Key Insights

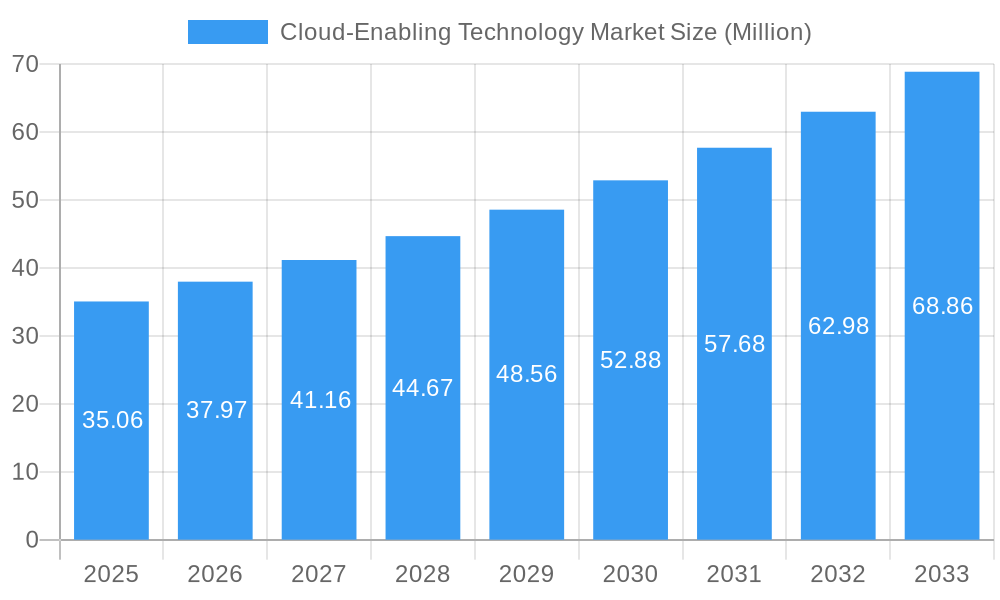

The global Cloud-Enabling Technology Market is projected for substantial growth, with a current market size of $35.06 million and an impressive Compound Annual Growth Rate (CAGR) exceeding 8.42% during the forecast period of 2025-2033. This robust expansion is fueled by a confluence of powerful drivers, primarily the escalating demand for scalable and flexible IT infrastructure across industries. Organizations are increasingly migrating their operations to the cloud to enhance agility, reduce operational costs, and improve data accessibility. The proliferation of big data analytics and the Internet of Things (IoT) further necessitates advanced cloud-enabling technologies for efficient data processing and storage. Furthermore, the ongoing digital transformation initiatives worldwide are a significant catalyst, compelling businesses to adopt cloud-centric solutions to stay competitive.

Cloud-Enabling Technology Market Market Size (In Million)

Key trends shaping this market include the rapid advancement in virtualization technology, which underpins the efficient utilization of resources, and the growing adoption of hybrid and multi-cloud strategies. These strategies offer businesses the flexibility to leverage the benefits of both public and private clouds, optimizing cost and performance. The service type segment is expected to be dominated by Platform-as-a-Service (PaaS) and Software-as-a-Service (SaaS) due to their ease of deployment and management. End-user industries like Banking, Financial Services, and Insurance (BFSI), Healthcare, and Telecom are leading the charge in cloud adoption, driven by the need for enhanced data security, regulatory compliance, and improved customer experiences. While the market presents immense opportunities, challenges such as data security concerns, vendor lock-in, and the complexity of integrating legacy systems with cloud environments will need to be strategically addressed by market players.

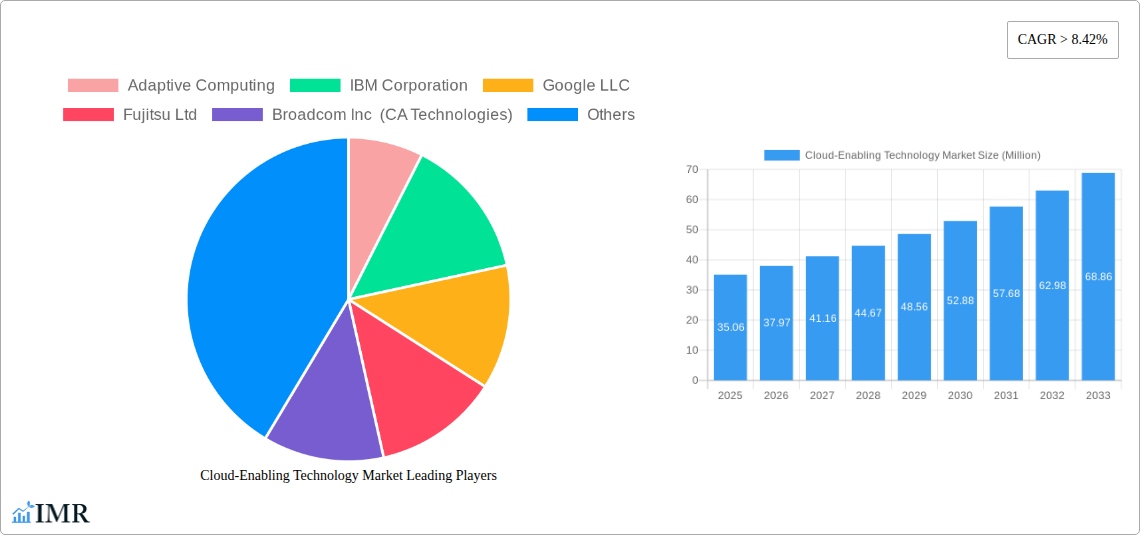

Cloud-Enabling Technology Market Company Market Share

This in-depth report provides a panoramic view of the global Cloud-Enabling Technology Market, a critical sector empowering digital transformation across industries. Delving into a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025, and a historical overview from 2019-2024, this analysis offers actionable insights for stakeholders navigating the rapidly evolving cloud landscape. We dissect market dynamics, growth trends, dominant regions, product innovations, key drivers, barriers, challenges, and emerging opportunities. The report leverages high-traffic keywords such as "cloud computing," "SaaS," "PaaS," "IaaS," "hybrid cloud," "private cloud," "public cloud," "data center technology," "virtualization," and "AI cloud solutions" to maximize search engine visibility.

Cloud-Enabling Technology Market Market Dynamics & Structure

The Cloud-Enabling Technology Market exhibits a dynamic and increasingly concentrated structure, driven by relentless technological innovation and strategic consolidations. Key players like IBM Corporation, Google LLC, Microsoft Corporation, and Amazon Web Services (AWS) dominate the landscape, leveraging their extensive portfolios of IaaS, PaaS, and SaaS solutions. Market concentration is further amplified by significant M&A activity, with companies seeking to acquire innovative technologies and expand their market reach. For instance, the acquisition of CA Technologies by Broadcom Inc. underscores the trend of large enterprises integrating specialized cloud capabilities. Regulatory frameworks, particularly concerning data privacy and security (e.g., GDPR, CCPA), are shaping deployment models, influencing the adoption of hybrid cloud and private cloud solutions alongside the prevalent public cloud. Competitive product substitutes are emerging, ranging from on-premises private cloud solutions to specialized industry-specific cloud platforms, posing a continuous challenge for established providers. End-user demographics are increasingly diverse, with small and medium-sized businesses (SMBs) alongside large enterprises actively migrating to the cloud to enhance agility and scalability.

- Market Concentration: Dominated by a few major hyperscalers and enterprise software giants, with increasing M&A activity driving further consolidation.

- Technological Innovation Drivers: Advances in virtualization technology, data center technology, and broadband networks and internet architecture are crucial. The integration of AI/ML capabilities is a significant innovation frontier.

- Regulatory Frameworks: Data sovereignty, privacy compliance, and security standards are pivotal in shaping cloud adoption strategies.

- Competitive Product Substitutes: On-premises private cloud, hybrid multi-cloud management platforms, and specialized vertical cloud solutions.

- End-User Demographics: A broad spectrum from startups to Fortune 500 companies across all major sectors.

- M&A Trends: Acquisitions focused on expanding cloud service offerings, acquiring AI capabilities, and strengthening hybrid/multi-cloud solutions.

Cloud-Enabling Technology Market Growth Trends & Insights

The Cloud-Enabling Technology Market is projected for robust growth, fueled by accelerated digital transformation initiatives across all sectors. The market size is expected to reach an estimated value of $XXX million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% between 2025 and 2033. This upward trajectory is underpinned by the increasing adoption of SaaS for business applications, the growing demand for scalable IaaS to support complex workloads, and the strategic implementation of PaaS for application development and deployment. Hybrid cloud adoption is emerging as a dominant trend, offering organizations the flexibility to leverage the benefits of both public and private cloud environments. This approach caters to diverse needs, from cost optimization and agility in the public cloud to enhanced control and security in the private cloud.

Technological disruptions, particularly in AI and machine learning, are profoundly influencing cloud service offerings. Cloud providers are integrating advanced AI capabilities, enabling data analytics, predictive modeling, and automation for businesses. This is driving the adoption of cloud services in sectors like BFSI and Healthcare for advanced analytics and personalized services. Furthermore, the proliferation of IoT devices and the explosion of data generated necessitate scalable and secure cloud infrastructure, further propelling Data Center Technology and Broadband Networks and Internet Architecture advancements. Consumer behavior shifts towards on-demand services and digital-first interactions also compel businesses to invest in cloud solutions to deliver seamless user experiences. The increasing demand for edge computing solutions, which complements cloud infrastructure by processing data closer to the source, also represents a significant growth driver. The sustained investment in cloud infrastructure by major players and the continuous development of new cloud-native applications are solidifying the market's upward trend. The ongoing digital transformation, exacerbated by the need for remote work capabilities and business continuity, has permanently shifted the paradigm towards cloud-first strategies.

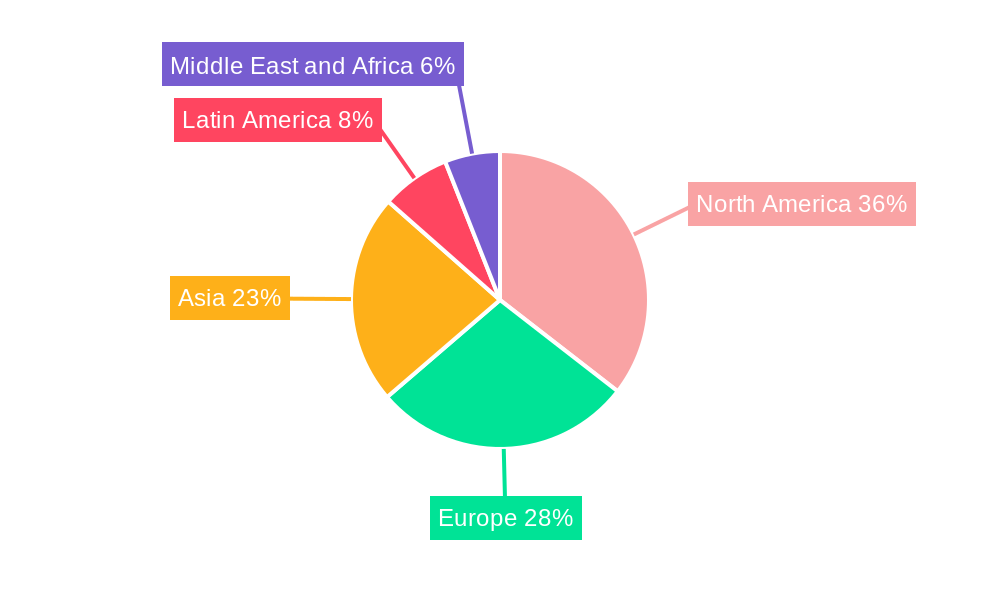

Dominant Regions, Countries, or Segments in Cloud-Enabling Technology Market

North America currently dominates the Cloud-Enabling Technology Market, driven by its early adoption of cloud services, a mature digital infrastructure, and a strong presence of leading technology companies. The United States, in particular, is a powerhouse, with significant investments in public cloud, private cloud, and hybrid cloud solutions across various end-user industries. The robust growth of the Telecom and IT sector, coupled with the expansive BFSI and Healthcare industries' reliance on cloud for data management and analytics, significantly contributes to North America's market leadership.

Public Cloud remains the most dominant deployment type globally, owing to its scalability, cost-effectiveness, and rapid deployment capabilities. However, Hybrid Cloud is experiencing remarkable growth as organizations seek a balanced approach to security, compliance, and performance. The Software-as-a-Service (SaaS) segment leads in terms of market revenue, with a vast array of cloud-based applications transforming business operations across all sectors.

Leading Region: North America, with the United States as the primary market.

- Key Drivers: Early adoption, robust technological ecosystem, significant investments by enterprises, and a large base of technology providers.

- Market Share: Holds a substantial percentage of the global cloud-enabling technology market share.

- Growth Potential: Continued innovation, expansion of AI/ML services, and increasing demand from emerging industries.

Dominant Deployment Type: Public Cloud, with Hybrid Cloud showing strong growth momentum.

- Public Cloud Drivers: Scalability, cost-efficiency, accessibility, and rapid innovation.

- Hybrid Cloud Drivers: Flexibility, enhanced security and compliance, optimized performance, and phased migration strategies.

Dominant Service Type: Software-as-a-Service (SaaS).

- SaaS Drivers: Broad accessibility, subscription-based models, continuous updates, and reduced IT overhead for end-users.

- PaaS & IaaS Growth: Significant growth driven by developers, IT infrastructure needs, and big data analytics.

Dominant Technology Type: Data Center Technology and Virtualization Technology are foundational.

- Data Center Drivers: Demand for massive storage, processing power, and advanced networking infrastructure.

- Virtualization Drivers: Efficiency, resource optimization, and enabling private and hybrid cloud deployments.

Dominant End-User Industry: Banking, Financial Services, and Insurance (BFSI) and Telecom and IT.

- BFSI Drivers: Need for advanced analytics, regulatory compliance, fraud detection, and enhanced customer experiences.

- Telecom & IT Drivers: Core infrastructure, network modernization, digital services, and rapid scalability.

Cloud-Enabling Technology Market Product Landscape

The Cloud-Enabling Technology Market is characterized by a dynamic product landscape marked by continuous innovation and enhanced performance metrics. Products range from comprehensive IaaS platforms offering scalable compute, storage, and networking resources to sophisticated PaaS solutions that streamline application development, deployment, and management. SaaS offerings are diverse, encompassing everything from customer relationship management (CRM) and enterprise resource planning (ERP) to specialized productivity and collaboration tools. Key technological advancements include the integration of AI and ML capabilities for advanced analytics and automation, enhanced security features, and improved multi-cloud management capabilities. Companies are focusing on delivering products that offer greater interoperability, flexibility, and cost optimization for their users, with unique selling propositions often centered around specialized industry solutions or advanced performance optimization.

Key Drivers, Barriers & Challenges in Cloud-Enabling Technology Market

Key Drivers: The Cloud-Enabling Technology Market is propelled by the pervasive need for digital transformation, enabling businesses to achieve greater agility, scalability, and cost-efficiency. Technological advancements in virtualization technology, data center technology, and broadband networks and internet architecture continue to lower barriers to entry and enhance performance. The growing adoption of AI and machine learning, which heavily relies on cloud infrastructure for processing power and data storage, is a significant accelerator. Furthermore, the increasing demand for remote work solutions and business continuity planning, highlighted by recent global events, has underscored the critical role of cloud services. Government initiatives promoting digital infrastructure development and favorable regulatory environments in several regions also contribute to market expansion.

Barriers & Challenges: Despite robust growth, the market faces several challenges. Security and data privacy concerns remain a primary barrier, particularly for sensitive data in industries like BFSI and Healthcare, leading to a preference for private cloud or highly secure hybrid cloud deployments. High initial migration costs and the complexity of migrating legacy systems can deter some organizations. Vendor lock-in is another concern, as switching between cloud providers can be challenging and expensive. Regulatory hurdles and differing compliance requirements across geographies add complexity. The shortage of skilled cloud professionals also presents a significant challenge, impacting the ability of organizations to effectively deploy and manage cloud solutions. Competitive pressures are intense, with established players and emerging startups constantly vying for market share, which can lead to price wars and margin erosion.

Emerging Opportunities in Cloud-Enabling Technology Market

Emerging opportunities in the Cloud-Enabling Technology Market are diverse and ripe for exploitation. The burgeoning field of edge computing presents a significant avenue for growth, as it complements cloud infrastructure by enabling localized data processing and reduced latency, crucial for applications like IoT and autonomous systems. The increasing demand for specialized Industry Clouds, tailored to the specific needs of sectors like manufacturing, healthcare, and retail, offers a niche for focused development and market penetration. Furthermore, the integration of blockchain technology with cloud services for enhanced security and transparency in data management and transactions represents an exciting frontier. The continuous evolution of AI and ML capabilities, particularly in areas like generative AI and explainable AI, will drive demand for more sophisticated cloud platforms and services. The growing focus on sustainability within the tech industry also opens opportunities for cloud providers offering energy-efficient data centers and services.

Growth Accelerators in the Cloud-Enabling Technology Market Industry

Several catalysts are driving long-term growth in the Cloud-Enabling Technology Market. Technological breakthroughs in areas like serverless computing, containerization, and quantum computing are continually enhancing cloud capabilities and enabling new applications. Strategic partnerships between cloud providers, software vendors, and hardware manufacturers are crucial for creating integrated solutions and expanding market reach. For instance, the expanded partnership between Fujitsu Limited and Amazon Web Services (AWS) to accelerate legacy application modernization on AWS Cloud exemplifies this trend. Similarly, collaborations like Amazon's AWS partnership with ISRO to advance AI capabilities in the space sector showcase the expanding application of cloud technologies. Market expansion strategies, including penetration into emerging economies and targeting underserved industries, are also key growth drivers. The ongoing shift towards digital-first business models across all sectors will continue to fuel the demand for scalable and flexible cloud solutions.

Key Players Shaping the Cloud-Enabling Technology Market Market

- Adaptive Computing

- IBM Corporation

- Google LLC

- Fujitsu Ltd

- Broadcom Inc (CA Technologies)

- Microsoft Corporation

- Hewlett Packard Enterprise Development LP

- BMC Software Inc

- Tata Consultancy Services Limited

- Domo Inc

- Oracle Corporation

- Amazon Web Service

- Citrix Systems Inc

- Dell Technologies

Notable Milestones in Cloud-Enabling Technology Market Sector

- March 2024: Fujitsu Limited and Amazon Web Services (AWS) announced an expanded partnership to accelerate the modernization of legacy applications on AWS Cloud by launching a Modernization Acceleration Joint Initiative. Fujitsu and AWS will provide assessment, migration, and modernization of legacy mission-critical applications running on on-premise mainframes and UNIX servers onto AWS Cloud. The joint initiative will support customers across industries, including finance, retail, and automotive, as they modernize legacy applications on AWS Cloud, helping to keep up with rapidly changing business conditions with the agility and resiliency of modern applications.

- September 2023: Amazon's AWS partnered with ISRO to advance its AI capabilities with cloud technologies. This collaboration would give space start-ups, research institutes, and students access to advanced cloud technologies that will accelerate the development of new solutions in the space sector.

In-Depth Cloud-Enabling Technology Market Market Outlook

The Cloud-Enabling Technology Market is poised for sustained and significant growth, driven by the indispensable role of cloud solutions in modern business operations. Future market potential is amplified by the ongoing digital transformation across all industries, the proliferation of data, and the increasing adoption of advanced technologies like AI, IoT, and edge computing. Strategic opportunities lie in addressing the evolving needs for hybrid and multi-cloud management, enhanced security and compliance, and specialized industry solutions. The market will witness continued innovation in PaaS for developer agility, IaaS for scalable infrastructure, and SaaS for diverse business applications. The increasing global push towards digital economies and the ongoing investments in cloud infrastructure by major players will ensure a robust and dynamic market landscape for the foreseeable future.

Cloud-Enabling Technology Market Segmentation

-

1. Deployment Type

- 1.1. Public

- 1.2. Private

- 1.3. Hybrid

-

2. Service Type

- 2.1. Platform-as- a-Service (PaaS)

- 2.2. Software-as-a-Service (SaaS)

- 2.3. Infrastructure-as-a-Service (IaaS)

-

3. Technology Type

- 3.1. Broadband Networks and Internet Architecture

- 3.2. Data Center Technology

- 3.3. Virtualization Technology

- 3.4. Web Technology

- 3.5. Multitenant Technology

-

4. End-user Industry

- 4.1. Banking, Financial Services, and Insurance (BFSI)

- 4.2. Manufacturing

- 4.3. Healthcare

- 4.4. Retail

- 4.5. Telecom and IT

- 4.6. Other End-user Industries

Cloud-Enabling Technology Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia

- 3.1. Japan

- 3.2. China

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. UAE

- 5.2. South Africa

- 5.3. Saudi Arabia

- 5.4. Rest Of MEA

Cloud-Enabling Technology Market Regional Market Share

Geographic Coverage of Cloud-Enabling Technology Market

Cloud-Enabling Technology Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 8.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Adoption of Cloud Deployment Services; Focus on Business Productivity

- 3.3. Market Restrains

- 3.3.1. Data Security and Privacy

- 3.4. Market Trends

- 3.4.1. Data Center Technology to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud-Enabling Technology Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 5.1.1. Public

- 5.1.2. Private

- 5.1.3. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Platform-as- a-Service (PaaS)

- 5.2.2. Software-as-a-Service (SaaS)

- 5.2.3. Infrastructure-as-a-Service (IaaS)

- 5.3. Market Analysis, Insights and Forecast - by Technology Type

- 5.3.1. Broadband Networks and Internet Architecture

- 5.3.2. Data Center Technology

- 5.3.3. Virtualization Technology

- 5.3.4. Web Technology

- 5.3.5. Multitenant Technology

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. Banking, Financial Services, and Insurance (BFSI)

- 5.4.2. Manufacturing

- 5.4.3. Healthcare

- 5.4.4. Retail

- 5.4.5. Telecom and IT

- 5.4.6. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia

- 5.5.4. Latin America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6. North America Cloud-Enabling Technology Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6.1.1. Public

- 6.1.2. Private

- 6.1.3. Hybrid

- 6.2. Market Analysis, Insights and Forecast - by Service Type

- 6.2.1. Platform-as- a-Service (PaaS)

- 6.2.2. Software-as-a-Service (SaaS)

- 6.2.3. Infrastructure-as-a-Service (IaaS)

- 6.3. Market Analysis, Insights and Forecast - by Technology Type

- 6.3.1. Broadband Networks and Internet Architecture

- 6.3.2. Data Center Technology

- 6.3.3. Virtualization Technology

- 6.3.4. Web Technology

- 6.3.5. Multitenant Technology

- 6.4. Market Analysis, Insights and Forecast - by End-user Industry

- 6.4.1. Banking, Financial Services, and Insurance (BFSI)

- 6.4.2. Manufacturing

- 6.4.3. Healthcare

- 6.4.4. Retail

- 6.4.5. Telecom and IT

- 6.4.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Deployment Type

- 7. Europe Cloud-Enabling Technology Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment Type

- 7.1.1. Public

- 7.1.2. Private

- 7.1.3. Hybrid

- 7.2. Market Analysis, Insights and Forecast - by Service Type

- 7.2.1. Platform-as- a-Service (PaaS)

- 7.2.2. Software-as-a-Service (SaaS)

- 7.2.3. Infrastructure-as-a-Service (IaaS)

- 7.3. Market Analysis, Insights and Forecast - by Technology Type

- 7.3.1. Broadband Networks and Internet Architecture

- 7.3.2. Data Center Technology

- 7.3.3. Virtualization Technology

- 7.3.4. Web Technology

- 7.3.5. Multitenant Technology

- 7.4. Market Analysis, Insights and Forecast - by End-user Industry

- 7.4.1. Banking, Financial Services, and Insurance (BFSI)

- 7.4.2. Manufacturing

- 7.4.3. Healthcare

- 7.4.4. Retail

- 7.4.5. Telecom and IT

- 7.4.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Deployment Type

- 8. Asia Cloud-Enabling Technology Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment Type

- 8.1.1. Public

- 8.1.2. Private

- 8.1.3. Hybrid

- 8.2. Market Analysis, Insights and Forecast - by Service Type

- 8.2.1. Platform-as- a-Service (PaaS)

- 8.2.2. Software-as-a-Service (SaaS)

- 8.2.3. Infrastructure-as-a-Service (IaaS)

- 8.3. Market Analysis, Insights and Forecast - by Technology Type

- 8.3.1. Broadband Networks and Internet Architecture

- 8.3.2. Data Center Technology

- 8.3.3. Virtualization Technology

- 8.3.4. Web Technology

- 8.3.5. Multitenant Technology

- 8.4. Market Analysis, Insights and Forecast - by End-user Industry

- 8.4.1. Banking, Financial Services, and Insurance (BFSI)

- 8.4.2. Manufacturing

- 8.4.3. Healthcare

- 8.4.4. Retail

- 8.4.5. Telecom and IT

- 8.4.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Deployment Type

- 9. Latin America Cloud-Enabling Technology Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment Type

- 9.1.1. Public

- 9.1.2. Private

- 9.1.3. Hybrid

- 9.2. Market Analysis, Insights and Forecast - by Service Type

- 9.2.1. Platform-as- a-Service (PaaS)

- 9.2.2. Software-as-a-Service (SaaS)

- 9.2.3. Infrastructure-as-a-Service (IaaS)

- 9.3. Market Analysis, Insights and Forecast - by Technology Type

- 9.3.1. Broadband Networks and Internet Architecture

- 9.3.2. Data Center Technology

- 9.3.3. Virtualization Technology

- 9.3.4. Web Technology

- 9.3.5. Multitenant Technology

- 9.4. Market Analysis, Insights and Forecast - by End-user Industry

- 9.4.1. Banking, Financial Services, and Insurance (BFSI)

- 9.4.2. Manufacturing

- 9.4.3. Healthcare

- 9.4.4. Retail

- 9.4.5. Telecom and IT

- 9.4.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Deployment Type

- 10. Middle East and Africa Cloud-Enabling Technology Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment Type

- 10.1.1. Public

- 10.1.2. Private

- 10.1.3. Hybrid

- 10.2. Market Analysis, Insights and Forecast - by Service Type

- 10.2.1. Platform-as- a-Service (PaaS)

- 10.2.2. Software-as-a-Service (SaaS)

- 10.2.3. Infrastructure-as-a-Service (IaaS)

- 10.3. Market Analysis, Insights and Forecast - by Technology Type

- 10.3.1. Broadband Networks and Internet Architecture

- 10.3.2. Data Center Technology

- 10.3.3. Virtualization Technology

- 10.3.4. Web Technology

- 10.3.5. Multitenant Technology

- 10.4. Market Analysis, Insights and Forecast - by End-user Industry

- 10.4.1. Banking, Financial Services, and Insurance (BFSI)

- 10.4.2. Manufacturing

- 10.4.3. Healthcare

- 10.4.4. Retail

- 10.4.5. Telecom and IT

- 10.4.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Deployment Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Adaptive Computing

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IBM Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Google LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fujitsu Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Broadcom Inc (CA Technologies)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Microsoft Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hewlett Packard Enterprise Development LP

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BMC Software Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tata Consultancy Services Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Domo Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Oracle Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Amazon Web Service

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Citrix Systems Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Dell Technologies

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Adaptive Computing

List of Figures

- Figure 1: Global Cloud-Enabling Technology Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cloud-Enabling Technology Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 3: North America Cloud-Enabling Technology Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 4: North America Cloud-Enabling Technology Market Revenue (Million), by Service Type 2025 & 2033

- Figure 5: North America Cloud-Enabling Technology Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 6: North America Cloud-Enabling Technology Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 7: North America Cloud-Enabling Technology Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 8: North America Cloud-Enabling Technology Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 9: North America Cloud-Enabling Technology Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: North America Cloud-Enabling Technology Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Cloud-Enabling Technology Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Cloud-Enabling Technology Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 13: Europe Cloud-Enabling Technology Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 14: Europe Cloud-Enabling Technology Market Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Europe Cloud-Enabling Technology Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Europe Cloud-Enabling Technology Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 17: Europe Cloud-Enabling Technology Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 18: Europe Cloud-Enabling Technology Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 19: Europe Cloud-Enabling Technology Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Europe Cloud-Enabling Technology Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Cloud-Enabling Technology Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Cloud-Enabling Technology Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 23: Asia Cloud-Enabling Technology Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 24: Asia Cloud-Enabling Technology Market Revenue (Million), by Service Type 2025 & 2033

- Figure 25: Asia Cloud-Enabling Technology Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 26: Asia Cloud-Enabling Technology Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 27: Asia Cloud-Enabling Technology Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 28: Asia Cloud-Enabling Technology Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Asia Cloud-Enabling Technology Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Asia Cloud-Enabling Technology Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Cloud-Enabling Technology Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Latin America Cloud-Enabling Technology Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 33: Latin America Cloud-Enabling Technology Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 34: Latin America Cloud-Enabling Technology Market Revenue (Million), by Service Type 2025 & 2033

- Figure 35: Latin America Cloud-Enabling Technology Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 36: Latin America Cloud-Enabling Technology Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 37: Latin America Cloud-Enabling Technology Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 38: Latin America Cloud-Enabling Technology Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Latin America Cloud-Enabling Technology Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Latin America Cloud-Enabling Technology Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America Cloud-Enabling Technology Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Cloud-Enabling Technology Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 43: Middle East and Africa Cloud-Enabling Technology Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 44: Middle East and Africa Cloud-Enabling Technology Market Revenue (Million), by Service Type 2025 & 2033

- Figure 45: Middle East and Africa Cloud-Enabling Technology Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 46: Middle East and Africa Cloud-Enabling Technology Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 47: Middle East and Africa Cloud-Enabling Technology Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 48: Middle East and Africa Cloud-Enabling Technology Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 49: Middle East and Africa Cloud-Enabling Technology Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 50: Middle East and Africa Cloud-Enabling Technology Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Middle East and Africa Cloud-Enabling Technology Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cloud-Enabling Technology Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 2: Global Cloud-Enabling Technology Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 3: Global Cloud-Enabling Technology Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 4: Global Cloud-Enabling Technology Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Cloud-Enabling Technology Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Cloud-Enabling Technology Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 7: Global Cloud-Enabling Technology Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: Global Cloud-Enabling Technology Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 9: Global Cloud-Enabling Technology Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Cloud-Enabling Technology Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Cloud-Enabling Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Cloud-Enabling Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Cloud-Enabling Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Cloud-Enabling Technology Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 15: Global Cloud-Enabling Technology Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 16: Global Cloud-Enabling Technology Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 17: Global Cloud-Enabling Technology Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Cloud-Enabling Technology Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Cloud-Enabling Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Cloud-Enabling Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Cloud-Enabling Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Cloud-Enabling Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Cloud-Enabling Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Europe Cloud-Enabling Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Cloud-Enabling Technology Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 26: Global Cloud-Enabling Technology Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 27: Global Cloud-Enabling Technology Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 28: Global Cloud-Enabling Technology Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 29: Global Cloud-Enabling Technology Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Japan Cloud-Enabling Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: China Cloud-Enabling Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: India Cloud-Enabling Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Australia Cloud-Enabling Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: South Korea Cloud-Enabling Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Asia Pacific Cloud-Enabling Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global Cloud-Enabling Technology Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 37: Global Cloud-Enabling Technology Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 38: Global Cloud-Enabling Technology Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 39: Global Cloud-Enabling Technology Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 40: Global Cloud-Enabling Technology Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Brazil Cloud-Enabling Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Argentina Cloud-Enabling Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Rest of South America Cloud-Enabling Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Global Cloud-Enabling Technology Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 45: Global Cloud-Enabling Technology Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 46: Global Cloud-Enabling Technology Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 47: Global Cloud-Enabling Technology Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 48: Global Cloud-Enabling Technology Market Revenue Million Forecast, by Country 2020 & 2033

- Table 49: UAE Cloud-Enabling Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa Cloud-Enabling Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Saudi Arabia Cloud-Enabling Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest Of MEA Cloud-Enabling Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud-Enabling Technology Market?

The projected CAGR is approximately > 8.42%.

2. Which companies are prominent players in the Cloud-Enabling Technology Market?

Key companies in the market include Adaptive Computing, IBM Corporation, Google LLC, Fujitsu Ltd, Broadcom Inc (CA Technologies), Microsoft Corporation, Hewlett Packard Enterprise Development LP, BMC Software Inc, Tata Consultancy Services Limited, Domo Inc, Oracle Corporation, Amazon Web Service, Citrix Systems Inc, Dell Technologies.

3. What are the main segments of the Cloud-Enabling Technology Market?

The market segments include Deployment Type, Service Type, Technology Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Adoption of Cloud Deployment Services; Focus on Business Productivity.

6. What are the notable trends driving market growth?

Data Center Technology to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Data Security and Privacy.

8. Can you provide examples of recent developments in the market?

March 2024: Fujitsu Limited and Amazon Web Services (AWS), an Amazon.com Inc. company (NASDAQ: AMZN), announced an expanded partnership to accelerate the modernization of legacy applications on AWS Cloud by launching a Modernization Acceleration Joint Initiative. Fujitsu and AWS will provide assessment, migration, and modernization of legacy mission-critical applications running on on-premise mainframes and UNIX servers onto AWS Cloud. The joint initiative will support customers across industries, including finance, retail, and automotive, as they modernize legacy applications on AWS Cloud, helping to keep up with rapidly changing business conditions with the agility and resiliency of modern applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud-Enabling Technology Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud-Enabling Technology Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud-Enabling Technology Market?

To stay informed about further developments, trends, and reports in the Cloud-Enabling Technology Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence