Key Insights

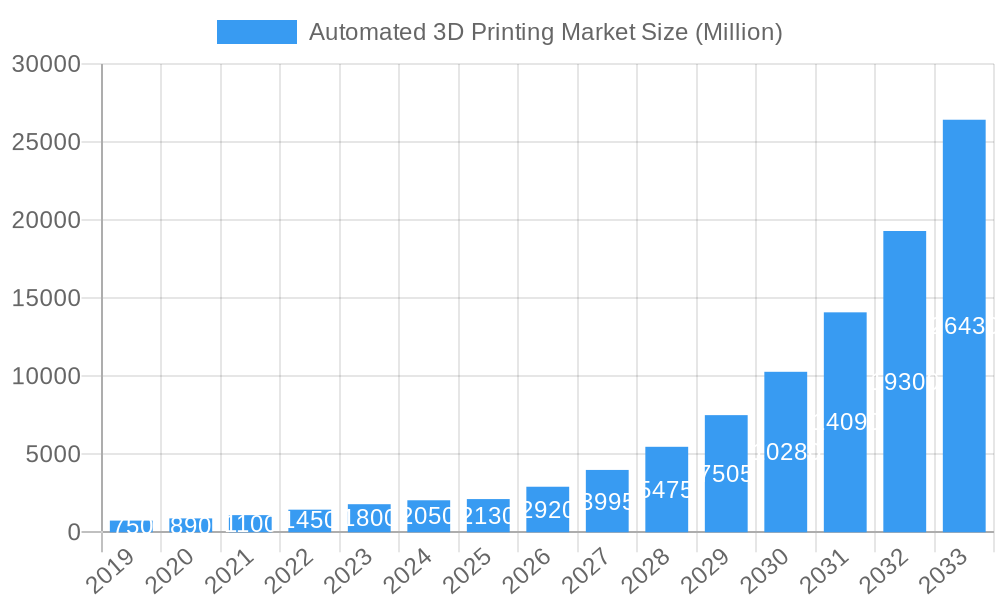

The Automated 3D Printing Market is poised for exceptional growth, projected to reach $2.13 billion by 2025, and expand at a robust Compound Annual Growth Rate (CAGR) of 36.49% during the forecast period of 2019-2033. This significant market expansion is primarily propelled by the increasing demand for enhanced production efficiency, reduced operational costs, and the growing adoption of additive manufacturing across diverse industries. Key drivers include the burgeoning need for rapid prototyping, on-demand manufacturing, and the customization of complex parts. The integration of automation technologies such as robotics, AI, and advanced software solutions is revolutionizing traditional 3D printing processes, enabling higher throughput, improved quality control, and greater scalability. Sectors like industrial manufacturing, automotive, and aerospace are leading this adoption, leveraging automated 3D printing for everything from tooling and jig production to intricate component manufacturing. The increasing sophistication of materials and the expanding capabilities of automated systems further contribute to this upward trajectory, making automated 3D printing a critical component of Industry 4.0 initiatives.

Automated 3D Printing Market Market Size (In Million)

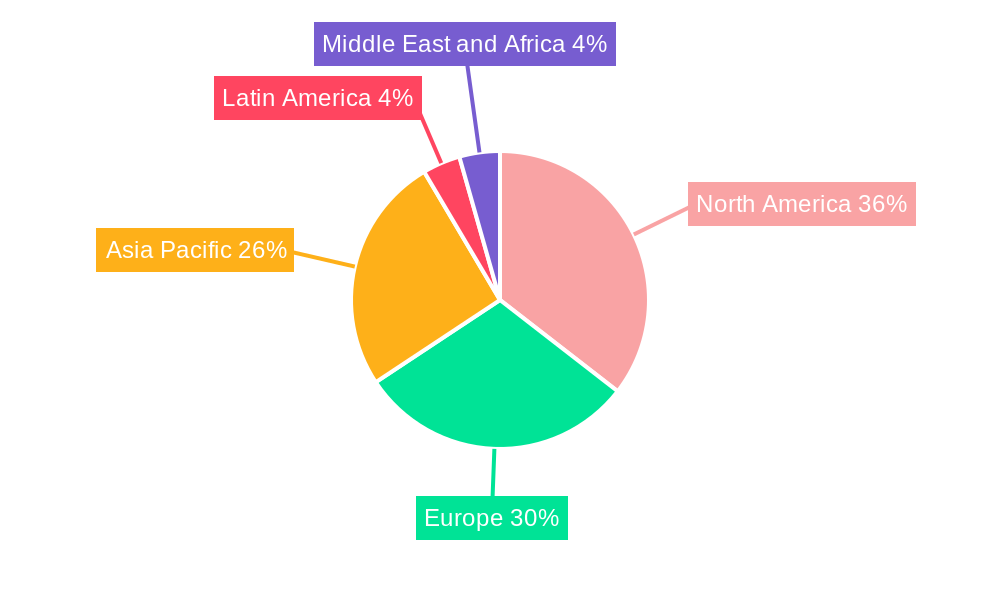

Emerging trends like the development of fully integrated, lights-out manufacturing cells and the use of multi-material printing with automated material handling are set to redefine the market landscape. While the market is characterized by strong growth, certain restraints, such as the high initial investment in automated systems and the need for skilled labor to operate and maintain them, warrant consideration. However, ongoing technological advancements and the increasing availability of advanced post-processing solutions are mitigating these challenges. The market segmentation reveals a strong emphasis on offerings like hardware, software, and services, with automated production and material handling being critical processes. Geographically, North America and Europe are expected to dominate the market, driven by early adoption and significant investment in advanced manufacturing technologies, followed closely by the rapidly growing Asia Pacific region. The continuous innovation in automated 3D printing solutions promises to unlock new possibilities and drive significant value creation across a wide spectrum of end-user verticals.

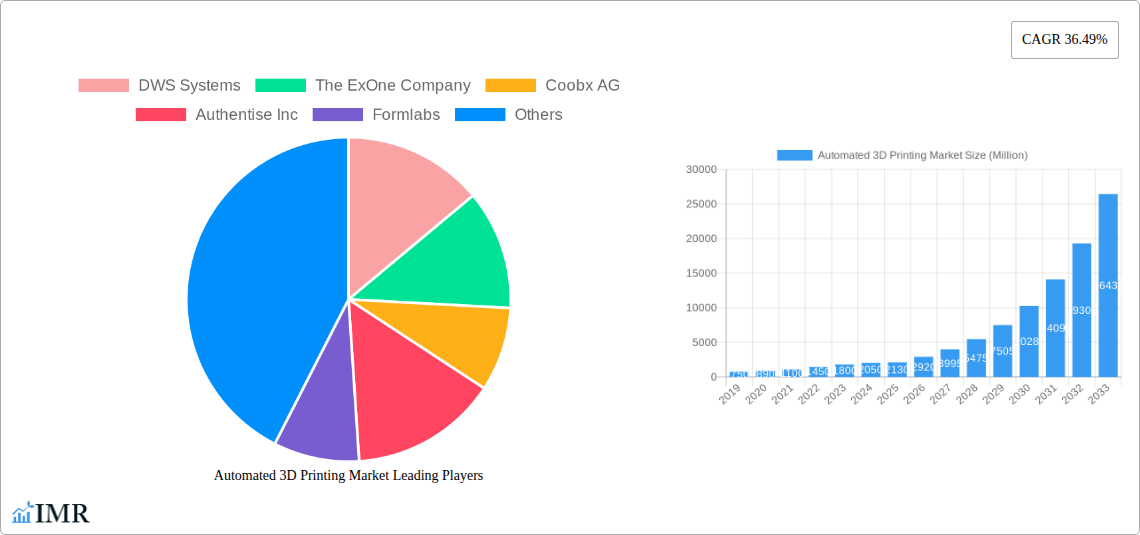

Automated 3D Printing Market Company Market Share

Automated 3D Printing Market: Driving Efficiency and Innovation in Manufacturing

This comprehensive report offers an in-depth analysis of the global Automated 3D Printing market, a rapidly evolving sector crucial for enhancing manufacturing efficiency, reducing lead times, and fostering product innovation. The study covers the period from 2019 to 2033, with a base year of 2025, providing detailed insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, emerging opportunities, and the strategic moves of major players. With a specific focus on advancements in automated production, material handling, part handling, post-processing, and multiprocessing, this report is an essential resource for industry professionals, investors, and policymakers seeking to navigate the complexities of additive manufacturing automation. The report utilizes high-traffic keywords such as "automated 3D printing," "additive manufacturing automation," "industrial 3D printing," "cobots in manufacturing," "workflow automation," and "smart factory solutions" to maximize search engine visibility and attract industry stakeholders. The market is segmented by Offering (Hardware, Software, Services), Process (Automated Production, Material Handling, Part Handling, Post-Processing, Multiprocessing), and End-user Vertical (Industrial Manufacturing, Automotive, Aerospace and Defense, Consumer Products, Healthcare, Energy, Other End-user Verticals). All values are presented in Million units.

Automated 3D Printing Market Market Dynamics & Structure

The Automated 3D Printing market is characterized by a dynamic interplay of technological innovation, strategic partnerships, and evolving end-user demands, driving significant growth and reshaping traditional manufacturing paradigms. Market concentration is gradually shifting as established players and emerging innovators vie for market share. Key drivers of technological innovation include the continuous development of advanced robotics for material handling and part manipulation, sophisticated AI-powered software for process optimization and quality control, and the integration of Industry 4.0 principles for seamless factory integration. Regulatory frameworks are slowly adapting to the unique aspects of additive manufacturing, particularly concerning standardization, quality assurance, and intellectual property protection. Competitive product substitutes, such as traditional subtractive manufacturing methods, are increasingly being challenged by the cost-effectiveness and customization capabilities of automated 3D printing for specific applications. End-user demographics are expanding, with a growing adoption by small and medium-sized enterprises (SMEs) alongside large industrial enterprises. Mergers and acquisitions (M&A) are a significant trend, with companies acquiring complementary technologies or expanding their service offerings to gain a competitive edge. For instance, the acquisition of Elements Technology Platform by Authentise Inc. in January 2022 highlights the trend of consolidation to enhance workflow management and data insights. Innovation barriers include the high initial investment costs for sophisticated automation solutions and the need for specialized workforce training.

- Market Concentration: Fragmented with growing consolidation through M&A activities.

- Technological Innovation Drivers: Advancements in robotics, AI, software algorithms, and material science.

- Regulatory Frameworks: Evolving standards for safety, quality, and interoperability in additive manufacturing.

- Competitive Product Substitutes: Traditional manufacturing methods, but automation is closing the gap for specific use cases.

- End-User Demographics: Broadening from large enterprises to SMEs across various industries.

- M&A Trends: Strategic acquisitions to expand technology portfolios and market reach.

- Innovation Barriers: High capital expenditure, skill gaps, and integration complexity.

Automated 3D Printing Market Growth Trends & Insights

The Automated 3D Printing market is poised for substantial growth, driven by an escalating demand for agile manufacturing solutions, mass customization, and localized production. The market size evolution is projected to be robust, with adoption rates accelerating as businesses recognize the transformative potential of integrating automation with additive manufacturing processes. Technological disruptions, such as the development of more advanced robotic arms for intricate part handling and the integration of sophisticated vision systems for real-time quality inspection, are pushing the boundaries of what is achievable. Consumer behavior shifts towards personalized products and on-demand manufacturing are also playing a pivotal role, compelling industries to adopt more flexible production methods. The market is anticipated to witness a Compound Annual Growth Rate (CAGR) of approximately 18.5% during the forecast period of 2025–2033. Market penetration is expected to deepen, particularly within the industrial manufacturing and automotive sectors, where the benefits of reduced tooling costs, faster prototyping, and the production of complex geometries are highly valued. The integration of cobots (collaborative robots) alongside 3D printers is a significant trend, exemplified by Universal Robots' expansion plans and participation in automation tours, aiming to optimize production efficiency. Furthermore, the development of end-to-end workflow solutions, as seen with Authentise Inc.'s acquisition, is streamlining the entire additive manufacturing process from design to finished part. This holistic approach to automation is crucial for unlocking the full potential of 3D printing in scalable manufacturing. The increasing focus on sustainability and resource optimization within manufacturing also favors automated 3D printing due to its potential for reduced material waste and localized production, thereby cutting down on transportation emissions.

Dominant Regions, Countries, or Segments in Automated 3D Printing Market

The Industrial Manufacturing segment, within the End-user Vertical, is currently the most dominant driver of growth in the Automated 3D Printing market. This dominance is underpinned by the inherent need for precision, efficiency, and the ability to produce complex, high-value components that traditional manufacturing struggles to achieve economically. The adoption of automated 3D printing in industrial settings allows for significant reductions in lead times for tooling, spare parts, and even end-use products, directly impacting operational costs and competitiveness. The Automotive and Aerospace and Defense sectors are closely following, driven by stringent quality requirements, the demand for lightweight yet strong components, and the critical need for rapid prototyping and on-demand part production.

Within the Process segment, Automated Production and Material Handling are the leading segments contributing to market expansion. Automated Production encompasses the integration of robotics and intelligent systems to manage the entire printing process, from material loading to part ejection, ensuring consistency and scalability. Material Handling is critical for the efficient and safe management of diverse printing materials, including powders, filaments, and resins. The development of automated systems for material storage, retrieval, and feeding directly into 3D printers significantly enhances throughput and reduces manual intervention, thereby minimizing errors and exposure to potentially hazardous materials.

Geographically, North America and Europe are currently the leading regions, characterized by advanced technological infrastructure, significant R&D investments, and the presence of major industrial players actively seeking to optimize their manufacturing processes. The supportive regulatory environments and government initiatives promoting advanced manufacturing further bolster adoption in these regions. Asia-Pacific is emerging as a rapidly growing market, fueled by increasing manufacturing output, a burgeoning automotive sector, and growing investments in smart factory technologies. The Hardware segment within the Offering category is seeing substantial investment due to the continuous innovation in industrial-grade 3D printers and sophisticated robotic systems.

- Dominant End-user Vertical: Industrial Manufacturing, due to its demand for efficiency and complex parts.

- Key End-user Verticals: Automotive and Aerospace & Defense, driven by lightweighting and on-demand production needs.

- Dominant Process Segments: Automated Production and Material Handling, enabling scalability and efficiency.

- Leading Regions: North America and Europe, supported by advanced infrastructure and R&D.

- Emerging Region: Asia-Pacific, driven by manufacturing growth and smart factory adoption.

- Dominant Offering Segment: Hardware, with ongoing advancements in printer and robotic technology.

Automated 3D Printing Market Product Landscape

The product landscape in the Automated 3D Printing market is characterized by a surge in integrated solutions that combine advanced 3D printing hardware with intelligent software and robotics. Innovations focus on enhancing build volumes, printing speeds, material versatility, and post-processing automation. Key advancements include the development of larger-format industrial printers capable of producing full-scale automotive or aerospace components, alongside sophisticated AI-driven software that optimizes print parameters in real-time for improved part quality and reduced waste. Automated material handling systems, designed for seamless powder or resin management, are becoming standard. Furthermore, robotic arms are being integrated for automated part removal, support structure removal, and surface finishing, creating truly lights-out manufacturing capabilities. Unique selling propositions revolve around increased throughput, reduced labor costs, enhanced design freedom, and the ability to achieve complex geometries with superior material properties.

Key Drivers, Barriers & Challenges in Automated 3D Printing Market

The Automated 3D Printing market is propelled by several key drivers that are fundamentally reshaping manufacturing.

- Technological Advancements: Continuous innovation in robotics, AI, material science, and printer technology enables more complex and efficient automated workflows.

- Demand for Mass Customization & On-Demand Production: Industries are increasingly requiring personalized products and agile supply chains, which automated 3D printing excels at delivering.

- Cost Efficiency & Lead Time Reduction: Automation significantly reduces manual labor costs and shortens production cycles, leading to substantial cost savings and faster time-to-market.

- Industry 4.0 Integration: The broader adoption of smart factory principles necessitates automated and connected manufacturing processes.

- Sustainability Goals: Automated 3D printing offers potential for reduced material waste and localized production, aligning with environmental objectives.

However, the market faces significant barriers and challenges that temper its growth trajectory.

- High Initial Investment Costs: The capital expenditure for sophisticated automated 3D printing systems and robotics can be substantial, posing a challenge for SMEs.

- Integration Complexity: Seamlessly integrating automated 3D printing solutions with existing manufacturing infrastructure can be technically demanding.

- Skill Gaps: A shortage of skilled professionals capable of operating, maintaining, and programming these advanced systems persists.

- Standardization & Quality Control: Developing and enforcing consistent standards for automated 3D printed parts, especially for critical applications, remains an ongoing challenge.

- Supply Chain Volatility: Disruptions in the supply of specialized materials and components for automated systems can impact production.

- Scalability Concerns: While improving, scaling automated 3D printing to match the output of traditional mass manufacturing for certain high-volume products can still be a hurdle.

Emerging Opportunities in Automated 3D Printing Market

Emerging opportunities in the Automated 3D Printing market lie in the expansion of its application into new verticals and the development of more specialized, integrated solutions. The healthcare sector, with its demand for patient-specific implants and prosthetics, presents a significant growth avenue. The construction industry is exploring automated 3D printing for on-site fabrication of building components, promising faster and more sustainable construction. Furthermore, the development of end-to-end automated platforms that encompass design, printing, post-processing, and quality assurance within a single ecosystem will unlock new efficiencies. The circular economy also offers opportunities, with automated systems facilitating the recycling and reuse of printing materials.

Growth Accelerators in the Automated 3D Printing Market Industry

Several catalysts are accelerating the long-term growth of the Automated 3D Printing market. Technological breakthroughs in additive manufacturing processes, such as the development of multi-material printing capabilities and faster curing mechanisms, are expanding the range of printable products and their functional properties. Strategic partnerships between hardware manufacturers, software developers, material suppliers, and automation specialists are crucial for creating comprehensive, turnkey solutions that address the end-to-end needs of manufacturers. Market expansion strategies, including increased focus on service bureaus offering automated 3D printing capabilities and the development of cloud-based platforms for managing distributed manufacturing networks, are also driving adoption. The growing realization of the benefits of localized production and resilient supply chains in the wake of global disruptions will further fuel demand.

Key Players Shaping the Automated 3D Printing Market Market

- DWS Systems

- The ExOne Company

- Coobx AG

- Authentise Inc.

- Formlabs

- 3D Systems Corporation

- SLM Solutions Group AG

- ABB Group

- Materialise NV

- PostProcess Technologies Inc.

- Universal Robots AS

- Stratasys Ltd.

- Concept Laser Inc (GE Additive)

Notable Milestones in Automated 3D Printing Market Sector

- June 2022: Triditive, a Spanish company, secures EUR 5 million to enhance industrial adoption of 3D printing through advancements in industrial machinery and automation software.

- February 2022: Universal Robots announces expansion to Ireland, highlighting cobots' role in optimizing production efficiency through automation during the Ireland Cobot Automation Tour 2022.

- January 2022: Authentise Inc. acquires Elements Technology Platform, integrating self-serve workflow tools for manufacturing, workflow management, real-time data insights, RFID, and AI technologies.

- September 2021: EnvisionTEC partners with Covestro to develop a new material and printer combination for DLP tool applications, accelerating industrial 3D printing adoption for molds and detailed part features.

In-Depth Automated 3D Printing Market Market Outlook

The outlook for the Automated 3D Printing market is exceptionally strong, driven by the convergence of Industry 4.0 principles, the imperative for agile manufacturing, and the relentless pursuit of operational efficiency. Future market potential lies in the deeper integration of AI for predictive maintenance and quality assurance, the development of fully autonomous printing cells, and the creation of digital twins that allow for virtual optimization of production processes. Strategic opportunities include expanding into emerging markets with tailored solutions and fostering collaborative ecosystems that accelerate innovation and adoption. The continued development of advanced materials and hybrid manufacturing approaches will further broaden the applicability and economic viability of automated 3D printing, solidifying its position as a cornerstone of future manufacturing.

Automated 3D Printing Market Segmentation

-

1. Offering

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Process

- 2.1. Automated Production

- 2.2. Material Handling

- 2.3. Part Handling

- 2.4. Post-Processing

- 2.5. Multiprocessing

-

3. End-user Vertical

- 3.1. Industrial Manufacturing

- 3.2. Automotive

- 3.3. Aerospace and Defense

- 3.4. Consumer Products

- 3.5. Healthcare

- 3.6. Energy

- 3.7. Other End-user Verticals

Automated 3D Printing Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Automated 3D Printing Market Regional Market Share

Geographic Coverage of Automated 3D Printing Market

Automated 3D Printing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 36.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Investments in R&D; Growth in Adoption of Robotics for Industrial Automation

- 3.3. Market Restrains

- 3.3.1. Lack of Enough Space to Build Self-storage Facilities

- 3.4. Market Trends

- 3.4.1. The Automotive Segment is Expected to Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automated 3D Printing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Process

- 5.2.1. Automated Production

- 5.2.2. Material Handling

- 5.2.3. Part Handling

- 5.2.4. Post-Processing

- 5.2.5. Multiprocessing

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Industrial Manufacturing

- 5.3.2. Automotive

- 5.3.3. Aerospace and Defense

- 5.3.4. Consumer Products

- 5.3.5. Healthcare

- 5.3.6. Energy

- 5.3.7. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. North America Automated 3D Printing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by Process

- 6.2.1. Automated Production

- 6.2.2. Material Handling

- 6.2.3. Part Handling

- 6.2.4. Post-Processing

- 6.2.5. Multiprocessing

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. Industrial Manufacturing

- 6.3.2. Automotive

- 6.3.3. Aerospace and Defense

- 6.3.4. Consumer Products

- 6.3.5. Healthcare

- 6.3.6. Energy

- 6.3.7. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. Europe Automated 3D Printing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by Process

- 7.2.1. Automated Production

- 7.2.2. Material Handling

- 7.2.3. Part Handling

- 7.2.4. Post-Processing

- 7.2.5. Multiprocessing

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. Industrial Manufacturing

- 7.3.2. Automotive

- 7.3.3. Aerospace and Defense

- 7.3.4. Consumer Products

- 7.3.5. Healthcare

- 7.3.6. Energy

- 7.3.7. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. Asia Pacific Automated 3D Printing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by Process

- 8.2.1. Automated Production

- 8.2.2. Material Handling

- 8.2.3. Part Handling

- 8.2.4. Post-Processing

- 8.2.5. Multiprocessing

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. Industrial Manufacturing

- 8.3.2. Automotive

- 8.3.3. Aerospace and Defense

- 8.3.4. Consumer Products

- 8.3.5. Healthcare

- 8.3.6. Energy

- 8.3.7. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Latin America Automated 3D Printing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by Process

- 9.2.1. Automated Production

- 9.2.2. Material Handling

- 9.2.3. Part Handling

- 9.2.4. Post-Processing

- 9.2.5. Multiprocessing

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. Industrial Manufacturing

- 9.3.2. Automotive

- 9.3.3. Aerospace and Defense

- 9.3.4. Consumer Products

- 9.3.5. Healthcare

- 9.3.6. Energy

- 9.3.7. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. Middle East and Africa Automated 3D Printing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 10.1.1. Hardware

- 10.1.2. Software

- 10.1.3. Services

- 10.2. Market Analysis, Insights and Forecast - by Process

- 10.2.1. Automated Production

- 10.2.2. Material Handling

- 10.2.3. Part Handling

- 10.2.4. Post-Processing

- 10.2.5. Multiprocessing

- 10.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.3.1. Industrial Manufacturing

- 10.3.2. Automotive

- 10.3.3. Aerospace and Defense

- 10.3.4. Consumer Products

- 10.3.5. Healthcare

- 10.3.6. Energy

- 10.3.7. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DWS Systems

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The ExOne Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Coobx AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Authentise Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Formlabs

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 3D Systems Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SLM Solutions Group AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ABB Group*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Materialise NV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 PostProcess Technologies Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Universal Robots AS

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Stratasys Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Concept Laser Inc (GE Additive)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 DWS Systems

List of Figures

- Figure 1: Global Automated 3D Printing Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automated 3D Printing Market Revenue (Million), by Offering 2025 & 2033

- Figure 3: North America Automated 3D Printing Market Revenue Share (%), by Offering 2025 & 2033

- Figure 4: North America Automated 3D Printing Market Revenue (Million), by Process 2025 & 2033

- Figure 5: North America Automated 3D Printing Market Revenue Share (%), by Process 2025 & 2033

- Figure 6: North America Automated 3D Printing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 7: North America Automated 3D Printing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 8: North America Automated 3D Printing Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Automated 3D Printing Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automated 3D Printing Market Revenue (Million), by Offering 2025 & 2033

- Figure 11: Europe Automated 3D Printing Market Revenue Share (%), by Offering 2025 & 2033

- Figure 12: Europe Automated 3D Printing Market Revenue (Million), by Process 2025 & 2033

- Figure 13: Europe Automated 3D Printing Market Revenue Share (%), by Process 2025 & 2033

- Figure 14: Europe Automated 3D Printing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 15: Europe Automated 3D Printing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: Europe Automated 3D Printing Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Automated 3D Printing Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automated 3D Printing Market Revenue (Million), by Offering 2025 & 2033

- Figure 19: Asia Pacific Automated 3D Printing Market Revenue Share (%), by Offering 2025 & 2033

- Figure 20: Asia Pacific Automated 3D Printing Market Revenue (Million), by Process 2025 & 2033

- Figure 21: Asia Pacific Automated 3D Printing Market Revenue Share (%), by Process 2025 & 2033

- Figure 22: Asia Pacific Automated 3D Printing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Asia Pacific Automated 3D Printing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Asia Pacific Automated 3D Printing Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Automated 3D Printing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Automated 3D Printing Market Revenue (Million), by Offering 2025 & 2033

- Figure 27: Latin America Automated 3D Printing Market Revenue Share (%), by Offering 2025 & 2033

- Figure 28: Latin America Automated 3D Printing Market Revenue (Million), by Process 2025 & 2033

- Figure 29: Latin America Automated 3D Printing Market Revenue Share (%), by Process 2025 & 2033

- Figure 30: Latin America Automated 3D Printing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 31: Latin America Automated 3D Printing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 32: Latin America Automated 3D Printing Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Automated 3D Printing Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Automated 3D Printing Market Revenue (Million), by Offering 2025 & 2033

- Figure 35: Middle East and Africa Automated 3D Printing Market Revenue Share (%), by Offering 2025 & 2033

- Figure 36: Middle East and Africa Automated 3D Printing Market Revenue (Million), by Process 2025 & 2033

- Figure 37: Middle East and Africa Automated 3D Printing Market Revenue Share (%), by Process 2025 & 2033

- Figure 38: Middle East and Africa Automated 3D Printing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 39: Middle East and Africa Automated 3D Printing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 40: Middle East and Africa Automated 3D Printing Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Automated 3D Printing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automated 3D Printing Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 2: Global Automated 3D Printing Market Revenue Million Forecast, by Process 2020 & 2033

- Table 3: Global Automated 3D Printing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Automated 3D Printing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Automated 3D Printing Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 6: Global Automated 3D Printing Market Revenue Million Forecast, by Process 2020 & 2033

- Table 7: Global Automated 3D Printing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global Automated 3D Printing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Automated 3D Printing Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 10: Global Automated 3D Printing Market Revenue Million Forecast, by Process 2020 & 2033

- Table 11: Global Automated 3D Printing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 12: Global Automated 3D Printing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Automated 3D Printing Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 14: Global Automated 3D Printing Market Revenue Million Forecast, by Process 2020 & 2033

- Table 15: Global Automated 3D Printing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 16: Global Automated 3D Printing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Automated 3D Printing Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 18: Global Automated 3D Printing Market Revenue Million Forecast, by Process 2020 & 2033

- Table 19: Global Automated 3D Printing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 20: Global Automated 3D Printing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Automated 3D Printing Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 22: Global Automated 3D Printing Market Revenue Million Forecast, by Process 2020 & 2033

- Table 23: Global Automated 3D Printing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 24: Global Automated 3D Printing Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automated 3D Printing Market?

The projected CAGR is approximately 36.49%.

2. Which companies are prominent players in the Automated 3D Printing Market?

Key companies in the market include DWS Systems, The ExOne Company, Coobx AG, Authentise Inc, Formlabs, 3D Systems Corporation, SLM Solutions Group AG, ABB Group*List Not Exhaustive, Materialise NV, PostProcess Technologies Inc, Universal Robots AS, Stratasys Ltd, Concept Laser Inc (GE Additive).

3. What are the main segments of the Automated 3D Printing Market?

The market segments include Offering, Process, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Investments in R&D; Growth in Adoption of Robotics for Industrial Automation.

6. What are the notable trends driving market growth?

The Automotive Segment is Expected to Drive the Market's Growth.

7. Are there any restraints impacting market growth?

Lack of Enough Space to Build Self-storage Facilities.

8. Can you provide examples of recent developments in the market?

June 2022 - Triditive, a Spanish company, nets EUR 5 million to boost 3D printing in the manufacturing sector. The company is focused on the development of industrial machinery and software which enables the automation of additive manufacturing to propel its industrial adoption.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automated 3D Printing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automated 3D Printing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automated 3D Printing Market?

To stay informed about further developments, trends, and reports in the Automated 3D Printing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence