Key Insights

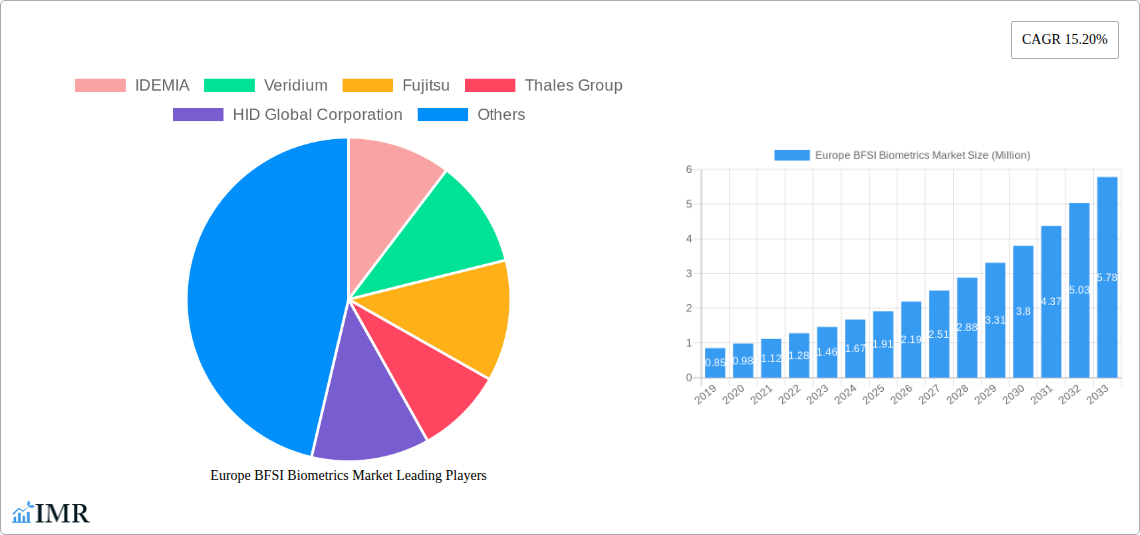

The European BFSI (Banking, Financial Services, and Insurance) biometrics market is poised for substantial growth, projected to reach $2.30 million with a robust Compound Annual Growth Rate (CAGR) of 15.20% from 2019 to 2033. This significant expansion is primarily driven by the escalating need for enhanced security measures to combat sophisticated fraud and cyber threats within the financial sector. Key technological advancements in biometric modalities, such as voice and facial recognition, coupled with the increasing adoption of multi-factor authentication, are fundamental drivers. The shift towards contactless solutions, including iris and vein recognition, is further accelerating market penetration, offering a more hygienic and convenient user experience, especially in the post-pandemic era. Growing consumer trust and regulatory mandates for stringent data protection are also contributing to the widespread implementation of biometric authentication across various BFSI applications, including ATM access, internet banking, and mobile payment systems.

Europe BFSI Biometrics Market Market Size (In Million)

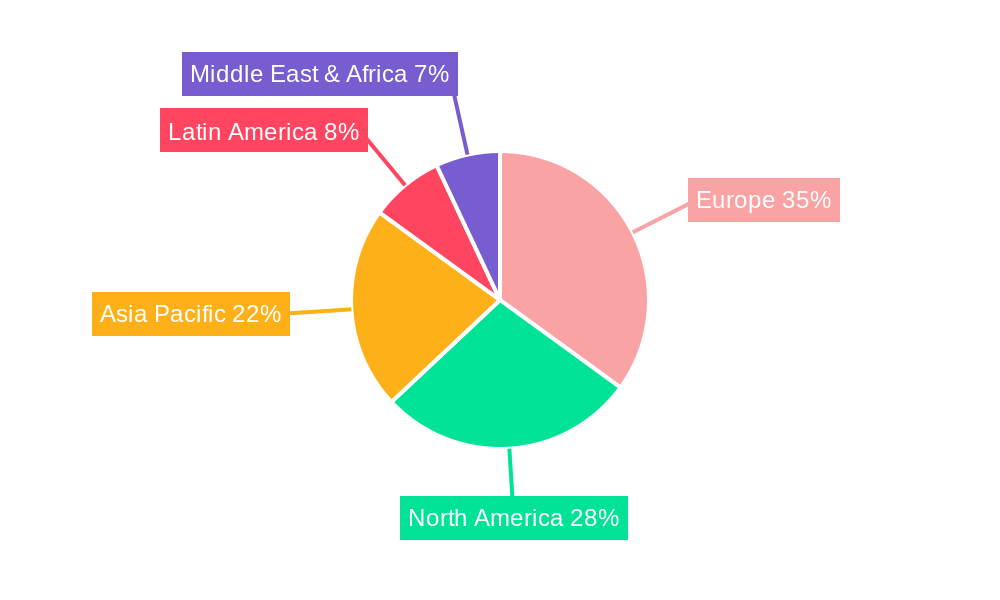

The market is segmented by authentication type, with multi-factor authentication holding a dominant position due to its superior security capabilities. Contactless biometric solutions are gaining traction over contact-based methods, reflecting a growing preference for speed and hygiene. Within product types, voice recognition and facial recognition are emerging as leading technologies, owing to their ease of integration and relatively lower implementation costs. The application landscape is dominated by internet banking and mobile banking, where the demand for secure and seamless customer authentication is paramount. Europe, with its strong regulatory framework and high adoption rate of digital financial services, is a key region for this market. Leading countries like the United Kingdom, Germany, and France are at the forefront of adopting advanced biometric solutions. Despite the strong growth trajectory, challenges such as high initial investment costs for some advanced technologies and concerns regarding data privacy and potential breaches could pose moderate restraints to even faster growth.

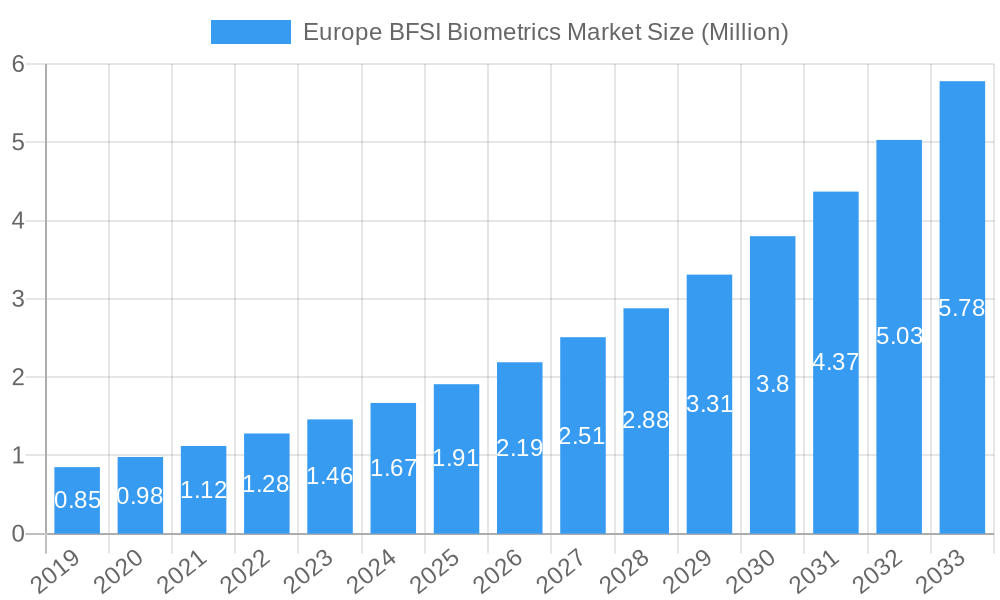

Europe BFSI Biometrics Market Company Market Share

Europe BFSI Biometrics Market: Comprehensive Report Analysis and Forecast (2019-2033)

This report offers a deep dive into the Europe BFSI Biometrics Market, a rapidly evolving sector driven by the increasing demand for secure and seamless financial transactions. With the Base Year at 2025 and a Forecast Period spanning 2025–2033, this analysis covers historical trends from 2019–2024 and provides an Estimated Year of 2025. We will explore market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, opportunities, growth accelerators, key players, notable milestones, and an in-depth market outlook. The market is valued in Million Units.

Europe BFSI Biometrics Market Market Dynamics & Structure

The Europe BFSI Biometrics Market exhibits a moderate to high concentration, with leading players like IDEMIA, Thales Group, and HID Global Corporation holding significant market share. Technological innovation is the primary driver, fueled by the constant pursuit of enhanced security and improved customer experience. The stringent regulatory landscape in Europe, including GDPR, mandates robust data protection and privacy, which indirectly promotes the adoption of secure biometric solutions. Competitive product substitutes exist, primarily traditional authentication methods like passwords and PINs, but their limitations in terms of security and convenience are increasingly evident. End-user demographics are shifting towards a tech-savvy population, comfortable with advanced authentication methods, particularly younger generations and digital banking users. Mergers and acquisitions (M&A) are on the rise as companies seek to consolidate market presence and acquire innovative technologies. For instance, the M&A activity has seen an estimated 5-10% of market players actively involved in strategic acquisitions or partnerships aimed at expanding their service offerings and geographical reach. Innovation barriers include the high cost of implementing advanced biometric systems and the need for extensive user education.

- Market Concentration: Moderate to High, with key players dominating market share.

- Technological Innovation Drivers: Enhanced security, fraud prevention, seamless customer experience, rise of digital banking.

- Regulatory Frameworks: GDPR, PSD2, and other data privacy regulations influencing solution design and adoption.

- Competitive Product Substitutes: Traditional passwords, PINs, OTPs.

- End-User Demographics: Growing adoption among millennials and Gen Z, increasing demand for mobile banking security.

- M&A Trends: Consolidation for technology acquisition and market expansion, with an estimated X million units in deal value.

Europe BFSI Biometrics Market Growth Trends & Insights

The Europe BFSI Biometrics Market is experiencing robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 15-20% during the forecast period. This expansion is underpinned by a significant increase in the adoption of biometric solutions across various financial services. The market size is expected to grow from an estimated value of XX Million Units in 2025 to reach XX Million Units by 2033. Technological disruptions, such as the advancement of AI and machine learning in biometric algorithms, are enhancing accuracy and speed, making them more appealing for widespread implementation. Consumer behavior is a critical factor, with a growing preference for convenient and secure authentication methods, especially for mobile banking and online payments. Biometrics offers a superior user experience compared to cumbersome traditional methods, leading to higher adoption rates. The push for digital transformation within the BFSI sector, coupled with the rising threat of cybercrime, necessitates the implementation of advanced security measures, making biometrics a non-negotiable component. Market penetration is projected to increase significantly, with an estimated XX% of financial transactions utilizing biometric authentication by the end of the forecast period. The integration of biometrics into payment cards, mobile wallets, and online banking platforms is accelerating this trend, promising a more secure and user-friendly financial ecosystem.

Dominant Regions, Countries, or Segments in Europe BFSI Biometrics Market

Within the Europe BFSI Biometrics Market, Multi-factor Authentication stands out as the dominant segment within Authentication Type. This dominance is driven by the critical need for layered security in financial transactions, a direct response to evolving cyber threats and regulatory mandates. The continent's mature financial services industry and high consumer awareness regarding data security further bolster the adoption of multi-factor solutions.

In terms of Contact Type, Non-contact Based biometrics, such as facial and iris recognition, are rapidly gaining traction, driven by hygiene concerns and the desire for seamless, contactless interactions, particularly in the post-pandemic era. However, Contact-based solutions, primarily fingerprint identification, maintain a strong presence due to their established reliability and cost-effectiveness in many applications.

Among Product Types, Facial Recognition is emerging as a significant growth driver, owing to its ease of integration into existing infrastructure and its ability to provide a user-friendly experience. However, Fingerprint Identification continues to hold a substantial market share due to its widespread deployment in mobile devices and payment cards.

The Application segment of Mobile Banking is experiencing the most explosive growth. The sheer volume of mobile banking users and the increasing reliance on smartphones for financial activities make it a prime area for biometric integration. Payment Authentication also plays a crucial role, encompassing in-app payments, online purchases, and contactless transactions.

Leading countries driving this growth include the United Kingdom, Germany, and France, owing to their robust financial sectors, proactive regulatory environments, and high adoption rates of digital technologies. Economic policies supporting digital innovation and strong investments in cybersecurity infrastructure further fuel the market in these regions. Market share within these dominant segments is estimated to be: Multi-factor Authentication (approx. 70%), Non-contact Based (approx. 55% growth in adoption), Facial Recognition (approx. 25% market share in new deployments), Mobile Banking Application (approx. 40% of all biometric applications), and the United Kingdom leading in overall market penetration.

- Dominant Authentication Type: Multi-factor Authentication.

- Dominant Contact Type: Non-contact Based (growing rapidly), Contact-based (established).

- Dominant Product Type: Facial Recognition (high growth), Fingerprint Identification (significant share).

- Dominant Application: Mobile Banking, Payment Authentication.

- Leading Countries: United Kingdom, Germany, France.

- Key Drivers: Robust financial sectors, proactive regulations, digital innovation, cybersecurity investments.

Europe BFSI Biometrics Market Product Landscape

The Europe BFSI Biometrics Market is characterized by continuous product innovation focused on enhancing accuracy, speed, and user experience. Leading companies are introducing advanced biometric solutions that integrate seamlessly with existing BFSI infrastructure. Innovations include contactless fingerprint sensors for payment cards, real-time liveness detection for facial recognition to prevent spoofing, and multimodal biometric systems that combine multiple authentication factors for superior security. Performance metrics are steadily improving, with lower false acceptance rates (FAR) and false rejection rates (FRR) being key benchmarks. The product landscape also features the development of more energy-efficient biometric modules for mobile devices and the integration of AI and machine learning algorithms to adapt and learn user patterns, thereby increasing security over time. Unique selling propositions often revolve around robust data encryption, compliance with stringent European data privacy regulations, and ease of integration for financial institutions.

Key Drivers, Barriers & Challenges in Europe BFSI Biometrics Market

Key Drivers: The primary forces propelling the Europe BFSI Biometrics Market are the escalating need for enhanced security and fraud prevention in the financial sector, driven by increasing cyber threats and sophisticated attack vectors. The growing adoption of digital banking services and mobile payments by consumers, who demand convenient and seamless authentication, is another significant driver. Supportive regulatory frameworks, such as PSD2, which encourages strong customer authentication, further accelerate market growth. Technological advancements in biometric algorithms, leading to higher accuracy and lower costs, also play a crucial role.

Barriers & Challenges: Significant challenges include the high initial investment costs associated with deploying advanced biometric systems, which can be a deterrent for smaller financial institutions. Regulatory hurdles and the complexities of data privacy regulations, like GDPR, require careful implementation and ongoing compliance efforts, posing a significant challenge. Public perception and user acceptance of biometric data collection, coupled with concerns about potential data breaches, can also act as a restraint. Furthermore, interoperability issues between different biometric systems and the need for robust infrastructure to support large-scale deployments present logistical challenges. Supply chain disruptions for specialized hardware can also impact deployment timelines. The estimated quantifiable impact of these challenges on market growth could be a reduction of XX-XX% in projected CAGR.

Emerging Opportunities in Europe BFSI Biometrics Market

Emerging opportunities in the Europe BFSI Biometrics Market lie in the expansion of biometric authentication for a wider range of financial services, including loan applications, insurance claims processing, and wealth management. The untapped potential in small and medium-sized enterprises (SMEs) within the BFSI sector presents a significant opportunity for cost-effective biometric solutions. Evolving consumer preferences for personalized and frictionless banking experiences are driving demand for more intuitive biometric interfaces. The development of biometric solutions for embedded finance, where financial services are integrated into non-financial platforms, also offers a fertile ground for innovation. Furthermore, the increasing focus on cybersecurity in the wake of rising cyberattacks is creating a continuous demand for advanced and reliable biometric technologies.

Growth Accelerators in the Europe BFSI Biometrics Market Industry

Catalysts driving long-term growth in the Europe BFSI Biometrics Market include groundbreaking technological breakthroughs in areas such as behavioral biometrics, which analyzes unique user patterns, and the increasing affordability of advanced sensors. Strategic partnerships between biometric technology providers and established BFSI institutions are crucial for market penetration and the development of tailored solutions. Market expansion strategies, including focusing on underserved regions and developing specialized biometric applications for niche financial services, will further accelerate growth. The ongoing digitalization of the BFSI sector, coupled with a strong consumer appetite for secure and convenient digital interactions, creates a sustained demand for biometric solutions.

Key Players Shaping the Europe BFSI Biometrics Market Market

- IDEMIA

- Veridium

- Fujitsu

- Thales Group

- HID Global Corporation

- Fulcrum Biometrics Inc

- Precise Biometrics AB

- Verint VoiceVault

- M2SYS Technologies

- Aware Inc

Notable Milestones in Europe BFSI Biometrics Market Sector

- December 2023: Fingerprint Cards (Fingerprints) announced the launch of an advanced iteration of Thales Gemalto biometric payment cards, primed for widespread global implementation. This cutting-edge solution from Thales incorporates Fingerprints' T-Shape sensor (T2) and biometric payment software platform, providing users with accelerated transaction speed, heightened power efficiency, and bolstered security measures.

- October 2023: Entersekt launched the integration of mobile application authentication with biometrics for financial institutions utilizing the Q2 Digital Banking Platform. Previously, Entersekt allowed bank and credit union clients to use biometrics for client login and transaction authentication through a browser. This new release extends the biometric authentication capabilities to their mobile banking platform, ensuring a seamless user experience across various banking channels.

In-Depth Europe BFSI Biometrics Market Market Outlook

The future outlook for the Europe BFSI Biometrics Market is exceptionally strong, driven by sustained innovation and increasing adoption across all facets of the financial services industry. Growth accelerators such as the continuous refinement of AI-powered biometric algorithms, the expansion of multimodal authentication systems, and the strategic integration of biometrics into emerging financial technologies like decentralized finance (DeFi) will propel the market forward. Strategic partnerships and collaborations between technology providers and financial institutions will continue to be pivotal in developing secure, compliant, and user-friendly solutions. The market is poised for significant expansion as financial institutions prioritize robust security measures and enhanced customer experiences in the face of an ever-evolving digital landscape, promising a secure and convenient future for financial transactions across Europe.

Europe BFSI Biometrics Market Segmentation

-

1. Authentication Type

- 1.1. Single Authentication Factor

- 1.2. Multi-factor Authentication

-

2. Contact Type

- 2.1. Contact-based

- 2.2. Non-contact Based

-

3. Product Type

- 3.1. Voice Recognition

- 3.2. Facial Recognition

- 3.3. Fingerprint Identification

- 3.4. Vein Recognition

- 3.5. Iris Recognition

-

4. Application

- 4.1. Door Security

- 4.2. ATM

- 4.3. Internet Banking

- 4.4. Mobile Banking

- 4.5. Payment Authentication

Europe BFSI Biometrics Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe BFSI Biometrics Market Regional Market Share

Geographic Coverage of Europe BFSI Biometrics Market

Europe BFSI Biometrics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Digitalization of Banking Services; Biometrics Enable Banks to Improve Customer Engagement Levels

- 3.3. Market Restrains

- 3.3.1. Increasing Digitalization of Banking Services; Biometrics Enable Banks to Improve Customer Engagement Levels

- 3.4. Market Trends

- 3.4.1. Fingerprint Biometric to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe BFSI Biometrics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Authentication Type

- 5.1.1. Single Authentication Factor

- 5.1.2. Multi-factor Authentication

- 5.2. Market Analysis, Insights and Forecast - by Contact Type

- 5.2.1. Contact-based

- 5.2.2. Non-contact Based

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Voice Recognition

- 5.3.2. Facial Recognition

- 5.3.3. Fingerprint Identification

- 5.3.4. Vein Recognition

- 5.3.5. Iris Recognition

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Door Security

- 5.4.2. ATM

- 5.4.3. Internet Banking

- 5.4.4. Mobile Banking

- 5.4.5. Payment Authentication

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Authentication Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 IDEMIA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Veridium

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fujitsu

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Thales Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HID Global Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fulcrum Biometrics Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Precise Biometrics AB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Verint VoiceVault

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 M2SYS Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Aware Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 IDEMIA

List of Figures

- Figure 1: Europe BFSI Biometrics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe BFSI Biometrics Market Share (%) by Company 2025

List of Tables

- Table 1: Europe BFSI Biometrics Market Revenue Million Forecast, by Authentication Type 2020 & 2033

- Table 2: Europe BFSI Biometrics Market Volume Billion Forecast, by Authentication Type 2020 & 2033

- Table 3: Europe BFSI Biometrics Market Revenue Million Forecast, by Contact Type 2020 & 2033

- Table 4: Europe BFSI Biometrics Market Volume Billion Forecast, by Contact Type 2020 & 2033

- Table 5: Europe BFSI Biometrics Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Europe BFSI Biometrics Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 7: Europe BFSI Biometrics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Europe BFSI Biometrics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 9: Europe BFSI Biometrics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Europe BFSI Biometrics Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Europe BFSI Biometrics Market Revenue Million Forecast, by Authentication Type 2020 & 2033

- Table 12: Europe BFSI Biometrics Market Volume Billion Forecast, by Authentication Type 2020 & 2033

- Table 13: Europe BFSI Biometrics Market Revenue Million Forecast, by Contact Type 2020 & 2033

- Table 14: Europe BFSI Biometrics Market Volume Billion Forecast, by Contact Type 2020 & 2033

- Table 15: Europe BFSI Biometrics Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 16: Europe BFSI Biometrics Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 17: Europe BFSI Biometrics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Europe BFSI Biometrics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 19: Europe BFSI Biometrics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Europe BFSI Biometrics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 21: United Kingdom Europe BFSI Biometrics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Europe BFSI Biometrics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Germany Europe BFSI Biometrics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Europe BFSI Biometrics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: France Europe BFSI Biometrics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: France Europe BFSI Biometrics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Italy Europe BFSI Biometrics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Italy Europe BFSI Biometrics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Spain Europe BFSI Biometrics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Spain Europe BFSI Biometrics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Netherlands Europe BFSI Biometrics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Netherlands Europe BFSI Biometrics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Belgium Europe BFSI Biometrics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Belgium Europe BFSI Biometrics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Sweden Europe BFSI Biometrics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Sweden Europe BFSI Biometrics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Norway Europe BFSI Biometrics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Norway Europe BFSI Biometrics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Poland Europe BFSI Biometrics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Poland Europe BFSI Biometrics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Denmark Europe BFSI Biometrics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Denmark Europe BFSI Biometrics Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe BFSI Biometrics Market?

The projected CAGR is approximately 15.20%.

2. Which companies are prominent players in the Europe BFSI Biometrics Market?

Key companies in the market include IDEMIA, Veridium, Fujitsu, Thales Group, HID Global Corporation, Fulcrum Biometrics Inc, Precise Biometrics AB, Verint VoiceVault, M2SYS Technologies, Aware Inc.

3. What are the main segments of the Europe BFSI Biometrics Market?

The market segments include Authentication Type, Contact Type, Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Digitalization of Banking Services; Biometrics Enable Banks to Improve Customer Engagement Levels.

6. What are the notable trends driving market growth?

Fingerprint Biometric to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Increasing Digitalization of Banking Services; Biometrics Enable Banks to Improve Customer Engagement Levels.

8. Can you provide examples of recent developments in the market?

December 2023: Fingerprint Cards (Fingerprints) announced the launch of an advanced iteration of Thales Gemalto biometric payment cards, primed for widespread global implementation. This cutting-edge solution from Thales incorporates Fingerprints' T-Shape sensor (T2) and biometric payment software platform, providing users with accelerated transaction speed, heightened power efficiency, and bolstered security measures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe BFSI Biometrics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe BFSI Biometrics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe BFSI Biometrics Market?

To stay informed about further developments, trends, and reports in the Europe BFSI Biometrics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence