Key Insights

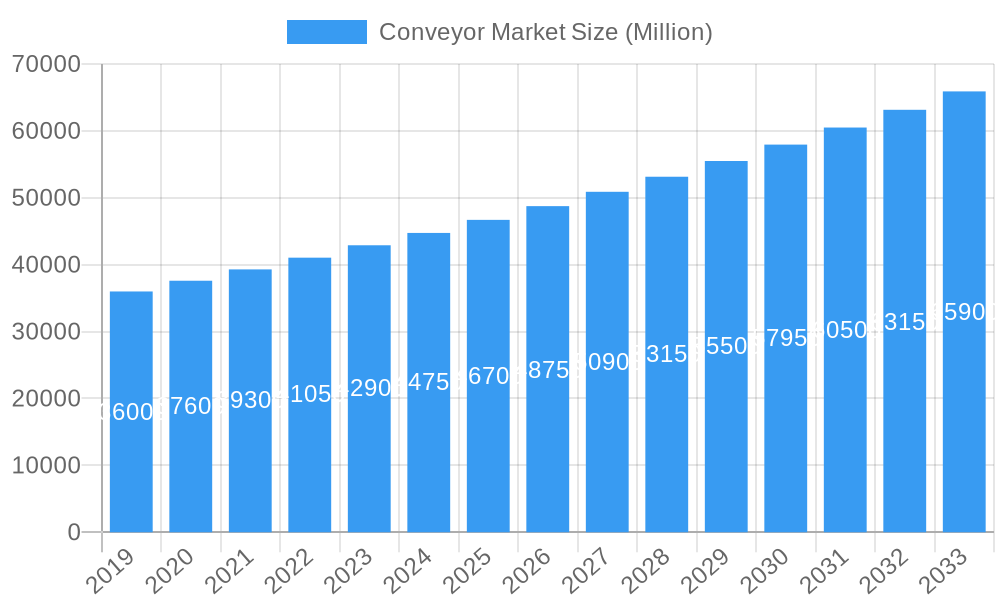

The global Conveyor Market is poised for significant expansion, with an estimated market size of approximately \$45,000 million in 2025, projected to grow at a robust Compound Annual Growth Rate (CAGR) of 4.50% through 2033. This sustained growth is primarily fueled by the escalating demand for automation across various industries, including e-commerce, manufacturing, and logistics. The relentless pursuit of enhanced operational efficiency, reduced labor costs, and improved throughput is driving substantial investment in advanced conveyor systems. Key market drivers include the burgeoning adoption of smart technologies, such as IoT integration for real-time monitoring and predictive maintenance, and the increasing complexity of supply chains, necessitating more sophisticated material handling solutions. The e-commerce boom, in particular, has amplified the need for efficient order fulfillment and last-mile delivery, directly benefiting the conveyor market.

Conveyor Market Market Size (In Billion)

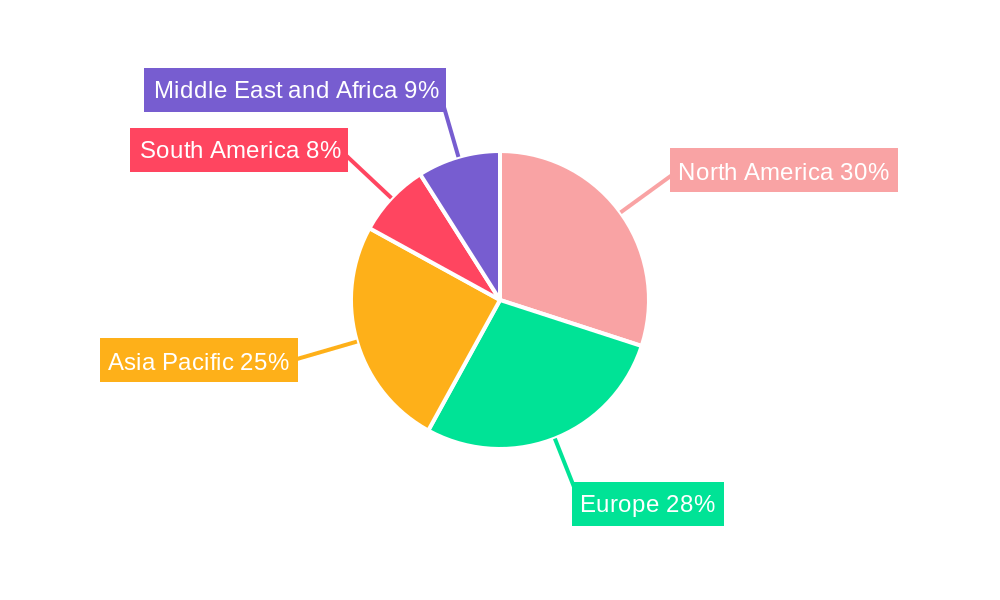

The market is segmented into various product types, with Belt Conveyors and Roller Conveyors holding dominant positions due to their versatility and widespread application in diverse industrial settings. Overhead conveyors are also gaining traction for applications requiring vertical movement and space optimization. Geographically, North America and Europe currently lead the market, driven by established industrial bases and significant investments in warehouse automation and smart manufacturing initiatives. However, the Asia Pacific region, propelled by rapid industrialization, a burgeoning manufacturing sector, and increasing e-commerce penetration in countries like China and India, is expected to emerge as the fastest-growing market. Despite the positive outlook, certain restraints, such as the high initial capital investment for advanced systems and the potential for operational disruptions during system integration, may pose challenges. Nevertheless, ongoing technological advancements and the clear economic benefits of automation are expected to outweigh these limitations, ensuring a dynamic and thriving conveyor market in the coming years.

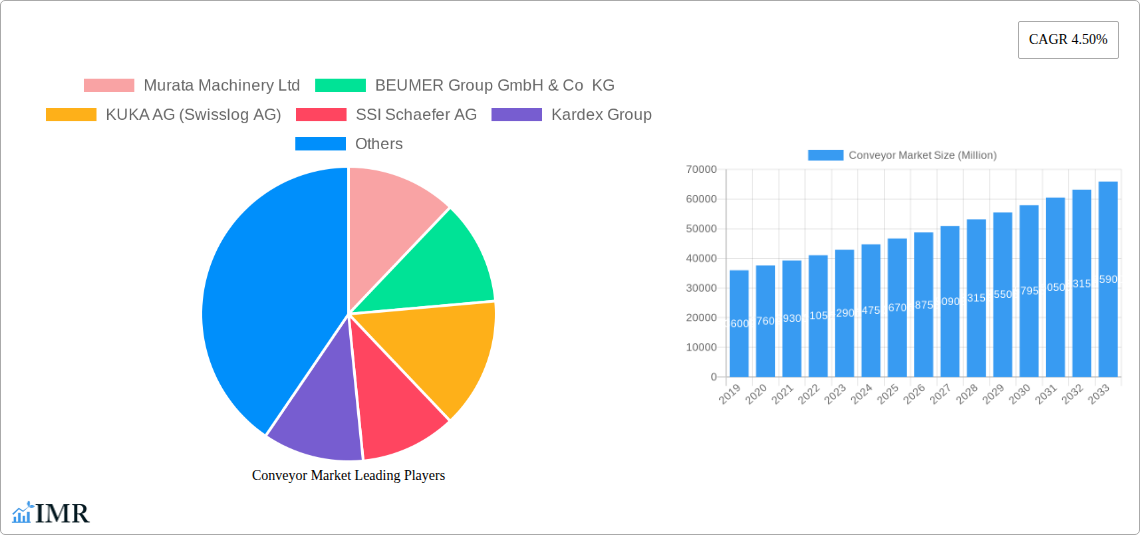

Conveyor Market Company Market Share

Comprehensive Conveyor Market Report: Global Trends, Regional Dominance, and Key Player Analysis (2019-2033)

This in-depth report provides a panoramic view of the global conveyor market, meticulously analyzing its current trajectory and forecasting future growth potential. Delving into parent and child market dynamics, the study offers unparalleled insights into market segmentation, technological advancements, and competitive landscapes. With a study period spanning 2019–2033, including a base year of 2025, an estimated year of 2025, and a forecast period of 2025–2033, this report is an indispensable resource for stakeholders seeking to capitalize on the burgeoning demand for efficient material handling solutions. All values are presented in Million units.

Conveyor Market Regional Market Share

Conveyor Market Market Dynamics & Structure

The global conveyor market is characterized by a moderately concentrated structure, with a few key players dominating a significant portion of the market share. Technological innovation is a primary driver, fueled by the relentless pursuit of automation, efficiency, and reduced operational costs across various industries. Regulatory frameworks, while generally supportive of industrial development, can influence safety standards and environmental compliance. Competitive product substitutes, such as automated guided vehicles (AGVs) and robotic arms, present evolving challenges and opportunities. End-user demographics are diverse, ranging from manufacturing and logistics to mining, automotive, and e-commerce, each with unique demands for conveyor systems. Mergers and acquisitions (M&A) are prevalent, with companies actively consolidating to expand their product portfolios, geographical reach, and technological capabilities.

- Market Concentration: Dominated by established players like Daifuku Co Ltd, Murata Machinery Ltd., and BEUMER Group GmbH & Co KG, the market exhibits a blend of consolidation and niche specialization.

- Technological Innovation: Focus on smart conveyors, IoT integration, predictive maintenance, and energy-efficient designs are key innovation drivers.

- Regulatory Frameworks: Compliance with safety regulations (e.g., OSHA in the US) and industry-specific standards are crucial.

- Competitive Substitutes: Increased adoption of AGVs and warehouse robotics is influencing conveyor system designs and integrations.

- End-User Demographics: Strong demand from e-commerce fulfillment centers, automotive manufacturing, and food & beverage processing sectors.

- M&A Trends: Strategic acquisitions are aimed at acquiring new technologies, market access, and expanding service offerings.

Conveyor Market Growth Trends & Insights

The conveyor market is poised for substantial growth, driven by the increasing adoption of automated material handling systems in industries worldwide. The global conveyor market size is projected to witness a significant Compound Annual Growth Rate (CAGR) throughout the forecast period. This expansion is fueled by the escalating demand for enhanced operational efficiency, reduced labor costs, and improved supply chain logistics. Technological disruptions, such as the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) into conveyor systems, are creating smarter, more adaptable, and data-driven solutions. Consumer behavior shifts, particularly the surge in e-commerce, have amplified the need for sophisticated sorting and fulfillment solutions, where conveyors play a pivotal role. Market penetration is deepening across developing economies as they industrialize and invest in modern infrastructure. The adoption rates of advanced conveyor technologies are on an upward trend, with businesses recognizing their strategic importance in maintaining a competitive edge. The evolution from basic conveyor units to integrated, intelligent systems reflects a significant shift in how material handling is perceived and implemented.

Dominant Regions, Countries, or Segments in Conveyor Market

The Belt Conveyor Market segment is anticipated to be the most dominant driver of growth within the overall conveyor market. This leadership is attributed to their unparalleled versatility, cost-effectiveness, and widespread application across a multitude of industries. Belt conveyors are indispensable in sectors such as mining, agriculture, bulk material handling, and general manufacturing, where the efficient and continuous movement of goods is paramount. Their ability to transport a wide range of materials, from raw ores and grains to finished products and packaging, makes them a foundational element of industrial operations.

- North America stands out as a leading region, propelled by a robust manufacturing sector, significant investments in logistics and warehousing infrastructure, and a high rate of technological adoption. The strong presence of key players and a well-established industrial base contribute to its dominance.

- Asia Pacific is exhibiting the fastest growth, driven by rapid industrialization, expanding e-commerce markets, and government initiatives supporting manufacturing and infrastructure development. Countries like China and India are significant contributors to this growth.

- Europe maintains a strong position due to its advanced manufacturing capabilities, strict environmental regulations that encourage efficient material handling, and a well-developed logistics network.

- Key Drivers in Product Type:

- Belt Conveyors: High volume applications in mining, agriculture, and bulk material handling; cost-effectiveness and reliability.

- Roller Conveyors: Essential for palletized goods in warehousing, distribution centers, and manufacturing assembly lines; flexibility in configuration.

- Pallet Conveyors: Crucial for automated warehousing and logistics, enabling seamless movement of unit loads; integration with automated storage and retrieval systems (AS/RS).

- Overhead Conveyors: Optimized for continuous flow in automotive, garment, and assembly operations; space-saving designs.

Conveyor Market Product Landscape

The conveyor market is witnessing an influx of innovative product designs and enhanced performance metrics. Belt conveyors are evolving with specialized materials for increased durability and chemical resistance. Roller conveyors are becoming more modular and intelligent, incorporating sensors for real-time monitoring and control. Pallet conveyors are seamlessly integrating with AS/RS and automated guided vehicles, creating highly automated material flow systems. Overhead conveyors are being optimized for energy efficiency and increased load capacities, catering to specialized industrial needs. Applications span across virtually every industry, from high-speed sorting in e-commerce fulfillment to robust material transport in heavy industries. Unique selling propositions often lie in customization, ease of maintenance, and advanced control systems that enable precise material flow management.

Key Drivers, Barriers & Challenges in Conveyor Market

The conveyor market is propelled by several key drivers, including the insatiable demand for automation across industries to boost efficiency and reduce operational costs. Technological advancements, such as the integration of IoT and AI for predictive maintenance and real-time data analysis, are significant growth accelerators. Government initiatives promoting industrial growth and infrastructure development also play a crucial role.

Conversely, challenges such as the high initial investment cost for advanced systems can act as a barrier, particularly for small and medium-sized enterprises. Supply chain disruptions, raw material price volatility, and the need for skilled labor to install and maintain complex systems also present significant hurdles. Intense competition among established players and emerging market entrants can lead to price pressures.

Emerging Opportunities in Conveyor Market

Emerging opportunities in the conveyor market lie in the growing adoption of smart logistics and Industry 4.0 technologies. The expansion of e-commerce into new geographical regions presents a substantial untapped market for automated warehousing and fulfillment solutions. The development of highly specialized conveyor systems for niche applications, such as pharmaceuticals, cleanroom environments, and food processing with stringent hygiene requirements, offers significant growth potential. Furthermore, the increasing focus on sustainability is driving demand for energy-efficient conveyor designs and solutions that minimize environmental impact.

Growth Accelerators in the Conveyor Market Industry

The conveyor market industry is witnessing significant growth acceleration driven by several catalytic factors. The relentless pursuit of operational efficiency and cost reduction by businesses across all sectors is a primary catalyst, pushing for greater automation in material handling. Technological breakthroughs, including advancements in robotics, AI, and IoT integration, are enabling the development of "smart" conveyor systems that offer enhanced flexibility, real-time monitoring, and predictive maintenance capabilities. Strategic partnerships between conveyor manufacturers and software providers are creating integrated solutions that optimize entire supply chains. Market expansion strategies, particularly in emerging economies undergoing rapid industrialization, are opening up new avenues for growth.

Key Players Shaping the Conveyor Market Market

- Murata Machinery Ltd.

- BEUMER Group GmbH & Co KG

- KUKA AG (Swisslog AG)

- SSI Schaefer AG

- Kardex Group

- Bastian Solutions Inc.

- Honeywell Intelligrated Inc.

- KNAPP AG

- Daifuku Co Ltd

- Viastrore Systems GmbH

- Mecalux SA

Notable Milestones in Conveyor Market Sector

- October 2022: Daifuku North America Holding Company (Daifuku) announced its new manufacturing plant in Boyne City, Michigan, USA. The company invested USD 26 million to build this world-class 225,000 sq. ft. manufacturing facility. The plant is on 22 acres of land and is operated by Jervis B. Webb Company, a Daifuku North America subsidiary. Moreover, Jervis B. Webb Company (Webb) builds conveyor components for complex systems that support airports, automotive, and general industries.

- August 2022: Hitachi Energy announced that it would implement the Kardex AutoStore solution in the Dietlikon site, which includes goods receipt and inspection, storage, picking & packing, and shipping of the service components. Kardex performed several system simulations with actual data during the planning phase for the customized design of Hitachi Energy's AutoStore solution. In the first expansion stage, the grid will only be equipped with 3,000 bins, two "Red Line" (R5) robots, and two Conveyor Ports.

In-Depth Conveyor Market Market Outlook

The conveyor market exhibits a promising outlook, with continued growth fueled by the pervasive trend of automation across global industries. The integration of advanced technologies such as AI, IoT, and robotics is transforming traditional conveyor systems into intelligent, interconnected solutions capable of optimizing material flow and enhancing operational efficiency. Strategic partnerships and collaborations between key players are expected to foster innovation and expand market reach. The burgeoning e-commerce sector, coupled with ongoing industrialization in emerging economies, will continue to drive demand for sophisticated material handling solutions. Companies that focus on developing energy-efficient, customizable, and data-driven conveyor systems are well-positioned to capitalize on the evolving needs of the market and secure substantial market share.

Conveyor Market Segmentation

-

1. Product Type

- 1.1. Belt

- 1.2. Roller

- 1.3. Pallet

- 1.4. Overhead

Conveyor Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. GCC

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Conveyor Market Regional Market Share

Geographic Coverage of Conveyor Market

Conveyor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Handling Larger Volumes of Goods and Improving Productivity; Rapid Growth of E-commerce

- 3.3. Market Restrains

- 3.3.1. High Initial Investments

- 3.4. Market Trends

- 3.4.1. Retail Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Conveyor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Belt

- 5.1.2. Roller

- 5.1.3. Pallet

- 5.1.4. Overhead

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Conveyor Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Belt

- 6.1.2. Roller

- 6.1.3. Pallet

- 6.1.4. Overhead

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Conveyor Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Belt

- 7.1.2. Roller

- 7.1.3. Pallet

- 7.1.4. Overhead

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Conveyor Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Belt

- 8.1.2. Roller

- 8.1.3. Pallet

- 8.1.4. Overhead

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Conveyor Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Belt

- 9.1.2. Roller

- 9.1.3. Pallet

- 9.1.4. Overhead

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Conveyor Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Belt

- 10.1.2. Roller

- 10.1.3. Pallet

- 10.1.4. Overhead

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Murata Machinery Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BEUMER Group GmbH & Co KG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 KUKA AG (Swisslog AG)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SSI Schaefer AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kardex Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bastian Solutions Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Honeywell Intelligrated Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 KNAPP AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Daifuku Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Viastrore Systems GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mecalux SA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Murata Machinery Ltd

List of Figures

- Figure 1: Global Conveyor Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Conveyor Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America Conveyor Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Conveyor Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Conveyor Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Conveyor Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 7: Europe Conveyor Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 8: Europe Conveyor Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Conveyor Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Conveyor Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 11: Asia Pacific Conveyor Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Asia Pacific Conveyor Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Conveyor Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Conveyor Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: South America Conveyor Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: South America Conveyor Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America Conveyor Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Conveyor Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 19: Middle East and Africa Conveyor Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Middle East and Africa Conveyor Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Middle East and Africa Conveyor Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Conveyor Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Conveyor Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Conveyor Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 4: Global Conveyor Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States Conveyor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada Conveyor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico Conveyor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Global Conveyor Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 9: Global Conveyor Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Germany Conveyor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Conveyor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: France Conveyor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Italy Conveyor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Spain Conveyor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Conveyor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Conveyor Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 17: Global Conveyor Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: China Conveyor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Japan Conveyor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: India Conveyor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Australia Conveyor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: South Korea Conveyor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Conveyor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global Conveyor Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 25: Global Conveyor Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Brazil Conveyor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Argentina Conveyor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of South America Conveyor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Conveyor Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 30: Global Conveyor Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: GCC Conveyor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: South Africa Conveyor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Conveyor Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Conveyor Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Conveyor Market?

Key companies in the market include Murata Machinery Ltd, BEUMER Group GmbH & Co KG, KUKA AG (Swisslog AG), SSI Schaefer AG, Kardex Group, Bastian Solutions Inc , Honeywell Intelligrated Inc, KNAPP AG, Daifuku Co Ltd, Viastrore Systems GmbH, Mecalux SA.

3. What are the main segments of the Conveyor Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Handling Larger Volumes of Goods and Improving Productivity; Rapid Growth of E-commerce.

6. What are the notable trends driving market growth?

Retail Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Initial Investments.

8. Can you provide examples of recent developments in the market?

October 2022: Daifuku North America Holding Company (Daifuku) announced its new manufacturing plant in Boyne City, Michigan, USA. The company invested USD 26 million to build this world-class 225,000 sq. ft. manufacturing facility. The plant is on 22 acres of land and is operated by Jervis B. Webb Company, a Daifuku North America subsidiary. Moreover, Jervis B. Webb Company (Webb) builds conveyor components for complex systems that support airports, automotive, and general industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Conveyor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Conveyor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Conveyor Market?

To stay informed about further developments, trends, and reports in the Conveyor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence