Key Insights

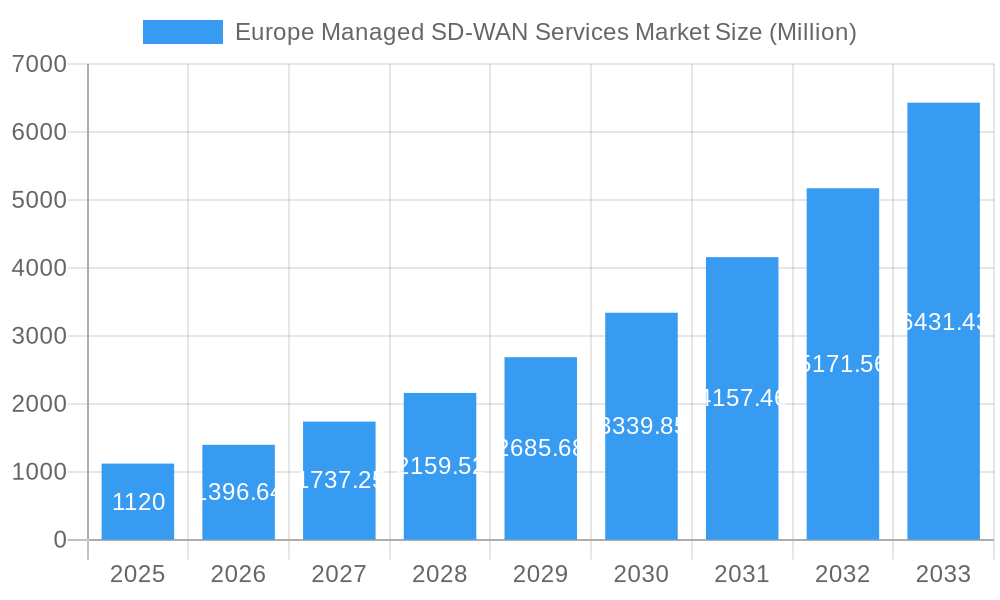

The European Managed SD-WAN Services Market is poised for explosive growth, projected to reach a significant valuation of $1.12 billion by 2025. This rapid expansion is fueled by a remarkable Compound Annual Growth Rate (CAGR) of 24.70%, indicating a strong demand for advanced network solutions. Key drivers behind this surge include the increasing need for agile, secure, and cost-effective network management, particularly as businesses grapple with the complexities of hybrid and multi-cloud environments. The proliferation of remote work and the growing adoption of cloud-based applications by organizations of all sizes, from small and medium-sized enterprises (SMEs) to large corporations, are also propelling this market forward. The IT and Telecom sector, BFSI, and Healthcare are at the forefront of adopting these solutions, leveraging them to enhance connectivity, improve application performance, and streamline operations. Furthermore, the ongoing digital transformation initiatives across the manufacturing and retail sectors are creating substantial opportunities for managed SD-WAN providers.

Europe Managed SD-WAN Services Market Market Size (In Billion)

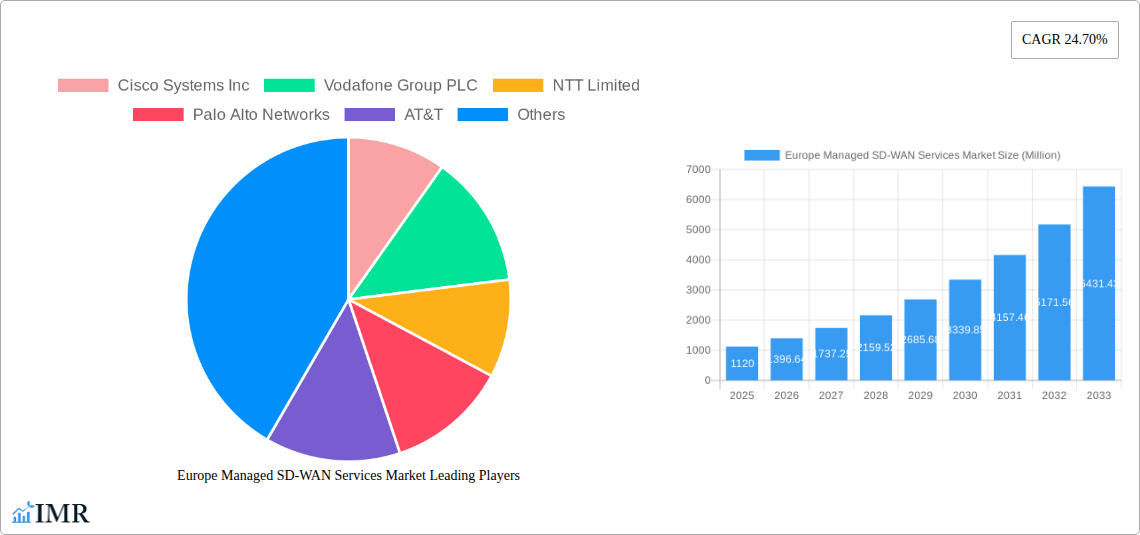

Emerging trends like the integration of AI and machine learning for network automation and predictive analytics are set to redefine the landscape of managed SD-WAN services in Europe. These advancements promise to deliver enhanced network visibility, proactive issue resolution, and optimized resource allocation, further solidifying the value proposition of these services. While the market is characterized by robust growth, certain restraints, such as the initial implementation costs and the need for specialized IT skills, may pose challenges for some organizations. However, the overarching benefits of improved network performance, reduced operational expenses, and enhanced security through centralized policy management are compelling businesses to overcome these hurdles. Leading companies like Cisco Systems Inc, Vodafone Group PLC, and Palo Alto Networks are actively shaping this market through continuous innovation and strategic partnerships, ensuring a dynamic and competitive environment that ultimately benefits end-users across key European nations like the United Kingdom, Germany, and France.

Europe Managed SD-WAN Services Market Company Market Share

Unlock critical insights into the burgeoning Europe Managed SD-WAN Services Market. This in-depth report, covering the period from 2019 to 2033 with a base year of 2025, provides a granular examination of market dynamics, growth trends, regional dominance, and the competitive landscape. With a focus on managed SD-WAN solutions, software-defined networking, and enterprise connectivity, this report is an indispensable resource for industry professionals, service providers, and stakeholders seeking to capitalize on the evolving digital infrastructure needs across Europe.

This report delves into key segments including Organization Size (Small and Medium Enterprises, Large Enterprises) and End User industries (BFSI, IT and Telecom, Healthcare, Retail and E-commerce, Manufacturing, Other End Users). We analyze the impact of significant industry developments, such as the June 2024 partnership between Haier Europe and Orange Business for dynamic SD-WAN implementation, underscoring the strategic importance of cloud, connectivity, and cybersecurity in modern enterprise transformation. All values are presented in Million units, offering a clear and actionable understanding of market scale and potential.

Europe Managed SD-WAN Services Market Market Dynamics & Structure

The Europe Managed SD-WAN Services Market is characterized by a dynamic and evolving structure, driven by rapid technological advancements and increasing enterprise demand for agile, secure, and cost-effective network solutions. Market concentration is moderately fragmented, with a mix of established telecommunication giants and specialized SD-WAN providers vying for market share. Technological innovation is a primary driver, with continuous advancements in cloud integration, network security, and application performance optimization shaping the competitive landscape. Regulatory frameworks, particularly around data privacy and cross-border connectivity, are also influencing service deployment and adoption strategies. Competitive product substitutes, such as traditional MPLS networks and basic VPN solutions, are gradually being outpaced by the flexibility and intelligence offered by SD-WAN. End-user demographics are broad, encompassing a diverse range of industries, each with unique connectivity requirements. Mergers and acquisitions (M&A) remain a significant trend, as larger players acquire innovative smaller companies to expand their service portfolios and geographical reach.

- Market Concentration: A blend of large-scale network providers and niche SD-WAN specialists, fostering both collaboration and competition.

- Technological Innovation Drivers: Focus on AI-powered network management, enhanced security features, and seamless multi-cloud integration.

- Regulatory Frameworks: Evolving compliance standards for data sovereignty and cybersecurity impacting network architecture decisions.

- Competitive Product Substitutes: Gradual shift from legacy WAN technologies to more flexible and cost-efficient SD-WAN solutions.

- End-User Demographics: Diverse adoption across sectors driven by digital transformation initiatives.

- M&A Trends: Strategic acquisitions to consolidate market position and enhance technological capabilities.

Europe Managed SD-WAN Services Market Growth Trends & Insights

The Europe Managed SD-WAN Services Market is poised for robust growth, fueled by the pervasive digital transformation across all enterprise sectors. The market size is projected to expand significantly from an estimated value of \$X,XXX Million in 2025 to \$XX,XXX Million by 2033, exhibiting a compelling Compound Annual Growth Rate (CAGR) of XX.X% during the forecast period. Adoption rates are accelerating as organizations increasingly recognize the limitations of traditional Wide Area Networks (WANs) in supporting cloud-centric applications, remote workforces, and real-time data analytics. Technological disruptions, including the integration of Artificial Intelligence (AI) for network automation and predictive analytics, are further enhancing the appeal of managed SD-WAN. Consumer behavior shifts, such as the growing reliance on hybrid work models and the demand for seamless user experiences, are compelling businesses to invest in agile and resilient network infrastructures. The proliferation of Internet of Things (IoT) devices and the increasing complexity of multi-cloud environments are also acting as significant catalysts for SD-WAN adoption. Furthermore, the inherent benefits of managed services, including reduced operational overhead, enhanced security posture, and access to specialized expertise, are driving adoption among Small and Medium Enterprises (SMEs) and even large enterprises seeking to streamline their IT operations. The shift towards edge computing and the need for localized data processing are also creating new opportunities for SD-WAN providers to deliver optimized connectivity solutions. The report will provide detailed market penetration figures and specific growth forecasts for each segment, offering a clear roadmap for understanding market evolution.

Dominant Regions, Countries, or Segments in Europe Managed SD-WAN Services Market

Within the diverse Europe Managed SD-WAN Services Market, certain regions, countries, and segments are emerging as dominant growth engines. Large Enterprises are currently leading the market, driven by their complex network requirements, substantial IT budgets, and the critical need for secure, high-performance connectivity to support global operations and extensive cloud deployments. The IT and Telecom sector, alongside BFSI (Banking, Financial Services, and Insurance), are exhibiting the highest adoption rates and contributing significantly to market valuation. These industries are at the forefront of digital innovation, requiring robust and scalable networks to manage vast amounts of data, facilitate real-time transactions, and ensure uninterrupted service delivery.

- Dominant Organization Size: Large Enterprises, accounting for an estimated XX% of the market share in 2025, are driving demand due to their intricate network needs and significant investments in digital transformation.

- Leading End User Industries:

- IT and Telecom: A consistent driver, leveraging SD-WAN for network modernization and service innovation, estimated at XX% market share.

- BFSI: High adoption due to stringent security requirements, real-time transaction processing, and regulatory compliance, projected at XX% market share.

- Key Dominance Factors:

- Economic Policies: Favorable digital infrastructure investment policies across leading European nations.

- Infrastructure Development: Advanced fiber optic networks and 5G deployment providing a strong foundation for SD-WAN.

- Digital Transformation Initiatives: Aggressive adoption of cloud computing, AI, and IoT across major industries.

- Security Concerns: Increasing cyber threats driving demand for integrated security features within SD-WAN solutions.

- Growth Potential: Emerging markets within Central and Eastern Europe are showing accelerated growth potential, indicating future shifts in dominance.

The UK, Germany, and France are expected to remain key geographical hubs due to their mature digital economies and proactive adoption of new technologies. However, Nordic countries and select Southern European nations are also demonstrating significant growth, driven by specific industry needs and government-backed digital agendas.

Europe Managed SD-WAN Services Market Product Landscape

The Europe Managed SD-WAN Services Market product landscape is defined by sophisticated and feature-rich solutions designed to address the complexities of modern enterprise networking. Key product innovations revolve around enhanced security integrations, including next-generation firewalls (NGFW) and intrusion prevention systems (IPS) directly embedded within the SD-WAN fabric. Performance metrics are continuously improving, with advancements in application-aware routing, dynamic path selection, and quality of service (QoS) ensuring optimal user experience for critical applications. Unique selling propositions include simplified management consoles, zero-touch provisioning, and advanced analytics for network visibility and troubleshooting. Furthermore, interoperability with major cloud providers and support for hybrid and multi-cloud environments are becoming standard. The trend towards secure access service edge (SASE) convergence is also shaping the product roadmap, integrating SD-WAN with other security functions like cloud access security brokers (CASB) and secure web gateways (SWG).

Key Drivers, Barriers & Challenges in Europe Managed SD-WAN Services Market

The Europe Managed SD-WAN Services Market is propelled by several key drivers. The escalating need for agility and flexibility in network infrastructure to support cloud adoption and remote workforces is paramount. Cost optimization, by reducing reliance on expensive MPLS circuits, is a significant motivator. Enhanced application performance and improved user experience are critical for businesses reliant on real-time data and collaboration tools. Increased security demands, with integrated threat protection, are also driving adoption.

- Key Drivers:

- Cloud adoption and hybrid work enablement.

- Cost savings through WAN optimization.

- Improved application performance and user experience.

- Enhanced network security features.

Conversely, several barriers and challenges exist. The initial investment cost and complexity of migration from existing infrastructure can be a deterrent for some organizations. A lack of in-house expertise for managing and implementing SD-WAN solutions can lead to reliance on managed services, which may not be feasible for all budgets. Interoperability issues between different vendor solutions and the need for robust standardization remain ongoing concerns. The evolving regulatory landscape, particularly concerning data residency and cross-border data flows, adds another layer of complexity.

- Key Barriers & Challenges:

- Initial deployment costs and migration complexity.

- Shortage of skilled IT professionals.

- Interoperability and standardization challenges.

- Navigating evolving data privacy regulations.

- Supplier lock-in concerns.

Emerging Opportunities in Europe Managed SD-WAN Services Market

Emerging opportunities in the Europe Managed SD-WAN Services Market are abundant, driven by the relentless pace of digital innovation. The expansion of 5G networks presents a significant opportunity for SD-WAN providers to offer enhanced connectivity for edge computing applications and IoT deployments. The growing demand for industry-specific SD-WAN solutions tailored to the unique needs of sectors like manufacturing (Industry 4.0) and healthcare (telemedicine) offers a niche growth avenue. The increasing adoption of hybrid and multi-cloud strategies by enterprises creates a demand for unified and secure network management across diverse cloud environments. Furthermore, the rise of the "as-a-service" model is opening doors for flexible, consumption-based SD-WAN offerings, appealing to a broader range of businesses.

Growth Accelerators in the Europe Managed SD-WAN Services Market Industry

Several catalysts are accelerating the growth of the Europe Managed SD-WAN Services Market. Technological breakthroughs in AI and machine learning are enabling more intelligent network automation, predictive analytics, and self-healing capabilities, significantly reducing operational overhead and improving network resilience. Strategic partnerships between network equipment manufacturers, cloud providers, and cybersecurity firms are creating integrated and comprehensive SD-WAN solutions, enhancing their value proposition. Market expansion strategies, including geographical diversification into emerging European economies and the development of tailored offerings for small and medium-sized businesses, are also fueling growth. The increasing recognition of SD-WAN as a foundational element for digital transformation, enabling seamless connectivity for remote workforces and the expanding Internet of Things (IoT), further solidifies its growth trajectory.

Key Players Shaping the Europe Managed SD-WAN Services Market Market

- Cisco Systems Inc

- Vodafone Group PLC

- NTT Limited

- Palo Alto Networks

- AT&T

- Verizon Communications Inc

- BT Group PLC

- Nokia Corporation

- Telstra

- Deutsche Telekom AG

- Fortinet Inc

Notable Milestones in Europe Managed SD-WAN Services Market Sector

- June 2024: Haier Europe partnered with Orange Business to implement a dynamic SD-WAN solution, underscoring a strategic roadmap focused on cloud, connectivity, and cybersecurity, with an initial phase featuring a versatile SD-WAN.

In-Depth Europe Managed SD-WAN Services Market Market Outlook

The outlook for the Europe Managed SD-WAN Services Market remains exceptionally strong, driven by a convergence of technological advancements and evolving business imperatives. The integration of AI for network automation and predictive analytics will continue to be a significant growth accelerator, enabling more efficient and resilient network operations. Strategic partnerships and the emergence of converged solutions like SASE will further enhance the market's value proposition. The expanding adoption of cloud-native applications, the growth of edge computing, and the increasing demand for secure remote connectivity will create sustained demand for managed SD-WAN services. The market is set to witness further innovation in security integration, simplifying compliance and threat management for organizations across all sectors. This dynamic landscape offers substantial opportunities for service providers who can deliver robust, scalable, and secure SD-WAN solutions tailored to the specific needs of the European market.

Europe Managed SD-WAN Services Market Segmentation

-

1. Organization Size

- 1.1. Small and Medium Enterprises

- 1.2. Large Enterprises

-

2. End User

- 2.1. BFSI

- 2.2. IT and Telecom

- 2.3. Healthcare

- 2.4. Retail and E-commerce

- 2.5. Manufacturing

- 2.6. Other End Users

Europe Managed SD-WAN Services Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Managed SD-WAN Services Market Regional Market Share

Geographic Coverage of Europe Managed SD-WAN Services Market

Europe Managed SD-WAN Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Lack of In-house Expertise Driving Organizations to Opt for Managed Network Services; Benefit of Extensive Focus on Core Operations and Cost-efficiency; Rapidly Growing Digital Transformation and Network Traffic in Various Industries

- 3.3. Market Restrains

- 3.3.1. Lack of In-house Expertise Driving Organizations to Opt for Managed Network Services; Benefit of Extensive Focus on Core Operations and Cost-efficiency; Rapidly Growing Digital Transformation and Network Traffic in Various Industries

- 3.4. Market Trends

- 3.4.1. Increased Adoption of Cloud Services to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Managed SD-WAN Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 5.1.1. Small and Medium Enterprises

- 5.1.2. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. BFSI

- 5.2.2. IT and Telecom

- 5.2.3. Healthcare

- 5.2.4. Retail and E-commerce

- 5.2.5. Manufacturing

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cisco Systems Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vodafone Group PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NTT Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Palo Alto Networks

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AT&T

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Verizon Communications Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BT Group PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nokia Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Telstra

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Deutsche Telekom AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Fortinet Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Cisco Systems Inc

List of Figures

- Figure 1: Europe Managed SD-WAN Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Managed SD-WAN Services Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Managed SD-WAN Services Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 2: Europe Managed SD-WAN Services Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 3: Europe Managed SD-WAN Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Europe Managed SD-WAN Services Market Volume Billion Forecast, by End User 2020 & 2033

- Table 5: Europe Managed SD-WAN Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Managed SD-WAN Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Europe Managed SD-WAN Services Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 8: Europe Managed SD-WAN Services Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 9: Europe Managed SD-WAN Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Europe Managed SD-WAN Services Market Volume Billion Forecast, by End User 2020 & 2033

- Table 11: Europe Managed SD-WAN Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Managed SD-WAN Services Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Managed SD-WAN Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Managed SD-WAN Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Managed SD-WAN Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Managed SD-WAN Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: France Europe Managed SD-WAN Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Managed SD-WAN Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Managed SD-WAN Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Managed SD-WAN Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Managed SD-WAN Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Managed SD-WAN Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Managed SD-WAN Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Managed SD-WAN Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Managed SD-WAN Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Managed SD-WAN Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Managed SD-WAN Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Managed SD-WAN Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Managed SD-WAN Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Managed SD-WAN Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Managed SD-WAN Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Managed SD-WAN Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Managed SD-WAN Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Managed SD-WAN Services Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Managed SD-WAN Services Market?

The projected CAGR is approximately 24.70%.

2. Which companies are prominent players in the Europe Managed SD-WAN Services Market?

Key companies in the market include Cisco Systems Inc, Vodafone Group PLC, NTT Limited, Palo Alto Networks, AT&T, Verizon Communications Inc, BT Group PLC, Nokia Corporation, Telstra, Deutsche Telekom AG, Fortinet Inc.

3. What are the main segments of the Europe Managed SD-WAN Services Market?

The market segments include Organization Size , End User .

4. Can you provide details about the market size?

The market size is estimated to be USD 1.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Lack of In-house Expertise Driving Organizations to Opt for Managed Network Services; Benefit of Extensive Focus on Core Operations and Cost-efficiency; Rapidly Growing Digital Transformation and Network Traffic in Various Industries.

6. What are the notable trends driving market growth?

Increased Adoption of Cloud Services to Drive the Market.

7. Are there any restraints impacting market growth?

Lack of In-house Expertise Driving Organizations to Opt for Managed Network Services; Benefit of Extensive Focus on Core Operations and Cost-efficiency; Rapidly Growing Digital Transformation and Network Traffic in Various Industries.

8. Can you provide examples of recent developments in the market?

June 2024: Haier Europe, in its push to transform into a data-centric enterprise, partnered with Orange Business to implement a dynamic SD-WAN solution. Orange Business unveiled a strategic roadmap focusing on three core elements: cloud, connectivity, and cybersecurity. The first phase of the Haier project features a versatile software-defined wide area network (SD-WAN), with Orange Business consultants guiding the selection of underlay and overlay configurations tailored to Haier's needs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Managed SD-WAN Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Managed SD-WAN Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Managed SD-WAN Services Market?

To stay informed about further developments, trends, and reports in the Europe Managed SD-WAN Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence