Key Insights

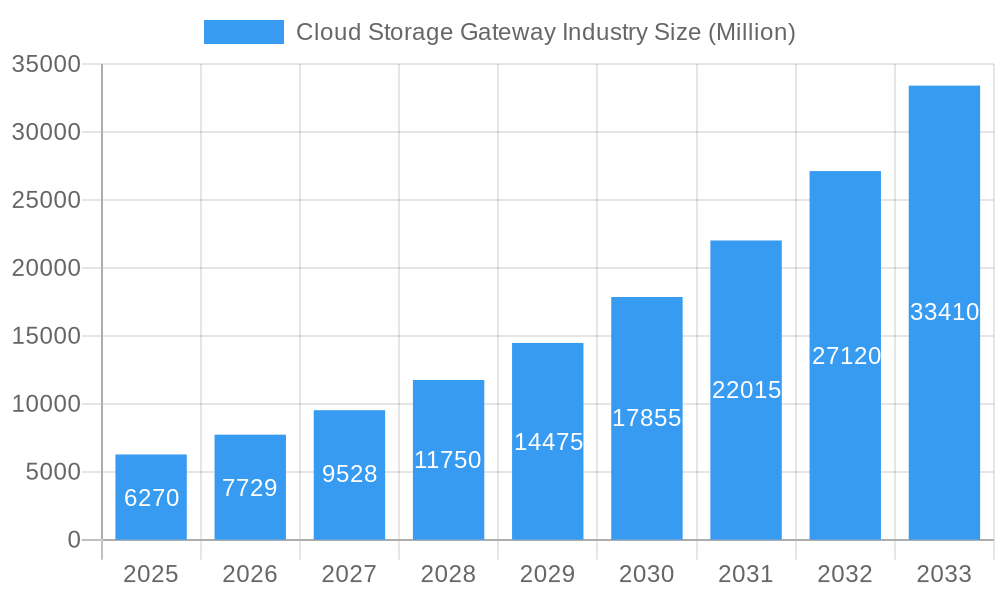

The Cloud Storage Gateway market is poised for remarkable expansion, projected to reach a substantial USD 6.27 billion valuation. This growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 23.47% from the base year 2025 through the forecast period ending in 2033. The primary drivers behind this surge include the escalating demand for scalable and cost-effective data storage solutions, the increasing adoption of cloud services across diverse industries, and the growing need for seamless integration between on-premises infrastructure and cloud environments. Organizations are increasingly recognizing the benefits of cloud storage gateways in enhancing data accessibility, improving disaster recovery capabilities, and streamlining backup processes, all while reducing the capital expenditure associated with traditional storage systems. The market's trajectory is further bolstered by advancements in cloud technology, including enhanced security features and improved performance metrics, which are allaying residual concerns about data safety and accessibility in the cloud.

Cloud Storage Gateway Industry Market Size (In Billion)

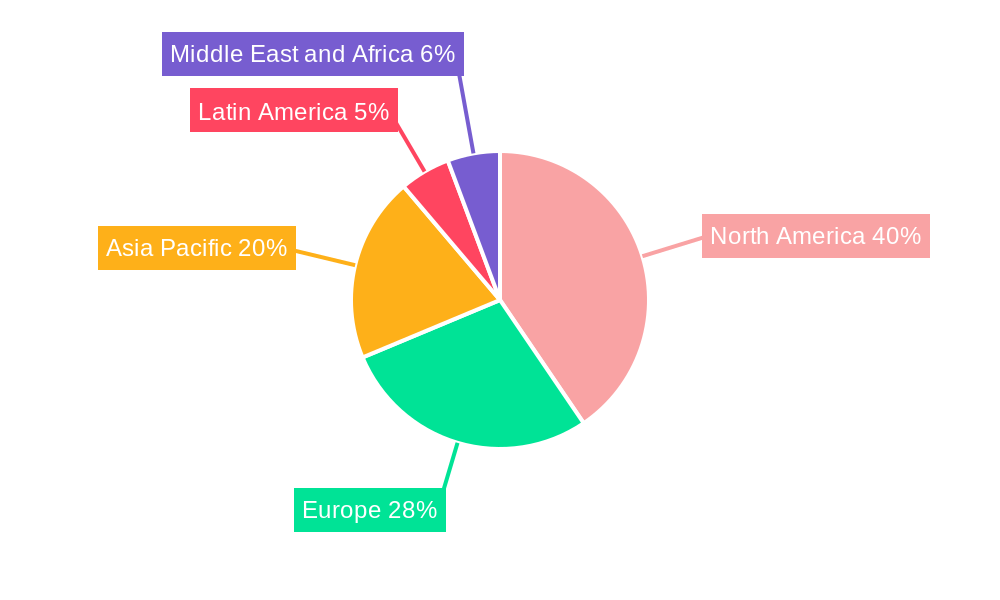

This dynamic market is segmented across various deployment models, with hybrid cloud solutions expected to witness significant traction due to their ability to offer flexibility and leverage existing infrastructure. The adoption is widespread across SMEs and large enterprises alike, highlighting the universal appeal of cloud storage gateways. Key end-user industries such as Retail, Healthcare, Manufacturing, and Media & Entertainment are leading the charge, driven by their substantial data generation and the imperative for efficient data management. Geographically, North America is anticipated to maintain a dominant market share, owing to its early adoption of cloud technologies and the presence of major market players. However, the Asia Pacific region is expected to exhibit the fastest growth rate, fueled by rapid digital transformation and increasing cloud investments. While the market is robust, potential restraints such as data security concerns, regulatory compliance challenges, and the initial migration costs need to be carefully addressed by vendors to ensure sustained and widespread adoption.

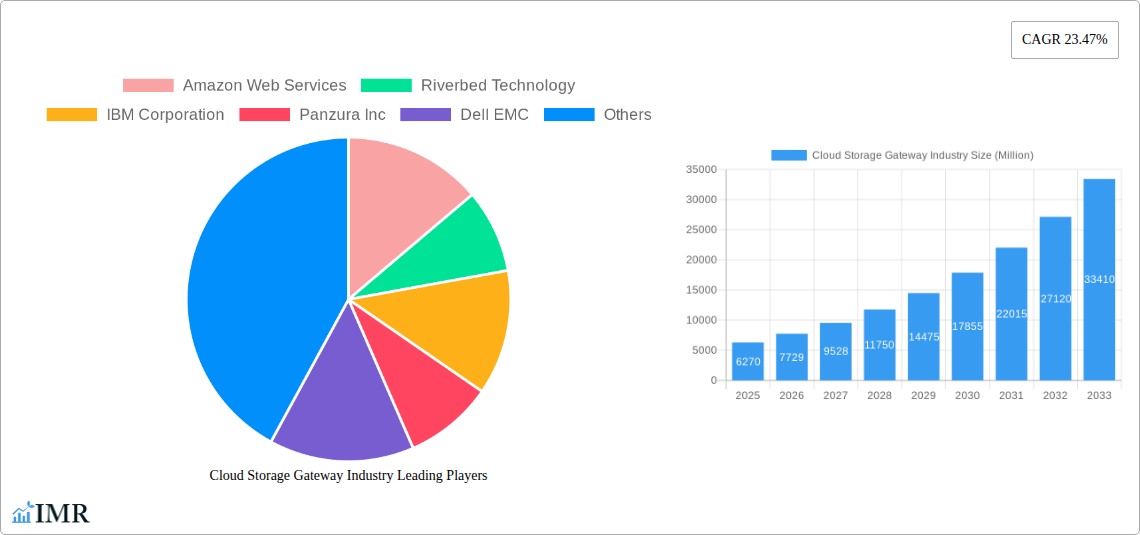

Cloud Storage Gateway Industry Company Market Share

Comprehensive Report on the Cloud Storage Gateway Market: Trends, Dynamics, and Future Outlook (2019-2033)

This in-depth report provides a strategic analysis of the global Cloud Storage Gateway market, offering critical insights into its current state, growth trajectories, and future potential. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025, this report is an essential resource for stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate the competitive landscape. We delve into key segments, influential players, technological advancements, and emerging trends, presenting data in millions of units for clarity.

Cloud Storage Gateway Industry Market Dynamics & Structure

The Cloud Storage Gateway market is characterized by a moderately concentrated structure, with major players like Amazon Web Services, IBM Corporation, and Microsoft Corporation holding significant sway. Technological innovation serves as a primary driver, fueled by the increasing demand for seamless hybrid cloud integration, enhanced data security, and improved application performance. Regulatory frameworks, particularly concerning data privacy and sovereignty, are evolving and influencing deployment strategies. Competitive product substitutes, such as direct cloud integration solutions and advanced NAS/SAN technologies, pose a challenge, necessitating continuous innovation in cloud storage gateway offerings. End-user demographics are shifting towards greater adoption by SMEs, alongside continued reliance from large enterprises. Mergers and acquisitions (M&A) activity, while not hyperactive, plays a role in market consolidation and expansion of service portfolios.

- Market Concentration: Dominated by a few key players, but with increasing participation from niche providers.

- Technological Innovation Drivers: Hybrid cloud adoption, edge computing integration, AI/ML data processing, and enhanced data security protocols.

- Regulatory Frameworks: GDPR, CCPA, and evolving data localization laws impacting global deployments.

- Competitive Product Substitutes: Direct cloud object storage, advanced SAN/NAS solutions, and software-defined storage.

- End-User Demographics: Growing adoption by SMEs for cost-efficiency and scalability, alongside enterprise-grade solutions for mission-critical applications.

- M&A Trends: Strategic acquisitions aimed at broadening cloud service portfolios and enhancing integration capabilities.

Cloud Storage Gateway Industry Growth Trends & Insights

The Cloud Storage Gateway market is poised for robust growth, driven by the relentless digital transformation across industries. Market size is projected to expand significantly, fueled by escalating data volumes and the imperative for efficient, secure, and scalable storage solutions. Adoption rates are climbing as organizations of all sizes increasingly embrace hybrid and multi-cloud strategies to optimize costs and enhance agility. Technological disruptions, including the advent of AI-powered data management and the proliferation of edge computing, are creating new avenues for cloud storage gateway functionality and demand. Consumer behavior shifts are evident in the growing preference for cloud-native solutions that offer simplified data access, robust disaster recovery capabilities, and seamless integration with existing IT infrastructures.

The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 15% from 2025 to 2033. This growth will be propelled by the increasing need for on-premises data access that mirrors the performance of local storage while leveraging the cost-effectiveness and scalability of cloud infrastructure. Penetration rates are projected to rise sharply, particularly in sectors heavily reliant on large datasets and real-time analytics. The industry is also seeing a trend towards increasingly sophisticated gateway solutions that offer advanced features like data deduplication, compression, and granular access control, further enhancing their value proposition. The shift from traditional on-premises storage to cloud-integrated solutions represents a fundamental change in data management paradigms, directly benefiting the cloud storage gateway market.

Dominant Regions, Countries, or Segments in Cloud Storage Gateway Industry

The Hybrid Cloud deployment model stands as the dominant force propelling the Cloud Storage Gateway market. This dominance is underpinned by its ability to offer organizations the best of both worlds: the security and control of on-premises infrastructure combined with the scalability and cost-efficiency of public cloud services. Large enterprises, with their complex IT environments and substantial data workloads, are primary adopters of hybrid cloud strategies, making them significant drivers of this segment.

Within end-user industries, the Retail sector is emerging as a key growth engine. The retail industry generates massive amounts of data from point-of-sale systems, e-commerce platforms, customer loyalty programs, and supply chain operations. Cloud storage gateways facilitate efficient management and analysis of this data, enabling personalized customer experiences, optimized inventory management, and improved supply chain visibility.

Hybrid Cloud Dominance:

- Enables flexible data management and workload placement.

- Supports regulatory compliance by keeping sensitive data on-premises.

- Facilitates seamless migration of applications and data to the cloud.

- Offers cost optimization by leveraging cloud elasticity for variable workloads.

- Market share within the deployment segment is estimated at over 45% in 2025.

Large Enterprises as Key Adopters:

- Possess the infrastructure and resources for complex hybrid cloud implementations.

- Require robust data protection and disaster recovery solutions.

- Drive demand for high-performance and scalable gateway solutions.

- Estimated to account for approximately 60% of the total market revenue in 2025.

Retail Sector as a Growth Hotspot:

- Driven by the need to manage vast amounts of customer and operational data.

- Facilitates advanced analytics for personalized marketing and inventory optimization.

- Supports omnichannel strategies by unifying data across online and offline channels.

- Projected CAGR for the retail segment is expected to exceed 18% from 2025-2033.

The increasing adoption of cloud-native applications and the growing emphasis on data-driven decision-making across all industries will further solidify the position of hybrid cloud deployments and attract more businesses, including SMEs, to leverage cloud storage gateways for enhanced data accessibility and management.

Cloud Storage Gateway Industry Product Landscape

The Cloud Storage Gateway product landscape is evolving rapidly, with a focus on enhancing performance, security, and integration capabilities. Leading vendors are introducing intelligent gateways that offer features such as automated data tiering, inline data deduplication and compression, and robust encryption at rest and in transit. These innovations are crucial for optimizing cloud storage costs and ensuring data integrity. Applications range from simplified backup and disaster recovery to seamless access for remote workers and efficient data analytics across hybrid environments. Performance metrics are increasingly being defined by lower latency, higher throughput, and improved availability, directly impacting digital application performance and data processing speeds.

Key Drivers, Barriers & Challenges in Cloud Storage Gateway Industry

Key Drivers:

- Accelerated Cloud Adoption: The ongoing shift to cloud computing, both public and private, necessitates efficient data transfer and access solutions.

- Explosion of Data Volumes: The exponential growth of data across all industries demands scalable and cost-effective storage management.

- Hybrid and Multi-Cloud Strategies: Organizations are increasingly adopting hybrid and multi-cloud environments, requiring seamless integration between on-premises and cloud resources.

- Enhanced Data Security and Compliance: Stringent regulatory requirements and the need to protect sensitive data drive demand for secure cloud storage solutions.

- Edge Computing Growth: The proliferation of IoT devices and edge computing deployments creates a need for localized data processing and efficient cloud integration.

Barriers & Challenges:

- Security Concerns: Despite advancements, concerns regarding data breaches and unauthorized access in cloud environments persist for some organizations.

- Integration Complexity: Integrating cloud storage gateways with existing legacy IT infrastructure can be complex and time-consuming.

- Vendor Lock-in: Dependence on specific cloud providers or gateway vendors can create concerns about flexibility and future migration.

- Cost Management: While cloud storage offers cost savings, ensuring efficient data tiering and optimizing egress costs remains a challenge.

- Lack of Skilled Personnel: A shortage of IT professionals with expertise in cloud storage and gateway management can hinder adoption.

Emerging Opportunities in Cloud Storage Gateway Industry

Emerging opportunities in the Cloud Storage Gateway market lie in the synergistic integration with advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML). AI-powered gateways can automate data management tasks, optimize storage utilization, and provide predictive analytics for data access patterns. The expansion of edge computing presents a significant opportunity, with gateways playing a crucial role in enabling localized data processing and then efficiently transferring relevant data to the cloud. Furthermore, specialized gateway solutions tailored for specific industries, such as healthcare (for medical imaging storage) and manufacturing (for industrial IoT data), represent untapped markets with high growth potential. The increasing demand for real-time data analytics across distributed environments will also drive the development of low-latency, high-throughput gateway solutions.

Growth Accelerators in the Cloud Storage Gateway Industry Industry

The long-term growth of the Cloud Storage Gateway industry is being significantly accelerated by technological breakthroughs in areas like software-defined storage and advanced networking technologies, which enhance the performance and efficiency of data transfer. Strategic partnerships between cloud providers, hardware manufacturers, and software vendors are creating more integrated and comprehensive solutions, simplifying adoption for end-users. Market expansion strategies, including targeting emerging economies and catering to the growing needs of Small and Medium-sized Enterprises (SMEs) with more accessible and cost-effective gateway solutions, are further fueling growth. The increasing focus on data sovereignty and localized data processing, particularly in regulated industries, is also creating demand for gateways that offer hybrid and private cloud integration capabilities.

Key Players Shaping the Cloud Storage Gateway Industry Market

- Amazon Web Services

- Riverbed Technology

- IBM Corporation

- Panzura Inc

- Dell EMC

- Google LLC (Alphabet Inc )

- Microsoft Corporation

- Nasuni Corporation

- NetApp Inc

- Cloud Gateway Co

- CTERA Networks Ltd

- Oracle Corporation

Notable Milestones in Cloud Storage Gateway Industry Sector

- January 2023: Amazon Web Services (AWS) launched AWS Local Zones in Australia, enabling Australian organizations to migrate additional workloads to AWS, supporting hybrid cloud migration and simplifying IT operations with low latency capabilities for faster data processing.

- March 2023: ASRock Industrial introduced a new series of gateways (iEP-7020E Series) for intelligent control at the edge, supporting real-time computing and connecting edge devices for applications in smart manufacturing, factory automation, and smart cities.

- December 2022: Tiger Technology launched Tiger Bridge software for digital pathology, enabling captured images to be sent to a public cloud repository for remote review by consultants, aiding in medical decision-making.

- December 2022: StarWind launched a storage gateway for Calamu, featuring advanced data protection technology that converts stolen or copied data into an unusable format, ensuring robust security for cloud-stored backup data.

In-Depth Cloud Storage Gateway Industry Market Outlook

The future market potential for Cloud Storage Gateways is exceptionally promising, driven by the pervasive digitalization of businesses and the escalating demand for efficient data management. Strategic opportunities lie in the development of highly specialized solutions for burgeoning sectors such as healthcare, media, and advanced manufacturing, which deal with massive and often sensitive datasets. The increasing adoption of edge computing further amplifies the need for intelligent gateways that can manage data locally before seamlessly integrating with cloud repositories. Furthermore, vendors that can offer robust security features, simplified integration processes, and transparent cost management will be well-positioned to capture significant market share. The ongoing evolution of cloud infrastructure and services will continue to shape the capabilities and applications of cloud storage gateways, making it a dynamic and critical component of modern IT architectures.

Cloud Storage Gateway Industry Segmentation

-

1. Deployment

- 1.1. Private Cloud

- 1.2. Public Cloud

- 1.3. Hybrid Cloud

-

2. Organization Size

- 2.1. SME

- 2.2. Large Enterprises

-

3. End-user Industry

- 3.1. Retail

- 3.2. Healthcare

- 3.3. Manufacturing

- 3.4. Media & Entertainment

- 3.5. Government

- 3.6. Education

- 3.7. Other End-user Industries

Cloud Storage Gateway Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of the Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of the Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Cloud Storage Gateway Industry Regional Market Share

Geographic Coverage of Cloud Storage Gateway Industry

Cloud Storage Gateway Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Cloud Adoption Across Several Industry Verticals; Growing Demand for Low Cost Data Storage and Faster Data Accessibility

- 3.3. Market Restrains

- 3.3.1. Security Concerns Over Cloud Storage

- 3.4. Market Trends

- 3.4.1. Healthcare End-user Industry Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud Storage Gateway Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. Private Cloud

- 5.1.2. Public Cloud

- 5.1.3. Hybrid Cloud

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. SME

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Retail

- 5.3.2. Healthcare

- 5.3.3. Manufacturing

- 5.3.4. Media & Entertainment

- 5.3.5. Government

- 5.3.6. Education

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Cloud Storage Gateway Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. Private Cloud

- 6.1.2. Public Cloud

- 6.1.3. Hybrid Cloud

- 6.2. Market Analysis, Insights and Forecast - by Organization Size

- 6.2.1. SME

- 6.2.2. Large Enterprises

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Retail

- 6.3.2. Healthcare

- 6.3.3. Manufacturing

- 6.3.4. Media & Entertainment

- 6.3.5. Government

- 6.3.6. Education

- 6.3.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Cloud Storage Gateway Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. Private Cloud

- 7.1.2. Public Cloud

- 7.1.3. Hybrid Cloud

- 7.2. Market Analysis, Insights and Forecast - by Organization Size

- 7.2.1. SME

- 7.2.2. Large Enterprises

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Retail

- 7.3.2. Healthcare

- 7.3.3. Manufacturing

- 7.3.4. Media & Entertainment

- 7.3.5. Government

- 7.3.6. Education

- 7.3.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Pacific Cloud Storage Gateway Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. Private Cloud

- 8.1.2. Public Cloud

- 8.1.3. Hybrid Cloud

- 8.2. Market Analysis, Insights and Forecast - by Organization Size

- 8.2.1. SME

- 8.2.2. Large Enterprises

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Retail

- 8.3.2. Healthcare

- 8.3.3. Manufacturing

- 8.3.4. Media & Entertainment

- 8.3.5. Government

- 8.3.6. Education

- 8.3.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Latin America Cloud Storage Gateway Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. Private Cloud

- 9.1.2. Public Cloud

- 9.1.3. Hybrid Cloud

- 9.2. Market Analysis, Insights and Forecast - by Organization Size

- 9.2.1. SME

- 9.2.2. Large Enterprises

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Retail

- 9.3.2. Healthcare

- 9.3.3. Manufacturing

- 9.3.4. Media & Entertainment

- 9.3.5. Government

- 9.3.6. Education

- 9.3.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Middle East and Africa Cloud Storage Gateway Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. Private Cloud

- 10.1.2. Public Cloud

- 10.1.3. Hybrid Cloud

- 10.2. Market Analysis, Insights and Forecast - by Organization Size

- 10.2.1. SME

- 10.2.2. Large Enterprises

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Retail

- 10.3.2. Healthcare

- 10.3.3. Manufacturing

- 10.3.4. Media & Entertainment

- 10.3.5. Government

- 10.3.6. Education

- 10.3.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Amazon Web Services

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Riverbed Technology

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IBM Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Panzura Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dell EMC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Google LLC (Alphabet Inc )

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Microsoft Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nasuni Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NetApp Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cloud Gateway Co

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 CTERA Networks Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Oracle Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Amazon Web Services

List of Figures

- Figure 1: Global Cloud Storage Gateway Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Cloud Storage Gateway Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Cloud Storage Gateway Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 4: North America Cloud Storage Gateway Industry Volume (K Unit), by Deployment 2025 & 2033

- Figure 5: North America Cloud Storage Gateway Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 6: North America Cloud Storage Gateway Industry Volume Share (%), by Deployment 2025 & 2033

- Figure 7: North America Cloud Storage Gateway Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 8: North America Cloud Storage Gateway Industry Volume (K Unit), by Organization Size 2025 & 2033

- Figure 9: North America Cloud Storage Gateway Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 10: North America Cloud Storage Gateway Industry Volume Share (%), by Organization Size 2025 & 2033

- Figure 11: North America Cloud Storage Gateway Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 12: North America Cloud Storage Gateway Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 13: North America Cloud Storage Gateway Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: North America Cloud Storage Gateway Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: North America Cloud Storage Gateway Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Cloud Storage Gateway Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Cloud Storage Gateway Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Cloud Storage Gateway Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Cloud Storage Gateway Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 20: Europe Cloud Storage Gateway Industry Volume (K Unit), by Deployment 2025 & 2033

- Figure 21: Europe Cloud Storage Gateway Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 22: Europe Cloud Storage Gateway Industry Volume Share (%), by Deployment 2025 & 2033

- Figure 23: Europe Cloud Storage Gateway Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 24: Europe Cloud Storage Gateway Industry Volume (K Unit), by Organization Size 2025 & 2033

- Figure 25: Europe Cloud Storage Gateway Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 26: Europe Cloud Storage Gateway Industry Volume Share (%), by Organization Size 2025 & 2033

- Figure 27: Europe Cloud Storage Gateway Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 28: Europe Cloud Storage Gateway Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 29: Europe Cloud Storage Gateway Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Europe Cloud Storage Gateway Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 31: Europe Cloud Storage Gateway Industry Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Cloud Storage Gateway Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Cloud Storage Gateway Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Cloud Storage Gateway Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Cloud Storage Gateway Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 36: Asia Pacific Cloud Storage Gateway Industry Volume (K Unit), by Deployment 2025 & 2033

- Figure 37: Asia Pacific Cloud Storage Gateway Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 38: Asia Pacific Cloud Storage Gateway Industry Volume Share (%), by Deployment 2025 & 2033

- Figure 39: Asia Pacific Cloud Storage Gateway Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 40: Asia Pacific Cloud Storage Gateway Industry Volume (K Unit), by Organization Size 2025 & 2033

- Figure 41: Asia Pacific Cloud Storage Gateway Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 42: Asia Pacific Cloud Storage Gateway Industry Volume Share (%), by Organization Size 2025 & 2033

- Figure 43: Asia Pacific Cloud Storage Gateway Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 44: Asia Pacific Cloud Storage Gateway Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 45: Asia Pacific Cloud Storage Gateway Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Asia Pacific Cloud Storage Gateway Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Asia Pacific Cloud Storage Gateway Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Cloud Storage Gateway Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Cloud Storage Gateway Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Cloud Storage Gateway Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Cloud Storage Gateway Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 52: Latin America Cloud Storage Gateway Industry Volume (K Unit), by Deployment 2025 & 2033

- Figure 53: Latin America Cloud Storage Gateway Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 54: Latin America Cloud Storage Gateway Industry Volume Share (%), by Deployment 2025 & 2033

- Figure 55: Latin America Cloud Storage Gateway Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 56: Latin America Cloud Storage Gateway Industry Volume (K Unit), by Organization Size 2025 & 2033

- Figure 57: Latin America Cloud Storage Gateway Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 58: Latin America Cloud Storage Gateway Industry Volume Share (%), by Organization Size 2025 & 2033

- Figure 59: Latin America Cloud Storage Gateway Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 60: Latin America Cloud Storage Gateway Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 61: Latin America Cloud Storage Gateway Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 62: Latin America Cloud Storage Gateway Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 63: Latin America Cloud Storage Gateway Industry Revenue (Million), by Country 2025 & 2033

- Figure 64: Latin America Cloud Storage Gateway Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Latin America Cloud Storage Gateway Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Latin America Cloud Storage Gateway Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Cloud Storage Gateway Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 68: Middle East and Africa Cloud Storage Gateway Industry Volume (K Unit), by Deployment 2025 & 2033

- Figure 69: Middle East and Africa Cloud Storage Gateway Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 70: Middle East and Africa Cloud Storage Gateway Industry Volume Share (%), by Deployment 2025 & 2033

- Figure 71: Middle East and Africa Cloud Storage Gateway Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 72: Middle East and Africa Cloud Storage Gateway Industry Volume (K Unit), by Organization Size 2025 & 2033

- Figure 73: Middle East and Africa Cloud Storage Gateway Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 74: Middle East and Africa Cloud Storage Gateway Industry Volume Share (%), by Organization Size 2025 & 2033

- Figure 75: Middle East and Africa Cloud Storage Gateway Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 76: Middle East and Africa Cloud Storage Gateway Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 77: Middle East and Africa Cloud Storage Gateway Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 78: Middle East and Africa Cloud Storage Gateway Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 79: Middle East and Africa Cloud Storage Gateway Industry Revenue (Million), by Country 2025 & 2033

- Figure 80: Middle East and Africa Cloud Storage Gateway Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: Middle East and Africa Cloud Storage Gateway Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Cloud Storage Gateway Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cloud Storage Gateway Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 2: Global Cloud Storage Gateway Industry Volume K Unit Forecast, by Deployment 2020 & 2033

- Table 3: Global Cloud Storage Gateway Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 4: Global Cloud Storage Gateway Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 5: Global Cloud Storage Gateway Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Cloud Storage Gateway Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Cloud Storage Gateway Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Cloud Storage Gateway Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Cloud Storage Gateway Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 10: Global Cloud Storage Gateway Industry Volume K Unit Forecast, by Deployment 2020 & 2033

- Table 11: Global Cloud Storage Gateway Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 12: Global Cloud Storage Gateway Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 13: Global Cloud Storage Gateway Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Cloud Storage Gateway Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Cloud Storage Gateway Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Cloud Storage Gateway Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Cloud Storage Gateway Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Cloud Storage Gateway Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Cloud Storage Gateway Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Cloud Storage Gateway Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Global Cloud Storage Gateway Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 22: Global Cloud Storage Gateway Industry Volume K Unit Forecast, by Deployment 2020 & 2033

- Table 23: Global Cloud Storage Gateway Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 24: Global Cloud Storage Gateway Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 25: Global Cloud Storage Gateway Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 26: Global Cloud Storage Gateway Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 27: Global Cloud Storage Gateway Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Cloud Storage Gateway Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 29: United Kingdom Cloud Storage Gateway Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Cloud Storage Gateway Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Germany Cloud Storage Gateway Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Cloud Storage Gateway Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: France Cloud Storage Gateway Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: France Cloud Storage Gateway Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of the Europe Cloud Storage Gateway Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of the Europe Cloud Storage Gateway Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Cloud Storage Gateway Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 38: Global Cloud Storage Gateway Industry Volume K Unit Forecast, by Deployment 2020 & 2033

- Table 39: Global Cloud Storage Gateway Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 40: Global Cloud Storage Gateway Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 41: Global Cloud Storage Gateway Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 42: Global Cloud Storage Gateway Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 43: Global Cloud Storage Gateway Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Cloud Storage Gateway Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 45: China Cloud Storage Gateway Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: China Cloud Storage Gateway Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Japan Cloud Storage Gateway Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Cloud Storage Gateway Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: India Cloud Storage Gateway Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: India Cloud Storage Gateway Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Rest of the Asia Pacific Cloud Storage Gateway Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of the Asia Pacific Cloud Storage Gateway Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Global Cloud Storage Gateway Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 54: Global Cloud Storage Gateway Industry Volume K Unit Forecast, by Deployment 2020 & 2033

- Table 55: Global Cloud Storage Gateway Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 56: Global Cloud Storage Gateway Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 57: Global Cloud Storage Gateway Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 58: Global Cloud Storage Gateway Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 59: Global Cloud Storage Gateway Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Cloud Storage Gateway Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: Global Cloud Storage Gateway Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 62: Global Cloud Storage Gateway Industry Volume K Unit Forecast, by Deployment 2020 & 2033

- Table 63: Global Cloud Storage Gateway Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 64: Global Cloud Storage Gateway Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 65: Global Cloud Storage Gateway Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 66: Global Cloud Storage Gateway Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 67: Global Cloud Storage Gateway Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 68: Global Cloud Storage Gateway Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud Storage Gateway Industry?

The projected CAGR is approximately 23.47%.

2. Which companies are prominent players in the Cloud Storage Gateway Industry?

Key companies in the market include Amazon Web Services, Riverbed Technology, IBM Corporation, Panzura Inc, Dell EMC, Google LLC (Alphabet Inc ), Microsoft Corporation, Nasuni Corporation, NetApp Inc, Cloud Gateway Co, CTERA Networks Ltd, Oracle Corporation.

3. What are the main segments of the Cloud Storage Gateway Industry?

The market segments include Deployment, Organization Size, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Cloud Adoption Across Several Industry Verticals; Growing Demand for Low Cost Data Storage and Faster Data Accessibility.

6. What are the notable trends driving market growth?

Healthcare End-user Industry Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Security Concerns Over Cloud Storage.

8. Can you provide examples of recent developments in the market?

January 2023: Amazon Web Services (AWS) made an important move by launching the AWS Local Zones location in Australia. This strategic step aims to enable Australian organizations to migrate additional workloads to AWS, thus supporting a hybrid cloud migration strategy and simplifying IT operations. The new location will provide low latency capabilities, which will be crucial in improving the performance of digital applications. It will also enable processing of large amounts of data faster, thus driving productivity gains.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud Storage Gateway Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud Storage Gateway Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud Storage Gateway Industry?

To stay informed about further developments, trends, and reports in the Cloud Storage Gateway Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence