Key Insights

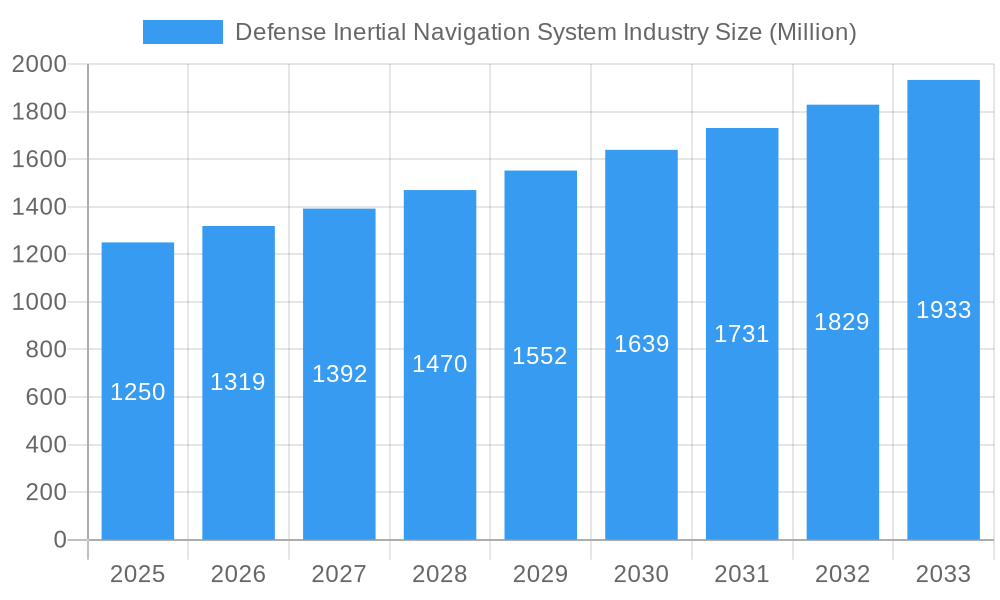

The global Defense Inertial Navigation System (INS) market is poised for significant expansion, projected to reach an estimated XX million by 2025 and demonstrating a robust Compound Annual Growth Rate (CAGR) of 5.55% through 2033. This growth is primarily fueled by escalating geopolitical tensions and the consequent surge in defense spending worldwide. Modern military operations increasingly rely on highly accurate and reliable navigation systems, particularly in contested environments where GPS denial or spoofing can be a critical vulnerability. INS, with its ability to provide continuous position, velocity, and attitude data independent of external signals, is becoming indispensable for a wide array of defense applications. Key drivers include the ongoing modernization of military fleets, the demand for enhanced situational awareness, and the integration of advanced INS technologies into unmanned aerial vehicles (UAVs), autonomous ground vehicles, and precision-guided munitions. The aerospace and defense sector leads in adoption, followed by the marine industry, where robust navigation is paramount for naval operations.

Defense Inertial Navigation System Industry Market Size (In Billion)

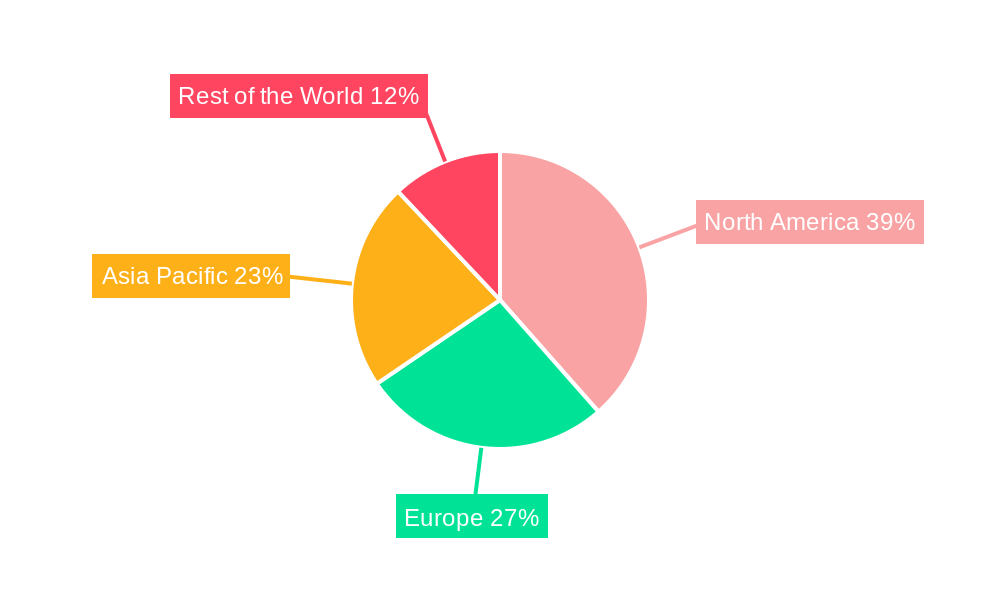

The market is characterized by dynamic trends and certain restraints that shape its trajectory. Emerging trends include the miniaturization of INS components, leading to more compact and power-efficient solutions suitable for smaller platforms, and the increasing convergence of INS with other navigation technologies like GNSS (Global Navigation Satellite System) to create resilient hybrid systems that mitigate single-point failures. Advancements in MEMS (Micro-Electro-Mechanical Systems) technology are further driving down costs and improving performance, making sophisticated INS more accessible. However, high development and integration costs, coupled with stringent testing and qualification processes for defense applications, present significant restraints. The complex supply chains and the need for highly specialized expertise also contribute to market barriers. Despite these challenges, the imperative for secure, accurate, and uninterrupted navigation in defense operations ensures sustained market growth, with North America currently holding a dominant regional share due to substantial defense investments.

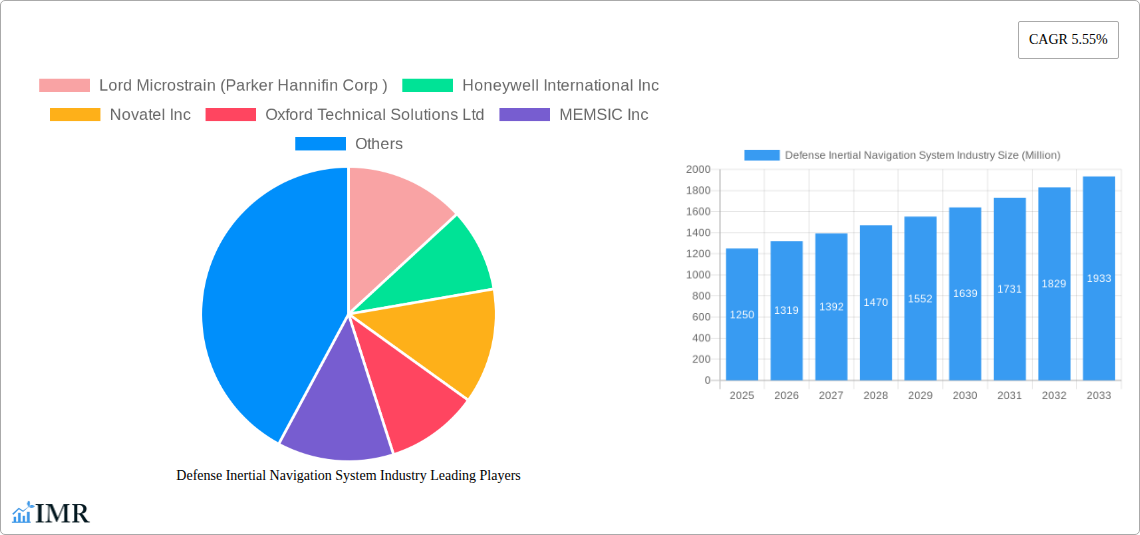

Defense Inertial Navigation System Industry Company Market Share

Defense Inertial Navigation System Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the global Defense Inertial Navigation System (INS) Industry, a critical sector underpinning modern military, aerospace, and advanced civilian applications. The study covers the historical period of 2019-2024, the base and estimated year of 2025, and projects market evolution through 2033. Leveraging high-traffic keywords such as "defense INS market," "inertial navigation systems," "aerospace and defense navigation," "military GPS alternatives," and "autonomous navigation technology," this report is optimized for maximum search engine visibility and engagement with industry professionals, defense contractors, and technology investors.

We dissect the market by parent and child segments, offering granular insights into how different end-user industries and technological advancements shape demand and supply. Quantified data on market size, growth rates, and adoption trends, presented in millions of units, provides a clear picture of current dynamics and future potential.

Defense Inertial Navigation System Industry Market Dynamics & Structure

The Defense Inertial Navigation System (INS) market exhibits a moderate to high concentration, driven by significant R&D investments and stringent performance requirements. Key players like Honeywell International Inc., Northrop Grumman Corporation, and Novatel Inc. dominate with proprietary technologies and established supply chains. Technological innovation is a primary driver, with advancements in MEMS, fiber optic gyroscopes (FOG), and ring laser gyroscopes (RLG) continuously improving accuracy, miniaturization, and cost-effectiveness. Regulatory frameworks, particularly those governing defense procurement and export controls, play a crucial role in shaping market access and product development. Competitive product substitutes, such as advanced GNSS receivers, often complement rather than replace INS due to INS's inherent immunity to jamming and spoofing. End-user demographics are increasingly shifting towards autonomous systems, unmanned aerial vehicles (UAVs), and precision-guided munitions, demanding highly reliable and autonomous navigation solutions. Mergers and acquisitions (M&A) are strategic tools for market consolidation and technology acquisition, with several significant deal volumes observed in the historical period.

- Market Concentration: Moderate to High, with key players holding substantial market share.

- Technological Innovation Drivers: Miniaturization, improved accuracy (lower drift rates), reduced power consumption, enhanced resistance to environmental factors (vibration, shock, temperature), and integration with sensor fusion algorithms.

- Regulatory Frameworks: Strict adherence to defense standards (e.g., MIL-STD), export control regulations (e.g., ITAR), and safety certifications.

- Competitive Product Substitutes: High-accuracy GNSS receivers, vision-based navigation, celestial navigation (historically).

- End-User Demographics: Growing demand from military modernization programs, unmanned systems proliferation, and advanced automotive applications.

- M&A Trends: Strategic acquisitions for technology integration, market expansion, and consolidation.

Defense Inertial Navigation System Industry Growth Trends & Insights

The global Defense Inertial Navigation System (INS) market is poised for robust growth, projected to expand significantly from its base year of 2025 through 2033. This expansion is fueled by an escalating demand for advanced navigation solutions across various sectors, driven by geopolitical developments, technological advancements, and the increasing proliferation of autonomous systems. The market size evolution is characterized by a steady upward trajectory, with adoption rates for high-performance INS systems accelerating, particularly within the aerospace and defense sector. Technological disruptions, such as the integration of artificial intelligence (AI) for sensor fusion and predictive maintenance, are enhancing the capabilities and reliability of INS, making them indispensable for modern warfare and complex civilian operations. Consumer behavior shifts are evident in the growing preference for solutions offering greater autonomy, reduced reliance on external signals like GPS, and enhanced operational efficiency. The Compound Annual Growth Rate (CAGR) is anticipated to remain strong, reflecting sustained investment in defense modernization and the burgeoning civilian applications. Market penetration is deepening as INS technology becomes more accessible and integrated into a wider array of platforms, from small tactical drones to large naval vessels.

Dominant Regions, Countries, or Segments in Defense Inertial Navigation System Industry

The Aerospace and Defense end-user industry unequivocally dominates the Defense Inertial Navigation System (INS) market, acting as the primary growth engine. This dominance is propelled by substantial government defense budgets, ongoing military modernization initiatives worldwide, and the critical need for highly accurate and reliable navigation in complex operational environments. Countries with significant defense spending, such as the United States, China, Russia, and key European nations, represent the largest markets for INS solutions. Economic policies within these regions often prioritize indigenous defense manufacturing and R&D, further bolstering the demand for advanced INS. Infrastructure development in terms of advanced testing facilities and research institutions also contributes to regional dominance. The proliferation of unmanned aerial vehicles (UAVs), guided munitions, and advanced fighter jets necessitates sophisticated INS to ensure mission success, especially in contested electromagnetic environments where GPS signals may be unreliable.

Key Drivers in Aerospace and Defense:

- Military Modernization Programs: Continuous upgrades to aircraft, naval vessels, and ground vehicles.

- Unmanned Systems Proliferation: Increasing deployment of drones for surveillance, reconnaissance, and strike missions.

- Precision Warfare: Demand for highly accurate targeting and navigation for guided munitions.

- Electronic Warfare Countermeasures: INS provides a crucial navigation fallback when GPS is jammed or denied.

- Strategic Importance: National security imperatives driving investment in self-sufficient navigation capabilities.

Dominance Factors:

- Market Share: The Aerospace and Defense segment accounts for over 70% of the global INS market revenue.

- Growth Potential: High, driven by continuous innovation and evolving defense strategies.

- Technological Sophistication: Requirement for state-of-the-art INS performance, pushing the boundaries of accuracy and reliability.

- Long Procurement Cycles: Defense contracts often involve long-term commitments and significant value.

Defense Inertial Navigation System Industry Product Landscape

The Defense Inertial Navigation System (INS) product landscape is characterized by continuous innovation in accuracy, miniaturization, and integration. Products range from high-end, strapdown inertial navigation systems (INS) for aircraft and missiles employing fiber optic gyroscopes (FOG) and ring laser gyroscopes (RLG) to more compact and cost-effective MEMS-based INS for UAVs and ground vehicles. Key applications include autonomous navigation, guidance and control of missiles and munitions, platform stabilization, and position, navigation, and timing (PNT) solutions for dismounted soldiers. Unique selling propositions revolve around ultra-high accuracy (low drift rates), rapid alignment times, robust performance in challenging environments (vibration, shock, extreme temperatures), and seamless integration with other sensors (GNSS, radar, lidar) for enhanced situational awareness and navigation resilience. Technological advancements focus on solid-state inertial sensors, improved Kalman filtering algorithms for sensor fusion, and embedded AI for adaptive navigation.

Key Drivers, Barriers & Challenges in Defense Inertial Navigation System Industry

Key Drivers: The Defense INS market is propelled by the escalating demand for autonomous navigation systems, particularly in the aerospace and defense sector, driven by advancements in UAV technology and precision warfare. The need for reliable navigation independent of GNSS signals, especially in jamming or spoofing environments, is a significant catalyst. Furthermore, the increasing adoption of INS in the automotive sector for advanced driver-assistance systems (ADAS) and autonomous vehicles, coupled with industrial applications requiring precise positioning, contributes to market growth. Technological advancements in MEMS and optical gyroscopes, leading to more compact and affordable solutions, also fuel adoption.

Barriers & Challenges: Despite robust growth, the Defense INS market faces significant challenges. High R&D costs and the lengthy development cycles associated with defense-grade INS present a substantial barrier to entry. Stringent regulatory compliance and certification processes, particularly for military applications, add complexity and time to product deployment. Competition from lower-cost, less sophisticated alternatives in some civilian applications can impact market penetration. Supply chain disruptions and the reliance on specialized components can also pose risks. Furthermore, ensuring cybersecurity for INS integrated with networked systems is an evolving challenge.

Emerging Opportunities in Defense Inertial Navigation System Industry

Emerging opportunities in the Defense INS market are concentrated in the rapidly expanding domain of autonomous systems. The development and widespread deployment of swarming drone technology for both military and commercial purposes present a significant opportunity for compact, highly accurate, and cost-effective INS. Advancements in AI and machine learning are unlocking new possibilities for INS to perform complex navigation tasks with reduced human intervention. The growing demand for enhanced situational awareness and navigation in challenging environments, such as underground operations, dense urban canyons, and underwater, opens avenues for specialized INS solutions. Furthermore, the integration of INS with emerging sensor technologies like quantum sensors holds the potential for unprecedented navigation accuracy and resilience in the future.

Growth Accelerators in the Defense Inertial Navigation System Industry Industry

Several key catalysts are accelerating growth in the Defense INS industry. Technological breakthroughs in miniaturization and cost reduction of high-performance inertial sensors (e.g., advanced MEMS, FOGs) are making INS more accessible across a wider range of platforms. The strategic imperative for nations to develop sovereign PNT capabilities, reducing reliance on external systems, is a significant growth accelerator. Partnerships between established defense contractors and agile technology startups are fostering innovation and speeding up the development of next-generation INS. Market expansion strategies focused on emerging economies with growing defense budgets and the increasing adoption of INS in commercial sectors like robotics and autonomous logistics further contribute to long-term growth.

Key Players Shaping the Defense Inertial Navigation System Industry Market

- Lord Microstrain (Parker Hannifin Corp)

- Honeywell International Inc.

- Novatel Inc.

- Oxford Technical Solutions Ltd

- MEMSIC Inc.

- Aeron Systems Pvt Ltd

- Inertial Sense LLC

- Tersus GNSS Inc

- Northrop Grumman Corporation

Notable Milestones in Defense Inertial Navigation System Industry Sector

- 2022/11: Northrop Grumman Corporation secures a significant contract for advanced INS for next-generation fighter aircraft, highlighting demand for high-performance systems.

- 2023/03: MEMSIC Inc. launches a new generation of compact MEMS IMUs, enabling wider adoption in smaller unmanned systems.

- 2023/07: Honeywell International Inc. announces enhanced sensor fusion capabilities for its INS, improving navigation in GNSS-denied environments.

- 2024/01: Novatel Inc. (part of Hexagon) introduces a new INS/GNSS integration solution targeting the burgeoning autonomous vehicle market.

- 2024/05: Oxford Technical Solutions Ltd (OXTS) showcases their latest INS/GNSS systems for advanced automotive testing and development, reflecting industry expansion.

In-Depth Defense Inertial Navigation System Industry Market Outlook

The future outlook for the Defense Inertial Navigation System (INS) industry is exceptionally promising, driven by an unwavering demand for robust, autonomous navigation solutions. Growth accelerators such as continuous technological innovation in sensor technology and algorithmic sophistication will ensure that INS remains at the forefront of critical applications. Strategic partnerships and the increasing emphasis on national PNT independence will further bolster market expansion. The integration of AI and machine learning into INS platforms promises enhanced adaptive navigation capabilities, opening up new frontiers for autonomous operations across defense, aerospace, and industrial sectors. The market is set for sustained growth, characterized by higher accuracy, smaller form factors, and greater integration with other sensing modalities.

Defense Inertial Navigation System Industry Segmentation

-

1. End-user Industry

- 1.1. Aerospace and Defense

- 1.2. Marine

- 1.3. Automotive

- 1.4. Industrial

Defense Inertial Navigation System Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Defense Inertial Navigation System Industry Regional Market Share

Geographic Coverage of Defense Inertial Navigation System Industry

Defense Inertial Navigation System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increase in Military & Defense Spending

- 3.3. Market Restrains

- 3.3.1. ; Lack of Awareness and Budget to Deploy INS in Emerging Economies

- 3.4. Market Trends

- 3.4.1. Aerospace and Defense Sector Dominates the Inertial Navigation System Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Defense Inertial Navigation System Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Aerospace and Defense

- 5.1.2. Marine

- 5.1.3. Automotive

- 5.1.4. Industrial

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North America Defense Inertial Navigation System Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Aerospace and Defense

- 6.1.2. Marine

- 6.1.3. Automotive

- 6.1.4. Industrial

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. Europe Defense Inertial Navigation System Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Aerospace and Defense

- 7.1.2. Marine

- 7.1.3. Automotive

- 7.1.4. Industrial

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Asia Pacific Defense Inertial Navigation System Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Aerospace and Defense

- 8.1.2. Marine

- 8.1.3. Automotive

- 8.1.4. Industrial

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Rest of the World Defense Inertial Navigation System Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Aerospace and Defense

- 9.1.2. Marine

- 9.1.3. Automotive

- 9.1.4. Industrial

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Lord Microstrain (Parker Hannifin Corp )

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Honeywell International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Novatel Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Oxford Technical Solutions Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 MEMSIC Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Aeron Systems Pvt Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Inertial Sense LLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Tersus GNSS Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Northrop Grumman Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Lord Microstrain (Parker Hannifin Corp )

List of Figures

- Figure 1: Global Defense Inertial Navigation System Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Defense Inertial Navigation System Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 3: North America Defense Inertial Navigation System Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: North America Defense Inertial Navigation System Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Defense Inertial Navigation System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Defense Inertial Navigation System Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 7: Europe Defense Inertial Navigation System Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Europe Defense Inertial Navigation System Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Defense Inertial Navigation System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Defense Inertial Navigation System Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: Asia Pacific Defense Inertial Navigation System Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Asia Pacific Defense Inertial Navigation System Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Defense Inertial Navigation System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Defense Inertial Navigation System Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 15: Rest of the World Defense Inertial Navigation System Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Rest of the World Defense Inertial Navigation System Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Rest of the World Defense Inertial Navigation System Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Defense Inertial Navigation System Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Defense Inertial Navigation System Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Defense Inertial Navigation System Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Defense Inertial Navigation System Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Global Defense Inertial Navigation System Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Defense Inertial Navigation System Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Defense Inertial Navigation System Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Defense Inertial Navigation System Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Defense Inertial Navigation System Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Defense Inertial Navigation System Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Defense Inertial Navigation System Industry?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the Defense Inertial Navigation System Industry?

Key companies in the market include Lord Microstrain (Parker Hannifin Corp ), Honeywell International Inc, Novatel Inc, Oxford Technical Solutions Ltd, MEMSIC Inc, Aeron Systems Pvt Ltd, Inertial Sense LLC, Tersus GNSS Inc, Northrop Grumman Corporation.

3. What are the main segments of the Defense Inertial Navigation System Industry?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increase in Military & Defense Spending.

6. What are the notable trends driving market growth?

Aerospace and Defense Sector Dominates the Inertial Navigation System Market.

7. Are there any restraints impacting market growth?

; Lack of Awareness and Budget to Deploy INS in Emerging Economies.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Defense Inertial Navigation System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Defense Inertial Navigation System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Defense Inertial Navigation System Industry?

To stay informed about further developments, trends, and reports in the Defense Inertial Navigation System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence