Key Insights

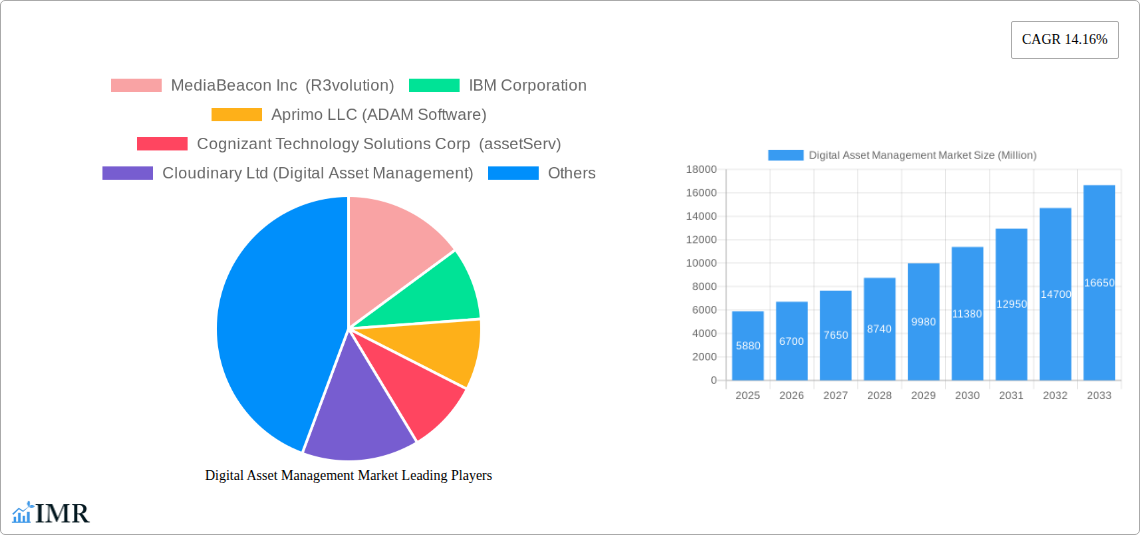

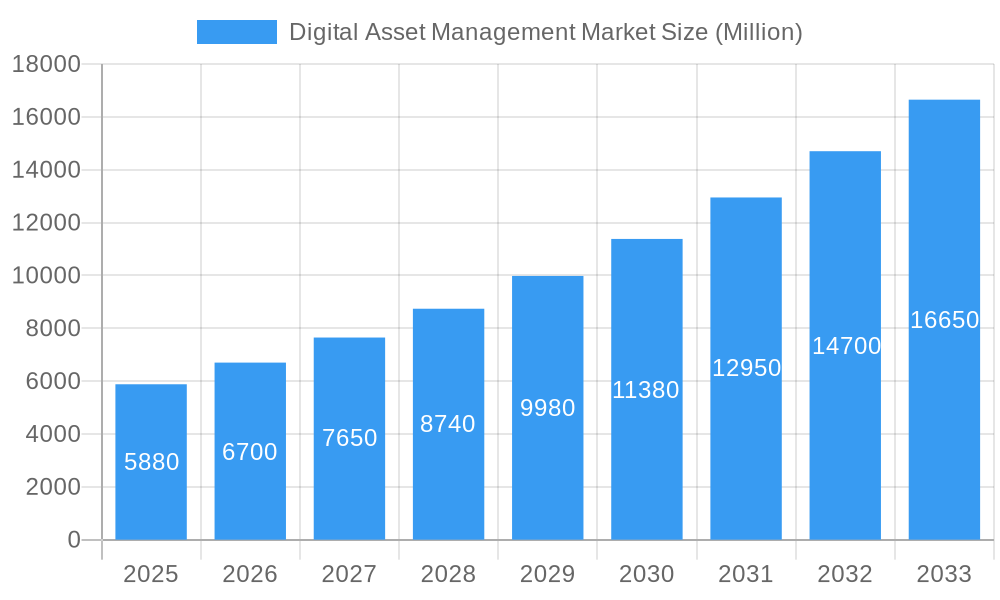

The Digital Asset Management (DAM) market is poised for significant expansion, projected to reach a substantial market size of USD 5.88 billion. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 14.16%, indicating a dynamic and rapidly evolving landscape. The increasing volume and complexity of digital content across industries are primary catalysts, compelling organizations to adopt sophisticated DAM solutions for efficient storage, organization, retrieval, and distribution of their valuable digital assets. The shift towards cloud-based deployments, particularly Software as a Service (SaaS), is a dominant trend, offering scalability, accessibility, and cost-effectiveness for businesses of all sizes. SMEs are increasingly recognizing the strategic importance of DAM, driving significant adoption alongside large enterprises. Key sectors like Media and Entertainment, BFSI, Healthcare, and Retail are at the forefront of DAM implementation, leveraging these solutions to streamline workflows, enhance brand consistency, and accelerate time-to-market for their digital content. The market's momentum is fueled by the growing need for collaboration, compliance, and the intelligent utilization of rich media assets in an increasingly digital-first world.

Digital Asset Management Market Market Size (In Billion)

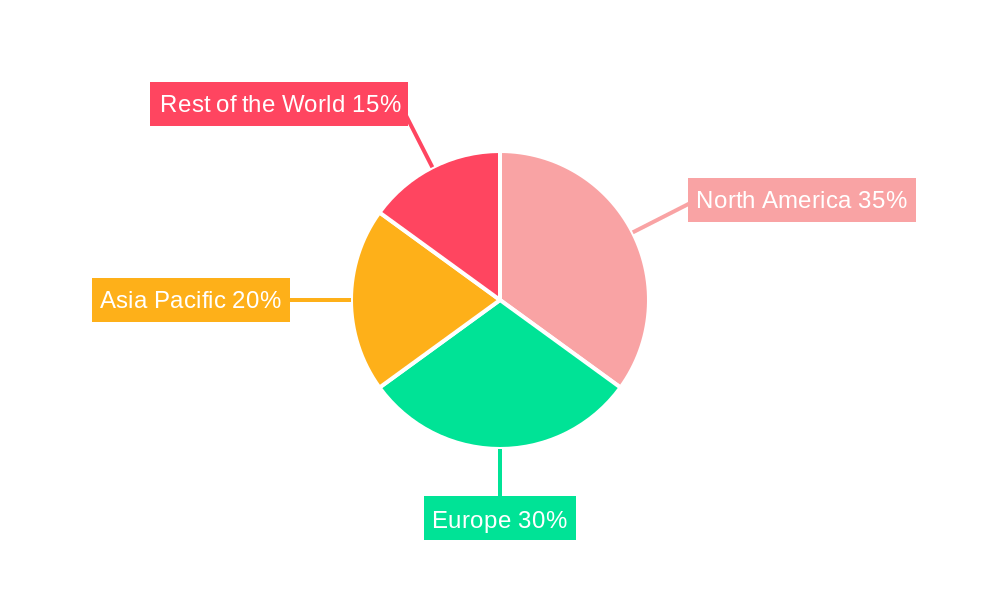

The forecast period from 2025 to 2033 signifies a critical phase for the DAM market, with substantial opportunities emerging for innovative solutions. While the market is experiencing robust growth, certain factors could influence its trajectory. Challenges such as the initial investment costs for comprehensive DAM systems and the need for effective change management within organizations could pose moderate restraints. However, the overwhelming benefits in terms of operational efficiency, risk mitigation, and enhanced brand value are expected to outweigh these challenges. Geographically, North America and Europe are expected to continue their dominance in market share, driven by early adoption and the presence of leading technology providers. Asia Pacific, however, is anticipated to exhibit the highest growth rate, fueled by rapid digital transformation and increasing investments in content creation and management across its burgeoning economies. The competitive landscape is characterized by the presence of established players offering comprehensive suites and emerging vendors focusing on niche functionalities, leading to a dynamic and innovation-driven market.

Digital Asset Management Market Company Market Share

This in-depth report provides a thorough analysis of the global Digital Asset Management (DAM) market, offering critical insights into its dynamics, growth trajectories, and future potential. Covering the period from 2019 to 2033, with a base year of 2025, this research leverages extensive data to pinpoint key drivers, emerging opportunities, and strategic imperatives for stakeholders. The DAM market is projected to experience significant expansion, driven by the increasing volume of digital content, the need for efficient content governance, and the burgeoning adoption of AI-powered solutions. We delve into parent and child market segments, deployment models, organization sizes, and diverse end-user industries to provide a holistic market overview. All monetary values are presented in Million USD.

Digital Asset Management Market Market Dynamics & Structure

The Digital Asset Management (DAM) market exhibits a dynamic and evolving structure, influenced by a confluence of technological advancements, evolving end-user demands, and strategic consolidations. Market concentration varies across different segments, with established players holding significant shares while emerging vendors introduce disruptive innovations. Technological innovation is a primary driver, with AI-powered tagging, intelligent search, and automated workflows becoming increasingly central to DAM solutions. Regulatory frameworks, particularly concerning data privacy and content usage rights, also shape market development, mandating robust governance capabilities within DAM systems. Competitive product substitutes, such as cloud storage solutions with basic asset management features, present a challenge, but dedicated DAM platforms offer superior functionality and integration. End-user demographics are diversifying, with a growing reliance on visual and multimedia content across all sectors fueling demand. Mergers and acquisitions (M&A) are a significant trend, as larger companies seek to expand their DAM portfolios and integrate advanced functionalities. For instance, the acquisition of Digizuite A/S by KeyShot in August 2023 underscores the consolidation aimed at bolstering digital supply chain solutions.

- Market Concentration: Moderately fragmented, with a mix of large enterprise solutions and specialized niche providers.

- Technological Innovation Drivers: AI/ML for metadata enrichment, automation, cloud-native architectures, integration with MarTech stacks.

- Regulatory Frameworks: GDPR, CCPA, and industry-specific compliance mandates (e.g., healthcare HIPAA) necessitate robust access control and audit trails.

- Competitive Product Substitutes: Cloud storage services (Dropbox, Google Drive), content management systems (CMS) with limited asset handling.

- End-User Demographics: Growing adoption in non-traditional sectors like manufacturing and e-commerce, alongside established media and retail.

- M&A Trends: Frequent acquisitions to gain technology, market share, and expand service offerings; expect continued consolidation.

Digital Asset Management Market Growth Trends & Insights

The Digital Asset Management (DAM) market is on a robust growth trajectory, propelled by the exponential increase in digital content creation and consumption across all industries. The estimated market size for 2025 stands at approximately $3,500 Million, with projections indicating a Compound Annual Growth Rate (CAGR) of 15.8% from 2025 to 2033. This impressive growth is underpinned by several key trends. Firstly, the shift towards remote work and distributed teams has amplified the need for centralized, accessible, and collaborative platforms for managing digital assets. Cloud-based (SaaS) DAM solutions are witnessing particularly rapid adoption due to their scalability, cost-effectiveness, and ease of deployment.

Technological disruptions, especially the integration of Artificial Intelligence (AI) and Machine Learning (ML), are revolutionizing DAM capabilities. AI-powered features such as automated metadata tagging, content analysis, and smart search are significantly enhancing efficiency and user experience, reducing manual effort and accelerating asset retrieval. This is particularly evident in the Media and Entertainment sector, where the sheer volume of video and image assets demands sophisticated management. Consumer behavior shifts, including the increasing preference for personalized and visually engaging content, are forcing brands and organizations to produce and manage larger volumes of diverse assets, further driving DAM adoption. The rise of e-commerce and digital marketing necessitates seamless content delivery across multiple channels, making robust DAM systems essential for maintaining brand consistency and accelerating time-to-market.

The penetration of DAM solutions is expanding beyond traditional enterprise users to Small and Medium-sized Enterprises (SMEs), which are increasingly recognizing the value of organized and accessible digital content for competitive advantage. This wider adoption is fueled by more affordable SaaS models and user-friendly interfaces. Industry developments, such as strategic partnerships and acquisitions, are also contributing to market expansion by broadening the scope of DAM solutions and enhancing their integration with existing business workflows. The forecast period of 2025–2033 is expected to witness continued innovation in areas like video asset management, 3D asset management, and the integration of DAM with extended reality (XR) technologies. The market is evolving from a mere storage and organization tool to a strategic platform for content marketing, brand management, and overall digital transformation.

- Market Size Evolution: From approximately $2,800 Million in 2023 to an estimated $3,500 Million in 2025, with strong projected growth.

- Adoption Rates: Rapid increase in Cloud (SaaS) deployment, exceeding on-premise solutions for new implementations. SMEs are increasingly adopting DAM solutions.

- Technological Disruptions: AI/ML for automated metadata, intelligent search, content recommendation engines, and automated workflows are transforming capabilities.

- Consumer Behavior Shifts: Demand for personalized content, visual storytelling, and consistent branding across all touchpoints drives the need for efficient asset management.

- Market Penetration: Significant growth potential remains, especially in industries like manufacturing and healthcare that are digitizing at an accelerated pace.

Dominant Regions, Countries, or Segments in Digital Asset Management Market

North America currently stands as the dominant region in the Digital Asset Management (DAM) market, driven by a mature digital infrastructure, high adoption of advanced technologies, and a strong presence of leading DAM vendors. The United States, in particular, accounts for a significant share of the global DAM market due to its large enterprise base, significant investments in digital marketing, and a robust media and entertainment industry. The region's early adoption of cloud computing and AI technologies has further cemented its leadership position.

The Cloud (SaaS) deployment model is unequivocally the leading segment within the DAM market. This dominance is attributed to its inherent flexibility, scalability, reduced upfront costs, and the ease of accessing and managing assets from anywhere. Businesses of all sizes are increasingly opting for SaaS solutions to avoid the complexities and expenses associated with on-premise infrastructure. This trend is particularly pronounced among SMEs, who find the subscription-based model more manageable for their budgets and IT resources.

Among end-users, the Media and Entertainment industry remains a primary driver of DAM market growth. The sheer volume and complexity of visual and audio content generated and consumed in this sector necessitate sophisticated asset management solutions for efficient storage, organization, retrieval, and distribution. However, other segments are rapidly gaining traction. The Retail sector is increasingly leveraging DAM for e-commerce content optimization, product visualization, and consistent brand messaging across various channels. The BFSI (Banking, Financial Services, and Insurance) sector is adopting DAM for regulatory compliance, secure document management, and enhanced customer communication. The Healthcare industry is also seeing a surge in DAM adoption for managing patient education materials, medical imagery, and research data securely.

The growth in North America is further fueled by strong economic policies that encourage technological innovation and digital transformation. The presence of a highly skilled workforce and significant R&D investments contribute to the development of cutting-edge DAM features. Government initiatives promoting digitalization across various sectors also play a crucial role. For instance, the U.S. government's focus on digital transformation in public services indirectly boosts the demand for robust content management systems, including DAM. The competitive landscape in North America is intense, with major players vying for market share through continuous product innovation and strategic partnerships.

- Leading Region: North America, particularly the United States, due to technological advancement and market maturity.

- Dominant Deployment Segment: Cloud (SaaS) solutions are the primary choice for their scalability, accessibility, and cost-effectiveness.

- Key End-User Segments: Media and Entertainment continue to lead, with significant and growing adoption in Retail, BFSI, and Healthcare.

- Driving Factors in North America: Strong IT infrastructure, high digital marketing spend, government initiatives for digitalization, and presence of major technology hubs.

- Market Share Potential: While North America leads, Europe and Asia-Pacific are showing accelerated growth, indicating a diversifying global market.

Digital Asset Management Market Product Landscape

The Digital Asset Management market product landscape is characterized by rapid innovation, focusing on enhancing user experience, streamlining workflows, and integrating advanced technologies. Modern DAM solutions offer sophisticated capabilities such as AI-driven metadata enrichment, automated content categorization, intelligent search functionalities, and version control. Unique selling propositions often lie in seamless integration with other marketing and creative tools, robust analytics for asset performance, and advanced security features. Technological advancements are enabling richer media support, including 3D models and extended reality (XR) content, catering to evolving industry needs. Customizable workflows and robust API integrations are key to adapting DAM systems to specific organizational requirements, thereby maximizing content ROI.

Key Drivers, Barriers & Challenges in Digital Asset Management Market

The Digital Asset Management market is primarily propelled by the escalating volume of digital content, the necessity for efficient content governance, and the growing demand for enhanced collaboration. Technological advancements, particularly AI and ML for automated tagging and search, are significant drivers. The shift towards digital-first marketing strategies and the increasing need for brand consistency across multiple channels further fuel market expansion. Economic factors, such as the drive for operational efficiency and reduced content creation costs, also contribute positively.

However, the market faces several barriers and challenges. High implementation costs and the perceived complexity of integrating DAM systems with existing IT infrastructure can be a deterrent, especially for SMEs. A lack of awareness regarding the full benefits of DAM solutions and resistance to change within organizations also pose significant hurdles. Furthermore, data security concerns and the need for robust compliance with evolving privacy regulations add to the complexity. Competitive pressures from alternative solutions and the ongoing need for skilled personnel to manage DAM platforms also present challenges.

- Key Drivers:

- Exponential growth in digital content creation and consumption.

- Need for centralized content governance and brand consistency.

- Advancements in AI and Machine Learning for automation.

- Increasing adoption of cloud-based (SaaS) solutions.

- Demand for enhanced collaboration and remote work enablement.

- Barriers & Challenges:

- Perceived high implementation and integration costs.

- Organizational resistance to change and adoption.

- Data security and privacy compliance concerns.

- Lack of skilled personnel for DAM management.

- Intense competition from various content management solutions.

Emerging Opportunities in Digital Asset Management Market

Emerging opportunities in the Digital Asset Management market lie in the expansion of AI-powered capabilities beyond basic tagging. This includes predictive analytics for content performance, automated content personalization for targeted campaigns, and intelligent content recommendation engines. The growing adoption of Extended Reality (XR) technologies, including Augmented Reality (AR) and Virtual Reality (VR), presents a significant opportunity for DAM systems to manage and deliver immersive digital assets. Untapped markets, particularly in developing economies undergoing rapid digital transformation, offer substantial growth potential. Furthermore, the integration of DAM with other enterprise systems, such as Product Information Management (PIM) and Customer Relationship Management (CRM), creates opportunities for more holistic digital workflows and enhanced business intelligence.

Growth Accelerators in the Digital Asset Management Market Industry

The Digital Asset Management (DAM) industry's long-term growth is being significantly accelerated by several key factors. Technological breakthroughs, particularly in the application of Artificial Intelligence (AI) and Machine Learning (ML) for automated metadata generation, content analysis, and predictive insights, are transforming DAM from a repository to a strategic intelligence platform. Strategic partnerships and ecosystem development, where DAM vendors integrate with a wider array of marketing, sales, and creative tools, are enhancing value propositions and expanding reach. Market expansion strategies, including the development of specialized DAM solutions for emerging industries like gaming and decentralized finance (DeFi), are opening new revenue streams. The increasing focus on content provenance and rights management, driven by regulatory pressures and ethical considerations, is also creating demand for more sophisticated DAM functionalities.

Key Players Shaping the Digital Asset Management Market Market

- MediaBeacon Inc (R3volution)

- IBM Corporation

- Aprimo LLC (ADAM Software)

- Cognizant Technology Solutions Corp (assetServ)

- Cloudinary Ltd (Digital Asset Management)

- Digizuite A/

- Adobe Systems Incorporated (Adobe Experience Manager Assets)

- Oracle Corporation (Oracle WebCenter Content)

- CELUM GmbH (CELUM Digital Asset Management)

- Nuxeo (Nuxeo Platform)

- Bynder (Webdam Inc)

- Extensis (Celartem Inc)

- Widen (Digital Asset Management)

- OpenText Corporation (Media Management MediaBin)

- Canto Inc (Canto Digital Asset Management)

Notable Milestones in Digital Asset Management Market Sector

- December 2023: OpenText and Vue.ai joined forces to expand their Digital Asset Management solutions, focusing on AI-powered tagging for media assets, signaling the growing demand for AI-driven DAM solutions.

- August 2023: KeyShot, a subsidiary of Luxion Group ApS specializing in 3D visualization software, made headlines with its acquisition of Digizuite A/S. This strategic move positions KeyShot to offer comprehensive solutions for the digital supply chain landscape by integrating Digizuite's digital asset management solutions, aiming to empower businesses with streamlined asset management, enhanced collaboration, and seamless content delivery.

In-Depth Digital Asset Management Market Market Outlook

The future outlook for the Digital Asset Management market is exceptionally promising, driven by continuous innovation and expanding strategic applications. Growth accelerators such as the pervasive integration of AI for predictive analytics and content personalization will transform DAM into an indispensable tool for intelligent content marketing. The market is poised to capitalize on the burgeoning demand for managing complex media formats, including 3D and XR assets, as these technologies become more mainstream across industries. Strategic partnerships and ecosystem expansion will further embed DAM solutions into broader business workflows, enhancing efficiency and ROI. The increasing emphasis on data governance and compliance will also solidify the role of DAM in ensuring secure and ethical content management. Organizations that invest in robust, AI-enhanced DAM solutions will be best positioned to leverage their digital assets for competitive advantage and drive future growth.

Digital Asset Management Market Segmentation

-

1. Deployment

- 1.1. On-premise

- 1.2. Cloud (SaaS)

-

2. Organization Size

- 2.1. SMEs (Small and Medium Enterprises)

- 2.2. Large Enterprises

-

3. End User

- 3.1. Media and Entertainment

- 3.2. BFSI

- 3.3. Government

- 3.4. Healthcare

- 3.5. Retail

- 3.6. Manufacturing

- 3.7. Other End Users

Digital Asset Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Rest of the World

Digital Asset Management Market Regional Market Share

Geographic Coverage of Digital Asset Management Market

Digital Asset Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Number of Digital Assets

- 3.3. Market Restrains

- 3.3.1. Risk of Data Security Threats

- 3.4. Market Trends

- 3.4.1. Cloud Deployment to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Asset Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-premise

- 5.1.2. Cloud (SaaS)

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. SMEs (Small and Medium Enterprises)

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Media and Entertainment

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Healthcare

- 5.3.5. Retail

- 5.3.6. Manufacturing

- 5.3.7. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Digital Asset Management Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. On-premise

- 6.1.2. Cloud (SaaS)

- 6.2. Market Analysis, Insights and Forecast - by Organization Size

- 6.2.1. SMEs (Small and Medium Enterprises)

- 6.2.2. Large Enterprises

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Media and Entertainment

- 6.3.2. BFSI

- 6.3.3. Government

- 6.3.4. Healthcare

- 6.3.5. Retail

- 6.3.6. Manufacturing

- 6.3.7. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Digital Asset Management Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. On-premise

- 7.1.2. Cloud (SaaS)

- 7.2. Market Analysis, Insights and Forecast - by Organization Size

- 7.2.1. SMEs (Small and Medium Enterprises)

- 7.2.2. Large Enterprises

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Media and Entertainment

- 7.3.2. BFSI

- 7.3.3. Government

- 7.3.4. Healthcare

- 7.3.5. Retail

- 7.3.6. Manufacturing

- 7.3.7. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Pacific Digital Asset Management Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. On-premise

- 8.1.2. Cloud (SaaS)

- 8.2. Market Analysis, Insights and Forecast - by Organization Size

- 8.2.1. SMEs (Small and Medium Enterprises)

- 8.2.2. Large Enterprises

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Media and Entertainment

- 8.3.2. BFSI

- 8.3.3. Government

- 8.3.4. Healthcare

- 8.3.5. Retail

- 8.3.6. Manufacturing

- 8.3.7. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Rest of the World Digital Asset Management Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. On-premise

- 9.1.2. Cloud (SaaS)

- 9.2. Market Analysis, Insights and Forecast - by Organization Size

- 9.2.1. SMEs (Small and Medium Enterprises)

- 9.2.2. Large Enterprises

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Media and Entertainment

- 9.3.2. BFSI

- 9.3.3. Government

- 9.3.4. Healthcare

- 9.3.5. Retail

- 9.3.6. Manufacturing

- 9.3.7. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 MediaBeacon Inc (R3volution)

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 IBM Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Aprimo LLC (ADAM Software)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Cognizant Technology Solutions Corp (assetServ)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Cloudinary Ltd (Digital Asset Management)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Digizuite A/

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Adobe Systems Incorporated (Adobe Experience Manager Assets)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Oracle Corporation (Oracle WebCenter Content)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 CELUM GmbH (CELUM Digital Asset Management)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Nuxeo (Nuxeo Platform)

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Bynder(Webdam Inc )

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Extensis (Celartem Inc )

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Widen (Digital Asset Management)

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 OpenText Corporation (Media Management MediaBin)

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Canto Inc (Canto Digital Asset Management)

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 MediaBeacon Inc (R3volution)

List of Figures

- Figure 1: Global Digital Asset Management Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Digital Asset Management Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Digital Asset Management Market Revenue (Million), by Deployment 2025 & 2033

- Figure 4: North America Digital Asset Management Market Volume (K Unit), by Deployment 2025 & 2033

- Figure 5: North America Digital Asset Management Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 6: North America Digital Asset Management Market Volume Share (%), by Deployment 2025 & 2033

- Figure 7: North America Digital Asset Management Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 8: North America Digital Asset Management Market Volume (K Unit), by Organization Size 2025 & 2033

- Figure 9: North America Digital Asset Management Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 10: North America Digital Asset Management Market Volume Share (%), by Organization Size 2025 & 2033

- Figure 11: North America Digital Asset Management Market Revenue (Million), by End User 2025 & 2033

- Figure 12: North America Digital Asset Management Market Volume (K Unit), by End User 2025 & 2033

- Figure 13: North America Digital Asset Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Digital Asset Management Market Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Digital Asset Management Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Digital Asset Management Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Digital Asset Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Digital Asset Management Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Digital Asset Management Market Revenue (Million), by Deployment 2025 & 2033

- Figure 20: Europe Digital Asset Management Market Volume (K Unit), by Deployment 2025 & 2033

- Figure 21: Europe Digital Asset Management Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 22: Europe Digital Asset Management Market Volume Share (%), by Deployment 2025 & 2033

- Figure 23: Europe Digital Asset Management Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 24: Europe Digital Asset Management Market Volume (K Unit), by Organization Size 2025 & 2033

- Figure 25: Europe Digital Asset Management Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 26: Europe Digital Asset Management Market Volume Share (%), by Organization Size 2025 & 2033

- Figure 27: Europe Digital Asset Management Market Revenue (Million), by End User 2025 & 2033

- Figure 28: Europe Digital Asset Management Market Volume (K Unit), by End User 2025 & 2033

- Figure 29: Europe Digital Asset Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Digital Asset Management Market Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Digital Asset Management Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Digital Asset Management Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Digital Asset Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Digital Asset Management Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Digital Asset Management Market Revenue (Million), by Deployment 2025 & 2033

- Figure 36: Asia Pacific Digital Asset Management Market Volume (K Unit), by Deployment 2025 & 2033

- Figure 37: Asia Pacific Digital Asset Management Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 38: Asia Pacific Digital Asset Management Market Volume Share (%), by Deployment 2025 & 2033

- Figure 39: Asia Pacific Digital Asset Management Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 40: Asia Pacific Digital Asset Management Market Volume (K Unit), by Organization Size 2025 & 2033

- Figure 41: Asia Pacific Digital Asset Management Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 42: Asia Pacific Digital Asset Management Market Volume Share (%), by Organization Size 2025 & 2033

- Figure 43: Asia Pacific Digital Asset Management Market Revenue (Million), by End User 2025 & 2033

- Figure 44: Asia Pacific Digital Asset Management Market Volume (K Unit), by End User 2025 & 2033

- Figure 45: Asia Pacific Digital Asset Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific Digital Asset Management Market Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific Digital Asset Management Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Digital Asset Management Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Digital Asset Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Digital Asset Management Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Rest of the World Digital Asset Management Market Revenue (Million), by Deployment 2025 & 2033

- Figure 52: Rest of the World Digital Asset Management Market Volume (K Unit), by Deployment 2025 & 2033

- Figure 53: Rest of the World Digital Asset Management Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 54: Rest of the World Digital Asset Management Market Volume Share (%), by Deployment 2025 & 2033

- Figure 55: Rest of the World Digital Asset Management Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 56: Rest of the World Digital Asset Management Market Volume (K Unit), by Organization Size 2025 & 2033

- Figure 57: Rest of the World Digital Asset Management Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 58: Rest of the World Digital Asset Management Market Volume Share (%), by Organization Size 2025 & 2033

- Figure 59: Rest of the World Digital Asset Management Market Revenue (Million), by End User 2025 & 2033

- Figure 60: Rest of the World Digital Asset Management Market Volume (K Unit), by End User 2025 & 2033

- Figure 61: Rest of the World Digital Asset Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 62: Rest of the World Digital Asset Management Market Volume Share (%), by End User 2025 & 2033

- Figure 63: Rest of the World Digital Asset Management Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Rest of the World Digital Asset Management Market Volume (K Unit), by Country 2025 & 2033

- Figure 65: Rest of the World Digital Asset Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Rest of the World Digital Asset Management Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Digital Asset Management Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 2: Global Digital Asset Management Market Volume K Unit Forecast, by Deployment 2020 & 2033

- Table 3: Global Digital Asset Management Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 4: Global Digital Asset Management Market Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 5: Global Digital Asset Management Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Digital Asset Management Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Global Digital Asset Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Digital Asset Management Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Digital Asset Management Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 10: Global Digital Asset Management Market Volume K Unit Forecast, by Deployment 2020 & 2033

- Table 11: Global Digital Asset Management Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 12: Global Digital Asset Management Market Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 13: Global Digital Asset Management Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Digital Asset Management Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Global Digital Asset Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Digital Asset Management Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Digital Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Digital Asset Management Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Digital Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Digital Asset Management Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Global Digital Asset Management Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 22: Global Digital Asset Management Market Volume K Unit Forecast, by Deployment 2020 & 2033

- Table 23: Global Digital Asset Management Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 24: Global Digital Asset Management Market Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 25: Global Digital Asset Management Market Revenue Million Forecast, by End User 2020 & 2033

- Table 26: Global Digital Asset Management Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 27: Global Digital Asset Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Digital Asset Management Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 29: United Kingdom Digital Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Digital Asset Management Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Germany Digital Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Digital Asset Management Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: France Digital Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: France Digital Asset Management Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Digital Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Digital Asset Management Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Digital Asset Management Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 38: Global Digital Asset Management Market Volume K Unit Forecast, by Deployment 2020 & 2033

- Table 39: Global Digital Asset Management Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 40: Global Digital Asset Management Market Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 41: Global Digital Asset Management Market Revenue Million Forecast, by End User 2020 & 2033

- Table 42: Global Digital Asset Management Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 43: Global Digital Asset Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Digital Asset Management Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 45: China Digital Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: China Digital Asset Management Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Digital Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: India Digital Asset Management Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Japan Digital Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Japan Digital Asset Management Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Rest of Asia Pacific Digital Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Digital Asset Management Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Global Digital Asset Management Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 54: Global Digital Asset Management Market Volume K Unit Forecast, by Deployment 2020 & 2033

- Table 55: Global Digital Asset Management Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 56: Global Digital Asset Management Market Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 57: Global Digital Asset Management Market Revenue Million Forecast, by End User 2020 & 2033

- Table 58: Global Digital Asset Management Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 59: Global Digital Asset Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Digital Asset Management Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Asset Management Market?

The projected CAGR is approximately 14.16%.

2. Which companies are prominent players in the Digital Asset Management Market?

Key companies in the market include MediaBeacon Inc (R3volution), IBM Corporation, Aprimo LLC (ADAM Software), Cognizant Technology Solutions Corp (assetServ), Cloudinary Ltd (Digital Asset Management), Digizuite A/, Adobe Systems Incorporated (Adobe Experience Manager Assets), Oracle Corporation (Oracle WebCenter Content), CELUM GmbH (CELUM Digital Asset Management), Nuxeo (Nuxeo Platform), Bynder(Webdam Inc ), Extensis (Celartem Inc ), Widen (Digital Asset Management), OpenText Corporation (Media Management MediaBin), Canto Inc (Canto Digital Asset Management).

3. What are the main segments of the Digital Asset Management Market?

The market segments include Deployment, Organization Size, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Number of Digital Assets.

6. What are the notable trends driving market growth?

Cloud Deployment to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Risk of Data Security Threats.

8. Can you provide examples of recent developments in the market?

December 2023: OpenText and Vue.ai joined forces to expand their Digital Asset Management solutions. They focused on AI-powered tagging for media assets, signaling the growing demand for AI-driven DAM solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Asset Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Asset Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Asset Management Market?

To stay informed about further developments, trends, and reports in the Digital Asset Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence