Competitive Substitutes: Omnichannel retail, social commerce, and direct-to-consumer (DTC) brands.

- End-User Demographics: Growing penetration across all age groups, with a strong influence from Gen Z and Millennials.

- M&A Trends: Strategic acquisitions for market expansion and technology integration.

Australia E-commerce Industry Growth Trends & Insights

The Australian e-commerce industry is poised for sustained and robust growth, driven by increasing internet penetration, rising disposable incomes, and a continuous shift in consumer purchasing habits towards online channels. The market size is projected to expand significantly from an estimated AUD 75,000 million units in 2024 to an impressive AUD 130,000 million units by 2033. This growth trajectory is underpinned by a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. Adoption rates for online shopping are consistently rising across all product categories, particularly in Fashion and Apparel, Consumer Electronics, and Food and Beverages, which are experiencing double-digit annual growth. Technological disruptions such as the widespread adoption of mobile commerce (m-commerce) and the increasing sophistication of payment gateways are further accelerating this expansion. Consumer behavior is demonstrably shifting, with a heightened emphasis on convenience, personalized shopping experiences, and the demand for fast, reliable delivery services. The integration of social media platforms into the shopping journey, driven by shoppable posts and influencer marketing, is also playing a crucial role in driving market penetration and engagement. The increasing trust in online payment security and the availability of diverse payment options are further solidifying consumer confidence in e-commerce.

Dominant Regions, Countries, or Segments in Australia E-commerce Industry

Within the Australian e-commerce landscape, the Fashion and Apparel segment consistently emerges as a dominant force, driven by its broad appeal, high purchase frequency, and the continuous introduction of new trends and collections. In 2025, this segment is estimated to contribute approximately 25% of the total e-commerce market value, translating to an estimated AUD 18,750 million units. The ease of online browsing, diverse style offerings, and competitive pricing make it an attractive choice for a wide demographic. Leading companies like Kmart Australia, Big W, and online pure-plays such as Kogan.com are actively expanding their fashion and apparel offerings, further fueling this segment's growth. Consumer Electronics follows closely, with an estimated market share of 20% (AUD 15,000 million units in 2025), propelled by the rapid pace of technological innovation and consumer demand for the latest gadgets. JB HI-FI and Amazon remain key players in this category.

- Fashion and Apparel:

- Key Drivers: Broad appeal, high purchase frequency, evolving trends, convenience, competitive pricing.

- Market Share (Estimated 2025): 25% (AUD 18,750 million units)

- Dominance Factors: Extensive product variety, seasonal promotions, influencer marketing, ease of comparison.

- Consumer Electronics:

- Key Drivers: Rapid technological innovation, demand for new gadgets, online deals and discounts.

- Market Share (Estimated 2025): 20% (AUD 15,000 million units)

- Dominance Factors: Wide selection of brands and models, product reviews, competitive pricing.

- Furniture and Home:

- Key Drivers: Growing home improvement trends, online convenience for larger items, competitive pricing.

- Market Share (Estimated 2025): 15% (AUD 11,250 million units)

- Dominance Factors: Online showrooms, virtual design tools, competitive delivery options.

- Beauty and Personal Care:

- Key Drivers: Personalized recommendations, ease of reordering, subscription models, growing awareness of online beauty retailers.

- Market Share (Estimated 2025): 12% (AUD 9,000 million units)

- Dominance Factors: Niche brands, user-generated content, targeted marketing campaigns.

- Food and Beverages:

- Key Drivers: Convenience, demand for grocery delivery, expansion of online supermarkets.

- Market Share (Estimated 2025): 10% (AUD 7,500 million units)

- Dominance Factors: Grocery delivery services, expanding product assortments, subscription options.

- Others (Toys, DIY, Media, etc.):

- Key Drivers: Seasonal demand (toys), hobby-specific purchases (DIY), digital media consumption.

- Market Share (Estimated 2025): 18% (AUD 13,500 million units)

- Dominance Factors: Specialized online retailers, digital content platforms.

Australia E-commerce Industry Product Landscape

The Australian e-commerce product landscape is characterized by continuous innovation and diversification across all segments. In Fashion and Apparel, we see the rise of sustainable and ethically sourced clothing lines, augmented by virtual fitting rooms and personalized styling services offered by platforms like MyDeal. Consumer Electronics are witnessing a surge in smart home devices and wearable technology, with brands like JB HI-FI leveraging online channels for exclusive product launches and bundled offers. The Food and Beverages segment is expanding its reach with a greater focus on fresh produce delivery and curated meal kits, pioneered by Woolworths and Coles' online ventures. In Beauty and Personal Care, personalized skincare formulations and subscription boxes are gaining traction, with Kogan.com offering a broad spectrum of beauty products. The Furniture and Home sector is benefiting from AR visualization tools that allow customers to virtually place furniture in their homes, enhancing the online purchasing experience for large items.

Key Drivers, Barriers & Challenges in Australia E-commerce Industry

The Australian e-commerce industry is propelled by several key drivers, including the increasing adoption of smartphones and high-speed internet, a growing preference for online convenience and wider product selection, and supportive government initiatives promoting digital transformation. Strategic partnerships between e-commerce platforms and logistics providers are also crucial for enhancing delivery efficiency.

- Key Drivers:

- Mobile Penetration: Widespread smartphone ownership enables seamless online shopping.

- Convenience & Selection: Consumers appreciate the ease of browsing and accessing a vast array of products from home.

- Digital Transformation Initiatives: Government support for a digital economy.

- Logistics Partnerships: Improved delivery networks for faster fulfillment.

Conversely, the industry faces significant barriers and challenges. Supply chain disruptions, particularly in global sourcing and last-mile delivery, can lead to delays and increased costs, impacting an estimated 15% of online orders historically. Evolving data privacy regulations and cybersecurity threats pose ongoing risks, requiring substantial investment in compliance and security measures. Intense competition among established players and the emergence of new online retailers necessitate continuous innovation and competitive pricing strategies, potentially squeezing profit margins for smaller businesses.

- Barriers & Challenges:

- Supply Chain Disruptions: Delays and cost increases affecting order fulfillment.

- Data Privacy & Cybersecurity: Evolving regulations and evolving threat landscapes.

- Intense Competition: Pressure on pricing and the need for continuous differentiation.

- Logistics Costs: Increasing expenses associated with last-mile delivery.

Emerging Opportunities in Australia E-commerce Industry

Emerging opportunities in the Australian e-commerce sector lie in the burgeoning circular economy with a focus on resale and rental platforms, tapping into environmentally conscious consumer preferences. The expansion of cross-border e-commerce, leveraging sophisticated international shipping solutions, presents a significant avenue for growth. Furthermore, the integration of AI-powered conversational commerce through chatbots and virtual assistants promises to revolutionize customer service and sales interactions. The growth of niche marketplaces catering to specific interests, such as artisanal goods or specialized hobby equipment, offers untapped potential. The increasing demand for personalized product recommendations driven by data analytics also presents substantial opportunities for businesses to tailor offerings and enhance customer loyalty.

Growth Accelerators in the Australia E-commerce Industry Industry

Several catalysts are accelerating the growth of the Australian e-commerce industry. The continuous advancement and adoption of AI and machine learning are personalizing customer experiences and optimizing operational efficiencies. Strategic partnerships between e-commerce giants and logistics providers are streamlining delivery networks, reducing transit times, and improving customer satisfaction. The ongoing development of innovative payment solutions, including buy-now-pay-later (BNPL) options and digital wallets, is making online purchases more accessible and appealing to a broader consumer base. Furthermore, the increasing investment in augmented reality (AR) and virtual reality (VR) technologies for e-commerce is enhancing product visualization and reducing return rates, thereby acting as a significant growth accelerator.

Key Players Shaping the Australia E-commerce Industry Market

- eBay Australia Pty Ltd

- Amazon Commercial Services Pty

- Kmart Australia

- JB HI-FI

- Woolworths

- Kogan com

- Big W

- MyDeal

- Gumutree Australia

- BigCommerce

- Coles

Notable Milestones in Australia E-commerce Industry Sector

- April 2022: Pinterest announced a strategic partnership with the e-commerce platform WooCommerce, enabling WooCommerce's 3.6 million merchants to convert product catalogs into Shoppable Pins on Pinterest. This collaboration introduced a new Pinterest app within WooCommerce, integrating features like tag deployment and catalog ingestion for enhanced online visibility and sales.

- May 2022: Marketplacer announced the completion of a new holistic online marketplace for True Woo. This e-commerce platform was designed to offer a diverse range of products and services targeted at individuals seeking to improve their wellbeing, focusing on mental, emotional, physical, and spiritual health.

In-Depth Australia E-commerce Industry Market Outlook

The Australian e-commerce industry is set for a dynamic future, driven by continued technological integration and evolving consumer demands. The expansion of same-day and next-day delivery services, facilitated by advanced logistics networks, will become a standard expectation. We anticipate significant growth in social commerce, blurring the lines between social media interaction and shopping. The increasing adoption of sustainable e-commerce practices, including eco-friendly packaging and carbon-neutral delivery options, will resonate with a growing segment of conscious consumers. Furthermore, the personalization of the online shopping journey through advanced AI algorithms will become paramount, offering tailored recommendations and customized promotions to enhance customer engagement and loyalty. The continued expansion of mobile commerce capabilities will solidify smartphones as the primary shopping device for many Australians.

Australia E-commerce Industry Segmentation

-

1. Application

- 1.1. Beauty and Personal Care

- 1.2. Consumer Electronics

- 1.3. Fashion and Apparel

- 1.4. Food and Beverages

- 1.5. Furniture and Home

- 1.6. Others (Toys, DIY, Media, etc.)

Australia E-commerce Industry Segmentation By Geography

- 1. Australia

Australia E-commerce Industry Regional Market Share

Geographic Coverage of Australia E-commerce Industry

Australia E-commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Purchase Frequency and Online Spending; Rising Adoption of Click and Collect Services

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Equipment than Conventional Radiography is Discouraging the Market Growth

- 3.4. Market Trends

- 3.4.1. Rise in Purchase Frequency and Online Spending

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia E-commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Beauty and Personal Care

- 5.1.2. Consumer Electronics

- 5.1.3. Fashion and Apparel

- 5.1.4. Food and Beverages

- 5.1.5. Furniture and Home

- 5.1.6. Others (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 eBay Australia Pty Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amazon Commercial Services Pty

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kmart Australia

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JB HI-FI

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Woolworths

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kogan com

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Big W

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MyDeal

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gumutree Australia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BigCommerce

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Coles

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 eBay Australia Pty Ltd

List of Figures

- Figure 1: Australia E-commerce Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia E-commerce Industry Share (%) by Company 2025

List of Tables

- Table 1: Australia E-commerce Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Australia E-commerce Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Australia E-commerce Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Australia E-commerce Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia E-commerce Industry?

The projected CAGR is approximately 13.70%.

2. Which companies are prominent players in the Australia E-commerce Industry?

Key companies in the market include eBay Australia Pty Ltd, Amazon Commercial Services Pty, Kmart Australia, JB HI-FI, Woolworths, Kogan com, Big W, MyDeal, Gumutree Australia, BigCommerce, Coles.

3. What are the main segments of the Australia E-commerce Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Purchase Frequency and Online Spending; Rising Adoption of Click and Collect Services.

6. What are the notable trends driving market growth?

Rise in Purchase Frequency and Online Spending.

7. Are there any restraints impacting market growth?

; High Cost of Equipment than Conventional Radiography is Discouraging the Market Growth.

8. Can you provide examples of recent developments in the market?

April 2022 - Pinterest announced a strategic partnership with the E-commerce platform WooCommerce, which will enable WooCommerce's 3.6 million merchants the convert their product catalogs into Shoppable Pins on Pinterest. with this partnership, a new Pinterest app within WooCommerce would be launched, which will include various Pinterest shopping features such as tag deployment and catalog ingestion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia E-commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia E-commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia E-commerce Industry?

To stay informed about further developments, trends, and reports in the Australia E-commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence