Key Insights

The global Condition Monitoring Equipment market is projected for substantial expansion, expected to reach $3.78 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 7% through 2033. This growth is driven by the increasing adoption of predictive maintenance strategies across industries to improve operational efficiency, reduce downtime, and extend asset life. Key growth catalysts include the increasing complexity of industrial machinery, stringent safety and reliability regulations, and the widespread integration of digital technologies such as IoT and AI for advanced data analysis and remote monitoring. The ongoing transition towards Industry 4.0 further underscores the necessity for sophisticated condition monitoring solutions in interconnected manufacturing environments.

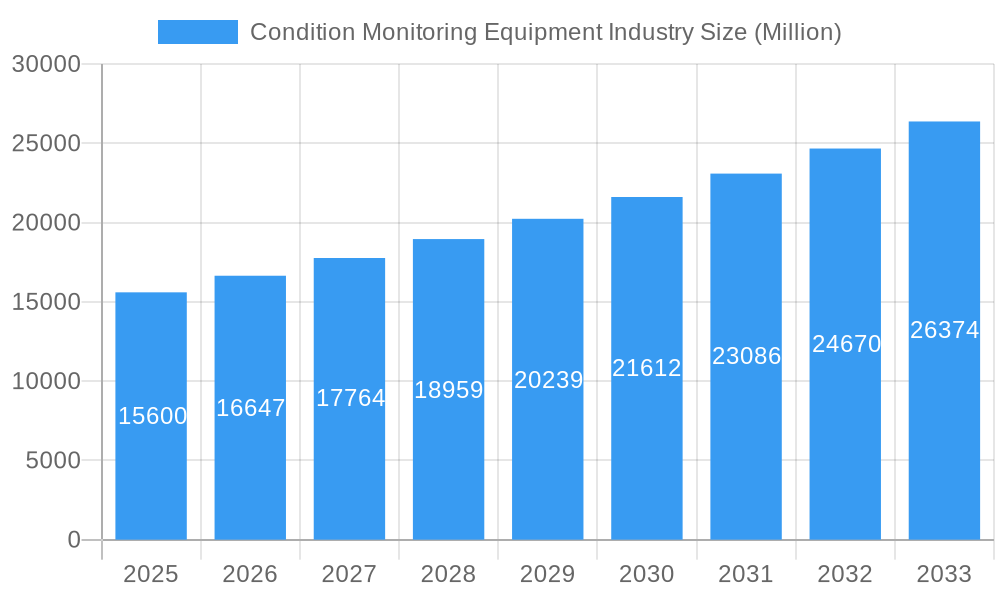

Condition Monitoring Equipment Industry Market Size (In Billion)

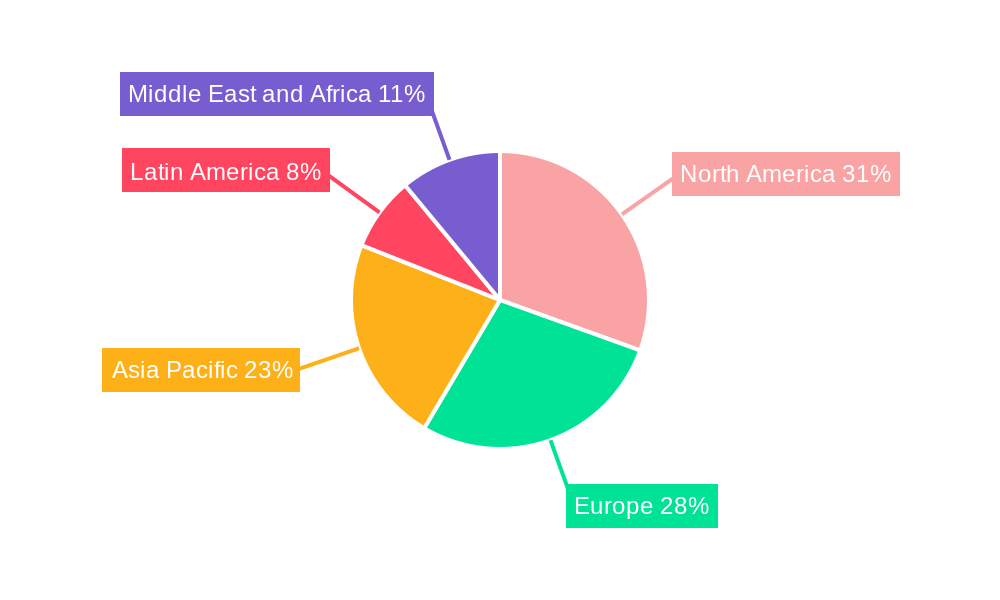

Market segmentation highlights strong demand for hardware components like Vibration Monitoring Equipment and Thermography Equipment, alongside the growing significance of advanced software solutions and specialized services. The Oil & Gas and Power Generation sectors are major end-users, prioritizing continuous operation and mitigating the high costs of unplanned outages. The Process & Manufacturing, Aerospace & Defense, and Automotive & Transportation industries also exhibit robust adoption, indicating widespread reliance on condition monitoring. Geographically, North America and Europe currently lead the market, owing to early technology adoption and developed industrial infrastructure. Asia Pacific is emerging as a high-growth region, propelled by rapid industrialization and increased manufacturing investments. The competitive landscape features prominent global players fostering innovation and market penetration.

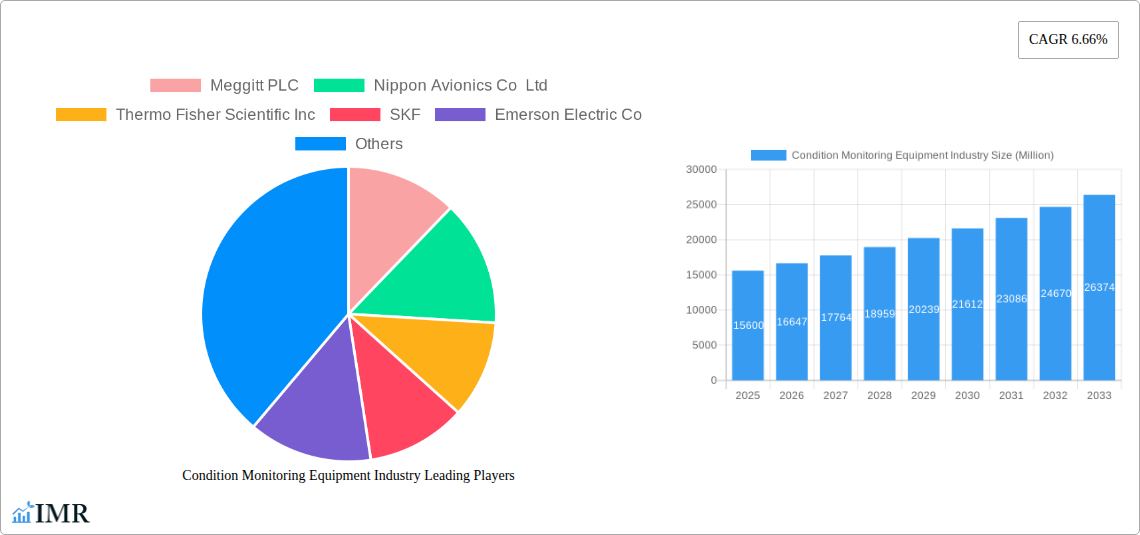

Condition Monitoring Equipment Industry Company Market Share

Condition Monitoring Equipment Industry Report: Navigating Market Dynamics, Growth Trends, and Key Innovations (2019-2033)

This comprehensive report offers an in-depth analysis of the global Condition Monitoring Equipment market, providing strategic insights into its evolution, growth drivers, and future trajectory. Spanning the historical period of 2019-2024, base year 2025, and a robust forecast period of 2025-2033, this report delves into market dynamics, segment analysis, product landscape, and key player strategies. We meticulously examine parent and child markets, integrating high-traffic keywords to maximize search engine visibility and deliver actionable intelligence for industry professionals, including those in Oil and Gas, Power Generation, Process and Manufacturing, Aerospace and Defense, and Automotive and Transportation.

Condition Monitoring Equipment Industry Market Dynamics & Structure

The Condition Monitoring Equipment industry is characterized by a moderately concentrated market, with key players investing heavily in technological innovation to drive competitive advantage. The increasing adoption of Industrial Internet of Things (IIoT), Artificial Intelligence (AI), and Machine Learning (ML) is central to product development, enabling more sophisticated predictive maintenance solutions. Regulatory frameworks, particularly those focused on industrial safety and environmental compliance, indirectly influence market demand for reliable monitoring systems. Competitive product substitutes, while present in rudimentary forms, are increasingly being overshadowed by advanced digital solutions. End-user demographics are shifting towards a greater demand for integrated, data-driven insights rather than standalone hardware. Mergers and acquisitions (M&A) are active, as larger entities seek to consolidate their offerings and expand their technological portfolios. For instance, the acquisition of Senseye by Siemens Digital Industries in June 2022 signifies a strategic move towards SaaS-based predictive maintenance.

- Market Concentration: Dominated by a mix of established industrial conglomerates and specialized technology providers.

- Technological Innovation Drivers: IIoT integration, AI/ML for predictive analytics, miniaturization of sensors, and cloud-based platforms.

- Regulatory Frameworks: Emphasis on predictive maintenance for safety-critical assets and compliance with environmental standards.

- Competitive Product Substitutes: Traditional scheduled maintenance practices are gradually being replaced by condition-based monitoring.

- End-User Demographics: Growing demand for integrated solutions and data-driven decision-making across all verticals.

- M&A Trends: Consolidation for broader solution offerings and access to advanced analytics capabilities.

Condition Monitoring Equipment Industry Growth Trends & Insights

The Condition Monitoring Equipment market is poised for significant expansion, driven by the escalating need for operational efficiency, asset longevity, and proactive maintenance strategies across diverse industrial sectors. The global market size is projected to grow from an estimated $XX million units in 2025 to $XX million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. This growth trajectory is fueled by the increasing awareness of the substantial costs associated with unexpected equipment failures, including production downtime, repair expenses, and potential safety hazards. The adoption rate of condition monitoring technologies is accelerating, particularly in sectors like Oil & Gas and Power Generation, where the continuous operation of critical machinery is paramount. Technological disruptions, such as the advancement in sensor technology for wireless data transmission and the development of sophisticated AI algorithms for anomaly detection, are reshaping the market. Consumer behavior is shifting from reactive repairs to proactive, data-informed asset management. The integration of these systems into the Industrial Internet of Things (IIoT) ecosystem is further enhancing their value proposition by enabling real-time data analysis and remote monitoring capabilities, thereby driving market penetration. The shift towards Industry 4.0 principles underscores the indispensable role of condition monitoring in optimizing industrial operations and ensuring robust supply chains. Furthermore, the demand for predictive maintenance software and condition monitoring services is surging, complementing hardware sales and offering comprehensive solutions to end-users.

Dominant Regions, Countries, or Segments in Condition Monitoring Equipment Industry

The Process and Manufacturing end-user vertical is emerging as a dominant force within the Condition Monitoring Equipment industry, driven by its vast array of critical machinery and the continuous pursuit of operational excellence. This segment encompasses a broad spectrum of industries including chemical, food and beverage, pharmaceuticals, and general manufacturing, all of which rely heavily on the uninterrupted functioning of their production lines. The inherent complexity and high operational costs associated with unexpected downtime in these environments make condition monitoring equipment an essential investment. Market share within this segment is substantial, estimated at XX% of the total market in 2025, with projected growth to XX% by 2033.

- Key Drivers in Process and Manufacturing:

- High Density of Critical Assets: Numerous motors, pumps, compressors, and other rotating machinery require constant monitoring to prevent failures.

- Emphasis on Productivity and Yield: Minimizing downtime directly translates to increased output and revenue.

- Stringent Quality Control: Consistent machinery performance is vital for maintaining product quality and reducing scrap.

- Adoption of Automation and IIoT: Integration of condition monitoring into smart factory initiatives.

- Cost Savings: Predictive maintenance significantly reduces unplanned maintenance costs and extends equipment lifespan.

The dominance of the Process and Manufacturing sector is further bolstered by supportive economic policies and the ongoing global drive towards advanced manufacturing techniques. Regions with strong industrial bases, such as North America and Europe, are leading this trend, with significant investments in upgrading existing facilities and implementing state-of-the-art monitoring solutions. The Automotive and Transportation sector also presents substantial growth potential, driven by the increasing complexity of vehicle systems and the growing adoption of electric vehicles, which have their own unique monitoring requirements. Within the Type segment, Hardware, particularly Vibration Monitoring Equipment and Thermography Equipment, continues to hold a significant market share due to their foundational role in detecting early signs of mechanical wear and thermal anomalies. However, the growth of Software for data analysis and predictive algorithms, along with Services like remote monitoring and expert consultation, is rapidly accelerating, indicating a strong trend towards integrated solutions.

Condition Monitoring Equipment Industry Product Landscape

The product landscape of the Condition Monitoring Equipment industry is evolving rapidly, with a strong focus on integrated hardware, sophisticated software, and comprehensive service offerings. Key product innovations include advanced sensor technologies for wireless connectivity and real-time data streaming, such as OMRON Corporation's K7DD-PQ Series of motor condition monitoring devices launched globally in March/April 2023. These devices numerically track trends in deterioration and wear, automating the monitoring of abnormalities and reducing inspection efforts. Furthermore, AI-powered analytics platforms are enhancing the predictive capabilities of Vibration Monitoring Equipment, allowing for more accurate prognostics of equipment failure. Thermography Equipment is becoming more sensitive and portable, enabling quick assessments of thermal issues in diverse applications. Lubricating Oil Analysis Equipment is also seeing advancements in automation and speed. The synergy between these hardware components and advanced Software solutions, particularly those offering SaaS-based predictive maintenance, is a defining characteristic of the current product landscape, driving enhanced performance metrics and unique selling propositions in reducing operational risks.

Key Drivers, Barriers & Challenges in Condition Monitoring Equipment Industry

Key Drivers: The Condition Monitoring Equipment industry is propelled by several critical factors. The escalating imperative for operational efficiency and asset longevity across industries like Oil & Gas and Power Generation is a primary driver. The increasing adoption of Industry 4.0 principles and the Industrial Internet of Things (IIoT) fosters the integration of condition monitoring solutions for enhanced data-driven decision-making. Furthermore, the growing awareness of the substantial cost savings associated with preventing unplanned downtime and the need to meet stringent safety and environmental regulations are significant market stimulants. Technological advancements in sensor technology and AI-powered analytics are also critical enablers.

Barriers & Challenges: Despite the robust growth, the industry faces several challenges. The initial investment cost of sophisticated condition monitoring systems can be a barrier for smaller enterprises. Lack of skilled personnel to operate and interpret data from advanced systems poses a hurdle. Data security concerns and the complexity of integrating new systems with legacy infrastructure can also slow down adoption. Supply chain disruptions can impact the availability of specialized components. Moreover, the resistance to change from traditional maintenance practices and the perceived complexity of predictive analytics present ongoing challenges that require targeted educational and implementation strategies to overcome.

Emerging Opportunities in Condition Monitoring Equipment Industry

Emerging opportunities in the Condition Monitoring Equipment industry lie in the expansion of IIoT integration for seamless data flow and remote asset management. The increasing demand for predictive maintenance as a service (PMaaS) presents a lucrative avenue for service providers. The burgeoning renewable energy sector, particularly wind and solar power, requires robust condition monitoring for turbines and inverters, opening up new market frontiers. Furthermore, the development of edge computing solutions for real-time on-site data processing and analysis, coupled with advancements in AI for more granular and accurate failure prediction, are significant opportunities. The application of condition monitoring in sectors like smart cities and autonomous transportation also represents untapped potential.

Growth Accelerators in the Condition Monitoring Equipment Industry Industry

Several catalysts are accelerating long-term growth in the Condition Monitoring Equipment industry. Technological breakthroughs in sensor accuracy, wireless communication, and AI-driven prognostics are continuously enhancing the capabilities and value proposition of these systems. Strategic partnerships between hardware manufacturers, software developers, and industrial service providers are creating integrated, end-to-end solutions that cater to complex customer needs. Market expansion strategies focusing on emerging economies and underserved industrial segments are also driving growth. The increasing emphasis on sustainability and circular economy principles further boosts demand for condition monitoring as a means to extend asset life and reduce waste.

Key Players Shaping the Condition Monitoring Equipment Industry Market

- Meggitt PLC

- Nippon Avionics Co Ltd

- Thermo Fisher Scientific Inc

- SKF

- Emerson Electric Co

- Gastops Ltd

- Fluke Corporation

- Rockwell Automation Inc

- Brüel & Kjær Vibro GmbH

- Spectro Scientific (AMETEK INC)

- General Electric Company

- Parker Hannifin Corporation

- Perkin Elmer

- Teledyne FLIR LLC

Notable Milestones in Condition Monitoring Equipment Industry Sector

- February 2023: OMRON Corporation announced the global launch of its K7DD-PQ Series of advanced motor condition monitoring devices, starting March 1, 2023, in Japan and then globally on April 3, 2023. This series automates monitoring of abnormalities and numerically tracks equipment deterioration trends to reduce inspection efforts and prevent unexpected failures.

- June 2022: Siemens Digital Industries acquired Senseye, a move that significantly bolstered its software-as-a-service (SaaS)-based approach to cloud-hosted predictive maintenance solutions. This acquisition followed a four-year cooperation and integrated Senseye's software into Siemens' MindSphere Industrial Internet of Things (IIoT) platform, underscoring strategic investments driving market growth.

In-Depth Condition Monitoring Equipment Industry Market Outlook

The Condition Monitoring Equipment industry is poised for sustained and robust growth, driven by the inherent value of operational optimization and risk mitigation in modern industrial landscapes. Future market potential is anchored in the continued evolution of predictive analytics, the widespread adoption of IIoT, and the increasing integration of condition monitoring into broader digital transformation initiatives across all major end-user verticals. Strategic opportunities abound in developing specialized solutions for nascent industries and leveraging emerging technologies like 5G for enhanced connectivity and real-time data processing. The ongoing global focus on industrial efficiency, asset reliability, and predictive maintenance, coupled with proactive investment from key players, ensures a dynamic and expanding market throughout the forecast period.

Condition Monitoring Equipment Industry Segmentation

-

1. Type

-

1.1. Hardware

- 1.1.1. Vibration Monitoring Equipment

- 1.1.2. Thermography Equipment

- 1.1.3. Lubricating Oil Analysis Equipment

- 1.2. Software

- 1.3. Services

-

1.1. Hardware

-

2. End-user Vertical***

- 2.1. Oil and Gas

- 2.2. Power Generation

- 2.3. Process and Manufacturing

- 2.4. Aerospace and Defense

- 2.5. Automotive and Transportation

- 2.6. Other End-user Verticals

Condition Monitoring Equipment Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of the Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of the Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Condition Monitoring Equipment Industry Regional Market Share

Geographic Coverage of Condition Monitoring Equipment Industry

Condition Monitoring Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Demand for Smart Factories; Increasing Focus on the use of Renewable Energy

- 3.3. Market Restrains

- 3.3.1. Unpredictable Maintenance Time Period

- 3.4. Market Trends

- 3.4.1. Increasing Focus on the use of Renewable Energy Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Condition Monitoring Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.1.1. Vibration Monitoring Equipment

- 5.1.1.2. Thermography Equipment

- 5.1.1.3. Lubricating Oil Analysis Equipment

- 5.1.2. Software

- 5.1.3. Services

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical***

- 5.2.1. Oil and Gas

- 5.2.2. Power Generation

- 5.2.3. Process and Manufacturing

- 5.2.4. Aerospace and Defense

- 5.2.5. Automotive and Transportation

- 5.2.6. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Condition Monitoring Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hardware

- 6.1.1.1. Vibration Monitoring Equipment

- 6.1.1.2. Thermography Equipment

- 6.1.1.3. Lubricating Oil Analysis Equipment

- 6.1.2. Software

- 6.1.3. Services

- 6.1.1. Hardware

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical***

- 6.2.1. Oil and Gas

- 6.2.2. Power Generation

- 6.2.3. Process and Manufacturing

- 6.2.4. Aerospace and Defense

- 6.2.5. Automotive and Transportation

- 6.2.6. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Condition Monitoring Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hardware

- 7.1.1.1. Vibration Monitoring Equipment

- 7.1.1.2. Thermography Equipment

- 7.1.1.3. Lubricating Oil Analysis Equipment

- 7.1.2. Software

- 7.1.3. Services

- 7.1.1. Hardware

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical***

- 7.2.1. Oil and Gas

- 7.2.2. Power Generation

- 7.2.3. Process and Manufacturing

- 7.2.4. Aerospace and Defense

- 7.2.5. Automotive and Transportation

- 7.2.6. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Condition Monitoring Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hardware

- 8.1.1.1. Vibration Monitoring Equipment

- 8.1.1.2. Thermography Equipment

- 8.1.1.3. Lubricating Oil Analysis Equipment

- 8.1.2. Software

- 8.1.3. Services

- 8.1.1. Hardware

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical***

- 8.2.1. Oil and Gas

- 8.2.2. Power Generation

- 8.2.3. Process and Manufacturing

- 8.2.4. Aerospace and Defense

- 8.2.5. Automotive and Transportation

- 8.2.6. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Condition Monitoring Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hardware

- 9.1.1.1. Vibration Monitoring Equipment

- 9.1.1.2. Thermography Equipment

- 9.1.1.3. Lubricating Oil Analysis Equipment

- 9.1.2. Software

- 9.1.3. Services

- 9.1.1. Hardware

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical***

- 9.2.1. Oil and Gas

- 9.2.2. Power Generation

- 9.2.3. Process and Manufacturing

- 9.2.4. Aerospace and Defense

- 9.2.5. Automotive and Transportation

- 9.2.6. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Condition Monitoring Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Hardware

- 10.1.1.1. Vibration Monitoring Equipment

- 10.1.1.2. Thermography Equipment

- 10.1.1.3. Lubricating Oil Analysis Equipment

- 10.1.2. Software

- 10.1.3. Services

- 10.1.1. Hardware

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical***

- 10.2.1. Oil and Gas

- 10.2.2. Power Generation

- 10.2.3. Process and Manufacturing

- 10.2.4. Aerospace and Defense

- 10.2.5. Automotive and Transportation

- 10.2.6. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Meggitt PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nippon Avionics Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Thermo Fisher Scientific Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SKF

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Emerson Electric Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Gastops Ltd *List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fluke Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rockwell Automation Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Brüel & Kjær Vibro GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Spectro Scientific (AMETEK INC )

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 General Electric Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Parker Hannifin Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Perkin Elmer

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Teledyne FLIR LLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Meggitt PLC

List of Figures

- Figure 1: Global Condition Monitoring Equipment Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Condition Monitoring Equipment Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Condition Monitoring Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Condition Monitoring Equipment Industry Revenue (billion), by End-user Vertical*** 2025 & 2033

- Figure 5: North America Condition Monitoring Equipment Industry Revenue Share (%), by End-user Vertical*** 2025 & 2033

- Figure 6: North America Condition Monitoring Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Condition Monitoring Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Condition Monitoring Equipment Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Condition Monitoring Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Condition Monitoring Equipment Industry Revenue (billion), by End-user Vertical*** 2025 & 2033

- Figure 11: Europe Condition Monitoring Equipment Industry Revenue Share (%), by End-user Vertical*** 2025 & 2033

- Figure 12: Europe Condition Monitoring Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Condition Monitoring Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Condition Monitoring Equipment Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Condition Monitoring Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Condition Monitoring Equipment Industry Revenue (billion), by End-user Vertical*** 2025 & 2033

- Figure 17: Asia Pacific Condition Monitoring Equipment Industry Revenue Share (%), by End-user Vertical*** 2025 & 2033

- Figure 18: Asia Pacific Condition Monitoring Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Condition Monitoring Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Condition Monitoring Equipment Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: Latin America Condition Monitoring Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Condition Monitoring Equipment Industry Revenue (billion), by End-user Vertical*** 2025 & 2033

- Figure 23: Latin America Condition Monitoring Equipment Industry Revenue Share (%), by End-user Vertical*** 2025 & 2033

- Figure 24: Latin America Condition Monitoring Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Condition Monitoring Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Condition Monitoring Equipment Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Condition Monitoring Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Condition Monitoring Equipment Industry Revenue (billion), by End-user Vertical*** 2025 & 2033

- Figure 29: Middle East and Africa Condition Monitoring Equipment Industry Revenue Share (%), by End-user Vertical*** 2025 & 2033

- Figure 30: Middle East and Africa Condition Monitoring Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Condition Monitoring Equipment Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Condition Monitoring Equipment Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Condition Monitoring Equipment Industry Revenue billion Forecast, by End-user Vertical*** 2020 & 2033

- Table 3: Global Condition Monitoring Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Condition Monitoring Equipment Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Condition Monitoring Equipment Industry Revenue billion Forecast, by End-user Vertical*** 2020 & 2033

- Table 6: Global Condition Monitoring Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Condition Monitoring Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Condition Monitoring Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Condition Monitoring Equipment Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global Condition Monitoring Equipment Industry Revenue billion Forecast, by End-user Vertical*** 2020 & 2033

- Table 11: Global Condition Monitoring Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Germany Condition Monitoring Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Condition Monitoring Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Condition Monitoring Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of the Europe Condition Monitoring Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Condition Monitoring Equipment Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Condition Monitoring Equipment Industry Revenue billion Forecast, by End-user Vertical*** 2020 & 2033

- Table 18: Global Condition Monitoring Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: China Condition Monitoring Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Japan Condition Monitoring Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: India Condition Monitoring Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of the Asia Pacific Condition Monitoring Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Global Condition Monitoring Equipment Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 24: Global Condition Monitoring Equipment Industry Revenue billion Forecast, by End-user Vertical*** 2020 & 2033

- Table 25: Global Condition Monitoring Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global Condition Monitoring Equipment Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 27: Global Condition Monitoring Equipment Industry Revenue billion Forecast, by End-user Vertical*** 2020 & 2033

- Table 28: Global Condition Monitoring Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Condition Monitoring Equipment Industry?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the Condition Monitoring Equipment Industry?

Key companies in the market include Meggitt PLC, Nippon Avionics Co Ltd, Thermo Fisher Scientific Inc, SKF, Emerson Electric Co, Gastops Ltd *List Not Exhaustive, Fluke Corporation, Rockwell Automation Inc, Brüel & Kjær Vibro GmbH, Spectro Scientific (AMETEK INC ), General Electric Company, Parker Hannifin Corporation, Perkin Elmer, Teledyne FLIR LLC.

3. What are the main segments of the Condition Monitoring Equipment Industry?

The market segments include Type, End-user Vertical***.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.78 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Demand for Smart Factories; Increasing Focus on the use of Renewable Energy.

6. What are the notable trends driving market growth?

Increasing Focus on the use of Renewable Energy Drives the Market.

7. Are there any restraints impacting market growth?

Unpredictable Maintenance Time Period.

8. Can you provide examples of recent developments in the market?

February 2023: OMRON Corporation announced that it would globally launch its K7DD-PQ Series of advanced motor condition monitoring devices, starting March 1, 2023, in Japan and then globally on April 3, 2023. The Series is the latest addition to OMRON's family of condition-monitoring devices that automate the monitoring of abnormalities on the manufacturing site in place of human workers. The K7DD-PQ numerically tracks trends in the deterioration and wear of servomotors, machine tools, and other equipment to reduce inspection efforts and prevent unexpected failure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Condition Monitoring Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Condition Monitoring Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Condition Monitoring Equipment Industry?

To stay informed about further developments, trends, and reports in the Condition Monitoring Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence