Key Insights

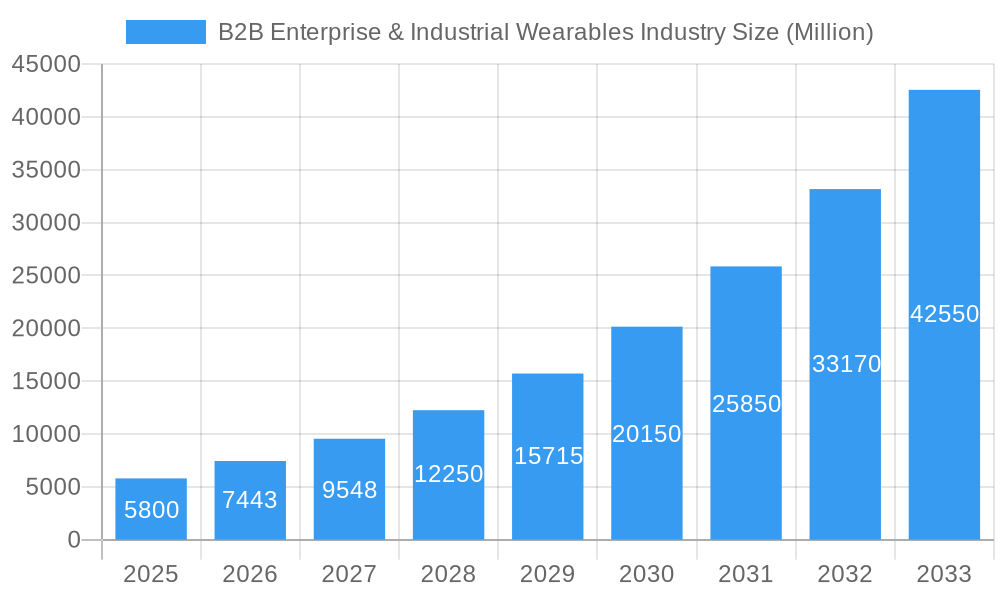

The B2B Enterprise & Industrial Wearables Industry is poised for explosive growth, projected to reach a significant market size of approximately $XX million and expand at an impressive CAGR of 28.20% from 2025 to 2033. This surge is primarily fueled by the accelerating adoption of smart technologies across various industrial sectors, driven by the need for enhanced productivity, improved worker safety, and streamlined operations. Key growth drivers include the increasing demand for real-time data analytics and remote monitoring capabilities, particularly in sectors like manufacturing, logistics, and field services. The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) within wearable devices is enabling more sophisticated applications, from predictive maintenance alerts to augmented reality-assisted tasks for technicians. Furthermore, advancements in battery life, sensor technology, and miniaturization are making industrial wearables more practical and cost-effective for widespread deployment. The ongoing digital transformation initiatives within enterprises globally are creating a robust demand for solutions that can empower the workforce with advanced tools and actionable insights.

B2B Enterprise & Industrial Wearables Industry Market Size (In Billion)

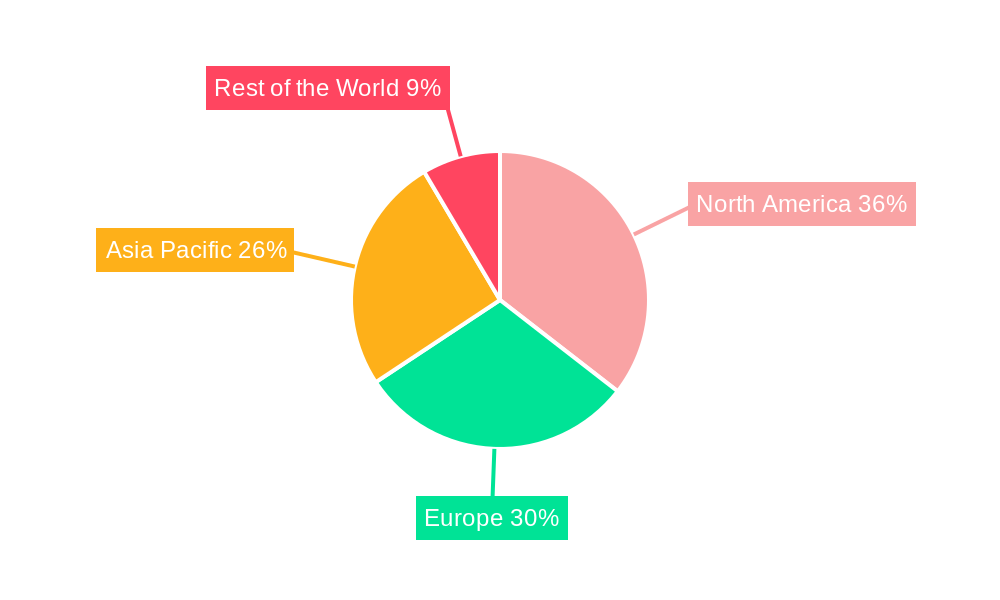

The market segmentation reveals a diverse landscape, with Head-Mounted Displays (HMDs) and Enterprise Smart Glasses leading the charge in transforming complex workflows and training. Wrist Wears, encompassing smartwatches and fitness bands, are gaining traction for their ability to monitor worker health and safety, as well as provide quick access to critical information. Smart Clothing and Body Sensors are emerging as crucial for specialized industrial environments requiring continuous physiological monitoring or environmental sensing. Geographically, North America and Europe are expected to maintain significant market share due to their early adoption of advanced technologies and strong presence of key industry players. However, the Asia Pacific region is anticipated to exhibit the fastest growth, driven by rapid industrialization, increasing investments in smart manufacturing, and a burgeoning demand for efficient operational solutions. While the potential is vast, potential restraints may include high initial investment costs for some advanced wearable solutions, concerns regarding data privacy and security, and the need for extensive employee training to ensure optimal utilization of these technologies.

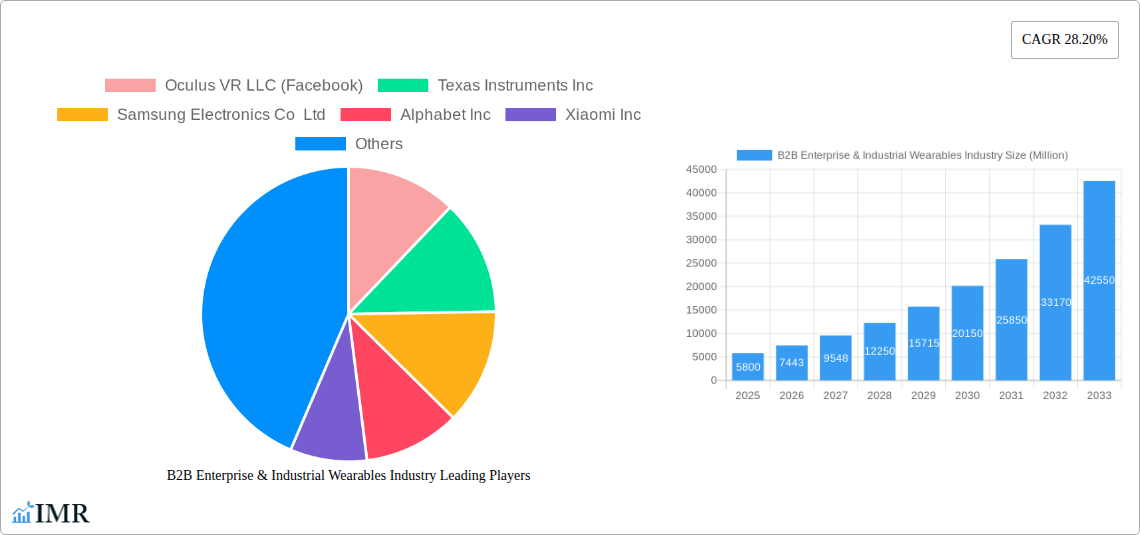

B2B Enterprise & Industrial Wearables Industry Company Market Share

This comprehensive report offers an in-depth analysis of the B2B Enterprise & Industrial Wearables Industry, providing critical insights into market dynamics, growth trajectories, regional dominance, product innovations, key drivers, challenges, and emerging opportunities. Covering the historical period of 2019-2024, a base year of 2025, and a robust forecast period from 2025 to 2033, this research is indispensable for stakeholders seeking to navigate and capitalize on this rapidly evolving sector. We analyze parent and child markets, presenting all quantitative values in Million units for clarity and comparability.

B2B Enterprise & Industrial Wearables Industry Market Dynamics & Structure

The B2B Enterprise & Industrial Wearables Industry is characterized by a dynamic and evolving market structure, influenced by significant technological advancements and a growing imperative for enhanced operational efficiency across various sectors. Market concentration varies across different device types and end-user industries, with key players investing heavily in research and development to drive innovation. Technological innovation serves as a primary growth catalyst, particularly in areas such as augmented reality (AR) for industrial training and maintenance, advanced sensor technology for real-time data collection, and robust connectivity solutions.

- Market Concentration: While a few dominant players hold significant market share, the landscape is becoming increasingly fragmented with the emergence of specialized solution providers.

- Technological Innovation Drivers: Miniaturization of components, improved battery life, enhanced durability, AI-powered analytics, and seamless integration with existing enterprise systems are key innovation drivers.

- Regulatory Frameworks: Data privacy regulations (e.g., GDPR, CCPA) and industry-specific safety standards significantly influence product development and deployment strategies.

- Competitive Product Substitutes: Traditional manual data collection methods, handheld devices, and desktop-based software represent indirect substitutes, though wearables offer distinct advantages in real-time accessibility and hands-free operation.

- End-User Demographics: The adoption is driven by industries seeking to improve worker safety, optimize productivity, streamline workflows, and enhance training effectiveness.

- M&A Trends: Mergers and acquisitions are prevalent as larger technology firms aim to acquire specialized expertise and expand their industrial IoT portfolios. For instance, the acquisition of Pebble by Mensa Brands highlights a trend towards consolidation and expansion within specific geographic markets.

B2B Enterprise & Industrial Wearables Industry Growth Trends & Insights

The B2B Enterprise & Industrial Wearables Industry is poised for substantial growth, driven by an accelerating adoption rate across diverse end-user sectors. The market size evolution is marked by a consistent upward trajectory, with projected Compound Annual Growth Rates (CAGR) indicating a robust expansion throughout the forecast period. This growth is fueled by a confluence of factors, including the increasing demand for real-time data analytics to optimize operational efficiency, the critical need for enhanced worker safety in hazardous environments, and the continuous technological advancements that are making wearable devices more powerful, intuitive, and cost-effective.

Consumer behavior shifts are indirectly influencing the B2B space, as employees become more accustomed to personal wearable technology, driving expectations for similar functionalities and ease of use in their professional lives. This has led to a greater acceptance and demand for enterprise-grade smart devices capable of performing complex tasks, from sophisticated diagnostics and predictive maintenance to immersive training simulations and remote assistance. Technological disruptions, such as the integration of advanced Artificial Intelligence (AI) and Machine Learning (ML) algorithms directly within wearable devices, are enabling more sophisticated data processing and actionable insights at the edge, reducing reliance on constant cloud connectivity and improving response times.

The market penetration of these devices is expanding beyond traditional industrial settings into sectors like healthcare for remote patient monitoring and surgical assistance, logistics for inventory management and route optimization, and even retail for enhanced customer engagement and staff productivity. The increasing affordability and ruggedization of these devices, coupled with the demonstrable return on investment (ROI) through improved productivity and reduced downtime, are further accelerating adoption rates. The convergence of IoT, 5G connectivity, and edge computing is creating a fertile ground for innovative wearable solutions that can transform operational paradigms, making the B2B enterprise and industrial wearables sector a critical component of digital transformation strategies globally.

Dominant Regions, Countries, or Segments in B2B Enterprise & Industrial Wearables Industry

The B2B Enterprise & Industrial Wearables Industry exhibits distinct regional and segmental dominance, with North America and Europe currently leading market growth, driven by advanced technological adoption and strong industrial bases. However, the Asia-Pacific region is rapidly emerging as a significant growth hub, fueled by expanding manufacturing sectors, increasing investments in smart factories, and government initiatives promoting digital transformation.

Dominant Device Types:

- Enterprise Smart Glass: This segment is experiencing particularly strong growth, owing to its application in augmented reality (AR) overlays for complex assembly, maintenance, and remote expert assistance in manufacturing and logistics. Companies are leveraging smart glasses to provide hands-free access to critical information and real-time guidance, significantly improving efficiency and reducing errors.

- Wrist Wears (Smart Watch and Fitness Bands): While a substantial portion of this segment caters to the consumer market, enterprise-grade smartwatches and ruggedized fitness bands are gaining traction in industries requiring worker monitoring for safety, fatigue management, and basic task management. Their widespread familiarity and ease of use contribute to their growing adoption.

- Smart Clothing and Body Sensors: This segment is gaining momentum in specialized applications such as advanced biometrics for worker health monitoring in hazardous environments (e.g., mining, construction), performance tracking for athletes, and detailed physiological data collection for healthcare and research. The integration of sensors directly into apparel offers a discreet and continuous data capture solution.

Dominant End-User Industries:

- Manufacturing: This industry is a primary driver, utilizing wearables for a wide array of applications including quality control, predictive maintenance, worker safety monitoring, training, and supply chain management. The demand for real-time data and hands-free operations makes wearables an indispensable tool for modern manufacturing facilities.

- IT and Telecom: Wearables are being adopted for field service technicians, remote IT support, and enhanced communication within large operational teams. The ability to access real-time diagnostics and collaborate remotely is critical in this sector.

- Healthcare: This sector is witnessing significant growth, with wearables used for remote patient monitoring, surgical assistance (via smart glasses), and healthcare professional workflow optimization. The ability to collect patient data continuously and provide real-time alerts is transforming patient care.

Key drivers for dominance in these regions and segments include robust economic policies supporting technological innovation, significant investments in R&D, well-developed digital infrastructure (e.g., 5G networks), and a proactive approach to adopting advanced technologies for competitive advantage. Market share in these leading segments is substantial, with continuous growth potential as new applications and functionalities are developed.

B2B Enterprise & Industrial Wearables Industry Product Landscape

The B2B Enterprise & Industrial Wearables Industry is characterized by a landscape of increasingly sophisticated and specialized products. Innovations are focused on enhancing durability, battery life, connectivity, and data processing capabilities. Enterprise smart glasses are offering advanced AR functionalities for guided workflows and remote expert assistance. Ruggedized smartwatches and fitness bands provide robust health and safety monitoring. Smart clothing and body sensors are enabling continuous, non-intrusive data collection for health and performance analytics. Wearable cameras are being integrated with AI for real-time object recognition and safety alerts. The unique selling propositions lie in their ability to provide hands-free operation, real-time data access, enhanced worker safety, and improved operational efficiency in demanding environments.

Key Drivers, Barriers & Challenges in B2B Enterprise & Industrial Wearables Industry

Key Drivers:

- Enhanced Worker Safety: Wearables can monitor worker vitals, detect falls, alert to hazardous conditions, and ensure compliance with safety protocols.

- Increased Productivity & Efficiency: Hands-free operation, real-time data access, and augmented reality guidance streamline workflows and reduce errors.

- Improved Training & Skill Development: Immersive AR/VR training experiences delivered via smart glasses enhance skill acquisition and retention.

- Real-time Data & Analytics: Continuous data collection from wearable sensors provides actionable insights for predictive maintenance and operational optimization.

- Technological Advancements: Miniaturization, improved battery technology, 5G connectivity, and AI integration are making wearables more capable and versatile.

Barriers & Challenges:

- High Initial Investment Costs: The upfront cost of deploying large-scale wearable solutions can be a significant barrier for some organizations.

- Data Privacy and Security Concerns: Protecting sensitive worker and operational data collected by wearables is paramount and requires robust security measures.

- Integration Complexity: Seamlessly integrating wearable data with existing enterprise systems and IT infrastructure can be challenging.

- User Adoption and Training: Ensuring that employees embrace and effectively utilize wearable technology requires comprehensive training and change management strategies.

- Regulatory Compliance: Adhering to evolving industry-specific regulations and data protection laws can be complex.

- Battery Life and Durability: Despite advancements, battery life remains a concern for continuous operation, and devices must withstand harsh industrial environments.

Emerging Opportunities in B2B Enterprise & Industrial Wearables Industry

Emerging opportunities lie in the increasing demand for specialized industrial smart clothing with integrated haptic feedback for remote guidance and advanced body sensors for real-time physiological monitoring in high-risk occupations. The integration of edge AI capabilities directly into wearable devices for instantaneous data analysis and decision-making presents a significant growth avenue, reducing reliance on cloud connectivity. Furthermore, the expansion of AR-enabled enterprise smart glasses for collaborative remote assistance and virtual prototyping offers transformative potential across industries. Untapped markets in emerging economies and the development of more affordable, yet robust, wearable solutions for small and medium-sized enterprises (SMEs) represent substantial growth avenues.

Growth Accelerators in the B2B Enterprise & Industrial Wearables Industry Industry

The long-term growth of the B2B Enterprise & Industrial Wearables Industry is being significantly accelerated by several key factors. The continuous advancements in miniaturized sensor technology, coupled with breakthroughs in battery efficiency, are enabling more compact, longer-lasting, and more powerful wearable devices. Strategic partnerships between technology providers, industrial companies, and specialized software developers are fostering the creation of integrated, end-to-end solutions tailored to specific industry needs. Furthermore, the widespread adoption of 5G networks is providing the high bandwidth and low latency required for real-time data transmission and complex AR/VR applications, unlocking new levels of operational efficiency and remote collaboration.

Key Players Shaping the B2B Enterprise & Industrial Wearables Industry Market

- Oculus VR LLC (Facebook)

- Texas Instruments Inc

- Samsung Electronics Co Ltd

- Alphabet Inc

- Xiaomi Inc

- Microsoft Corporation

- Toshiba Corporation

- Seiko Epson Corporation

- Fitbit Inc

- Apple Inc

- HTC Corporation

- Sony Corporation

Notable Milestones in B2B Enterprise & Industrial Wearables Industry Sector

- Sept 2022: Amazfit (Zepp Health) partnered with Adidas Runtastic to enhance athletic motivation through advanced workout tracking, leveraging their BioTracker PPG sensor technology for accurate health and fitness metric monitoring.

- Jun 2022: Mensa Brands acquired India's smart wearable brand Pebble, expanding its reach in audio products, fitness, and charging solutions, and strengthening its offline distribution network.

In-Depth B2B Enterprise & Industrial Wearables Industry Market Outlook

The future market outlook for the B2B Enterprise & Industrial Wearables Industry is exceptionally promising, driven by a convergence of technological innovation and pressing industrial demands. Growth accelerators such as the pervasive adoption of AI at the edge, the expansion of robust 5G infrastructure, and the increasing sophistication of AR/VR technologies will continue to fuel the development of smarter, more integrated wearable solutions. Strategic partnerships and the continuous development of specialized applications for sectors like manufacturing, healthcare, and logistics will unlock new revenue streams and deepen market penetration. The ongoing focus on enhancing worker safety, optimizing operational efficiency, and enabling remote capabilities positions this industry as a critical enabler of digital transformation, presenting significant strategic opportunities for continued expansion and innovation.

B2B Enterprise & Industrial Wearables Industry Segmentation

-

1. Device Type

- 1.1. HMDs

- 1.2. Wrist Wears (Smart Watch and Fitness Bands)

- 1.3. Enterprise Smart Glass

- 1.4. Smart Clothing and Body Sensors

- 1.5. Wearable Cameras

- 1.6. Other Device Types

-

2. End-user Industry

- 2.1. IT and Telecom

- 2.2. Healthcare

- 2.3. Retail

- 2.4. Insurance

- 2.5. Manufacturing

- 2.6. Other End-user Industries

B2B Enterprise & Industrial Wearables Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

B2B Enterprise & Industrial Wearables Industry Regional Market Share

Geographic Coverage of B2B Enterprise & Industrial Wearables Industry

B2B Enterprise & Industrial Wearables Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 28.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing App Ecosystem Will Fuel Enterprise Adoption; Demand for Smart Factory Setups are Expected to Aid Growth of Wearables

- 3.3. Market Restrains

- 3.3.1. Lack of Business Applications is a Primary Challenge in Deploying Wearables; Perennial Concerns about Data Security and Existing Tech Integration Issues

- 3.4. Market Trends

- 3.4.1. Demand for Smart Factory Setups are Expected to Aid Growth of Wearables

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global B2B Enterprise & Industrial Wearables Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. HMDs

- 5.1.2. Wrist Wears (Smart Watch and Fitness Bands)

- 5.1.3. Enterprise Smart Glass

- 5.1.4. Smart Clothing and Body Sensors

- 5.1.5. Wearable Cameras

- 5.1.6. Other Device Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. IT and Telecom

- 5.2.2. Healthcare

- 5.2.3. Retail

- 5.2.4. Insurance

- 5.2.5. Manufacturing

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. North America B2B Enterprise & Industrial Wearables Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. HMDs

- 6.1.2. Wrist Wears (Smart Watch and Fitness Bands)

- 6.1.3. Enterprise Smart Glass

- 6.1.4. Smart Clothing and Body Sensors

- 6.1.5. Wearable Cameras

- 6.1.6. Other Device Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. IT and Telecom

- 6.2.2. Healthcare

- 6.2.3. Retail

- 6.2.4. Insurance

- 6.2.5. Manufacturing

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. Europe B2B Enterprise & Industrial Wearables Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. HMDs

- 7.1.2. Wrist Wears (Smart Watch and Fitness Bands)

- 7.1.3. Enterprise Smart Glass

- 7.1.4. Smart Clothing and Body Sensors

- 7.1.5. Wearable Cameras

- 7.1.6. Other Device Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. IT and Telecom

- 7.2.2. Healthcare

- 7.2.3. Retail

- 7.2.4. Insurance

- 7.2.5. Manufacturing

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. Asia Pacific B2B Enterprise & Industrial Wearables Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. HMDs

- 8.1.2. Wrist Wears (Smart Watch and Fitness Bands)

- 8.1.3. Enterprise Smart Glass

- 8.1.4. Smart Clothing and Body Sensors

- 8.1.5. Wearable Cameras

- 8.1.6. Other Device Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. IT and Telecom

- 8.2.2. Healthcare

- 8.2.3. Retail

- 8.2.4. Insurance

- 8.2.5. Manufacturing

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. Rest of the World B2B Enterprise & Industrial Wearables Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 9.1.1. HMDs

- 9.1.2. Wrist Wears (Smart Watch and Fitness Bands)

- 9.1.3. Enterprise Smart Glass

- 9.1.4. Smart Clothing and Body Sensors

- 9.1.5. Wearable Cameras

- 9.1.6. Other Device Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. IT and Telecom

- 9.2.2. Healthcare

- 9.2.3. Retail

- 9.2.4. Insurance

- 9.2.5. Manufacturing

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Oculus VR LLC (Facebook)

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Texas Instruments Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Samsung Electronics Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Alphabet Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Xiaomi Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Microsoft Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Toshiba Corporation*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Seiko Epson Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Fitbit Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Apple Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 HTC Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Sony Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Oculus VR LLC (Facebook)

List of Figures

- Figure 1: Global B2B Enterprise & Industrial Wearables Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America B2B Enterprise & Industrial Wearables Industry Revenue (Million), by Device Type 2025 & 2033

- Figure 3: North America B2B Enterprise & Industrial Wearables Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 4: North America B2B Enterprise & Industrial Wearables Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America B2B Enterprise & Industrial Wearables Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America B2B Enterprise & Industrial Wearables Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America B2B Enterprise & Industrial Wearables Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe B2B Enterprise & Industrial Wearables Industry Revenue (Million), by Device Type 2025 & 2033

- Figure 9: Europe B2B Enterprise & Industrial Wearables Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 10: Europe B2B Enterprise & Industrial Wearables Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe B2B Enterprise & Industrial Wearables Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe B2B Enterprise & Industrial Wearables Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe B2B Enterprise & Industrial Wearables Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific B2B Enterprise & Industrial Wearables Industry Revenue (Million), by Device Type 2025 & 2033

- Figure 15: Asia Pacific B2B Enterprise & Industrial Wearables Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 16: Asia Pacific B2B Enterprise & Industrial Wearables Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific B2B Enterprise & Industrial Wearables Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific B2B Enterprise & Industrial Wearables Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific B2B Enterprise & Industrial Wearables Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World B2B Enterprise & Industrial Wearables Industry Revenue (Million), by Device Type 2025 & 2033

- Figure 21: Rest of the World B2B Enterprise & Industrial Wearables Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 22: Rest of the World B2B Enterprise & Industrial Wearables Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Rest of the World B2B Enterprise & Industrial Wearables Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Rest of the World B2B Enterprise & Industrial Wearables Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World B2B Enterprise & Industrial Wearables Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global B2B Enterprise & Industrial Wearables Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 2: Global B2B Enterprise & Industrial Wearables Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global B2B Enterprise & Industrial Wearables Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global B2B Enterprise & Industrial Wearables Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 5: Global B2B Enterprise & Industrial Wearables Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global B2B Enterprise & Industrial Wearables Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global B2B Enterprise & Industrial Wearables Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 8: Global B2B Enterprise & Industrial Wearables Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global B2B Enterprise & Industrial Wearables Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global B2B Enterprise & Industrial Wearables Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 11: Global B2B Enterprise & Industrial Wearables Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global B2B Enterprise & Industrial Wearables Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global B2B Enterprise & Industrial Wearables Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 14: Global B2B Enterprise & Industrial Wearables Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global B2B Enterprise & Industrial Wearables Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the B2B Enterprise & Industrial Wearables Industry?

The projected CAGR is approximately 28.20%.

2. Which companies are prominent players in the B2B Enterprise & Industrial Wearables Industry?

Key companies in the market include Oculus VR LLC (Facebook), Texas Instruments Inc, Samsung Electronics Co Ltd, Alphabet Inc, Xiaomi Inc, Microsoft Corporation, Toshiba Corporation*List Not Exhaustive, Seiko Epson Corporation, Fitbit Inc, Apple Inc, HTC Corporation, Sony Corporation.

3. What are the main segments of the B2B Enterprise & Industrial Wearables Industry?

The market segments include Device Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing App Ecosystem Will Fuel Enterprise Adoption; Demand for Smart Factory Setups are Expected to Aid Growth of Wearables.

6. What are the notable trends driving market growth?

Demand for Smart Factory Setups are Expected to Aid Growth of Wearables.

7. Are there any restraints impacting market growth?

Lack of Business Applications is a Primary Challenge in Deploying Wearables; Perennial Concerns about Data Security and Existing Tech Integration Issues.

8. Can you provide examples of recent developments in the market?

Sept 2022: Amazfit, a leading global smart wearables brand of Zepp Health, teamed up with digital health partner Adidas Runtastic to motivate the diverse international athletic community through industry-leading workout tracking and sharing using Amazfit's proprietary multi-generation BioTracker PPG biometric tracking optical sensor technology, which allows users to monitor a comprehensive range of health and fitness metrics accurately.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "B2B Enterprise & Industrial Wearables Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the B2B Enterprise & Industrial Wearables Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the B2B Enterprise & Industrial Wearables Industry?

To stay informed about further developments, trends, and reports in the B2B Enterprise & Industrial Wearables Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence